The development of the margarine B2C and B2B market: Are Chinese consumers ready for margarine? | Daxue Consulting

The market demand for margarine in China is steadily increasing with a 4-year CAGR of 21.83% in 2017 and a 1.5-million-ton demand. When looking at the baking oil and fats industry, which includes butter, margarine, olive oil, cream and all other types of oil or fats used in industrial baking and home baking consumption, the demand reached 2.797M tons in 2017 with a 4-year CAGR at 15%. Of this grouping, margarine accounted for more than 50% of the total demand and is used heavily by industrial baking companies in production while currently, end consumers are not very familiar with margarine.

Importation of margarine to China

China as a country is not a strong margarine exporter globally but its importation and consumption are very high. This is seen with China ranking second in the world imports list by OEC with 6.1% of total margarine imports value and volume globally equalling 300 million US dollars. This is as there is a huge demand for margarine in China with domestic margarine makers not being able to keep up with consumer consumption.

Are western trends driving the margarine demand in Mainland China?

In 2017, the market demand for margarine accounted for approximately 1.5 million tonnes, while the market consumption in 2016 was at 1.06 million tonnes. The consumption difference in a year shows the growing trend of margarine consumption which can be partially attributed to the recent western lifestyle adoption in larger cities. This is especially with the urbanization and rise of the middle-class which has contributed to the development of western lifestyles and alternative food trends in China. Chinese people, especially those in higher tier cities, welcome western food especially baked goods, cakes and sweet pastries, and the increase of bakeries is directly linked to margarine sales.

Moreover, consumption on the go has increased in China with consumers in higher tier cities living a faster pace of life. This is as the large busy cities themselves has led those working between the ages of 25 to 44 years old changing their consumption habits. This group is having fast lunches and consumer a lot of taking away food which includes products usually made with margarine such as fast food, sandwiches and bread-based meals. This is made easier by the availability of delivery services, convenience stores and restaurants catering to the consumption habits of these consumers.

Chinese people are also very active on social media with social network and status being of great importance to them. Posting pictures on social media feed such as Wechat and Weibo are a very common practice with food being a popular topic among Chinese consumers. This is evident with consumers posting pictures of cakes from famous brands of homemade baked goods which also helps perpetuate the popularity of baked products leading to increased consumption by Chinese consumers as a whole.

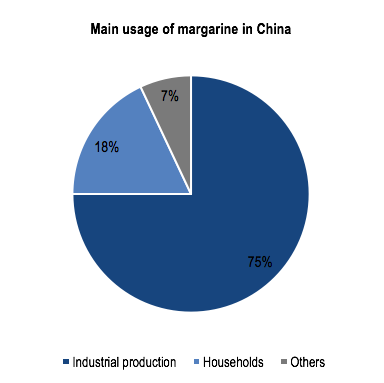

Industrial demand vs consumer demand for margarine in China

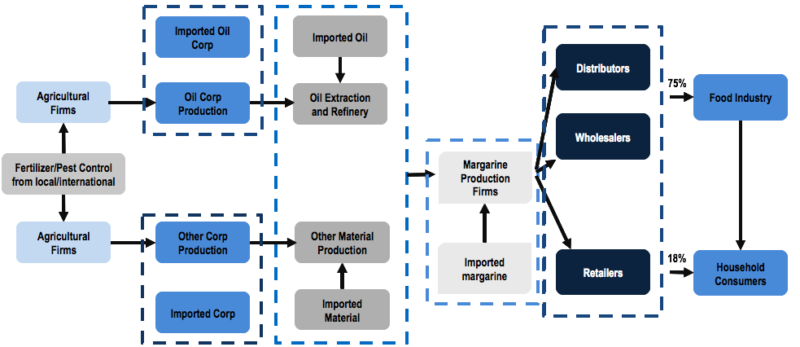

The business to consumer demand is very low in the Chinese market with it being only 18% of the total demand. This is as margarine does not yet have a strong awareness among Chinese consumers and is not a commonly used product. Industrial demand is very high, however, with it being 75% of the total demand as bakeries frequently use margarine in baking products. This figure can be linked to the globalization of food, with more international food being integrated into the Chinese lifestyle especially in tier 1 cities. This is with over 80% of Chinese people buying imported products which, as a result, is influencing margarine consumption as a whole. Consequently, the main place to target in order to enter the Chinese market is industrial production.

Chinese consumers concern about health in 2019

Food safety is a huge concern among Chinese consumers in general, with other health issues arising in the past. As a result, consumers tend to look for information about products before buying them- especially in regards to new products. The use of processed trans fats is a recurrent question with consumers asking about trans fatty acids effect on health. This is evident, for example, with consumers being concerned about whether margarine is cardiovascular unfriendly. This concern is heightened with the South China Morning post talking about margarine causing a cancer-risk food scare this year for Hong Kong.

