Pricing Strategy in China

How to effectively apply the pricing strategy in Chinese market?

Becoming dominant in its saturated industry while optimizing its market positioning, generate margin profit on a highly competitive environment and still upscale sales volume, upgrade brand equity without impacting the reach of consumer segments; pricing management in China can imply various complex and strategic business questions. We believe that, to efficiently answer these questions and optimize international brands’ pricing strategy in China, a data-driven approach and modelization is to be adopted, based on:

- Comprehensive price audit of the product categories, both in store (store-check) and online (marketplaces and e-commerce data scrapping)

- Benchmark metrics of key market players, along with brands from different sectors but offering similar revenue generation model in China. Metrics include, along with the overall pricing model, sales, promotion & distribution costs and brand recognition performances.

- End-consumer research, both for need analysis (building of the pricing model) and marketing mix validation (testing phase)

- Market-driven trends and perspective on evolution of the pricing, but also distribution and promotion model in China

- Best practices understanding and collection with in-depth interviews of local professionals (brand, purchase, marketing managers or other any top-level management role within brands in your industry).

Among all the aspects, pricing plays a vital role for the success of a company. How ticket revenue of London 2012 Olympic Games exceeds that of the preceding three Olympic Games (Beijing, Athens, and Sydney) combined is a spectacular example illustrating the powerful role a sophisticated pricing strategy can play. Paul Williamson, who was responsible for managing the ticket program in London 2012 Olympic Games, used prices not only as an effective revenue and profit driver but in addition as a powerful communications tool. The digits of the prices themselves were designed to send a message without any additional commentary. The lowest standard price was £20.12, and the most expensive was £2,012. The number “2012” appeared over and over again in the jkprice points, and everyone knew immediately that such price points referred to the Olympic Games. Finally, Williamson and his organization generated ticket revenues of £660 million ($1.1 billion), almost 75% more than anticipated.

The pricing strategy in the London 2012 Olympic Games shows that a good pricing should have three prerequisites: create value, quantify value, and communicate value.

Then what is the optimum pricing strategy, what are the differences of pricing strategy between countries and what specific winning pricing strategies in China all need to be considered? After choosing the optimum pricing strategy, the company has to focus on the application process in order to smoothly utilize the pricing strategy in the real-life situation. How to protect a company’s margin, what features should be considered before setting the price for a company and how to plan a pricing strategy for the Chinese market are all necessary to pay attention to. This article is going to discuss these topics step by step in order to find out how to effectively apply the pricing strategy in China market and introduce the experience of pricing strategy in Daxue Consulting company.

What pricing strategies are available and commonly leveraged in China?

What are the strategies to set up optimum pricing in China?

When it comes to set up optimum pricing, there are many methods based on a variety of factors, such as overall marketing objectives, consumer demand, product attributes, competitors’ pricing, and market and economic trends. In this passage, we mainly elaborate on the following methods: value-based, cost-based, renting/ownership, substitute, freemium/premium, performance/subscription based business model.

Value-based pricing

This pricing strategy considers the value of the product to consumers rather than the how much it cost to produce it. Value is based on the benefits it provides to the consumer. Where it is successfully used, it will improve profitability through generating higher prices without affecting greatly sales volumes.

Examples of value-based method usage in China are to found within firms that produce technology, medicines and beauty products.

Cost-based pricing

This pricing method in which a fixed sum or a percentage of the total cost is added (as income or profit) to the cost of the product to arrive at its selling price.

Examples of cost-based method in China are to be found within OEM, factories to enter a market in which price war always occurs.

Renting / Ownership

This pricing method based the payment on the leasing period of the product or the service being used.

Examples of renting/ownership method in China are Mobike, Apple icloud, SaaS (service as a software).

Subsitute (replace a function):

This pricing method attaches bigger importance on the functional part. The product is charged largely for the function the product generates.

One of the pricing method example in China is the xiaomi(小米) shoes, the price is not only based on the shoes, but also on the function of counting footsteps.

Freemium/Premium/Subscription

Let’s take the mobile apps for examples. Freemium (a portmanteau of “free” and “premium”), stands for an app which is free to download and use. However, some features inside the app are unavailable until you pay for them. Premium apps have an upfront price before they can even be downloaded. Subscriptions are a regular fixed fee the user is charged automatically via the App Store for using the app. One successful example for the subscription based model is the Birchbox. The Birchbox was originally born in New York. Each customer only needs to pay 10 dollars per month and could get a box of cosmetic products with prestigious brands. It became a success and the business model spread to China and new brands like Glossybox、MEITODAY (美天)、Yipingyiguan(一瓶一罐) appear in the Chinese market.

