Digital strategy in China: Map and optimize your customer Journey

The perfect China social media marketing strategy starts here

Daxue Consulting research team has developed a step-by-step digital strategy approach that will help your business to draw a comprehensive Customer Journey Map from traffic generation to sales conversion for your brand’s sales funnels in China:

Understand the Chinese digital ecosystem and user journey (from traffic generation to conversion)

- Get knowledge and high-level understanding of the Chinese interconnected digital ecosystem

- Identify your brand’s untapped promotion and sales areas

- Create hypothesis for optimization of the user experience on your platform, both for traffic generation and on-site conversion

Develop a unique e-commerce experience adapted to your Chinese customers

- Understand and breakdown the key expectations (need analysis phase) and behavioral preferences (testing phase) of the Chinese users on your platforms

- Design a road-map to create an optimized and positive user experience on any platform leveraged by your brand on the Chinese market

Daxue Consulting team is available at any time to discuss further its vision of Consumer Experience Management in China and assist you to map your customer journey.

Rethinking your digital customer journey maps in China

Multiplication of touch points: a dense and interconnected ecosystem in China

With the multiplication of devices and touch points, customers now benefit from an unprecedented autonomy. They have the freedom to buy anywhere and at any time according to their desires: search engines, websites, sellers, newsletters, mailings and e-mailings, media advertising, catalogues, social media, mobile and tablets applications, etc.

In China touch points are especially diverse and above all interconnected. It means that customer journeys will be more fragmented than in the West, while the user navigation will be smoother because traffic generation (promotion) and conversion platforms (sales) are often part of one single interconnected ecosystem.

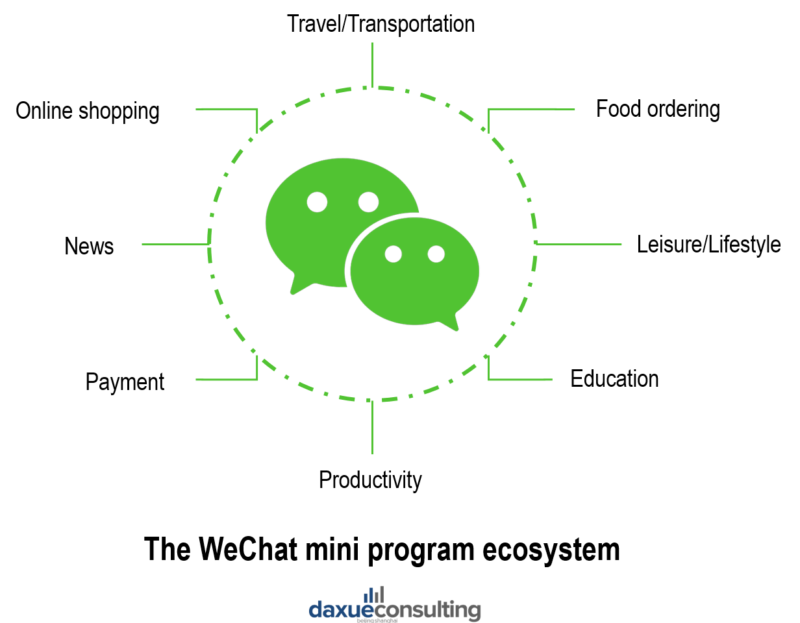

See for example how the giant Tencent and its messaging application Wechat work.

The platform is designed like a multi-tasked tool, which is not the case for Western giants (Facebook, Whatsapp). Indeed Wechat gives friction-free access to many services called mini programs: music streaming, taxi ordering (Didi), money transfer to friends, donations to associations, bill payments, food ordering (Dianping), carpooling and all kinds of online shopping (Jingdong). Mini Programs are sub-applications within the ecosystem of WeChat.

The platform highlights these partners with a shortened access that promises an extremely smooth and seamless use: users can access any possible web-App through the browser. It makes the touch points even more complex for brands because they should integrate this inter-platform connection into their strategic design: they should be analyzed as sales funnels altogether.

Chinese people are exposed to countless messages every day, especially on their phones

According to digital marketing experts, a typical adult has potential daily exposure to about 4,000 ads in any form. Chinese people are even more affected by this phenomenon because they are hyper-connected: as of 2018, we estimate that the total social network users and digital buyers in China have reached 616.5 million and 800 million respectively.

Thus, it is important to know that China is a mobile-centric nation: Chinese consumers account for 1.1 billion mobile internet subscriptions, more than 2.5 times those in the U.S which is the next largest market. In China your mobile phone number is as important as a social security number. Also, scanning a QR code is very common. Many sites offer QR codes to download a mobile app or access WeChat’s corporate account. This turns classic user navigation into a much more fluid and direct navigation where the QR Code is a relay to the mobile on many topics: payments, dowloads, social media, etc.

