The rise of the Stay-at-home Economy in China | How COVID-19 boosted indoor consumption

The Stay-at-home Economy in China is a series of consumption and commercial activities carried out by people at home, such as online shopping, entertainment, work, education and fitness. Stay-at-home Economy includes almost all aspects of daily life: online shopping, online entertainment, social media, delivery services, online education, online fitness training, telemedicine, and remote work.

Consumer profile of the Stay-at-home Economy in China

The expression of Zhai people (宅人群) refers to men and women who depend on the internet to meet their daily needs without leaving their homes. They are usually keen on online videos, games and social media. Apart from recreation, Internet also enables them to buy food and clothes, learn remotely, and read. During COVID- 19, most Chinese people adopted the Zhai lifestyle. Thus, the Stay-at-home economy in China has expanded.

“Zhai people” aka “宅男 and 宅女” (Zhai men and zhai women) is originally a Japanese word “Otaku” meaning “geeks”, now it is widely used to describe people who don’t like outdoor activities. They normally spend less than 3 hours outside and around 8 hours on the internet every day.

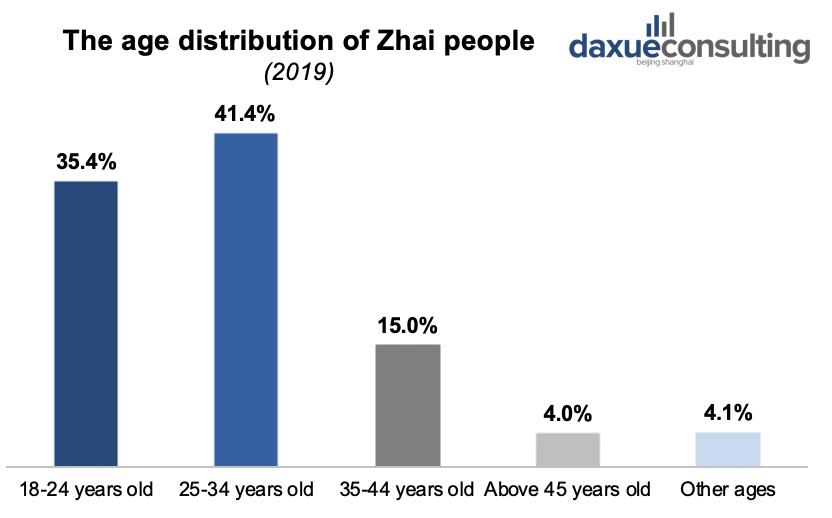

Among the Zhai people, 55.5% are men and the rest 44.5% are women. 76.8% of Zhai people are younger than 35 years old, but COVID-19 pushed the Zhai lifestyle to older generations too. Regarding geographical distribution, Zhai lifestyle are not unique to tier-1 cities. In fact, 60% of Zhai people under 30 years old live in tier-1.5 and tier-2 cities.

Internet accessibility and Mobile payment are the foundation of the Stay-at-home Economy in China

China’s fast-growing internet enables people to enjoy many services without leaving their homes. According to the most recent report from China Internet Network Information Center, 65% of Chinese population are mobile internet users. According to Mckinsey, total time spent online per user per day amounts to 358 minutes, with social apps (44%), content apps (20%) and other apps (36%).

