How the Chinese Instant Food Market is changing | Daxue Consulting

Due to the successful “reforming and opening-up”, China’s social structure has changed rapidly and the urban lifestyle has become more and more fast-paced. The average worker has a busier schedule; therefore, do not have time to treat themselves with decent meals. Therefore, because of the large population base, China is the largest instant food market in the world. In August 2018, the total sales of snacks were 3.45 billion RMB. However, China’s overall expanding speed in the instant food industry is decreasing and people are expecting higher quality, especially healthier and better tasting instant food. According to Chinese News, supermarkets and local markets are seizing one-third of the spaces that was originally for the instant noodles; instead, the spaces are occupied with more variety of other types of ready-to-eat foods which are more nutritious, like instant rice and instant hot pot. With this trend observed this report analyzes the reasons behind the changing focus of Chinese citizens on the instant food market and provides a broad prediction of the future for this industry.

What parts of the instant food market are on the decline?

China’s instant noodle market

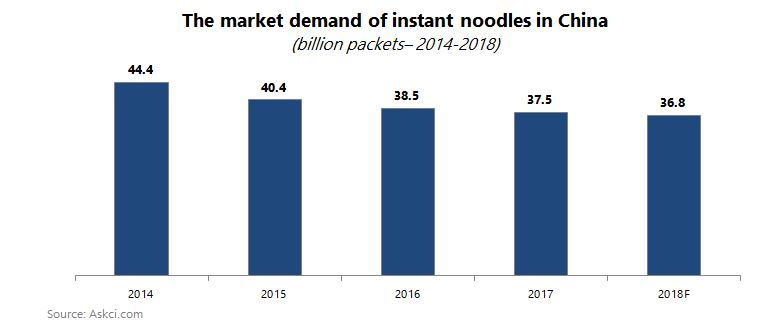

The ready-to-eat market consists of two parts: Instant meals and snacks. In this review, we discuss the instant food market in China. Instant food includes instant noodles, instant meat, canned food, instant rice, quick-frozen food and etc. Among them, instant noodles are the most popular one. Since 1970, China has started to manufacture instant noodles and international instant food brands entered China in the 1990s. For now, instant noodles have a history of 60 years. According to the World Instant Noodles Association’s research, in 2014, the total instant noodle demand around the world was 103.96 billion packets, which China consumed 44.4 billion packets. However, as the graph shows, the demands for the instant noodles are slightly decreased from 2014 to 2018; in 2018, the forecasted total demands dropped to 36.8 billion, which demonstrates a 17% decrease.

China’s canned food market

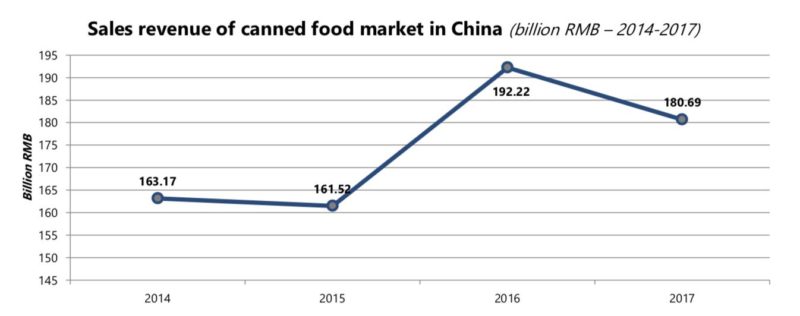

As for the canned food market, the market is expected to reach USD 118 billion by 2023, at a CAGR of 3.8%, during the forecast period (2018-2023). China has been the largest canned food producing country with around 12.9 million tons produced in 2017, but a large of them exported to other countries, which means the actual consumption of this canned food in China can be decreasing. China’s annual per-capita consumption of canned food is 8kg, which is much lower than USA (90 kg) and Western Europe (50 kg). According to the graph below, the sales revenue of canned food market in China are fluctuating from 2014 to 2018, from 163.17 billion RMB to 180.69 billion RMB.

Chinese instant food market: The reason behind the sales decrease

The possible main cause for the significant decrease in instant noodle sales and fluctuation relating to the canned food market would be the fast development of Chinese food delivery system. According to The Economist’s analysis, by the end of June in 2017, the registered users for the food delivery system had risen to 295 million, which was a 40% more than at the end of last year. According to Chinese Industry Information, as China’s industrialization and urbanization is continuing, the food delivery market penetration rate will reach 10% in 2020, which means the whole industry will expand to more than 500 billion RMB; if the penetration rate can reach 15%, the transaction level will then become more than 500 billion RMB in 2020, which is indeed a vast market. Therefore, such high penetration rate will certainly affect the willingness of the consumers to consume instant food; instead, calling for food delivery from local restaurants might be healthier and more rational choice.

Consumer analysis: What do Chinese consumers want?

