Brand health check in China

Brand survival in the Chinese market

In the fastest-growing market, second-largest economy on earth with high consumption power, every brand is trying to sell its self in the market, get a reasonable or highest market share. Brand health check in China seems to be the key to conquering the Chinese market, surviving the market competition as well as keeping customer and brand loyalty. Brand health check in China measures the performance of a brand and identify its success/failures in the Chinese market. However, the Chinese market is now becoming more and more volatile, competition is getting higher from both local and foreign brand and unforeseen government regulations. Therefore, companies often consider brand health check as an effective measure of achieving organizational aims. A healthy brand in China guarantees a significant impact on consumer awareness and serves as the bottom line for accessing new markets.

Brand health check in China: fundamental to achieve brand success

A healthy brand is the hallmark of a company that is prepared to prosper. Brand health check in China is essential to follow the evolution of a brand among consumers. This must be done on an ongoing basis and must always be communicated internally so that all employees are aware of it. There are some fundamental questions for brand success in the market which includes:

1. How is the business changing? Is it growing, merging, revising the company’s strategic plan, changing its name, or moving from being a local to a regional or national brand?

2. Is the market environment changing? Are there behavioral changes in the marketplace that impact the company’s products or services?

3. How is the company’s/business’s core client base evolving?

4. What are the company’s mission and vision? How are the company’s employees familiar with the mission?

5. Does the company/business use multiple logos that seem used randomly?

6. Does the business printed materials (brochures, manuals, advertisements, promotional pieces) exhibit a range rather than a single unified visual and messaging presentation?

7. What is the key message on the company’s website? Is it different from the printed and marketing materials? Does it match the company’s sales pitch?

8. Does the company lack comprehensive brand guidelines that are consistently used by everyone internally and externally?

What is included in a brand health check in China?

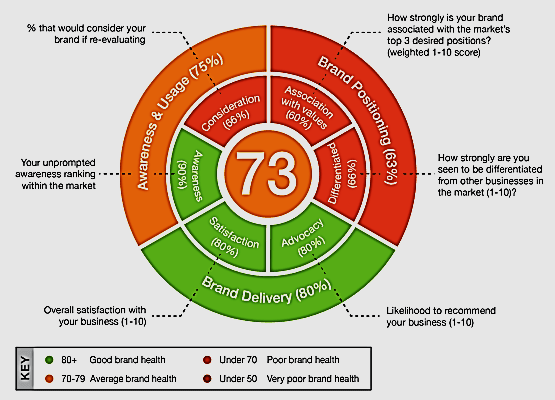

Brand health check in China concentrates on three important components. A key framework to measure and track brand health is the “Brand Health Wheel” which reveals an overall brand health score that can be tracked over time. Brands play a very important role in business decisions, accounting for 50% in some instances. Strong brand health in China is therefore crucial to maintaining a competitive advantage.

- Brand awareness measures the company’s unaided awareness ranking within the market environment and the percentage of customers that would consider buying the brand.

- Brand positioning evaluates the strength of the brand and how it is associated with the market’s top three desired positions, and how strongly the brand is seen to be differentiated from the other brands.

- Brand delivery measures the overall satisfaction derived from the brand and the likelihood of customers to recommend it to others.

Measuring brand equity in China

Brand equity is the intangible value of a particular company or product based on consumers’ perception of the brand name. Many factors contribute to brand equity including advertising, consumer reviews, and advertising. A brand with high equity tends to be well-known and seen in a positive way by many consumers. This helps create the perception that its products or services are better than those of lesser-known brands.

A brand’s power derived from name recognition can be translated into higher sales volume and higher profit margins against competing brands. Brand equity in China is usually measured in three levels:

- the firm level;

- the product level;

- the consumer level.

What market research methods do Daxue Consulting use for a brand health check in China?

