The baked goods market in China: How are brands are responding to the growing consumer demand | Daxue Consulting

The baked goods market in China

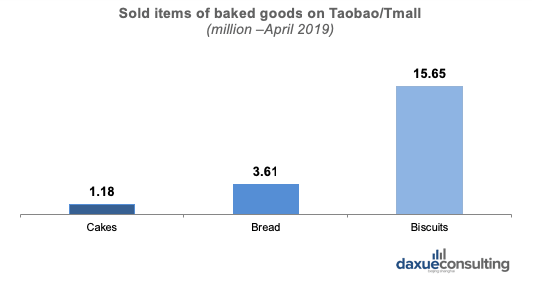

The baked goods market in China began to gain momentum in 1980 and boomed between 2000 and 2010. During this period, all kinds of foreign brands entered the Chinese market. Foreign baked goods have become the breakfast of many Chinese people. The most common baked goods in China include bread, cakes, biscuits and cookies.

Daxue consulting completed a report on the baking industry in China in 2018. This article pulls from the report to inform about the Chinese baked goods market with consumer analysis, current trends, competition analysis, distribution, and promotion.

Read the French version hereThe development of the baked goods market in China

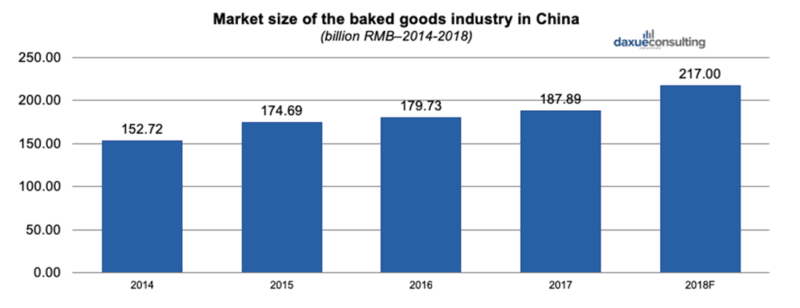

The market size of baked goods in China is growing

The market size of the baking industry in China has been growing considerably fast in recent years, with more than 10% YOY growth rate. Compared with the worlds average level (18.7 Kg per person), the per capita consumption of baked products is still relatively low (6.9 Kg).

According to the China industry research institute, the retail value of the baked goods market in China was nearly 217 billion yuan in 2018.

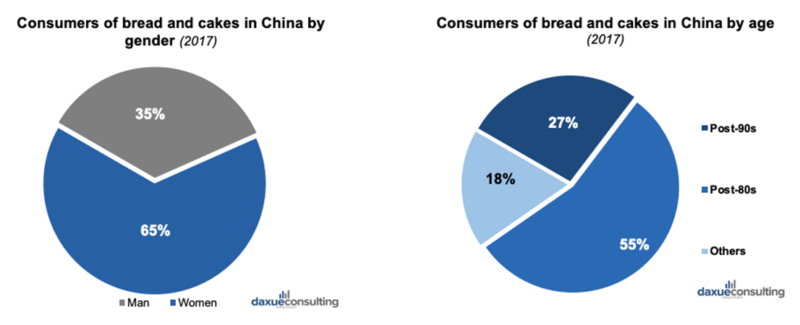

Baked goods consumer analysis

Cakes and bread are the most popular baked goods in the Chinese market. In terms of gender, Chinese women are more interested in bread and cakes than men, which accounts for 65% of sales in 2017.

In addition, most sales in 2017 came from those who born in the post-80s and 90s. It can be inferred that bread in China and cakes in China are mainly preferred by young consumers. For them, bread is not only breakfast but also a popular choice for afternoon tea.

Consumers’ preference for baked goods in China

Nowadays, baked goods in China such as bread and cake are common for Chinese people to eat as snacks or breakfast. Young consumers and aging consumers have different preferences towards baked products. What they have in common is the desire for healthy and delicious baked goods.