Texture and flavor are Chinese consumers two main criteria instant food

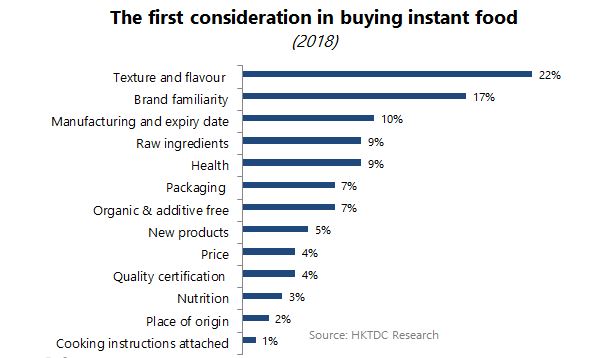

According to the survey results below from HKTDC research, in China, the most important purchasing factors for instant food are texture, flavor, brand image and word-of-mouth, manufacturing and expiry date. It can be assumed Chinese consumers choosing the instant food focus on taste and brands.

In addition, KOL’s opinions can affect consumer choices. On Weibo, XiaoHongShu and Zhihu, there are numerous KOLs who are sharing their opinions about the instant food and snacks. At the same time, at the end of the post, they usually make recommendations for certain types of instant food. Accordingly, Chinese Netzines value these recommendations and are willing to purchase these products and give them a try. This trend also develops the individual business on WeChat stores at the same time.

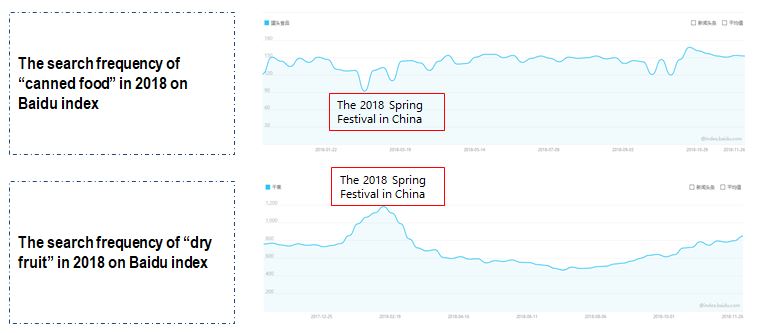

Consumer’s interest is related to Chinese traditional holidays

According to the Baidu Index of “Canned Food” (shown below), the number of searches of canned food reached the lowest point in February 2018 for the Spring Festival and the number of searches of dried fruit sharply increased early February and reached the highest point in the Spring Festival, correspondingly. Spring Festival is one of the most important holidays in China and Chinese people usually prepare food as gifts to their families. Therefore, the demand for canned food will drop significantly as it is not considered an appropriate gift for the holidays. Dried fruit, on the other hand, is a traditional gift for the Spring Festival. Therefore, the search results increase indicating that the consumers are having a stronger interest of dried fruit during the spring festival than other periods in the year.

The similar trend is also observed for “instant food” and (膨化食品)search results on Baidu index. The search index of “instant food” fluctuated around its average value and reached the lowest point during February 2018, Spring Festival, likely for the same reasoning as “canned food” can be applied here as well. Additionally, the number of searches of “puffed food” showed decreasing and reached the lowest point during September and October 2018 for the Mid- Autumn Festival and the Chinese National day, when people travel and do not need to store too much of the puffed food.

A semantic approach of Baidu Index

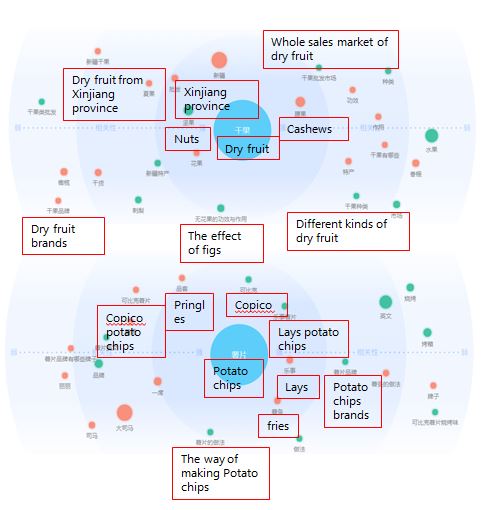

The popular search relating to “dry fruit” and “potato chips” can also be analyzed in a semantic manner. For example, the most related keywords of “Dried fruit” are “Cashews”, “nuts”, “wholesales market of dry fruit” and “dry fruit from Xinjiang province”. This means the consumers are trying to search for the product which is of the highest quality, especially from its original producing place, while still considering the price factor, as they would like to purchase the products from wholesales market, which usually offers a much lower price than regular markets.

The most related keywords of “Potato chips” are “Lays”, “Lays potato chips”, “Copico/Copico potato chips”, “Pringles” “fries”, “the way of making potato chips” and “potato chips brands”. Demonstrating that for potato chips, the brand is the most important factor that consumers consider.

The results for “cookies” and “cooked food” are also intriguing: The most related keywords of “Biscuits” are “Cookie”, “original taste cookie”, and “Lady Finger” (a kind of biscuit from Italy). This approach means that Chinese consumers are more interested in differentiated types of biscuits and even recipes for homemade cookies, instead of purchasing from the market.

The most related keywords of “Cooked food” are “Cooked food franchise”, “top 10 brands of delicatessens” and “Tianfuhao” (a Chinese processed food brand).

Chinese consumers concerns and information gathered on the instant food market

There are several social media platforms in China, including Weibo, XiaoHongShu and Zhihu. On Zhihu, questions and answers about instant food can fit into one of two categories: 1) Products recommendation based on different needs (mainly about tastes, convenience and safety); 2) Knowledge about instant food, such as production process and nutrition. From former buyer’s experience, the consumers can have a more in-depth understanding of the product and can make their most “correct” choice.

