Red meat imports in China: France and USA step into the game

Will the increasing red meat imports in China be able to feed the growing Chinese appetite for beef and sheep meat?

This question is especially relevant as China banned many countries from exporting meat to China after scandals like the bovine spongiform encephalopathy (BSE) crisis in the 1990s in Europe or in the US in 2003, where the mad cow disease also took place. Daxue Consulting takes upon this question and shows that China recognized that it needs to open up again in terms of importing red meat such as beef, mutton or lamb in order to satisfy the increasing demand of the Chinese population for those kinds of meat.

The Chinese food culture shows that pork is the meat of choice for Chinese consumers, with 40.85 million tons consumed in 2016. However, this number mirrors the change of the eating habits in China, where nowadays especially the generation between 20 to 35-year-olds tries to eat healthier. While the government wants to lead to a healthier China by suggesting to cut down the meat consumption in general, Chinese consumers rather change the type of meat they consume. The pork consumption in 2016 was a new low after decreasing for three consecutive years. Therefore, especially beef becomes more and more popular among Chinese consumers.

Variety in Chinese meat consumption: pork consumption drops from 90% of the overall meat consumption 30 years ago to 60% today

Beef is known to be lean and, therefore, healthier as pork with its both lean and fatty parts. That is why, recently the Chinese consumers rather go for a beef brisket than the typical and widely consumed Chinese dish ‘hóng shāo ròu’ (红烧肉, braised pork). Another driver for increasing red meat consumption in China is that the pork prices have hit a record high in 2016. Due to a lower output, as farmers had to cull millions of hogs as of a consequence of losses during 2013-2015, prices rose up to the high in May 2016 of RMB 26.58/kg, according to the Ministry of Agriculture of China (MOA, 中华人民共和国农业部).

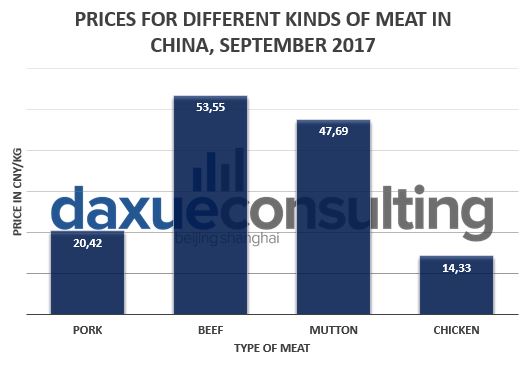

One year later, the current meat prices in China have stabilized as follows:

As of September 2017, beef is the most expensive regularly consumed meat in China while the pork price stabilized around RMB 20/kg. Reproduced by Daxue Consulting with data from MOA.

The prices for pork may have dropped again – however, the main driver for the increasing consumption of red meat is the growing middle class in China. With prices becoming less of a driver, the quality of the meat as well as the desire for variety in both nutrition and taste determine more and more which kind of meat the Chinese consumers prefer for their protein consumption. In doing so, pork nowadays accounts for 60% of the overall Chinese meat consumption, which is a drop from 90% thirty years ago, according to an agricultural outlook report of the OECD-FAO. This trend of the Chinese consumers to vary their meat consumption leads to problems of providing the demanded quantity of red meat in the future, though.

China expected to demand nearly half of the world’s beef by 2030, preferring imported meat

In particular, the trend of the rising demand for beef will be a problem for China. The expected demand of the Chinese consumers for beef may exceed the production volume of domestic beef and China’s current major beef exporters such as Brazil, Canada and Australia combined. Thereby, the Chinese consumers prefer imported beef as the domestic beef is considered to be of low quality for several reasons:

- While the overall production level may be high, China has become the third-largest beef producer by 2016, according to Research and Markets, the overall market structure is undeveloped in terms of production, slaughter processing, cold chain management and shipping

- According to the Journal of Fisheries and Livestock Production, 78.9% of the beef produced in China in 2014 was produced by small-sized cattle operations that only slaughter less than 50 cattle per year, of which the majority (66.1%) even only slaughters less than ten cattle per year. The quality of the meat of these operations suffers especially from little government control leading to poor safety checks as well

