What you need to know to sell online in China

China is the world’s leading E-commerce market

With more than 610 million digital consumers, China is currently the world’s leading e-commerce market. With such potential, it is not surprising that China has become the new goldmine for online retailers, local or international. In this article we outline the basic information to sell online in China.

China cross-border e-commerce grew to a 16.86 billion USD market at the end of 2018. The number of Chinese consumers who buy foreign products online is estimated to exceed 200 million by 2020. To reach Chinese consumers, selling on Chinese e-commerce platforms is a quick and effective way.

Choose the right e-commerce platform based on product positioning

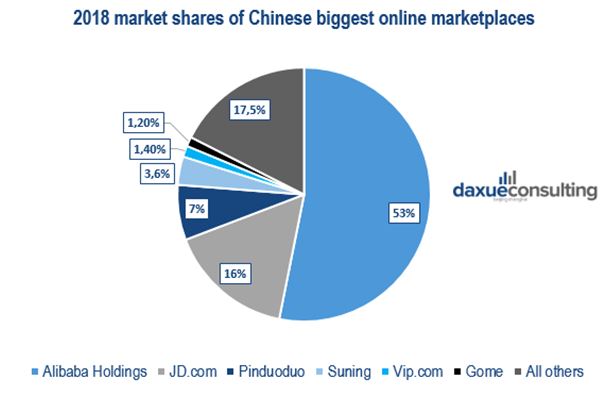

China has dozens and dozens of marketplaces but 6 of them dominate the market:

[Data Source: e-marketer, Market shares of Chinese online marketplaces]

Other than the official website of the brand, also known as brand.com, there are many e-commerce platforms that are more convenient for consumers to choose from. Depending on the brand’s individual needs, each platform could be used to sell online in China.

Taobao & Tmall

Tmall is preferred over Taobao by foreign brands in China. The main reason for this is that Taobao requires a presence in China, a registration of the brand in China, which is not the case for Tmall.

[Source: Taobao.com, sell online in China through Taobao]

Global brands have opened shops on Tmall such as Ray-Ban, Gucci, GAP, Calvin Klein, Samsung, Burberry, and many more. From a general point of view, the platform does everything to be more premium than Taobao by pushing international brands with a specific program allowing direct purchases from Europe, the United States, Hong Kong or Australia. Additionally, sellers have to put guarantee deposits to prove the authenticity of their products.

[Source: Tmall.com, sell online in China through Tmall]

In terms of page interface, Tmall has a simplified interface, more neutral and more organized products to give itself a more premium side and to look less like an old market.

Jingdong, also known as JD.com

JD.com is Alibaba’s main competitor. It sells all types of products and has an English version. JD’s cross-border service, JD Worldwide, allows international merchants to sell directly to Chinese consumers without a physical presence in China.

[Source: JD.com, sell online in China through JD.com]

JD.com is also the leading company in terms of high tech, AI delivery through drones, robots, and autonomous technologies worldwide.

Choosing between JD.com and Tmall will depend on many factors including your marketing strategy. If you want to develop a strong social media strategy when selling online in China, JD.com is surely a better choice. This will optimize your WeChat performance. If you prefer to have the greatest possible visibility and work on your SEO directly on Chinese online marketplaces, then Tmall is more powerful. Its search engine and referencing system are quite simple to use.

Kaola.com

Kaola.com is a cross-border platform selling hundreds of western brands. It lets sellers showcase their products across many online forums, portals, and marketing channels. It is mainly known for offering reliable and genuine products, especially from Japan. This trust from customers on Kaola comes from the fact that it is owned by Netease, which has come up with a business reputation for 20 years.

Pinduoduo

Pinduoduo is today an undisputed leader in e-commerce in China with more than 418 million buyers in 2018. This Chinese online marketplace, which offers low-cost deals. If your goal is to reach the Tier-3 and Tier-4 cities when selling online in China, then Pinduoduo is a good option.

The app is specialized in bulk or grouped purchases at very low prices. It is prevalent among the players in the farming industry in China.

Xiaohongshu or RED

[Source: Xiaohongshu, sell online in China through Xiaohongshu social commerce]

Xiaohongshu is not a classic marketplace but a mix between a social network and an e-commerce website, also known as social commerce. It is like a forum where users post their opinions on products, trends and the best brands. Today the platform has a search engine to find product information, reviews, ratings, and online shops. Xiaohongshu can be considered a model for the future of Chinese online marketplaces.

