China’s Semiconductor Industry: 60% of the global semiconductor consumption

The growth and development of China’s semiconductor industry is the product of two related trends. First, the Chinese government incentivized companies to locate in China while simultaneously lowering the barriers to entry for foreign participants in China’s domestic semiconductor production. Second, Taiwanese investors and semiconductor executives moved their manufacturing operations to China, which provided for the initial foundation of China’s semiconductor industry.

Chinese semiconductor demand exceeds production

China’s semiconductor market is the largest in the world. Annually, China consumes more than 50 percent of all semiconductors, both for internal use and eventual export. As such, the rapid growth of Chinese demand lifted the entire industry worldwide. However, domestic Chinese manufacturers are still only capable of meeting approximately 30 percent of their own demand. Therefore, to rebalance China’s reliance on external semiconductor demand, the Chinese government has urged its national champions and leading digital businesses to improve their domestic semiconductor manufacturing capabilities.

China’s State Council ‘2014 “National Integrated Circuit Industry Development Guidelines” set the goal of becoming a global leader in all segments of the semiconductor industry by 2030. In addition, the Made in China 2025 initiative maintains achieving the know-how with regards to advanced semiconductor manufacturing as a vital component of China’s future economy and society. Lastly, in the midst of shifting supply chains and macroeconomic policy, the Chinese government is spending aggressively in semiconductor investment, acquisition, and talent recruitment to uplift the industry by on-shoring chip manufacturing equal to those of the world’s top foundries.

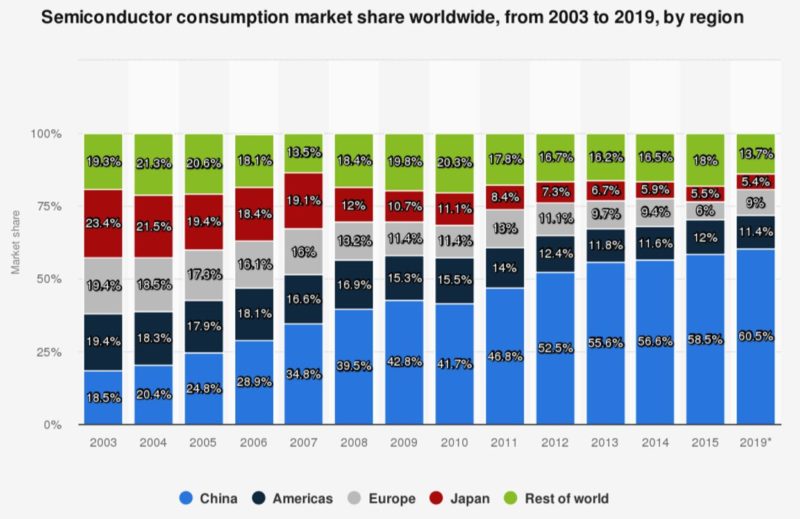

[Sources: PwC; SIA; IC Insights, Gartner; CCID Consulting, Statista. China’s semiconductor consumption is around 60% of global consumption.]

What drives the Global Semiconductor Market

In the figure above, China has witnessed a trajectory of steady growth in the global consumption market, far outweighing the Americas, Europe, Japan, and the rest of the world. Simply stated, the growing demand for smartphones, tablets, digital televisions, wireless communications infrastructure, network hardware, computers and electro-medical devices is stimulating global demand of semiconductors.

However, the global semiconductor industry is expected to witness low growth in the near future, paving the way for industry consolidation via mergers and acquisitions. On the other hand, the Chinese semiconductor industry is expanding in terms of domestic manufacturing in order to bridge the gap between the consumption and production of semiconductors domestically. With the emergence of China as the largest supplier of electronic devices, the consumption of semiconductors has grown drastically in the last decade. However, China’s ability to manufacture semiconductors is still far lesser than domestic demand. Therefore, several Chinese semiconductor industry acceleration plans are being initiated by the government, creating great potential and opportunity for relevant firms to maximize on.

