Behind the counterfeit product industry in China

Forgeries of luxury-brand products are more prevalent in China than in any other country in the world. When on the metro or walking down the street, it can seem as if nearly everyone is sporting a flashy brand name product. But much deadlier than casual counterfeits are the “real fakes”– counterfeit goods so similar to the real thing that differences are nearly imperceptible. The impact of counterfeit products in China can be seen in the loss of sales, damage to brand integrity, trademark dilution, and the high costs of enforcing intellectual property rights. For the world’s luxury brands, counterfeit goods from China represent a major threat.

Two drivers of China’s counterfeit production

The counterfeits industry in China: a consequence of economic growth

The counterfeit industry in China is seen as a problem but it should also be studied as a symptom of economic growth. In 1978, Deng Xiaoping started reforming China’s economy. For the first time, foreign investments where encouraged. Many companies wanted to relocate there because of low wages and domestic potential. The industrial power grew and the country became the factory of the world as the the international production process. Global brands like Nike or Adidas have a part of a part of their production there. In many sectors, the country started to adopt new technologies.

While China’s living standards improved greatly, the new industrial power lead to counterfeits, as factories could cheaply re-create brand products. The counterfeit industry in China seems like a minor symptom of industrialization. Hence, even if it is necessary to tackle counterfeits, it was just the result of a growing Chinese industry.

China counterfeiting is linked with brand culture

Since the early 1990’s, the counterfeit phenomenon increased quickly in China. During this decade brand culture emerged as the opening of western luxury stores in country. Fashion brands became hyped, and counterfeits were a mean to obtain luxury goods without spending years’ worth wages. Since, fakes continue to progress fulfilling the domestic market of China.

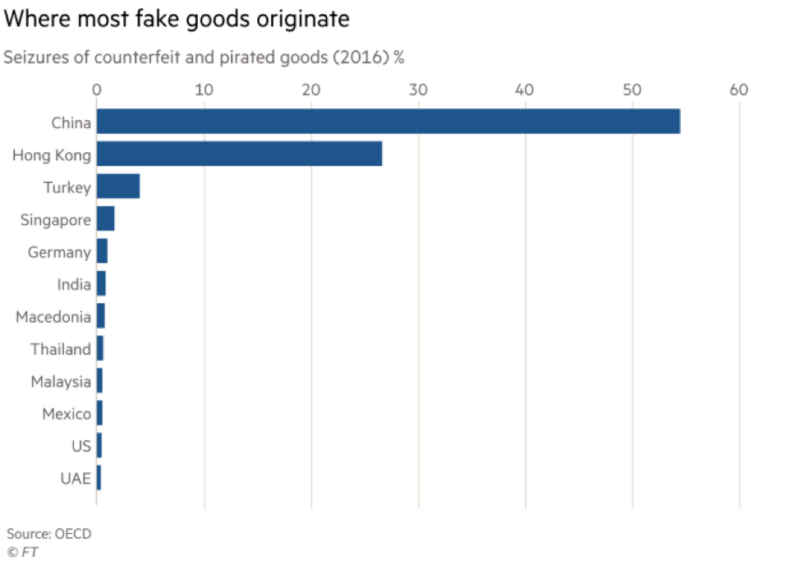

In 2015, China and Hong-Kong represented 86% of the global counterfeit industry, which is around 400 billion USD every year, according to Europol. Thanks to years of relocating for foreign companies, Chinese factories now have the skills needed to copy almost everything. In Chinese stores, 60% of luxury goods are imitations and you can also find some complete fake stores who just looks like a real one. For instance, A fake supreme store opened in Shanghai. The counterfeit phenomenon highly increased following the luxury market starting in China.

Size of the market for counterfeit products in China

The global counterfeit trade for all items, from purses to electronics to software, is worth USD 461 billion, about 2.5% of all trade worldwide. That is more than the global drug trade. Despite attempts regulation, international trade in counterfeit goods has almost doubled since 2008.

According to the 2018 Global Brand Counterfeiting Report, worldwide losses suffered due to counterfeiting amounted to USD 323 billion in 2017, with handbag companies alone accounting for $20 billion of that.

80% of the world’s counterfeit goods come from China, and many of the market’s consumers are in China as well.

