What international brands must know about the domestically dominated healthy snacks market in China | Daxue Consulting

Healthy snacks market in China. How to eat healthy without sacrificing taste is more or less a worldwide concern. This is certainly the case with Chinese consumers. Chinese consumers are on the search for healthy snacks to fill their stomachs. In China, traditional Chinese recipes provide a solution to this conundrum. Many healthy snacks are derived from Chinese medicine, like walnuts and Chinese dates. However, some of them are not popular among young consumers because of their plain flavors. After the reform and opening up in 1978, International brands started to enter the Chinese market, but they mainly provided common snacks, including candy and cookies, instead of healthy food. Since the 1990s, more healthy snacks started to appear in China, but common unhealthy snacks were still more popular due to their better taste, and perhaps consumers’ lack of health consciousness at that time. In the 21st century, as healthy habits become more important, Chinese consumers started to choose healthy snacks ranging from fresh fruit to dried fruit, nuts, and yogurt.

What’s the size of the Chinese healthy food market?

Nuts

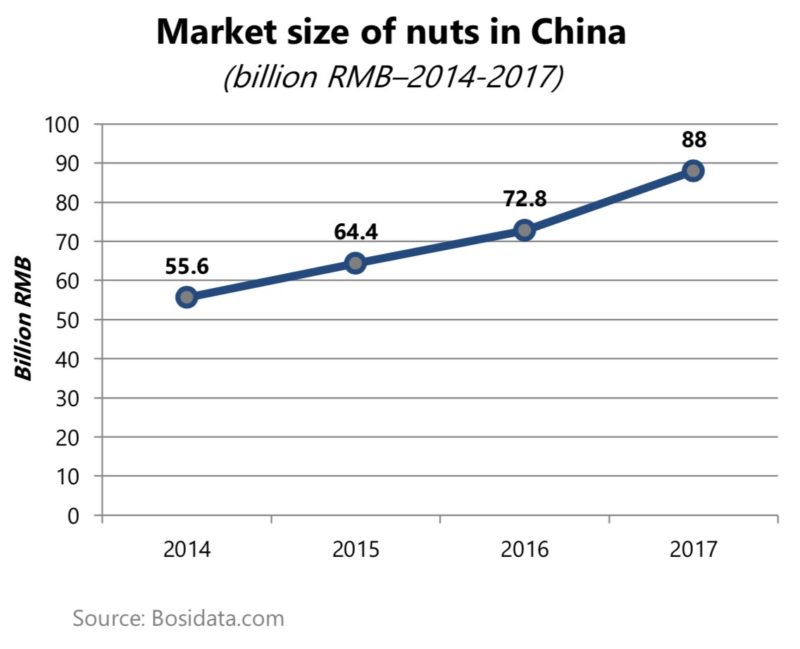

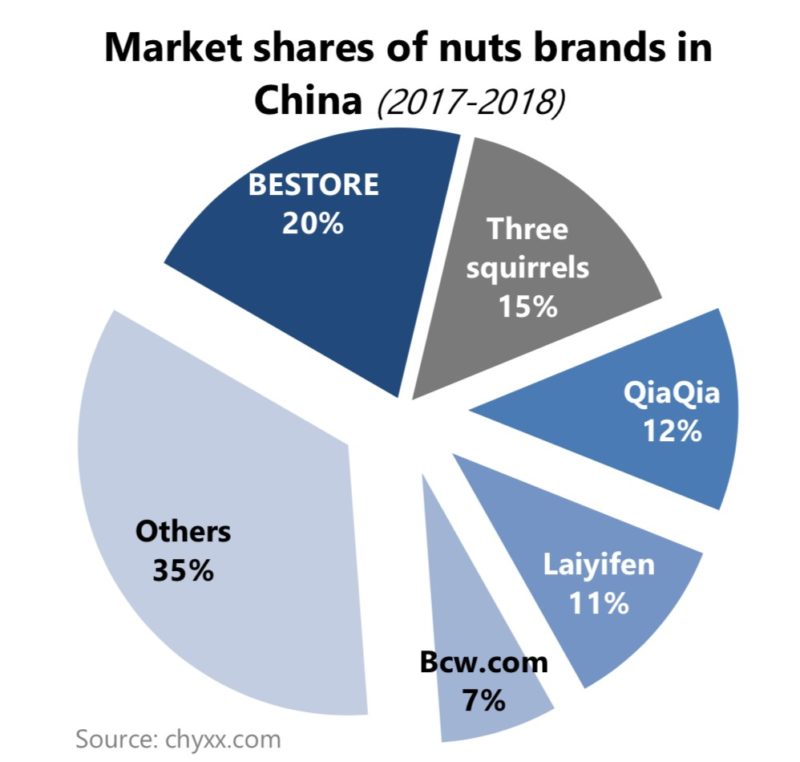

As one of the most popular healthy snacks, nuts perfectly fit Chinese people’s rising demand for healthy eating. Nuts provide key proteins, unsaturated fats and antioxidants to assist the reduction of cholesterol, which can lead to a longer life expectancy. Nowadays, Chinese consumers have a clearer understanding of the benefits of intaking nuts, which reflects a much higher market size of nuts. As shown in the graph below, the market size of nuts is growing rapidly from 55.6 billion RMB in 2014 to 88 billion RMB in 2017, which has a growth rate of 58.3%.