This mobile hyper-connectivity is to be taken into account when developing your digital strategy and customer journey map in the Chinese market because consumers engage in a unique way depending on the channel, and understanding mobile engagement will help your customer journey become even more relevant.

What is a customer journey map in China?

Identifying Chinese customers’ pain points and opportunities

A company’s relationship with its customers goes far beyond improving the purchasing experience or customer service. A good Consumer Experience Management in China means understanding what consumers experience from the very beginning: when they first think about your brand.

Thus, a customer journey map is a graphic map that describes your users’ journey and all the interactions with your brand (called touch points). It reports how your customers surf on your different platforms, when and where they are blocked (pain points) or what excites them (opportunities). This part is called UX Design and takes into account and anticipates the expectations and needs of the user to create a pleasant, ergonomic and above all efficient platform.

Differences between the Western model and the Chinese UX design model

The typical Western consumer journey is a circular journey with four or five phases:

- Awareness

- Consideration

- Purchase

- Experience

- Advocate

It turns out that such a model isn’t relevant for the Chinese Market:

- Awareness and research

For the first phase of the conversion tunnel, the Chinese consumer compares in a different way than his counterparts. Chinese customers rely mainly on user-generated content that can be considered as more authentic and trustworthy. They are skeptical when it comes to business-generated content, such as websites or traditional advertising. They have a very strong trust in their family, friends and other Key Opinion Leaders (KOL). This is one of the reasons for their strong activity on social networks. KOLs have now become a huge phenomenon in China.

- Choice & Purchase

Because the first phase is much more developed on the Chinese model, the choice is often already made before the prospect arrives in store or on the e-shop. Online platforms are designed to provide, at the same time, convenient content and services for consumers to choose products, place orders and finish payments.

This is a direct consequence of the interconnection of platforms.

- Experience/Post-sale Service

The Chinese customer requires a consistent service among all channels, such as when he wants to return an online purchased product to an offline store. Flexibility is therefore eagerly awaited on this point. It’s necessary to be particularly vigilant because the touch points are once again diverse and interconnected. For example, offline experience centers only serve as a complimentary channel that provides high-quality consumer and membership services.

- Loyalty & Advocate

Chinese customers like to share their opinions after the purchase of a product as they also rely on the opinions of others before buying. Thus, the way a company is able to shape a positive customer experience before, during and after the conversion, influences the customer’s decision to become loyal or even to become a prescriber.

So a big difference is that the Chinese consumer enters the loyalty loop more quickly and the challenge is then to make your consumer stick in this loyalty loop.

However, although there is theoretical understandings of the Chinese customer journey, experts in Consumer Experience Management in China at Daxue Consulting truly believe that a customer journey map is unique and has to be designed ex nihilo for each brand.

Case study: Customer Journeys in China’s luxury market

Traditional channels dominate while online sales grows rapidly for the luxury goods category

Although the share of online luxury goods sales remains currently small, it is important to note its rapid growth. Driven by changes in consumer behaviour and the omnichannel development in luxury brands, the share of luxury goods sales through online channels is expected to continue to increase.

In terms of luxury categories, consumer preferences for purchasing luxury goods vary by the different categories of goods. For example, in 2016, online wine purchases took up 10% of total wine purchases while the online purchase ratio of luxury portable devices (electronics) was nearly zero, and those of luxury stationary, jewelry, and clock & watches were also very low, all lower than 5%.

