The Kitchen Appliance Market in China

Outlook of the kitchen appliance market in China

According to IBISWorld, in 2019, the revenue of the kitchen appliance market in China was $51.9 billion. From 2019 to 2024, the revenue is forecast to increase at an annual rate of 2.8% to $59.55 billion.

Compared to developed countries, the penetration rate of household appliances in China is relatively low. Hence, China has great potential in the household appliance market. In the next five years, the household appliance market in China will integrate cloud-computing, Big Data, the internet of things and other cutting-edge technology.

What will drive the market growth?

In the following five years, it is anticipated that demand for replacing appliances will be a major driver of growth. The household appliance market in China is significantly affected by the real estate sector. What is more, the penetration rate of household appliances in China in tier 1 and 2 cities has reached 85%. The penetration rate of household appliances in China in tier 3 and 4 cities is less than 50%, which indicates that households in these areas will be a major growth market for this industry. The focus for tier-1 and 2 cities will be replacing current appliances, while in lower tier cities it will be first time purchases.

In the past, domestic brands in China’s household appliance market have focused on middle- and low-end markets while high-end markets are dominated by foreign brands. With the development of China’s living standards, domestic demand for high-end products is increasing, which will motivate domestic brands to launch more of these products over the next five years.

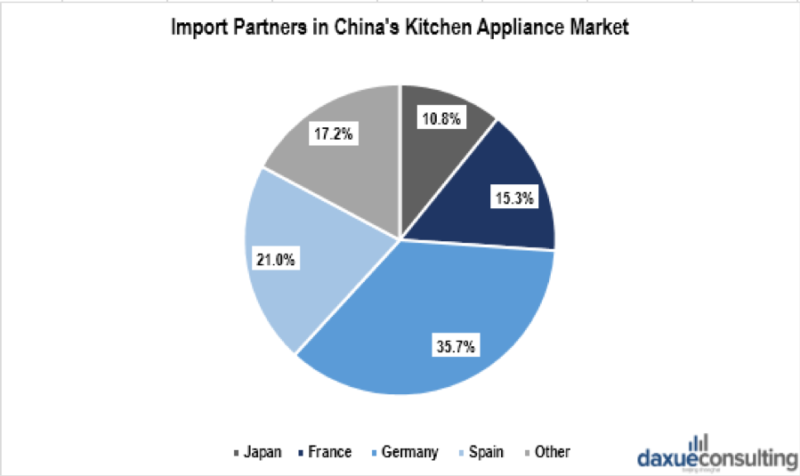

Low import demand: influenced by culture and lifestyle

According to IBISWorld, compared to exports, imports in China’s household appliance market are low, with a value of $288.6 million in 2019, which was 0.9% of domestic demand. Major imported products are dishwashers and electric stoves, occupied 55.7% of the total imported value.

Over the five years, import growth in China’s household appliance market experienced a significant fluctuation, growing 48.3% in 2015. Imports grew significantly from 2010 to 2012, owing to the increase in export rebates.

In the future, imports are expected to increase at an annual rate of 5.7% from 2019 to 2024. However, imported products will continue to account for a small percentage of the domestic market due to the cultural and lifestyle differences in China. In addition, favorable government policies and the remarkable performance of domestic brands impedeon imports.

[Data source: IBISWorld, ‘Import partners in China’s kitchen appliance market’]

Overview of the kitchen appliances market in China

Influenced by adjusting policy of China’s real estate market and fierce competitions among market players, the household appliance market in China has underperformed. Additionally, the gross margin rate of the kitchen appliances sector was over 40%.

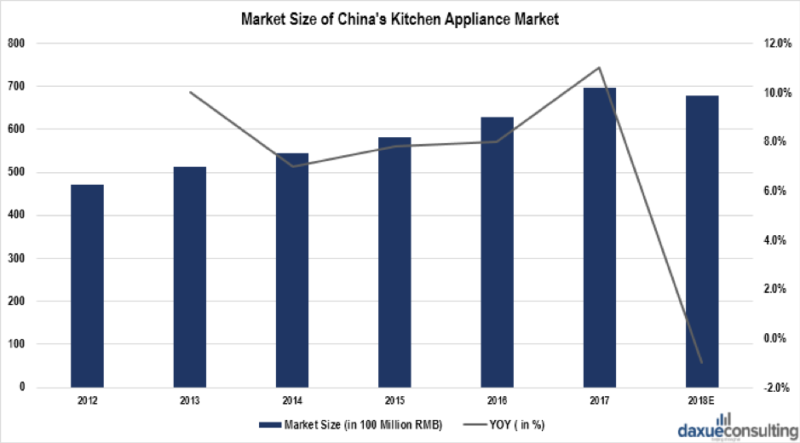

Shrinking market size: affected by the real estate sector and market competitiveness

