Growing awareness of coffee is transforming the coffee machine market in China

How is the coffee machine market in China responding to evolving Chinese attitude towards coffee?

The coffee machine market in China is often described as being dominated by world-renowned brands and for being difficult to penetrate. However, far from being saturated, this market offers tremendous business opportunity due in part to the growth potential of coffee machine sales and the evolving tastes of Chinese customers towards more regular and sophisticated coffee consumption. Our research at Daxue Consulting has previously revealed an increased demand for high premium and new blend coffee machines in China as well.

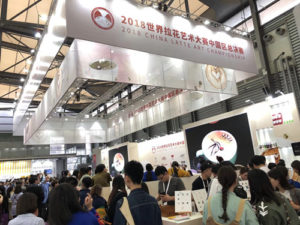

Now the growing number attendees to annual conferences such as the HOTELEX exhibition in Shanghai (上海国际酒店用品博览会), the largest international trade fair for the hospitality industry, stand as an additional testament to the fervent interest for coffee machines across the mainland. This article further explores the latest market trends and uncovers sources of future market growth for the coffee machine market in China with research conducted, compiled and analyzed by Daxue Consulting.

Coffee’s evolution from the fringes to the mainstream of Chinese society

How a society with brisk reverence for tea came to develop a taste for coffee merits close attention and analysis. The advent of coffee in China traces its origins back to the 19th century when a French missionary planted seeds in the areas surrounding his church in Yunnan, a province that still accounts for 98% of domestic coffee production in China. Despite this, coffee remained absent from Chinese lifestyles until 1978, when reforms opened the country and the coffee market in China could really take off.

Coffee industry growth over the past 40 years has come in four waves, according to Jim Lee, a 25 year coffee industry veteran and founder of Ocean Grounds Coffee Roasters (Weibo: OG咖啡), a China-based coffee shop chain that began in Beijing in 2010 and has since opened three more stores in Shanghai. Jim further explained that the first wave began when American coffee brands such as Folgers (福爵) and Maxwell House (麦斯威尔) started selling ground coffee in tins, which quickly became popular across the United States and other Western countries.

The second wave came in the 1980s, with Starbucks (星巴克) opening coffee shops across the U.S. and introducing the American consumer to more European café styles such as espressos, lattes, cappuccinos, the French press, and more. The third wave started in 2000s, when coffee enthusiasts started obsessing about the coffee bean itself: where was its origin, its traceability, the method of processing & making it, and how this produced distinctive coffee flavors and cafe experiences. Customers in a third wave coffee shop would see their baristas in more modern hipster attire, taking great care like an artisan when crafting a cup of coffee.

The current and final stage, commonly named “the Fourth wave of coffee” (第四波咖啡费文化), has seen the opening of coffee shop brands and roasteries which bring more refined coffee culture to a mass audience with a mixologist approach, blending roasting masters, baristas & barman know-how into a full hospitality experience. Characterized by specialty coffee baristas with specific tools and skills, this current era provides customers with more specific flavors and a wide variety of freshly roasted and ground coffees to choose from.

As Chinese urbanites have adopted Western café culture and its sophistication for coffee, a unique phenomenon is happening on the Mainland. The 2nd wave, 3rd wave and 4th wave of coffee are growing and developing at the same time within China, while abroad each wave gave pace to the next in a more gradual procession. “In Shanghai, you can experience Starbucks Reserve stores (2nd wave) next to boutique coffee shops with modern design like the Chinese coffee chain SeeSaw Coffee in this huge Chinese coffee market there is space for everyone.” added Jim.

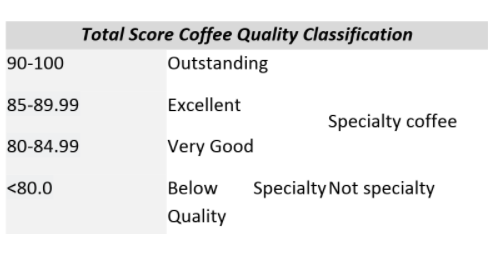

Jim Lee, CEO and Owner of Ocean Grounds Coffee Roasters (OG咖啡), uses specialty coffee beans that scores over 85 (classified “excellent”) on the Specialty Coffee Association of America (SCAA) classification. Photo Credit: Ocean Grounds Coffee Roasters.

