The rise of Chinese domestic cosmetics brands: Florasis, Little Dream Garden, WIS, and Perfect Diary

With an increasing income and the growth of related industries like e-commerce, the cosmetics industry is gaining incredibly momentum. Historically, foreign cosmetics brands took a larger market share, however as of 2020, Chinese domestic cosmetic brands are giving foreign brands a run for their money. This piece explores the marketing strategies of Chinese cosmetics brands, and what we can learn from them.

Overview of the Chinese cosmetics market

China’s cosmetics performance in the global stage

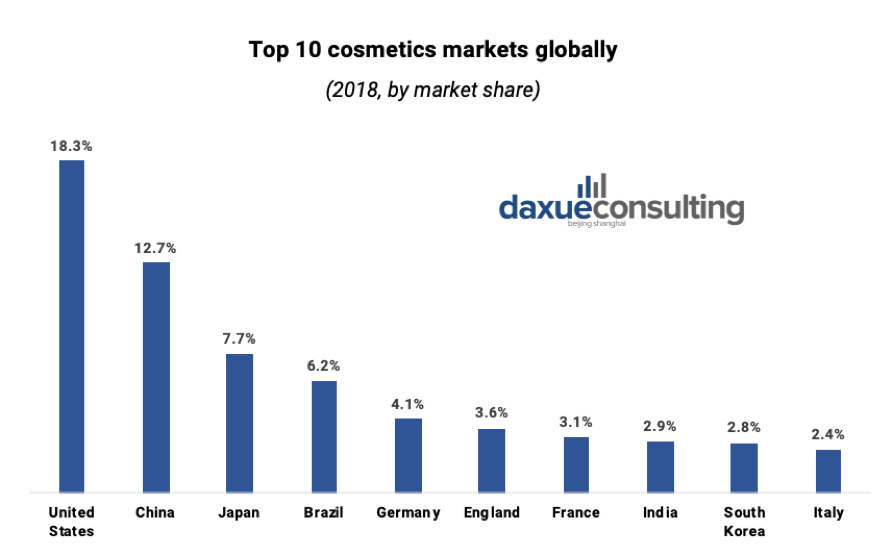

According to Euromonitor, China’s cosmetics market occupies 12.7% of the global cosmetics market, becoming the second-largest market after the US.

Data source: Euromonitor, Top 10 cosmetics markets globally

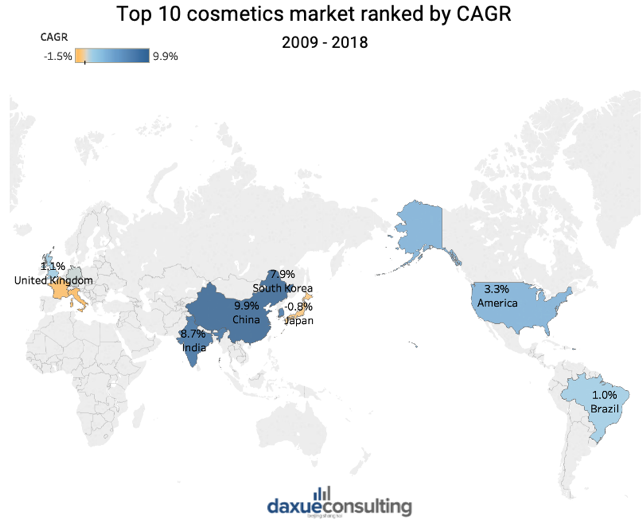

Even after several years of market expansion, the market still seems to have a fine potential for growth in the future. According to Euromonitor, the CAGR of the Chinese cosmetics market is the highest in the world.