Performance based business model in China

“People don’t want to buy a quarter-inch drill. They want a quarter-inch hole!”–Theodore Levitt. The migration to a service-based economy is leading to a fundamental shift in manufacturing industries toward a business model in which the service component of products, based on the value they provide to customers, is becoming dominant.

For example, Xerox(施乐) has been very successful in establishing a service business. Company created Managed Print Services many years ago in which it manages fleets of printers and multi-function devices, even those made by other companies, for enterprise clients. Xerox provides maintenance, upgrades, paper and toner replenishment. Clients only pay for pages printed, for a simpler experience and lower operating cost.

Others models are applied in China:

- Skimming Pricing

- Penetration Pricing

- Competition Pricing

- Product Line Pricing

- Bundle Pricing

- Premium Pricing

- Psychological Pricing

- Optional Pricing

What are the differences of price strategies between Chinese market and Western market?

Views of Price war between companies from Western market and Chinese market vary tremendously. Wharton marketing professor Z.John Zhang said “a price war is something to be avoided in the west.” However, in China, where companies have earned a reputation for easily starting price wars, the outbreak is considered a legitimate and effective business strategy. In the past years, according to Zhang, businesses in China have initiated price wars in a wide range of industries, including consumer electronics, home appliances, personal computers, mobile telephones and automobile.

Since China has a big market based on the comparatively large number of population who tend to be easier to be influenced by the price than western countries, those companies initiated price shrinking in China would be more likely to get profit rewards than in foreign market.

Changhong (长虹) are one of the good examples to illustrate how much influence the price war could exert on the market when used smartly. Changhong at that time was the largest and most efficient color TV producer in China with 17 production lines and a manufacturing capacity that was at least double that of the next-largest producer, however all the capabilities could not secure the long-term top position in TV production industry. After the price war, which put small, inefficient, domestic TV manufacturers at a disadvantage, Changhong kept its leading role in the industry. Also, Galanz, a microwave oven manufacturer is a good example of how the price war can help the company to occupy the market when lowering the price to capture more volume. With the price war within the microware manufacturer industry, consumer landscape changed. The microwave switched from a luxury in the kitchen to an ordinary tool in all households.

Not only the customers’ perspectives, but also the cultural aspect and governmental regulation in Chinese and western countries are different. When a company enters a market and wants to set up new pricing strategy for a completely new environment, it needs to be cautious and alert to the potential conflicts a new area may bring.

Focus on China: what are the winning pricing strategies for Chinese market?

If a company wants to obtain a leading position in its Chinese market, it should consider carefully not only about the company’s own business life cycle and competitors’ strategies, but also about the behavior of Chinese customers and their inner driving forces. Chinese customers are different from the majority of westerners because the Chinese are sensitive to prices fluctuations and at the same time they tend to spend large amount of money when they are convinced of the product’s good quality or value of the brand.

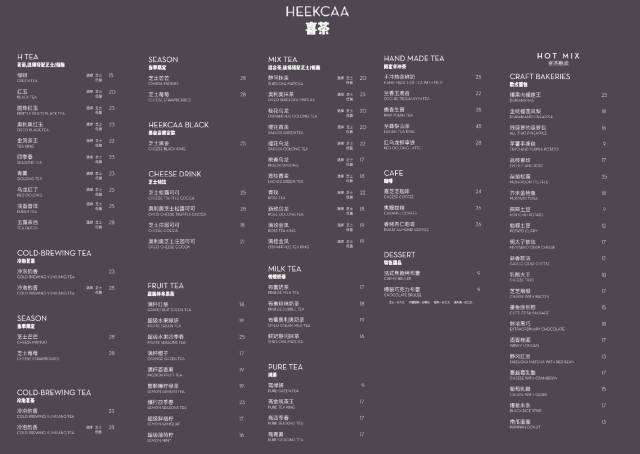

HEYTEA(喜茶) (high-quality & cost-effective model)

The marketing strategy of Chinese brand HEYTEA turned out to be a success when it was first introduced to the public. Each store sells anywhere between 2,000-3,000 cups a day. Add to that an average price of RMB 25 per drink for a conservative daily average of 2,500 cups – that translates into a weekly revenue of RMB 437,500; in Dollar terms, a cool $66,000. The success is from the combination of the price strategy, premium locations and unique promotional campaign.