Young consumers like baked goods with various tastes, this is one of the reasons why there are so many different flavors of baked goods in China. Besides, product packaging is also considered by consumers. Small packages are more preferred by young consumers for they are easy to carry and suitable for office workers to replenish energy.

On the other hand, aging people prefer baked goods with bigger packages since they like sharing snacks with their family or friends. Older consumers also tend to prefer soft baked goods with less sugar.

Online trends of baked goods in China

Interest trends & Semantic analysis

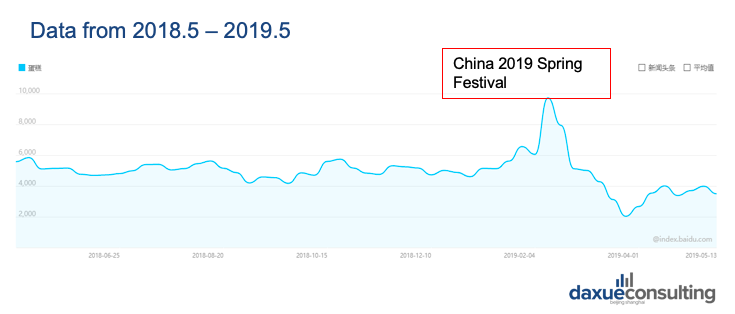

The search index of ‘bread’ on Baidu fluctuated around its average number in the past one year. Two low points were reached in June 2018 during the Dragon Boat Festival and February 2019 during the Spring Festival.

People search for bread on Baidu generally to query the definition of bread and browse the official website of famous bread brands. The most related keywords to “Bread” are “Bread with milk flavor”, “Cake”, “Old-fashioned bread”, “Bread websites” and “Learn to make bread”.

The search index of cake on Baidu reached the highest peak in February 2019 during the Spring Festival.

Similarly, people search for cake in China on Baidu usually browse cake brands’ websites and online cake stores on Taobao/Tmall. The most related keywords to “Cake” are “Learn to make cakes”, “Birthday”, “Steam cakes by a rice cooker”, “Bake cakes”, “Bread” and “Oven”.

Consumer perceptions of baked goods on social media

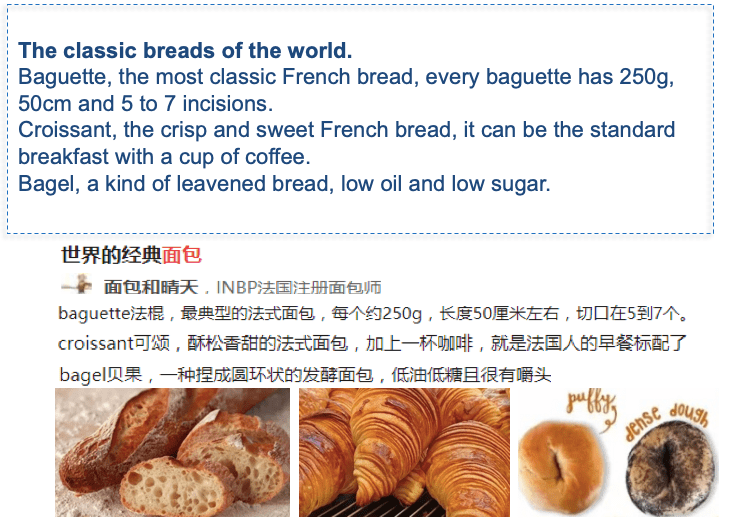

On Zhihu, the most common questions and posts about baked goods in China consist of the following:

How to make baked goods at home? What are delicious and healthy baked goods? Where to buy baked goods in China/how to pick good and healthy baked goods ?

On social media platforms such as Weibo and WeChat, positive feedbacks about baked goods include three aspects: Taste delicious, nutritious, and have various flavors; the packages and baked goods often have nice appearances; easy to store and carry.

When selling baked goods in China On Tmall/Taobao and JD, except for good taste, other positive feedback includes price, attractive packaging, nutritious, easy to carry, and fast delivery.

Complaints about baked goods contain a large amount of trans-fatty acids which will cause cardiovascular diseases; too many colorings and preservatives; lots of sugar.

