The ready-to-eat soup market in China reached a new high during COVID-19

Chinese consume a massive amount of soup

60% of Chinese families eat soup every day, meaning about 500 million bowls of soup are consumed nationwide every day, 320 billion bowls of soup every year. The average person consumes 4.6 bowls of soup per week. That is to say, the magnitude of the soup market in China is enormous, dynamic, and recession-proof.

Overview of the ready-to-eat market in China

Soup is one of the most popular ready-to-eat foods in China. As people’s lifestyles change, the demand for ready-to-eat food is expected to grow faster than in the past five years. There is a growing demand for ready-to-eat food, especially for middle-income and high-income consumers, who can afford higher prices. Meanwhile, the ready-to-eat soup market in China reached a new high during COVID-19. On the one hand, the epidemic has led to the offline consumption of leisure snacks to be interrupted and forced consumers to shift to online shopping; on the other hand, ready-to-eat food is accelerating to become a powerful consumption supplement for the catering industry.

Ready-to-eat soups are healthier and tastier alternatives and the convenience of instant soups supports these consumers’ fast-paced lifestyles. Factors such as high availability, less cooking time and travel friendly packaging push the development of the ready-to-eat soup market.

China Dominates the ready-to-eat soup market in Asia-Pacific Region

The expansion of the instant food market will further support the growth of the ready-to-eat soup market in China. Manufacturers are using various methods to increase their share on the ready-to-eat soup market in China. This include distributing innovative products, strengthening their presence in new markets or regions, as well as their base in existing markets.

Market size in China peaked during COVID-19

Under the influence of Covid-19, ready-to-eat food is quickly growing in China. Since February 2020, data shows that the overall sales of ready-to-eat food on Tmall have increased nearly sevenfold from a year earlier.

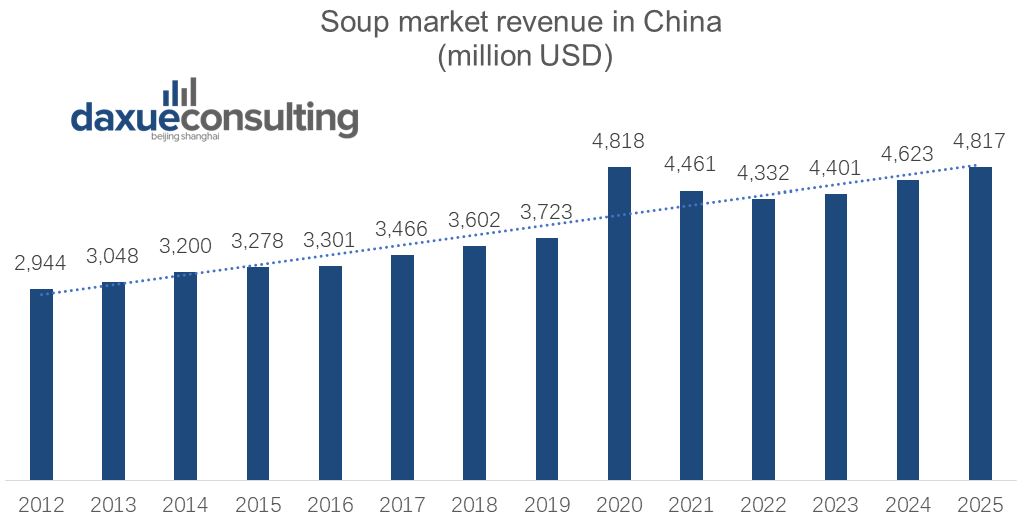

It is expected that by 2020, the business of soup market in China will reach US $4.818 billion in revenue. The average revenue of soup segmentation in China in 2020 will be US $3.33 per capita. In terms of volume, China’s per capita consumption of soup food will be 0.5 kg in 2020.

Source: Statista.com-Revenue in the soup segment in China (Forecast adjusted for expected impact of COVID-19), June 2020

According to data from the ecommerce PinDuoDuo, sales of more than 1,000 products including fresh fruits, ready-to-eat food and leisure snacks exceeded 100,000 during the “Not closing for the Spring Festival Campaign” in 2020. According to Tmall international, ready-to-eat food has become the new choice for ‘staying at home’.

