The Coffee Market in China: How Luckin Coffee is capturing the lion’s share of the market | Daxue Consulting

The Coffee Market in China

On January 3 of 2019, the CEO of Luckin Coffee, Qian Zhiya, spoke at a briefing about grand ambitions to open an additional 2,500 outlets this year, bringing the company’s total number of outlets to 4,500 by the end of 2019. This means Luckin is on track to surpass Starbucks not only in number of stores, but also in the number of cups of coffee sold. As of September 2019, Luckin Coffee has opened more than 3,000 stores across the country and is rapidly moving onto the turf of other competitors in China’s coffee industry.

What is brewing in China’s coffee market

The coffee industry in China has grown substantially over the past 30 years, with a 15% year-on-year growth rate in 2019. That puts the growth rates of coffee industries in the US (5%) and Brazil (9.6%) to shame. Worth more than $8 billion in 2019, China’s coffee industry is still far from the world’s largest. In fact, it is worth only a tenth of the coffee market in the US ($80 billion in 2019). However, given China’s burgeoning 400-million strong middle class and impressive growth rates in its coffee industry, the potential for coffee companies in the Middle Kingdom is substantial. China’s coffee industry has been historically concentrated in Eastern and Southern coastal cities. Perhaps that trend is now shifting inland with Luckin Coffee’s clever marketing strategies.

China’s coffee market has historically been dominated by instant coffee, with in-store coffee sales making up only a sliver of sales across the country. While this has been the trend over the past few decades, another is occurring as urban youth acquire more expensive tastes. This shift may be captured by the likes of coffee shops such as Luckin, that offer an in between product, more expensive than instant coffee, but not as expensive at Starbucks or other coffeehouses.

Luckin’s incredible surge in China’s coffee market: what marks success in the middle kingdom’s caffeine business?

In the past few months, China’s homegrown Luckin Coffee has pushed through three major thresholds in the highly competitive Coffee market in China. The first threshold is the opening of a “Relax” Luckin Coffee outlet inside of Beijing’s Forbidden Palace, which was previously the location of a controversial Starbucks that was removed in 2007 amid cries of Western invasion. This marks the expansion of Luckin Coffee into not only tourist areas in mainland China, but also into areas previously deemed off limits to outside fast-food chain stores. Despite this breakthrough, coffee shops still have a lot of potential for expansion into tourist areas, as many tourist areas across China have yet to open any form of coffee shop.

The second threshold broken by Luckin Coffee is its clever expansion on university campuses across mainland China. In recent months, outlets have opened up on the campuses of Beijing University, Shanghai Foreign Language School, Xiamen University, South China University of Technology and Sichuan Foreign Language School. In addition to these outlets, the company has plans to open on more campuses across China. As mentioned before, the tastes of young people across China is projected to slowly move from instant coffee to in-house purchases. An early expansion to campuses is a smart move on Luckin’s part.

The third and most iconic threshold broken by the company is the opening of various Luckin Coffee outlets inside of major transit hubs across mainland China. Chongqing East and North Train Stations have recently opened Luckin Coffee outlets. Outlets have opened in Shanghai’s Hongqiao Airport, Nanjing’s Lukou Airport and Xiamen Gaoqi Airport. On the Luckin Coffee mobile app, there are two stores in development at Beijing’s Daxing International Airport, which is set to open at the end of the month, as well as one outlet poised to open at Shenzhen Bao’an Airport, one of the busiest airports in mainland China. This is significant because it is only the second company in China’s coffee industry to be able to expand into so many transit hubs, after Starbucks.

These thresholds that Luckin Coffee has broken in recent months, plus its CEO’s ambitious goals to have more stores than Starbucks by year end, are reasons to take the coffeehouse seriously when considering how to expand into China’s coffee market.

Using clever market strategies to win over the coffee industry in china

When asked why Luckin Coffee has become so popular in mainland China in the past few months, many will claim it’s because of the company’s clever branding, widespread advertisement and the fresh design of their “little blue cups.” While this may be true, there is also more to their success. Luckin Coffee has been able to grab such a large share of the coffee market in China in such a short amount of time using four key market strategies: deliveries, fulfillment stores, promotional discount codes and a heavy dose of investor funding. Let’s take a closer look at what this amounts to.

Why Luckin Coffee uses pick-up stations instead of shops

Some java lovers may be disappointed the first time they go to a Luckin Coffee outlet, unlike Starbucks and Costa Coffee, Luckin Coffee is not designed as a place to sit and chat with a friend while drinking a cup of coffee. Nor is it intended to be a place to open your laptop, connect to the wifi and get some work done.

While there are indeed some “Relax” Luckin Coffee outlets that feature seating areas, the vast majority of stores are just a counter for pickups, behind which a few staff members busily prepare orders. Customers simply order their beverage online a few minutes before arriving at the store. They arrive at the store and flash a QR code unique to their order, and then take their order.

Luckin Coffee outlets are located in all kinds of places, but the most common place is in the lobby of a hotel, office block or shopping mall. These pick-up stations provide quick access to a large number of customers. Many of the locations in Shenzhen are in the lobbies of 50+ story office buildings, right next to the elevator. Hundreds of busy people walk by this daily, providing the opportunity and potential to attract more coffee fans or simply curious first-time coffee drinkers.

Not only does this pick-up station strategy reduce on costs associated with rent and facility maintenance, but it also acts as a conduit to Luckin Coffee’s market strategy, which is to offer quick high-quality coffee on the go. There is no store lobby for workers to clean up or for customers to have to walk around to get to the front counter, as seen at Starbucks. Instead, customers walk in, grab and go.

