Hosa Fitness closed its doors. What is causing the downfall of China’s traditional fitness centers? | Daxue Consulting

In June 2019, the fitness chain Hosa Fitness (浩沙健身) closed overnight, causing a heated discussion. Hosa Fitness started in 1999, and it had 86 stores in 2009. How could such a big fitness brand go out of business? What are the problems of fitness centers in China? Will all of China’s traditional fitness centers face this dilemma?

China’s fitness industry has experienced both an explosion and now a recession

The history of fitness centers in China

China’s fitness industry started around 2000. After that, Beijing’s successful bid for the Olympic Games in 2001 and the SARS epidemic in 2003 set off a nationwide fitness trend. China’s fitness industry was in its prime. During that time, many well-known chain brands such as Hosa Fitness, Nirvana sports, and UION Life began to appear. The industry gross margin exceeded 40%, attracting a large number of players to enter.

After 2004, the fitness industry in China showed explosive growth. In 2010, Beijing had 530 fitness clubs. However, due to the serious homogenization of fitness clubs and the single profit model, gyms competed with price wars. On the demand side, the global financial crisis in 2008 and the rise in housing prices, the spending of white-collar workers on fitness decreased, and the growth of the fitness industry market slowed down. In 2011, the number of gymnasiums in the country showed negative growth.

Until 2015, with the rise of fitness apps represented by “Lefit“, “Keep“, “Super Monkey“, the fitness industry once again ushered in rapid development. However, the new direction of development did not favor traditional fitness centers, and exposed the problems of fitness centers in China.

The current conditions of China’s fitness industry

The population of gym-goers in the United States accounts for 20.3% of the total population, while in China it is only 3.1%. Though China still has a large gap in the number of fitness clubs and the number of fitness members, China’s fitness industry is continuously expanding. According to the National fitness plan 2016-2020, the number of people who take part in physical exercise at least once a week will reach 700 million in 2020, and the number of people who take part in physical exercise regularly will reach 435 million

Compared with the North American market, the development of China’s fitness industry is relatively lagging due to the following reasons: Firstly, the domestic cost of fitness is higher; the per capita fitness expenditure in China is more than the US. Additionally, the fitness industry in China has a single format and a serious homogenization of service content.

Hosa Fitness collapsed overnight. The mass closure of fitness centers in China

Problems of fitness centers in China: the prepaid model leads to high debt ratio

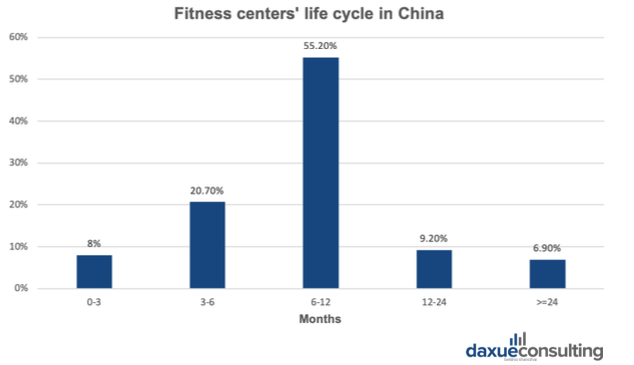

According to the 2018 fitness industry report, nearly 84% of fitness clubs last less than 12 months. There are various reasons for the closure, such as increased competition in the market, poor management, the downturn in the economic cycle, etc. However, problems of fitness centers in China are all about “cash flow drying up”.

Just as most service industries, China’s fitness industry adopts a prepaid model. Fitness clubs receive cash flows for the next year or even five years at the moment they sell their year cards and private courses, which makes the payoff period extremely short. Some clubs can even recoup their investment costs as soon as they open, and locking up customers at the same time. The problem, though, is that these huge cash flows are not counted in the club’s profits. There’s a joke going around in the fitness industry.

“When the club’s membership consultant makes money, the coach makes money, and even the front desk makes money, the boss doesn’t necessarily make money.”

