The dairy market in China will be the world’s largest by 2022

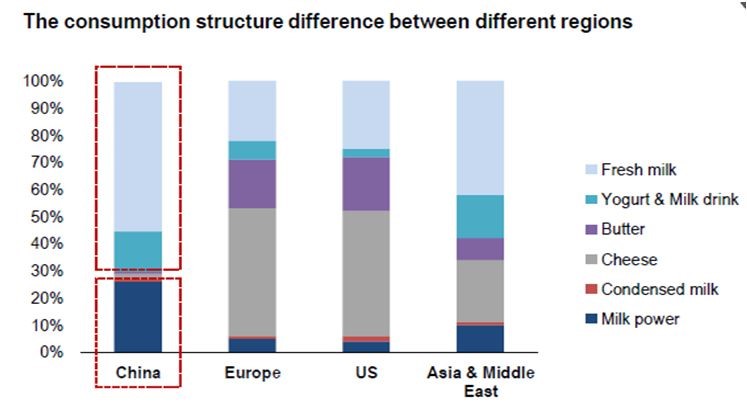

The total revenue of the dairy market in China 359.041 billion yuan in 2017, with a YOY increase of 7.85 percent. The most consumed diary products in China are fresh milk, milk powder and yogurt, while cheese and butter are less popular. Currently, China ranks second in terms of market volume after the US while it is estimated to overtake the US as the largest dairy market in the world by 2022, according to research by Euromonitor International.

Growth of the dairy market in China

It is widely acknowledged that the dairy products in China serve as the pillar in people’s livelihood. It is a highly integrated industry, and at the same time, it extends from the primary industry (agriculture) to the secondary industry (food processing industry) and the third industry (distribution and logistics). China, as one of the world’s largest economies, has witnessed the surge of the dairy industry, prompted by economic, social, and many other factors. Even though the whole development history is not very long, the status of dairy products in people’s dietary structure has been greatly improved.

The dairy market in China has witnessed the steady and substantial growth since the beginning of 1990s and even with the widespread 2008 Melamine scandal which disrupted consumer confidence as well as domestic production, the market only experienced a short period of turbulence after the Chinese government has taken several measures, including cracking down on illegal producers, enforcing new regulations to better ensure the safety and quality of domestic dairy products in China.

At the same time as the restructuring process, China is becoming the most dynamic sector in the global dairy market, and the whole industry has gradually shifted from scale growth to quality upgrading.

Contact us for any question on the Chinese marketHow the market overcomes the obstacle of lactose intolerance in China?

It is true that Asian people are genetically predisposed to lactase-deficiency (around 85% of people suffer from lactose intolerance in China). Older generations of Chinese who were not used to consuming dairy products in their diets are also mostly lactose intolerant.

But this lactose intolerance in China will not slow down the market. First, because to create new generations of milk drinkers, society and government have taken several measures. Today Chinese babies are born with the ability to make lactase, which is the enzyme needed to digest the milk vector and which is lost as they grow older. Moreover, children do not stop drinking milk as they grow up and therefore continue to produce this enzyme.

Government support of the dairy industry

Within the health community, new official nutrition guidelines were also issued recommending that more dairy products should be consumed in daily life. Health professionals, hospitals, and clinics have also been trained to explain to parents that their children need a lot of milk.

In 2000 the government also launched a program in all schools to give each child a cup of free milk.

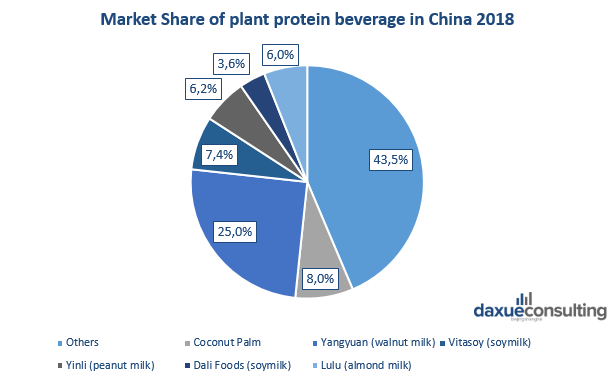

Plant based milks are hugely popular in China

Finally, this problem could easily be overcome with all the alternatives that exist: plant-based milk in China. Indeed, from 2015 to 2017, plant-based milk sales increased by 17%. More and more companies are setting up production lines for plant-based milk in China. For example, the Swedish oat milk brand Oatly has recently opened an office in Shanghai and deployed a new Chinese character for ‘vegan milk,’ that is to say, plant-based milk in China.

Finally, the industry knows that fermenting milk helps break down lactose, so new yogurt products are also marketed to overcome lactose intolerance in China.

