The decoration market in China: A competitive market reaching maturity

The Chinese decoration market includes two sectors, the building materials market and the home-decorating market. The market as a whole is experiencing rapid growth due to increase of government investments and improvement of general living standards. It is extremely competitive as there is a large amount of small and mid-sized firms within the decoration market in China. The overall size of the industry is huge with low entrance barriers.

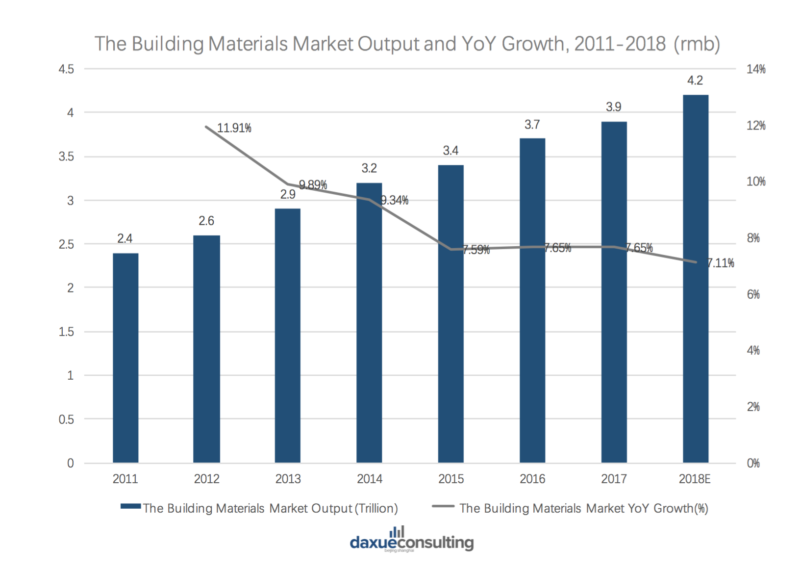

The building materials market in China

The building materials market in China refers to the materials used as exterior and interior decorations for public buildings. The rapid growth of this sector is mainly due to the macro environment and the government polices.

[Data source: qianzhan, Output and YoY Growth of the Building Materials Market in China]

The total output of the building materials market in China was ¥ 3.94 trillion rmb in 2017. This represents an increase of 280 billon from 2016 and a growth rate of 7.65%.

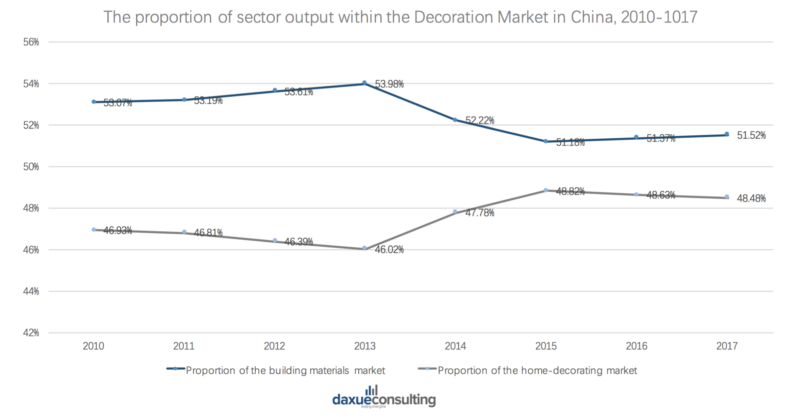

[Data source: qianzhan.com, The proportion of sector output within the decoration market.]

Overall, the growth of the building materials market exceeds the growth of the home-decorating market. However, the growth of the two sectors is gradually balancing out. While in 2017 the building materials market occupied around 52% of the total output of the decoration market in China, the home-decorating market occupied around 48%. Furthermore, the continued expansion of the building materials market in China may imply that China is still at the stage that requires the implementation of basic infrastructure and public facilities.

The home-decorating market in China

The home-decorating market in China refers to the interior decorations of residential houses.