The market for fake goods in China

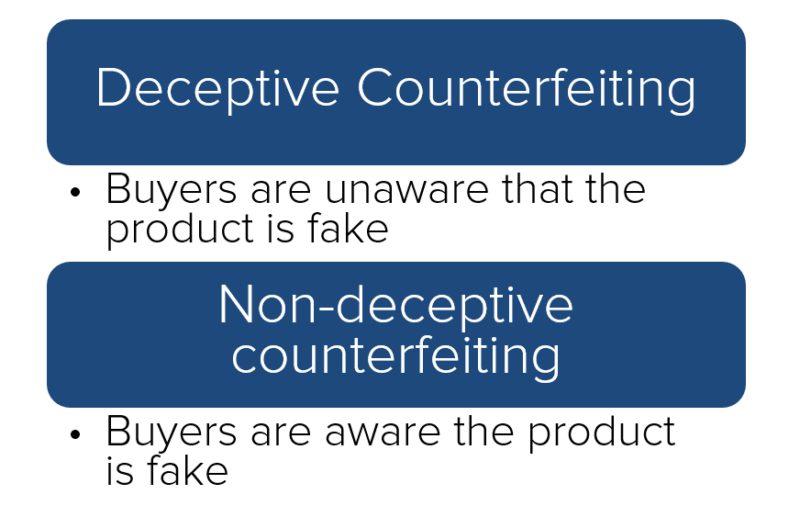

There are several distinct market segments of consumers who purchase fake goodsin China. The primary segment is buyers unaware that they are purchasing fake products. This deceptive counterfeiting is rampant, but the market for fake goods in China is largely driven by consumers who actively search for and purchase counterfeit products.

Middle-class shoppers who value brand prestige make up a large segment of the non-deceptive counterfeit market. They can afford the occasional $500-$1000 bag, but not the luxurious $15,000 Louis Vuitton or Birkin. These aspirational Chinese shoppers purchase fake goods for the same reason the wealthy buy real products: to emulate their high-class idols, impress peers, and enhance social status. Fake goods allow shoppers to “consume” prestigious brands without actually buying the high-quality goods.

Some consumers knowingly buy counterfeit goods even though they could afford a genuine product. They have ample funds but believe that the high prices of authentic products are unwarranted, especially when they can get a similar version at a much cheaper price.

Chinese Fashionistas chasing the trends

Some wealthy buyers of counterfeit goods in China are known as “fashionistas.” These fashionistas want to buy the hottest new products, but know that another trend will replace it next season and are thus unwilling to invest the money to stay on trend season after season. Furthermore, they see counterfeit purchases as low risk, because limited-edition or recently released products are less familiar to the general public, making it more difficult to call out a fake.

Buyers of counterfeit goods impose a hidden cost on the brand and people who buy the real thing: they make the brand less exclusive. All non-deceptive counterfeit market shoppers share one attribute: they are willing to pay for visual attributes and functions, but not willing to shop the genuine products.

Government regulation of the fake market in China

Affected parties have previously complained that punishments for selling counterfeit goods in China are too light to deter offenders. In February 2017 Alibaba reported that of the 1,910 cases of suspected counterfeiting they passed on to authorities, only 129 people were found guilty.

In August 2018 the State Administration for Market Regulation stepped-up efforts to crack-down on the illegal production and sale of counterfeit goods in China.

The regulator announced strict punishments for online trading platforms that fail to protect the rights of consumers and trademark owners, or that do not actively cooperate with market regulatory authorities.

They demanded that other regulators such as the Shanghai Administration for Industry and Commerce launch targeted investigations into sales of counterfeit goods in China, and specifically called out offending platforms such as Pinduoduo.

The new China’s e-commerce law, which took effect on January 1st, aims to discourage counterfeiting in China through heavier fines and places more responsibility on digital platforms to remove sellers of fake goods. The law also addressed false-advertising, consumer protection, data protection, and cybersecurity.

The new law targets three groups: e-commerce platform operators like Taobao, merchants who sell goods on sites like Taobao, and vendors with their own websites or who sell on social media. Merchants who sell exclusively on social media platforms had been previously unregulated, but now these sellers will need to register their businesses and pay relevant taxes.

In an effort to spur major e-commerce platforms to crack down on counterfeits being sold on their sites, the law makes platform operators jointly liable with the merchants selling fake goods. Previously, only the individual merchants were liable. Platform operators can now be fined up to 2 million RMB (USD 290,000) for the property infringement that comes with selling counterfeit goods in China.