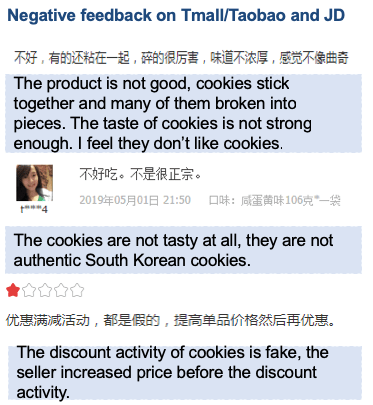

On e-commerce platforms used to sell baked goods in China, negative feedback focuses more on bad taste, low quantity, broken packages, expired products and high price.

Based on information from Weibo, WeChat and other Chinese social media platforms, the most common contexts of buying baked goods among Chinese customers are breakfast, snacks, and birthday parties.

E-commerce landscape of different baked goods in China: How baked goods brands should to the Chinese market

Competition analysis: Bread, Cake, Biscuits and Cookies in the Chinese market

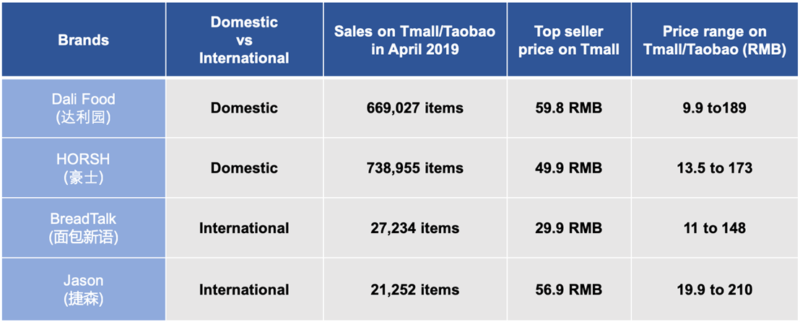

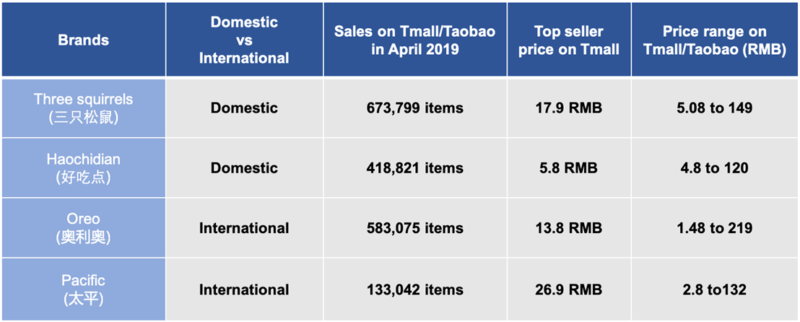

On Taobao/Tmall, the sales of domestic bread brands are higher than foreign brands for they are better at appealing to local tastes. In addition, international brands focus more on offline stores instead of e-commerce platforms to sell baked goods in China. One common distributor is coffee shops.

500g bread sells for around 40 RMB on Tmall, with small price fluctuation. Bread with a high sales volume is about 30RMB. Among them, milk is the most popular flavor of bread in China. The top seller of bread on Tmall is Three Squirrels with a price of 29.9RMB.

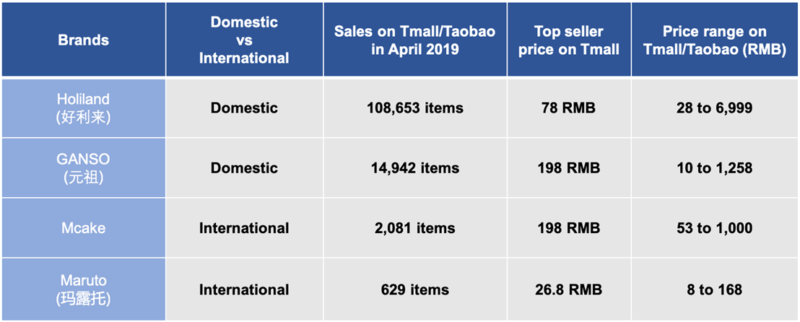

International cake brands mostly come from France, Japan, and South Korea. Chinese cakes brands also have more sales than foreign brands on Taobao/Tmall even though they have higher prices. In addition to being more fit to domestic flavor preferences, another possible reason for Chinese cakes higher sales is a closer delivery allows the cakes to be fresher.