Omni-channel strategy continues to develop for the luxury brands and platforms

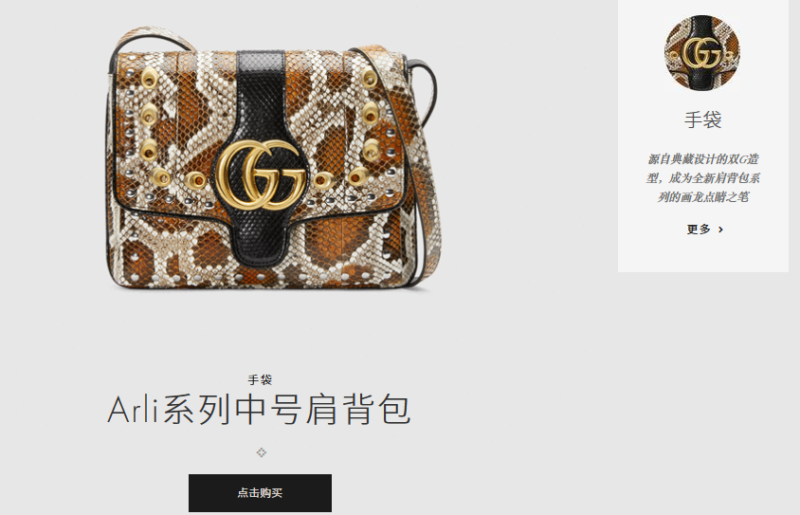

Secoo, a luxury platform in China provides consumers with integrated omni-channel platforms for the offline and online purchase of luxury goods, including the Secoo website, mobile app and offline experience center. This trend is confirmed with international brands: in late 2017, Gucci opened e-commerce stores to sell directly to customers in China. Calvin Klein and Ralph Lauren shared plans with investors to increase their presence through e-commerce and physical stores, and work with influencers in China.

How can customer journey maps help your digital strategy in China?

The best way to increase your traffic and conversion rate

The ultimate goal of customer journey maps is therefore to optimize your channels to better attract and especially better convert consumers on your platforms.

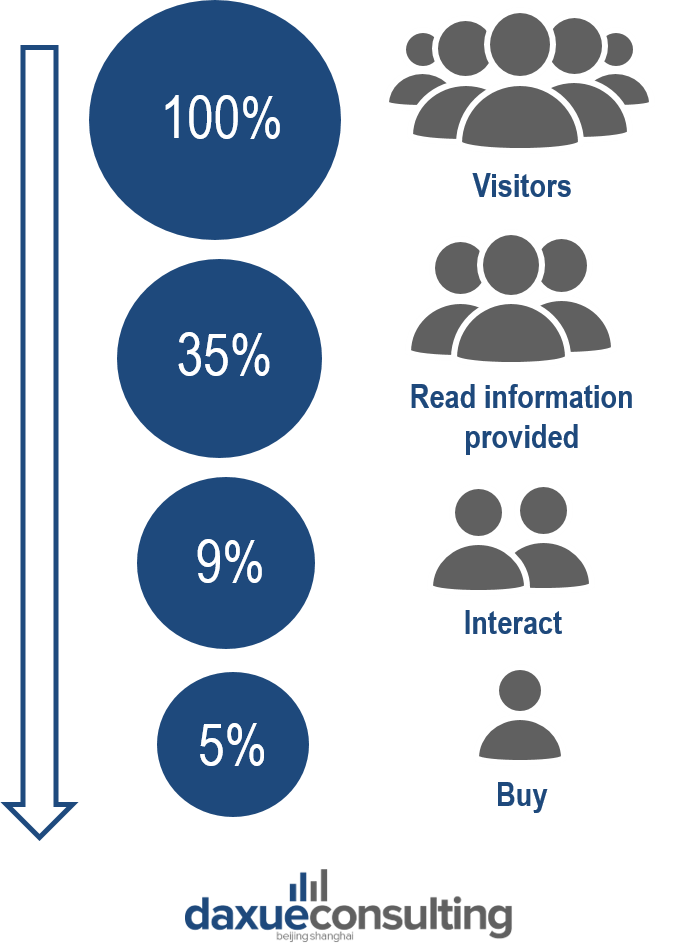

Today the average conversion rate on a platform is actually quite low:

It means that this is a big issue for digital marketing. But it also means that there are many opportunities to increase sales conversion.

Many benefits Consumer Experience Management in China can bring to your company

- Figuring out where customers interact most with your brand and thus maximize the impact of your marketing actions

- Determining whether the customer journey is in a logical order

- Highlighting the differences between the desired customer experience and the one perceived by customers

- Focusing on your customer’s specific needs at different stages of the purchase funnel

- Giving you an outside perspective on your sales process by allowing tracking of the sales funnel to identify where you are losing or gaining consumers

- Identifying your business development priorities

- Allowing you to focus your efforts and expenses on what matters most to maximize the effectiveness of your different marketing expenses: the idea is to make sure the budget is allocated towards the right channels. Today challenges to prove ROI and the relevance of having a lot of channels mean understanding the customer journey has never been so important

- Bringing a better understanding of the environment in which you work within your different work teams

By doing so, you may reduce process and development costs, increase customer satisfaction and loyalty, which will necessarily result in favorable recommendations for your brand. It will allow you to be in the right place at the right time and offer the best possible experience to your customers. And excellent online experience means conversion, loyalty and a valuable brand image in China.

How to design a customer journey map to create an optimized user experience in China on any platform leveraged by your brand?

