Instant noodles market in China: a recession-resistant meal

Instant noodles are made of dried and precooked noodles, along with flavoring powder and seasoning oil. They are popular all over China and are made by just adding hot water. In 2016, the global consumption of instant noodles reached 97.5 billion units. Equivalently, the daily consumption of instant noodles was 270 million units around the world, which indicates the popularity of instant noodles among global consumers. The instant noodles market in China may be resistant to the economic impact of COVID-19.

Overview of the instant noodles market in China

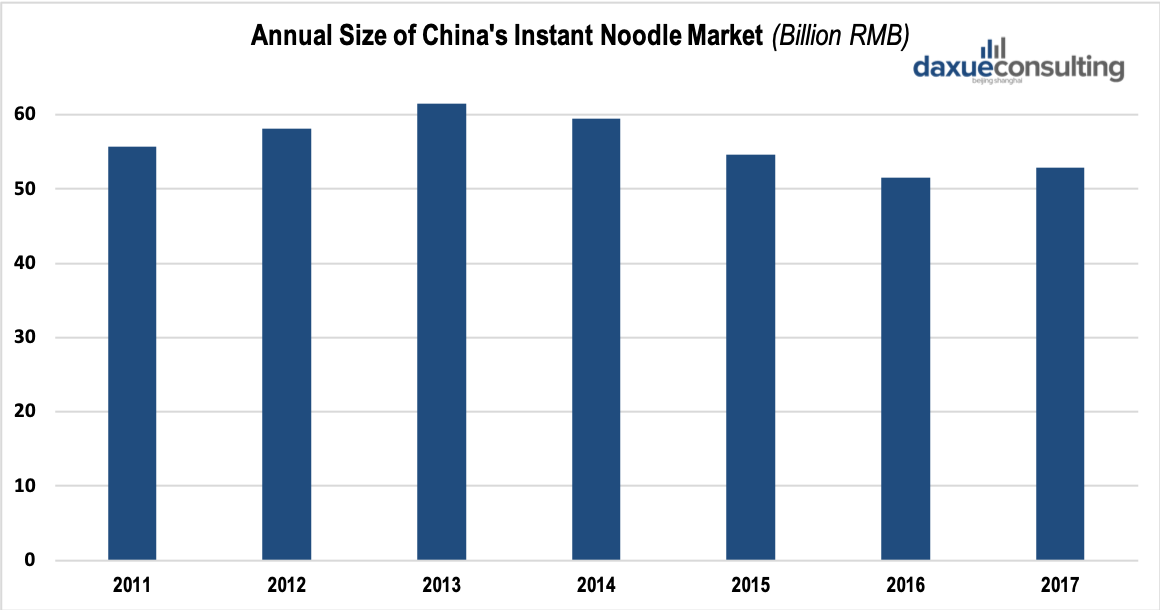

A Euromonitor study showed that the consumption of instant noodles in China had increased significantly since 2003. The industry has maintained a positive growth rate for five consecutive years, with 69.5 per cent sales growth to 59 billion yuan in 2008 – up from 34.8 billion yuan in 2003.

In 2012, industries suffered in the global financial crisis, the instant noodle sector, however, suffered no damage.

Consumption growth driven by premiumization

According to Euromonitor, the instant noodles market in China continued to see the rise in sales in 2019. The strong performance of mid-to-premium products facilitated the upturn in this market. The product segment took advantage of the increasing demand for health-conscious and premium products. The broth is a critical factor in driving growth while emphasizing healthier food, upgraded from a MSG base to include more natural flavors. Instant noodle companies in China now emphasize high-quality ingredients. Apart from developing premium products with better quality and new flavors, brands are also shifting part of their packaging from pouches to cups to meet the need for busy urban instant noodles consumers in China.