Data source: Euromonitor, Top 10 cosmetics market ranked by CAGR

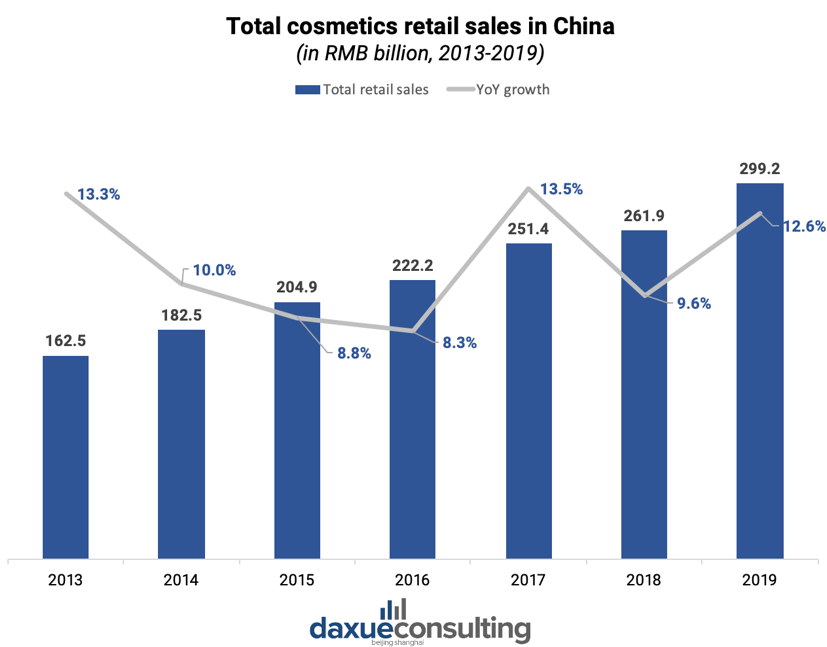

Based on data from the National Bureau of Statistics, the yearly growing pace is remaining at about 10% since 2013 and the total retail sales reached 299.2 billion RMB in total. Hence, investing in such a large and consistent growing market can bring high revenue to the company.

Source: National Bureau of Statistics, Total cosmetics retail sales in China

Chinese domestic cosmetics brands are prospering

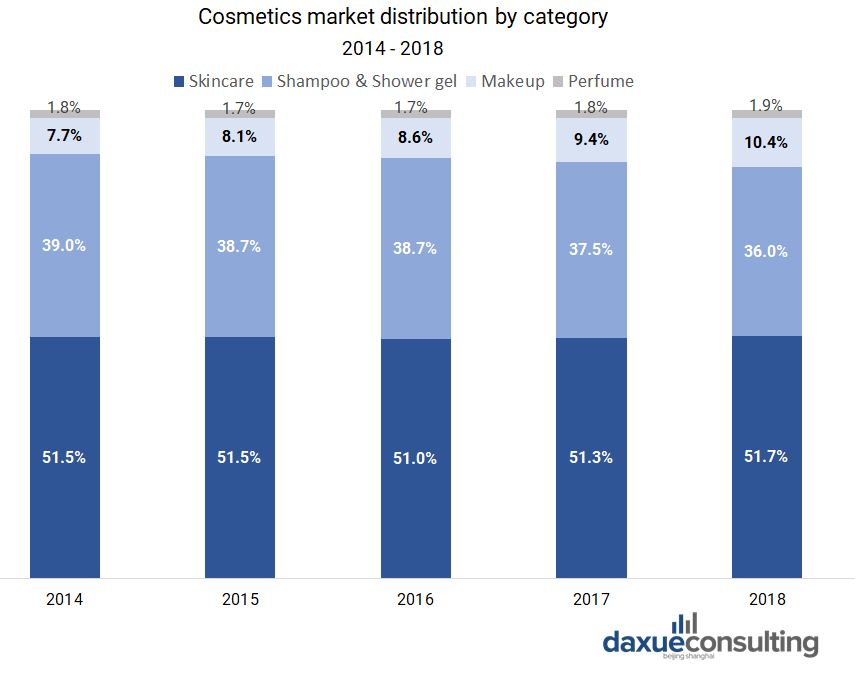

Cosmetics comprise a wide range of products like skincare, makeup and perfume. In the Chinese cosmetics market, skincare products are the main consumption force, and makeup products increased its market share year by year. Skincare products consistently accounted for over 50% of the Chinese cosmetics market. On top of this, makeup products have been continuously increasing since 2014.