In 2016, the market size of kitchen appliances was 62.7 billion RMB while the growth rate was 7.9%. In 2017, it reached its peak with the market size of 69.7 billion RMB and the growth rate was 11.2%. Since 2018, the tightening policy of China’s real estate market has significantly affected the performance of the household appliances market in China, including the kitchen appliance sector. Due to increasing number of new entrants in the kitchen appliance market in China, the market competitiveness has become tighter. Moreover, the business development model of kitchen appliance market in China is problematic and lacks dynamics.

[Data source: qianzhan, ‘Market size of China’s kitchen appliance market’]

Relatively low market penetration

The penetration rate of kitchen appliances in China is relatively low in comparison with that of developed countries (i.e. United States, Germany, France and United Kingdom).

[Data source: qianzhan, ‘Comparison of penetration rate of kitchen appliances between tier1 & 2 cities in China and developed countries’]

Market expansion in tier 3 and 4 cities: great business opportunity

In China, due to decades of urbanization, the market demand of tier 1 and 2 cities are nearly saturated. Rising household income in tier 3 and 4 cities and rural areas indicate potential business opportunities.

The penetrated distribution channel of e-commerce service providers has facilitated the market expansion of kitchen appliances in tier 3 and 4 cities. For example, Suning has established 1300 direct-sale stores, 1800 authorized service stations and 200 online concept stores. JD has established 1300 service stations and 1000 county-based service centers, hired 50,000 promoters in rural areas. More than 18,000 of online stores have been set up on Taobao, which can reach 10 provinces with the population of 200 million in the countryside.

Trends of the kitchen appliance market in China: quality and function matter

According to qianzhan, kitchen appliance consumers in China are more demanding of quality, appearance and function. In order to fulfill their needs, companies in this sector have dedicated to providing a variety of products with different functions.

In terms of functions, kitchen appliance consumers in China ask for integrated kitchen, juicers, electric ovens and steam stoves is rising. With the growth of middle class in China, Chinese consumers will be more demanding, and this will foster the innovation of products in China’s kitchen appliance market.

In terms of product intelligence, value-added functions (i.e. Wi-Fi, intelligent reminder and remote control) are now applied in kitchen appliance products.

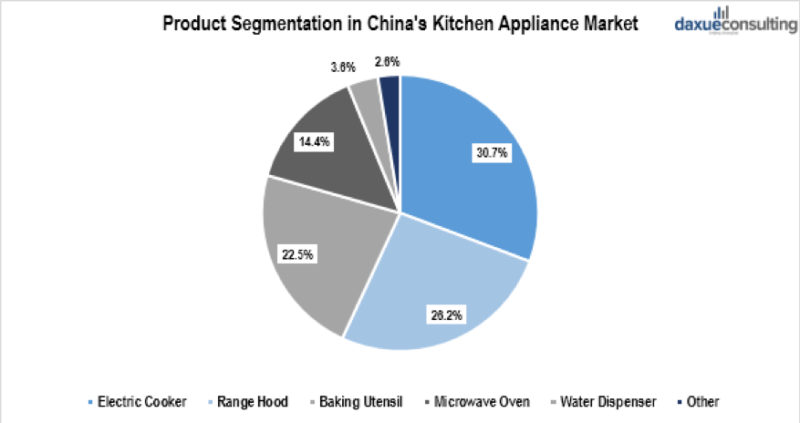

Product segmentation of the kitchen appliance market in China

[Data source: IBISWorld, ‘Product segmentation in China’s kitchen appliance market’]

The electric cooker market in China: occupies the largest market share

According to IBISWorld, in 2019, electric cooker market in China was the largest, accounting for 30.7% of total industry revenue. China is the largest global production base for electric cookers. Currently, low- and middle-end products make up the largest share of the segment. However, domestic brands in China’s kitchen appliance market are working to develop high end products to fulfil rising demand. With changes in consumption patterns and increases in consumer purchasing power, demand for middle- and high-end products, such as induction heat and tailless electric cookers, has surged in recent years. Domestic brands in China’s kitchen appliance market are also developing new high-end energy-efficient products.