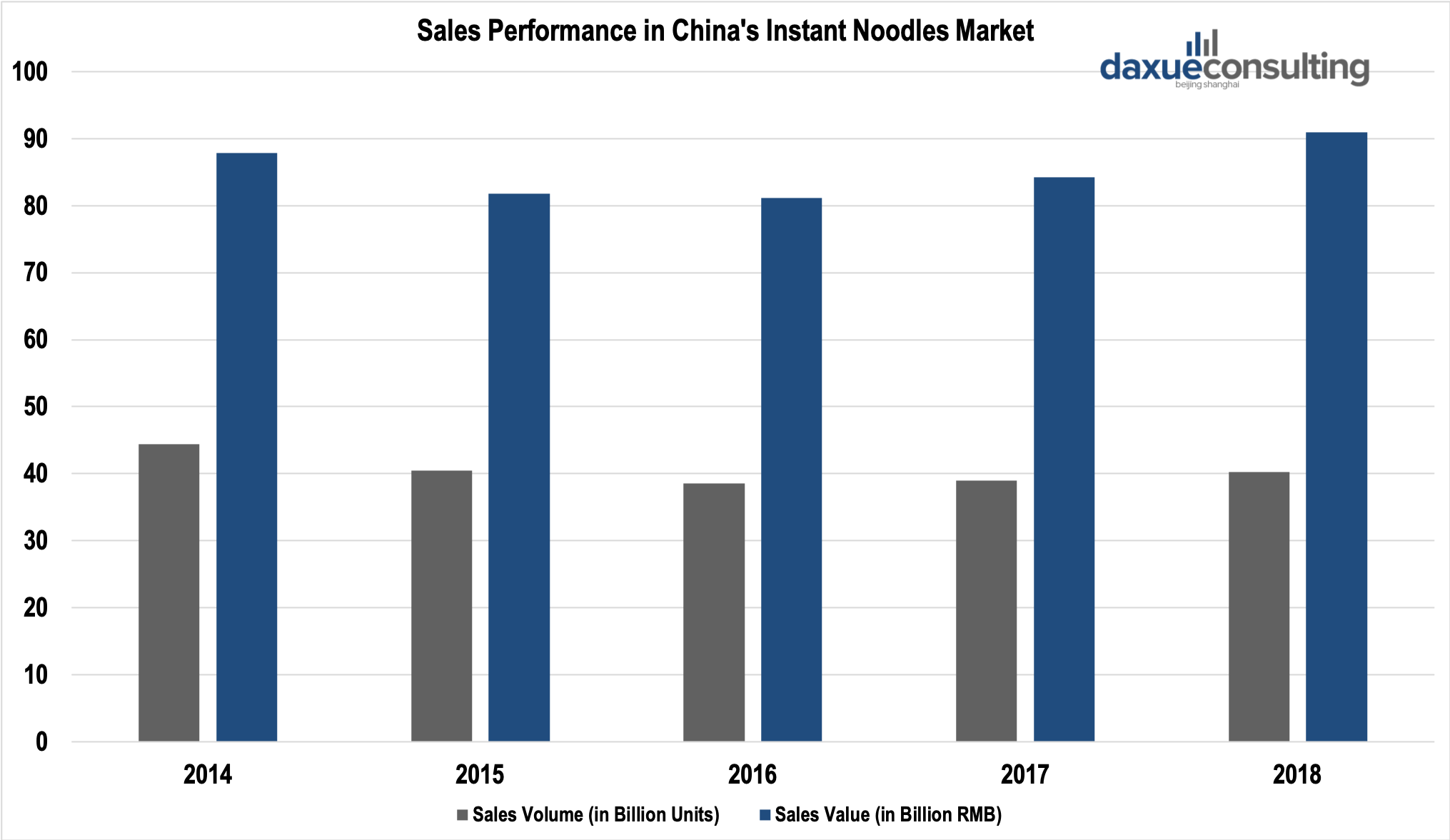

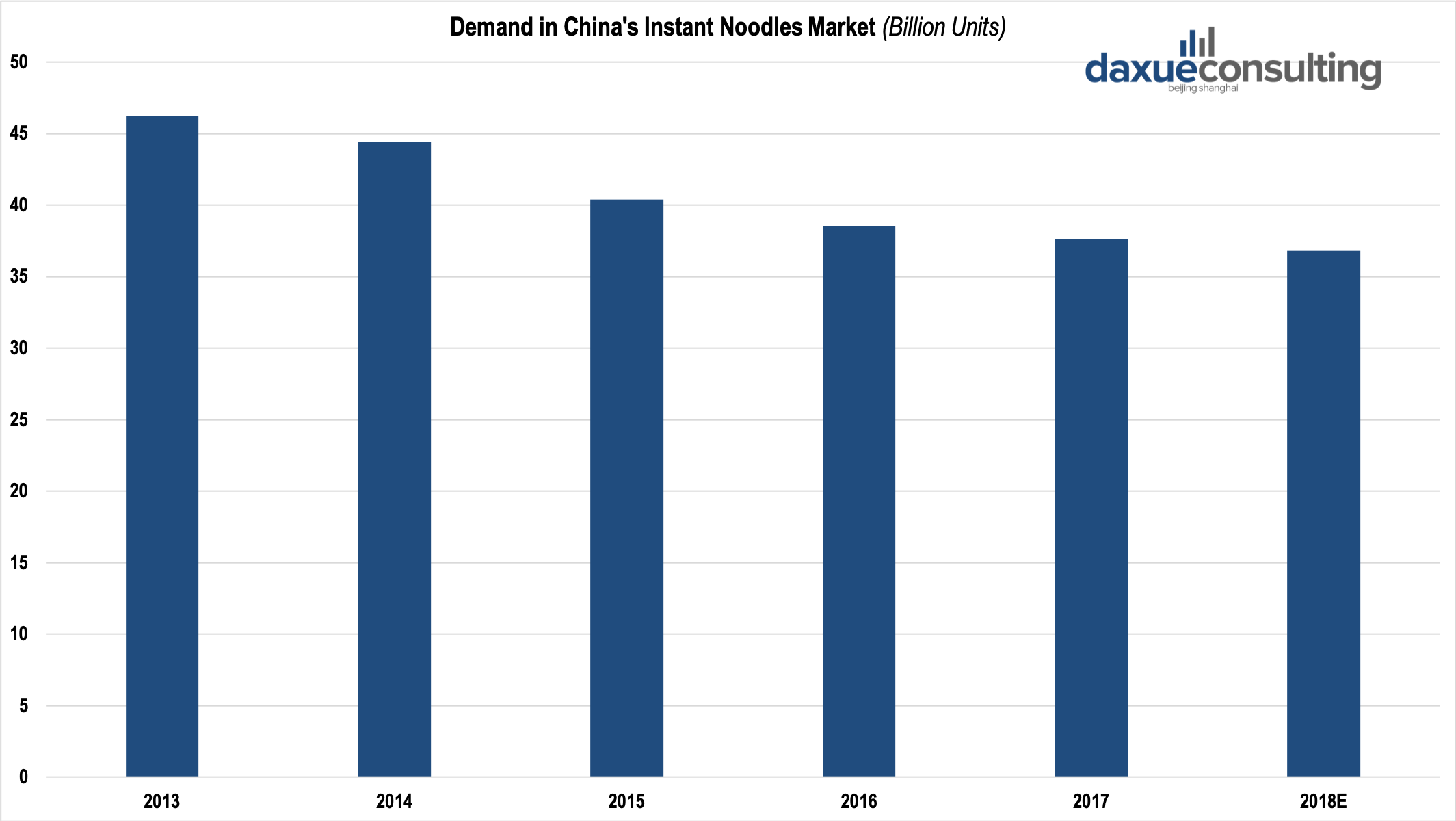

Sales performance influenced by delivery industry

The Instant noodles market in China has been the largest world over the last decade. However, from 2013 to 2017, the sales volume had been decreasing. This was due to the remarkable performance of China’s food delivery industry. From 2017 onwards, the sales performance of this market has been recovering because of the market turbulence of competitors’ sectors. Therefore, in the foreseeable future, the sales