Data source: Euromonitor, Cosmetics market distribution by category

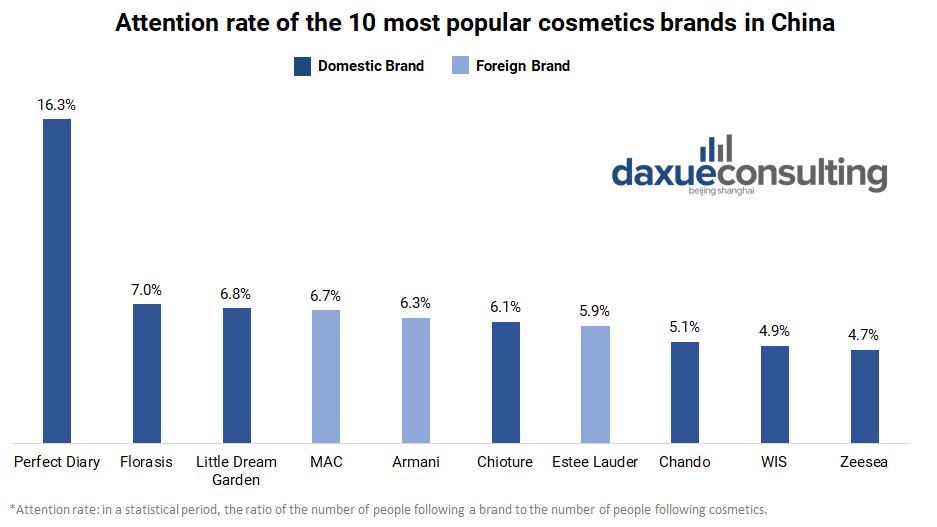

Seven of the ten top cosmetics brands in China sare Chinese domestic cosmetics brands. The attention rate of Perfect Diary is far higher than other brands, meaning that a lot of cosmetics fans in China follow Perfect Diary.

Data source: QuestMobile New Media, Which Chinese domestic makeup brands are the most popular

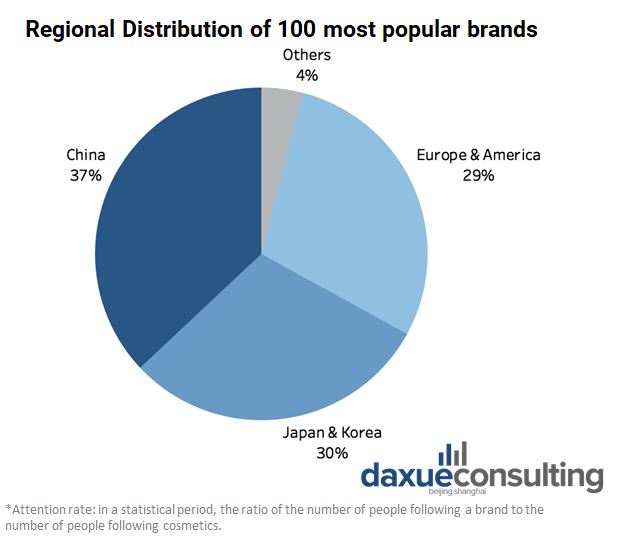

Among the top 100 most popular cosmetics brands in China, 37% are Chinese domestic makeup brands.

Data source: QuestMobile New Media, Regional Distribution of top popular 100 brands