- Along with the second reason is the fact that new regulations in China about cattle slaughter and the animal welfare are likely to be only applied to the biggest market players and are difficult to control for the millions of small-sized cattle operations all over China (according to the journal, there are more than 11 million operations that slaughter nine or fewer cattle per year, as of 2014)

- Also, due to the fact that the large majority of Chinese cattle operations is small-sized (in 2014, only 1.03% of all operations slaughtered more than 50 cattle per year, according to the journal), the quality of the beef produced in these operations suffers from low breeding, slaughtering and processing technologies that are not as advanced as technologies from other countries

- As procedures are not as advanced, cold chain storage and shipment remains a key challenge for most players and may affect the quality of the beef

These problems with the quality of the Chinese beef are good news for foreign meat exporters, though, as they can expect China to react to these issues and start importing even more red meat from more countries to meet the consumers’ demands.

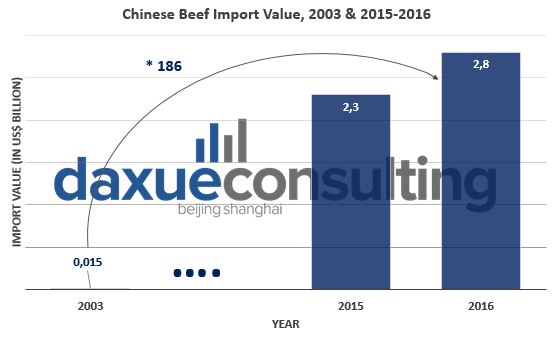

According to a recent study on Chinese beef imports from Daxue Consulting, the Chinese beef imports already increased by a factor of 186 between 2003 and 2016 to a value of US$ 2.8 billion.

The Chinese import value of beef increased by 186 times between 2003 and 2016, a study of Daxue Consulting shows. Source: Daxue Consulting.

Our study furthermore shows that China’s annual per-capita consumption of beef today is only at 3.9kg. This is immensely below the world’s average, with countries like Brazil (27.4kg), USA (25kg) or Australia (23kg) showing the highest beef consumption. “However, the current Chinese beef consumption accounted for an overall amount of 5.34 billion kg in 2016, which equals to 56% of the Brazilian production, 243% of the Australian production and even 445% of the Canadian production,” states Clément Mougenot, Director of Research at Daxue Consulting.

Moreover, combined with the fact that China may has become the third-largest beef producer, but can only increase its production slowly by 1% per year as beef cattle breeding takes a long period of time, this enhances China’s dependence on beef imports to meet the future Chinese demand for beef. Indeed, the OECD-FAO report forecasts an increase of the Chinese combined annual beef and veal consumption from 6 billion kg in 2016 to 9 billion kg by the end of the next decade in 2026. This will lead to China even demanding 47% of the world’s beef consumption by 2030, according to a forecast of NGO WildAid. As the Chinese government is well aware of this development, it is set to re-open its market for exporters from several countries.

China set to start importing red meat from USA and France again

As to find solutions against a potential deficit between the demand for red meat (beef especially) and the production and red meat imports in China, the government announced that it will allow imports from USA and France, respectively. As of today, Brazil, Australia, Uruguay and Canada were the biggest red meat exporters to China. Examples of beef exporters are Frigorífico Better Beef for Brazil, Instituto Nacional de Carnes (INAC) for Uruguay, well-known Samex for Australia and CanadaBeef that sell to China.

Australian Beef is among the most popular in Chinese supermarkets. However, “Aussie” beef will have to face competition from France and the US now. Photo credit: Daxue Consulting.

As for Europe, almost all European countries are still banned from exporting red meat to China. Currently, the only two countries that are excluded from this ban are Ireland, that exports to China via the Irish Food Board, Bord Bia, for instance, and Hungary, represented in exports to China by Hungary Meat.

By starting to import beef again from the US, restricted to animals of an age under 30 months to ensure good quality, the Sino-American cooperation seeks to fulfill two advantages at one time: first, from the American point of view, to lower the trade deficit between the two world’s largest economies of US$ 310 billion in 2016 (which accounts for 60% of the total American trade deficits last year). Moreover, from the Chinese point of view, China obviously tries to meet the rising demand of its consumers with further imports of the second-largest beef producer in the world.

