The meat market in China: Pork making way for the growth of Beef

The meat market in China is the second largest sector in the country’s retail food market, after the fresh vegetables sector. However, it is one of the last to be affected by the development of new retail. Much of the meat sold in retail outlets are sold at traditional wet markets, most of which are in open-air market places or streets. These markets provide a venue at which the customer can buy live poultry or freshly slaughtered meat produce direct from local farmers. However, these markets are gradually being removed from cities, merged into supermarkets and hypermarkets.

Chinese are consuming more meat than ever

China’s meat market has less to do with company and brand shares than sector growth: local consumers eat far greater quantities of fresh meat than they did before economic reforms were launched some 40 years ago. Not only are today’s consumers able to buy more meat than ever before: they also have a far wider choice of meat from which to choose. Traditionally, China’s meat of choice is pork, however recently there has been growth in more diverse meats, for example, the veal meat market in China.

China’s role in the global meat market

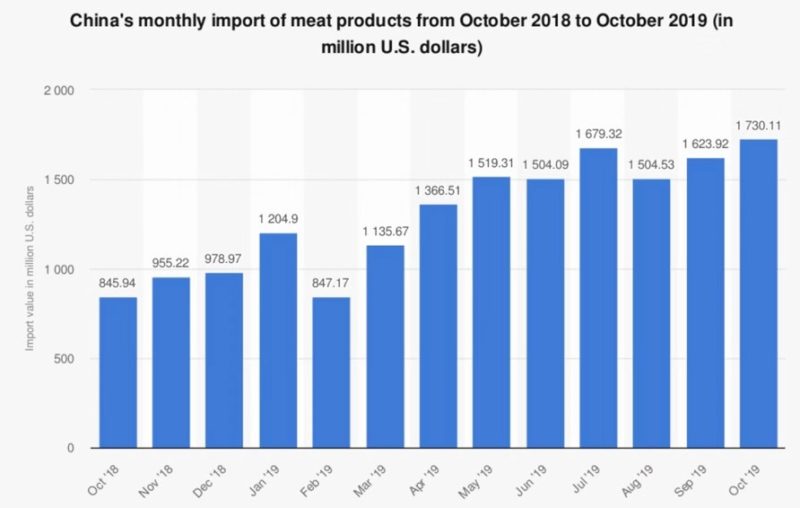

China is now the world’s largest producer, consumer, and importer of meat. In 2019, the country consumed around 28 percent of the global meat supply, which accounts for 73 percent of the Asia-Pacific meat market value. In the same year, the monthly import of meat products in China reached 1 billion U.S. dollars, with Brazil being the leading meat supplier whereas imports from the EU countries including Netherlands, Spain, and Germany growing the fastest. In 2013, a Chinese meat processing company Shineway acquired the world’s largest pork company Smithfield to meet heavy Chinese demand for pork. According to the industry profile, the Chinese meat market consumption volume increased with a CAGR of 2.4% between 2014 and 2018, reaching a total revenue of $209 billion in 2018 and is expected to rise steadily over the next three-year period 2020-2023. China, therefore, will continue to play a significant role in global growth of meat products.

Pork makes up 80% of the market

Pork sales accounted for the highest value in the Chinese meat market

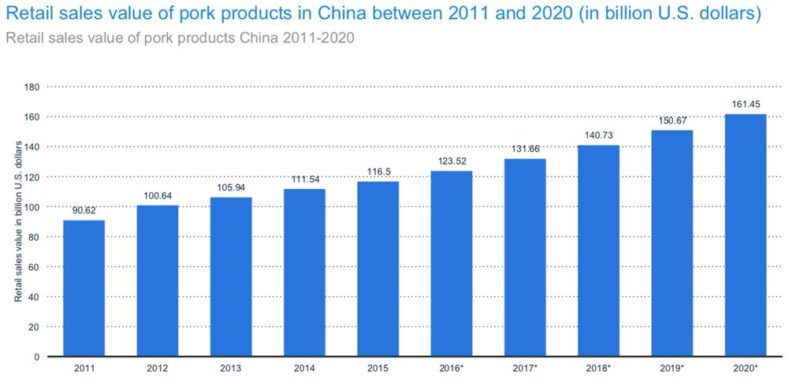

As food scandals and the general interests in healthy food rises, fresh meat sales are representing strong growth in the Chinese meat market. Fresh meat sales in China make up nearly 80% of the market value. Among all the types of meat, pork sales dominate the market, followed by poultry, beef. It is expected, however, that the Chinese beef and veal meat market will witness a rising demand, with the current per capita consumption rates increased by at least 25 percent in the next decade, whereas pork market growth will slow. These trends are in line with the growth of the overall meat market value. It is also not hard to believe that the prolonged increase in pork prices will have an impact on the domestic consumption behavior, leading to lower per capita pork consumption rate and greater demand for beef/veal in the near future.