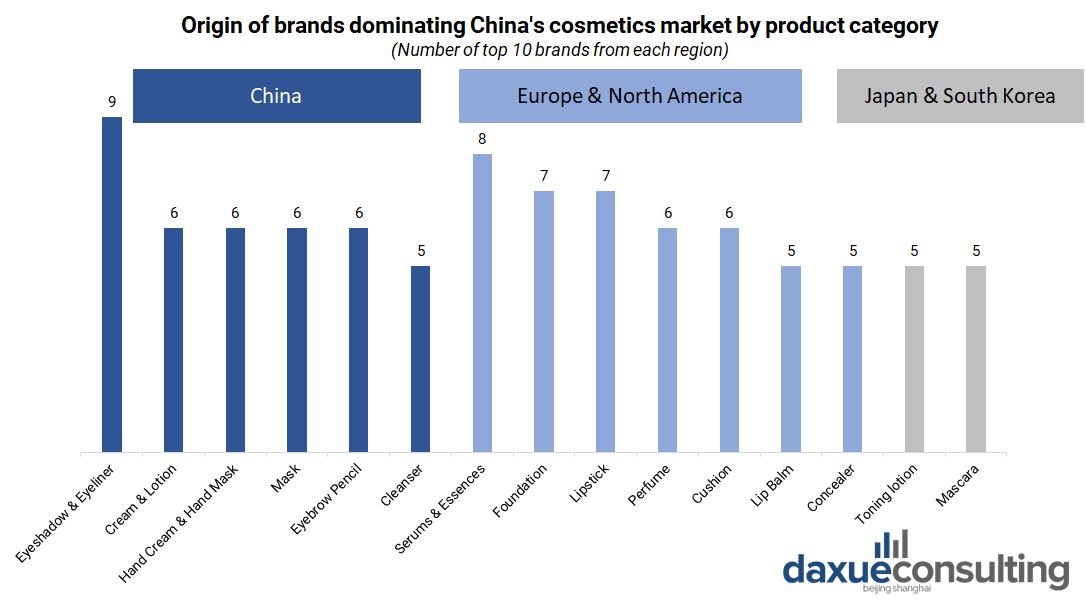

There are two cosmetics categories where Chinese domestic cosmetics brands have a strong position. These categories are essential skincare related products and eye make-up. Essential skincare products like hand cream, mask and cleanser have high daily consumption. Chinese domestic cosmetics brands could use price advantage to compete, through controlling the supply chain to lower cost. Besides, unique design helps Chinese domestic makeup brands make eyeshadow and eyebrow pencil hot products.

Data source: QuestMobile New Media Database, Origin of brands dominating China’s cosmetics market by product category

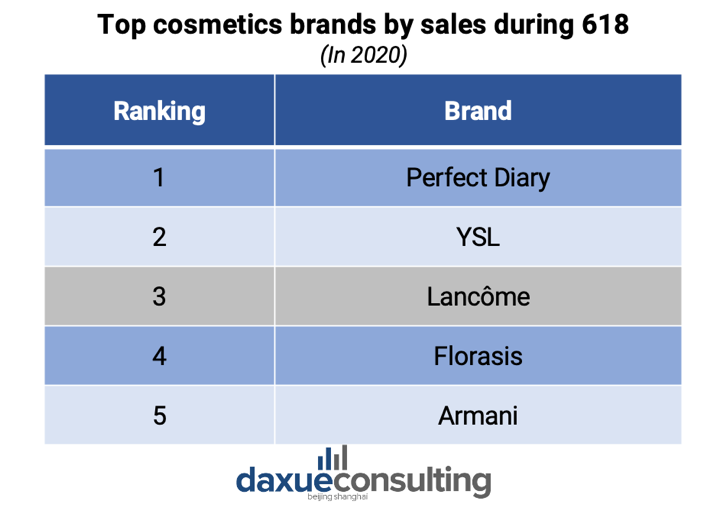

The rise of Chinese domestic makeup brands is correlated with sales promotions. According to Askci, 2 of the top 5 sales brands were Chinese domestic cosmetics brands during 618 shopping festival in 2020. Perfect Diary and Florasis ranked first and fourth respectively.

Data source: Askci, Cosmetics brands sold most during 618 shopping festival

Chinese cosmetics consumers portrait

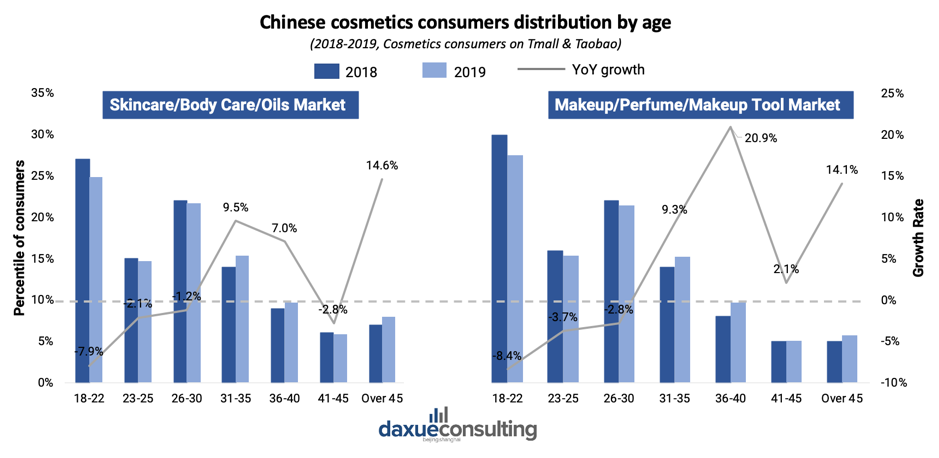

According to data on Tmall and Taobao, consumers under 30 years old place most of cosmetics orders. Most of them are post-90 or even post-00. Students aged 18–22 made up over 25%, but their market share has decreased.

Data source: Tmall & Taobao, Chinese cosmetics consumers distribution by age

However, the share of consumers over 30 years old has an overall increase. This increase might because people aged over 30 gradually build and wake up the awareness of using skincare and makeup. Therefore, the demand for cosmetics among them goes up.