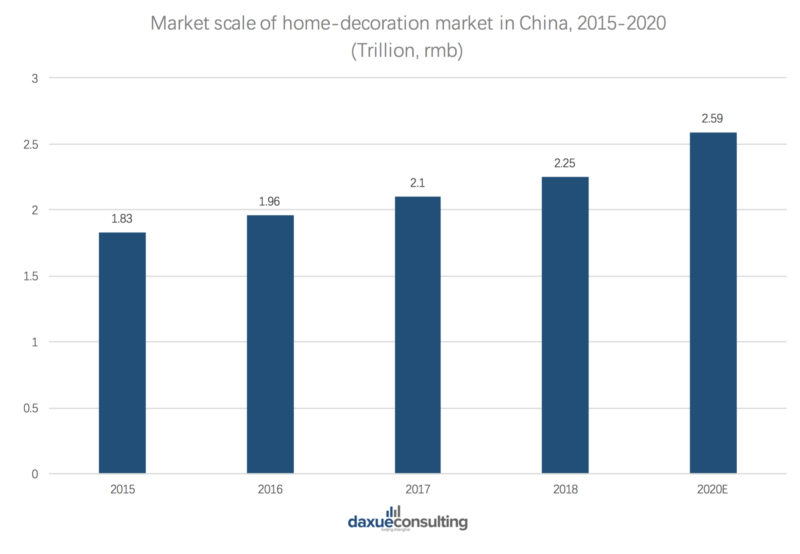

[Data source: qianzhan.com, Market scale of home-decorating market in China]

The continuous growth of real estates sales and of the Chinese economy provide the foundation for the home-decorating market to further grow. The market scale had reached ¥2.23 trillion rmb in 2018, and is estimated to exceed over ¥2.59 trillion rmb by 2020.

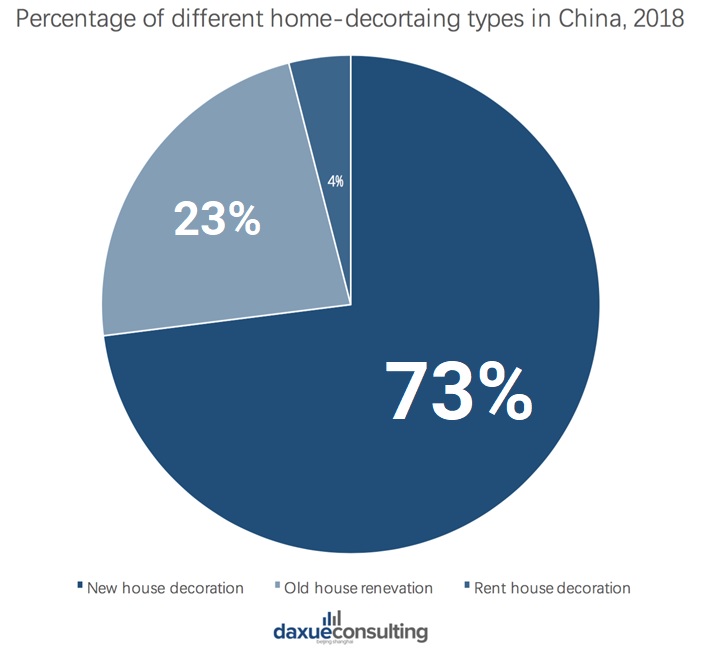

[Data source: qianzhan.com, Percentage of different home-decorating in China, by type]

Newly purchased homes are the main driver of the home-decoration market in China. Nearly 73% of the total revenue is contributed by new home decoration.

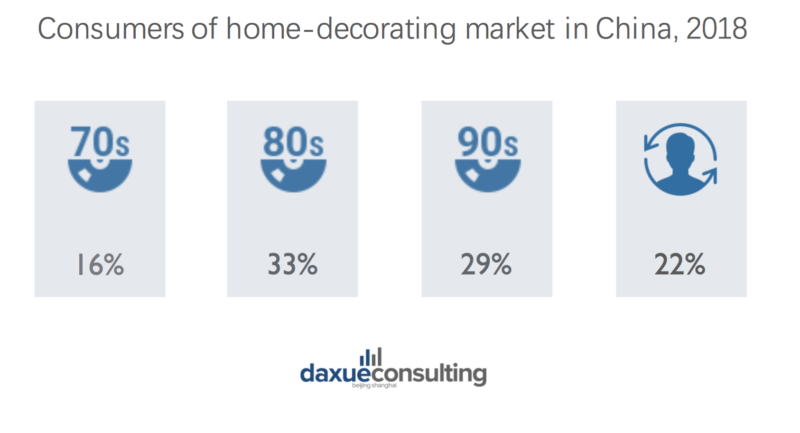

[Data source: qianzhan.com, Consumers of home-decorating market in China]

The main consumers of the home-decorating market are millennials, which are those born during the 80s and 90s. They contribute to more than 60% of the market revenue. Those born in the 70’s are also a large consumer group at 16%, while the remaining 22% other ages.

