Branding in China: Connecting directly to Chinese consumers

To successfully develop a brand in China, it is not enough to take a short-term outlook and try to sell into every available market. Doing so risk eroding long-term prospects. So, some brands sell directly to Chinese consumers through direct-to-consumer (DTC) channels while branding in China. International brands like Nike or Louis Vuitton have already put “direct to consumers” on their brand strategies in China. They are unanimously building an independent brand image through creating direct relationships with consumers in both distribution and communication on their brand-owned channels.

Distribution channels fully controlled by brands

[Source: daxue consulting, “Different distribution channels for branding in China”]

There are three main kinds of distribution channels for branding in China. Being present on third party e-commerce platforms is the most expensive and least controllable.

With social e-commerce’s popularity, brands can control better, but it is still hard to collect first-hand users’ data. Brand-owned channels have the most highly independent level, which means it can connect directly to Chinese consumers with full control on all processes. It would be the most cost-effective way, as well as the new rising trend for branding in China.

Branding to sell directly to consumers in China

The market environment is friendly for selling directly to Chinese consumers in 2020

In July 2019, the import tariff in China was announced to decrease, covering 1,449 product items. The average tariff rate for clothing, shoes, hats and sports-related products was reduced from 15.9% to 7.1%. The decrease in import tariffs makes brand-owned channels more attractive by enclosing the price gap with the market.

E-commerce platforms becoming crowded

[Source: daxue consulting, “Logic of DTC strategy”]

Many global brands are now trying to connect directly to Chinese consumers instead of only relying on Chinese B2C e-commerce platforms. It is mainly because there isn’t much room on a large marketplace’s website to differentiate itself with a unique proposition for the Chinese consumers. Besides, brands can no longer make huge profits on marketplaces where the competition is increasingly intensive. However, brands can have a bigger control of branding, customer data, as well as gain higher margins through direct-to-consumer (DTC) channels.

Leveraging the popularity of Chinese social media

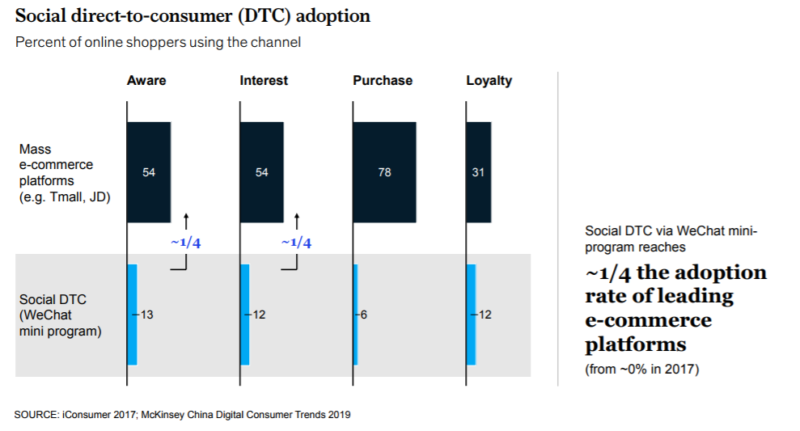

[Source: McKinsey, “Social direct-to-consumer (DTC) channel adoption”]

In addition to giving brands a platform to leverage social elements to build consumer awareness and engagement in third-party channels, social media now also offer new Direct-to-Consumer (DTC) channels to influence and engage with consumers. It is the case of WeChat mini-programs, which have grown from nothing to driving one-fourth of the awareness in the digital consumer’s decision journey.

Establishing independent brand image in China should be taken into consideration

Direct-to-Consumer (DTC) channels are the most effective and efficient ways to promote products to Chinese consumers and build company recognition. Brands can definitely get benefits from connecting directly to Chinese consumers as below:

More cost-effective marketing

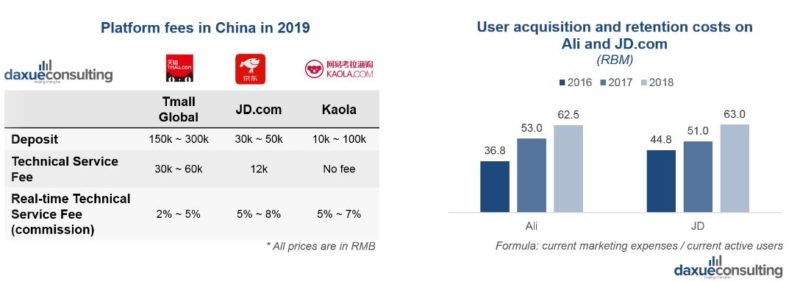

[Source: daxue consulting, “Increasing cost on marketplace for branding in China”]

With higher platform fees and increasing user acquisition costs on public marketplaces, only 10-20% of brands are making profits on Tmall. Thus, being independent and building brand-owned ecommerce channels may be more worthy of investment.

Build truth before purchase

Cross-border marketplaces in China are often criticized for offering fake goods. Chinese consumers tend to purchase products through brand-owned channels where they can ensure that the brands have full control on the whole retail process.

Strengthen personal relationship after purchase

As brands connect directly to Chinese consumers, they achieve stronger growth and become more innovative. Successful brands enjoy benefits impacting their entire value chain: higher value chain margins, satisfied consumers, first-hand consumer insights, and higher entry barriers for competitors.

