Costco’s crazy Shanghai debut: what is the potential for Costco in China? | Daxue Consulting

On 27th August 2019, the US grocery retail giant Costco Wholesale opened its first brick-and-mortar store in Shanghai (Minhang District), marking the debut of Costco in China (mainland). After 5-years of experience in China’s grocery retail market through its flagship store on Tmall Global, Costco has found out who their target consumers are and has built up its brand popularity (Costco Tmall Global flagship store has 1.45 million followers). They have detected that most of the buyers came from East China, especially from Shanghai. China will be a key focus of the US company and the Shanghai store’s performance will serve as a gauge for it to assess whether to push deeper into China’s grocery retail market, said Richard Zhang, the company’s president for Costco Asia.

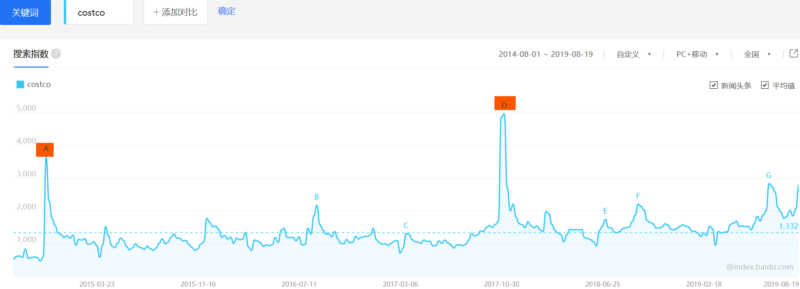

As we can see from Baidu Index, the search term “Costco” has been increasing over the past six months. The two peaks were at Oct. 2014 (A), as Costco and Alibaba announced to start strategic cooperation; and at Sept. 2017 (D), when Costco announced to open offline stores in mainland China. The Chinese name of Costco – 开市客 (Kai shi ke) has not been included in Baidu index yet. Actually, Costco in China has been called 好市多 (hao shi duo), which is the official Chinese name of Costco Taiwan. However, according to Costco, the new name has been registered in Mainland China, and the resulting cognitive loss will need to be compensated by more brand image construction.

The crazy first week of Costco in China

Last Tuesday, Costco opened its door for the first time in Shanghai. Long queues and frenzied shopping are not uncommon in China, German discounter giant Aldi also experienced it just a couple of months ago, as it opened its first two offline stores in Shanghai. However, early shut-down of Costco on the opening day is quite shocking. “In order to provide you with better shopping experience, Costco will suspend business in the afternoon, please do not come.” Said Costco China in the text message to its members.

Costco in Shanghai is facilitated with 1200 parking spaces – more than any other Costcos in the world, however, it seems to be not enough. The streets around the store were paralyzed and the highway nearby was congested. Police were deployed to restore order and manage the traffic. One policeman was standing on the street holding a sign, which warned for 3-hour waiting time for the parking lot.

Inside the store, Costco got so overcrowded that the shopping carts couldn’t even pass through, and consumers had to wait up to two hours in the queues at the checkout counters. Last Wednesday, Costco China issued an apology on its WeChat official account, announcing that it will limit the maximum allowed number of customers in the store to 2,000. Since then, Costco China members have received several text messages everyday with the alert for traffic jam and long waiting time for the parking lot.

Regardless, the huge buzz of Costco in China on the first days does not guarantee the success in the long term. As being observed, the majority of the first-day shoppers were older people living near the store. Most likely, they just went there for the grand-opening special offers. Some of them are probably not even members of Costco. The success of Costco in China still depends on how well it can adapt to China’s grocery retail market, which is extremely dynamic.

Although, according to the data released by IGD, the international grocery research organization, China’s grocery retail market was forecast to grow by 32.6% to 2022, grocery retailers in China have been facing hard situations. There are sufficient grocery retailers in China offering an immensely wide range of products – both national and international. Retailers such as Hema Xiansheng (Alibaba’s New Retail supermarket) and JD.com’s 7Fresh provide consumers with an extremely convenient shopping experience with little boundary of online and offline. On the contrary, global grocery retailers in China have lost their charm to modern Chinese people. For instance, French hypermarket Carrefour, which once dominated China’s grocery retail market, saw its sales in the market fall 5.9% to $4.67 billion last year and decided to sell an 80% stake in its China business, including more than 200 stores for about $700 million.

Challenges for Costco in China

1. Membership-based grocery store in China

Costco in China has started membership recruitment several months ago, with the regular annual membership fee of 299 RMB (42 USD). About one month before the grand opening, Costco announced a discount of 100 RMB for customers registering on and before 26th August. According to Zhang, on the 20th August, Costco in China has already had tens of thousands members, with the majority of frequent buyers living within 30 to 45 minutes driving distance. In the same interview, Zhang said that the store is aiming to have 100,000 members to make its operation sustainable.