What Chinese domestic cosmetics brands consumers purchase most

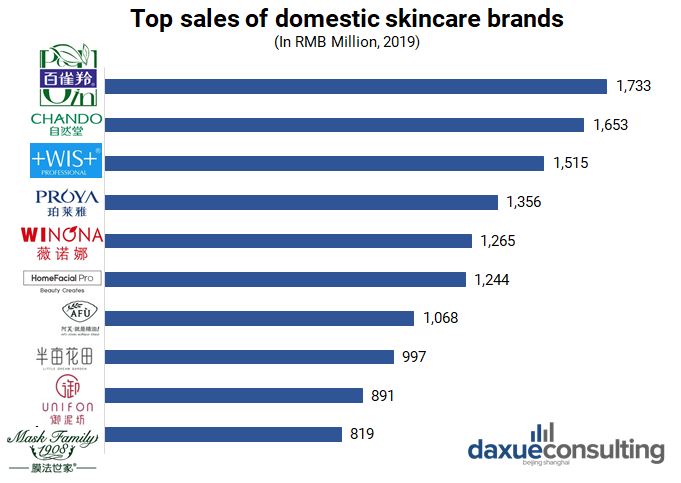

According to the skincare top sales, Pechoin harvested 1,733 million RMB in sales, ranking first, followed by Chando and WIS, with 1,653 and 1,515 million RMB respectively.

Data source: Tmall & Taobao, Top Chinese skincare brands

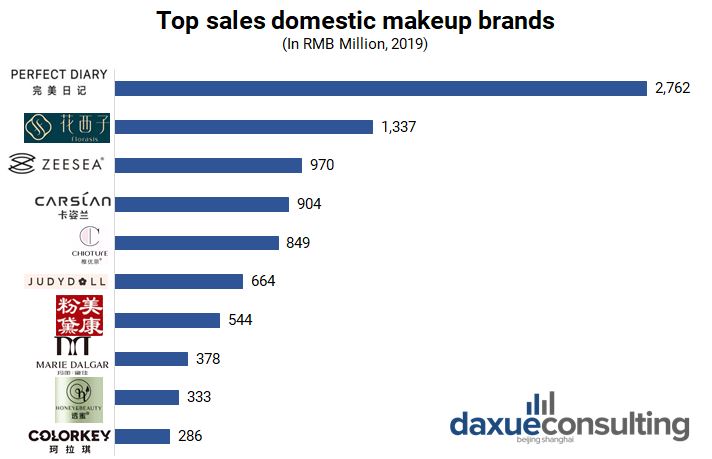

In the makeup market, top brands are different from top skincare brands, although some makeup brands provide cosmetics products. Perfect Diary maintained its performance and ranked first, with 2,762 million sales.