volume and value are projected to grow steadily and will reach 0.937 billion RMB with the YOY of 2.9% in 2021.

Manufacturing and consumption of instant noodles in China

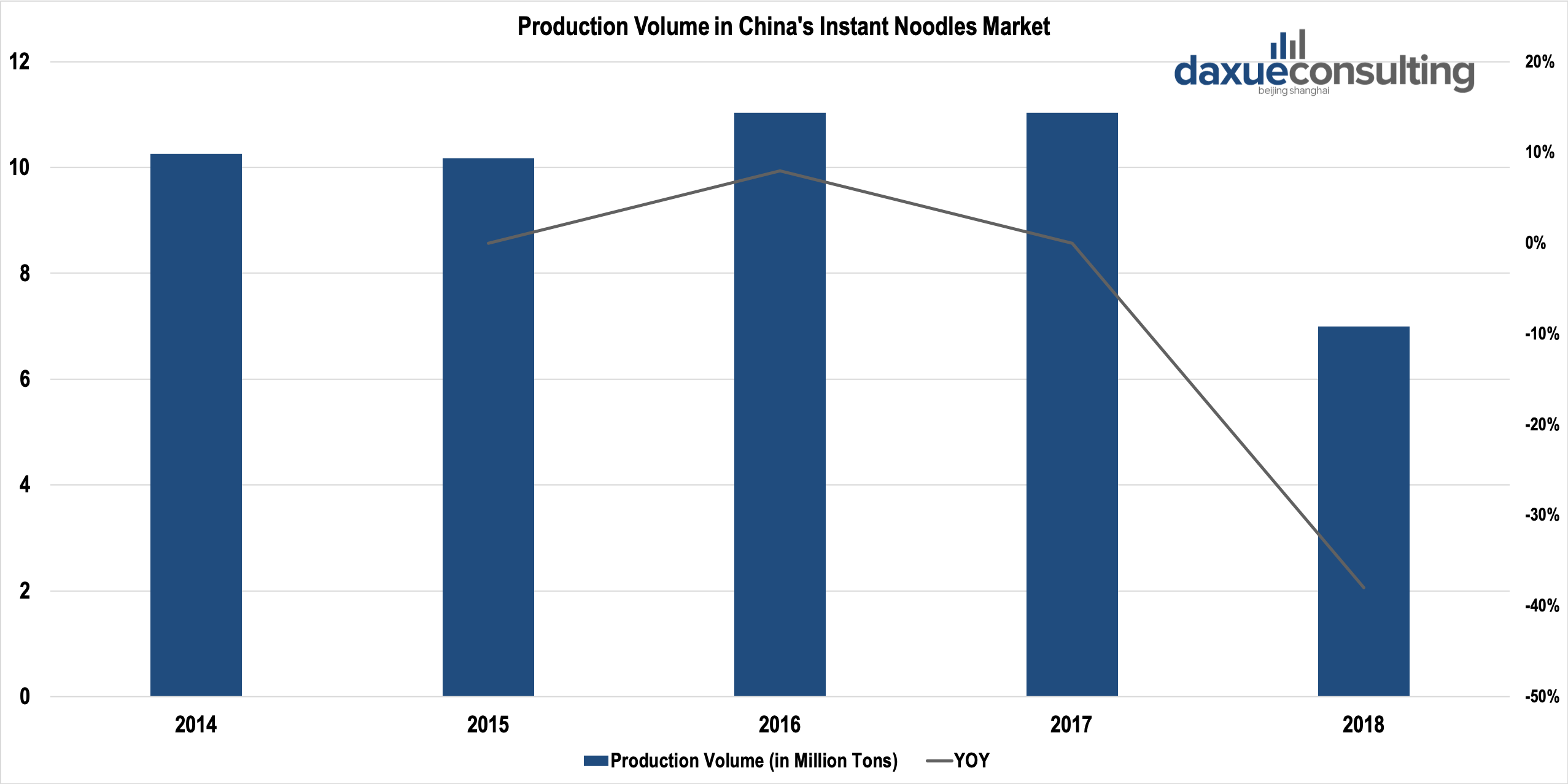

Influenced by the Chinese consumers’ rising health consciousness and development of other industries, instant noodles companies in China experienced a downturn from 2014-2017, and the production volume maintained at 10 million tons. In 2018, it plummeted to 7 million tons and dropped by 36% in comparison with the figure in 2017.