Jim Lee, CEO and Owner of Ocean Grounds Coffee Roasters (OG咖啡), uses specialty coffee beans that scores over 85 (classified “excellent”) on the Specialty Coffee Association of America (SCAA) classification. Photo Credit: Ocean Grounds Coffee Roasters.

Source: Specialty Coffee Association of America (SCAA).

Professionals in the specialty coffee industry concur that the typical cup of coffee served in China scores below 80 on the SCAA quality score classification. A majority of Chinese consumers don’t have the education to tell the difference between a cup of specialty coffee and a regular cup. According to Jim Lee, 90% of people in China still don’t really understand the craft and variety of coffee on offer today. “They are mostly drinking to be in a place. It’s about the show. This is the goal of newly opened Starbucks Reserve Roastery Shanghai: it’s visual and it gives customers an environment”.

New coffee sensations are coming to China based on evolving consumer tastes. December 2017, Ocean Grounds, 283 Huaihai Middle Road, Shanghai. Photo Credit: Daxue Consulting.

New coffee sensations are coming to China based on evolving consumer tastes. December 2017, Ocean Grounds, 283 Huaihai Middle Road, Shanghai. Photo Credit: Daxue Consulting.

Despite having lower per capita coffee consumption in China compared to other Asian countries, the hot beverage has already entered the daily zeitgeist for many Chinese. Concurrent with the previously discussed four stages of development and the evolving attitudes of Chinese people towards coffee, making coffee at home is now part of the daily routine for many city dwellers.

Min Chun, Senior Project Leader and F&B specialist at Daxue Consulting, says that with the increasing amount of disposable income and the boom in F&B industry in China, more Chinese consumers are intent on moving from the “mundane lifestyle of drinking tea in a rather traditional environment” towards being “more open to consuming coffee in trendy comfortable café”.

Min Chun, Senior Project Leader and F&B specialist at Daxue Consulting, says that Chinese consumers are now “more open to consuming coffee in trendy comfortable café”.

Although China remains predominantly a tea-consuming nation, production and consumption of coffee has been growing at a double digit pace, around 16%, over the past ten years, according to the International Coffee Organization (ICO). Our estimates at Daxue Consulting, corroborated with the findings of multiple market research firms, predict that China will become the largest consumer of coffee worldwide within the next ten years. At well over 80% of the market, instant coffee sales dominate, however recent trends show Chinese consumers are increasingly open to trying freshly ground coffee. In line with these changes, the coffee machine industry in China, a lucrative segment of the global coffee market, is poised for considerable expansion, rendering itself relevant for further market research and analysis.

Shanghai International Hospitality Equipment & Food Service Expo (also known as HOTELEX Shanghai), plays host to 30+ world-renowned events, such as the World Barista Championship (WBC) and features famous coffee machine brands from all around the world. The 2018 edition (March 26-29) hosted 143,500 visitors, 2,352 exhibitors and 4,814 overseas buyers. Photo Credit: Daxue Consulting.

Shanghai International Hospitality Equipment & Food Service Expo (also known as HOTELEX Shanghai), plays host to 30+ world-renowned events, such as the World Barista Championship (WBC) and features famous coffee machine brands from all around the world. The 2018 edition (March 26-29) hosted 143,500 visitors, 2,352 exhibitors and 4,814 overseas buyers. Photo Credit: Daxue Consulting.

Coffee stores and home use still account for majority of the coffee machine market in China

Chinese coffee machines can be divided into two different segments based on their automation level: fully automatic and semi-automatic. Each segment of the coffee machine marketin China possesses distinct advantages and drawbacks. In terms of application, coffee machine sales in China can be further split into commercial (coffee chains and F&B) and non-commercial (household and office) usage segments.