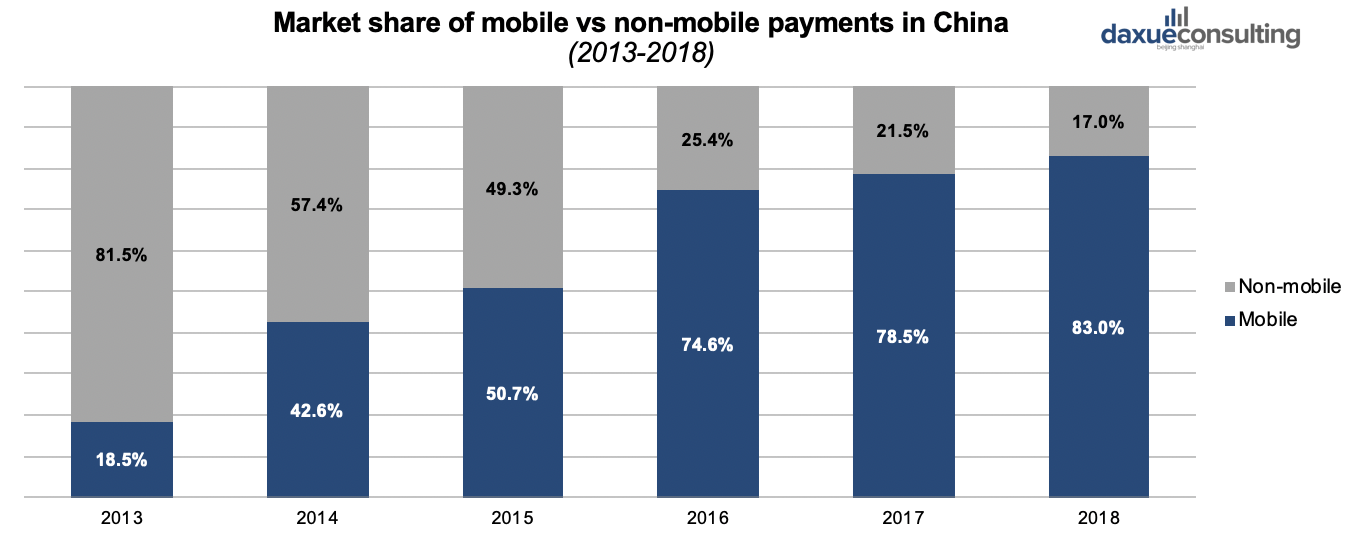

Another important driver of the Stay-at-home Economy in China is the wide use of mobile payment. 92% of people in China’s largest cities use WeChat Pay or Alipay as their main means of payment.

COVID-19 mandated Stay-at-home, which pushed Chinese activities further online

Time spent online has steadily increased for several years in China, COVID-19 enhanced this trend. During the epidemic, Chinese reliance on the internet increased and they were exposed to more diverse platforms.

- Mobile gaming: Multiplayer online battle arena sector is the most popular with the game Honor of Kings reached more than 100 million daily active users.

- Social media platforms: On Weibo, some topics about COVID-19 reached over 1 million reads per minute.

- Online Shopping: In February 2020, Taobao app had 720 million users in China, increased by 33 million users compared with December 2019.

- Online fitness classes: KEEP fitness app registered a 185% increase in followers on the live-streaming platform Douyin.

- Remote work and study platforms: The Tencent Meeting app was downloaded 430,000 times a day, up from 370 before the outbreak.