Further, the food scandals that have taken place over the last decade has made Chinese consumers wanting to know the ingredients of what they are eating and seeking out seek out quality and healthy food as a result. Consequently, these health concerns have shaped the margarine industry, with opportunities arising for international companies to appeal to Chinese consumers by improving, innovating or developing new products which are lower in fat or contain a limited amount of trans fatty acids.

Further, even the industry itself has mixed feelings towards margarine with international giants and Chinese companies showing a split. Mcdonalds responding to consumers and trying to change its health perception stated and stopped using liquid margarine and started using real butter in its fast food. Further, the world’s largest margarine and spreads producer Unilever also sold its margarine business to KKR as it didn’t see the business as still profitable. In comparison, Chinese lifestyle firm Fosun and food company Sanyuan is jointly buying the French margarine maker St-Hubert, as they see the business is still growing. Opportunity is brewing with brands having the chance to appeal to and address the health concerns of Chinese consumers.

|

|

Do Chinese consumers understand the difference between margarine and butter?

As stated, food safety is very important to Chinese consumers and as such with the low awareness of margarine and what it contains is an issue for the market. This is with 80% of Chinese consumers buying butter whilst 20% of consumers are buying vegetable margarine. Moreover, for consumers, the difference between butter and margarine is not clear. This can be attributed to the Chinese characters used for both products with the distinction being quite small with only the first character differing.

- Butter: 动物黄油 è literal translation: animal butter

- Margarine: 植物黄油 è literal translation: vegetable butter

This is evident, for example, when looking for margarine on online supermarkets, results are often a mix of butter and margarine. This is further a key issue in business to consumer promotion with brands not always making clear their classification as either butter or margarine. This leads to confusion as consumers sometimes end up buying one or the other without paying attention due to the lack of clarity by the brand. Further, the most popular questions asked by consumers in regards to margarine makes it clear that Chinese people do not know the difference between both products and how to use and eat margarine.

The three questions most asked about:

- 动物黄油和植物黄油区别? What is the difference between butter and margarine?

- 植物黄油有什么用途? How to use margarine?

- 植物黄油怎么吃? How to eat vegetable butter?

Another reason for margarine lack of awareness by Chinese consumers is its lack of presence in supermarkets or general shopping areas. This is as Chinese cooking traditionally usually involves cooking with vegetable oils such as soybean or sunflower oil. Moreover, unlike western households, a lot of modern Chinese kitchens do not contain ovens because baking is so uncommon. This is due to time, the convenience of baked goods already available and unfamiliarity. China is still expected to become more westernized over time but it is likely to still keep a lot of its own traditions especially in regards to home cooking. As a result, margarine is still very new to consumers and not yet adopted by China’s population. This, however, has the potential to change over time with greater awareness and adoption being needed in order to integrate it into Chinese home consumption and cooking practices.

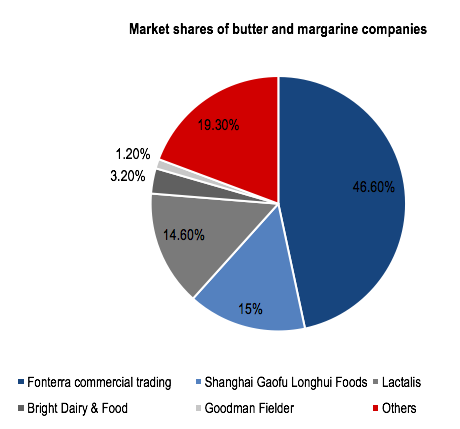

Major players in the margarine and butter market in China

When looking at the overall product range of the main market players in China, it can be noted that margarine is only a small part of their business. This is as margarine is a more recent development in the Chinese market and to be successful, brands need other products to support them in order to stay profitable. The products that these brands offer are mostly dairy and baking products. This is as margarine is considered as a butter replacement and therefore it is relevant for dairy businesses to have it within their offerings. This is the case with Shanghai Gaofu Longhui Foods Co Ltd, Bright dairy and Food Co. Ltd and Goodman Fielder Ltd all selling margarine as only part of their business model. Further, this business structure provides a good platform off of which known brands can develop new products and benefit from their awareness and customer loyalty. This is especially important as the dairy industry has suffered from several food safety issues thereby making imported products and raw materials a major competitive advantage for international brands.

Margarine manufacturers in Mainland China

Domestic vs international raw materials in China

Soybeans are the main material used for margarine production in China. Despite this, less than 10% of the soybean production is used for modern processed productions including margarine. Soybeans are grown in three regions in China including the north (Heilongjiang, Jilin, Liaoning and Inner Mongolia provinces) with large production farms, the Huang Huai Hai area which includes the Central region of China and South China around the Yangtze River Valley area.