[Source: daxue consulting, “Benefits of direct-to-consumer (DTC) channel”]

Empower data integration to optimize products and services

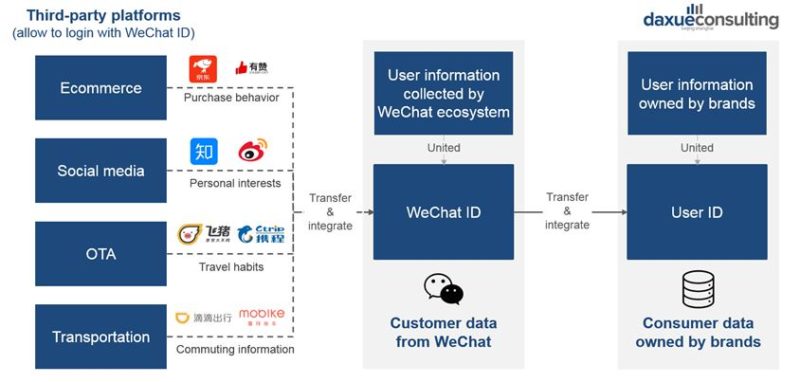

[Source: daxue consulting, “Logic of empowering data integration”]

Third-party platforms currently allow users to login with WeChat ID, which means the sharing data could be collected by WeChat ecosystem as well. Integrating WeChat CRM with Enterprise CRM, a single key identifier can bind a WeChat platform (whether OA, MP or third-party site) with an existing CRM. Then, brands are able to build their own CRM system and connect directly to Chinese consumers. So, it will be easier for brands to collect first-hand customers’ insights and then efficiently optimize their services or products.

Brands that manage to have an independent branding strategy in China

As brands unfold their branding strategies in China, they need to play with a mix of levers in two fundamental axes: Improve brand power and establish a direct distribution model.

Brands need to smartly choose the most relevant initiatives, which have the highest impacts according to their branding strategies and choose suitable strategic objectives.

[Source: Benjamin Maupetit, LinkedIn Pulse, “Initiatives related to different strategic objectives for branding in China”]

To improve brand awareness and foster brand loyalty in China, companies can learn from these successful examples and focus on connecting directly to consumers and offering distinctive value proposition.

Perfect Diary: A strong connection with end consumers

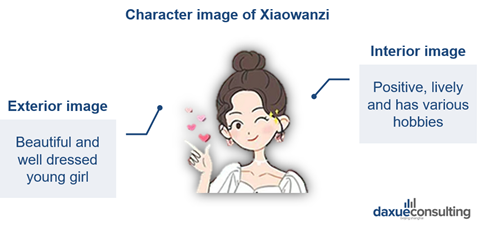

[Source: daxue consulting, “Character image of Xiaowanzi”]

Perfect Diary created a virtual KOC character Xiaowanzi小完子, who has similar characteristic with Perfect Diary’s targeted consumers and plays the role of a customer’s beauty consultant, friend, provider of benefits-related information and real-time customer service. This KOC character can help the brand build closer relationship with consumers. That way, Perfect Diary makes communication more effective. In order to reach more customers, Perfect Diary leveraged group control technologies to create a personal account matrix to provide customized service and connect directly to Chinese consumers.

Beast: Offers a distinctive value proposition

Beast offers a distinctive value proposition through storytelling, which also brings romance and special meanings to their products. Every bunch of flowers is customized for each customer who will then become the story owner. By telling stories, Beast differentiates itself with a unique proposition for the Chinese consumers and drives emotional engagement.

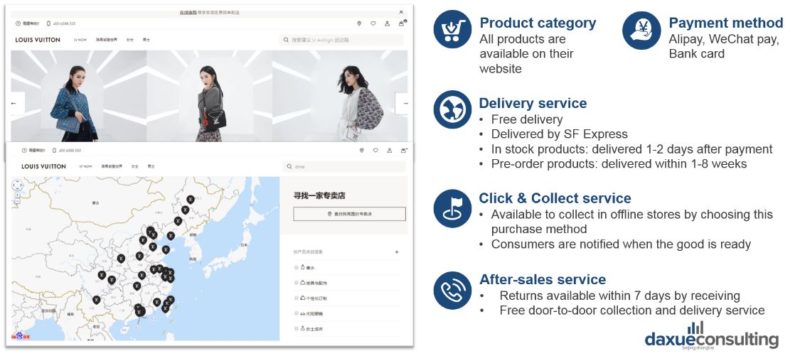

Louis Vuitton: Sell directly to consumers

[Source: daxue consulting, “Louis Vuitton sells directly to Chinese consumers”]

With little presence on China B2C E-commerce platforms, LV’s official website and app have been put in the central position of Louis Vuitton China strategy. Louis Vuitton China ‘s official website has the main function of selling directly to Chinese consumers with more brand values, convictions and brand vision.

Intimate branding through brand owned channels

As a result, Perfect Diary, Beast and Louis Vuitton have connected deeply with their consumers, and developed their direct sales, reducing their exposure on China’s large e-retailers at the same time. Chinese B2C e-commerce giants like Tmall and JD have become the intuitive destinations for most brands. But establishing brand-owned channels can help brands effectively deal with these evermore-serious challenges of soaring consumer acquisition costs, increasingly sophisticated demands and needs, loss of loyalty, and loss of ownership to e-commerce giants.

If you want to learn more about how moving closer to your consumers, email our project team at dx@daxueconsulting.com to start working on your brand strategy for the Chinese market.

Let China Paradigm have a positive impact on your business!

Listen to China Paradigm on iTunes