The Chinese government is playing an important role in increasing dairy consumption in China

The current party in China has included the consumption of dairy products in its 13th five-year plan. It identifies one of its top priorities the transition from small herds to larger industrial farms to supply its population of 1.4 billion people with milk. Official dietary guidelines recommend consuming three times as much dairy products in China as people do today.

But on the other hand, China imports a lot of dairy products, and it has some impacts on the country’s domestic dairy producers such as the decline in sales revenue and profit margins. In this respect, the government is also taking action to regulate dairy imports, which of course has an impact on the brands and products consumed by Chinese people.

Stricter regulations on infant formula

For example, to restrict the import of infant formula milk powder, in early 2018, the China Food and Drug Administration take measures called ‘‘Measures for Administration of Registration of Formulas of Infant Formula Milk Powder’’ that stipulate that infant formula milk powder that has not been registered in China is not allowed to be sold in China, and the Certificate of Registration of Formulas of Infant Formula Milk Powder must be obtained according to the law for imported infant formula milk powder to be marketed in China.

A bit later in 2018, the Announcement of the State Certification and Accreditation Administration on Renewing the Registration of Overseas Manufacturers of Imported Infant Formula Milk Powder in China specified that the registration of overseas producers of imported infant formula milk powder in China would be valid for four years and should be renewed upon expiration. These policies should curb the entry of more than 80% of the 2,000 brands of powdered infant milk imported into China.

The expanding middle class are consuming more dairy products in China

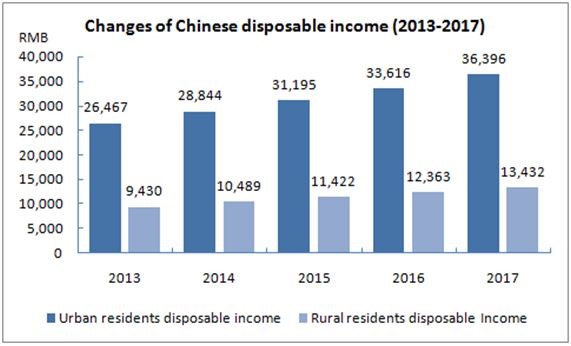

The national economic strength undoubtedly plays a significant role in the rapid development of the dairy industry in China. The below chart illustrates the change in per capita disposable income of urban and rural residents from 2013-2017, which implies the improvement of living standards. Consumers now have higher purchasing power and are increasingly exposed to international trends, resulting in a shift in lifestyles that towards westerners.

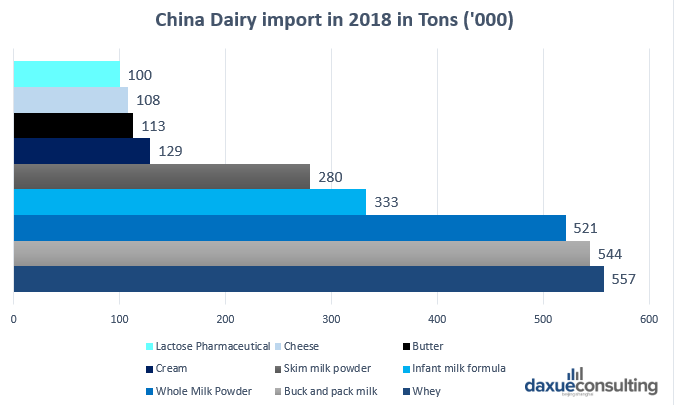

In 2018, among all dairy products, milk powder imports contributed nearly 70% to the import value of dairy products in China. The milk powder imported includes infant formula milk powder in China, raw milk powder, etc. This is, therefore, by far the most consumed by the Chinese.

Growing health awareness accelerates dairy consumption in China

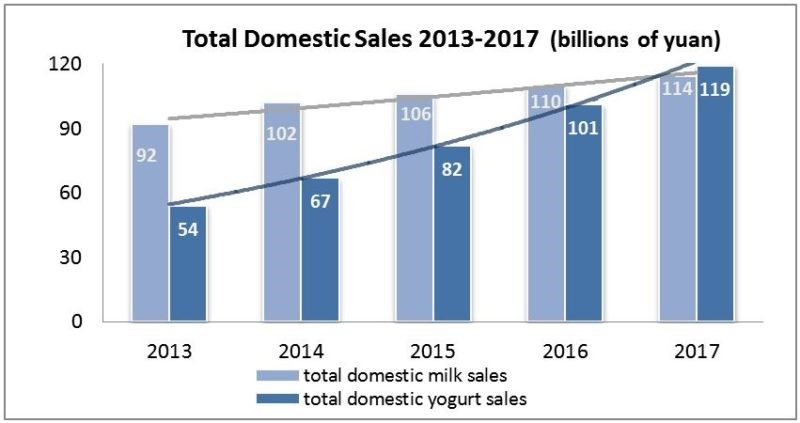

Another main factor that influences dairy consumption in China health consciousness. Dairy products are a useful source of protein, calcium, vitamins, and several minerals. Yogurt in China is one emerging category that has catered to Chinese’s growing health awareness as it is often believed to help digestion and strengthen the immune system.