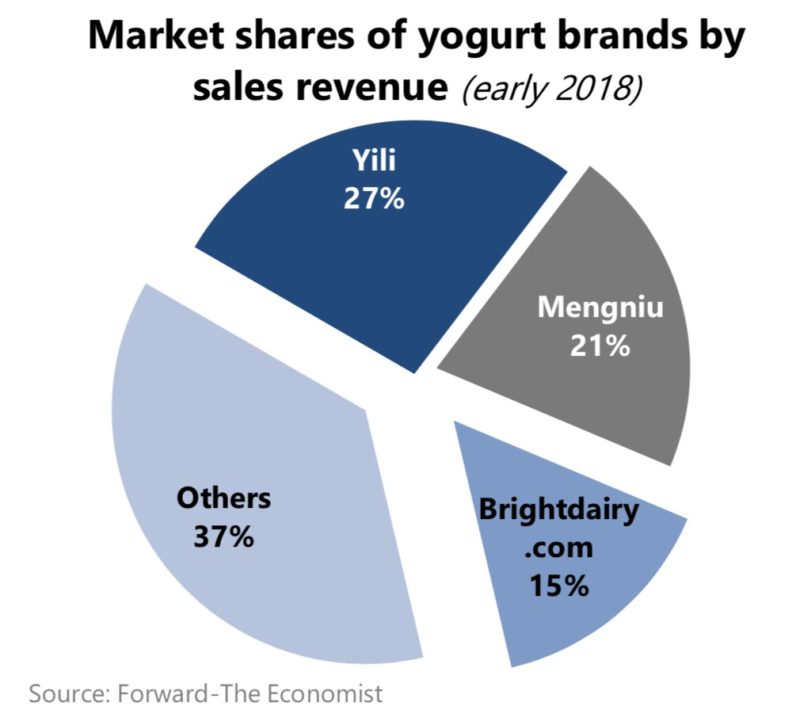

Yogurt

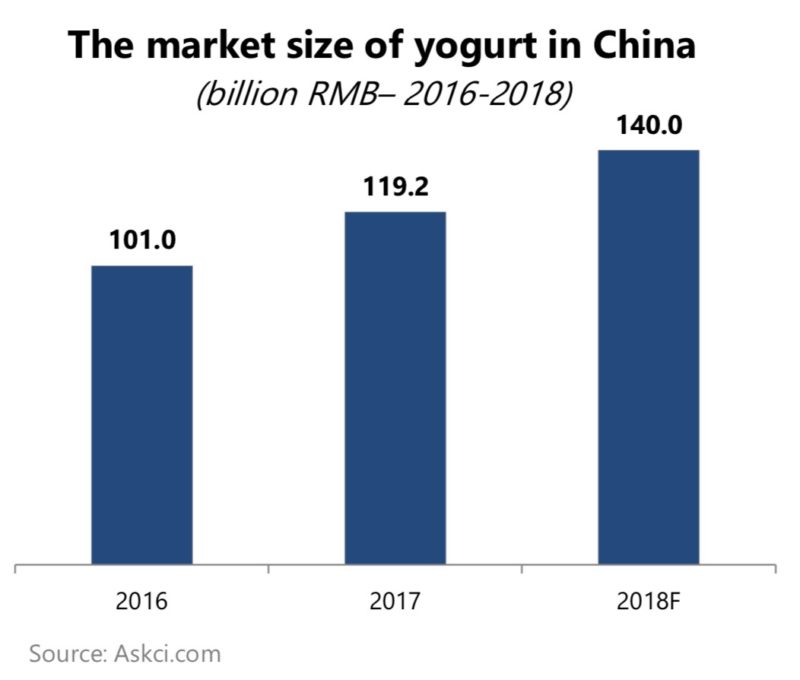

Yogurt can also fit in a “popular healthy snack” category. It contains a large amount of protein, but the yogurts available in Chinese grocery stores have reduced fat. Yogurt can facilitate the consumer’s weight loss and muscle buildup process. Similar to nuts’ market size expansion, yogurt’s market size has continuously increased from 2016 to 2018 with a growth rate of 38.6%. However, in China, the diversity of yogurt product is limited, especially for sugar-free, less processed options; customers can only find sugar-free yogurt in import merchandise store and specialized yogurt store.

Baidu Index correlates with customer’s interests in healthy snacks with traditional holidays

Baidu is the #1 search engine in China and its volume of search (more than 3⁄4 of the total search made on Chinese Internet) exhibits the market digital trends and how customers are interested in this targeted market. For healthy snacks, the customer’s interest is highly correlated to the traditional holidays. In this section, Baidu index of “healthy snacks”, “dried fruits”, “nuts” and “yogurt” are analyzed.

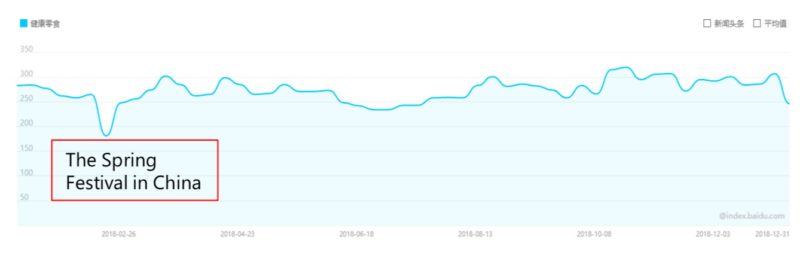

Healthy Snacks

As shown in the graph below, the search frequency of healthy snacks is relatively consistent throughout the year but reaches its lowest point during the spring festival period (February 2018). One must note that a dip in searches may not correlate with consumption habits. The subgroups of healthy snacks, like nuts and dried fruit, experienced surges on Baidu index.

The search frequency of “healthy snacks” in 2018 on Baidu index

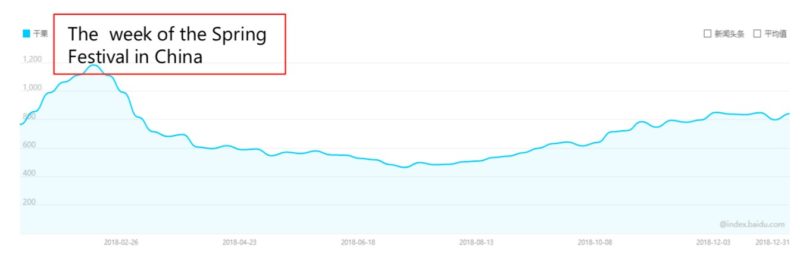

Dried Fruits

However, the searching frequency of dried fruits reaches its peak during the spring festival. According to Chinese tradition, during the Spring festival, dried fruits and nuts should be offered to the guests and it is ubiquitous to have several dishes that contain dried fruits in the banquet. Dried fruit is also a typical gift to offer during the holiday. Therefore, it is understandable that the consumers are paying significant attention to the dried fruit market during the Spring festival.

