Towards a smart home future: China’s Smart Systems and Smart Devices | Daxue Consulting

With a global trend towards an “internet of things,” China’s technological innovation has led to rising demand in the smart home market from Chinese consumers. A smart home is defined by Google Dictionary as: a home equipped with lighting, heating, and electronic devices that can be controlled remotely by smartphone or computer. Smart home systems, including lighting control systems, security systems, entertainment systems (audio and video), home appliances, and others; and smart home devices, including speakers, in particular, are some of the strongest segments of the smart home market. While this is a relatively new trend, both intelligent home systems and devices continue to gain support from the wealthier Chinese population. The market has a relatively narrow market segmentation, as most of its consumers have higher disposable income. However, regardless, as China’s middle class continues to grow, we expect to see positive growth in the overall smart homes market. This report will focus on the two main parts of the smart home market: smart home systems and smart home devices(speakers).

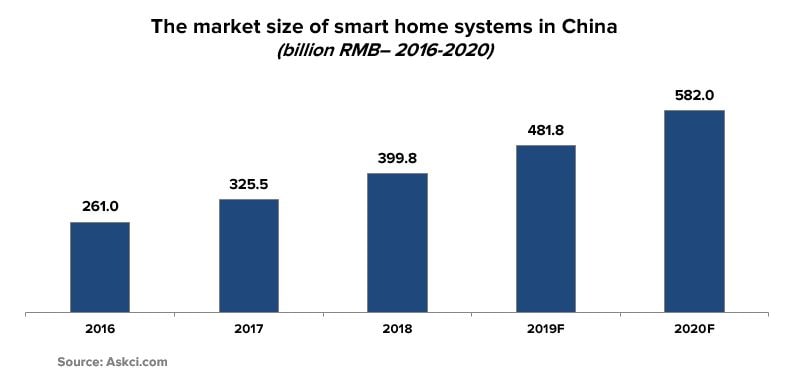

The market size of smart home systems in China

China’s central smart home systems consist of lighting control systems, security systems, entertainment systems (audio and video), home appliances, and others. Recent trends reveal the market size of smart home systems to be increasing at an annual rate of 20%, with smart home appliances as the largest segment of this market in China. The trend demonstrates the high development of AI technology in China, as well as consumers’ increasing demand for high-tech products aside from just their mobile phone and laptops.

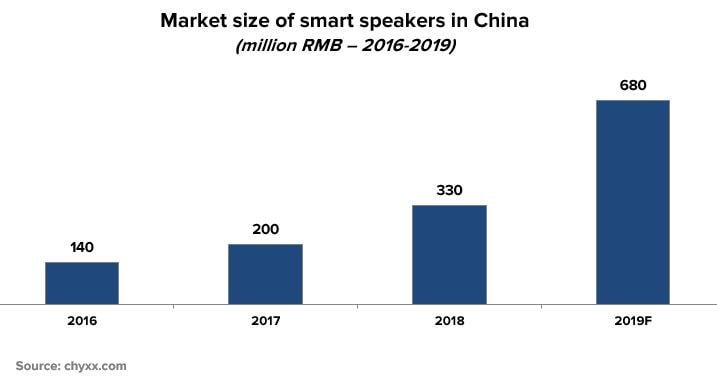

What is a smart home speaker and why are they now popular in the Chinese market?

