The cheese market in Shanghai: Cheese evolution | Daxue Consulting

Cheese market in China.

Historical reasons explain the rejection of cheese by Chinese consumers

Traditionally, dairy products were associated with the nomadic tribes who lived on the fringes of China and who were regarded as barbarians. So back then, eating cheese was associated with an unsavory lifestyle.

Also, the majority of Chinese people avoided the consumption of dairy products, including cheese, because so many of them are lactose intolerant. In fact, many East Asians are lactose intolerant because of a lack of exposure to cheese. It’s a vicious cycle.

Cheese currently becomes trendy in China: Booming cheese market

Daily dairy intake is consistently an important theme in China, however, cheese consumption, while growing still remains low. Chinese dairy consumption of fresh & UHT milk, yogurt, and milk powder account for 95% total cheese market share. Cheese, butter and other dairy products share the remaining 5%. Cheese consumption in China recorded 0.1kg per capita in 2016. Looking at the neighbor countries, Japan and South Korea, both were over 20 times higher than China (2.4kg and 2.6kg respectively), which implies a significant opportunity for cheese in China in the future.

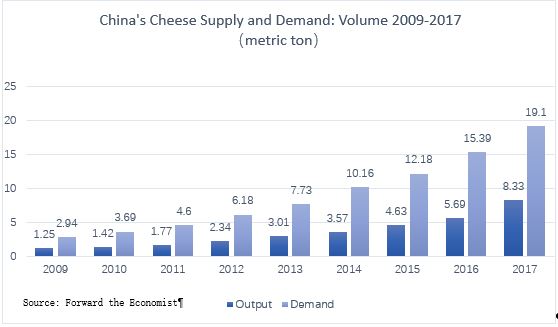

The market has seen a surprising growth, revenue in the Cheese segment amounts to US$1,056m in 2019. The Chinese cheese market is expected to grow annually by 5.3% (CAGR 2019-2021). Between 2009 and 2017, the volumes of cheese demand, as well as supply, see continued growth, thanks to emerging diverse formats, acceptable flavors, and textures catering to Chinese palates. Domestic suppliers of cheese still account for less than half of the whole demand, meaning cheese consumption in China relies heavily on imported cheese.

By 2019 the cheese currently becomes trendy in China particularly Shanghai and other 1-tire cities. This may be preceded by the following reasons. First, Increasing upper-middle-class and affluent households. Second, a new generation of freer-spending, sophisticated consumers, born since 1980. Third, the growing power and ease of e-commerce delivering cheese to China’s doors. Forth, the rapidly accelerating Western culinary influences have introduced cheese to these cultures. Last but not least, an increasing number of expats requiring Western goods and, as a result, the active growth of imported stores.

Cheese consumption in China: What’s the image of the cheese?

The Chinese Nutrition Society issued updated dietary guidelines for Chinese consumers in 2016, recommending that each adult should consume 300 grams of dairy products per day – current consumption is 100 grams.

Most of the time, protein and calcium intakes are presented to Chinese consumers. “Good for pregnant women and the elderly” states Baidu Baike (the Chinese Wikipedia). The nutritional side is explained and the description highlights that the cheese is a concentrate of milk, from 10 kilograms of milk only 1 kilogram of cheese is producing.

Moreover, amidst increasing awareness of children’s diets, cheese snacks have been well-received by parents, especially in tier1 and tier2 cities. Kids cheese market dominates 55% of the retail cheese market (Kantar 2017) and sees positive growth in the near future. Therefore, many processed kinds of cheese can be seen as more common in supermarkets and convenience stores due to light flavors.

[Source: Yili]

“Cheeses do not only attract expatriates any more. We can see a lot of Chinese customers coming to buy cheeses,” said an experienced dairy salesperson in Ole, an upscale supermarket in Shanghai.

The landscape has changed a lot recently compared with the situation in 2015. Before 2016, it was nearly impossible to find cheese in small stores, and 94% of the imported cheese market was sold through large international supermarkets and hypermarkets.