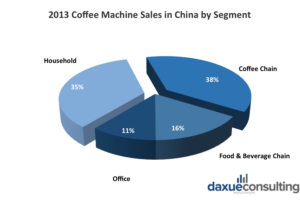

Coffee chains and households are the primary consumers of coffee machines in China. Source: Reproduced by Daxue Consulting with data from China Market Research Center (中国市场研究中心).

Coffee chains and households are the primary consumers of coffee machines in China. Source: Reproduced by Daxue Consulting with data from China Market Research Center (中国市场研究中心).

As evidenced from the pie chart, in China commercial use accounts for more than half of all coffee consumption, with coffee chains taking up the lion’s share at around 38% and F&B following with a 16% market share. 35% of the market, second highest, is made up by household coffee consumption, while the office segment makes up the lowest percentage at 11%. How these trends in consumer behaviorand market awareness affect the coffee machine market in China will be discussed further below.

Educated Chinese customers are changing how coffee machines perform in the commercial segment

The commercial coffee machine market will continue to be one of the most important drivers in the continued growth of the coffee machine market in China. The machinery used in commercial settings are either automatic one touch brewing systems that are suitable for quick service environments or are semi-automatic coffee machines that utilize baristas with café expertise, for more nuanced coffee tastes.

“When purchasing coffee machines, commercial coffee machine actors take into account three factors: budget, volume of coffee and target customers”, said Jim Lee.

The growing appetite of Chinese customers for a higher quality of gourmet coffee has further led commercial producers to make more premium and highly customizable coffee machines. Expect to see more of these machine makers target operators across the two different commercial segments: coffee chains and F&B establishments.

Brand image and location are major factors determining which machines coffee shops select

The number of cafes in mainland China has swelled to over 90,943 as of 2016. Currently, the coffee shop industry in China is dominated by famous western chains such as Starbucks and Costa Coffee (悦达咖世家). These brands have been able to establish a strong domestic presence due to their innovative growth strategies including “celebrity effect” marketing and selective product “localization” (adaptation of beverage to Chinese taste). The success of coffee shop chains like these has been a driving force behind the coffee machine industry in China.

In an interview with the Hong Kong Trade Development Center (HKTDC Research经贸研究), Taiwanese coffee equipment proprietor Yang claims that it was Starbucks’ arrival on the mainland that spurred the growth of the market. Since he registered his business in Hong Kong over 20 years, he has seen his company grow headcount and turnover by over 1,000%.

The world’s largest Starbucks Reserve Roastery (星巴克烘焙工坊与臻选品鉴馆) opened on 762 West Nanjing Road, Shanghai in December 2017. It stands as symbol of the brand’s confidence in the China coffee market. Photo Credit: AFP/Getty Images.

The world’s largest Starbucks Reserve Roastery (星巴克烘焙工坊与臻选品鉴馆) opened on 762 West Nanjing Road, Shanghai in December 2017. It stands as symbol of the brand’s confidence in the China coffee market. Photo Credit: AFP/Getty Images.

[ctt template=”2″ link=”gbd8o” via=”yes” ]“A great coffee machine is just as important as having quality coffee beans, water and the barista skill for making outstanding coffee” says Jim Lee, Founder of Ocean Grounds Shanghai”.[/ctt]

Coffee machine equipment is one of the most crucial components for the coffee shop industry, a core part of every café’s store strategy that differentiates brands from each other. Famous international coffee chains have a specified brand coffee machine, often with custom-tuning to their operational requirements, which are purchased from local professional coffee machine suppliers.

For example, Starbucks have equipped and updated all their coffee machines store-wide in China with the Swiss fully automatic coffee machine brand Thermoplan (热力计划) and the corporate wholesale machine Mastrena. Although expensive at a 200,000 yuan (32,000 $) price point, Mastrena coffee machines meet Starbucks’ needs due to their product design that can consistently serve high quality coffee at great pace. It is not surprising that Starbucks competitor Costa Coffee also uses the same brand coffee machines to ensure the consistency of high quality coffee during rush hour periods in China.

Costa Coffee (悦达咖世家) uses Mastrena brand coffee machines throughout its stores in China to ensure a high standard of service. Photo Credit: Daxue Consulting.