China’s Agenda for Semiconductor Dominance

Many Chinese companies are designing specialized semiconductors for AI, as well as chip architectures that are at the bleeding edge of the mobile smartphone industry. Due to the strong coordination between state and domestic manufacturers, China wields a great deal of capital strength to advance its interests. MIC 2025 and the National IC Plan represent China’s most prominent plans for semiconductor industrialization and manufacturing. Taken together, these two strategies encourage China’s semiconductor industry players to adopt a “fast-follower” approach. This scenario calls for the industry to leapfrog several generations ahead to catch up with international competitors at a time when the decay of Moore’s Law is slowing the ability of leading firms to win the innovation race simply by building faster and more powerful chips.

The Chinese government’s commitment to building up its local semiconductor industry by offering huge capital and tax incentives to IC makers is expected to be the major driver of the market. However, China still depends on various countries to meet its semiconductor demand. Nonetheless, the Chinese government aims to reduce these imports, shrink the sizable trade deficit, and achieve self-sufficiency for its semiconductor needs.

Specifically, China has formally created a $29 billion state-backed fund to invest in the semiconductor industry, advancing its goal of reducing a dependency on U.S. technology. China is the world’s biggest chip importer, and the long-awaited 204 billion yuan ($28.9 billion) fund will fuel Beijing’s efforts to forge its own semiconductor supply chain from chip design to manufacturing. It will play a key role in steering the overall strategy and investment in the integrated circuit sector, which includes processors and storage chips used in smartphones and data centers.

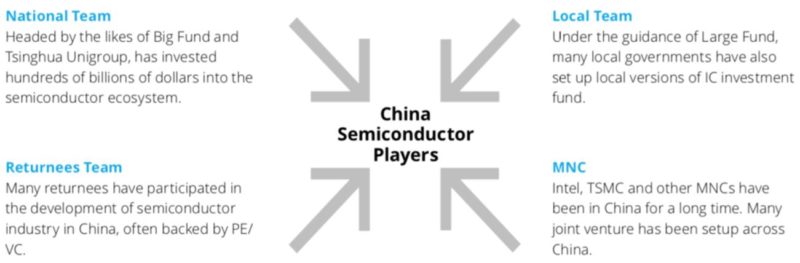

[Source: Deloitte, players in China’s semicondutor industry.]

Major Players in the Chinese Semiconductor Market

China’s Strategy for Chip Manufacturing

The figure above made by Deloitte provides an organized picture of the major players in the Chinese Semiconductor Market. From this, we can say, in essence, that China’s ambitious goal is to create national champions in each semiconductor market segment. At the low end of the market, they have had considerable success. China now supplies more than half of the world microelectronics and hopes to build on this to create similar success in memory, CPU, and AI chips. But China has had embarrassing failures in its efforts to make logic chips. Memory chips are less complex and less expensive to manufacture. There is a huge global market for them that China, building on its strong microelectronics sector, hopes to use as a stepping stone to more sophisticated products. Memory chips will likely be the first major market sector that Chinese semiconductor policy will disrupt.

Chinese firms are becoming competitive in memory chips but face difficulties in manufacturing CPUs or other specialized chips that are globally competitive in price and performance. China still relies on U.S. suppliers for high-end products. Making advanced semiconductors requires more than sophisticated production machinery and advanced designed. It requires “know-how,” knowledge and skills built up with years of experience. Even if China gains access to advanced manufacturing equipment, there is still a need for know-how when it comes to making high quality chips with consistent performance at a competitive price.