Korean instant rice, Vietnamese instant noodles with salted egg yolk, Japanese vegetable miso ready-to eat soup and Australian whole wheat instant cereal are all popular dishes for home diners. The data shows that sales of imported instant noodles rose 12 times year on year, while ready-to-eat soup and instant rice rose more than 80% year on year.

Consumption upgrade in ready-to-eat foods

Since 2013, the consumption of instant noodles in China has seriously declined. In recent years, Chinese people pay more and more attention to their health, so ready-to-eat market in China is also forced to either upgrade or lose consumers. This trend in consumer preference contributes to the rise of premium ready-to-eat foods.

In line with consumption upgrading, the large traditional ready-to-eat food companies have successively launched premium ready-to-eat products, ‘original soup’ instead of seasoning powder and ‘meat slices instead of dehydrated meat. Ready-to-eat food has got rid of the marketing message of ‘make you full’ and is moving towards ‘nutritious, delicious and convenient’.

After the outbreak, ready-to-eat food may become a daily consumer product

Ready-to-eat food will be one of the six annual food trends for 2020, according to Tmall’s 2019-2020 national taste data released at the end of 2019. Sales of semi-finished food rose 111% year-on-year in 2019. Sales of ready-to-eat foods such as ready-to-eat soup and self-heating hotpot grew by more than 50% on Tmall.

The epidemic has helped shift the nature of ready-to-eat food from a popular trend online to a daily consumer product.Therefore, if the ready-to-eat industry and enterprises can grasp the changes in consumer demand after the epidemic and promote the ‘return’ of health value from a strategic perspective, they will surely achieve the greater development after the epidemic.

Competing brands in China’s ready-to-eat soup market

Source: taobao.com – 5 flavors of ready-to-eat soup from Su Bo

Combined with the ranking and evaluation of soup brands on Chinese e-commerce sales channels and Chinese brands ranking websites such as Paizi10.com,Qiang100.com and Sougou Guide, the following brands in the ready-to-eat soup market in China are summarized.

Chinese ready-to-eat soup brands

SuBo (苏伯)

Source: taobao.com – Spinach egg soup from Su Bo

‘SuBo’ is similar to the pronunciation of ‘soup’. It originally comes from Shandong Province. The brand is one of the best performers in the soup market in China in terms of overall performance. It is not only a popular Chinese soup brand in China, but also in Europe, America, Japan, Southeast Asia and other countries. Today, the ready-to-eat soup of this brand is sold in Chinese supermarkets, fast food chains, high-speed trains and on the Internet.

XinMeiXiang(新美香)

‘Xin Mei Xiang’, a company from Hubei province, produces and sells ready-to-eat soup, cooking package, freeze-dried fruit, dehydrated seafood, meat, vegetables and other products. ‘Xin’ means new, ‘Mei’s stands for beautiful, while ‘Xiang’ goes for appetizing.

The products are exported to the United States, Japan, South Korea and other countries. The company has several freeze-drying production lines and vacuum freeze-drying technology to give the customers innovative and appetizing experiences.

Xiao Yao Lao Yang Jia(逍遥老杨家)

This Chinese soup brand name means free and unfettered Mr.YANG. This brand, from Henan Province, is famous for its ‘Hu La Soup’. ‘Hu La’ soup is a famous kind of local cuisine in Henan province which is made with pepper, chili, and bone soup. ‘Hu La soup’ differentiates itself with its spicy taste.

Source: Taobao.com – Hu La soup from Xiao Yao Lao Yang Jia

A Yi Bo(阿一波)

A Yi bo Food Industry and Trade Co., LTD., originated from Jinjiang City, Fujian Province, was established in 1990. It is a well-known brand of nori, and a large enterprise specializing agricultural products deep processing and focusing on the production of Marine green food. In terms of instant soup, Nori ready-to-eat soup from A Yi Bo has an outstanding performance on Taobao sales.

Source: paizi10.com – Nori egg drop soup from A Yi Duo

Li Ziqi’s flagship store on T-mall(李子柒旗舰店)

Li Ziqi is a KOL who makes short food videos. With more than 25 million followers on Weibo, 38.9 million followers on Tiktok, and more than 11 million on YouTube, she is known as the “The expert of oriental food and lifestyle”.

Source: Youtube.com – The youtube homepage of Li ZiQi, Chinese food KOL

Li Ziqi’s flagship is her online food store (most of which are ready-to-eat food) on T-mall, which sells a variety of delicacies including a variety of ready-to-eat soup.

