ALDI opened its first two stores in Shanghai: highlight of China’s grocery retail market | Daxue Consulting

On 7 June, German discount retailer ALDI opened its first two pilot grocery stores in China. The Shanghai debut has caused huge responses among consumers, both online and offline. In order to have a sight of the first brick-and-mortar ALDI store in China, hundreds of Chinese people were waiting outside of the stores before the grand opening. As a matter of fact, this is not only the offline debut of ALDI on China’s grocery retail market but in the whole continent of Asia.

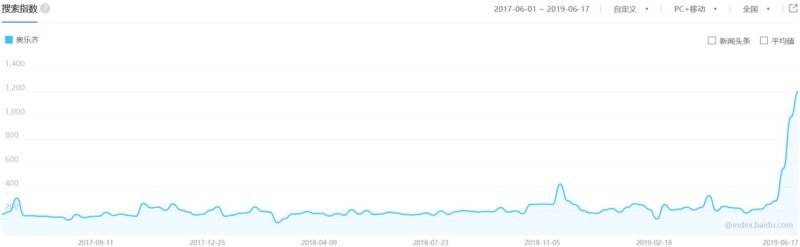

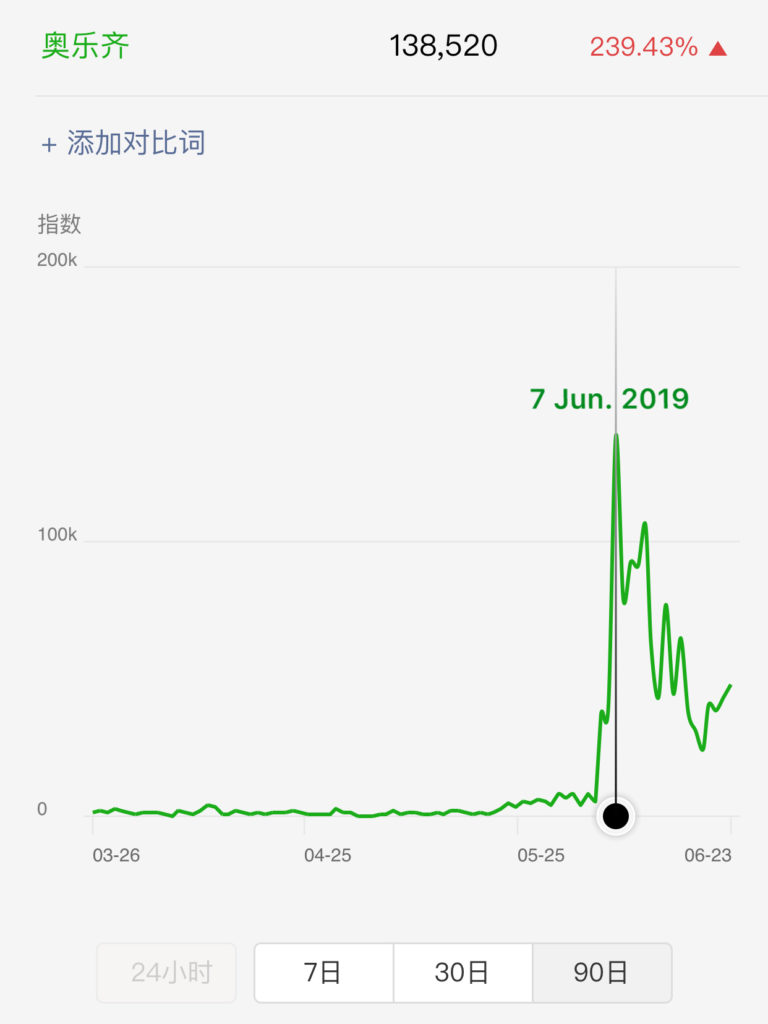

Baidu index shows us that the search index of “奥乐齐” (Ao le qi, a Chinese name for ALDI) has stayed stable since the beginning of 2017, as the German discount retail giant entered China’s grocery retail market through its flagship store on Alibaba’s Tmall Global in early 2017. Thereafter, ALDI launched its Tmall Flagship Store in early 2018. Most recently, the search index reached the peak during the grand opening week in Shanghai. At the same time, the search index of “奥乐齐” on WeChat, as well, went extremely high on the opening day.