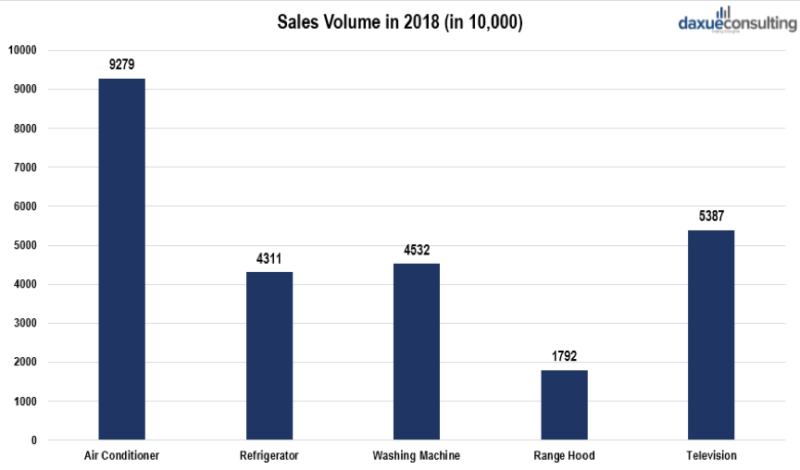

The range hood market in China: potential business opportunity

According to IBISWorld, in 2019, range hood market in China account for 26.2% of total industry revenue. Range hoods have become necessities in Chinese kitchens over the past three decades. To appeal to more customers, companies have launched new products like near-suction range hoods, which occupy 20.7% of total range hood sales.

In 2018, the sales volume of range hoods was 18 million, which was way smaller than the sales volume of air conditioners, refrigerators, and washing machines combined(40 million). This indicates a potential business opportunity in the range hood market in China. However, in 2018, affected by the periodical recession of real estate industry in China, the sales performance of range hoods failed to meet the expectation.

[Data source: chyxx, ‘Sales volume of kitchen appliance market in China (2018)’]

Baking utensil market in China: becoming a trendy kitchen appliance

According to IBISWorld, in 2019, the baking utensil market in China accounted for an estimated 22.5% of total industry revenue. Spurred by the development of ovens and induction cookers, and the growing popularity for baked goods, the sales volume of electric baking utensils has been rising. Cabinet and desktop ovens are common in baking utensil market in China while cabinet ovens are more favored by kitchen appliance consumers in China. In 2018, the sales volume of cabinet ovens was predicted to be 557 thousand with the YOY of 6.8%.

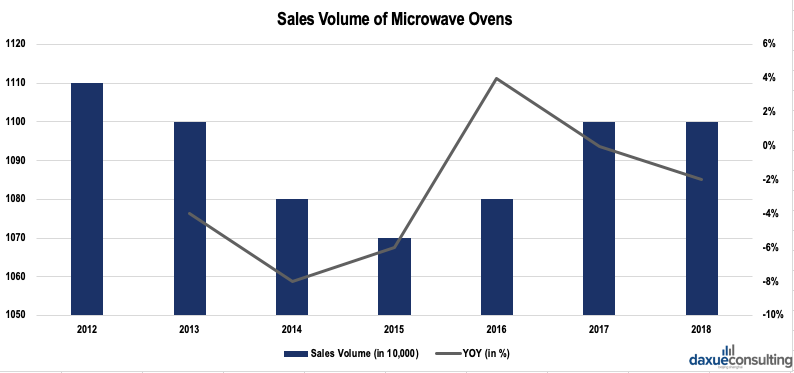

The microwave oven market in China: stable sales volume

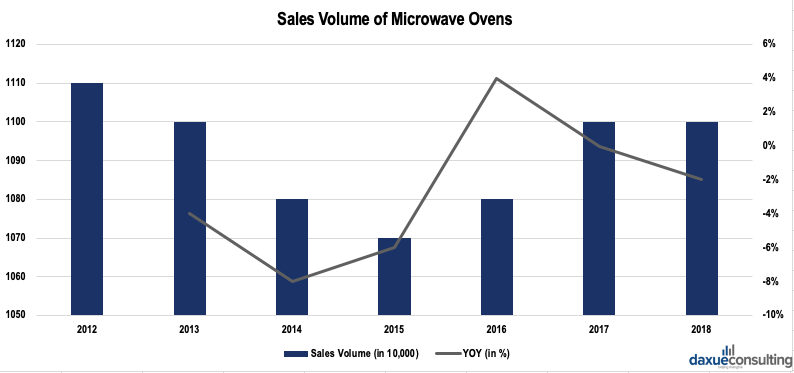

According to IBISWorld, in 2019, the microwave oven market in China contributed 14.4% of industry revenue, with sales of 77.8 million units. From 2012 to 2018, the average sales volume maintained at 110-130 million. It is expected that sales growth rate will maintain at 6%-10% until 2030.