Data source: Tmall & Taobao, Top Chinese makeup brands

What makes Chinese domestic cosmetics brands different

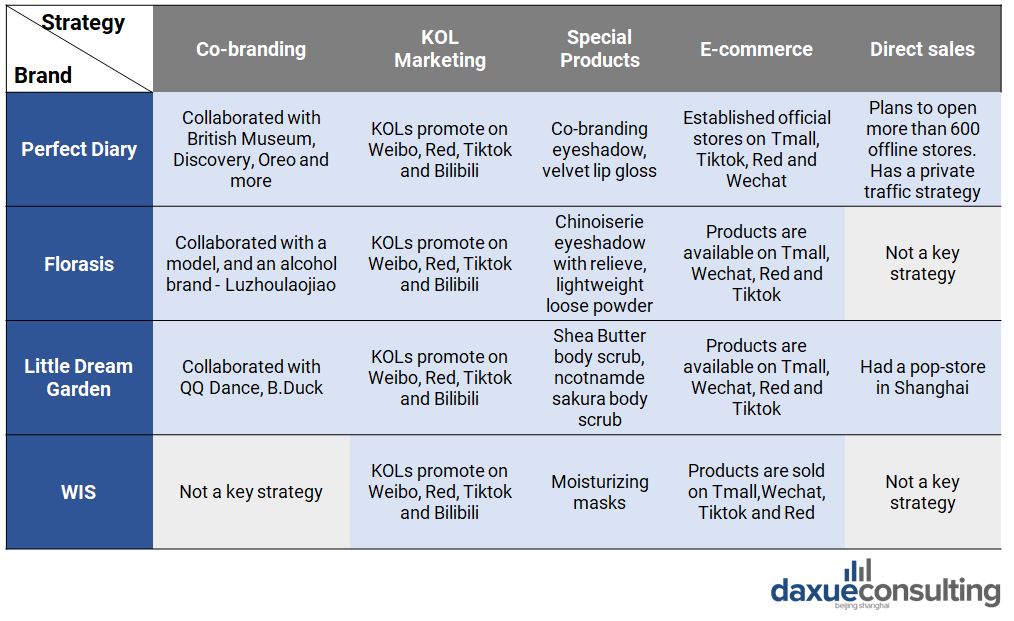

Compared to foreign cosmetics brands, Chinese brands seem to put their eggs in more baskets. Their marketing efforts are spread through much more variety of activity and spread across many more platforms.

Creating a KOL marketing feedback cycle with short video apps, live-streams and KOLs

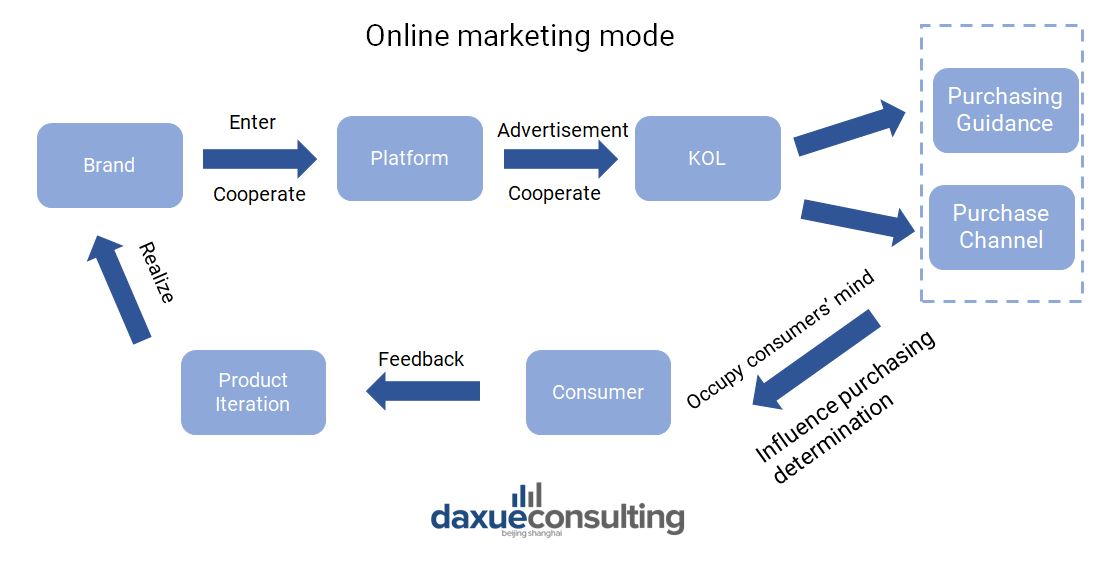

The rise of most Chinese domestic cosmetics brands attributes to social seeding through KOL marketing and cooperations. This feeds a feedback cycle where consumers give feedback on open platforms, where brands can then apply to their product development.