Sales commissions for membership consultants and coaches are paid out the same month. In order for a fitness center’s owner to profit, the gym needs to continuously acquire new customers. Many clubs’ owners bet on the ‘hot headed’ compulsive buying of fitness beginners. In other words, the gyms profits are dependent on the immediate decisions of beginners, but not on retaining loyal customers. Under this condition, many fitness centers are more concerned with the selling power of membership consultants and coaches rather than the quality of service they provide for current members.

This creates a vicious circle. A fitness club can only roll cash flow by absorbing new members without any intention to improve service quality. Without improving service, there will be no renewal rate in the second year. Therefore, it is the norm for fitness clubs to go out of business after only two or three years. The biggest problem here is that the prepaid model makes the club’s debt ratio too high.

The impact of debt on fitness centers in China

What are the consequences of a high debt ratio?

From the management perspective, the fitness club will only have expenses with no income in the coming year for every member. The gym loses money even if members only come to bathe without using any equipment.

In terms of capital, high debt ratio makes the club’s ability to resist risks very weak. Once the market environment changes, it is easy for traditional fitness centers to crash. Hosa Fitness is a typical example. Once Hosa International (the parent company of Hosa Fitness) stock price crashed, the company’s capital chain fractured. Negative news triggered consumer panic, causing the performance of the Hosa Fitness to decline. Because the cash flow was no longer sustainable, Hosa international was unable to provide support, and Hosa Fitness failed to seek financing alone and eventually collapsed.

In fact, when Hosa Fitness announced its official opening in 2017, it should have encountered insufficient funds. Normally, fitness chains insist on directly operating their stores, but Hosa Fitness had to switch to franchising their stores to get funds.

For the prepaid model, China’s government departments lack effective regulatory measures. According to the “Corporate Bankruptcy Law“, when enterprises are bankrupted and liquidated, the wages and labor insurance expenses owed by the enterprises are preferentially paid off. Then is the taxes owed by the bankrupt enterprises. Since gyms that bust tend to owe large salaries, there has been a lot of spending chaos. For example, it is hard to re-sell memberships, and the gyms refuse to give refunds, hence gym members encounter unfair treatment in the fitness centers.

Traditional gym chains in China are often battered with negative reviews. According to the comments on Dianping, among the 18 fitness clubs of 6 well-known chain brands, the lowest rate of negative comments is at 9.7%, the highest at 31.1%, reaching 21.5% on average, and the rate of positive comments is only 65.6% on average.

How can China’s traditional fitness center survive and go further?

With the warning of Hosa Fitness, is there a way out for China’s traditional fitness centers? What are solutions to the problems of fitness centers in China?

Firstly, reducing the prepaid period can reduce debt, switching the annual membership to a monthly system. America’s experience may be instructive here. The mainstream of fitness clubs in the US offer monthly membership. In general, the monthly card is charged 50-60USD, and the high-end one is about 100USD per month. Also, there are some compromised approaches, such as a seasonal card or half-a-year card, etc. But this way will also increase the pressure on cash flow, pressing higher requirements for the operation.

Another option is to improve the attendance of classes. Registrations for classes and training sessions are good indicators of the success of a fitness center, as they are a method to make secondary profit from current members. Data show that in 2018, the average number of private training sessions in Hosa Fitness was only 67.3 classes per month.

There are also ways to improve cash flow by increasing retail sales, such as water bars, nutritional supplements, and peripherals. But for now, this is still a small supplement. According to the 2018 fitness industry data report by 三体云动, retail sales account for only 3.1 % of gym revenue.

It is difficult to achieve a low debt ratio in traditional fitness clubs without changing the target users and product forms. In terms of problems of fitness centers in China, traditional gyms need further transformation and upgrading. The model of traditional fitness clubs in the future must not be as sales-oriented and must pay attention to service and reputation. The profit model in the past will be gradually eliminated, and the traditional fitness clubs will eventually return to being service-oriented.

For example, gyms can use group classes to attract new customers. The Chinese fitness population is small and the starting point is low. Classes offer a good starting point for beginner, and can stimulate secondary consumption. Judging from the popularity of Super Monkey, Spacecycle, Keepland, traditional fitness clubs in China also need group courses to increase users.