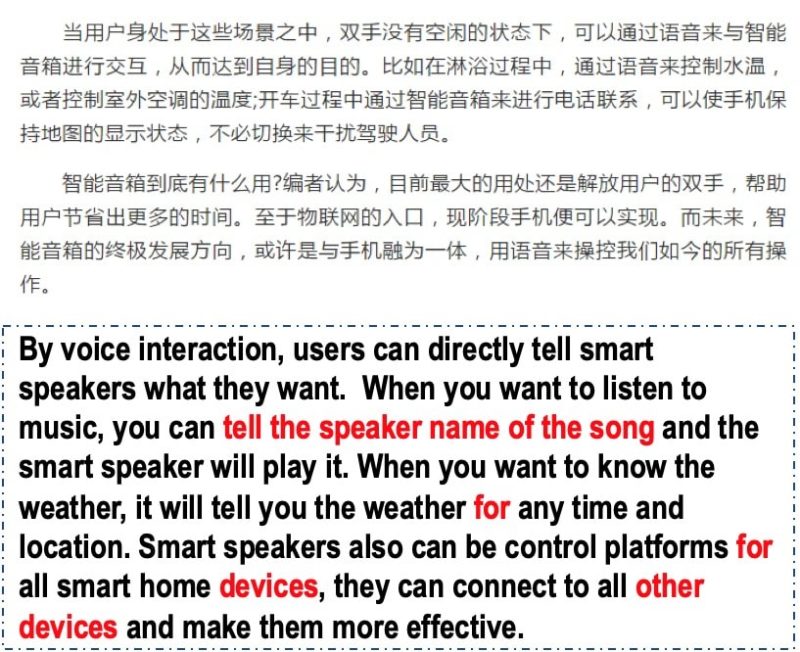

By integrating voice command and smart assistant technology, smart speakers allow the user to perform many functions via voice control. Smart speakers offer the ability to connect to your other smart devices, such as phones or laptops, as well as home systems such as lighting systems, security systems, television, etc. The market for smart speakers has grown significantly since 2016 and has more than doubled since 2018. Recently, Chinese tech giants Tencent, Baidu, JD, and Alibaba have all come out with their smart speakers. These domestic brands are trendy in the Chinese market. Going along with China’s trend of “consumption upgrade,” we can see that Chinese consumers are now more sophisticated and are leaning more towards technologically advanced products.

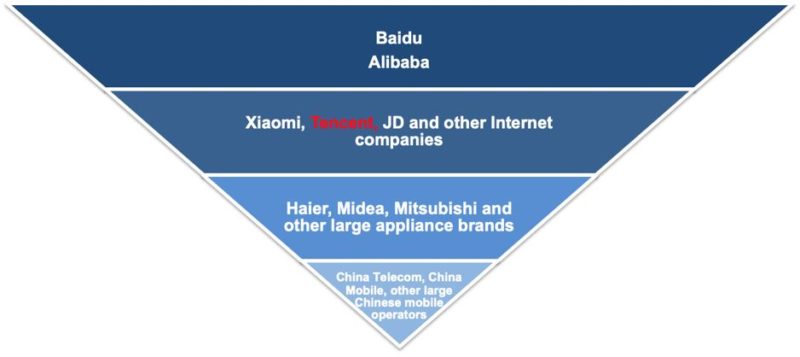

How do Internet giants, appliance companies, and mobile phone operators compete in the Chinese Smart Homes market?

The market is primarily occupied by large internet/e-commerce brands, appliance companies, and Chinese mobile operators. Many tech giants Baidu, Alibaba, Xiaomi, Tencent, JD, Baidu, and Alibaba have launched their smart home system products. Baidu and Alibaba dominate this market primarily due to their brand presence and name popularity amongst Chinese consumers. While large appliance brands such as Haier, Midea, and Mitsubishi have been operating longer in the smart home systems market with their intelligent appliances, most of their products are priced higher than those released by their Internet/e-commerce counterparts. For example, Haier released its first smart home systems in 2004 is considered a pioneer in smart home systems. However, many consumers were not yet familiar with smart home products at the time. The market boomed around 2014 – 2016, Midea, JD, Alibaba, Huawei, Xiaomi, and other high-tech companies released more smart home products and systems in China. Higher disposable income paired with a more tech-savvy population led to openness towards smart home products in the Chinese consumer. In 2017 – 2018, other internet brands launched their smart home systems products, which largely boosted its popularity and usage within China. Additionally, while Chinese mobile operators such as China Telecom and China Mobile offer smart home solutions via broadband and smart/intelligent terminals (such as the popular set-up-box), these solutions aren’t very visible to the consumer, and thus mobile operators are not the most relevant or present brands in the minds of the Chinese population.

[Source: Daxue Consulting]