The demand for instant noodles in China has been dropping gradually. From 2013 to 2016, the annual consumption of instant noodles in China fell by 8 billion. In 2017, the demand decreased to 0.385 billion units. Since then, the figure has maintained below 0.4 billion.

[Data source: chnci, ‘Demand in China’s Instant Noodles Market’]

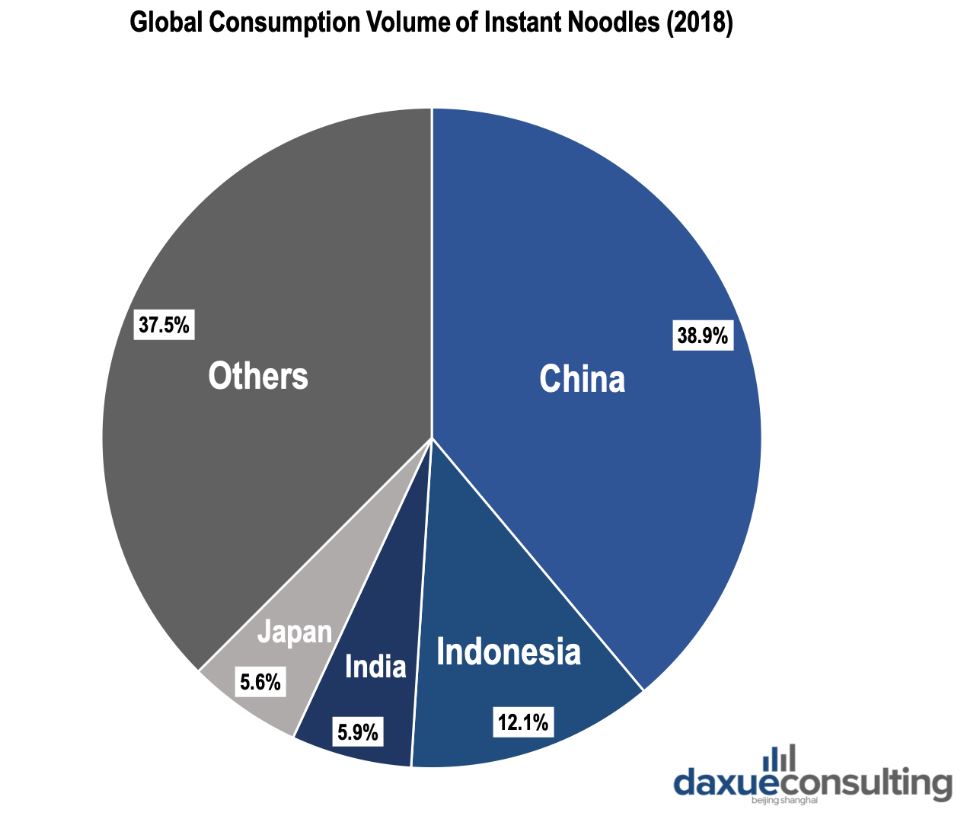

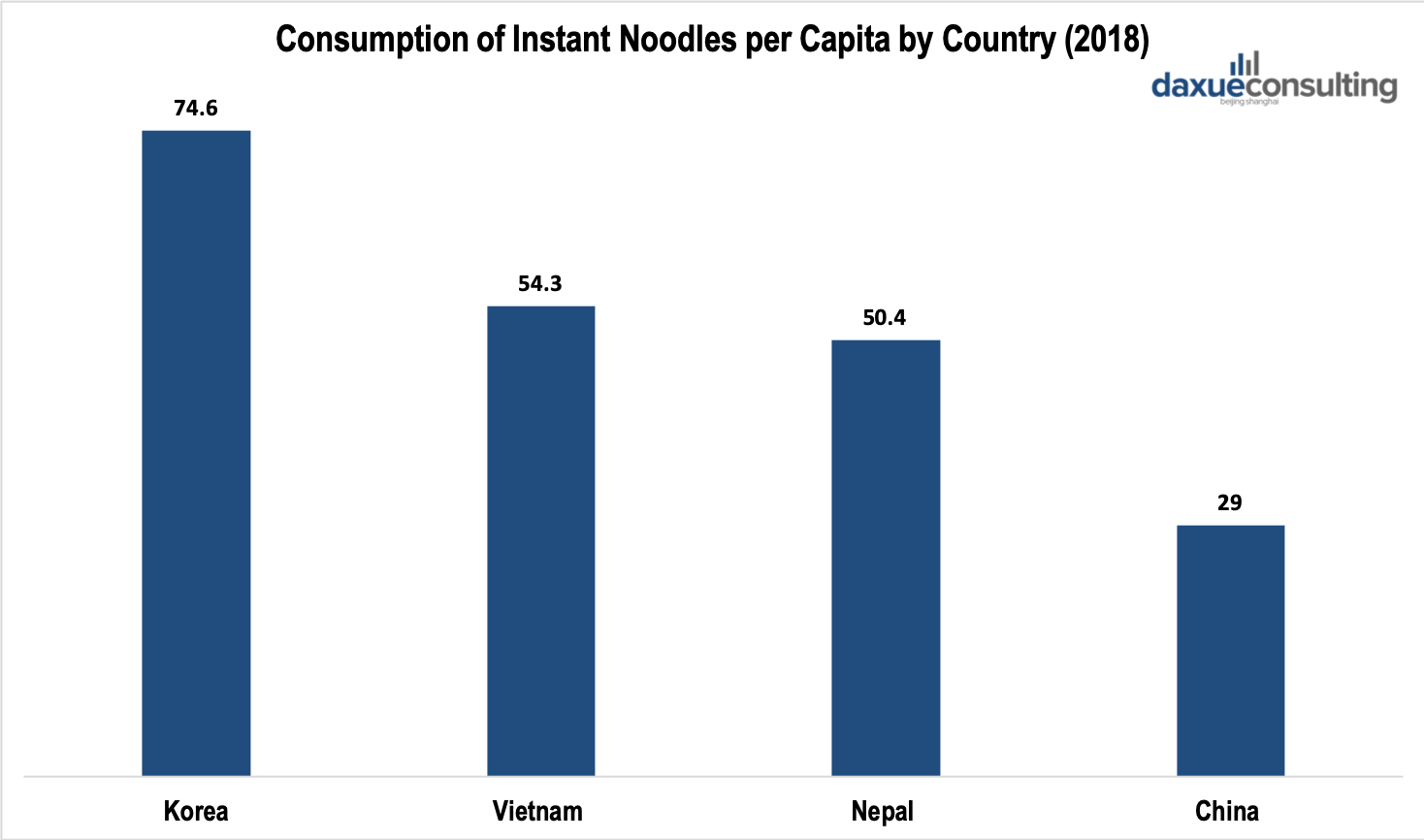

In 2018, China was the largest market for instant noodles with 40.3 billion units of sales volume and consumed 38.9% of total instant noodles. Even though the total consumption of instant noodles in China was the largest all over the world, the consumption per capita was way lower than that in other countries. With the rising middle class and increasing purchasing power, China will become the potential market for high-end instant noodles.

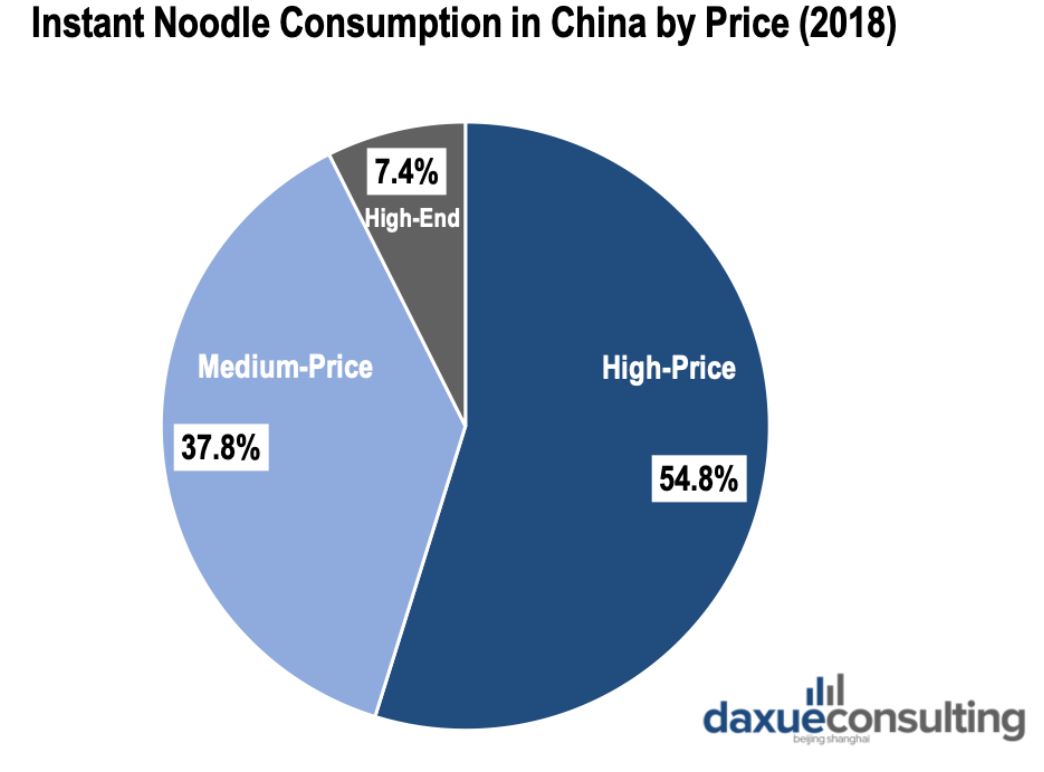

In terms of the consumption pattern, the instant noodles market in China is evolving towards the high-end market. In 2018, the high-price instant noodles product in China was the most popular and accounted for more than 50% of the total consumption of instant noodles in China.

Instant noodles products in China: high standardization

Packing methods, cooking methods and texture of noodles are the key characteristics of instant noodle products in China. Instant noodles in China can be sold in cups or bags.

Regarding the texture of instant noodles, non-fried instant noodles are healthier. They skip the fried process and include a low amount of palm oil and saturated fatty acid. However, fried instant noodles are the most original product. Since instant noodles consumers in China have become increasingly health-conscious, instant noodles manufacturers have modified the process to avoid heavy oil.

Lastly, wet-processed instant noodles are the healthiest products among these three. They need to be boiled before serving, and they are the result of rolling, boiling, pickling, sterilization and package sealing. Due to their moistness and freshness, these features have differentiated wet-process instant noodles from others and become the high-end products in the market.