On Tmall, the price range of cakes in China is between 9.9Rmb and 225.2RMB. Popular cakes are relatively cheap. However, the unit price of the imported cake is relatively high and with less quantity.

Large Chinese and International biscuits brands both sales well on Taobao/Tmall, since they all provide tasty biscuits with reasonable price.

Similar to cakes, the price range of biscuits and cookies in china is large. Popular biscuits are at relatively low prices (about 10RMB-30RMB) and usually have individual packaging. The top seller of biscuits is Tango with a price of 19.9RMB.

French baked goods are popular around the world, many domestic and foreign brands devote to imitating them. However, Chinese people are not used to the taste of authentic French baked goods. Therefore, most brands of the baked goods market in China localized their goods to match the flavors of Chinese people and attract customers with reasonable prices, beautiful appearance, and good taste.

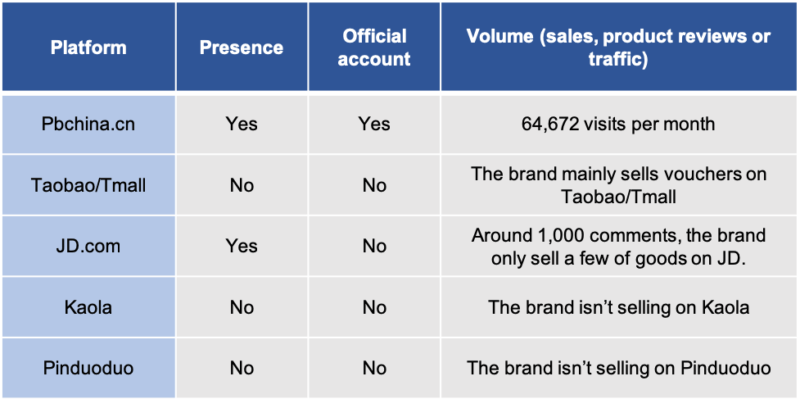

Paris Baguette

Paris Baguette is a South Korean bakery that entered the baked goods market in China in 2003. Its core value is that ‘freshly baked in a stylish place’. The official website of Paris Baguette shows its main products (bread, cakes, and pastries), store locations, events, and brand stories.

Compared with its online store, Paris Baguette focuses more on the offline sales channels (bakeries). There are more than 200 offline shops in China that using French culture for marketing by imitating French baked goods. To attract children, teenagers and young women, the brand launched cooperation with Disney.

The most related keywords to “Paris Baguette” are “Cakes of Paris Baguette”, “The official website of Paris Baguette”, “Purchasing goods from Paris Baguette’s website” and “The price list of Paris Baguette’s cakes”.

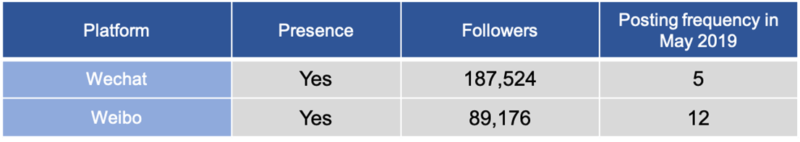

On social media platforms (Weibo and WeChat), Paris Baguette mainly releases info about its new arrivals in China, discount activities and other important events (such as lucky draw activities).