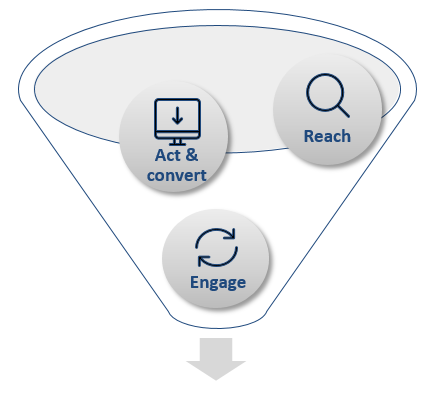

Your Customer journey map should focus on two aspects of your marketing conversion funnel:

- REACH = traffic generation or how to get an optimized customer journey

- ACT & CONVERT = traffic conversion or how to get an optimized user experience

In-depth understanding of the Chinese digital ecosystem and user journey

Understand the ecosystem in which you live with desk research and benchmarks

The first essential step when talking about Consumer Experience Management in China is to immerse yourself entirely in the Chinese digital ecosystem to understand its key specificities, regarding UX/UI but also regarding the overall user journey in China. You can compare the Chinese digital environment to your Western environment.

Daxue Consulting draws up a list of helpful questions to ask like:

- How should I choose between integrated e-commerce platforms, vertical e-commerce platforms, social platforms and self-built brand websites?

- How to breakdown the sales channels and are there some that could be leveraged on top of the current Chinese operations?

- What are the key platforms for each step and how should be distributed my investment among each?

- What are the must-have and best practices for navigation and on-page conversion in China?

The objective is to extract the best practices and must-have for your brand in China. Daxue Consulting offers thorough benchmarks of players identified as successful in your business sector. The purpose of benchmarking analysis is to gain a level of insight regarding local players – with focus on 2 to 3 international brands that have successfully implemented its own digital sales platform in China- and their UI design set up to.

Customer Journey Benchmark example: How to use promotion as a decisive entry door to the user experience?

Study case: Swiss watch brands in China

Several Swiss watch brands present on the Chinese market have recently developed different types of digital strategy to generate more traffic, and above all a more qualified traffic, to their online sales platforms.

For example, Roger Dubuis recently unveiled a special edition watch designed exclusively for Chinese consumers on the social media platform WeChat. The idea was to share a content that could become viral to immediately redirect people to their own platforms or to convert them online: they added a countdown saying the length of the campaign was 8,888 minutes. And it was successful, attracting approximately 17,000 engagements and acquiring the brand an additional 7,500 followers on its WeChat account.

Another commonly used strategy by brands to get Chinese people into their user journey is to work with bankable Chinese celebrities. The rich Chinese consumers like to buy luxury products which have a strong reputation. The brand’s popularity is therefore becoming a key factor in Chinese purchasing decisions. This is why Longines has launched a campaign of influence on social networks, especially on Weibo, using the reputation of the Hong Kong singer and actor Aaron Kwok to raise brand’s awareness. Omega has opted for the same strategy of influence in hiring the mainland Chinese actress Zhang Ziyi to generate traffic as quickly as possible.

English version: This Sunday, I will be the @LONGINES elegant ambassador to attend the 7th Longines Hong Kong Equestrian Masters @LonginesMastersHK to witness the birth of the equestrian emperor. AsiaWorld-Expo, February 17th, agrees!

#Longines #LonginesHK #OWeblink#EleganceisanAttitude #OWeblink#LonginesMastersHK

International watch brands also further tapped into the Chinese market by collaborating with the country’s second-largest e-commerce platform JD.com for Super Watch Day, an event where consumers get access to exclusive deals on luxury watches through the app, and in which JD.com introduced many new brands to its platform including Chopard, Tag Heuer, Zenith, and Citizen. Thanks to this promotional strategy, these brands have succeeded in positioning themselves in the right place, i.e. at the heart of the Chinese shopping experience and at the right time.

Identify untapped opportunities and missed touch points for your brand on China’s digital market with a meticulous audit

Then you have to analyze and dive into all the online platforms that are available for your brand. The objective here is to know exactly where you are and where you are not to improve the user journey (and therefore the overall user experience).

You should be able to identify:

- The different types of online marketing, promotion and communication strategy you can use for each platform

- The level of brand management on each platform

- What are your operations on each E-commerce platforms (sales commissions, deposits, warehousing, logistics?)

- The differentiated positioning on each E-commerce platform and marketplace

- The ranking of the most suitable platforms for your brand based on your criteria

This audit of your current online activation in China will help you to understand the most relevant channels to activate to generate massive traffic. You will find out where the potential painpoints are and which moments can be opportunities that are not leveraged and could provide your business with incremental sales as well as brand recognition without massive investment.