[Data source: chyxx, ‘Sales volume of microwave ovens in China (2012-2018)’]

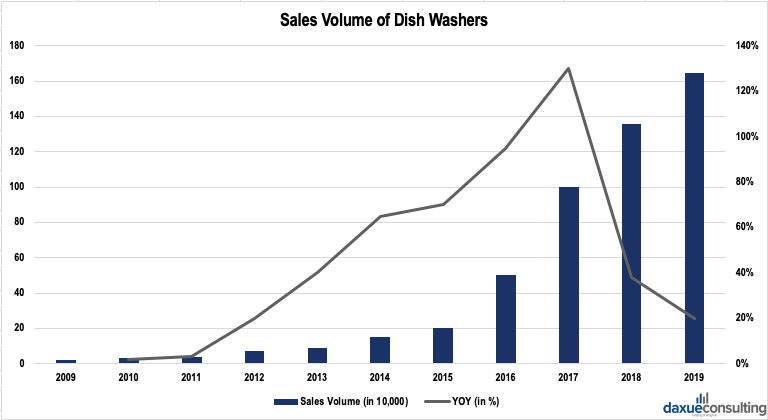

The dish washer market in China: significant growth in recent years

In 2018, the sales volume of dish washers was 1.36 million with the value of 5.9 billion RMB. Even so, dish washer market in China is relatively small and the penetration rate of dish washers in China is relatively low in contrast with developed countries. However, in long term, it is predicted that dish washers will become necessities in China as the penetration rate of dish washers is positively correlated with the economic development. This has been proven to be correct. From 2010 onwards, the YOY of dish washers has been surging. In 2020 and 2030, the YOY is projected to be 73% and 36% respectively.

[Data source: chyxx, ‘Sales volume of dish washers in China (2009-2019)’]

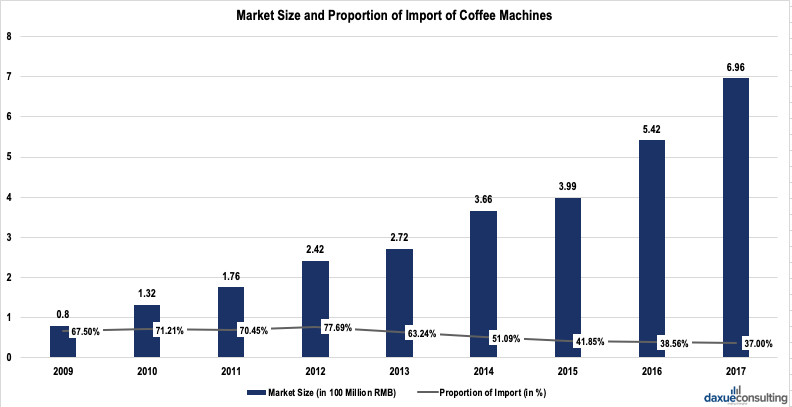

The coffee machine market in China: growing market size

Regarding the performance of coffee machine market in China, since 2009, the market size has been growing. In 2017, the sales volume was 2.29 million and the market size was 0.6 billion RMB. It is anticipated that the market size of coffee machine sector in China will have continuous growth in the future.

[Data source: abaogao, ‘Market size and proportion of import of coffee machines (2019-2017)’]

Key players in the kitchen appliance market in China

Overall, the top brands in are domestic, Media, Robam, FOTILE and Galanz.