Social media and news apps are more embedded into Stay-at-home Economy in China

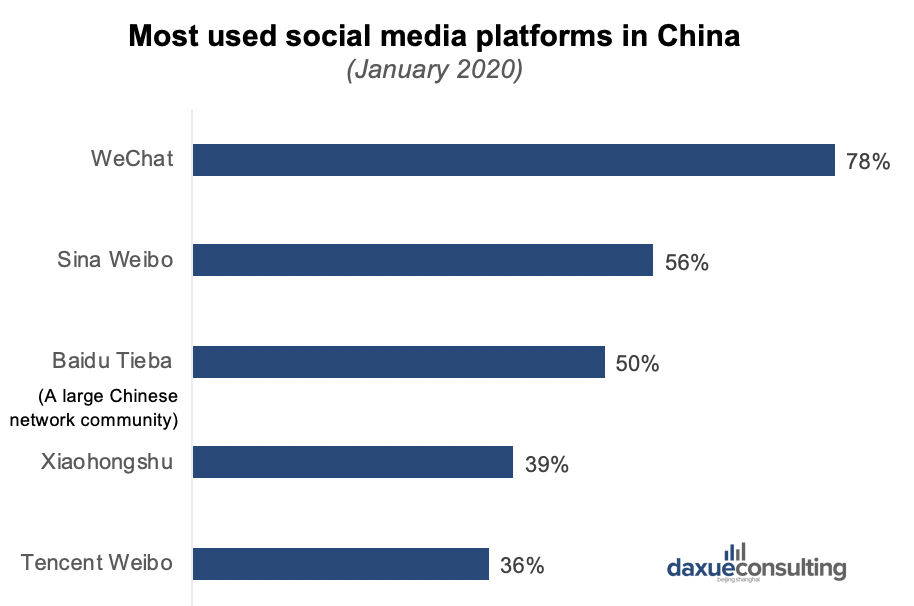

On average, every Chinese social media user has 9.3 social media accounts. 98% of Chinese netizens visited social media platforms in January 2020. All of the active social media users have access via mobile. They averagely spend more than 2 hours per day on social media and 45% of them used social media platforms for work.

COVID-19 drive the demand for news apps as well as social media

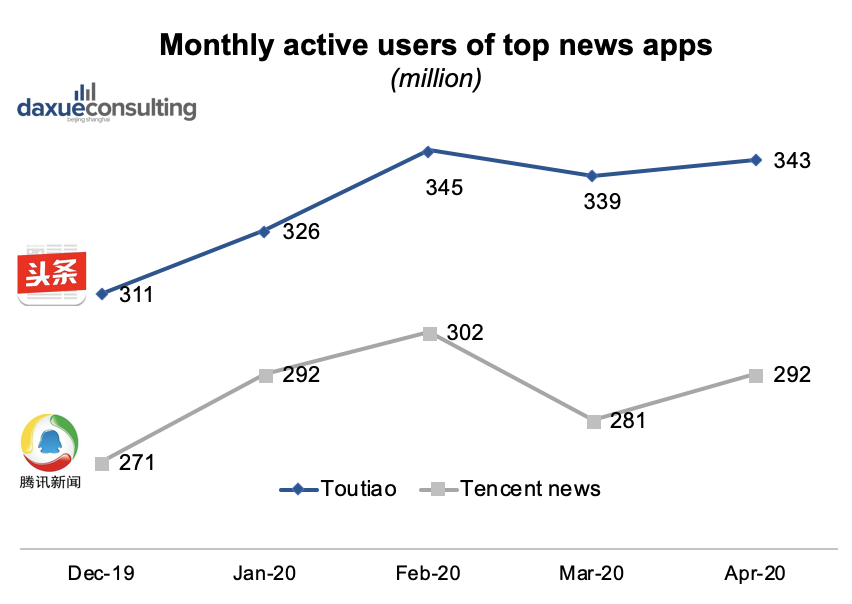

Both the time spent and the number of active users of daily news apps increased since December 2019. Along with the development of COVID-19, users’ demand for news apps peaked in February when China entered the height of the epidemic. Then, it had another growth in April when China’s market started to recover from the epidemic. Qianfan Analysis reported a 12.4% increase in the monthly average time spent on news apps per use, from 17 to 19 hours.

[Data source: Qianfan Analysys ( 易观千帆), Questmobile, monthly active users of China’s top news apps during COVID-19]

Outside of news apps, WeChat, Weibo, and short video apps became the main channels for Chinese to obtain relevant information about COVID-19. Information channels on social media are more likely to gain traffic in the future. 48% said they will continue to spend more time in information acquisition after the outbreak. A popular science KOL PaperClip went viral explaining the COVID-19, attracting over 2 million views on Weibo alone.

The 4 types of entertainment rising in the Stay-at-home Economy in China

The mobile games market still has growing potential

The revenue of mobile games had already been steadily increasing, and COVID-19 lead to an influx of new gamers. Additionally, many long-time players spent more time gaming during the epidemic. According to Quest Mobile, the Chinese New Year (CNY) holiday had a 41% year-on-year increase in terms of average time spent on gaming. In the same comparison period, the revenue of mobile games in China increased 30% from $530 million to $668 million.

Most of the top games have some social or multiplayer aspect. Mini games are also popular since they are less time consuming and suitable for stress release. The 5 top mobile games people played during the epidemic include:

- Honor of King: the number of daily active users exceeded 50 million during the 2020 Chinese New Year. On the first day of the new year, the number reached the peak of 54 million.

