Mobility in China: Opportunities and challenges of when ride-hailing meets delivery

The champions of mobility in China include the ride hailing service Didi Chuxing and the food delivery service Meituan. But in the overlapping space between food delivery and ride-hailing, China lacks a dominant competitor which can do both like Uber in the west. However, that does not mean Didi or Meituan have not taken their shot at capturing the entire market. We evaluated the methods and challenges of expanding into each-others business territory to see just how much room is left for opportunity.

Meituan officially launched its own ride-hailing APP Meituan Dache (美团打车Meituan ride-hailing) for Shanghai and Nanjing’s markets.

Meituan Dianping is a Chinese website and APP for food delivery services, consumer products and retail services. As a very typical representative of mobility in China, Meituan Dianping was originally called Meituan. After merging with Dazhong Dianping it changed its name to Meituan Dianping.

As a leading food delivery APP, Meituan also started to develop its ride-hailing service in China, which is a significant step of its business strategy to improve the system of mobility in China. Meituan Dache, Meituan’s ride-hailing app in China, ranked third in the App Store Free download list after its official launch in Shanghai for a week in February, 2017.

On March 21, 2018, Meituan officially announced its first batch of expansion cities of new ride-hailing business, including Beijing, Shanghai, Hangzhou, Xiamen, Chengdu, Fuzhou and Wenzhou. Also, Meituan began to recruit drivers in these cities. However, the plan was not implemented after a year-long period of stagnation.

Challenges for Meituan: Competition and regulations

After entering Nanjing, Meituan heavily subsidized the drivers to grasp more opportunities to compete with Didi. Also, Meituan divided the drivers into three levels and gave different subsidies accordingly. For instance, at the beginning, the standard earning for new drivers was 2,200 yuan per week. After reaching the standard, the drivers can get 800 yuan extra bonus per week.

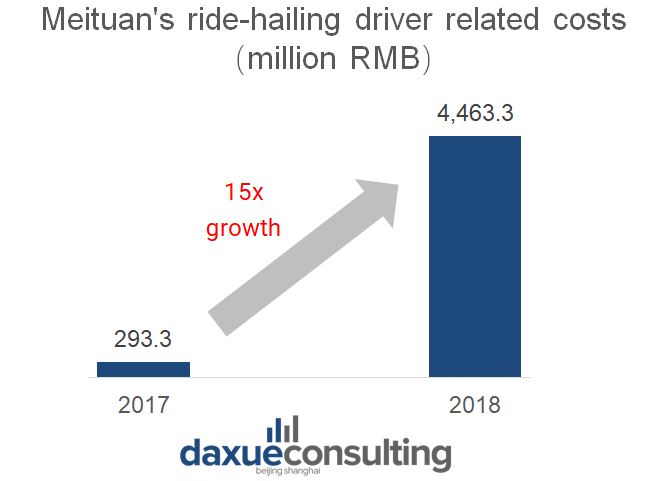

Hence, the cost associated with its ride-hailing drivers increased exponentially, from 290 million RMB in 2017 to 4.46 billion RMB in 2018, with an average monthly investment of 370 million RMB in 2018.

Date Source: Meituan Dianping 2019 annual report – Meituan’s ride-hailing driver related costs (million RMB)

In order to expand the market share quickly, Meituan launched a price war against Didi through subsidies in Shanghai and Nanjing. But the war did not last long since Meituan cut its subsidies shortly after. To maintain its market share in Nanjing and Shanghai, Meituan lost 50 million dollars per month. Additionally, the transportation sector intervened and warned Meituan against disturbing social order by starting price wars.

The Meituan Dache APP drained Meituan’s finances

According to the Q1 2019 financial report released by Meituan, the new Meituan business, including the travel business, spent 31.3% of the sales cost but only contributed 20.8% of the revenue. This added to a total loss of 439 million RMB in Q1 of 2019.

The cost of sales of Meituan new business decreased from 5.2 billion RMB in Q4 2018 to 4.4 billion RMB in Q1 2019 and the revenue also decreased from 4.2 billion RMB in Q4 last year to 3.9 billion RMB in Q1 2019.

As for the two financial figures, the report explained that it was mainly due to the significant reduction of subsidies for ride-hailing services in China in Q1 2019 and improved profit margins of new businesses and other divisions. Meanwhile, Meituan will continue to restructure mobike’s overseas business in order to reduce the loss of the bike-sharing business.

Merged to Meituan APP from Meituan Dache APP

Since late April 2019, although Meituan’s ride-hailing endeavor has once again been launched in Nanjing, Shanghai and other 17 cities, it is no longer the former Meituan ride-hailing APP. Meituan Dache was transformed from the self-management team to an aggregation platform.

The new Meituan ride-hailing APP in China provides travel services for users by accessing travel service providers such as Caocao travel service, Shouqi car-hailing service and Shenzhou special car service. This means that Meituan no longer did its own business, but instead became an aggregation platform.

Users can go directly to ‘ride hailing’ from the restaurant booking page, which allows them to call a car in real time or for reservation. Meanwhile, users can choose from a menu of car types including taxi, economy, comfort, business and luxury by Shouqi Taxi, Caocao Taxi and Shenzhou Private Car.