China’s grocery retail market is experiencing fast growth

According to the data released by IGD, the international grocery research organization, the grocery retail market in China was forecast to grow by 32.6% to 2022. Euromonitor International has indicated in a study that “Chinese consumers’ shopping habits became increasingly polarized, as many consumers, especially those in higher-tier cities, started to focus more on convenience and quality, in line with their rising disposable incomes and the fast pace of daily work and life”, others were “still more price-sensitive”.

Global grocery retailers in China are facing challenges

Due to the fast growth of online retail, global grocery retailers in China are facing significant challenges. The French hypermarket Carrefour, which once dominated China’s grocery retail market, saw its sales in the market fall 5.9% to $4.67 billion last year, the hypermarket decided to sell an 80% stake in its China business, including more than 200 stores for about $700 million.

Chinese consumers are used to purchasing almost everything online, including groceries, which offers them better prices and more convenience. Local grocery stores such as Alibaba’s Hema Xiansheng and JD.com’s 7Fresh are conducting the concept of New Retail, providing consumers with the extremely convenient shopping experience with little boundary of online and offline. On the contrary, Global grocery retailers such as Walmart and Carrefour have lost their charm to modern Chinese people. Since simply offering a wide range of products with low prices cannot attract Chinese consumers anymore.

Boutique supermarkets in China

To meet the need of modern people living in big cities, numerous of boutique supermarkets (精品超市 in Chinese, such as CityShop, Olé, etc) have appeared on the highly competitive grocery retail market in China in the last decade. Due to the food safety concerns, the demand for high-end groceries is growing among the wealthier Chinese. These boutique supermarkets have been able to satisfy the affluent middle class’s needs by offering them well-selected imported groceries. In addition, this kind of grocery stores has a more comfortable set-up, which makes it more convenient to shop around. The stylish in-store environment also makes the shopping experience more exclusive.

Moreover, Chinese consumers highly value freshness and normally go to grocery stores several times a week. On the other hand, urban Chinese city apartments do not have enough storage space for a large load of groceries. As a result, compared to the American styled hypermarkets, boutique supermarkets in China are more suitable for the Chinese consumers’ lifestyle.

It remains to be seen if ALDI will survive with its physical presence on China’s grocery retail market

As said before, the competitive advantages of discount retailers in China based on pricing and wide range of products are no longer sufficient. It is not easy for global retailers in China to compete with local giants such as Alibaba and JD, and at the same time, to give Chinese consumers convincing reasons to leave the convenience of online shopping. ALDI plans to open more physical grocery stores in China and will also launch a program on Chinese biggest messaging and social app WeChat, offering products with instant delivery within three kilometers of each store.

“ALDI has always been committed to a long-term presence in China, and we want to ensure that we are pacing our development in China appropriately,” said ALDI to the South China Morning Post. The company said its target audience was Chinese consumers looking for high quality, imported products at good value.

The image of ALDI is more a boutique supermarket in China. Compared to ALDI’s stores in its home market, Germany, and other western markets, the interior design of the stores and the product presentation are more superior. At the same time, according to the German newspaper Lebensmittelzeitung, the discount retailer ALDI will present itself as having a much wider range of products than in Germany.

Moreover, ALDI’s model of increasing profit margins by selling its own-label products will be a challenge since customers prefer branded goods in grocery stores in China. Instead, the German discount retailer adapted itself by offering products which already have a good reputation among Chinese consumers (e.g., dairy products from Australia).

Author: Chencen Zhu

Make the new economic China Paradigm positive leverage for your business

Do not hesitate to reach out our project managers at dx@daxue-consulting.com to get all answers to your questions