Costco is not the first membership-based grocery store in China. Metro entered China’s grocery retailer market in 1996 and only allowed companies to sign up to be members. To date, Metro operates 95 stores across the whole country. After years of struggling in China, the German wholesale store in China decided to open the membership also to private customers, for free. SAM’s Club charges 260 RMB (36 USD) per year for a membership. Costco, as the third membership-based grocery store in China, seems to be targeting middle to high-end consumers with its relatively high annual fee.

2. Wholesale store in China

Chinese consumers highly value freshness and normally go to grocery stores several times a week. On the other hand, new retailers such as Hema supermarket have made grocery shopping even more convenient. Moreover, unlike in the US and European countries, Chinese city apartments do not have enough storage space for a large load of groceries. Will such a wholesale store in China fit the lifestyle of urban Chinese consumers? It remains to be seen.

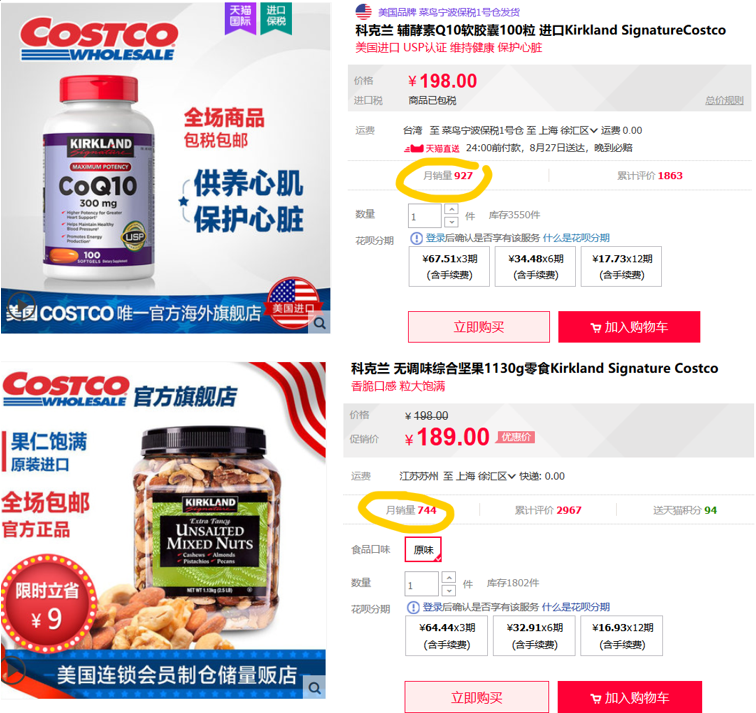

3. Own-label products in China

In general, Chinese consumers prefer branded goods. However, consumers in Shanghai are open-minded and used to foreign products and new models. The sales volume of certain Costco’s own-label products (Kirkland) maybe a reassuring sign for it.

What do Chinese consumers say about Costco in China?

32-year-old working mom named Bai told Daxue Consulting, “I got excited the second I heard about Costco opening a store in Shanghai. But 299 RMB annual membership fee sounds a bit too much… Then I saw the special offer with 100 RMB discount, and I signed up for it right away.” She added:” One can use the card in all Costco stores around the world, doesn’t that sound cool?”

Although she actually never has been in one, Bai is already familiar with Costco. That’s due to a KOL she has been following on Chinese social media for years, who is a young Chinese mom living in the US. Since Costco plays a significant role in this KOL’s family life, and she often posts pictures of them shopping at Costco on weekends. Somehow, after a while, Bai also started to feel connected with this wholesale store she has never been to.

But why would she like to shop at Costco in China, considering the fact that it is already extremely convenient to purchase groceries in Shanghai, both online and offline? Bai agreed that people have more than enough options in China’s grocery retail market, especially in big cities like Shanghai. However, Costco in China will not just about grocery shopping for Bai, but a lifestyle. “Just like hanging around in IKEA, shopping in huge malls or this kind of wholesale store is a leisure activity for me and my husband with our kid,” She said, “We always spend hours there, looking around, chatting and dining all in one place. It is relaxing and everyone is happy.”

60-year-old retiree Xun also signed up to be a Costco member before the grand opening. She is also a member of SAM’s Club and a VIP of Hema Xiansheng. Xun is very happy with the vast options of grocery stores in Shanghai. For different grocery necessities, she will compare and choose the best store.

“Hema offers every user one free delivery within 3 km per day, regardless of the purchase amount. I order groceries on my Hema App several times a week, it arrives at my door within just 30 minutes.” She added, “I also have been with SAM’s club for some years now, but I’m considering not renewing next year. The annual fee is 260 RMB, which is not cheap. And they only deliver if you order more than 300 RMB.” Xun said she is happy to see the fierce competition in China’s grocery retail market, because it brings more benefits for consumers.

Author: Chencen Zhu

Let China Paradigms have a positive economic impact on your business

Listen to China Paradigms Podcast in iTunes