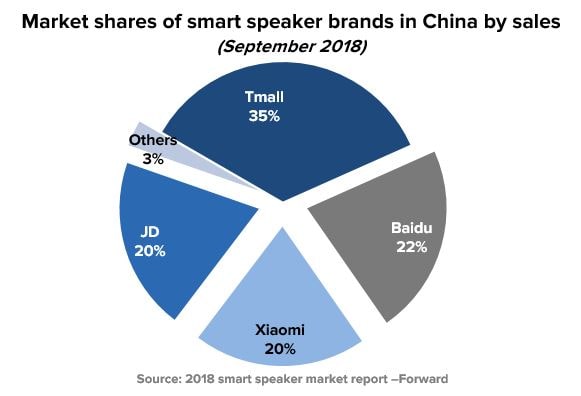

Domestic players dominate the Smart Speakers Market in China

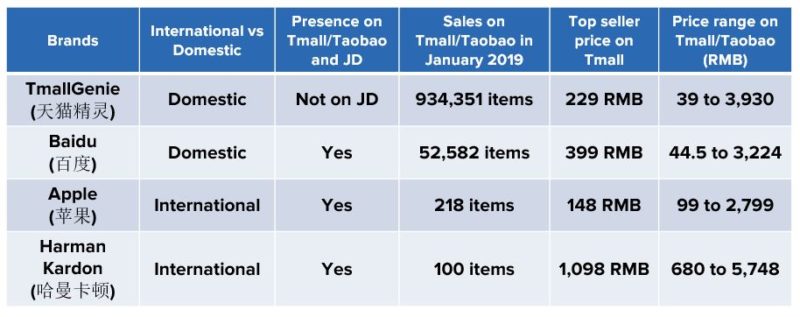

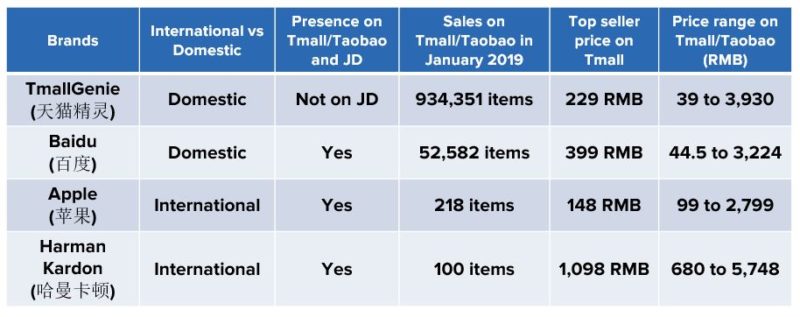

As of September 2018, Tmall, Baidu, Xiaomi and JD were the dominant players in China’s smart speaker market. In total, they occupied more than 90% of the market share. Western products, such as Amazon’s Alexa and Google Home have not penetrated the Chinese market. This is because of domestic brands since Chinese products have a much better understanding of the Chinese language. Additionally, the price of smart speakers by local Chinese brands is much lower than international brands.

On Taobao/Tmall, sales of smart speakers are mostly from big internet/e-commerce companies. These large domestic brands have dominated the online sales of smart speakers by making full use of network traffic, lower prices, and Chinese shopping festivals (such as Double 11/Singles Day, which is the largest offline and online shopping day in China launched by Taobao).

[Source: Daxue Consulting]

Those with high disposable income are the primary consumers for Smart Products

Most of the Chinese population have not developed a consciousness for smart home systems. While smart speakers are the central segment of intelligent devices that have generated popularity amongst consumers, these products are still relatively new to the market and are costly to purchase. For example, many companies believe that smart home systems can be installed in private houses and apartments, but due to its high expense, many Chinese consumers have not developed a desire for these products. Based on information from Weibo and Wechat, consumers of the smart home market usually purchase smart systems for three main reasons: to make their lives more convenient and comfortable, for the enjoyment of high tech and AI products, and to increase home security (such as through alarm systems). From this, we can see that consumers of this market are mainly those who live a comfortable life with high disposable income to enhance their experience through the use of technology. As new markets, however, hotels and offices are showing large demand for smart home systems as well to create a more comfortable and efficient indoor environment.

[Source: Daxue Consulting]