[Source: Statista – The prolonged increase in pork prices will lead to the growth in pork market value]

The local meat market is mature and constrained by limited resources

Chinese domestic big meat retailers: Shineway and Yurun

Shuanghui Group, now WH Group, is the largest meat processing company in China and offers high-temperature meat products, low-temperature meat products, fresh meat, and frozen meat. It was the first meat processing company to pass ISO9001. It was established in 1994 and is headquartered in Luohe, Henan. The company mainly focuses on hog slaughtering and pork processing, and fresh frozen meat consists of more than 30 percent of the company’s total revenue. The group’s beef and poultry meat sectors have increased in recent years, in response to the rising demand in the market.

Yurun Group Limited is one of the largest meat product manufacturers in Mainland China. It is headquartered in Nanjing (南京), Jiangsu (江苏). It operates in two segments, chilled and frozen meat and processed meat products. Its products are marketed under its brand names of Yurun, Furun, Wangrun, and Popular Meat Packing.

China will continue to import meat from foreign markets

With domestic meat production constrained by limited land and water reserves, China will continue to import a significant amount of meat from foreign markets. In the first 9 months of 2019, China’s frozen beef imports showed a y-o-y growth by 48.3%, while poultry imports increased by 46.1%. China’s rising import needs had also lead to an influx of foreign direct investment in China’s meat market, and food inflation in China has now reached an all-time high.

Moreover, as new middle class and fitness trends sweep across the country, Chinese shoppers are likely to shift towards premiumization. This includes the desire for premium, fresher, and healthier meat. This will create opportunities for foreign meat suppliers that can offer organic meat and premium beef/veal products to meet consumers’ more sophisticated tastes.

[Source: Statista – China’s import demands showed an upward trend]

Distribution in the Chinese meat market

Hypermarkets and supermarkets are becoming the leading distribution channel in the Chinese meat market

Improved choice stems in part from vast improvements in China’s distribution networks – thanks, in turn, to expanding transportation networks, which have helped to develop more regional trade in fresh and processed meats. More produce is, therefore, reaching consumers in less populated regions. Processed meat products are mainly sold through new retail formats such as supermarkets and hypermarkets, dominated by Hema Fresh (盒马生鲜) and Yonghui (永辉), the former has developed an innovative online-to-offline (O2O) value proposition. This suits the increasingly sophisticated and demanding needs of urban fresh-food shoppers with rising incomes. People are now able to buy more expensive cuts of meat than before, leading to greater demand for variety and quality of produce. Foreign hypermarkets like Walmart, ALDI, and Costco also have been reaping the benefits of China’s growing meat market.

eRetailers are gaining popularity as a retail place for purchasing meat

The popularity of online shopping has surged in China, paralleled with China’s rapidly growing e-commerce market. Hypermarket and supermarket chains now are gravitating towards offering a seamless online-to-offline shopping experience. Hema Fresh, Alibaba’s grocery chain, is one of the leading fresh food retailers that offer mobile applications for online orders as well as in-store catering and offline shopping.

Around 60 percent of the sales in Hema are made via the Hema mobile application, and shoppers can have the orders delivered free within 30 minutes within a 3-kilometer radius of each store. Hema’s successful pilot in China’s “new retail” landscape has given rise to food retailers to rethink their distribution networks, and perhaps through creating opportunities for partnership or licensing. It is reported that the RT-Mart’s online sales have grown from 3 percent to 20 percent of total sales after the partnership with Hema and is on track to increase profits.

[Source: Hema Fresh mobile application – Hema Fresh makes fresh-food shopping more convenient]

Drivers of China’s meat market

Premiumization

Various sociocultural, economic, legal factors have collectively led to the general growth of the meat market. From the customer side, premiumization and the desire for a healthier diet, along with the rise of disposable income, will be key growth drivers across all categories, especially the food and drinks sector. As food and drinks account for almost one-fourth of the total household spending, the growth in household income will go to food expenditure. Due to more Chinese being lifted out of poverty, more families can afford meat and eat it daily.

Busy lifestyles

Moreover, the strong growth of processed food could be attributed to the fast-growing supermarket and hypermarket chains and the busy lifestyle of Chinese consumers. Improved farming techniques and management are leading to larger-scale operations that increasingly rely on automation in production, packaging, and transportation – a process that ultimately will create significant meat supply companies. However, frequent food safety scares, especially related to hygiene, disease and the use of food additives, have all added to reluctance among consumers about the meat they buy. These issues have the potential to seriously harm the market.

Why foreign farmers should export their meat to China

Following the end of the Trans-Pacific Partnership (TTP), farmers wishing to pursue business in Asia can select China to export their products, where demand for meat is on the rise. Since China cut tariffs on 859 consumer goods including frozen pork from 1 January 2020, it is, therefore, easier for foreign meat suppliers to reach the meat market in China, a $209 billion market. Indeed, many multinational manufacturers have voiced their interests in establishing a local production system and new deals to be made in the profitable Chinese meat market, where imported goods and organic products are increasingly in demand. Lower entrance barriers, ever-growing demands of the population, and China’s rising import demand will benefit more foreign meat suppliers in the future.

Let China Paradigm have a positive impact on your business!

Listen to China Paradigm on iTunes

![[Infographic] The beef meat industry in China](../wp-content/uploads/2017/01/Screen-Shot-2017-01-04-at-12.05.57-PM-150x150.png)