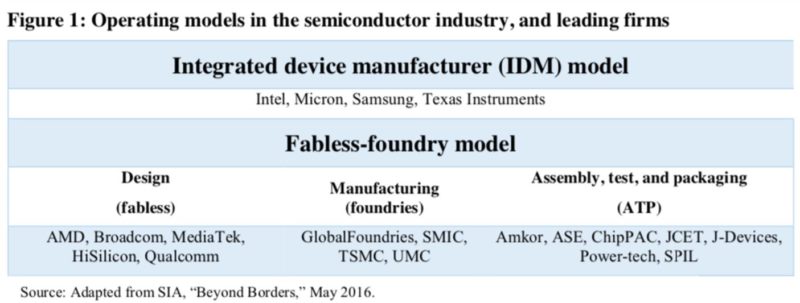

Industry Disaggregation

Here we can see just how broad and yet intricate the semiconductor industry is. In essence, semiconductor manufacturing has been reshaped by disaggregation, as firms have divided along the stages in the manufacturing process into design houses, wafer production, foundries, assembly houses, and testing houses. This “horizontal segmentation” has led to a “fabless” approach to semiconductor manufacturing, which now accounts for about 17 percent of semiconductor production and continues to grow. Horizontal segmentation makes it easier for firms in China to find a place in the production cycle of the semiconductor industry.

[Source: SIA, “Beyond Borders,” May 2016. Operating models in the semiconductor industry]

The disaggregation of chip production and the increase in fabless chip production means that design, fabrication, and testing is spread among different countries, including China. China is more likely to develop indigenous chip supplies if it relies on Chinese design houses (of which there are more than 1,000) and then contracts out production to a dedicated semiconductor foundry, such as the Taiwan Semiconductor Manufacturing Company (TSMC). The dilemma so far for China in using a fabless approach is that these chips are designed to meet Chinese standards. This can make them less valuable for the global market.

The ability to manage this global supply chain is one of the keys to profitability. Disentangling this integrated supply chain, created under different and more favorable political conditions, will be difficult if not impossible. This creates opportunities for China in the acquisition of semiconductor technology, but it also creates obstacles in trying to build a purely national industry since competitive advantage lies with the international supply chains. China is still dependent on foreign expertise for semiconductor production, particularly from Taiwan and the United States. Imports of both chips and technology will be the norm in China for many years to come.

China’s semiconductor industry’s Achilles Heel

Despite decades of efforts to develop a robust domestic semiconductor industry, China remains weak in the design and fabrication of leading-edge memory and processors. This weakness is particularly grave for fabrication, where SMIC and other Chinese players continue to lag years behind in leading-edge process nodes.

Of particular concern is the persistent gap between semiconductor consumption and production. China has been the largest market for semiconductors since 2005. Yet only slightly more than 15 percent of China’s total semiconductor consumption was supplied by China-based production in 2018. Additionally foreign companies with fabs in China may account for almost half of that domestic fab capacity.

While the U.S. semiconductor industry has consistently retained nearly half of the global market, China-based production has only around 5 percent. Other well-documented weaknesses are in leading-edge multi-core processors and memory devices, and China’s embryonic stage of development in semiconductor equipment and design tool services.

Noteworthy achievements of China’s semiconductor industry include optical devices (especially LED), low-power embedded processors, sensors, and discrete devices, with China now approaching self-sufficiency. Equally important is the surge of China’s semiconductor assembly, packaging, and testing (APT) industry, which has moved ahead of Taiwan and Japan.

Segmenting the Chinese Semiconductor Industry & Market

China’s semiconductor market comprises the total consumption of semiconductors in China. This includes both the production of semiconductors in China, and the semiconductors imported from foreign countries. China’s semiconductor industry denotes the total semiconductor manufactured in China. It includes the semiconductors manufactured by foreign players in China and the semiconductors manufactured by the domestic players

[Source: daxue consulting, China’s semiconductor market vs industry]

What drives the growth of China’s semiconductor industry

The major factors driving the growth of the Chinese semiconductor industry are the increasing demand for semiconductors from major end-use verticals and government initiatives to promote domestic manufacturing. The market for various end-use verticals such as data processing, communications, consumer, and automotive is growing due to continuous technological advancement and development and intense competition. Consumer electronic devices in China have shown tremendous growth in recent years. Furthermore, the aims of the Chinese government, as stated in the 13th Five-Year Plan, for improved national optic fiber coverage as well as the full roll-out of 4G mobile communication technology will also drive the market. Similarly, the increasing electrification of vehicles is expected to boost the demand for semiconductors in the automobile vertical.