- Online chess and card games: People in northern China prefer card games and southerners like chess.

- Werewolf: Werewolf (狼人杀) is a popular board game in China. Its active users increased by 20% every day during the 2020 CNY.

- Sandbox games: The number of daily active users of sandbox grew by 6 million since the 2019 CNY, to reach 76 million during the 2020 CNY.

- Mini games: OPPO mini games became the third most popular game series according to active users during the 2020 CNY.

Short videos enjoyed explosive growth and commit to user stickiness after COVID-19

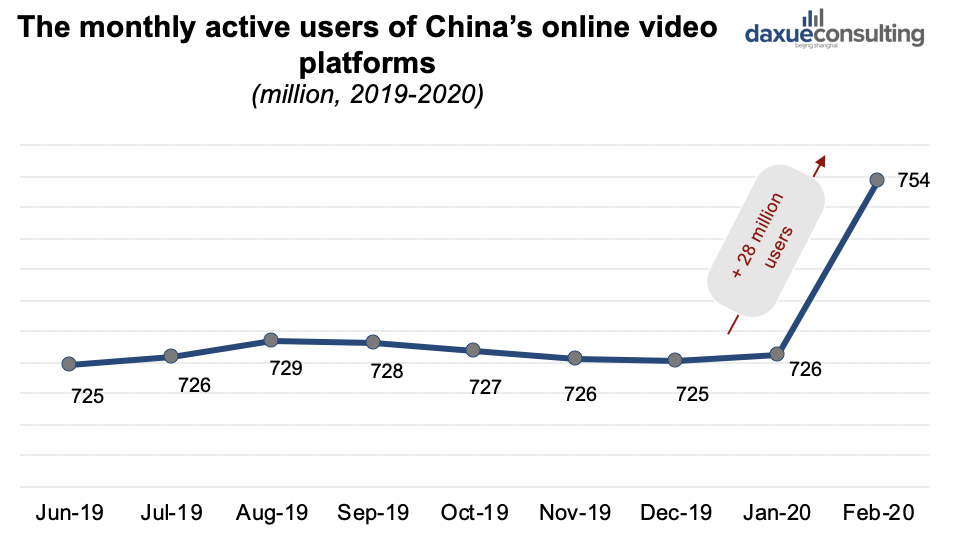

Short videos have been one of the most important forms of entertainment in China during the past a few years. Now, short video apps provide quick news and info about COVID-19. The number of monthly active users of online video platforms had a large increase during COVID-19. According to iResearch, short videos claimed 68.4% of the spare time of Chinese people, only second to TV series (69.8%). Some movies released on online video platforms rather than in cinema and they had a large number of views. Cinema is no longer the only option for releasing films, online video platforms are challenging its leading position.

[Data source: quest mobile, the monthly active users of China’s online video platforms]

The industry concentration of short videos in China is high. The top short video platforms reached many new users over 40 years old because they could quickly get updates about COVID-19. Douyin (13%), Kuaishou (17%) and Xigua (19%) all witnessed double-digit growth from December 2019 to March 2020.

The number of paid users of online video platforms increased significantly during COVID-19. And those platforms are determined to keep the trend going. COVID-19 halted the shooting of many TV series, movies and shows, which decreased high-quality content. People will have higher demand for higher quality and diverse media. Video platforms are working hard to buy more high-quality video content to increase user stickiness.

Music and concert industry responded to COVID-19 in ways that ensured its growth

During the epidemic, music platforms offered songs and whole albums related to fighting against COVID-19, resulting in increased online traffic. It’s possible those new users will be paid users in the near future. According to Tencent music group, Kuwo 酷我音乐, a big online music platform in China achieved 3.5 billion total exposure during the epidemic. 462 musicians and singers also published epidemic-related songs in Q1 2020.

Offline concerts were all canceled or postponed during COVID-19, while online concerts offered extraordinary audio-visual experience to fans and received large traffic. Online concerts effectively help online music platforms reach more new users, it can be expected that online concerts will be one of the main ways for music platforms to gain traffic. For example, Tencent music group held on 11th April 2020 an online concert “I am A-Lin”, and attracted 20 million views of its Weibo topic. 4 days later, it held another online concert “To see you whenever I want” became the No.1 Weibo hot topic.