The Chinese cheese market should overcome cultural barriers

The cheese consumption mix in China is dominated by processed cheeses, which are more suited to the local palate. Chinese consumers, in general, do not favor the strong tastes and scents of many natural cheese varieties. Furthermore, processed cheese is easier to handle when used in hamburger and pizza preparation.

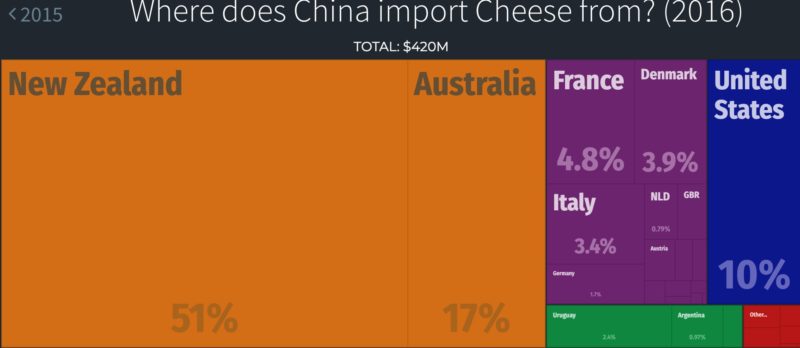

The attractiveness of the Chinese cheese market as a large consumer of cheese is enforced by the lack of Chinese cheese producers, enabling international companies to shape the market. Despite France being the largest producer of cheese in the world, France only accounts for 4% of the current market share. New Zealand, Australia, and the U.S. are the largest exporters of cheese in China.

[Source: OEC]

Shanghai is for many years the leading power of China economic and trade development. International trade of goods is facilitated in Shanghai, enabling the city to discover new products at an earlier stage; it includes the cheese market implementation.

Therefore, the deep analysis of the Chinese taste and cheese preferences will help to study this market and the audience and in the future easily predict acceptation from customers. Shanghai Roria, a European food importer offered tastings of various French, Italian and Spanish cheeses in Shanghai. As a result, the rate of satisfaction toward the strong blue cheese was extremely low, as only 30% said it was amazingly good. Unlike in western countries, a lot of Chinese consumers have never tried Cheese and have an image of a bad smell concerning to this good; this is illustrated very well by the Chinese word for cheese “nailao” (奶酪), meaning “milk jelly”. Whereas Cheese has another Chinese name: “zhishi”(芝士, a buzz word now in China ), is mostly being used in the context indicating cheese.

Why the Cheese market in Shanghai can lead the way

In Shanghai, people enjoy experiencing new products and discovering new tastes from imported products. For foreign companies, educating and changing consumer tastes represents a real challenge. That’s why firms such as Bongrain Food preferred other strategies to enter into the Chinese market by adapting to the market and introducing tailored products according to Chinese tastes. Thus their products have already seen 50 new varieties. In Shanghai, the most famous cheese brands are cheese snacks for children such as Stick Cheese, Kiddy Cheese and Small Triangle Cheese. Those may represent the beginning of the Chinese adaptation to the taste of cheese; especially by going through new Chinese youth.

In Shanghai, people enjoy experiencing new products and discovering new tastes from imported products. For foreign companies, educating and changing consumer tastes represents a real challenge. That’s why firms such as Bongrain Food preferred other strategies to enter into the Chinese market by adapting to the market and introducing tailored products according to Chinese tastes. Thus their products have already seen 50 new varieties. In Shanghai, the most famous cheese brands are cheese snacks for children such as Stick Cheese, Kiddy Cheese and Small Triangle Cheese. Those may represent the beginning of the Chinese adaptation to the taste of cheese; especially by going through new Chinese youth.

According to Euromonitor, cheese is being added to school lunch menus in many primary schools in Shanghai.