On WeChat, most posts and articles about instant food are recommendations of instant food with good taste, both international and domestic brands. Different kinds of instant noodles brands are very popular among those posts and the writers will share their experience eating these instant foods as well. Moreover, health and safety issues are also very important concerns for the readers and some of the writers will share their experience of how to eat instant food in a healthy way.

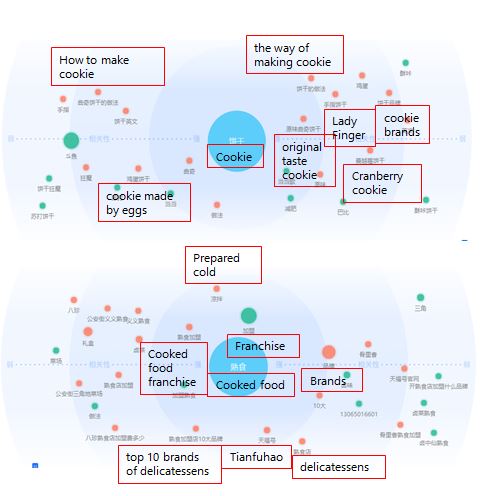

On Weibo, the main posts relating to instant food are the sharing of instant/processed seafood, noodles, meat and dumplings. International brands and domestic brands are both popular among those posts, many consumers like instant food from other Asian countries, such as South Korea.

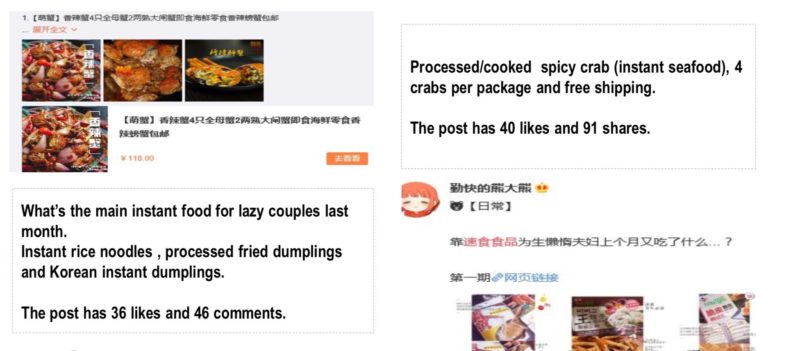

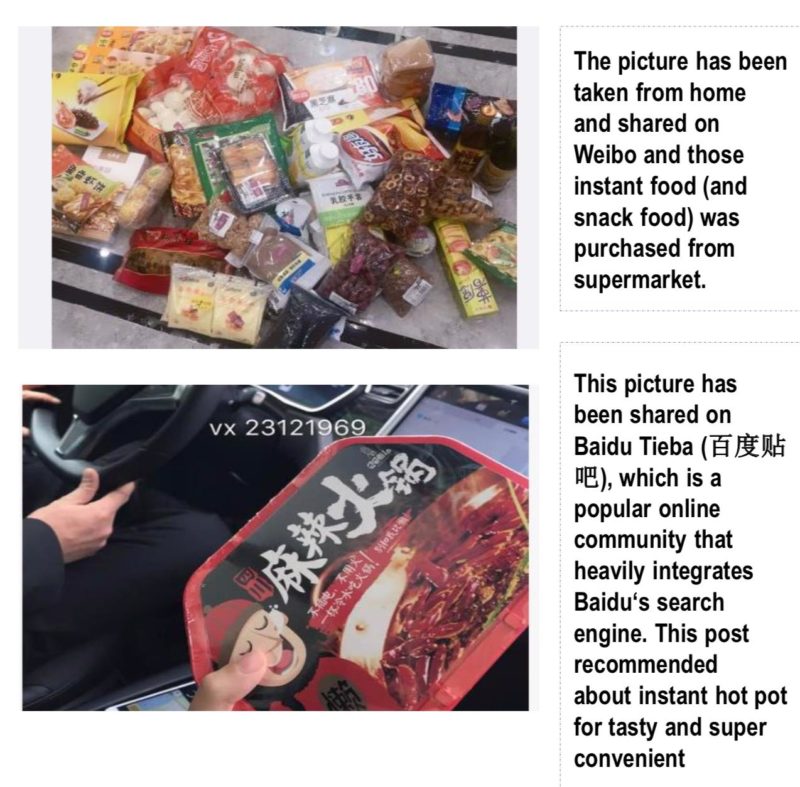

On social media, pictures about instant food are usually taken from the consumers’ home, cars, supermarket and convenience stores, most of the pictures are recommending different kinds of instant food because they are cheap, tasty and super convenient. Domestic brands and international brands are both very popular among Chinese consumers. Therefore, a large variety of instant food has gradually become a part of daily life for a part of the netizens.