The rise of the E-commerce home-decorating market

E-commerce home-decorating market in China boomed in 2015, which has become the key contributor to and further intensified the competition within the overall decoration market in China.

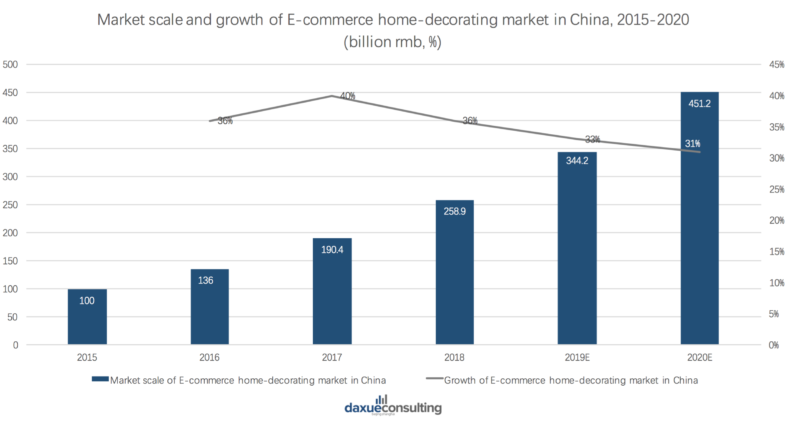

[Data source: ebrun, Market scale and growth of E-commerce home-decorating market in China]

The market scale of the E-commerce home-decorating market in China reached ¥258.9 billon rmb and achieved a 36% growth rate in 2018. Nonetheless, it is currently experiencing a bottleneck period with less than 5% penetration rate. This rate is fairly low when compared to other E-commerce markets such as car-hailing platforms and online travel agencies with around 1/3 penetration rate.

E-commerce , helps address the non-equilibrium profit margins that lie within traditional home-decorating market. E-commerce home-decor companies standardize decoration methods, prices, and simplify the working procedure. However, many consumers believe the materials and the user experience of E-commerce decoration companies are too expensive for the quality. As e-commerce does not always offer acceptable after service provision, many consumers are switching back to traditional of home-decoration methods.

Consumers are constantly pushing for transparency and information symmetry. The future of the E-commerce decoration market will no longer be on price wars, but quality and value wars.

Decoration companies in China

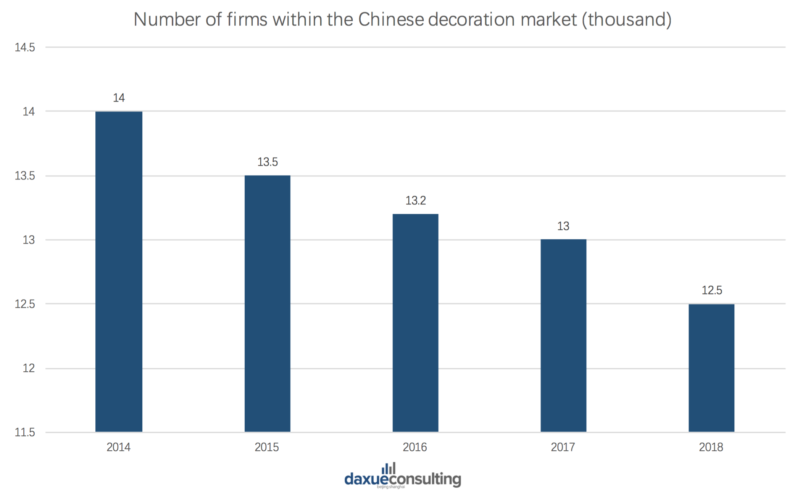

[Data source: qianzhan.com, Number of firms within the Chinese decoration market]

The market share of Chinese decoration market is fairly scattered. Around 82% are traditional decorating companies and around 18% are E-commerce home-decorating companies. There is currently a large amount of small to mid-sized decoration firms in China. The market scale is huge with fairly low entry barrier. Although, the total amount of firms within the industry experienced a decrease of 2.22% from 2015 to 2016, the total output had increased by ¥0.277 trillion rmb. This may suggest that the market share has became concentrated as regulations imposed on the Chinese decoration market gradually standardize.