E-commerce platforms crackdown on the sale of the counterfeit good industry in China

Taobao and fake goods

In 2015, Alibaba was the subject of intense state scrutiny as the State Administration of Industry and Commerce unveiled that only 37% of the luxury goods authorities examined on its Taobao platform were genuine. In a strongly worded white paper, state authorities criticized Taobao for lax internal controls, declaring that many of the products sold on the site were substandard, violated trademarks, or were just plain illegal. Chinese consumers agreed and called on the government to tighten supervision over Taobao. Alibaba declared a zero-tolerance policy towards counterfeits, and created a new 300-person team to ramp up the fight against fake good in the Chinese market.

Luxury brands were unimpressed, and in May 2015 Gucci, Balenciaga, YSL and other brands filed a lawsuit alleging that Alibaba’s negligence encouraged the sale of fake goods on its sites. A US federal court dismissed the suit, but Alibaba’s reputation as a haven for counterfeiters persisted.

In 2017, Alibaba was again under consumer and government pressure when Taobao was found to have over 240,000 vendors selling fake goods, up from 180,000 vendors the previous year. To assay consumer anger and protect investor relations, Taobao in mid-2017 launched an initiative to crack down on the fake goods being funneled through their site. That initiative has led to 95% of takedown requests and red-flagged listings being processed within 24 hours, a significant improvement in processing times. 97% of listings for counterfeit items are now deleted before transactions even take place.

How does Pinduoduo handle counterfeit items?

Pinduoduo, the third-largest e-commerce platform in China, is another site criticized for selling low-priced knockoffs. In August 2018 the State Administration for Market Regulation investigated Pinduoduo and announced that Pinduoduo should strengthen platform management and better regulate activities of third-party vendors. Pinduoduo soon removed more than 10 million fake items from its site and blocked more than 40 million product links suspected of copyright violations. It is working with over 400 luxury brands to fight counterfeiters and has created a hefty 150 million RMB account to refund consumers who were unwittingly sold fake products.

How counterfeiters in China get around AI controls online

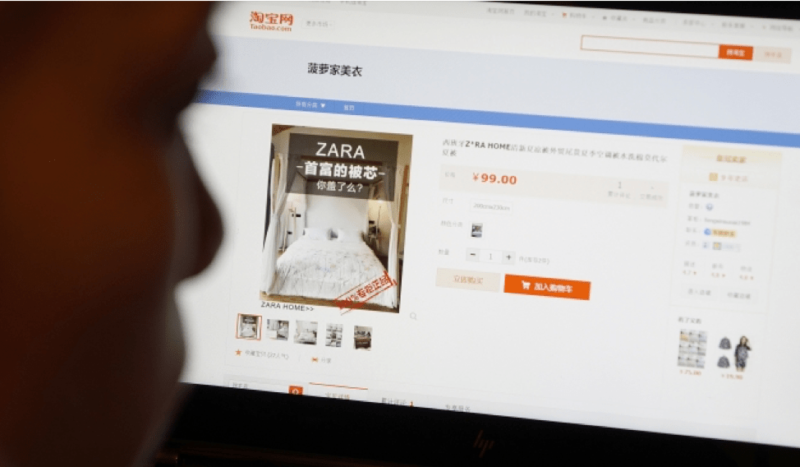

There are many intricate ways in which sellers of fake goods in China have evaded regulation online. One common trick is for sellers to redirects clients to separate websites, where they can browse options and place an order. Another method is to label items as “haute couture,” which consumers are aware implies ‘high-quality copy.’ Aside from this label, Taobao sellers can change the name of the brand they are copying, or display just part of it. One seller of copycat Zara clothes lists his items as ZA or Z*ra, which allows him to sneak past the filters set by Taobao.

Taobao’s AI tools are constantly upgrading to become more difficult to trick, especially with the introduction of filters against luxury products priced below a certain point. Accordingly, some sellers of fake goods will display a price for their product that is consistent with the price for the real thing, or display a price that is outrageously high. Interested customers will talk to the shop in Taobao’s private chat function, and sellers will reveal the real, much lower price.

In-person sales of counterfeit goods in Shanghai and Beijing

Counterfeit goods sold online in China work hard to avoid detection, but physical brick-and-mortar ‘fake markets’ in cities like Shanghai and Beijing are out in the open, easy to find and even reviewable on sites like Trip Advisor. Officials routinely inspect physical stores, but they may not take the job too seriously because they know local vendors rely on the income. Regulators let the stalls peddling cheap and fake goods slide, instead choosing to target merchants who lead interested buyers to unmarked apartments, back rooms, or closets full of high-quality fake Gucci, Prada, Michael Kors, and Louis Vuitton handbags.

Aside from avoiding government regulation, counterfeiters in China work hard to stay under the real company’s radar. One fake good peddler in Beijing explains: “We careful. Louis Vuitton. They send spies and they sue. So we hide.”