Source: Meituan App open interface

If the users of Meituan ride-hailing want to call a cab to a restaurant, they can also directly click the ‘ride-hailing’ button on any restaurant business page in the Meituan APP. The system will identify the location of the user and the address information of the restaurant, automatically fill in the starting and ending address. As a result, Meituan created a ‘one click’ solution to call a car directly to the restaurant, all within the same app.

Didi Chuxing started its food delivery business in China

Source: losborgia.com – Didi launched the food delivery business in China

Didi Chuxing Technology Co., formerly named Didi Dache, is a Chinese transportation company. As the leading company in ride-hailing in China, Didi Chuxing (滴滴出行) launched its food delivery service locally. On March 6, 2018, the first 9 cities to launch Didi Takeaway (滴滴外卖) were Wuxi, Nanjing, Changsha, Fuzhou, Jinan, Ningbo, Wenzhou, Chengdu and Xiamen. Didi Takeaway wanted to win the first batch of merchants and users by reducing commission and issuing rewards. Wuxi city was the first target city for Didi, in June 2018, and then Didi entered Nanjing, Taizhou, Chengdu and Zhengzhou in July. Didi Takeaway has posted their discounted information on the platform, such as 1 RMB ice cream, 2 RMB tofu pudding and 2.5 RMB barbecue. These discounts have helped Didi attract many users in a short time. However, Didi failed to enter the sixth target city, Ji’nan, due to the low profitability in previous five cities.

So far, Didi has not entered a sixth city and the previous five cities are still operating normally. Nevertheless, according to consumers, because the subsidies lasted only a short time and there were only a few merchants in the app. Additionally, some said Didi poorly designed the interface of the takeaway platform, hence Didi delivery was largely forgotten in the market.

Didi has invested 1 billion rmb in food delivery service in China in 10 months

In December 2017, Didi launched their food delivery business in China. Some people think that as Meituan entered the ride-hailing market in China, Didi fought back by entering the food delivery Chinese market.

There have also been media reports that profitability of UberEats, a food delivery business run by its international rival Uber, inspired Didi.

However, although Didi invested more than 10 billion rmb in food delivery business in China, the result wasn’t as good as expected. On 15th February 2019, Cheng Wei, founder and CEO of Didi Chuxing, announced that Didi will focus on its most significant ride-hailing business in China, continue to increase investment in safety and compliance while improve efficiency, so the non-core business may be closed.

Didi will shift the market for its food delivery business abroad

Mobility in China is becoming more mature and competitive. As a result, companies try to develop into overseas markets. Didi launched its food delivery service ‘Didi food’ service in Osaka, Japan in April 2020.

Source: Twitter.com – Commercial of Activities by Didi post on twitter in Japan (Summer delicacies for you to eat! Activities in progress)

Meanwhile, DiDi Food announced its expansion to Aguascalientes, Toluca, Chihuahua, Torreón, and Saltillo in Mexico on 22th April, 2020. So far, the company has already been operating in Mexico City, Guadalajara, and Monterrey. The mobility in Mexico is still in its infancy compared to the mobility in China.

Additionally, Didi has expanded restaurant delivery service from convenience stores and pharmacies to encourage people to stay at home during the COVID-19 epidemic.

87% of restaurants in the Didi app are small and medium-sized enterprises. Sales of these partner restaurants have risen 45% since the lockdown began. So far, restaurant enrollments have increased to 75% per week, while delivery partner enrollments have increased to 250% per week.

Source: kr-asia.com – Didi wants to challenge Uber by bringing Didi Food delivery service to Mexico City

The challenges that Meituan and Didi are facing

Didi and Meituan are definitely the giants of mobility in China. However, there are still big challenges as they try to overlap the ride-hailing business and food delivery business in China.

As an instrumental APP, the simple platform of Didi is far from being a life-oriented aggregation platform, as it focuses primarily on ride-hailing. At present, users have not yet cultivated the habit of ordering food from Didi, since users are used to the aggregation platform like Meituan or Ele.me (an online food delivery service).

Different from the ride-hailing business in China, which basically needs only online operation and maintenance, Didi needs a large offline business develop team to expand its food takeaway market.

Also, it’s not easy for Meituan. The transportation bureau intervened and warned Meituan against disturbing social order by starting price wars on the day Meituan launched in Shanghai. They announced that all registered cars and drivers of Meituan ride-hailing business in China must obtain the relevant business license for online ride-hailing in Shanghai and the relevant data need be connected to the regulatory platform.

In addition, the Shanghai Municipal Commission of Communications, Municipal Public Security Bureau, Market Price Bureau also warned Meituan that they shall not disrupt the normal market order for the purpose of crowding out competitors or monopolizing the market by operating at a price lower than the cost. Meituan’s should change its advertising slogans such as “starting with one yuan”.

Wang Gang, CEO of Didi analyzed that the competition between Meituan and Didi is not just about ride-hailing business and food delivery business, but “a battle for access to secondary traffic”. Whether Meituan is involved in ride-hailing service in China or Didi is involved in food delivery service in China, both parties can take good use of their users’ consumption scenarios as the basis and form a data circulation system about their users’ consumption preferences for ‘basic necessities of life’. If successful, it will greatly enhance the development of mobility in China.

Author: Qing Zheng

Listen to 100 China entrepreneur stories on China Paradigms, the China business podcast

Listen to China Paradigm on Apple Podcast