Define some initial User Experience and User Interface hypothesis and improvement areas

Then you have to create hypothesis for optimization of the online operations, both for traffic generation and on-site conversion. Based on the various research findings, you will be able to write guidelines concerning key platforms with most significant influence on your customers in order to:

- Develop the online consumer journey for your client’s target segments

- Create recommendations for the various step of the user journey within the User Interface to develop a smooth navigation

The idea is to develop an adapted version of your current user interface in China in order to evaluate features and navigation attributes during the testing phase.

Creation of a unique e-commerce experience adapted to the Chinese market

If you really want to have an effective digital customer journey map for the Chinese market then you must absolutely test and validate your criteria and hypothesis. This test phase is essential to ensure that you will provide the most optimized user experience on your platforms.

Teams in Consumer Experience Management in China at Daxue Consulting can collect relevant first-hand consumer insights for you through different methodologies such as traditional focus groups, consumer roudtables, workshops, but also tech-driven A/B testing, usability tests or Eye-tracking in China.

Test the relevancy: need analysis thanks to focus groups in China

First of all you can test your hypothesis by interacting with users to collect insights on their expectations and preferences when navigating on your type of platform. The idea is to deeply understand what are the standards for Chinese users, especially when it comes to your business sector.

Mike Vinkenborg, one of Daxue Consulting’s project leaders, stated that “the need analysis can be used in a customer knowledge logic, and even more so for digital targeting and online experience. They can draw a vision that corresponds to people’s values. And sometimes, if you go straight to quantitative testing (through closed questions) you may end up with tests that omit important factors and thus can end up being biased. In this perspective, this initial step of qualitative insights, without even confronting yet the participants to the user interface to be validated, is necessary.”

To optimize the insight collection on digital customer journey and user experience, this qualitative step should focus on the following elements:

- Validation and ranking of most significant attributes of online shopper motivation to trigger a purchase

- Design of the ideal UX proposition from a consumer perspective

Test the impact: behavior analysis thanks to usability tests in China

To test your different China user interface options and mock designs to observe the effectiveness in a natural way and gather qualitative feedback from the participants is usually conducted through usability testing.

It will allow you to understand what are the key triggers and deal breakers on your platform in terms of navigation and conversion. You will learn if your users are able to complete basic tasks on your platform, how long it will take for them and if they are satisfied with the navigation experience you offer. The goals still remain the same: improve the overall experience association with the brand and improve the sales.

There are many different benefits of usability testing in China:

- Chinese consumers’ attitude toward an experience proposition can be particularly difficult to identify and putting them in a real situation can be revealing

- Data are provided directly by end users

- Given the complexity of the Chinese digital ecosystem, this method is particularly useful because it allows several types of data to be collected and the interface to be analyzed from several angles

- It allows your IT and marketing teams to issues problems before they are coded and thus to reduce expenses

Usability Testing will allow you to finally define the ideal UI for your brand in China with must-have features and pain points to avoid in order to improve your platforms and facilitate online conversion.

Combine the analyses of all these data to create an effective Customer Journey Map

- Combination, triangulation and synthesis of all collected data and insights related to the potential extension of your user journey in China (traffic generation mapping + sale conversion mapping)

- Road map for the implementation of UX design attributes and features on your different channels

This process about Consumer Experience Management in China defined by Daxue Consulting was set up in order to create the best positive user experience on any platform leveraged by your brand in the Chinese ecosystem and then optimize your digital strategy.

By following these steps carefully, you will be able to draw a final comprehensive Customer Journey Mapping for traffic generation and sales conversion for your brand’s sales funnels in China.

Every UX research project in China is different and unique so if you want to learn more about Daxue Consulting Customer Journey Research in China or talk about your customer’s experience in the Chinese market, please contact our team directly.

Digital strategy in China includes:

- Website digital identity tested through A/B testings, mouse trackings, speed tracking, etc.

- Social network presence tracked through sentiment analysis, editorial lines, KOL, etc.

- PR through platforms and the press on the internet

- SEO, SEM, SNO, SNM to improve your company’s position on internet search engines

- Community management

Daxue Consulting has worked on several projects involving digital strategy and Consumer Experience Management in China in the main cities as Shanghai and Beijing as well as in second-tier cities like Chengdu, Guangzhou, Shenzhen, Tianjin, Hong Kong, Macau, and Hangzhou.

Contact us to know more about our Consumer Experience Management in China or other services !