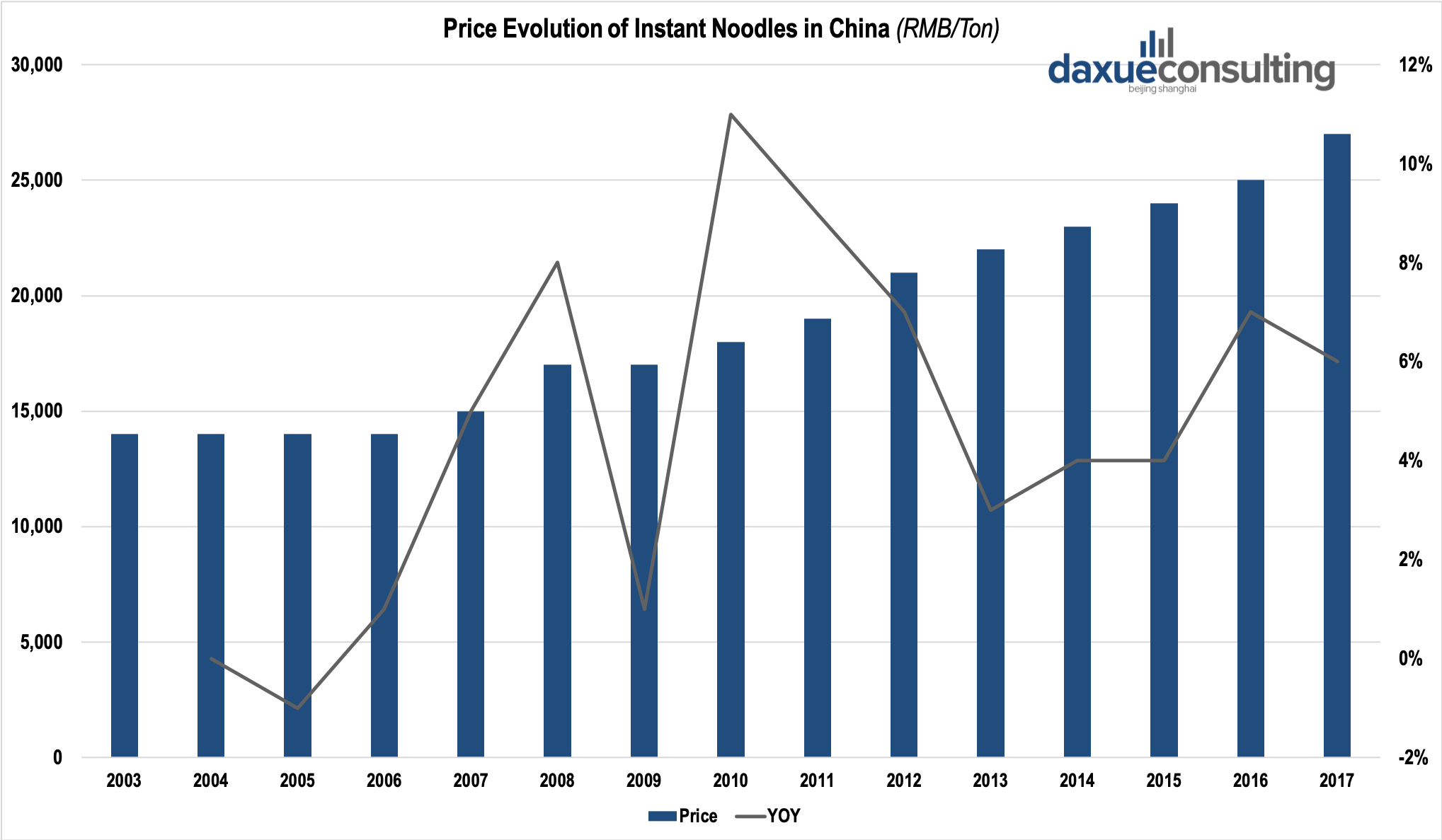

Price of instant noodle market in China: a gradual increase

From 2003 onwards, price of instant noodles in China has experienced stable growth, from 15,000 RMB/ton in 2003 to 26,000 RMB/ton in 2017, with a fluctuating YOY.