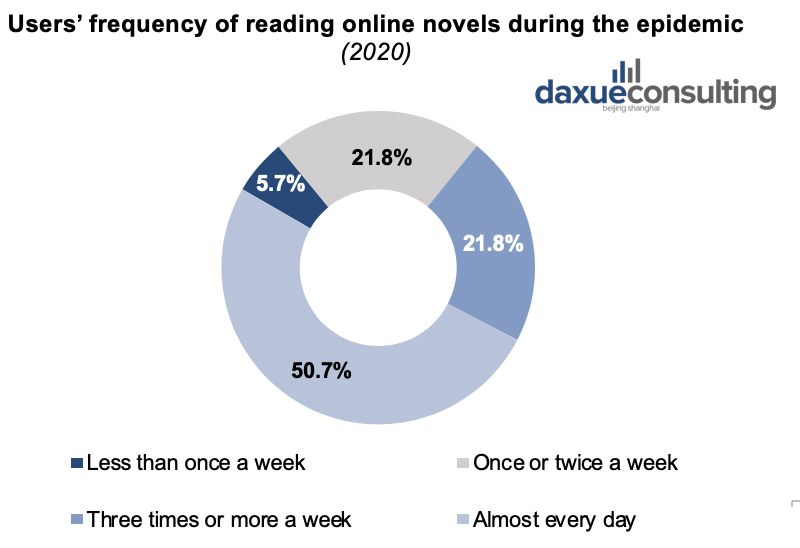

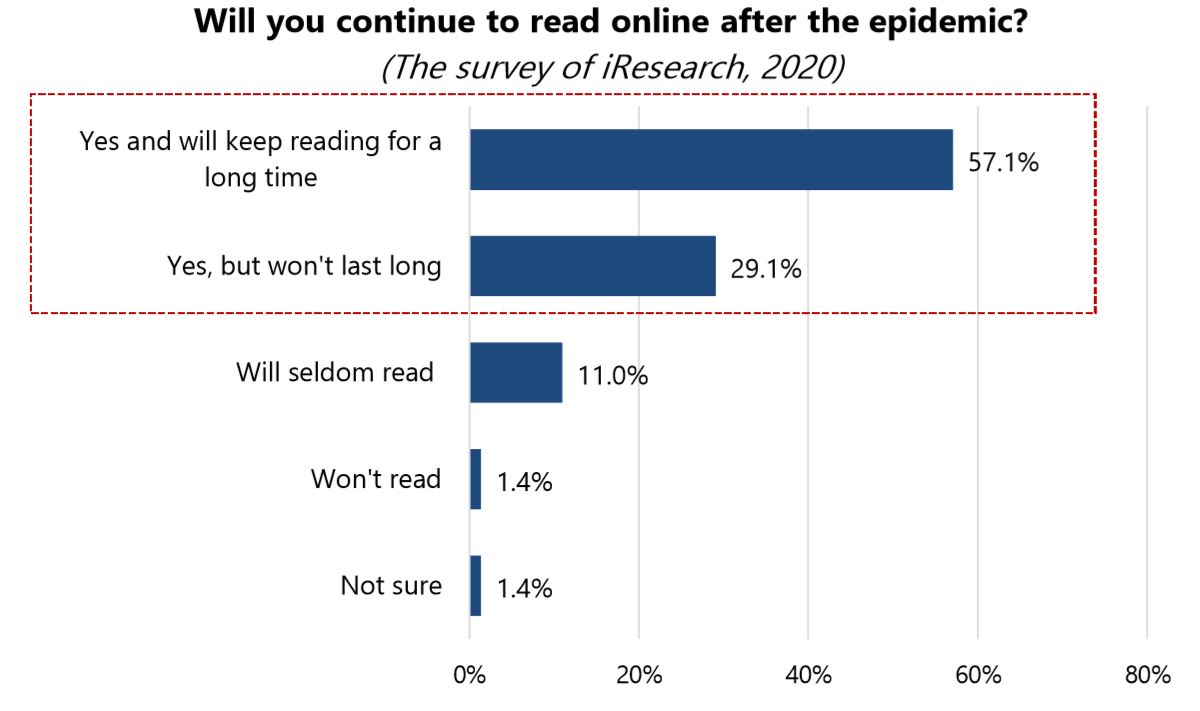

COVID-19 promoted online reading in a somewhat permanent way

More than 50% Chinese readers chose to read novels almost every day. The average daily online reading time increased by 20% during the epidemic compared to last year. Most new readers are those who did not have much free time to read before. Now they have formed the habit of reading online and boosted the growth of the market.

86.2% of people say they will continue to read after the epidemic, hence the online reading market will likely grow in the near future.

E-commerce and delivery further developed the Stay-at-home Economy in China

E-commerce is further enhanced by KOL live-streaming

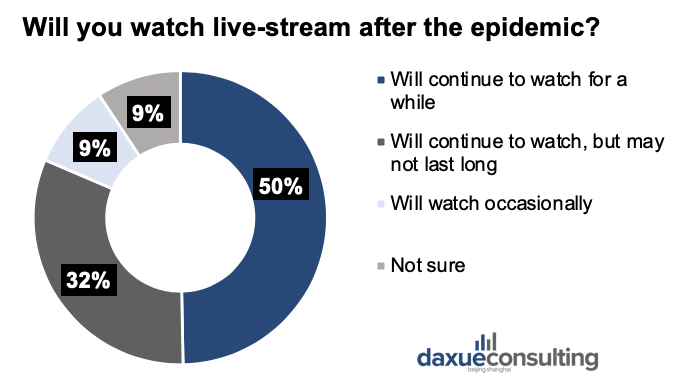

The matured e-commerce system provides more convenient conditions for Chinese consumers. But its growth rate has declined, as the scale of users has gradually reached the ceiling of netizens and the cost of acquiring traffic is getting higher and higher. However, Chinese people’s purchasing decisions are heavily affected by KOLs and live-stream and some top short video platforms (Kuaishou and Douyin) already entered the e-commerce market by live-stream + KOLs. They achieved very high sales. Hence, “live-stream e-commerce” will become the next outlet in China’s e-commerce industry.

During the epidemic, live-stream and KOLs played even more important roles in online marketing. The top short video platforms made full use of their huge traffic to work with top KOLs in live-stream marketing, they have achieved extraordinary results. Live-stream marketing is becoming the most efficient online marketing tool in China. For example, Kuaishou live-stream achieved over 620 million RMB turnover on 18th of April alone.