Legislation and fees of selling online in China

In China, the platform fees can be significant. With a brand.com website, there are lower per-transaction costs as you are not required to pay commissions to the marketplace operator.

*All prices are in RMB

In addition, VAT in China is not as low as people might think. The standard VAT payer status is 6-17%.

All different options have their advantages and disadvantages, the best-fit e-commerce platform for a company need to base on more considerations. For instance, the product, the capital available to the company, the marketing plan, and the regulations of all platforms.

As far as regulation is concerned, some steps can become very disrupting when selling on Chinese online marketplaces. First, new product listings require approval from the operator, which can take weeks or even months. Also, in most cases, it is much easier to have a legal presence in China. The key to success in this challenge is to establish relationships with local partners you can trust for local operations like domestic warehousing, national delivery service, Chinese speaking customer service and return policy referenced to a local Chinese address.

What’s new for E-commerce model in China?

Recently, social platforms and video platforms combined with e-commerce models is a trend in China. Many brands choose to reach their customers in social platforms such as Xiaohongshu, WeChat and Weibo; and video platforms such as Douyin, Bilibili, and Youku. Since these social platforms and video platforms already have a large number of fan base, the combination of e-commerce here can receive a high brand exposure. Not only they have the official account of the brand and the latest news, but also make it easier to advertise, release product links and communicate with their fans.

[Source: Bilibili, ‘Bilibili e-commerce function to sell online in China’]

KOL marketing in China

What matters on social platforms is how to harness the power of KOLs (Key opinion leader). Nowadays, KOLs have a huge influence in China, and the choice of KOL sometimes directly determines the sales volume of a product.

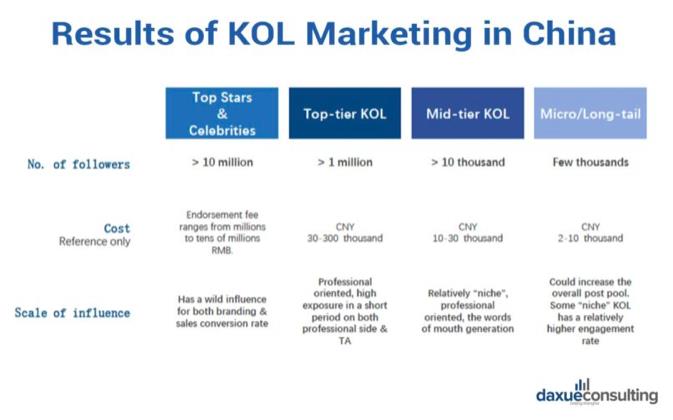

[Source: Daxue consulting, ‘results of KOL marketing in China’]

A KOL strategy in China is centred on the influence of KOLs which determine a brand’s ROI and awareness. The effects of KOL marketing can be received in 1 to 3 months after implementing KOL campaigns. The KOL market in China is segmented and complex, and it is crucial that a company chooses the right KOL for the target audience. Top stars & celebrities with over 10 million followers have a wild influence for both branding & sells conversion rate. Top-Tier KOLs in China with more than 1 million followers are professionally oriented with high exposure in a short period on both the professional side and target audience. Mid-tier KOL in China with more than 10 thousand followers are relatively “niche,” professional-oriented lies within the word of mouth generation. Micro/Long – tail with a few thousand followers, could increase the overall pool of posts. Some “niche” KOLs has a relatively higher engagement rate.

Tips for KOL marketing in China

- Avoid making advertisements too commercial

- Choose the right channels for your products

- Search for feedback from your target audience to know which KOLs are favoured

- Stay up-to-date on platform regulations

- Communicate with marketing team or agencies as detailed as possible

- Make a clear objective in your KOL plan

- Understand what mix of KOL and micro KOL fit the desired ROI

- “Attitude” “value” “lifestyle” “aesthetic sense”, make sure you choose the right emotional “TouchPoints” for consumers

- Plan with reactivity, KOL marketing in China changes rapidly

Let China Paradigm have a positive impact on your business!

Listen to China Paradigm on iTunes