Effect of E-commerce on the instant food market in China

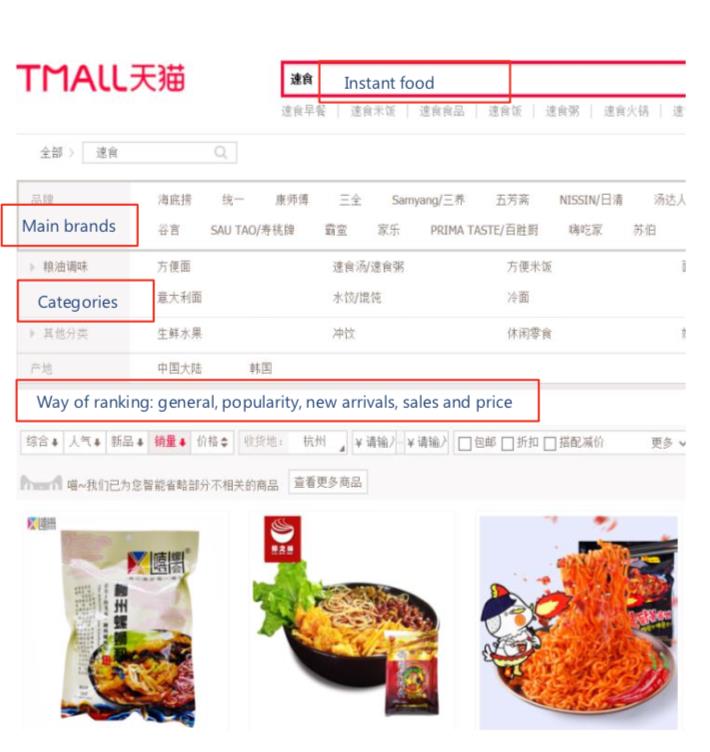

Since 2002, E-commerce gradually became the main way of shopping in China. With all the E-commerce platforms, the consumers can easily obtain the instant food they are looking for in the lowest expense. Additionally, the commenting and sharing platform on E-commerce also provides the consumers a broader overview of the products that they want to purchase and have more comprehensive information that they need to evaluate the quality of the product.

China’s ready-to-eat market: Instant food brands are in vigorous competition with each other

The Chinese market share breakdown

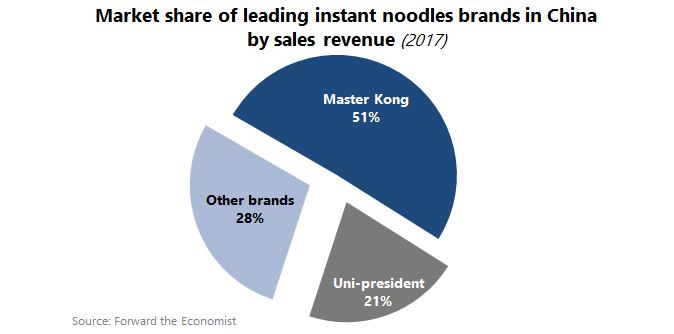

As the most popular instant food in China, the instant noodles market is dominating by large domestic brands. As the pie chart shows below, Master Kong is occupying 51% of the market and Uni-president is occupying 21% in 2017. Therefore, the industry is locked in a monopoly-oligopoly situation and only 28% of the whole market is sharing by other brands. In recent years, more international brands have entered China’s instant noodles market, mainly from Asian countries, such as South Korea and Japan. Such new competitor entrance also increases the competition as the consumers are having more choice. Moreover, KOLs in China also help the international brand to enter the market as the consumers will be curious to try the new brand out due to the low cost of the products and the increased disposable income that the consumers have.

E-commerce overview of the main brands/products in the Chinese market

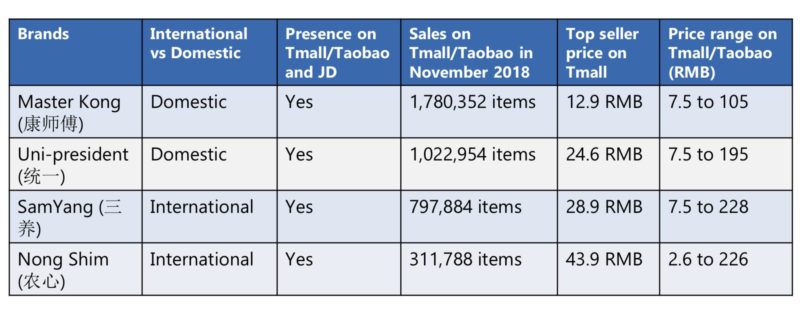

On Taobao/Tmall, the sales of domestic instant noodles brands (leading brands) are much higher than most international brands. As the table demonstrates below, international brands like SamYang and Nong Shim and are having their top seller’s price almost 3 times higher than the price of Master Kong’s top seller and the price range for the international brands are also much wider. Such a trend indicates that the consumers are willing to pay more for the instant food from international brands but with a higher expectation.

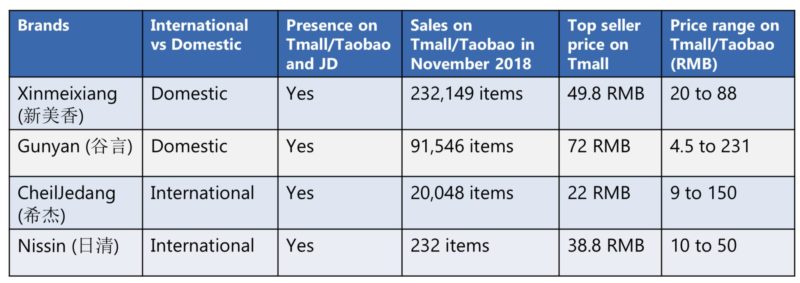

As for instant rice, on Taobao/Tmall, the most sales of instant rice (mixed with other cooked food) come from domestic brands. As shown in the table below, International brands’ online sales are significantly lower than the domestic brands, even if they are cheaper. For example, Xinmeixiang, the most popular brand of these 4 brands, has a sale that is 1000 times more than Nissin, the lowest sale brand among these four.