As a result, yogurt has experienced explosive growth which fueled the general demand for dairy products in China. According to China Daily, the total yogurt sales in 2017 has overtaken the milk sales for the first time in the country. As depicted in the below chart, the total domestic yogurt sales have risen by 108.6 percent from 2013 to 2017, whereas milk sales grew by just 18 percent in the same period.

Top yogurt brands in China

Furthermore, among all yogurt sector, the ambient yogurt maintains the fastest growth. The craze initially started with the Momchilovtsi(莫斯利安) from Brightdairy in 2009 then Yili introduced Ambrosia(安慕希) in 2014, successfully generating buzz in the country.

The ability to store and transport at room temperature is the major characteristic of ambient yogurt, which seems quite exotic to westerners since they consider chilled yogurt as mainstream. Nevertheless, being able to transport at room temperature is important as the chilled chain infrastructure is still underdeveloped in China. This entirely new wave is providing a wider distribution network as well as offering convenience for both retailers and consumers. At present, this sector is soaring not only in the dairy market in China, but also in the food and beverage market. It is mainly targeted at young consumers, both male and female.

One famous example is Yili Ambrosia(安慕希), a brand of yogurt in China, it is endorsed by Chinese popular actress Angelababy and has been the title sponsor of the popular Chinese reality show Running Man(奔跑吧兄弟). It took advantage of the celebrity effect to achieve precision marketing and dramatically increased the total sales and now occupies the first place in that segment.

Since the scale as, as well as the technology of chilled chain, all need to be improved; ambient yogurt will continue to appeal to Chinese consumers. The potential for the total yogurt sector is still huge, and the trend would probably lie in the innovation of flavors and premium products.

Will the emerging cheese market in China be the next leader?

Apart from the outstanding performance of yogurt in China, cheese also drove the growth of the dairy market in China. We have already carried out research in Cheese market in China in 2013 and 2015 and compared with that time, Chinese consumers are becoming more and more aware of the health benefits of cheese. Cheese and other dairy products in China which are rich in protein and calcium offer a more nutritious, healthy choice over many other food types. This segment is thus receiving attention from dairy players.

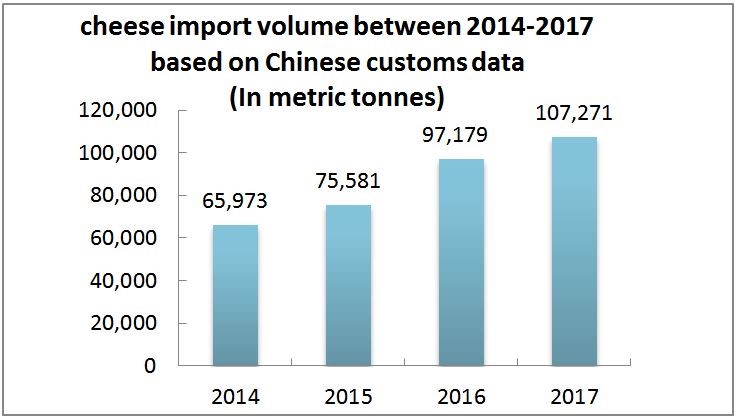

The cheese market in China now relies heavily on import, and the import volume boosts steadily throughout the years. In terms of top three cheese exporters to China in 2017, they are New Zealand (55,329 tonnes), Australia (20,012 tonnes), and the United States (12,841 tonnes).

Despite consistent sales growth for cheese led by great interest in the particular category, the per capita consumption is still lagging behind compared with other neighboring Asian countries, let alone with western standards.

In all, the cheese market in China is expected to continue positive retail value growth over the following years. Cheese’s development in China is still in the early stage with low per capita consumption. And most cheese offered in China is processed cheese, such as Anchor(安佳) from the Netherlands, La Vache Qui Rit (乐芝牛) from France. With Chinese, especially Millennials’ lifestyles, moving towards westerners, the demand will keep increasing. The adaptation of the taste of cheese will be crucial, and future improvement would also lie in the spread of relevant knowledge, information, digital marketing campaigns, and health-focused innovations.

Various channels intensified the battle between domestic and import dairy products in China

Since the central government has approved the universal two-child policy, the demand for milk as well as other dairy products in China will still be strong in the following years. China dairy major players have accommodated to diversified needs and implemented innovation constantly, including Mengniu Dairy, Inner Mongolia Yili Group Co Ltd, and Brightdairy for East China. However, fierce competition has been intensified with the appearance of foreign brands. According to Mintel, Chinese consumers still prefer imported products over domestic ones, due to the lack of trust and price advantages.