However, China remains a net importer of technology. At present, China depends on imports for 84 percent of its semiconductor requirements. Because of its ever-increasing purchase and import demand for semiconductors, it remains a key market for global businesses operating in different technology sectors.

China is the largest market for semiconductors in terms of consumption, and each of the top 10 worldwide firms in 2018 had a presence in China ranging from R&D centers to fabrication facilities. This is due to the large and growing demand for chips used in goods that China produces and consumes domestically. According to various estimates, 90 percent of the world’s smartphones, 65 percent of personal computers, and 67 percent of smart televisions are made in factories located in mainland China, though some of this production is done in facilities operated by non-Chinese-headquartered firms.

The Central Government wants to push China’s semiconductor industry forward

Yet, in spite of this reliance on chips and chip-enabled goods, Chinese-headquartered semiconductor firms supply less than 5 percent of the worldwide market and remain at least two generations behind international competitors in their ability to produce semiconductors that are incorporated into consumer electronics. Though Chinese firms lack worldwide market share, the semiconductor industry has had a long presence in the country. China’s central role in the global electronics value chain has prompted many of the leading chip firms to establish back-end assembly, test, and packaging facilities in the country to take advantage of low labor costs and proximity to the Chinese market.

Thus, developing and strengthening the industry is a high priority for the Chinese government. China wants to move “up the value chain” from assembling final products from imported components to creating advanced technology in China itself. Despite this inclination, imports of chips and technology will be the norm for years to come. Today, only 16 percent of the semiconductors used in China are produced in-country, and only half of these are made by Chinese firms. China is very dependent on foreign suppliers for advanced chips. In 2015, China introduced the Made in China 2025 initiative to achieve technological self-reliance in sectors such as robotics, IT, and new energy vehicles. With this initiative, the Chinese government aims to produce 40 percent of its semiconductor requirements by 2020 and 70 percent by 2025.

Market Opportunities

- China is the largest and fastest growing semiconductor market in the world, representing 29 percent ($100 billion) of the $335 billion global market in 2015.

- China, in particular, commands almost half of overall market value, split roughly 50-50 between domestic demand and Taiwan-based, world-leading ODMs (e.g. Foxconn and Quanta) or foundries (e.g. Taiwan Semiconductor Manufacturing Company TSMC) serving global clients.

- China has become a source of income for top global semiconductor companies, many of which generate over half of their revenue from China.

- Near-term prospects for China’s overall market seem favorable and stable for many sectors, including high-end ICT goods and services.

- Domestic consumption is mainly being driven by data processing and communications applications sectors, with consumer electronics also being a significant contributor.

- China’s appetite for semiconductors is so great that domestic production only counts for 9 percent of consumption – leaving 91 percent of China’s demand to be satisfied by imports.

- Demand is growing for high quality semiconductor devices.

- Expected increases in Chinese spending on semiconductor manufacturing equipment to equip and upgrade fabrication (fab) facilities.

- China’s integrated circuit design sector continues to be the fastest growing part of China’s semiconductor industry.

[Source: daxue consulting, SWOT analysis of China’s semiconductor industry]

China’s Semiconductor Manufacturing Industry

The Semiconductor Manufacturing industry manufactures semiconductors and electronic devices, including diodes, triodes transistors, power transistors, transducers and sense devices. Industry firms may also manufacture special parts for these electronic devices.

Semiconductor manufacturing requires experience, ownership of (or access to) a substantial amount of IP, managerial skills, a highly-skilled workforce, and a close connection to scientific research. It also requires a close understanding of the market and the product in which the chip will ultimately be used, an area of “know-how” where China has lagged. Currently, the United States leads in chip design, followed by Taiwan.