Due to the good reputation of Chinese domestic brand of instant rice in the market and many international brands significantly focus more on instant noodles, instant rice market on E-commerce platforms is dominated by domestic brands.

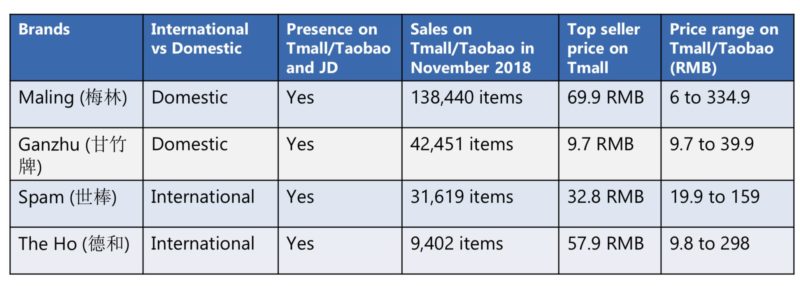

Instant meat is also a popular product among Chinese instant food industry. The sales of domestic brands of instant meat are obviously higher than international brands on Taobao/Tmall, which means domestic brands are also more popular among Chinese consumers as well. One of the possible reasons for the popularity of the domestic brands might be their price as the brands like Ganzhu offers a price that is 3 times less than international brands like Spam and The Ho.

Instant food brands overview-Master Kong, SanQuan, Shuanghui

Master Kong

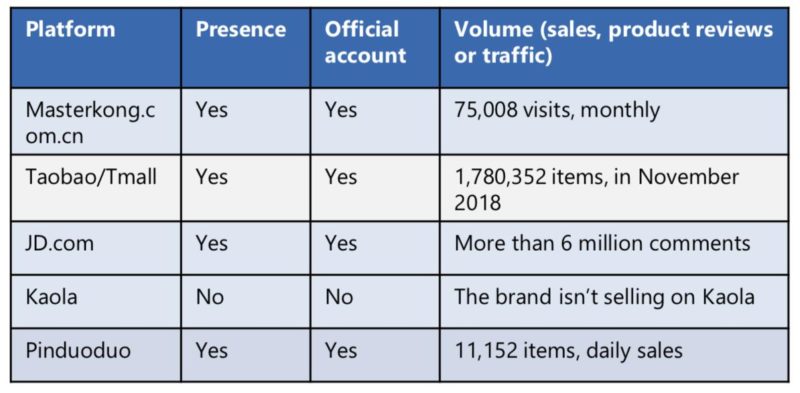

Master Kong is the largest and most popular instant noodles brand in China. The brand’s official website mainly focuses on introducing new arrivals and brand stories. Since the 2018 Double 11 shopping day (the largest offline and online shopping day in China, launched by Taobao), the sales of Master Kong’s instant noodles increased rapidly, in November, compared with previous months.

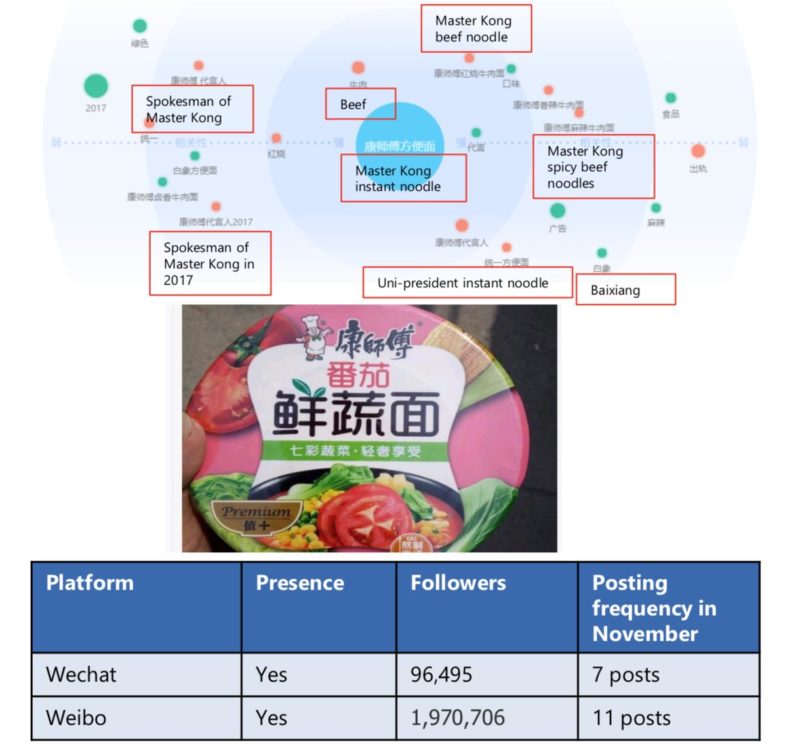

As for the Baidu index analysis, the most related keywords of “Master Kong instant noodle” are “Master Kong beef noodle”, “spokesman of Master Kong” and its competitors, such as “uni- president” and “Baixiang”. In addition, the brand mainly releases advertising videos, pictures and articles about new arrivals, important events and discount activities on Weibo and WeChat accounts.