Costa Coffee (悦达咖世家) uses Mastrena brand coffee machines throughout its stores in China to ensure a high standard of service. Photo Credit: Daxue Consulting.

Unlike their internationally famous counterparts, most independent coffee shops in China can’t afford these coffee machines and instead make a separate coffee machine selection for different cities, according to Jim Lee. He further stated that coffee machine prices sometimes can go as high as or be equal to the amount spent on opening the café. Therefore, the selection of coffee machine requires comprehensive consideration and stringent market analysis due to the differing consumption level and purchase prices across different tier cities in China. Coffee distribution must be considered in a similar way.

In first tier Chinese cities, coffee shops tend to use expensive and famous coffee machine brands as people are relatively more educated about coffee and the coffee making process. Jim Lee said that in order to “show off” and display a sense of professionalism, coffee shop owners in China prefer to invest in famous brands such as Black Eagle (黑鹰) or La Marzocco (拉玛祖可), to help market their establishment. “People in the industry look at the machine first, even more in China, where everything is about branding”, said Jim Lee. According to the latest survey results, the three most used commercial coffee machine brands in the Chinese market are La Marzocco, and the two American brands, Synesso (斯奈索), and Slayer (杀手).

The Italian high-end coffee machine brand La Marzocco (拉玛祖可) is the most widely used machine model across indie coffee shops in China. EDM café, March 2017, 348 Jianguo West Road, Shanghai. Photo Credit: Daxue Consulting.

The Italian high-end coffee machine brand La Marzocco (拉玛祖可) is the most widely used machine model across indie coffee shops in China. EDM café, March 2017, 348 Jianguo West Road, Shanghai. Photo Credit: Daxue Consulting.

Seven, a certified barista at EDM café in Shanghai, points out that La Marzocco, the Italian high-end coffee machine brand, priced between ¥50k-70k for a two head machine, is the most widely used machine model in indie coffee shop brands in China, especially in first tier cities. Jim Lee also started with La Marzocco before switching to Black Eagle.

Seven further elaborated that the high investment cost of the machine is correlated to the willingness and intention of coffee shop owners to be more competitive and better able to cater to the taste of the coffee-savvy Chinese customers who see premium coffee as a mark of an aspirational cosmopolitan lifestyle.

Another aspect of these premium coffee machines is their durability. They can last up to twenty years with proper maintenance, while the warranty and maintenance services extended by the supplier last for one year. On the more affordable end of the market, coffee shop operators will use domestic and cost-effective brands for the second and third tier cities in China such as the American Clover (车轴草), Dutch brand Saeco (喜客咖啡) (produced by Philips), Spanish brand Expobar (爱宝) (Crem International), and the Italian local brand Faema(飞马). These foreign brands have established production bases within China and in some cases, co-produce coffee machines in cooperation with domestic manufacturers. It should be said as well that coffee shop brandsare not the only outlets driving the growth of the coffee machine marketin China. Coffee-craving Chinese customers have motivated the conventional F&B industry in China to include coffee in their daily menu offerings. Although still incremental, F&B chains are making inroads into the coffee machine industry in China as well.

F&B: Lucrative niche for efficient and speedy automatic coffee machines

China’s soaring demand for coffee has stimulated the adoption of fully automatic coffee machines across the F&B sector. Japanese convenience store chain FamilyMart (全家) operates the German brand WMF’s (福腾宝) fully automated coffee machines in China. Photo Credit: Daxue Consulting.

China’s soaring demand for coffee has stimulated the adoption of fully automatic coffee machines across the F&B sector. Japanese convenience store chain FamilyMart (全家) operates the German brand WMF’s (福腾宝) fully automated coffee machines in China. Photo Credit: Daxue Consulting.

Recent years have seen impressive growth bythe F&B sector in China, spurred by the arrival of internationally famous convenience stores, bakeries, and fast food chains. F&B chains have scored impressive feats in the Chinese market due to their novelty, quality, competitive prices and air of sophistication. Although a recent trend, F&B chains have responded to the evolving tastes of Chinese customers and the potential of the coffee market in China by offering coffee drinks to their customers.