Luckin Coffee’s Success and the Discount Marketing Strategies in China

As mentioned before, China’s coffee market is still young. Many coffee drinkers in China aren’t willing to spend 30 yuan ($4.20) for a cup of coffee from Starbucks, so why would they want to spend nearly the same amount at Luckin Coffee?

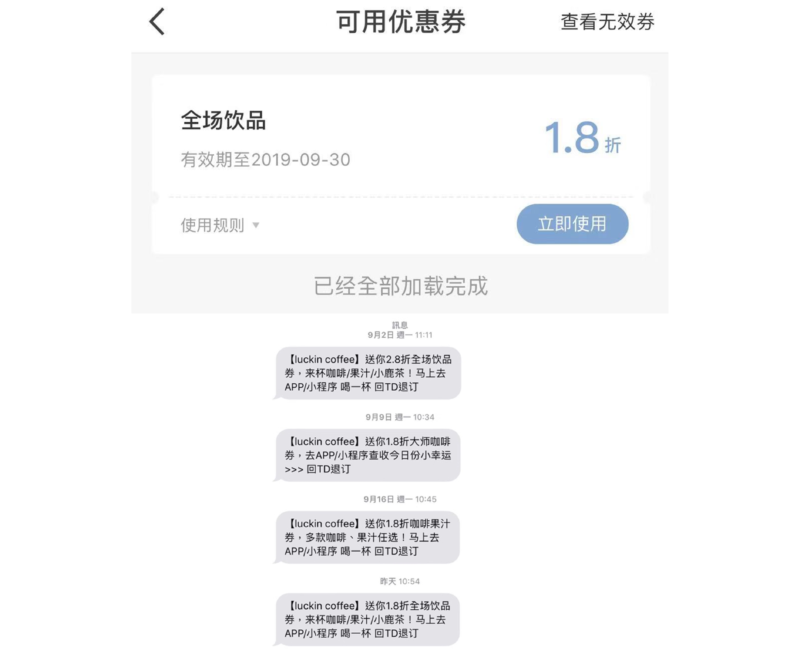

Much like famous ridesharing platforms and Chinese takeout conglomerates, Luckin Coffee has thrown money directly at its customers in the form of discount coupons. Discount marketing strategies in China, aimed at phone-wielding urbanites, just like in other markets, are usually present in the food and mobility industries, such as Elema, Meituan and Didi Chuxing. Despite burning through billions of yuan, discount marketing strategies have helped all these companies capture a large market share. As such, Luckin’s intensive discount marketing strategy has allowed it to rapidly expand its customer base with the first cup of coffee being free, followed with coupons of up to 89% off.

In addition to stiffly discounted coffee, Luckin also sends a coupon for a free Americano to new users as well as a discounted bakery items. Luckin’s discounts have proved to be a valuable tool in sucking up new coffee drinkers.

Delivery Market in China: Why it’s Necessary to Take Advantage of Delivery

Many visitors to China may initially be shocked by the multitude of take-out deliveries being ferried around on electric scooters during lunch hour every day in urban areas. This phenomenon of takeout deliveries has become ubiquitous across not only China’s wealthy coastal cities, but also first- and second-tier cities in the inland regions of Western China.

Luckin Coffee is riding the wave of growth in China’s food delivery market, which has seen single double-digit growth for the past few years. By using the Luckin Coffee mobile app, users can simply tap a button and have their coffee delivered directly to their home or workplace, often at a discounted price.

How Luckin Coffee won over the hearts of investors

As Southern Weekly reports, a large portion of Luckin Coffee’s success may indeed be due to its relationship, or guanxi, with domestic investment partners. The article talks about Luckin Coffee’s luck in securing an initial round of investment from the current CEO’s former colleague at UCAR Inc., an automotive enterprise. Without the capital to get started, it would have been difficult for Luckin to get off the ground and open nearly 4,000 stores in less than two years.

Since then, Luckin has secured further investment through an initial public offering in New York. Despite plunging stock prices on the second day of trading, Luckin Coffee was still able to earn more than $600 million. That round of investor funding and additional planned rounds are what will provide Luckin Coffee with the cash that it needs to fuel its planned expansion to 4,500 stores by the end of 2019.

How to get in on the action: What brands can learn from Luckin’s takeover of China’s coffee market

As Mark Zuckerberg famously said, “Move fast and break things.” Perhaps that is the lesson for anyone hoping to enter China’s fast-paced and competitive coffee industry. Just like Facebook, Luckin Coffee has experienced rapid growth in a short amount of time and is in a position to break things in the coffee industry.

Luckin Coffee has demonstrated it is still possible to gain a large market share from the dominant players of the market. With a strong New Retail business model, but also a pricing strategy that puts them between premium coffee and convenience store coffee. In order to win over youthful urbanites with a taste for java, coffee companies in China will have to be adept at imitating mobile sales strategies reminiscent of other successful companies in China, such as Meituan and Elema.

These companies are both heavyweights in deliveries in China as well as promotional marketing in China, using a mixture of the two to appeal to more customers. Any F&B newcomer will have to adjust to this by throwing money at customers and offering speedy delivery services, or coming the two together!

Finally, like China’s coffee market, e-commerce is an absolute must in any industry in China. One area of concern with Luckin Coffee’s marketing strategy is the inability to pay for coffee outside of the app, to which WeChat mini-programs could be a solution.

Let China Paradigm have a positive economic impact on your business!

Listen to China Paradigm on iTunes

![[Podcast] China paradigm #15: How to successfully run a coffee shop chain in China](../wp-content/uploads/2018/12/Daxue-consulting_china-paradigm_Carol-Liu-Big-Sur-Tea-and-Coffee-150x150.jpg)