According to the total sales data of 21 products currently sold in Li Ziqi’s flagship store, the e-commerce wholly-owned news calculated that its total sales volume exceeded 1.3 million, and the total sales value reached 71 million RMB.

Haifusheng(海福盛)

Established by Xinsanhe (Yantai) Food Co., LTD., Haifusheng brand is specialized in the R&D, production and sales of high-end ready-to-eat food, such as instant soup, instant porridge, instant noodles, instant fruit and other ready-to-eat food.

Tian Li (天利)

Tian Li Food (Xuzhou) Co., LTD., founded in September 2009, is invested by Hong Kong Tian Yi International Group Co., LTD., located in Xuzhou, China. The company takes arctium burdock as the main raw material to form a green deep processing industry of agricultural and sideline products, among which the Wu Xing vegetable soup is deeply loved by the public. (The Wu Xing, also known as the Five Elements, is a fivefold conceptual scheme that many traditional Chinese fields used to explain a wide array of phenomena, from cosmic cycles to the interaction between internal organs and from the succession of political regimes to the properties of medicinal drugs. The “Five Phases” are Fire, Water, Wood, Metal and Earth.)

Han Chang (酣畅)

Han Chang brand was founded in 2010. As a professional brand of western food, it has been focusing on western food for 7 years and advocating the life concept of “Eating stylish western food and living a good-quality life”. The brand’s ready-to-eat western thick soups, such as mushroom cream soup, chicken corn soup, borscht, are popular among Chinese soup consumers.

Super Hi(超级嗨)

Super Hi, a brand from Sichuan province, has flagship stores on JD.com and Taobao. The brand began selling self-heating products, with popular categories such as self-heating rice and self-heating hotpot. The products have been well received by Chinese soup consumers. The chicken soup and duck soup from Super Hi have been recognized for their original taste. Since the Spring Festival 2020, the online orders of Super Hi have increased by 200%-300%, which is remarkable.

Source: Taobao.com – Chicken soup from Super Hi

Foreign ready-to-eat soup brands in China

Jia Le家乐 (Knorr)

Founded in 1838, Jia Le (Knorr) is the world’s No.1 condiment brand owned by Unilever. Its products are sold in more than 100 countries and are consumed by 320 million people worldwide. The products from the brand Jia Le (Knorr) has always been committed to producing high-quality products and bringing fresh and delicious ingredients to consumers. Its breakthrough innovation in flavoring products not only satisfies the taste of global consumers, but also adds endless fun to the gourmet life.

In 1993, Jia Le (Knorr) came to China, launching Jia Le chicken powder, leading to a new concept of health. Subsequently, in order to continuously satisfy the taste of Chinese soup consumers, Jia Le introduced other soup powder products and sauce products. In September 2007, Jia Le launched Thick soup Bao, a kind of ready-to-eat soup in China, which opened a new page for the seasoning market of the Chinese catering industry.

Chinese ready-to-eat soup consumer characteristics

Chinese soup customers have a higher degree of trust in brands

Brand is what Chinese soup consumers value most when choosing soup. The branded soup gives people a much greater sense of security than non-branded soup. Also, word of mouth plays an important role in consumers’ choice of ready-to-eat soup.

Young “Zhai people” in China are bursting out with great consumption potential

The expression of Zhai people (宅人群) refers to men and women who depend on the internet to meet their daily needs without leaving their homes. Also, people who don’t like to go out except for work and prefer to stay at home are described as ‘zhai’. These people usually rely on food delivery services, but because of the COVID-19 outbreak, ready-to-eat food has become their first choice.

On the other hand, with 240 million single people, the ‘single economy’ in China is flourishing. Also, people living alone also have a greater need for ready-to-eat food. This group of consumers will become the new target group of the soup market in China. Moreover, ready-to-eat soup fits this demographic’s spending habits.

‘Healthy’ has become the new rigid demand for the soup market in China

With the further enhancement of health awareness, ‘healthy’ has become the new rigid demand. The health-related products, knowledge, content and activities have attracted more attention of Chinese soup customers.

Author: Qing Zheng

Learn more about China’s ready-to-eat market

Listen to 100 China entrepreneur stories on China Paradigms, the China business podcast

Listen to China Paradigm on Apple Podcast