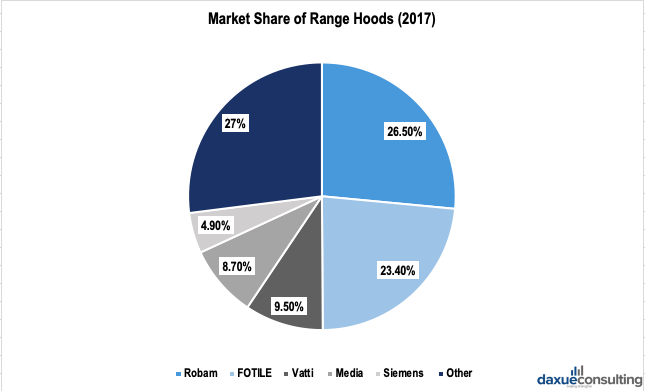

Key players in China’s range hood and stove market: Ruled by domestic brands

[Data source: chyxx, ‘Market share of range hoods brands in China (2017)’]

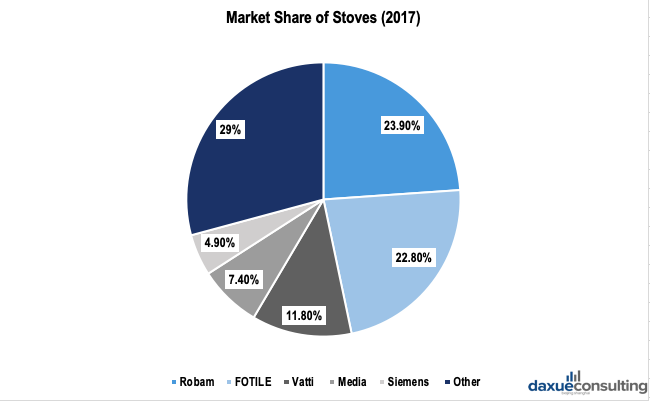

[Data source: chyxx, ‘Market share of stove brands in China (2017)’]

The top 4 players in China’s range hood and stove market are domestic brands and they occupied more than 50% of the market share in 2017. Robam and Fotile were the main players and accounted for more than 30% of the market share. Followed by Midea, Vatti and Siemens with the average market share of 10%.

Key players in China’s microwave oven market: overwhelmingly dominated by domestic brands

[Data source: dingkeji, ‘Market share of microwave oven brands in China (2019)’]

Galanz and Midea, as the notable domestic brands and had and accounted for more than 90% of the market share in 2019. While Panasonics, as a Japanese brand, occupied merely 2.1% of the market share. Other foreign brands such as Whirlpool, SANYO, Toshiba, Siemens together accounted for less than 2%.

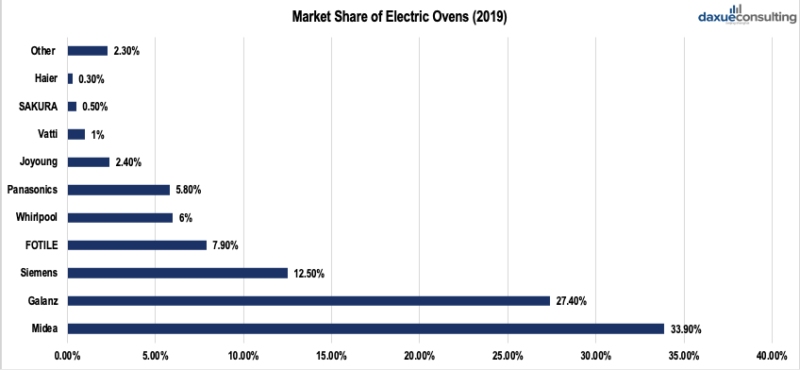

Key players in China’s electric oven market: Siemens ranked at third

[Data source: dingkeji, ‘Market share of electric oven brands in China (2019)’]

In China’s electric oven market, the top 2 players were still domestic brands, Midea and Galanz, accounted for 33.9% and 27.4% of the market share respectively in 2019. The top 3 brands together accounted for more than 62.5% of the market share. Siemens is the top foreign brand with the market share of 12.5%.

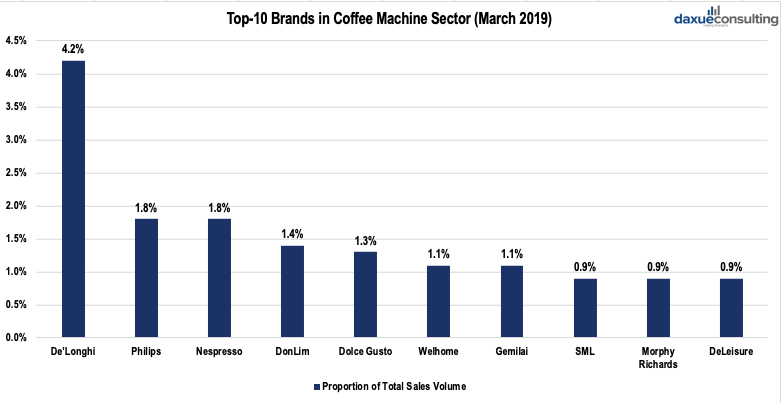

Key players in China’s coffee machine market: led by foreign brands

[Data source: dingkeji, ‘Online stores: top-10 brands in coffee machine sector (March 2019)’]

The China’s coffee machine market partially relies on import since domestic manufacturing has already met China’s market need. In 2017, foreign brands occupied approximately 44.97% of the market share whereas domestic brands occupied 55.03% of that.