Regarding its pricing policy, HEYTEA positioned itself as providing high value-added products. Each cup of HEYTEA costs between 11 to 29 yuan, with an average of 25 yuan. In comparison, Yi Dian Dian–– champion of the blind test hosted by Food-tasting Group in Shanghai —offers tea at undercut prices ranging from 6 to 18 yuan per cup, with an average price of 14 yuan, according to DazhongDianping (大众点评). With the high performance-price ratio, the high-quality & cost-effective HEYTEA rapidly become popular in the Chinese market.

Taobao(淘宝) (freemium model)

It is difficult for Chinese consumers to pay for a company’s product or service since nowadays there are so many alternatives in the market. However, freemium model is still a good option. This is when company gives users access to limited functionality for free, and then ask them to pay for “premium” or “advanced” features, generally through a subscription. Take Taobao for an example, one significant feature different from Ebay is that seller on Taobao does not need pay commission fee to the platform. Since a large number of sellers are attracted for the free platform, later a new need to be ranked on top of the sellers’ list appears. Thus many sellers begin to spend money in order to be placed on the most obvious area and attract more buyers (similar to the SEM practice for search engine). This is how a freemium model is like, and it not only become popular in the selling platform, but also in social websites like LinkedIn(领英) or other video games.

Vipshop(唯品会) (discount retail)

Unlike in the US, where the biggest chains have had decades to build their brands and consolidate their leads, discount retailers in China haven’t been around that long. Discount retail service is scattered especially in the second-tier cities. However, Vipshop grasped the chance and became a China-based online discount retailer that sells apparel, household goods, cosmetics and other branded lifestyle products. The company specializes in “flash sales,” in which a set number of goods are sold over a limited period of time, often during the retail off-season. Vipshop helps manufacturers reduce overstocking by selling merchandise to customers who might not otherwise have access to it. Because the company operates in a category without much history or entrenched competition in China, analysts give it high marks for growth potential. The company is already well on its way. Citigroup analyst Muzhi Li notes that Vipshop’s relationships with more than 3,000 apparel manufacturers and 7,000 brands make it China’s largest aggregator of discounted apparel.

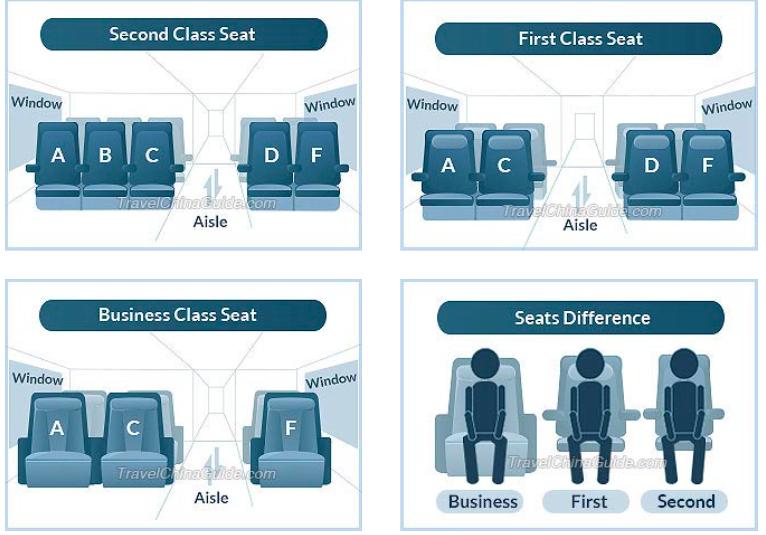

Trains (value-based model)

In China, there are different kinds of trains offered to people with various needs. The prices are set up according to the trains’ type, travel distance and seats’ comfort, etc. Based on those various factors, customers can figure out the most satisfied ticket to realize their needs.

Trains’ type:

- G trains(high-speed trains, “Gaosu 高速” in Chinese) are the fastest and most comfortable trains in China with a speed of 250–400 km/h, for example G101 from Beijing South to Shanghai Hongqiao.

- D trains(bullet trains, “Dongche 动车” in Chinese) are the next fastest trains in China after G trains, usually running at a speed of 200–250 km/h, for example D333 from Beijing South to Qingdao.

- C trains(“Chengji 城际” in Chinese) are high-speed intercity trains running for a short distance between two nearby cities with a top speed of 350 km/h, e.g. C2003 from Beijing South to Tianjin.