After the BSE scandal (also called “mad cow disease”) in the 1990s, the World Trade Organization (WTO, 世界贸易组织) deemed EU beef collectively as safe and said that all bans and restrictions must be lifted as soon as possible, according to a statement of the European Union – European External Action Service. However, so far China just lifted the ban for French meat in March 2017. How come?

A big opportunity for both France and China

Although the EU emphasizes that the safety of the whole European beef is ensured by strict control and surveillance measures, China chose to only open up trade in beef with France first. This happens to be the case because China has unique sanitary standards that it requires from its exporters to prevent import of tainted meat. According to a spokesperson of the Fédération Nationale Bovine (FNB), an industry body of L’Association Nationale Interprofessionnelle du Bétail et des Viandes – INTERBEV, the French meat industry has “the required guarantees”. Moreover, the FNB stated that the country’s individual traceability and slaughterhouses are France’s big advantages compared to other countries.

US and French beef will soon be found in Chinese supermarkets – will other countries follow? Photo credit: Daxue Consulting.

Therefore, the opportunity for China is to import yet more beef in demand. At the same time, thanks to France’s distinct advantages in traceability and sanitary standards of its slaughterhouses, France can develop to a highly trusted partner of China for future beef exports to China. This is expected to be extremely lucrative as China currently has a low beef consumption per-capita, which only shows the large potential for beef sales in China in the future. China, at the other hand, can stock up its much needed beef imports with meat of an origin that ensures to live up with the overall great quality of imported meat in the country.

Surely, French beef exporters, such as INTERBEV, are chomping at the bit now to start exporting their French beef to China. As for INTERBEV, they already launched a new label called ‘FRENCH BEEF, a taste of terroirs’ to boost the French meat’s reputation abroad and to show that they can meet the Chinese consumers’ expectations. It will be interesting to see what the future holds in terms of the achievement of French red meat exporters in China.

Daxue Consulting’s experience in helping red meat exporters exporting to China

In the past, Daxue Consulting already helped red meat exporters from Europe and South America to export their meat to China .One example would be when a South American client, the tremendous growth prospects for the Chinese beef market in mind, contacted us to assist with building a branding strategy to promote the particular country’s beef. In order to best do so, our project managers created a 3-step research design to assess the attitudes, perceptions, valued attributes and buying habits of the targeted consumer segments to finally recommend the best branding/positioning approach to the Chinese beef market.

The first step involved Digital Social Listening to gain a first understanding of the Chinese consumers’ awareness and perceptions towards the client’s home country’s beef. Therefore, Daxue’s research team used Baidu (百度), the largest search engine in China, analytics platforms to measure the country’s beef reputation compared to other countries by assessing the particular numbers of searches, for instance. The second step, a consumer survey, aimed to map China’s consumption habits and behaviors. In total, 1000 regular beef consumers were surveyed in five Tier-1 or Tier-2 cities with an online survey that was designed in correspondence with the client. Lastly, four focus groups were conducted to gain an in-depth understanding of the key segments’ purchasing process when buying beef in China. In Beijing as well as Shanghai, two focus group discussions each were held with 6-8 participants. The composition of these groups differed in terms of which key segment the participant were allocated to. However, all of the participants needed to prove that they purchase beef in supermarkets or on e-commerce platforms in China at least once a month..

At the end, Daxue’s project managers combined, compared and triangulated the results of all these three steps in a final report. This report provided an overview of the consumer segment’s awareness and perceptions about the client’s home country’s beef as well as buying habits when purchasing beef. Finally, it provided the client with objective recommendations about best branding strategies as well as key positioning opportunities.

Clément Mougenot (r), Head of the research team in Shanghai, with Mike Vinkenborg (l), project leader at Daxue Consulting.

Contact us now to discuss with our project managers how to best export your red meat to the booming and opening red meat market in China.

![[Infographic] The beef meat industry in China](../wp-content/uploads/2017/01/Screen-Shot-2017-01-04-at-12.05.57-PM-150x150.png)