SanQuan

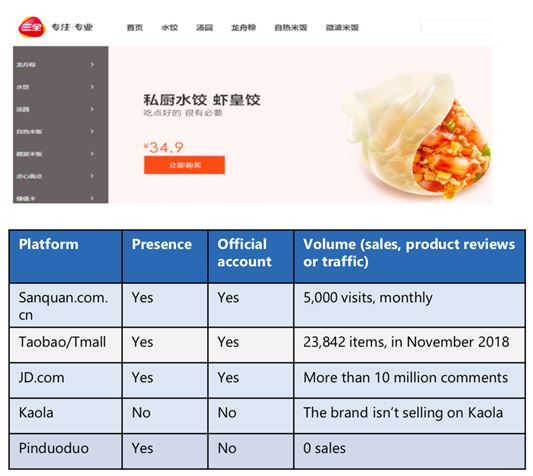

Sanquan is a well-known Chinese brand specialized for frozen/instant food. The brand’s official website provides info about new arrivals and its most popular food in China. Sanquan’ products have been selling on the main e-commerce platforms in China, such as Tmall, JD and Pinduoduo and the sales detail is provided in the table below.

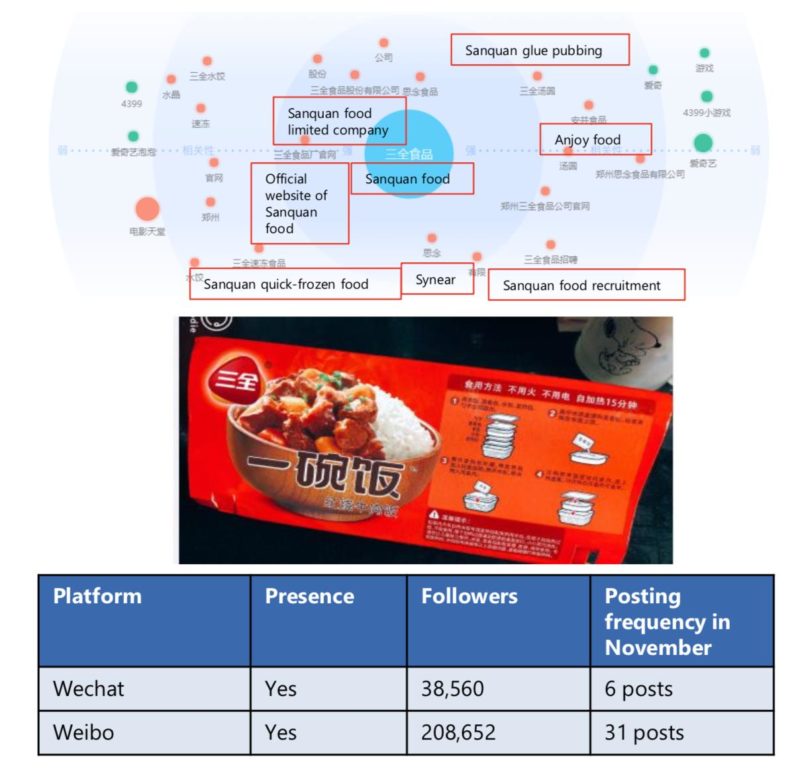

As for the Baidu index, the most related keywords of “Sanquan food” are “Sanquan food limited company”, “Sanquan official website”, “Sanquan glue pudding” and its competitors, such as “Synear food” and “Anjoy food”. The brand has built official accounts on WeChat and Weibo and published videos and posters about events and new arrivals.