BreadTalk

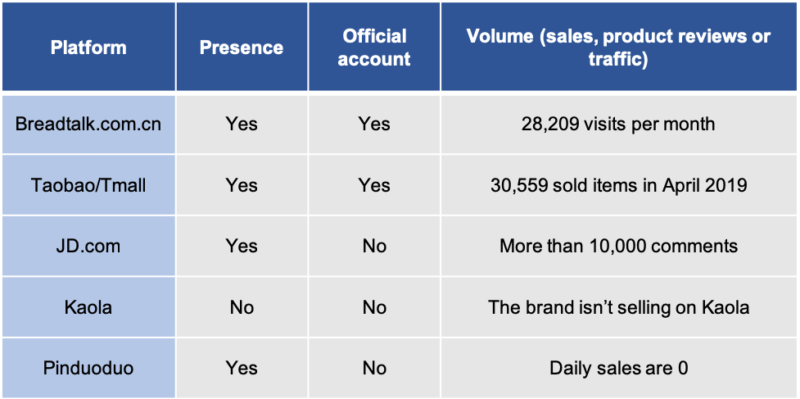

BreadTalk is from Singapore and entered the Chinese market to sell bread in China in 2003. Its official website is mainly composed of its products (bread and cakes), brand stories and company events. The brand has built offline bakery shops in more than 50 cities in China, it also chooses e-commerce platforms to sell baked goods in China. BreadTalk is devoted to developing baked goods made by all-natural raw materials to adapt to the increasing demand for healthy lifestyles among Chinese people

The most related keywords of “Breadtalk” are “The official website of Breadtalk”, “Cakes”, “The price list of cakes from Breadtalk”, “Ordering BreadTalk’s cakes online” and “The franchise fees of Breadtalk”. Breadtalk usually posts about promotion activities (luck draw, free gifts, etc.) and its popular goods on social media platforms. The brand also launches goods with the design of popular movie characters, such as Minions.

Mcake

Mcake’s official website mostly shows its main products (cakes, pastries, and cookies), discount activities and important events. Mcake specialized in well-designed French cakes and pastries. In addition to offline retail stores, it also has Taobao and its own official website. The brand’s French-style goods have a colourful appearance and localized tastes, which attract many Chinese consumers.

On Dianping.com (a review web, where Chinese locals rate local businesses and share their reviews), positive feedback consists of nice tastes, good quality, wonderful designs and friendly services. Negative feedback is mainly about the high price.

On social media platforms, Mcake usually releases information about its new arrivals and promotion activities, such as free gifts, lucky draw, limited-edition cakes, etc. The brand also promotes its goods in Chinese movies and TV series by providing custom cakes to their opening ceremonies.

Retail and promotion of baked goods in China

Combination of online retail and on-the-shelf

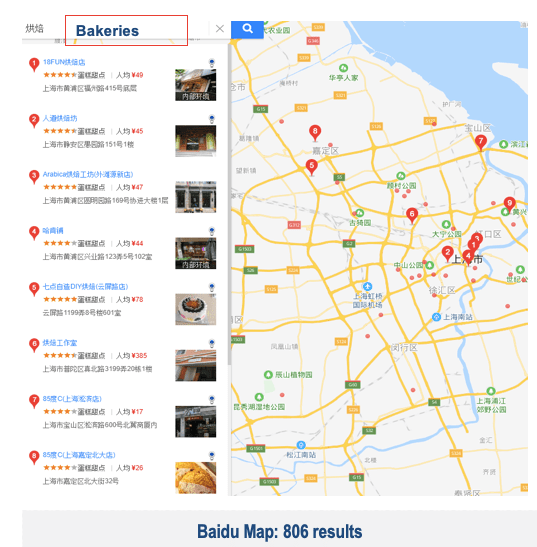

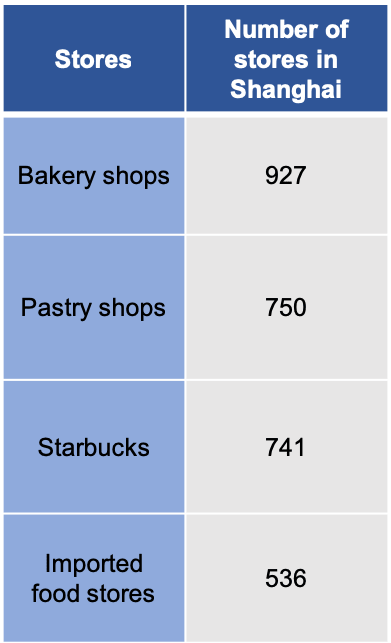

Foreign baking brands generally take offline shops as their main distribution channel in China. Four normal forms for the baking industry in China are bakeries and coffee shops, supermarket, and convenient stores, imported food stores, and specialized snacks stores.