The search frequency of “dried fruit” in 2018 on Baidu index

Nuts

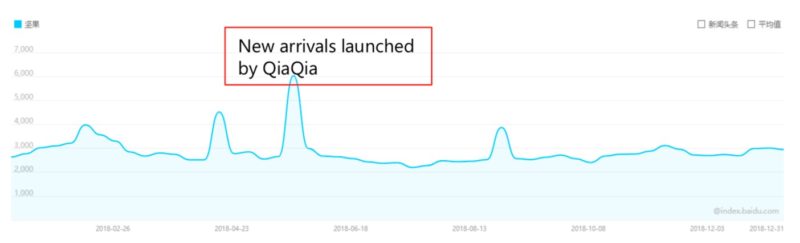

The search frequency of nuts is correlated with the activities of noticeable brands. For example, as shown in the graph below, the number of searches of nuts reached the highest point in May 2018 when the well-known snacks brand QiaQia (洽洽食品) launched its new arrivals (nuts). This means the customers are paying attention to the recognized brands and have a high expectation on their new product, which also indicates that the nuts market in China is not fully saturated as consumers are continuously looking forward to having higher quality products.

The search frequency of “nuts” in 2018 on Baidu index

Yogurt

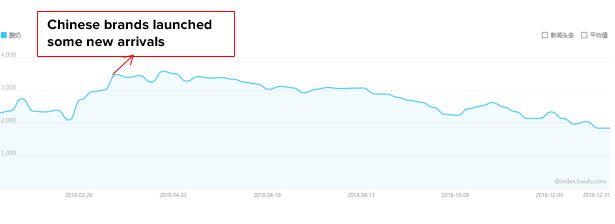

The Baidu search index of yogurt shown below indicates that the search for yogurt experienced a fast increasing from February and reached a peak on April 21st in 2018. There were also various new arrivals (yogurt products) launched by Chinese brands at the beginning of March. We assume such interrelation demonstrates that the Chinese yogurt brands are closely analyzing customer’s behavior and choose to release their products at the beginning of the booming trend to maximize their sales revenue.

The search frequency of “yogurt” in 2018 on Baidu index

CONTACT US NOW TO ANSWER YOUR QUESTIONS ABOUT BUSINESS IN CHINA

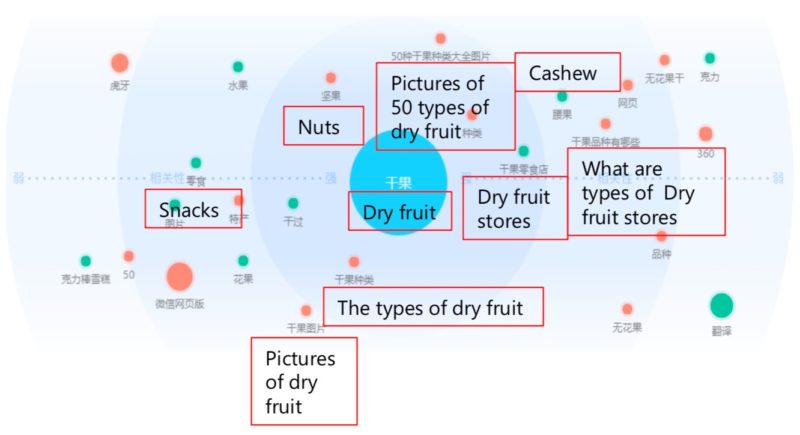

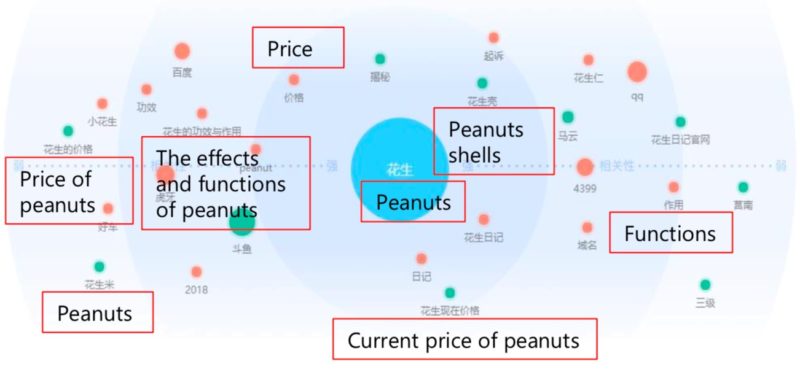

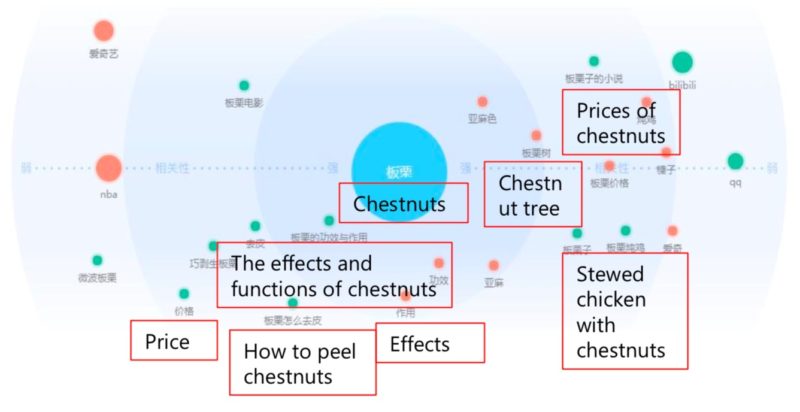

Semantic analysis relating to healthy snacks

The related words that link to “healthy snacks” can also demonstrate consumer’s interest and expectation of the products. As shown in the diagram, the most related keywords to “Healthy snacks” are “office snacks”, “healthy snacks for kids”, “top 10 healthy snacks list” and “what are healthy and tasty snacks”. Such trend illustrates that the parents and office workers are the main consumer group that concerns most on the healthiness of the snacks. For office workers, they have more time to eat these snacks, which motivate them to find tastier yet healthy snacks. Parents are also an important consumer segment as children’s health is always a crucial concern for the parents and they would be willing to invest more in snacks to ensure their children’s health.