- Z trains(“Zhida kuaiche 直达快车” in Chinese) are direct express trains with a top speed of 160 km/h, for example Z19 from Beijing West to Xi’an.

- T trains(“Tekuai lieche 特快列车” in Chinese) are express trains travelling at a top speed of 140 km/h. There are usually a limited number of stops along their routes, e.g. T321 from Shenyang North to Baotou.

- K trains(“Kuaisu lieche 快速列车” in Chinese) ironically called ‘fast trains’ with a top speed of 120 km/h, e.g. K5 from Xi’an to Chengdu.

Seats’ level:

Mobike (renting model)

Mobike pioneered the concept in Shanghai in April in 2017. With a penetration rate of 13.9% according to iResearch, the market leader is currently present in more than 50 cities and boasts 7.69 million users per week. The brand’s basic models, Mobike Classic and MobikeLite (featuring silver red wheels in Beijing and orange wheels in Shanghai) target middle and upper-class consumers. For instance, while Ofo only asks new users for a deposit of 99 RMB to register with the service, a Mobike account costs 299 RMB up-front. However, the service price is equivalent with 1 RMB for a half hour ride and 0.5 RMB with MobikeLite.

Focus on China: What kinds of problems does a company often encounter when setting up prices in the Chinese market?

Being too premium or not premium enough

For example, H&M and Zara are two brands that adopt the low cost method to provide low price for customers. This price can attract a large group of sensitive buyers, but the problem is that the brand is often refered to as “cheap” and the customer service is practically non-existant.

Another examples are Muji(无印良品) and Angelina. Muji prides itself for providing high quality products cheaply in Japan, as encapsulated by their corporate mission: “Lower Priced For Reason”. However, when the brand comes to China, Muji sells at a premium. Many customers were complaining for the high price which resulted in the popularity to plummet.

Copycat

Although China has developed fast in the tech area and succeed in many industries for its innovative ideas, such as Wechat(微信) and Mobike(摩拜单车), many companies are still using the copy-cat method when setting up new product. Therefore, when a new company enters to China, it need to keep in mind that the factor of potential copycat issue exists and should be reduced.

Perpetual innovation

Since many companies in Chinese market are finding new ways to create profits for the company, competitive environment is created for the whole industry. Thus if a company wants to maintain leading role, it always needs to figure out the innovative ideas and realize the new business model in the real-life market.

Customer feed-backs

There is a huge population of customers in the Chinese market, the company should pay attention cautiously to the customers’ feedback not only because the large number but also because the information relevant to the product or service could be spread quickly especially among the large number of customer base.

How to apply the pricing strategy and make profit in the highly competitive Chinese market?

In the previous paragraphs different types of pricing strategies have been discussed, but a company knows what the pricing strategy should be adopted does not necessarily guarantees the effectiveness the company could utilize the pricing strategy. Therefore, how to apply the methods and make profit in a real life situation need to be considered before application. Things should be taken into account are as follows,

Acquisition, Conversion, Retention of Chinese clients

Different pricing strategies can cause various types of feedbacks or reactions from the potential or existing customers. Before applying any pricing strategies, the company should figure out what exactly the goal is for the company, thus the proper pricing strategy could be used in order to acquire, converse or retain clients as expected.

Repeated cash flows or one payment

Whether the company is an innovative firm and wants to obtain a large sum of money in the beginning stage is important when deciding to set up the pricing strategy. Repeated cash flows or one payment is always suitable to different kind of company.

Mass market or premium model is a key distinction on the Chinese market

The target group of the customer is also a very important factor to consider in order to achieve success in China. Product for mass market or a focused group would be different when determining the pricing strategy.

Chinese Discounts, psychological effect when using figures in Chinese market

When it comes to Mandarin Chinese discounts, they are expressed the opposite of English. In English, discount signs are labeled as X% off. In Chinese stores, discount signs will tell you the percentage of the original price that you now have to pay. So don’t get too excited when something is marked 9 折 (jiǔ zhé); that doesn’t mean 90% off. It means you can buy it for 90% of its regular price – a 10% discount. The format for discounts is number + 折. Western (Arabic) numbers are used instead of Chinese characters. Here are some examples:7 折qī zhé 30% off, 5 折wǔ zhé 50% off, 2.5 折èr diǎn wǔ zhé 75% off.