A huge market with hundreds and millions of small businesses

Over 70% companies within the Chinese decoration market achieved revenue growth in the first half year of 2018. Gold Mantis (金螳螂) achieved top revenue gain of ¥10.904 billion rmb and China Red Star (红星美凯龙) was ranked at second place with ¥6.374 billion rmb revenue. The top three players within the home-decorating market are, listed in order; Gold Mantis, China Red Star and Oppe In (欧派家居).

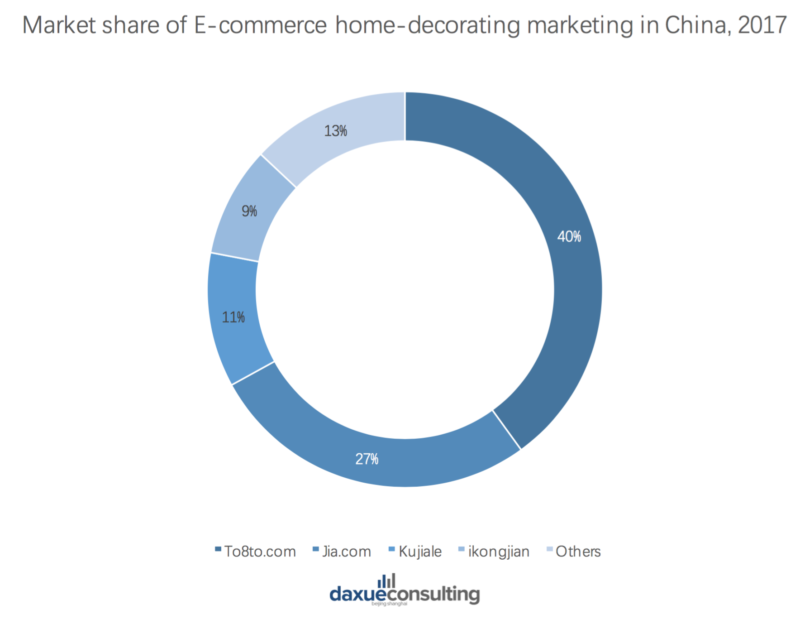

[Source: ebrun Market share of E-commerce home-decorating market in China]

On the other hand, E-commerce home-decorating market is concentrated. To8to.com (土巴兔) occupied around 40% of the total market share, and Jia.com around 27%.

Although the overall market is fairly competitive, it has not yet reached the mature stage. This means that there is still a large room for small firms to develop along with the expansion of medium to large-sized firms.

Opportunities in the Chinese decoration market

Aesthetic home-decoration market in China

Currently, the decoration products in China are rather homogenous. However, consumers are gradually valuing creativity, quality and environmental aspects of decoration products as their living standards improve and consumption upgrades. The aesthetic home-decoration market in China may be the answer to consumers’ concerns. It refers to the mid- to high-end furniture brands with good designs and quality products. Firms have began implementing strategies to target luxury consumers by offering environmental friendly materials, customized product design, and foreign luxury brands.

Standardized regulation across the decoration market

As regulations imposed upon the Chinese decoration market become more standardized, the industry is expected to become more concentrated. Comparing to the current market environment with mixed standards, quality and prices, the future expectation for the market will center around transparency and price equilibrium. For E-commerce home-decorating, focusing more on after-sales provision and product quality allows room for future development.

Smart home is the new go-to for modern Chinese households

Smart home stores in China offer Chinese consumers a new form of experience. Many sellers of intelligent home technologies seek to introduce their products to potential consumers through such experiences. Examples of smart home technologies include automatic adjusting lights and Homepod etc. The smart home stores in China allow consumer to touch, test and experience the products in real person. A direct-to-customer strategy by engaging customers through these brick-and-mortar stores. Smart home technology is definitely a future trend that decoration or furniture companies need to consider.

The decoration market in China has a large potential to further grow in the near future. However, the development needs more funding and more creative and quality products.

Author: Chenyi Lyu

Let China Paradigm have a positive impact on your business!

Listen to China Paradigm on iTunes