[Source: Daxue Consulting]

[Source: Daxue Consulting]

[Source: Daxue Consulting]

[Source: Daxue Consulting]

What are Chinese consumers saying about healthy snack brands?

Buyers are gaining knowledge on healthy snacks on Zhihu

Besides searching on Baidu, the consumers also spend time collecting information about high-quality healthy food on social media like Zhihu. Zhihu is the first Q&A website in China and has transitioned to a social media sharing platform gathering more than 100 million answers on various topics. The platform is especially relevant to reach higher and well-educated social classes. On Zhihu and other platforms, the main questions about healthy snacks consist of the following: 1) What are tasty and healthy snacks for office staff, elderly and kids? 2) Where can you purchase healthy snacks (different types)? Chinese consumers are not only focusing on the nutrition and calories the snacks, but they are also looking for snacks that have low sugar, high protein and dietary fiber content as these are the important features of healthy snacks.

Buyers are gaining knowledge on healthy snacks on Zhihu [Source: Daxue Consulting]

Peeking into how Chinese consumers regard healthy snack products

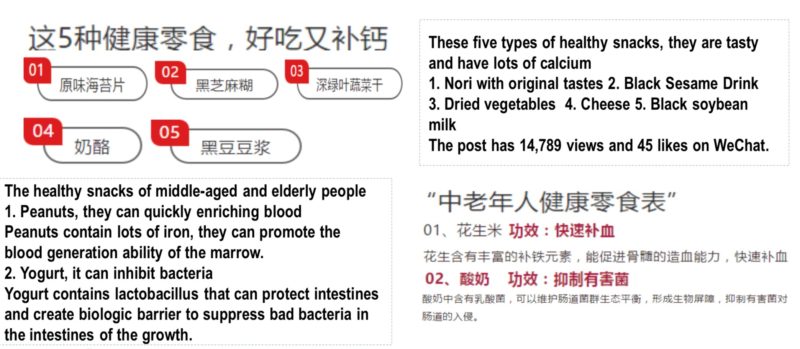

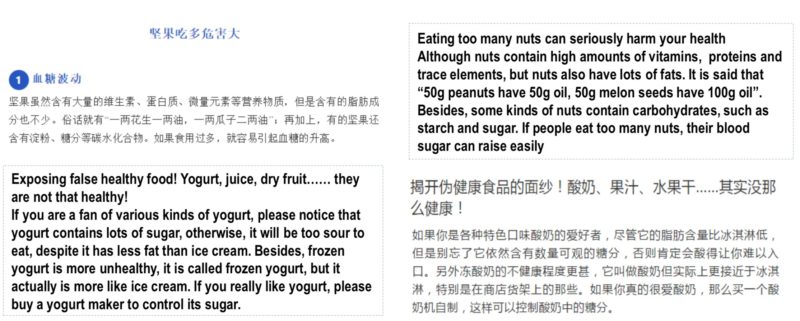

Sina Weibo and WeChat are also important platforms to obtain customer opinions. WeChat is the #1 social media in China and an absolute must-have for a market entry promotion; it accounts for over 1 billion active users. Sina Weibo is a microblogging site with nearly 400 million monthly users and is a well-leveraged platform to spread marketing campaign on the Chinese Internet. On Sina Weibo and WeChat, there are numerous positive and negative feedbacks regarding products’ qualities and nutrition. As shown in the screenshot below, netizens enjoy making recommendations on the snacks that are delicious and healthy, like seaweed, black sesame drinks, and dried vegetables. Netizens will also provide more scientific information relating to the snacks they recommended. For example, here is a post explaining how yogurt contains helpful bacteria which can protect intestinal health.

Netizens feedback and recommendations on snacks on Sina Weibo and WeChat [Source: Daxue Consulting]

Negative feedback relating to the healthy snacks on the Chinese social networks [Source: Daxue Consulting]

E-commerce functions as another way to show consumer perspectives

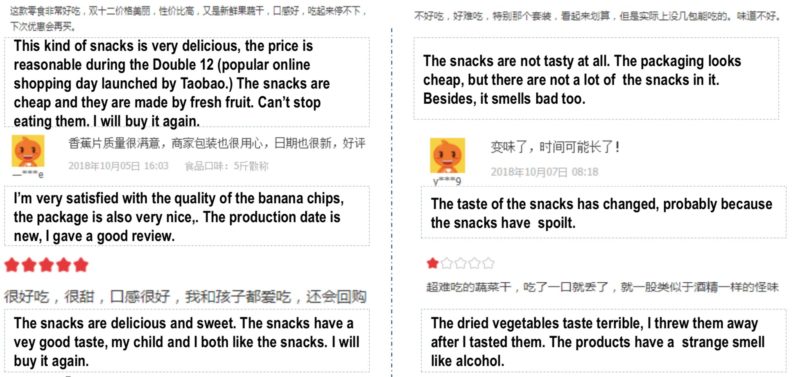

In addition to sharing their experience on social media, customers also leave their comments on E-commerce platforms like Tmall/Taobao and JD. Other than good flavor, recent production date/freshness, fast delivery and low price are also competitive advantages of the mainstream products. There are also some negative feedbacks that focus more on bad tastes, high price, slow delivery and expiration.