The emerging authentication industry in China

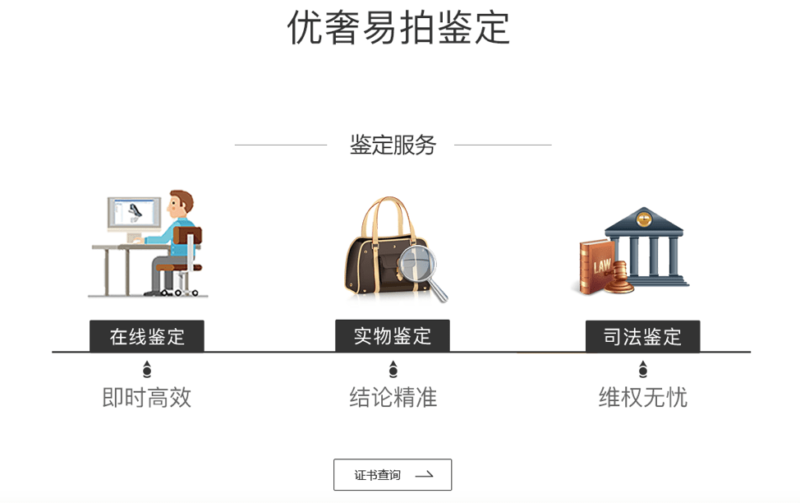

The prevalence of fake goods in China and consumers’ subsequent fears of being scammed into accidentally purchasing knockoffs has created a new sector: product authentication.

There are dozens of apps on the Chinese Apple iOS app store that offer to verify luxury goods. Authentication company Zhiduoshao has hundreds of thousands of users who pay 49 RMB for a product to be checked virtually by an expert. Founder and CEO of Zhiduoshao maintains that 95% of authentication requests can be answered online via photos. Authenticators tell users what kind of photos to upload, and then carefully inspect the monogram, fabric, and technique. Often, the process only takes a few minutes.

Similar app Isheyipai boasts an “expert jury” of 12 authenticators. Users upload photographs of the item in question and choose who they want to check their product. Prices range from 49 RMB for a junior authenticator to 99 RMB for senior staff. Appraisers each have areas of expertise, such as bags, jewelry, or shoes.

Private companies offer training courses that teach appraisers-in-training how to inspect a wide range of luxury brands and products, with advice about texture, logos, stitching and everything else that a counterfeiter might get wrong. A 10-day program can cost up to 40,000 RMB.

Authentication companies in China have an uneasy relationship with the brands whose integrity they claim to protect. Cartier maintains that their products should be bought only from “authorized sellers,” while Audemars Piguet states that it does not endorse any authentication app and De Beers says it is unaware of them.

Brand wariness of authentication services is rational because Chinese counterfeiters are now imitating these authenticators too. Seemingly authentic sites copy the names, website layouts, and imagery of established authentication platforms like Zhiduoshao in order to scam consumers seeking product verification out of their money. In one case, consumers discovered that an authentication app was faking reviews and authentications to sell knockoff goods.

How brands can fight back against Chinese counterfeiting

Anti-counterfeiting strategies must be brand specific to take into account the company’s target market, the types of counterfeits produced, and how the counterfeits are being manufactured, distributed, and sold. An effective strategy combines IP protection, export and customs controls, and retail market controls.

But no matter how sophisticated the anti-counterfeit strategy is, where there is a demand there will be a supply. The only surefire way to shrink the market for counterfeit products in China is to deter consumers from purchasing fake goods in the first place. However, typical deterrence strategies that luxury brands have used in the West will not work in the Chinese market.

Many consumers are aware that their purchases are counterfeit

Most consumers who purchase counterfeit products in China are well aware that the quality is not on par with the real product. When consumers buy fake goods, they do so despite the possibility that the product will fail them. Additionally, the prevalence of sophisticated fakes means that consumers can easily buy counterfeit products with nearly genuine quality. Thus, highlighting the poor performance quality of counterfeit goods is not an effective deterrence strategy for brands to adopt in China.

Where in other countries purchase of knockoff goods is a punishable crime, in China consumers are not liable for their counterfeit purchases. Deterrence of counterfeit purchases in China cannot then be fear-based.

There are two main deterrence strategies that luxury brands can adopt to dampen Chinese consumer demand for fake goods: the ethics emphasis, and the psychosocial emphasis.

Contact us for any question on the Chinese marketAnti-counterfeiting in China: The ethical approach

Counterfeiting is not a victimless crime, and luxury brands should tell consumers who gets hurt when they buy fake products in China.