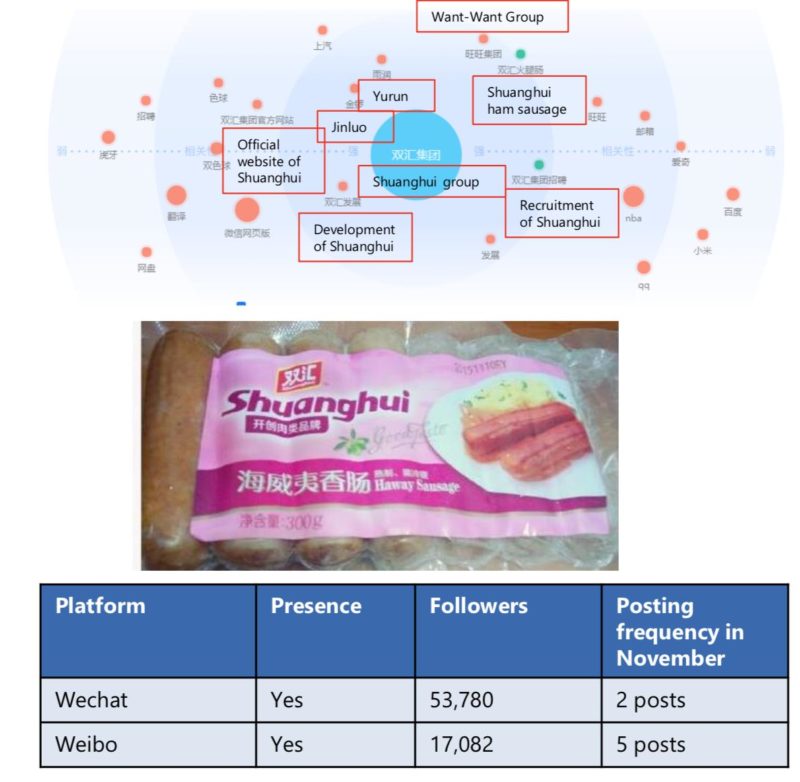

ShuangHui

Shuanghui is a famous Chinese food brand focuses on processed / instant meat, its signature product is pork sausage. The brand’s official website usually shows information about its popular products, discount activities and company news. The brand also has built official stores on the main e-commerce platforms in China, such as Taobao/Tmall and JD.

As for Baidu Index, the most related keywords of “Shuanghui group” are “the development of Shuanghui”, “Shuanghui’s official website”, “recruitment of Shuanghui” and the brand’s competitors, such as “Yurun” and “Jinluo”.

The brand promotes its products in China by releasing news and info about its important events and new arrivals on Weibo and WeChat, but those two platforms haven’t been fully used by the brand in November.

Comparing online interest for ready-to-eat leading brands in China

On Baidu index, Master Kong showed the highest search frequency, Sanquan had the second highest search frequency and Uni-president showed the lowest search index during the past year. Such trend demonstrates that Master Kong has a large market penetration rate and excellent reputation among the industry. Also, on WeChat index, Master Kong showed the highest search frequency and much higher than the other three brands in past 30 days.

Instant food consumption in Mainland China: Distribution channels

The distribution channels of instant food in China consist of 5 parts: supermarket, convenient stores, e-commerce platforms (Taobao/Tmall and JD), wholesales market and vending machines.

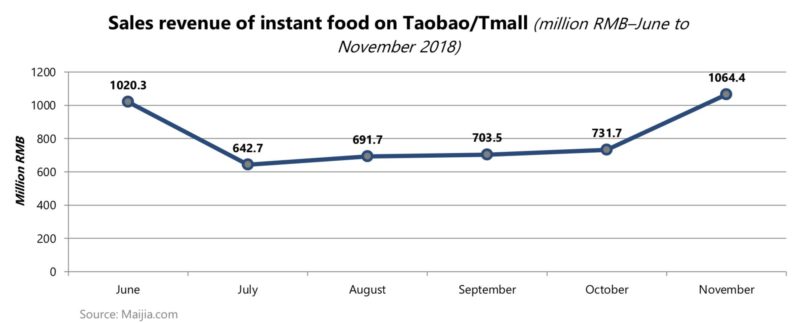

Online sales

As the most important online sales channel, Taobao/Tmall showed high instant food sales in June and November for 618 Ideal Life Carnival and Double 11 shopping Carnival (both are large shopping days launched by Taobao/Tmall). Therefore, the consumers tend to store instant food during the campaign period and wisely plan the purchase frequency.

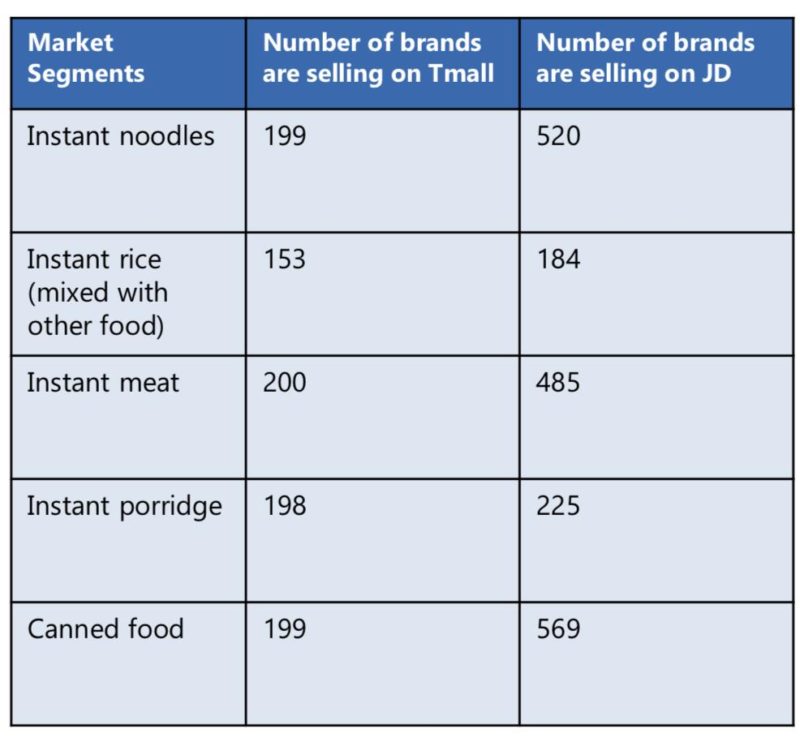

Online retail coverage in China

The number of brands on JD is more than Tmall, mainly due to the higher requirements and deposit of Tmall for those brands want to enter the platform. International and imported brands mainly come from Europe countries (Italy, England and etc.), Southeast Asia (Singapore and Thailand) and South Korea.