Negative feedback relating to the healthy snacks on Tmall/Taobao and JD [Source: Daxue Consulting]

The competitions of healthy food brands are fierce in China

In China, more than 60% of the market share of yogurt and nuts are occupied by large domestic brands. Since those brands have built high-end images by using attractive packages and inviting celebrities to be their spokesmen, these domestic brands have a larger customer stream. Moreover, their products have flavors that are more familiar to and more easily accepted by Chinese consumers, which further facilitates their success in the Chinese market.

|

|

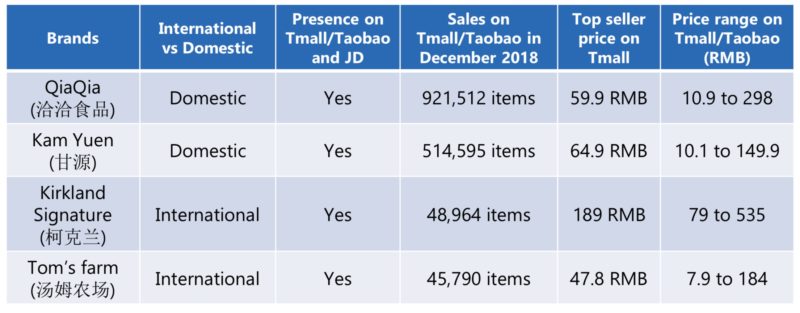

Nuts

As shown in the following chart, recognized Chinese brand, QiaQia and Kam Yuen are compared with international brand Kirkland Signature and Tom’s farm. According to the chart, the sales of domestic brands are much higher than the international brands on Taobao/Tmall.

For international brands, American and European brands usually set relatively higher prices than the Asian brands (South Korea, Japan). However, comparing to the Chinese brands, brands from both regions have significantly lower sales.

Chinese nuts brands comparing with international brands [Source: Daxue Consulting]

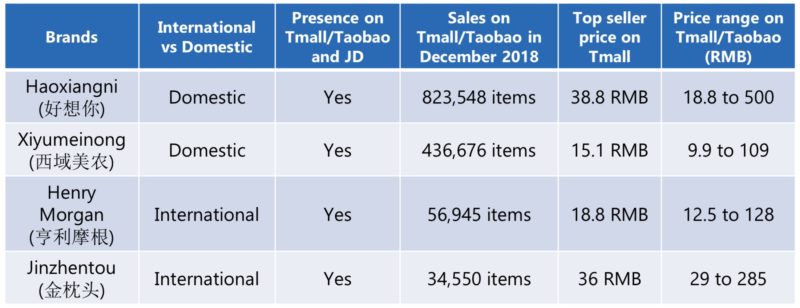

Dried fruit and vegetables

Dried fruits and vegetables are other popular categories of healthy snacks. On Taobao/Tmall, the most sales of dried fruit and vegetables also come from domestic brands, even though some international brands also have low prices. For example, comparing to Jinzhentou, Haoxiangni has almost 24 times more sales on Tmall/Taobao and Henry Morgan also has significantly lower sales than Xiyumeinong. Such sale discretion may be because Chinese large brands have already established a good reputation and have been competitive players for years, which increases the barrier of entry of international brand and make the market hard to penetrate.

Chinese dried fruit and vegetable brands comparing with international brands [Source: Daxue Consulting]

Fruit and veggie chips

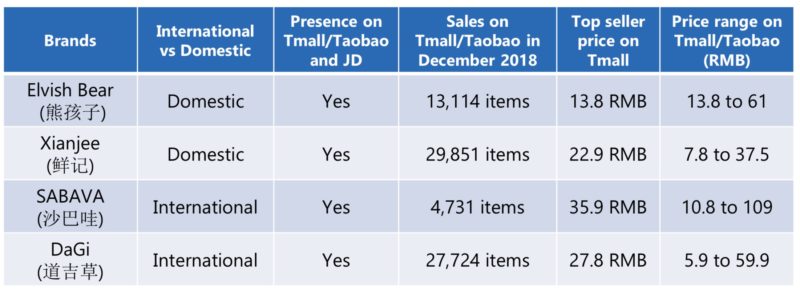

Compared to the previous two categories, fruit and veggie chips have relatively low sales, as they are not as popular in the Chinese market as healthy snacks. In this case, international brands have a larger growth rate than domestic brands and most international brands come from Southeast Asia, such as Vietnam, Thailand and the Philippines. In this category, International brands are actively competing with domestic brands. For example, DaGi has a similar sale as Xianjee and is much higher than Elvish Bear and SABAVA.

Chinese fruit and veggie chips brands comparing with international brands [Source: Daxue Consulting]

Learn from the healthy snack leaders —Three Squirrels, BESTORE, Be&Cherry

Three Squirrels

As one of the most popular domestic snack brands in China, Three Squirrels is a popular nut brand. By using adorable squirrels, the brand successfully establishes an adorable image to sell their products. The brand quickly attracted a large number of Chinese consumers by its packages designs with attention-grabbing squirrels cartoons and the continually updated tastes of snacks. The brand is also well-covered on all the mainstream E-commerce platforms to increase its exposure to the customers.

Three Squirrels’ Internet promotion includes witty and humorous slogans, which also help to penetrate into the market As shown below, the poster has most of the space filled with high-quality, delicious nuts with the symbolized squirrel image in the back to represent the brand.

Three Squirrels Poster – “Go eat this large head (Three Squirrels) if you want some nuts! This brand is so prevalent on the internet; it changes the Chinese food industry [Source: Souhu.com]

Nice! Nice! Nice! (Although this reply consists of only one word, it deeply reflects my sincere wish and emotion, which is concise and precious and shows my strong writing skills. The usage of exclamation marks makes my reply even more valuable) [Source: Daxue Consulting]

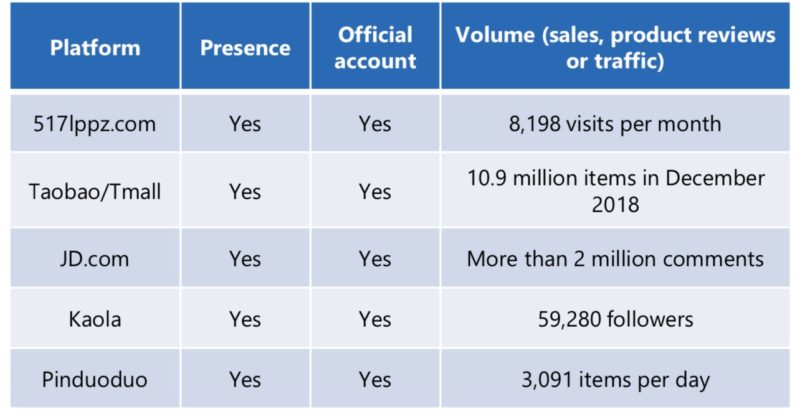

BESTORE

BESTORE is a famous Chinese high-end snacks brand and its products cover most types of snacks, including healthy snacks. By inviting popular Chinese actors, such as Kris Wu, to become their spokesman, BESTORE quickly raised their brand awareness among Chinese consumers. Its relatively smaller package helps the buyers to carry healthy snacks easily during their journey and also attract more customers. The website of BESTORE generally releases content about new arrivals, important events and brand stories. They are also well-covered in all the main E-commerce platform.

