Supermarkets and Hypermarkets in China: A revolution yet to come | daxue consulting

How is the supermarket and hypermarket industry in China currently performing?

Supermarkets and hypermarkets in China are becoming more and more prevalent. A supermarket is a large form of the traditional grocery store: a self-service shop offering a wide variety of food and household products, organized into aisles. A hypermarket, on the other hand, differs slightly in that it is a superstore combining a supermarket and a department store. It is an expansive retail facility carrying a wide range of products under one roof, including full grocery lines and general merchandise. In this article, we look at the evolution of supermarkets and hypermarkets in China.

Competitors in the supermarket and hypermarket industry in China

There are a lot of large domestic and international companies in the supermarket and hypermarket industry in China, such as Wal-Mart, Metro, Carrefour, Trust-mart, Tesco, Lotus, Lotte Mart, RT-Mart, Yonghui(永辉), Renrenle (人人乐), Hualian(华联), and Watsons. Most of these chains have shares held by foreign investments. Only a few are fully domestic to China.

Smaller scale supermarket chains are also frequently seen in China. Most of these are local, and their business is limited to certain geographical regions. For example, Shanxi(山西) province has its domestic chain supermarket brand, Meet All(美特好).

Looking back at 2013, traditional forms of grocery retailers in China rarely achieved an increase in revenue or profit growth in the booming digital era. Many, have since either suffered or struggled to maintain their presence in the market over the past few years. Carrefour, with its sales continuing to plunge, sold an 80% stake of its China unit for 4.8 billion Yuan to Suning.com Co. in June 2019. Bloomberg suggests that Carrefour’s exit represents the ‘end of an era’ for traditional forms of foreign grocery retailers in China. Once a leading hypermarket chain, it failed to improve e-commerce formats against the intensive digital rival within the industry.

Although the grocery retailers in China have been facing fierce competition and stagnating sales growth over the past few years, sales recovery has resumed gradually as many foreign groceries entered the Chinese market and others’ planned to adopt new retail format tailoring to consumer needs. Traditional supermarket chain Yonghui Superstore achieved a 19.7% growth in revenue for the first half of 2019, which represents a CNY 411.73 billion in sales. Similarly, Hema Xiansheng (盒马鲜生)-the leading new retail brand, generated CNY 140 billion sales in 2018. The performance of these two brands should cast no doubt in the ability of the grocery retail industry in China to take grow in the near future.

Market Research of the supermarket and hypermarket industry in China

Legacy players in the supermarket and hypermarket industry in China:

In geographical segmentation, Hualian(华联) has its main business in North China and Mid China, but it is now expanding its business in Southeast China in cities such as Shanghai(上海). It has also opened branches along the Huning(沪宁) and Huhang(沪杭) superhighways.

RT-Mart, the Taiwanese brand which had over 100 shops in mainland China in 2013, centers its business in East China. Huarun Wanjia(华润万家), a Chinese company, centers its business in Suzhou(苏州). Wal-Mart’s main market lies in south China and southwest China, and coastal regions such as Jiangsu(江苏) and Zhejiang(浙江).

Leader in China’s hypermarket industry: Lianhua

As the leader in China’s hypermarket industry, Lianhua has established a complete goods sourcing network and the first intelligent distribution center in China. Its competitive advantage comes from its reasonable prices, the clear allocation of goods its stores, and limited waiting time for customers in line to pay. These factors all cater to the needs of its target customers—mid-income consumers around the age of 30.

Facing increased competition: Carrefour

In 2013, Carrefour operates shops in over 14 provinces and cities in China. Most of its shops are located in relatively developed provinces such as Guangdong (广东), Shanghai (上海), Tianjin (天津), Beijing (北京), and Jiangsu(江苏). Carrefour five most attractive selling points for its customers are: getting what you need with a single purchase; super-low prices; fresh products; self-selection and free parking. Among these five, the super-low prices and fresh goods make it the most competitive. However, in 2019 Carrefour has faced unforeseen challenges. With the sudden rise of online retail, Carrefour’s sales in the market fall 5.9% to $4.67 billion. China’s consumer preferences are changing, and Carrefour.

The retail revival: New entrants and New retail in supermarkets and hypermarkets in China

Players in the supermarket and hypermarket industry in China are embracing the New Retail strategy

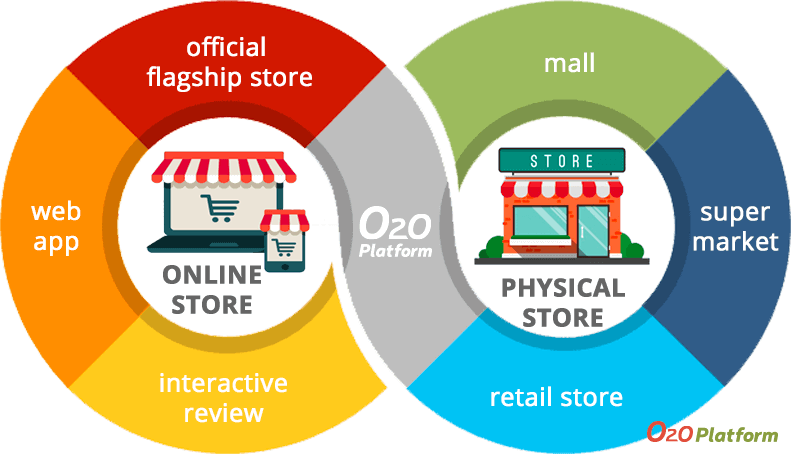

New retail is considered as a key strategy that will lead to a new era of the grocery retail industry in China. It is a seamless approach that integrates both online and offline experiences and relies heavily on digitalization and consumer data.