Online Sales-Volume assessment

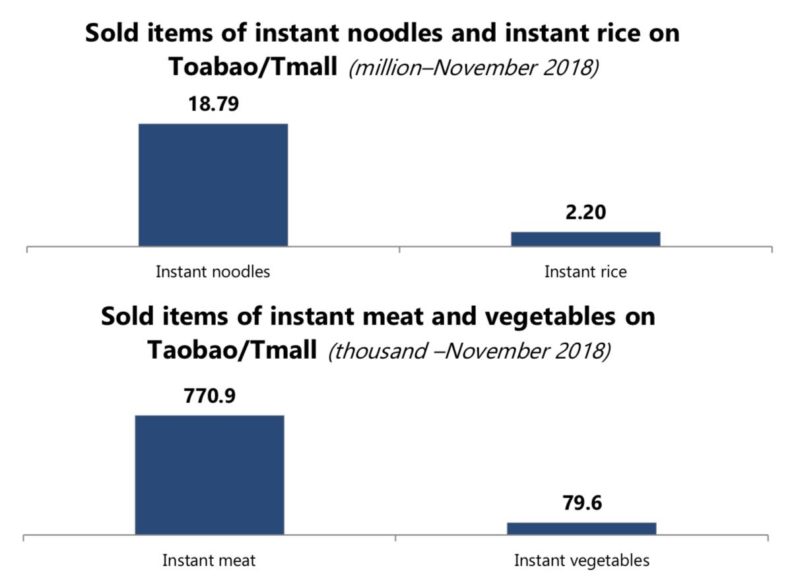

Instant noodles showed the highest sales on Tmall/Taobao, which was the 9 times of instant rice (rice mixed with meat and vegetables) sales on the same platforms. The sales of instant meat were much higher than instant vegetables, which means instant/processed vegetables haven’t been popular in China.

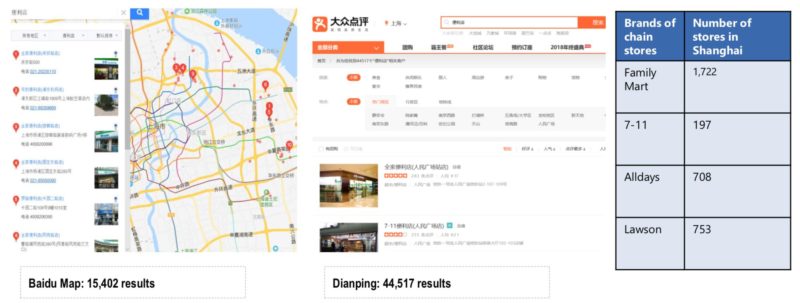

Offline retail-coverage in Shanghai

Since the instant food is one of the most common food in China, supermarket and convenient stores are its important offline retail channels. We use Shanghai’s convenient stores (different brands) as examples of distribution channels. As the table shows, Family Mart is the most significant channel to sale the instant food, which has 1722 stores in Shanghai, following by Alldays and Lawson, which consists 708 and 753 stores, respectively.

On-the-shelf: representation of the category in stores

As one of the most common products in China, instant food is purchased by consumers in a supermarket, convenient and cooked/processed food stores. In those stores, instant food usually has an individual area (several shelves) and one segment (such as instant noodles ) have one shelf. Most types of instant food are cheap products in those stores since they are daily/fast food.

New trends in China’s F&B market

In order to increase the sales of instant food in China, most brands (domestic and international) are investing more resources in R&D to create new products.

Health is the direction of development in the instant food industry. For health perspective, low-fat food, low calorie (sugar) food and low-salt food are becoming popular among Chinese consumers and the instant food brands have created more healthy instant food, such as the non-fried instant noodles and additive free instant food. As for becoming more nutritious, the raw ingredients of instant food has also been improved. There are more vegetables, fruit and whole grains have been a significant part of many types of instant food in China. Therefore, the future of instant food will focus more on the value and innovation of the product.

Therefore, as analyzed above, even though the Chinese instant food market is slightly shrinking due to the efficiency of the food delivery system, it is still a large industry that affects almost everyone’s daily life. For the leading brands, it is important to actually understand what the consumers are expecting and developing new products that are healthier and more nutritious. Also, increase the variety of instant food and allowing consumers to have the food ready in a more convenient way can also be the focus for companies.

Author: Xiangyu (Lavender) Mao

In such Chinese market as ready-to-eat is not easy to enter and even more difficult to gain a foothold. One of the reason is the growing demand and acceptance for local brands, along with the overchoice consumers are already facing in stores. Still, a step-by-step methodological approach should allow you to find your positioning in the Chinese markets and introduce product concepts to the local consumers.

One of the important tasks before entering such a market is competitors study. Who are your competitors? What products or services do they sell? What is each competitor’s market share? What are their past strategies? What are their current strategies? What type of media is used to market their products or services? – and much more.

China is a market full of opportunity in some sectors, and Daxue Consulting is here to provide you and your business with the right tools to be at the top of your game within your market. So, to find answers to all questions do not hesitate to contact our project managers at dx@daxueconsulting.com.