Kris Wu becomes the spokesmen of BESTORE

Different from the “slogan and image” strategy that Three Squirrels adopts, BESTORE chooses to invite popular actor and singer, Kris Wu, to attract customer’s attention. Kris is one of the most influential superstars in China and has more than 46 million fans on Sina Weibo. Most of his fans are the woman. Therefore, his influence on the female market is significant. Considering the main consumers of healthy snacks are women and children, having Kris as BESTORE’s spokesmen help the brand to attract more attention from their targeted customers. According to Chunhong Yang, the CEO of BESTORE, on the day of newly released promotion containing Kris Wu, the searching amount of BESTORE online increases for 200 times, which demonstrates the success of brand exposure via popular actors.

[Source: Daxue Consulting]

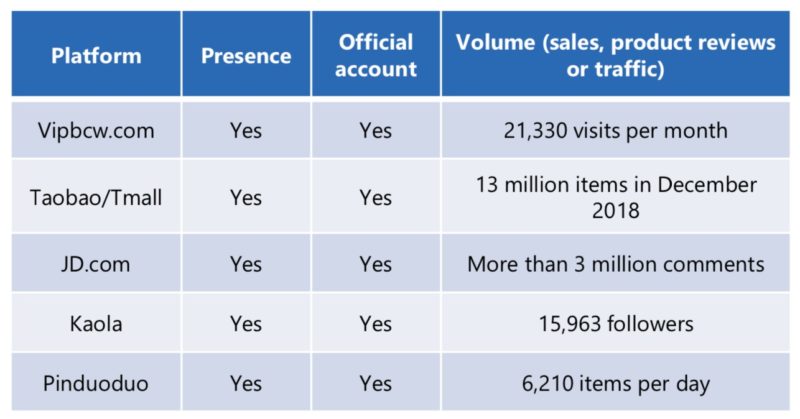

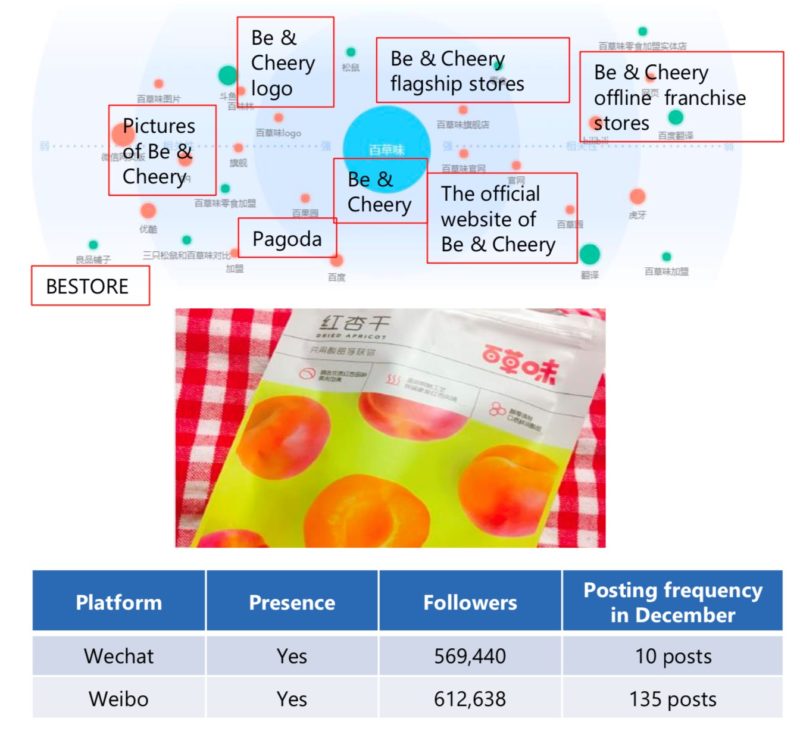

Be&Cheery

Be & Cheery is a well-known snack and processed food brand in China that provides all types of snacks. Its comprehensive product mixture helps it to attract more customers from different social and age groups. The brand’s website mainly offers information on its products, brand stories, news and mobile app. It also has flag-stores on the main E-commerce platforms. Be & Cheery is focusing on online sales and promotion channels. In 2017, around 80% of its sales revenue came from online stores. Besides, the brand achieved significant exposure through advertisements implanting in China’s popular TV series.

Be & Cheery is a well-known snack and processed food brand in China that provides all types of snacks

[Source: Daxue Consulting]

[Source: Daxue Consulting]

Online searching amount revealing the successful marketing strategy of leading brands

On Baidu index, Three squirrels showed the highest search frequency and BESTORE had the second highest search frequency. However, BESTORE’s search frequency was significantly higher in August 2018 when the brand disclosed its strict food safety detection process.

On WeChat index, BESTORE showed the highest search frequency and reached the highest point in January 2019 for the brand used the famous Chinese actor KRIS (吴亦凡) as its new spokesman.

[Source: Daxue Consulting]

Marketing strategies in the Chinese market—video and brand naming

Video

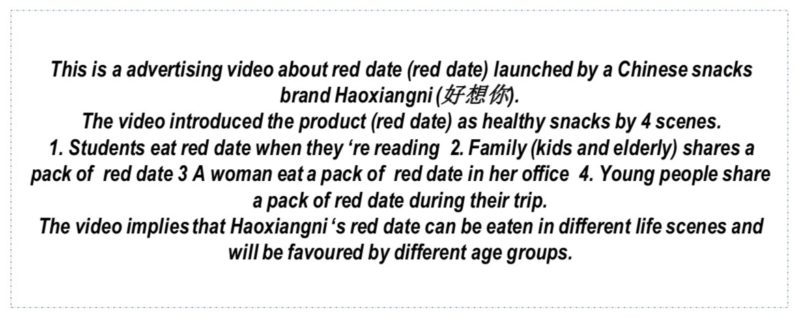

The advertising video was released by a well-known Chinese snack (red date) brand Haoxiangni (好想你).