The major players in China’s semiconductor manufacturing industry are:

- On Semiconductor Corporation (China)

- Fairchild Semiconductor (China)

- NXP Semiconductors (Guangdong) Co., Ltd

- Infineon Technologies (China)

- ST Microelectronics (China)

The majority of semiconductors manufactured by Chinese enterprises are low-end products with low technology. To better satisfy domestic demand, domestic manufacturers will have to enhance their research and development (R&D) capabilities and expand output. In the next five years, industry revenue will increase 2.2 percent annually to $83.5 billion in 2023. The main drivers of industry growth will be steady increases in overall demand, gradual growth in demand from downstream domestic industries and increasing demand for the industry’s exports. The main markets for semiconductor devices will remain the computer and peripheral equipment manufacturing industries and the network communications industries.

Moving Forward: Industry Outlook

The Chinese semiconductor manufacturing industry is in the growth phase of its life cycle. Contributing to the industry’s development phase has been the rapid rate of technological change occurring within the industry. In recent years, foreign manufacturers have introduced new advanced technologies and management knowledge into the local industry. At the same time, domestic manufacturers have experienced a high level of development, which is expected to continue as they expand their local operations. In addition, given the size of the domestic market, there still exists considerable potential for demand growth for high quality semiconductor devices.

What are the Major Markets for Semiconductor Manufacturers in China?

Computer and peripheral equipment manufacturers: Demand from this market segment is increasing due to the development of the computer and peripheral equipment manufacturing industries, which is being driven by demand for products such as memory boards, personal computer modems, loaded computer boards and peripheral controller boards.

Network communications firms: In line with the strong development of the communications sector in the past five years, there has been increased demand for semiconductor devices to be used in telegraph transformers, fiber-optic connectors and wireless communication terminal equipment.

Electrical lighting manufacturers: Indicator lights and LED displays and lighting.

Consumer electronic goods manufacturers: China is one of largest producers of household electrical goods, which is reflected in the high level of demand for semiconductor device products from consumer electrical goods manufacturers.

Automobile electrical equipment manufacturers: This segment is expected to grow in the next few years due to the development and expansion of China’s Automobile Manufacturing industry.

What are the key success factors for succeeding in China’s Semiconductor Market

- Having links with suppliers

- Access to highly skilled workforce

- Ability to quickly adopt new technology

- Establishment of export markets

- Economies of scale

- Effective quality control

- Undertaking technical research and development

- Having a good reputation

No One-Size-Fits-All Solution for Market Entry

Multinationals trying to access the Chinese market should consider a multitude of factors such as policies, technologies, marketing, logistics and global strategies. It is also important for multinationals to realize the position they are in before entering China to come up with the best entry strategy. Obviously, there is no one single correct method, but in general, MNC’s technology status as well as China’s domestic technology status play a crucial role.

Domestic demand from China will still be a growing source of revenue for foreign semiconductor manufacturers over the next few years. This encourages MNC’s to continue targeting Chinese consumer electronics, data processing and communications companies manufacturing in China. However, semiconductor firms, in addition to providing chips, must find ways to either monetize new technologies beyond the actual chips themselves or expand into new business models enabled by those technologies. Companies that do so will thrive. Those that don’t will be overtaken by more agile competitors.

When an MNC has the upper hand in technology, it has higher bargaining power and will have less incentive to share intellectual property. However, MNCs might altogether avoid cases where domestic players are already strong. For instance, China is relatively weak in the high-end design of semiconductors and manufacturing, and competition is not high, so MNCs typically need to set up regional offices or a wholly foreign-owned enterprise (WFOE) to access the market. In areas where China is relatively strong such as packaging, testing and low-end design, MNCs may opt to setup a JV or avoid the market altogether.

Author: Jeffrey Craig

Let China Paradigm have a positive impact on your business!

Listen to China Paradigm on iTunes