Data source: QuestMobile, Online marketing mode

Leverage traffic of multi-channel, post content in different forms

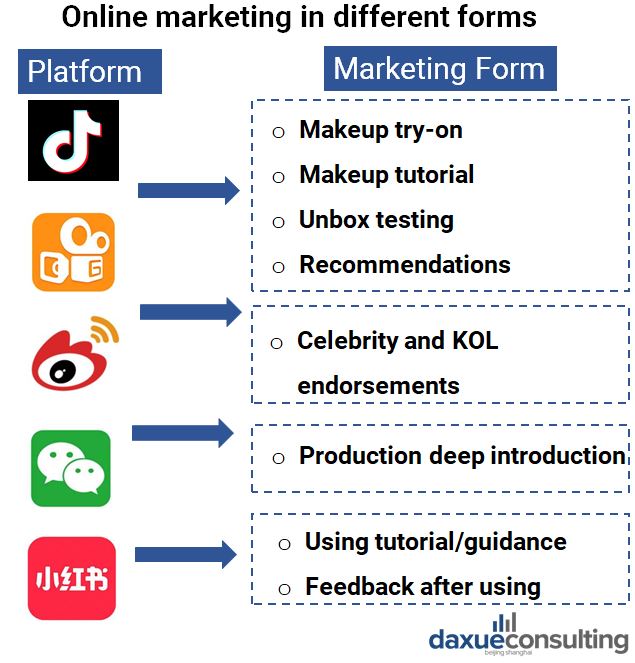

Traffic in multi-channel is other boost for the development of Chinese domestic cosmetics brands. It is common to market on Douyin, Kuaishou, Weibo, Wechat and Red, but each social platform has its own marketing strategy. On Douyin and Kuaishou, where people post short videos, brands cooperated with KOL to post makeup try-on, makeup tutorial and unbox testing. On Weibo, brands normally implement celebrity endorsement. On Wechat official account, brands post deep introduction of products. On Red, brands and KOLs post products-related tutorial.

Data source: QuestMobile, Online marketing in different forms

Launch cross-over products in big e-commerce promotion

Co-branding is more a strategy to get hold of targeted audiences who have complex behaviors. Through cooperating, brands can find a connection between consumers and brands. For example, Chando’s cooperation with Bilibili is a new try for its marketing strategy. As a place attracts most young generation, Bilibili provides a platform for Chando to increase consumers base.

Source: Chando, Chando X Bilibili

Unique marketing strategies for each Chinese domestic cosmetics brand

Perfect Diary, a textbook case for private traffic

Perfect Diary, established in 2016, is one of the young Chinese domestic brands. It targets 20-35 year old women, which is a high spending power group. In March 2017, it opened an online store on Taobao and Tmall. Half a year later, Perfect Diary opened on Red, WeChat store and hosted three Pop-up stores in Shanghai. In 2018, It established a Douyin and JD store. On January 19th, 2019, it owned the first offline experience store in Guangzhou and expanded to 40 offline stores now.

Behind Perfect Diary’s bold IP collaborations

IP cooperation is becoming a popular marketing method for domestic Chinese brands. Perfect Dairy cooperated with lots of IPs to launch new products. The most popular IP cooperation is with the Discovery channel.

Source: Tmall, Perfect Diary X Discovery

The history of Perfect Diary’s IP cooperation consists of three stages. In the first stage, Perfect Diary started to explore the market and launched fashion week related products. It reached celebrities, who have high credibility and cultivate the trust in the market. In the second stage which is the explosive phase, Perfect Diary cooperated with cross-over IP and KOLs to promote a single product. In this stage, it cooperated with makeup KOLs and reached to the followers, which increase the influencing power of brand. In the third stage where the brand continuously grew, it cooperated with mass and trendy IP. This cooperation helps to expand customers group, including people make-up beginners.

Perfect Diary implements private traffic to build brand-owned traffic pool

Perfect Diary builds private traffic in two ways and uses two virtual BA (Beauty Advisor) to manage different types of consumers. Xiaowanzi (小完子) is in charge of consumers, who purchase online and joined through a lucky money card. Xiaomeizi (小美子) maintains the consumers who attracted from offline pop-stores or give aways. The source of customers is different, which requires two virtual BA to communicate customers in different tactics.

Data source: Maoshihu, Process to reach Xiaowanzi

Florasis redefines the oriental cosmetics

Florasis’ sales performance is rising

Florasis was founded in March 2017 and opened its Tmall flagship store in August 2018. Although the sales for 2018 were only 43.19 million RMB, Florasis’ sales reached 1.1 billion RMB in 2019, rising nearly 25-fold.

Florasis also presents an excellent in its first Double Eleven promotion. According to Mktindex, Florasis gained 220 million RMB sales and ranked fifth among the top 10 Chinese cosmetics brands that gained most sales.

Distinctly Asian makeup

As a chinoiserie cosmetics representative, the idea behind Florasis brand is ‘the Oriental makeup, using flowers to nourish the makeup look’. It includes everything from product ingredients to package design. Product ingredients highlight to use nature grasses and flower, and nourish the skin mildly. Package design and product name also filled with chinoiserie. For example, Florasis’s carved lipstick replicates the ancient Chinese carving technique and carved flowers on the lipstick, creating a precedent for the three-dimensional texture lipstick in China.