Red dates are a traditional Chinese healthy dried fruit, and it has the functions of enriching blood (based on Chinese medicine), resisting fatigue and etc. By using different scenes and including different age groups, the video effectively showed the benefits of red dates to the consumers and highlighted that the processed date products from Haoxiangni are also healthy.

|

|

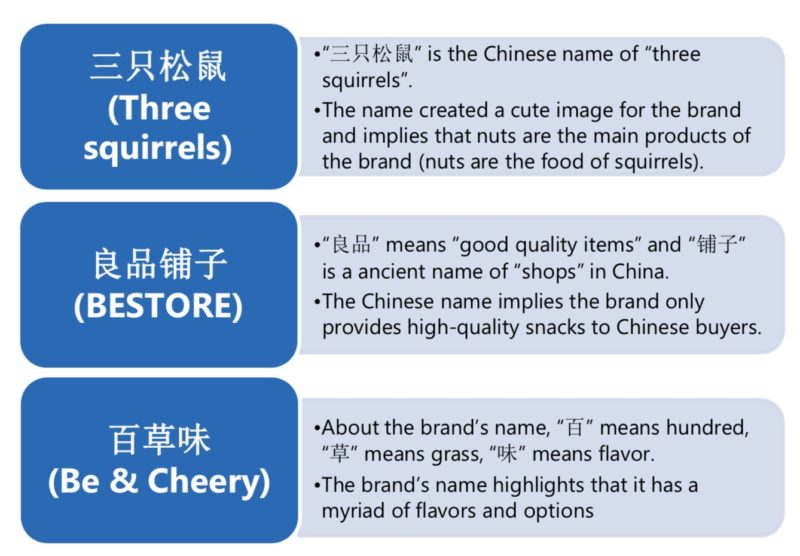

Brand Naming

The Chinese names of healthy snacks brands generally contain two meanings: 1) Implies the types of snacks provided by the brand; 2) Highlights the brand’s (healthy) snacks have good quality and taste. Most Chinese names of healthy snacks brands are easy to remember (for consumers) and brands prefer to highlight some advantages (quality, tastes and etc.) of those brands.

Brand naming of healthy snacks in China [Source: Daxue Consulting]

Distribution channel of healthy snacks—a season-related strategy

Online retail Coverage in China

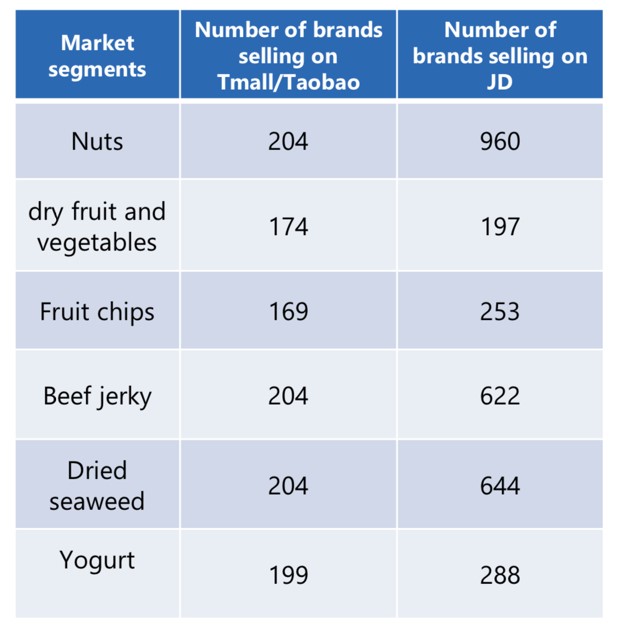

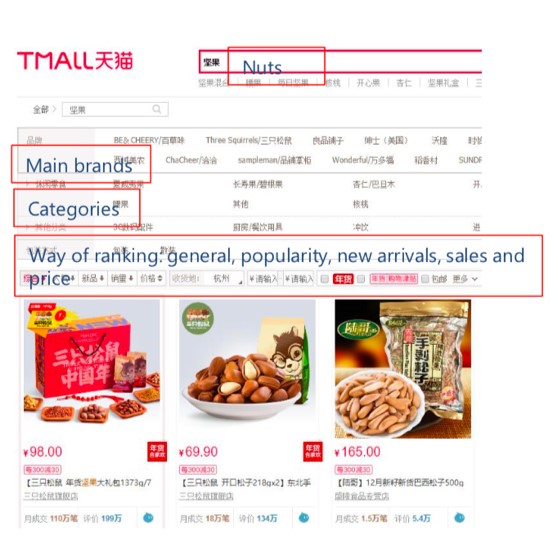

The number of healthy snacks brands on JD is far more than Tmall/Taobao, mainly due to the higher requirements and deposit from Tmall for those brands want to enter the platform.

Distribution channel of healthy snacks in China: Online retail coverage [Source: Daxue Consulting]

Offline retail: Coverage in Shanghai

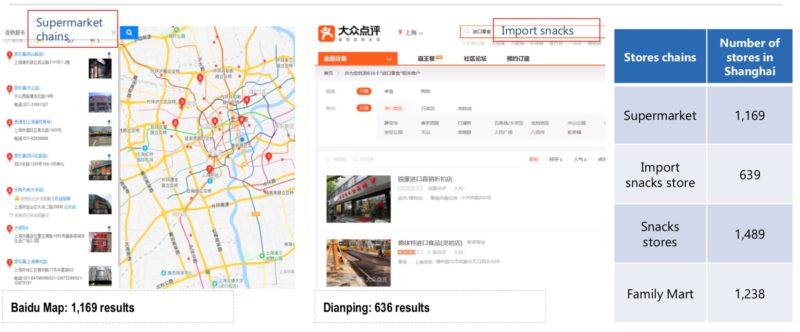

Healthy snacks are mainly sold in a supermarket, brand stores, part of convenience stores (such as Family Mart), import stores and specialized snacks shops.