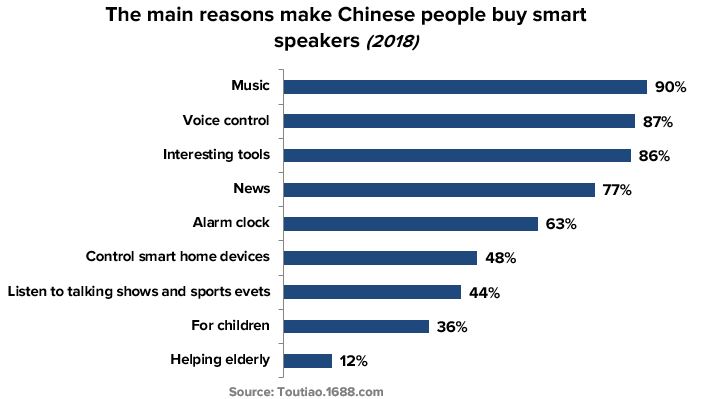

Chinese consumer analysis: Smart speakers

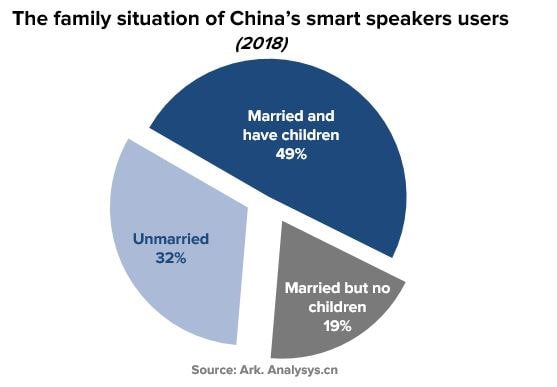

Married people and families with children are the main buyers of smart speakers in China. This is interesting because smart speakers generally have capabilities for children such as educational applications, storytelling, etc. Consequently, these functions have attracted many Chinese parents who feel like smart speakers would be of great use for their children, or if they feel like they have little time to spend with kids.

In addition, while smart speakers have many capabilities, Chinese consumers still mainly use smart speakers for listening to music, not taking advantage of the many functions of smart speakers and its smart assistant technology. Smart speakers are preferred over regular speakers in this case because voice control is seen as a novel and entertaining. Consumers usually use smart speakers in their living room, where they can listen to music or the news with their families. The kitchen is the second most common place that people utilize smart speakers, so they may utilize its handsfree wireless capabilities while cooking.

How do Chinese consumers feel about Smart products?

On social media, consumers of smart products have varied responses. On Taobao and JD, positive feedback of intelligent systems includes enhancement of convenience, high quality, and efficiency of use. Negative reactions concern difficult operations, slow responsiveness, poor quality, and high price. For smart speakers, positive responses also include enhancing convenience, being able to effectively control other smart home devices, and having interesting conversations with smart speakers. Negative feedback on smart speakers concerns the difficulty of an understanding speaker, slow responses, and lack of useful functions. On e-commerce websites, negative feedback on smart speakers also usually focus on the speaker’s lack of understanding ability and its high cost. Overall in the smart homes market, cost seems to be an occurring limiting factor for smart home-related purchases.

[Source: Sina Weibo. Translated by Daxue]

Case Study of two leading brands: Baidu Xiaodu vs. Tmall Genie

Tmall Genie

Taobao/Tmall launched their smart speaker “Tmall Genie” in 2017. Like all other speakers on the market, Tmall Genie is mostly sold online, while having one offline store in Hangzhou. This speaker is targeting all age groups, and TmallGenie frequently releases new arrivals (such as smart mini speakers for children) and events (such as discounted shopping) to attract more Chinese consumers of different ages. Tmall decreased its price by different discount activities during some famous shopping days (such as Double 11 shopping carnival). This strategy quickly increased its sales, and to expand its sales channels even further, TmallGenie is working with many big appliances brands to make its smart speakers be the control centers of more intelligent home devices.

Baidu Xiaodu

[Source: Tencent Video]

It is also one of the most favored among Chinese consumers, as Chinese people view Baidu’s smart speakers as being cost-effective products, high in quality, and rich in music resources. Baidu also made famous Taiwanese host Kevin Tsai as a spokesman for its Xiaodu smart speaker. The brand is also working with Haier, a leading smart appliances company, to make its intelligent speakers the control center for more smart appliances.

Xiaomi: A leader in smart home systems

[Source: Xiaomi website]

Future prospects for foreign companies in the Chinese smart home market

China’s market for smart home systems and devices are in an exciting position. While currently, smart products are mainly reaching consumers of the wealthier segment due to its costly purchase and installation, as the Chinese middle class continues to grow and its technologies continue to advance, there is a reason to believe that China will be moving towards a trend of smart homes. Smart home systems such as lightning and alarm systems are currently of interest by hotels and workspaces, a trend indicating its future growth. Smart speaks are the most crucial sector of smart devices that have seen tremendous growth in the past two years, with major tech giants releasing their lines of intelligent speakers. This shows that interior design and real estate agencies are becoming important buyers of smart home systems as many brands are seeking partnerships with them to expand distribution channels, and smart speaker technology will continue to advance with pairing other smart products as the main priority. Foreign companies should be aware that the smart home market has a highly competitive domestic landscape, with Chinese tech giants dominating the market share over foreign companies. International competitors may find it hard to penetrate the Chinese market, especially due to language barriers. However, with constant innovative developments in AI technology, foreign companies should be well aware of a smart home future in China that could be well under way.

Author: Julia Qi

Daxue Consulting helps you get the best of the Chinese market

Do not hesitate to reach out to our project managers at dx@daxueconsulting.com to get all answers to your questions.