In the nearly past, Cheese was strictly considered as a luxury food. But with the rise of consumer awareness of the nutritious benefits of the product due to exposure to western culture and style in large international cities such as Shanghai, parents have started to buy cheese snacks for their children. Typical families believe that the presence of calcium in cheese will support vital functions in the growth of children.

Another sign of the increasing popularity of the cheese market in Shanghai is the recent apparition of traditional cheese makers in the streets. La Parisienne and La Formaggeria, for example, offer both a decent array of cheese right in the center of Shanghai. A wide range of cheese can be found on the Internet and deliver high-quality cheese in China quickly.

Also, there is an increasing amount of tasting events held in Shanghai and will get more Chinese consumers to try cheese for the first.

A variety of cheese-related foods sparks the wave of “cheese lover”

Western-style cuisine began to enter into the Chinese market a decade ago, and now it has been widely accepted by Chinese people, no matter the burgers from McDonalds or KFC, or pizza from Pizza Hut, or creative popular dishes all having options for cheese flavors. But still, Cheese’s development in China is at an early stage with low per capita consumption and novelty driving sales.

1. Cheese has emerged thick and fast in many recipes

Nowadays, Chinese netizens are favor of sharing everything about their daily lives through social media, such as LRB, short for Little Red Book(小红书), a social network for Chinese users. If we search “芝士”(Cheese)on LRB, more than 220,000 posts are shown in the results, teaching you how to cook “Tomato cheese rice”, “Cheesecake” or other dishes receipts of each include cheese.

[Source: Little Red Book]

2. Cheese milk cap (奶盖) becomes ridiculously popular amongst the young generation

With the rise of Wanghong drinks (网红饮品),for example, HEYTEA and Lelecha among famous cheese tea brands, young milky tea lovers are obsessed with the type of tea with cheese on the top. According to HEYTEA’s official website, this type of topping is made of salty cheese imported from New Zealand. Cheese tea lovers are willing to queue up for several hours only to order one cup of drinks.

[Source: HEYTEA]

3. Cheese snacks are gaining more popularity in Shanghai

Cheese snacks in retail performed well in 2018, and most of them are processed cheese which is trendy at the moment.

How to select proper cheeses for kids?

- 4 critical contents: protein, fat, calcium, sodium;

- Cheese is the concentration of milk, ready for kids supplementing protein and calcium;

- Cheese can be categorized into “natural cheese” and “processed cheese”, most kids cheeses are processed one. In terms of nutrition, these two types of cheese are almost the same.

Similar to kids cheeses, normal cheese snacks are majorly processed and have a variety of shapes, including stick, mini cup portion, cube, ball, triangle, bar shape and so forth. Considering user-friendly, convenience-in-use and easy-to-carry is a crucial factor for snacking consumption. On the other hand, innovative appearance is leading consumer trends. It’s very likely that in the near future, traditional original flavor cheese snacks can hardly meet the varied demands of sophisticated Chinese consumers. Compared to slight taste improvement by foreign brands, some Chinese brands provide very unique offerings, such as potato, date, peanut, and pizza flavor.

Shanghai given its unique attributes about open to new things and large disposable income of citizens, is expected to lead the cheese evolution in China. Lactose intolerance, according to studies, can be less of a problem if people begin to have cheese and milk in a younger age. It is reasonable to believe that exponential cheese consumption is expected to grow continuously in the foreseeable future.

Daxue Consulting helps you get the best of the Chinese market

Daxue Consulting can provide you with support in discovering the Cheese Market in Shanghai. We conduct all the market research and consulting services you may need, such as potential analysis, cost analysis, implementation feasibility etc. To know more about the Chinese cheese market, do not hesitate to contact our dedicated project managers by email at dx@daxueconsulting.com.

![[Podcast] China Paradigm 43: How to make a profitable e-commerce store in China](../wp-content/uploads/2019/06/e-commerce-store-China-podcast-150x150.jpg)