Distribution channel of healthy snacks in Shanghai: Offline retail coverage [Source: Daxue Consulting]

On-the-shelf: representation of the category in stores

In China, consumers usually purchase healthy snacks from convenience stores, supermarkets, import stores and snacks brands stores. The prices of nuts are generally higher than other healthy snacks in offline stores. Many brands are using smaller packages that make healthy snacks be easily carried. In some stores, healthy snacks have QR codes on their price tags for consumers to scan (with a smartphone) and pay by WeChat or Alipay.

Distribution channel of healthy snacks in Shanghai: On-the-shelf representation [Source: Daxue Consulting]

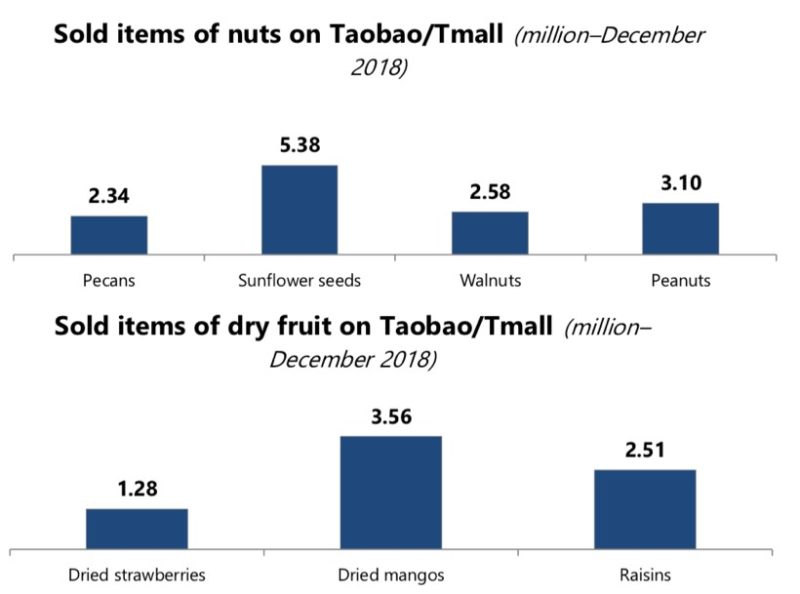

Online sales: volume assessment

Sunflower seeds and peanuts both showed very high sales in December 2018 on Taobao/Tmall. For dried fruit, dried mangos had the highest sales on Taobao/Tmall due to its widely-accepted taste and convenience of eating.

[Source: Daxue Consulting]

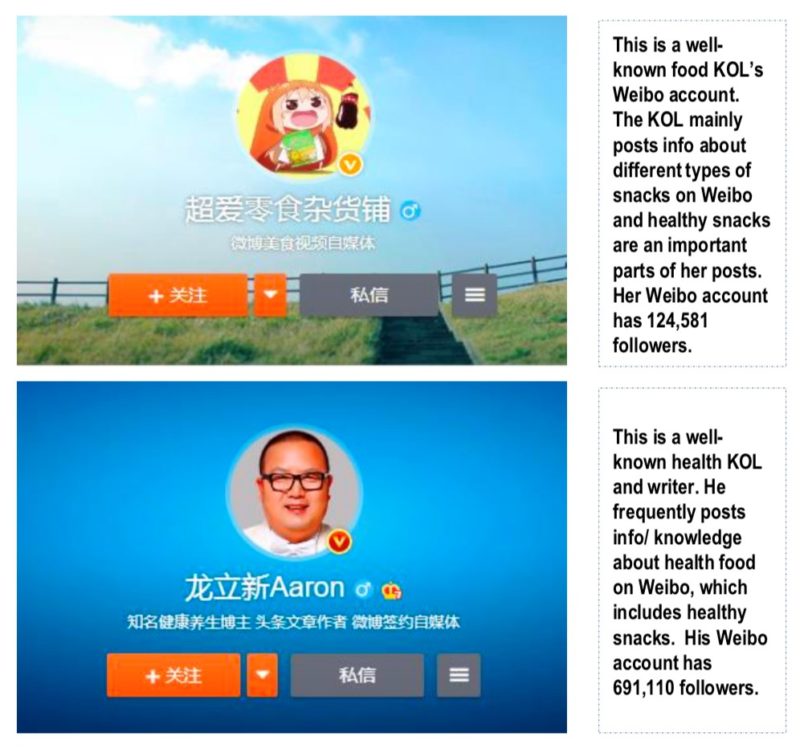

KOL landscape in China

[Source: Daxue Consulting]

The Key Opinion Leader (KOL), or influencers, are a major part of the Chinese online journey, and, therefore, of the online marketing funnels for international brands in China. KOL will especially be as relevant to the target niche audience (micro-KOL) and mainstream consumers (mass-market). For international brands, KOLs are a huge part of modern Chinese snacks promotions, and healthy snacks consumers are influenced by KOL’s shared opinions and experiences. China’s KOLs, who usually post content about healthy snacks on Weibo, mainly consist of food/ snacks KOLs, health KOLs and sports/ bodybuilding KOLs.

To sum up, as analyzed above, there are three strategies for the companies to occupy more market share in the healthy snack industry. Firstly, it is important to have more variety of healthy snacks to offer more specialized options to the customers. Secondly, more promotion through popular TV series/dramas can be helpful to raise the brand reputation and exposure. In addition to video advertisements, large healthy snack brands, such as BESTORE, are also trying to raise their awareness by implanting brands’ names and logos in popular Chinese TV series, which is an effective product placement strategy according to their raising sales revenue. In addition, package design is becoming more and more important. In order to attract more Chinese consumers and build a strong brand image, more brands have been working on personalized and small package design that can show their unique brand characteristics and also can be easily carried by consumers, which is favored by the customers.

Author: Xiangyu (Lavender) Mao

Daxue Consulting helps you get the best of the Chinese market

Do not hesitate to reach out to our project managers at dx@daxueconsulting.com to get all answers to your questions.