Nevertheless, the market of high-end coffee machines in China is dominated by foreign brands. In March 2019, the top 3 coffee machines brands that had the most sales volume in online stores were De’Longhi, Philips and Nespresso.

Brand analysis: top brands in China’s kitchen appliance market

Midea Group

[Photo source: 16pic.com, ‘Logo of Midea’]

According to IBISWorld, established in 1968, the Midea Group is a large integrative modern corporation that dedicates to manufacture household appliances, but also provides transportation, real estate and financial services. In 1980, Midea Group entered the household appliances industry, launching the Midea brand in 1981.

The main industry products of Midea Group are rice cookers, extractor hoods, microwave oven and induction cookers. The company has become one of the largest white goods manufacturers in China. It has 14 domestic manufacturing bases in China, covering five major regions.

Midea has expanded its network to cover many third- and fourth-tier markets in China. The company has established 1,500 service centers to cover covered all third-tier cities.

Additionally, Midea Group has collaborated with other firms to expand their product categories in the last 2 decades. The group established business relationships with Sanyo and Toshiba to make high-end electric cookers and microwaves.

In February 2014, Midea Group built Shunde Innovation Center. In 2017, Midea continued to develop its manufacturing operations as demand increased. In the first half year of 2018, Midea was awarded nine patents for its dishwashing technology including its world-first hot air-drying technology.

Hangzhou Robam Appliance Co. Ltd.

[Photo source: qqzhi.com, ‘Logo of Robam’]

According to IBISWorld, established in 1979, Hangzhou Robam Appliance is headquartered in Hangzhou, Zhejiang province. Robam has developed into a professional producer of kitchen appliances such as range hoods, gas stoves, disinfection cabinets, electric ovens, steamers, electric pressure cookers and induction cookers.

In 2011, Robam developed 38 new products, opened 200 new specialty stores, and expanded its online and TV shopping distribution channels.

In 2015, the company set up 450 new specialty stores, with the total nationwide at 2,450. In 2016, the firm set up and rebuilt 89 experience stores and 449 specialty stores. By the end of 2016, the specialty stores of the company totalled 2,650.

In 2017, Robam expanded and set up 2,614 retail stores. In the first half year of 2018, the company continued to expand. The market shares of major products including hoods, gas stoves, disinfection cabinets, electric ovens, steamers had high ranking in China.

Ningbo FOTILE Kitchen Ware

[Photo source: ebrun.com, ‘Logo of FOTILE’]

According to IBISWorld, established in 1996, Ningbo FOTILE Kitchen Ware Co. Ltd. manufactures electric and gas appliances and integrated kitchen solutions. Distribution channels of FOTILE include home appliance chain stores, building materials supermarkets, tradition general merchandise stores, exclusive agencies and e-commerce. The company also has a research and development (R&D) team of 200 employees. Investment on R&D absorbs over 5.0% of production costs every year and the company owns 400 patents, 55 of which are invention patents.

Galanz Group

[Photo source: NetEase, ‘Logo of Galanz’]

According to IBISWorld, founded in 1978, Galanz Group is a comprehensive company that mainly manufactures microwave ovens, air conditioners. The company has R&D centers in Shunde and Zhongshan, 13 subsidiaries and 60 sales offices in China, and branches in Hong Kong, Seoul and North America.

Other household appliances made from Galanz Group include water heaters, gas stoves, range hoods and disinfection cabinets. Sales of Galanz household appliances experienced substantial growth in 2011. In June 2011, Galanz began to set up specialty stores in over 2,000 county-level cities for the purpose of market expansion.

In order to use advanced technology resources, Galanz sets up R&D centers in Japan, South Korea, the United States, Hong Kong and other locations in 2013.

Let China Paradigm have a positive impact on your business!

Listen to China Paradigm on iTunes