The offline supermarket Hema Xiansheng, opened by Alibaba in 2016, has successfully implemented the new retail strategy that made it stood out from the fierce digital rivalry. With more digitalized features incorporated in-store, initial high labour costs associated with traditional forms of grocery retails can be significantly reduced and consumer data can be collected at ease. Hema App converges online and offline retail experience altogether to provide an omni-channel experience for its customers. They can easily scan bar codes via the App to find out product information, process payments or get products delivered to home within 30 minutes. Through the use of the App, consumer data which is considered as the most important element in redefining retail can be collected more frequently to help stores better understand and target their customers. Moreover, much less labor is required to run the stores because many human operations are now replaced by digital tools such as ‘self-checkout’ via Alipay using the Hema App or the automated distribution chain. In this way, reduced cost can contribute to much higher profit growth sustaining normal operation.

Overall, Hema’s success suggests that the new retail revival is largely dependent on the ability of grocery retailers in China to understand consumer needs to implement good service. However, since Hema’s growth began to slow down this year, grocery retailers in China will need to improve further on technology and customer experience in order to get a foothold in the industry.

Foreign giants’ attempt to break into the crowded retail grocery market in China

Despite that the miserable exit of Carrefour had casted a cloud over the future of the supermarket and hypermarket industry in China, many foreign grocery retailers such as Aldi and Costco entered the Chinese market this year with hopes to succeed.

In 2019, the German discount retailer Aldi and the US membership-based grocery retailer Costco Wholesale have both opened their first brick-and-mortar stores in Shanghai, China. Thousands of Chinese people lined up outside and waited for the stores to open for the first time. The craze for these two foreign retail brands clearly indicates that Chinese consumers are curious about new grocery retail formats and retains interest in bargains despite pursue for freshness. One large factor attributing to Costco’s success so far is that it offered luxury products such as Moutai and Hermes bags for a reasonable price at the store’s debut. However, the hyper has begun to fade as luxury products were sold out and memberships withdrawn.

Although China remains a viable potential market for foreign supermarket and hypermarket brands to grow, huge challenge lays ahead for these brands to truly grab the Chinese market facing rapid growth of online retails and intense competition of local retails.

The outlook of supermarkets and hypermarkets in China: challenges and future trends

Digitalization

In order to respond to the rapid digital growth, many brands have established future plans to improve current technologies in-store by becoming more AI-oriented. Alibaba has introduced AI-powered Hema stores recently to drive digitalization of retail industry. While the newly adopted check-out machines incorporate facial recognition payment function, the continuous upgrades of machine learning AI algorithms will match more precisely consumers’ need.

Moreover, many high-tech ‘unmanned’ grocery stores have opened recently, which implies a fully automated future of supermarkets and hypermarkets. Customers only need to scan QR code once before they enter the store. The price of the products they grab and go will be automatically deducted from their digital wallet as they walk out of the store. These stores are generally quite small in size, nevertheless is expected to further expand in the near future.

Establish stronger O2O integration

O2O is a online-to-offline business strategy that draws customers from online channels to purchase offline. The fierce online and offline competitions in the Chinese market means that a strong O2O is required for traditional forms of grocery retailers to gain a competitive position. Establishing partnership with China’s internet giants such as Alibaba, Tencent and JD.com will allow retailers the access to different tools, big data analytics, etc.

Not only traditional grocery retailers should be seeking partnerships with the big internet companies, but also should those foreign grocery retail giants such as Walmart, Costco or Aldi. In June 2018, Walmart reached strategic cooperation with Tencent. This movement by Walmart allows it to utilize the strength of Tencent to provide enhanced omni-channel shopping experiences for its customers through precision marketing, membership system upgrade, comprehensive payment services, etc.

More efforts on private labels

Despite that SKUs of private label products increased from 435 in 2016 to 633 in 2017 for the Top 100s, its sales only accounted a mere 6.4% of the total sales in 2017. Profit margin for these products are around 15% higher than those that are not. However, there is currently not enough effort being put on developing and marketing these products. Therefore, developing private label will be an effective strategy to penetrate the market as most of the leading grocery retailers in China have not yet effectively launched successful private labels.

Although many foreign retailers have already successfully launched their own private labels such as Kirkland Signature by Costco and Specially Selected by Aldi, more efforts are required to build positive brand images within consumers’ minds for these brands.

What is next for supermarkets and hypermarkets in China?

Overall, under rapid market growth, upgrades of technology and omni-channel experience is unavoidable to supermarkets and hypermarkets in China for the foreseeable future. Grocery retailers have to gain more understanding of Chinese consumers in order to maintain presence in the market and acquire more market share.

Let China Paradigm have a positive economic impact on your business!

Listen to China Paradigm on iTunes