According to the research, young consumers (post-80s and 90s) usually choose to buy baked goods in China from bakery shops, coffee shops, and convenient stores. Old generations prefer to buy baked goods in China from the supermarket and hypermarket. In those stores, different types of baked goods are separately placed on shelves. In terms of packaging, many brands are using smaller packages to make baked goods be easily carried.

On the other hand, young consumers also prefer to buy baked goods on e-commerce platforms. The number of baking brands on JD is far more than brands on Tmall/Taobao, which mainly due to the higher requirements and deposit from Tmall for those brands want to enter the platform. Most Chinese brands have built official stores on e-commerce platforms to sell baked goods in China, which increased their sales in the market.

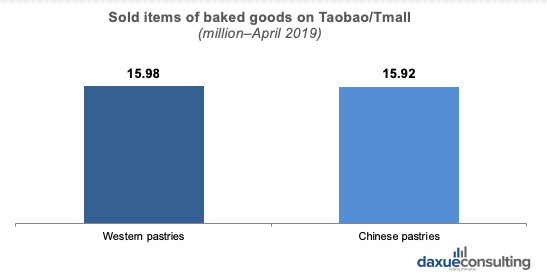

Chinese traditional pastries are made from rice or different types of flour, with fruit, sweet beans paste or sesame-based fillings. Unlike in China, western pastries often incorporate more cream-like fillings. With the growth of western culture in China, Chinese people began to accept western baked goods.

Western pastries and Chinese pastries had similar sales in April 2019. It shows that more Chinese people accepted foreign pastries.

On Taobao/Tmall, biscuits and cookies in China showed significantly high sales in April 2019, since biscuits are the most common snacks among Chinese people.

Promotion channels for the foreign baked goods brands in China: Apps & KOLs

Dedicated websites and specialized magazines are popular channels to leverage for international brands in the baked goods market in China. Gmx91.com (桂美轩) is a specialized bakery website, it provides different types of baked goods, such as pastries, cakes, and cookies.

Café & Gateaux (亚洲咖啡西点) is a popular magazine focusing on coffee and western pastries.

WeChat official accounts are increasingly popular among young customers. Brands will release new products and activities on WeChat official accounts. For the young people who increasingly integrate social media and e-commerce habits, the new products released on WeChat official account are easier to notice than the official website, because they rarely actively search the bakery’s official website.

Additionally, many brands have also launched WeChat stores and food delivery services to sell baked goods in China on WeChat apps.

For international brands, KOLs are an influential promotion channel in China. Chinese KOLs, who usually post content about baked goods on Weibo or Xiaohongshu mainly consist of food/ dessert KOLs, health KOLs and tourism KOLs.

Future trends in China’s baked goods market

Young consumers are the main force of baked goods consumption. The baking industry in China is constantly developing to adapt to their tastes, including the production and promotion channels of baked goods. In addition, consumers are increasingly focusing on food safety and healthy nutrition. Specifically, baked goods are changing the status quo of high sugar, high fat, and high calorie, and developing towards the direction of light and balanced nutrition. Low-sugar, low-energy healthy baked goods are the trend.

Except for tier-1 and tier-2 cities, Chinese lower-tier cities also have the great market potential for baked goods. Thus, many baked goods brands are trying to enter the baked goods market in China from lower-tier cities and directing marketing campaigns accordingly. Some independent bakeries are starting to attract customers in a variety of ways, including providing the experience service of DIY baked goods. Consumers are likely to recommend their experiences in the bakery stores to their friends.

Author: Rita Fan

Make the new economic China Paradigm positive leverage for your business

Listen in China Paradigm in iTunes