Grocery delivery stands out with the help of contactless delivery service

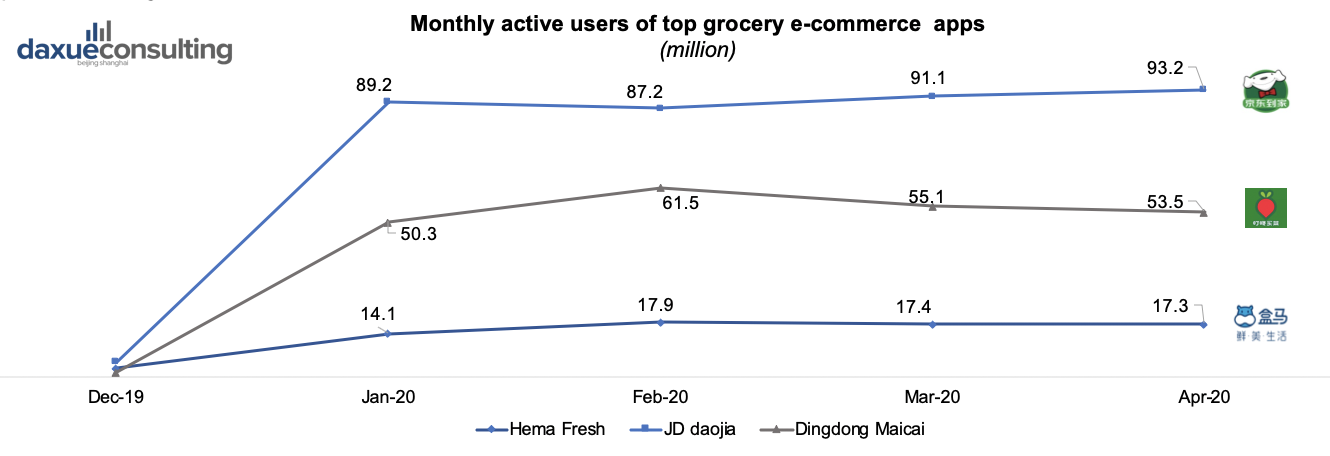

Although January is a traditional low season for e-commerce platforms, the COVID-19 impact on Chinese consumption is evident in the grocery e-commerce market. In the long run, the main problems for fresh food e-commerce are high transportation and storage costs. Fresh food is not easy to preserve and it’s price is usually high. Therefore, it’s essential for fresh food e-commerce companies to optimize storage to lower costs.

Diverse and safe express delivery methods can increase consumers’ desire to shop online and hedge part of the consumption crisis brought by the epidemic. JD.COM has used an unmanned delivery robot for contactless delivery in Wuhan, which promoted the application of AI tech in daily life. Similarly, China’s largest delivery service provider CaiNiao (菜鸟available everywhere in China) started to use the “contactless pickup” service to reduce personnel contact since 28th January. Thus, consumers’ demand for contactless delivery cabinets is expected to continue even after COVID-19.

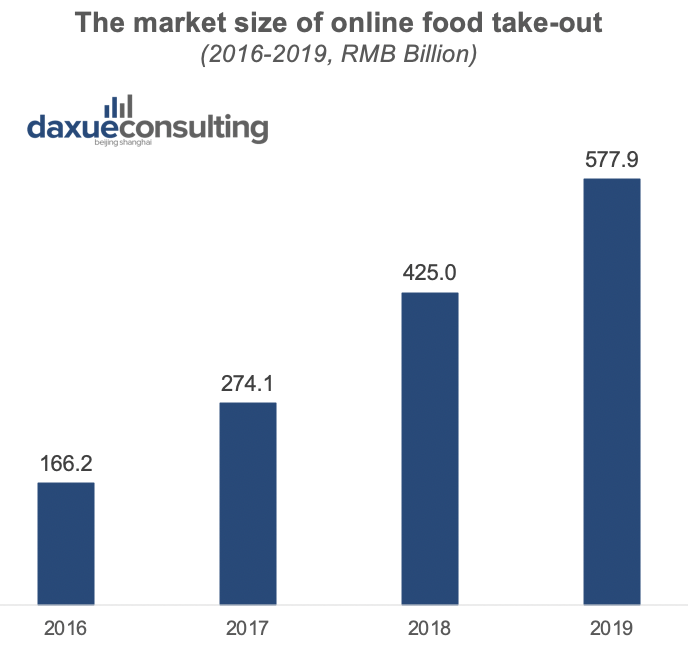

Online food delivery is essential in the Stay-at-home Economy in China

In the first two months of 2020, the catering industry’s revenue decreased by 43.1% year-on-year. More than 90% of the Chinese restaurants had to close. Luckily, contactless delivery, which was already quite developed in China over the years reduced infection. Two online food ordering platforms Meituan and Ele.me adapted their delivery services to reduce infection risks. This includes taking the temperature of all the people involved in the delivery process.

Seeing the success of contactless delivery, the catering industry all turned to O2O food delivery. According to the survey of iiMedia, 78% of the restaurants mainly sold online to ensure the continuity of their operations during COVID-19. Among them, 70% said they will remain online.

Read our full report on the Stay-At-Home Economy in China!

Listen to 100 China entrepreneur stories on China Paradigms, the China business podcast

Listen to China Paradigm on Apple Podcast

![[Podcast] China paradigm #20: How to get the most out of XiaoHongShu](../wp-content/uploads/2019/04/China-paradigm-China-business-podcast-20-150x150.jpg)