Group classes can also increase the stickiness of service. Under the current system, the level of private coach’s service is widely criticized. On the one hand, the expertise of fitness coaches is uneven. The data shows that half of the coaches in China have been in business for less than two years, and the coaches from professional sports colleges only accounted for 25.2%. On the other hand, the sales-focused model of fitness clubs does not play a positive role in consumer experience. Therefore, to improve service and increase the stickiness, the key is to improve the level of personal trainers and create a consumer-focused management system.

The new emerging business model of the fitness industry in China

The threat of new-style fitness centers

As mentioned earlier, the new type of fitness club is threatening the traditional gyms. The following will introduce the profit model of the new type of fitness club in China.

Take SUPERMONKEY as an example. SUPERMONEY is a fitness brand from Shenzhen. The first group class studio of SUPERMONKEY came out in 2015. Most of its studios are located in business districts, with class times before working hours, during lunch, and after working hours.

SUPERMONKEY profits mainly from two aspects: one is cash flow, and the other is cost structure control. In terms of cash flow, the price of each class of SUPERMONKEY ranges from 69 RMB to 239 RMB. Normally, one studio can hold 300 training classes a month, with about 15 people for each class, so the annual revenue of a single store is about 3.8 million RMB.

SUPERMONKEY classes are booked through the WeChat mini program, which allows customers to select and pay online based on store location, class type and class time.

In terms of cost structure, there are six types of SUPERMONKEY stores: universal stores, theme pavilions, bicycle studios, parent-child stores, static stores, and fitness cabins. The area of a store generally between 200-300m2 often located on the second or third floors of malls and office buildings. To reduce costs, there is no front desk or locker rooms. The coach only comes during class, and the users can enter the classroom by entering a code sent only to those who register for the class, which greatly reduces spending on employees.

In the course development and coaching reserve, half of the courses currently come from Lesmills courses, and others are the independently development by SUPERMONKEY. The copyright price of introducing a Lesmills course is high, more than RMB 100,000. Therefore, 90% of the gyms in China, especially the small gyms, do not purchase copyright. In addition, SUPERMONKEY established the Super Scarlet Academy to train its fitness instructor. This is also a preparation for the SUPERMONKEY to start a large-scale private training course or even open a comprehensive fitness center.

A good way to target fitness beginners as the main customers

Whether it’s SUPERMONKEY, Lefi or Keepland, they are all doing the same thing: targeting fitness beginners. Once again, the penetration rate of the fitness population in China is only 3.1%. According to insiders, 99% of those who signed up for an annual membership in traditional fitness centers are fitness beginners. In terms of the current market and the people’s fitness levels, group classes are more in line with the needs of fitness beginners.

Specifically, what are the needs of fitness beginners? They do not need to time and money into a rigorous training schedule with a personal trainer. Rather, they desire to experience the feeling of fitness, find happiness in sweating, and even to show off their healthy lifestyle in WeChat moments. Therefore, the pay-per-visit group classes are enough to meet the needs of fitness beginners.

What about the future?

Targeting fitness beginners is just one of the hottest trends in China’s fitness industry right now. Whether it is a traditional fitness club, or a new type of group classes studio, it is not that easy to lock-in customers. Li Lu from Daxue consulting says,

“Nowadays, customers are disloyal, especially younger ones. Group exercise classes and traditional fitness centers have to find their own irreplaceable points to lock-in customers.“

Unique courses, professional coaches and appealing studios can all be features of a fitness club. Fitness centers need to provide a sense of belonging to disloyal customers. In addition, marketing measures for traditional fitness clubs are old-fashioned, such as flyers and telemarketers. Gyms are better off switching from flyers to digital marketing. When the focus shifts away from desperately making profit to serving the customers, a lot more fun and attractive business models are available to gyms.

Author: Rita Fan

Make the new economic China Paradigm positive leverage for your business

Listen in China Paradigm in iTunes

![[Podcast] China paradigm #21: How to make profit in the fitness industry without establishing a gym](../wp-content/uploads/2019/04/Daxue-consulting_China-paradigm-fitness-industry-150x150.jpg)