McDonalds (麦当劳) and KFC (肯德基) started trial businesses to sell fresh coffee in 2009 and in the light of the huge potential sales, convenient stores began adding coffee to their daily offerings as well. This included companies such as FamilyMart (全家) who launched ParCafé (湃客咖啡), its own coffee brand, in Shanghai in 2007. According to research from Daxue Consulting, 57% of consumers in China are willing to buy coffee in a convenient store, and 60 % of convenient store customers prefer to have a meal at stores that offer coffee as drink option over those that do not.

The convenience store chain FamilyMart (全家) launched ParCafé (湃客咖啡), its own coffee brand, in Shanghai in 2007. One cup is priced between 10 and 14 yuan. March 28, 2018, FamilyMart store, 208 Dapu Road, Huangpu District, Shanghai. Photo credit: Daxue Consulting.

The convenience store chain FamilyMart (全家) launched ParCafé (湃客咖啡), its own coffee brand, in Shanghai in 2007. One cup is priced between 10 and 14 yuan. March 28, 2018, FamilyMart store, 208 Dapu Road, Huangpu District, Shanghai. Photo credit: Daxue Consulting.

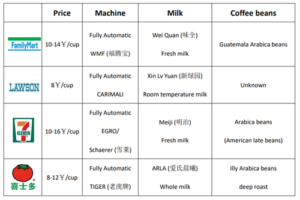

The F&B sector accounts for 16 % of coffee machine sales in China and the figure is bound to grow given the increasing popularity of the coffee among average Chinese customers. In stark contrast to coffee chains, F&B operators prefer to use fully automatic machines in order to ensure a consistency of high quality at a quick service pace. Our findings at Daxue Consulting show that bakeries and convenient store chains in the China F&B market adopt the same coffee machine across every branch to ensure a consistent standard of quality service.

Another marked difference between coffee chains and the F&B sector is that while coffee chains offer specialty coffee and cater to the demand of educated consumers, the F&B sector focuses primarily on mid-level customers with a more limited knowledge of coffee. Product taste testing has shown that different target customers prefer different flavors and strengths, which leads to different coffee machine purchases being made by shops based on individual financial and business considerations. Therefore, as the selling price for coffee generally ranges from ¥8 to ¥16 yuan in convenience stores in China, shop ownerschoose fully automatic coffee machines priced in the ¥30k-50k yuan range to get greater bang for their buck.

Leading convenience store chains in China operate German, Italian, Swiss and Australian fully automatic coffee machines in their stores. Source: Reproduced by Daxue Consulting with data from Penguin Guide (企鹅吃喝).

Leading convenience store chains in China operate German, Italian, Swiss and Australian fully automatic coffee machines in their stores. Source: Reproduced by Daxue Consulting with data from Penguin Guide (企鹅吃喝).

FamilyMart uses German brand WMF (福腾宝) machines, 7-eleven prefers Swiss brands Schaerer (雪莱) and EGRO (埃尔戈) machines, and C-store (喜士多) operates Australian brand Tiger (老虎). Hotel chains are also following suit stores and have included more coffee options on their menus. While internationally famous hotel chains prefer high quality fully automatic coffee machines to quench the coffee thirst of their more sophisticated customers, local brands remain more budget conscious about their coffee machine selection in China as they don’t yet believe it is a primary sales factor amongst their existing customer segments.

Home and office becoming points of interest

According to the latest statistics from the International Coffee Organization, coffee consumption in China grows at an annual pace of 15%, while figures for Europe and North America, the bedrock of coffee consumption, hovers at around 2% annually. What is missing in these numbers is the share of household consumption, which accounts for a remarkable 40% of this annual increase in China. In a recent interview with The Telegraph, Alfonso Troisi, Business Executive Officer of Nespresso China (奈斯派索), claimed “there is a common perception that outside coffee consumption is bigger in China, whereas home coffee drinking still accounts for the bulk of the coffee consumption”. Businesses have caught on that household consumption is becoming the most significant driving force behind the increasingly lucrative coffee machine industry in China.