Source: Taobao, Florasis’s classical relievo

Pregnant woman friendly

Florasis gives people a safe and harm-free impression. It emphasizes that its products contain zero alcohol, zero-hormones and contains no harmful ingredients. An actor (Jiani Zhang) in Story of Yanxi Palace, which is a popular Chinese drama, recommended Florasis’ CC cushion. Zhang posted her using experience as a pregnant woman on Red, which drew most followers’ attention and discussion.

Source: Red, Jiani Zhang promoted Florasis’ product

Picking right KOL and spokesman

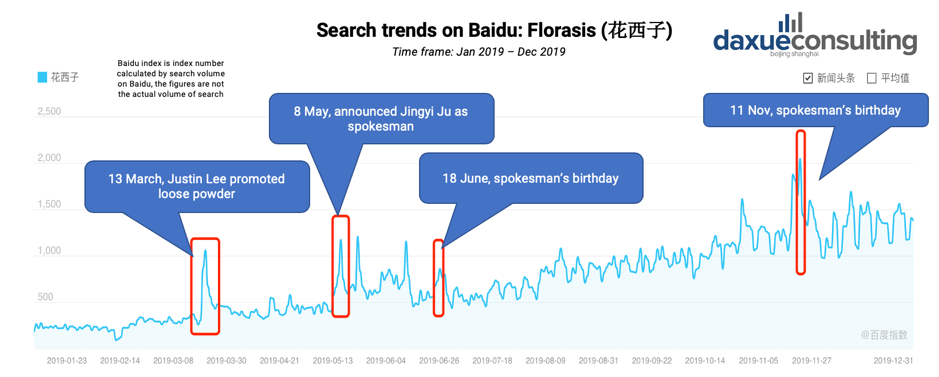

According to Baidu Index, the spokesman’s effect can be observed. On 3rd March 2019, search word ‘花西子’ peaked because Justin Lee promoted Florasis’ loose powder. Another peak on 18th May 2019 is because Florasis announce Jingyi Ju as spokesman. Jingyi and Florasis is a perfect match, because Jingyi owns high traffic and was known as the oriental beauty.

Data source: Baidu index, What increase the search of ‘Florasis’

Little Dream Garden, a black horse in the body care market

Targets ingredient-oriented consumers

Little Dream Garden is a Chinese cosmetic, focusing on developing body care products. It targets customers who care about the ingredients. Therefore, it emphasizes the ingredient and efficacy, naming product by main ingredient, such as Shea Butter body scrub and Ceramide body lotion.

Source: Taobao, Shea Butter body scrub

Posts testing video to build trust

Little Dream Garden leverages KOLs and KOCs to post product testing videos on Red, guiding users to join in the discussion. The opinion of KOL and KOC can increase trust rate and prompt consumers to buy the products.

Source: Red, Products testing video

How WIS involves celebrities on Weibo

WIS is a Chinese domestic skincare brand, created in 2011. It aims to provide scientific and effective products. It does not have any offline store so far. The brand targets consumers aged 18 -35 who have the strong social ability. For brand positioning, low-price capture lots of post-90 and post-00’s interest.

Source: Wechat, WIS products

Weibo is WIS’ social marketing asset

The popularity of WIS results from social marketing on Weibo. For example, a member of Happy family, Weijia Lee, recommended its product on Weibo, which attracted more than 240 million readers and brought around ten thousand followers for WIS. At the same time, celebrities, such as Jiu He and Na Xie, reposted the Weibo and reinforce the marketing effect.

Source: Weibo, Weijia Lee promoted WIS

What can brands learn from the success of Chinese domestic cosmetics brands

Although foreign cosmetics brands represented more than half of the cosmetic market in China, the rise of Chinese cosmetics cannot be overlooked. In fact, they can provide a learning opportunity on how to effectively appeal to Chinese consumers.

- Listen to the customers

Under short video App + Live Broadcast + KOL marketing mode, brands not only promote their products but also listen to the feedback from customers. Upgrading products according to the feedback is an important strategy to maintain brands’ sales performance.

- Pick the right brands for collaborations

Most Chinese domestic cosmetics brands implement cooperation with brands in different fields, celebrities and etc. to launch limited products. This campaign can bring the brands more consumers, strengthen brand image and increase brand volume.

- Promote in an appropriate form

Chinese cosmetics brands promote their products in different forms according to the character of a product. A testing video will gain more trust for a product that emphasizes its harmless ingredients.

Learn more about the Chinese cosmetics and personal care market

Listen to 100 China entrepreneur stories on China Paradigms, the China business podcast

Listen to China Paradigm on Apple Podcast