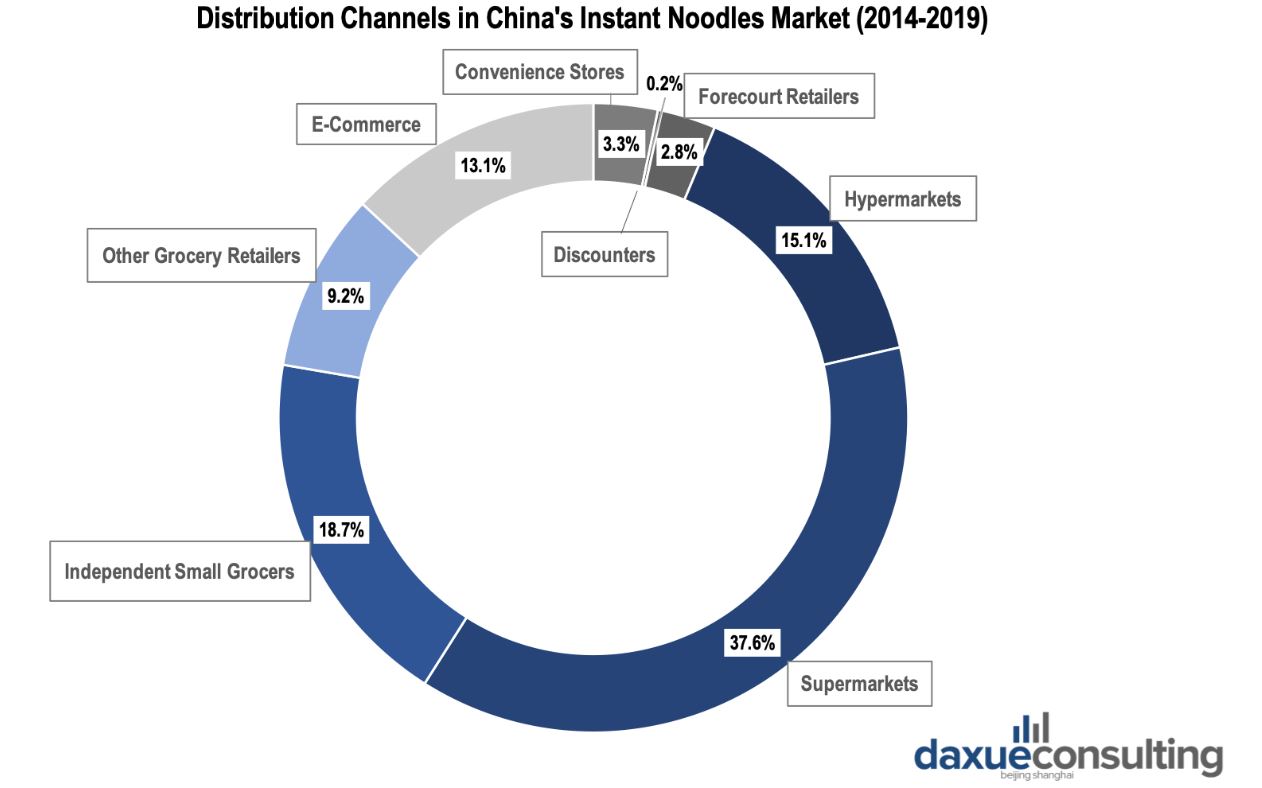

Distribution channels on the instant noodle market in China: supermarkets dominate

Owing to the feature of instant noodles, convenience and time saving, it has attracted different consumer groups. Instant noodles consumers in China can shop in supermarkets, convenience stores, vending machines, service stations, and so on. Customers in China consume instant noodles in various contexts, home, train, canteens, flights, etc. With the development of E-commerce in China, shopping for instant noodles online has become easier. Instant noodles consumers are likely to shop on mainstream platforms such as Tmall and JD and other delivery apps.

Localization and health

China produces many instant noodle dishes that reflect the unique flavors of various regions. One example is Zhengzhou lamb noodle soup. Different regions develop their tastes to differentiate from competitors.

Crossover collaboration is the latest trend in the food industry in China. The frozen food industry in China has applied this strategy by collaborating with the catering industry and E-commerce sector in China. It has developed the signature dishes which are healthy and accessible. The instant noodles market in China can imitate and apply a similar strategy to maintain and occupy more market share.

Health is always the critical priority of instant noodles consumers in China. Therefore, instant noodles companies in China can leverage R&D and develop more nutritious and natural products. For example, steamed and boiled noodles are the latest innovations in the instant noodles market in China. The product maintains the nutrition and taste of traditional Chinese noodles. Another outstanding example is the fine dried noodle, which includes vegetables and grains, can satisfy current consumers’ need.