Psychological price and price value association are significant criteria of choice in China

The aspect of customer value association has a big influence in pricing in China. It means that the perceived customer value immensely affects the pricing strategies in China. In China, it is possible that prices convey a meaning. For example, 520 (wǔ èr líng) sounds almost the same as the words for ‘I love you’ (wǒ ài nǐ). Also, the number 8 (bā) is highly favored in pricing as well. It has a similar pronunciation with the word for ‘fortune’ or ‘wealth’ (fā), which is also why many Chinese people try to choose mobile numbers, house numbers or any important dates with eights in it (remember also the 2008 Olympic opening ceremony in Beijing, on August 8, kicking-off at exactly 8:08 PM). While in the US, a retailer may end a price with the 9, in China, Japan, or Korea, it’s not unusual to see that number rounded down to an 8. See also how Apple prices the iPad mini on its Chinese website:

KOL leverage for marketing and pricing in China

Since few years, KOLs became a real part of the influencer marketing. They are numerous and powerful. Most brands call on KOLs because they are an effective tool in business. KOLs are often Chinese celebrities, popular social media users, experts of a specific subject, columnists, socialites, fashionistas, or bloggers. They have created a viral content and developed a community around them. They post on various social media websites on all types of different topics: sports, video games, fashion, food, traveling, luxury goods, cars, etc. They provide advices, instructions, feedback to their followers and users love them, because they trust KOLs more than brands.

Take Papi Jiang as an example. Papi Jiang (Jiang Yilei) is in China a superstar. She is very famous with over than 40 million followers. She works with lot of brands of different size. Huge brand like New Balance and smaller brand like Lilly&Beauty, which invested USD 3.5 million to be the first business to place an ad in one of her videos. She has been selected as the most famous person of the year in 2016 in China. With all her contracts and followers, she is arguably most powerful influencer all over the world.

Finally, there are some special elements which could be added when planning pricing strategy for the Chinese market:

- Product life cycle

- Lifetime value of a consumer

- Play with pronunciation

- Consider the inflation and recent changes in one generation

- Digital payment and etc.

What are Daxue’s experiences in pricing strategy?

Daxue Consulting is a China-based market research dedicated to the market entry and/or expansion of international brands within the Chinese market. In this perspective, our organization includes a specific focus on the definition of models and strategies related to pricing in China. As market research firm with national coverage, extensive network in any industries and a large panel of end-consumers available for interactions, Daxue Consulting has the right capabilities to collect the metrics and data that will allow a reliable, methodological and factual approach to any brand’s pricing management in China. Our pricing strategy solution are to be:

- Leveraged as stand-alone project, for example for the Planning of the price life (full price, then discount, then flash sales, then bentering)

- Integrated into a more comprehensive marketing mix approach, with the price as key attributes of a conjoint analysis

- Focused on market intelligence, with benchmark of price management in successful market entry cases and price audit in offline and online stores

- Involving tech and innovative research processes, with for instance Virtual Reality (VR) simulation for near-in-vivo testing of the price within the categories

Source :

- Olympic game example-<63.Confessions of the Pricing Man_ How Price Affects Everything-Copernicus (2015)>

- Value based definition-http://www.learnmarketing.net/price.htm

- Freemium/Premium/Subscription-http://latticelabs.com/blog/2013/09/premium-freemium-subscription/

- Performance based business model –http://innodigest.com/performance-based-contracts

- Difference of pricing strategy between China and Western market-http://knowledge.wharton.upenn.edu/article/how-and-why-chinese-firms-excel-in-the-art-of-price-war

- Microsoft pricing strategy in China-https://www.tomsguide.com/us/Microsoft-Office-China-Piracy,news-4289.html

In today’s business, companies turn their back to cutting costs and shift to driving growth with new Pricing Strategies in China. As pricing is the only part of the marketing mix that actually generates revenue, it has, therefore, greater impact than ever before. But with greater impact comes greater responsibility – and customer perception, increased competition as well as an ever-changing economy make it even more difficult to fine-tune the pricing tools to ensure sustainable impact and profitability. You have to ask yourself: what is the best path for our goals to do so?

This logic is true for China, too. However, some distinct characteristics of the Chinese customer/market make it even more complex to find the right pricing strategy for your product or service. Daxue Consulting can provide insights to better understand these unique characteristics of China. Due to our excellent market research, we command a large base of data about the Chinese market. Furthermore, thanks to our extensive consumer research in China or full-service focus groups, we know more than anyone else about the Chinese customer.