There is a sharp increase in soybean imports and a decline in domestic production. This is with the price of domestic soybean production being higher than the beans produced in the USA or Brazil, due to the smaller and rarely mechanical based farms in China. In the oil production process, cheap prices and the oil extraction rate are the most important, with imported products being preferred. China, however, does not measure up on a global scale with Chinese produced domestic bean oil content remaining 3 to 5% lower than imported beans from other countries causing its soybean production to decline steadily.

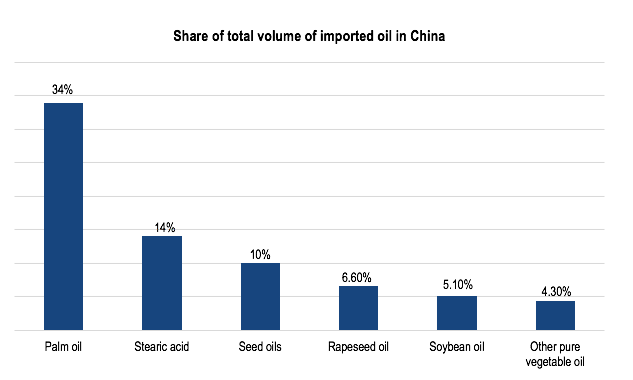

Imported materials consequently are a significant source of raw materials for margarine production in China. As stated by OEC, in 2016, major oil imports in China include Palm Oil, Coconut Oil, Seed Oils, Rapeseed Oil, Soybean Oil and other pure vegetable oils. Most of these oils can be used as raw ingredients in margarine production especially palm oil, rapeseed oil and soybean oil. The main suppliers for raw materials are the USA and Brazil where they have larger scale production farms.

[Source: Daxue Consulting]

International margarine manufacturers in China

Some of these companies produce imported raw material as the basis of their business model for margarine production. These include Unilever, Cofco and Fuji oil who are all international producers and only have margarine as part of their business along with soybean oil, rapeseed oil and palm oil (mostly vegetable oil). There are also other companies who also specialize in margarine but also produce other oil-based products such as Daxin Oils & Fats Industrial Co. Ltd, Anhui Kangermei Oil & Far Co. Ltd and Guangzhou Yahe Food Ingredients Co. Ltd.

Importance of imported products in the value chain of margarine in China

The value chain of margarine in China also illustrates the reliance of China on imported raw and processed material. This is with these materials being present in the very early stages of margarine production. The demand from the food industry requires margarine producers to source beyond domestic suppliers for raw materials as domestic producers are currently unable to efficiently meet the quantity needed or the cost-effective measures undertaken by other countries in production. Furthermore, beyond sourcing, domestic margarine production just cannot sustain China’s food industry with its smaller scale production farms. This current situation has, as a result, caused China to rely heavily on margarine imports.

Opportunities for international brands in China

The Economist indicated that from 2017, margarine sales in Asia-pacific region will not grow much but that butter sales will grow at a faster rate from 2017 to 2021 approximately double the total sales in five years. Similar trends have already happened in the US as in 2013; the per capita consumption of butter exceeded that of margarine for the first time since the middle of the 1950s. This increase in demand for butter in China has caused a butter crisis in Europe with the increasing demand from Chinese consumers. Further, other demand in the oils and fats industry includes soybean oil, rapeseed oil and olive oil (mainly vegetable oil).

Foreign expertise in margarine production is highlighted as strength in the industry. This is especially so where international organizations could partner with Chinese manufacturers to bring technology for margarine production and improve competitiveness in the Chinese market. Additionally, another opportunity for international brands is to provide new production techniques in order to provide healthier margarine that would align better with Chinese consumer needs and wants. Moreover, awareness is also needed in order to educate consumers about the difference between margarine and butter. The fast pace of western lifestyle trends is also likely to continue to increase consumer demand in the future. It is also highly recommended for brands to import raw material in order to obtain better quality products and to keep the added advantage of foreign knowledge and value in margarine production. This is especially with the need for international brands to focus on maintaining the competitive advantage in industrial production supply. As a whole, there are a variety of ways for international brands to get involved with production technology. This includes by providing new production techniques to the domestic market, by providing healthier product developments and by targeting industrial production.

Author: Jessica Farrell

Finding accurate data concerning distribution and supplier in China has become nearly impossible. Daxue Consulting has the capacity of screening in China with the help of our nationwide reach network involving main actors of universities, industries, and cities.

So, to use such a service as Distribution & supplier screening in China and find answers to all questions do not hesitate to contact our project managers at dx@daxueconsulting.com.