Brand analysis of instant noodles market in China

Key players in China’s instant noodles market: high CR4

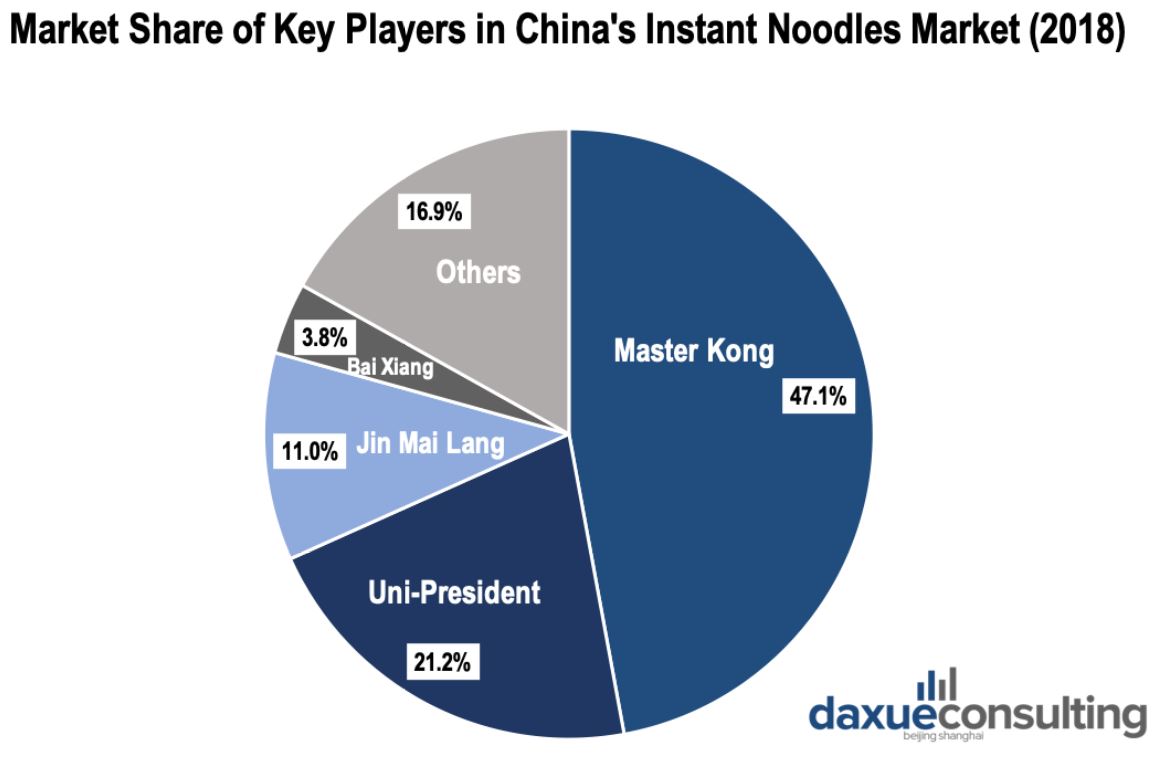

[Data source: chyxx, ‘Market Share of Key Players in China’s Instant Noodles Market (2018)’]

The brand concentration degree in instant noodles market in China has been increasing. In 2018, the key players in this market were Master Kong, Uni-President, Jin Mai Lang and Bai Xiang, occupied more than 80% of the total market share in the instant noodles market in China. Master Kong and Uni-President accounted for 60% of the overall market share, which indicated their overwhelming brand loyalty in this market.

Brands of instant noodles market in China: Master Kong and Uni-President dominate

In the competitive instant noodle market dominated by Taiwan’s Master Kong and Uni-President Enterprises Corp, the only way for smaller Asian rivals to gain a larger market share may be to resort to magic. Perhaps that is why Huafeng recently hired famed magician Liu Qian as its brand spokesman, hoping to boost sales in the country’s vast second- and third-tier cities.

For a company without an established distribution network, it will be challenging to compete with Master Kong and Uni-President. The market research firm Euromonitor International reported that Ting Hsin International Group, which owns Master Kong, led in domestic market share with 27.2 per cent in 2007, followed by Uni-Present with 7 per cent. Huafeng, with a 1.3 per cent share, ranked ninth among leading instant noodle makers. However, Huafeng, which suffered losses from the end of the 1990s through 2004, has recruited a fresh new management team. Market conditions in China’s first-tier cities have been extremely competitive, dominated by top brands that created barriers to entries due to their economies of scale.

Master Kong and Uni-President

Ting Hsin International Group is a Taiwanese-owned company based in Tianjin, PR China. It is China’s biggest instant noodle maker, owning the Kang Shi Fu brand, also known as Master Kong or Tong Yi. It also partly holds 33.2% of shares of its associate Tingyi Holding Corporation. Uni-president Enterprises Corporation is an international food conglomerate based in Tainan, Taiwan. It is the largest food production company in Taiwan as well as in Asia and has a significant market share in dairy product, foods and snacks, and the beverage market. It is also responsible for running Starbucks, 7-Eleven, Mister Donut and Carrefour in Taiwan. Besides, Uni-President also has subsidiaries in China and Thailand.

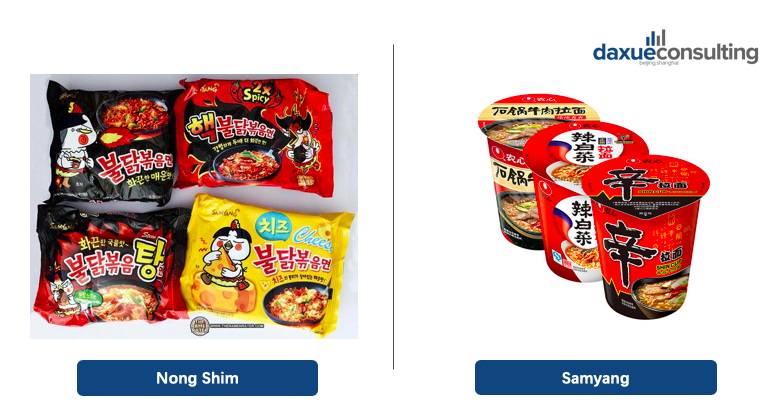

Foreign instant noodles brands in China: Korean instant noodles

According to Euromonitor, domestic brands continue to dominate in the instant noodles market in China. However, foreign instant noodles brands in China offering novel and exotic products can still find space to expand, especially as demand moves upmarket. Amongst those foreign brands looking to enter China’s instant noodles market, Samyang has drawn Chinese consumers’ attention successfully. Spicy Buldak Ramen noodles have become popular in China owing to a viral online spicy noodle challenge, the endorsement of K-pop stars and multi-channel distribution.

Shin Ramen is a distinctive brand of Korean instant noodles produced by Nong Shim Ltd. since 1986. It exports its products to over 80 different countries and is the highest-selling brand of noodles in Korea. Shin Ramyun comes with a seasoning packet and a packet of dehydrated vegetables and is usually prepared in a pot or other container. It is also sold in an instant cup or instant bowl form. This debut version came out in Korea in 1981.

[Photo source: Nong Shim, Voiello and Samyang, ‘Products of foreign brands in China’s instant noodles market’]

Author: Amelia Han

Let China Paradigm have a positive impact on your business!

Listen to China Paradigm on iTunes