Traditional supermarkets and hypermarkets

The battle between domestic or imported dairy products in China has been escalated due to the development of e-commerce. Online platforms have played a critical role and facilitated the efficiency of the distribution network. In addition to that, the trend of cross-border commerce or buying dairy products by Daigous (代购) is becoming more popular, especially among younger generations in urban areas.

Against the slow-down in the growth of the overall FMCG, the import dairy market in China still maintained rapid growth. The official import figures of dairy products for the first quarter of 2018 has shown an increase by 15.3 percent year-over-year, with rises for Bulk and Packaged Milk, Whole Milk Powder (WMP), Whey, Skimmed Milk Powder (SMP) and Infant formula. Chinese dairy imports exceeded 750,000 tonnes between January and March 2018. Moreover, China’s growing appetite for high-value-added products resulted from increasing disposable income suggests that consumers are putting more emphasis on quality.

Unequal regional dairy consumption in China implies room for improvement

Regarding Chinese consumers’ consumption structure and occasion, generally different consumers have their preferences. Common consumption occasions include between-meal snacks, at breakfast, as a dessert or beverage. According to a survey by Mintel, 40% of Chinese consumers said that they consume yogurt at least once every day and 17% consume lactobacillus beverage at least once every day while contrarily, those figures were only 15% and 11% in 2013.

Different age groups dairy consumption

The research also found that different age groups of consumers have their preference. For example, young white-collar workers prefer one-time consumption and 1-2 bottles each time and are willing to choose a slightly more expensive product. Family members have a fixed habit of dairy consumption, a dozen or more each time, favoring fruit-flavored or calcium-rich products for children and paying more attention to promotions.

Regional differences in dairy consumption

The acceptance of dairy products in China also varies from region to region. Northwest China is the main raw milk production area in China, so the per capita consumption is higher. In addition, the per capita consumption of Beijing, Tianjin, the Yangtze River Delta region and the Pearl River Delta Region is also higher due to the prosperous economy. But in Northeast China, Southern China, central China, and southwest China, the consumption of dairy products per capita still has room for improvement. Also, it is evident in China that UHT milk is way more popular than pasteurized milk. The market performance of the latter is fairly limited to coastal cities because of its relatively short storage period and costly logistic expenses.

Likewise, more and more urban residents are willing to purchase premium products and therefore generating a lucrative niche market for certain high-end products for instance, organic, low fat, low calorie, since health concern remains the key determinant in consumer purchasing behavior. Whereas, in rural areas, a large proportion of people used to drink soy milk, but now more are inclined to consume milk since the penetration of dairy advertising as well as sales channels.

Distribution is also facing great evolution. First-tier city consumers are more inclined to shop online, and the penetration rate is over 90 percent while the lower-tier city or rural area only got 20 percent as the penetration rate for dairy products in China. Such kind of unequal distribution implies that dairy manufacturers have to extend their sales channels, both offline and online, which is a great challenge for retailers.

Future trends continue to flourish China’s dairy market

In general, the dairy market in China has entered a slow-speed development stage and is shifting from scale growth to product upgrade. The dairy consumption in China has been fluctuating in the past decades, yet the market’s total value and volume are huge. Compared with western countries, China possesses a large amount of fresh milk and milk powder but a lower amount of butter and cheese.

There already exists a great number of domestic and foreign brands in the market and several local brands such as Shengmu(圣牧), Xinxiwang(新希望), Junlebao(君乐宝), Huishan(辉山) are rising quickly. These young brands took share from the largest players and therefore lowered the concentration of the top brands. It is true that low loyalty is a macro trend in FMCG as consumers are provided with even more options. As a result, dairy players need to identify and cater to the diversified yet changing needs of consumers and apply the corresponding marketing strategy.

Pan Gang, chairman of the Yili Group, once said that there are only two kinds of people in his eyes. One is a person who drinks milk; the other is a person who doesn’t drink milk. And his wish is to convert the second kind of people into the first kind – “milk drinking man” – people who enjoy milk nutrition and health. For the time being, it is still domestic dairy companies that are leading China’s dairy market. With the booming economy, accelerated globalization and rising health concern, future product transformation will be mainly focused on the flavors, quality, and variety of the products. Premium product market will thrive under the selling points like organic, health, and nutrition. The ambient products stick to be the mainstream in the following years, while chilled ones are also expected to expand its market share to better foster the growth of China’s dairy market.

Daxue Consulting has a robust background in the dairy industry in China:

Our market research team has already carried out research for the cheese industry and various food and beverage industries in China. If you want to know more about these industries in China do not hesitate to contact us at dx@daxueconsulting.com

Make the new economic China Paradigm positive leverage for your business