As abovementioned, the greater the impact, the more complex pricing strategies are becoming. There is no single pricing strategy which will lead you to assured and sustainable success. In the end, it is your ultimate goal which heavily impacts your pricing strategy, whether you look for market domination, maximizing your profit or creating repeat sales. At Daxue Consulting, we deal with every case individually and work with our clients shoulder to shoulder – until we find the best solution.

Insights: What to Take into Consideration when setting up a Pricing Strategy in China

According to the findings of the BCG, three external forces are determining the value for setting your right price at a point with the highest value extraction – the customer value, the economy and the competition.

Especially the aspect of customer value has a big influence in China. More in detail it means that the perceived customer value immensely affects the pricing strategies in China. First of all, that is, because in China it is possible that prices convey a meaning. For example, 520 (wǔ èr líng) sounds almost the same as the words for ‘I love you’ (wǒ ài nǐ). Also, the number 8 (bā) is highly favored in pricing as well. It has a similar pronunciation with the word for ‘fortune’ or ‘wealth’ (fā), which is also why many Chinese people try to choose mobile numbers, house numbers or any important dates with eights in it.

The occurrence of psychological effects of the prices is another specificity of the part of perceived customer value in China. Chinese customers immensely believe that high prices automatically indicate the best quality and best choice. Also, they buy the most expensive brand to show that they can afford it. Thus, e.g., when operating in a luxury industry it might be important to set the price according to this and always ensure to be the most expensive in the industry. In this case, the price is a feature of the product and one can speak of “prestige pricing”. Moreover, this also shows the role of the competition. The described scenario would mean that you’d find yourself in a reverse price-war with your competitors, which is a specificity of the Chinese market.

Referring to the economy, one can say that the internet and mobile are of enormous importance in China. Technology has invaded many aspects of life with innovative business models changing the way Chinese conceive pricing such as rental over ownership, credit-based payment versus one payment, micro-payment, freemium/premium strategies or hongbao (red package).

Despite these specificities in China, in order to set the right price we use methodologies like the ones used in most countries such as cost-based analysis or benchmarking. However, it is very important to consider a decent amount of qualitative research in order to assess the price perception of your product or service in China which could be very different from the rest of the world.

Our Solutions

Defining the right pricing is much more than putting numbers in a software and applying formulas. It is linked to your core strategy. Whether you look for market domination or maximizing your profit or creating repeat sales, your pricing strategy will be heavily impacted by your ultimate goal. It is also about dynamics that emerge through new models. Relying on a simple quantitative analysis is as dangerous as relying on a simple qualitative analysis. The perspectives need to be confronted and the necessary tools need to be leveraged. We look at pricing from a higher level.

At Daxue Consulting, we believe that new pricing can only be evaluated through a holistic approach. The questions we would like to answer with our research are for instance:

- How much can your product or service make your clients save money, efforts or even make them earn money or more efficient? What pain points do you solve and how much can it be valued at?

- How high can you go in pricing?

- What pricing model will make you gain market share, increase your profit and increase your value towards your clients?

In order to get the answers, a typical research on pricing could look like this:

Step 1: the first step is about getting the big picture and all the variables to take into consideration. Therefore, we will have an interview with your team to assess the objective for the new pricing strategy. Also, we will conduct some additional research to benchmark and analyze the dynamics at work.

Step 2: in the second step we define the research plan to find the right pricing strategy. Among this research plan, we go through:

- An assessment of the following: your product or service, the use and perception by your clients, the environment of purchase and use, life cycle position, benchmarking and substitutes. Also, we segment your clientele through desk research, test the product or service and conduct surveys, focus groups and in-depth interviews.

- The perception of pricing for several occurrences of the products (in vivo test, picture-based or VR-based) with a process of iteration. Features that can change are packaging, colors, options, linked sales, package model, volume/size/weight, environment of the sales (guarantee, promise of the after sales, etc.). Factors that can change through the iterations depend on the product or service and requirement

- The economic impact of changing in price or pricing models

- The impact of competing business models and pricing wars or pricing aggressions (creating scenarios through core audiences and versatile audience analysis)

Hereafter, an end report will be given to you which describes two to five different strategies for the next three years over time. Included into this end report will also be a description of the dynamics to grasp the big picture and qualitative approach as well as a cash-flow statement to assess the impacts of pricing. Referring to the different strategies, it is to say that each one is following trees of choices so that you are able to react according to the movement and changes of your competitors and environment.