Systematic analysis of prospective clients, customers, and bystanders to get their opinion is an important part of brand health check in China. This analysis can be done with a study to ascertain the levels of awareness, positioning, and delivery of a brand in a competitive market environment. The analysis may also include several visual presentations accompanied by interview series of clients, potential customers, bystanders, and other market participants. These studies not only aimed at helping companies to understand the results of their marketing campaigns but also to help them prepare for upcoming communication campaigns. The methods usually applied in market research for brand health check in China include:

- Focus groups in China: selecting a group of 8 to 12 people (usually customers, market analysts, or other stakeholders) to ascertain their views on the key fundamentals of a brand, identifying its prospects and challenges within the market environment.

- Social Media listening in China: enabling companies to better understand how consumers are engaging with brands online in comparison to competitors. Online visibility and popularity can be accessed through the images Chinese consumers associate with the brand and the level of interaction online. Social media platforms such as WeChat and Weibo are specific to the Chinese market, hence they require local expertise.

- Customer feedback analysis in China: this is another important tool to work on brand health check in China because this plays an important role in the functioning of a business and helps the business to realize its shortcomings and customer’s demand. Thus customer feedback analysis in China is an effective tool for assessing customer’s satisfaction regarding a new or existing brand product or service. In this kind of assessment, various segments are taken into consideration for a thorough analysis.

Case studies of brand health check in China

The success of a brand health check in China: IKEA

Furniture Retail Giants, IKEA Group a franchisee of Inter Ikea Systems BV brings its unique style and sales model to China. IKEA in China belongs to IKEA Group and operates as a joint venture. This venture served as a good approach to test the market, understand the local needs and adapt strategies to gain competitive advantage. IKEA had to make adjustments to its marketing strategy as the company uses its product catalog as a major marketing tool.

IKEA in China realized that digital marketing was the way to go. They used digital technologies such as Chinese social media and micro-blogging for their marketing campaign to gain brand recognition. Also, Ikea had to adjust its store location strategy as most consumers in China use public transportation. Rather than the usual stores in the suburbs, IKEA set up stores on the outskirts of cities which are connected by rail or metro networks.

IKEA in China has demonstrated courage, adaptation, and awareness to shift its production, work with local sources, overcome legal requirements and adapt brand proposition to suit the level of development of the market and consumer perception. With that, to grow globally requires sacrifices and innovation from global teams that listen, respect and learn with an open mind. After learning from their past mistakes, IKEA entered the Chinese market with a new brand which penetrated the changing market environment.

No brand health check: Marks & Spencer’s failure

Marks & Spencer (M&S) Group has completed its withdrawal from China by closing its remaining online store on Tmall and selling its franchise business in Hong Kong and Macao after shutting down 10 brick-and-mortar stores on the Chinese mainland in 2016. This is mainly attributed to poor brand health check in China among other factors. There are several factors that led to this episode and among them are 3 key issues;

The shift in the domestic brand

Study on fast-moving consumer-goods sales by Bain & Co. found that even as China’s economic slowdown weighs on consumption, foreign firms are faring worse than home-grown ones. International-brand sales in 26 categories from shampoo to beer shrank 1.4 percent last year. Sales of local brands, typically quicker to adapt to shifting tastes, rose 7.8 percent.

M&S lacks understanding of Chinese consumers

Marks & Spencer’s other mistake — outside of none-too-trendy clothes and some bad store locations — was a lack of basic understanding of the Chinese consumer. Many of their fashions didn’t even fit local body shapes. Brand health check in China requires consumers’ feedback and awareness in order to promote a brand which can guaranty customer satisfaction.

M&S online presence is weak

The retailer’s departure also marks a bigger lesson for mid-tier foreign players. An internet presence is crucial — 20 percent of China’s retail is already online — and without a local partner, companies will have a tough time getting inside the heads of middle-class consumers. Unless your proposition is unique, like Starbucks Corp. or the cosmetics of South Korea’s Amorepacific Corp., it’s an uphill battle. For some of the world’s biggest brands, the quest to win over China’s consumer is getting a lot harder. Online brand presence is crucial, especially to clients in e-commerce businesses. Engaging with consumers online can significantly increase the quantity and value of purchases.

Want to know more about Brand health check in China? Or do you have other questions about branding strategies in China? Contact our team of experts and analysts now.