Most counterfeit goods in China are made in sweatshops by children and slave laborers who are often the victims of human trafficking. These sweatshops are overwhelmingly in low-tier Chinese cities, and these child workers are often Chinese, making the issue hit particularly close to home for Chinese consumers of knock-offs.

The Chinese counterfeit industry’s use of child labor is much more damaging than the use of child labor by companies like Walmart and Target. Corporations can beare held accountable for exploiting cheap labor: when labor abuses are exposed, companies face plummeting share prices, lawsuits, and customer boycotts. Counterfeiters face no such risk, because consumers of knock-off goods do not know who manufacturers their handbags or sneakers.

Brands can educate against counterfeiting practices in China

Additionally, brands can educate Chinese consumers about the criminals who benefit when a shopper buys a counterfeit good. Production and distribution of counterfeit goods are heavily controlled by ultraviolent Chinese triads, who traffic in narcotics and sex slavery alongside fake products.

Consumer awareness of the hidden costs associated with their counterfeit purchase can create shame and guilt that might deter some Chinese consumers from buying knock-off goods.

Anti-counterfeiting in China: The psychosocial approach

In the West, there is a shame that comes when one admits to buying counterfeit products, and luxury brands should work hard to foster that stigma in China. For some people, the regular purchase of fake goods is a normal part of life: many Chinese consumers who own fake goods assume that the luxury brands sported by their peers are fake as well.

In 2018 the Japan Patent Office launched an anti-counterfeiting campaign that revolved around embarrassing consumers who buy knock-off products.

It is too early to see the results of Japan’s shame-based anti-counterfeit strategy, but the premise is solid. Luxury brands effected by Chinese counterfeiting could emulate the approach, and work to create a social stigma against knock-offs.

Across the board, the most effective strategies to deter Chinese consumers from buying counterfeit products are shame-based.

Who is benefiting from the counterfeits industry in China?

China is responsible for more than 70% of counterfeiting according to the World Customs Organization. Where all the money from this industry is going? Alain Rodier, in his book: The Triads: the hidden threat, indicates that the counterfeiting is linked with Chinese triads. They are using the money received from counterfeiting to invest in other illegal activities. However, the money can also be legally re-injected into the country. Alain Rodier argues that criminal money is largely reinvested in the country’s legal economy: “As far as the Chinese triads are concerned, they would have a worldwide turnover of 200 billion dollars. Much of this money is reinvested in the legal economy”. For instance, the Sun Yee On triad would have largely participated in the development of Shenzen. Even though triads and other organizations directly benefit of counterfeiting, it can be noted that this money is sometimes reinvested in the legal economy.

Rethinking the fashion industry

One way of tackle the fake industry is to completely change the opinion of people concerning clothing. Trends should focus more on quality than brands. Fast fashion might also be a big issue in consumption because of its impact on the environment. If the fashion industry evolves to its simplest form, people would not be sensitive to brand image. Without the importance of brand image, there is no demand for counterfeit luxury goods anymore. Naomie Klein with its book “no logo” lead this movement in the end of the 1990s. One way to wipe out counterfeits is to educate people to consume goods differently, without being obsessed with brands.

To conclude, the counterfeit industry is a direct consequence of the industrial growth in the country combined with the value placed on brand image. It is difficult to tackle this gigantic phenomenon generating billions each year. You have both to address the production and the consumption of counterfeit goods. The counterfeit goods industry is injuring companies because it negatively impacts their brand image, consumers who are genuinely interested in the luxury products may lose faith that what they are buying is authentic.

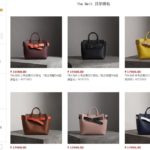

What brands can do to avoid intermixing with counterfeits in China

For luxury brands to avoid being sold alongside counterfeits, brands can try a brand independence, or direct to consumers strategy in China. Counterfeits are sold easily on e-commerce platforms, but selling from a brand’s own website, or brand.com, is a surefire way to avoid competing with counterfeits and keep a pure brand image.

Authors: Alison Bogy & Enzio Cacciotto

Daxue Consulting helps you get the best of the Chinese market. Do not hesitate to reach out to our project managers at dx@daxueconsulting.com to get all answers to your questions.

Luxury brands in China do not have to compete with counterfeits

Download our brand independence in China report to learn more about direct-to-consumer marketing in China

Listen to 100 China entrepreneur stories on China Paradigms, the China business podcast

Listen to China Paradigm on Apple Podcast