This is backed up by data from decisiondog.cn (数据狗), a Chinese survey platform, that shows home-use coffee machine sales growth rates reached 26.74% in 2017, which was 1.23 times the overall growth of the coffee machine market in China that year. The same data for the commercial segment was a mere 2.35%. Businessman Zhang Xuhong (张绪红), who intends to open a coffee products company in China, said that three years ago, a coffee company’s sales to offices typically accounted for just 15% of total sales. According to Felipe Cabrera, director of wholesale coffee at Ocean Grounds and formerly of V COFFEE in Shanghai, office workers are now complementing the coffee machine market in China, as wholesale coffee business is increasingly developing inside offices and working spaces across the mainland.

In general, coffee machine sales through non-commercial channels have been divided into three different product categories: traditional drip, automatic espresso and pod & capsule coffee machines. Traditional drip has been on a decline over the past years whereas automatic espresso and pod & capsule machines have displayed a steady growth and gained more market share.

Foreign brands dominate the coffee machine market in China

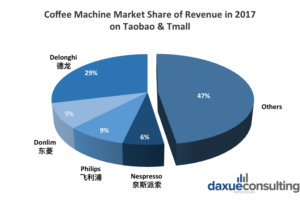

As more Chinese embrace aspects of western lifestyles, so to has coffee making at home and the office gained significant popularity, with coffee machines becoming an increasingly common occurrence throughout China. Due to their fast service speed and efficiency, fully automatic coffee machines and capsule machines top the charts for personal use. According to market research firm China Market Monitor (中怡康时代), foreign and joint-venture brands currently have the highest share of the household and office coffee machine market in China.

International brands have a strong presence on China’s leading e-commerce platforms, with Italian brand De’Longhi (德龙) leading the way. Source: Daxue Consulting, reproduced with data from China Market Monitor (中怡康时代).

International brands have a strong presence on China’s leading e-commerce platforms, with Italian brand De’Longhi (德龙) leading the way. Source: Daxue Consulting, reproduced with data from China Market Monitor (中怡康时代).

Notwithstanding its late penetration into Chinese market with slow drip coffee machines, Dutch brand Philips (飞利浦) has the largest market and second largest revenue share amounting to 35.55% and 29.33% respectively. Philips was able to obtain the highest share in China’s coffee machine market due to the affordable prices of its products that start from only 200 yuan. Having a special focus on automatic espresso, Italian brand De’Longhi (德龙), is below of Philips in market share at 11.09%, but outranks them in total revenue share at around 37.48 % of the market, due in part to their good reputation, product quality and commensurate higher prices. Other famous foreign brands in the top five include China-German joint venture Melitta (美乐家), Swedish brand Electrolux (伊莱克斯),and American brand ACA (北美电器).

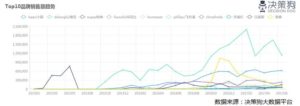

The state of the coffee machine industry in China is not constant however, as a recent decline in the demand for automatic espresso machines has reshuffled the market substantially. The average age of Chinese coffee drinkers now overlaps with the country’s tech-savvy youth demographic and their modern lifestyle choices. Looking at online data and sensory research in China reveals more about recent trends in the coffee machine market for China’s youth. Chinese data analysis platform Decision Dog (决策狗), underscored the new trend in their recent article saying that “small coffee machines (capsule coffee machines) have become the trendiest part of the coffee machine market that reflects the preference of the consumers”.

High demand for capsule coffee machines has placed more and more Chinese brands among the top ten players with the most noteworthy example being Donlim (东菱), the local Chinese brand that generated more revenue than Philips in 2017. The annual growth rate of the online market for capsule coffee machines over the past 12 months is 157.2%. There are 31 competitive brands in the capsule coffee machine segment. The Top 10 brand’s sales accounted for 92.83% of the entire capsule coffee machine market, and it occupies almost the entire market with high market concentration. Among them, De’Longhi, Bear (小熊) and RLRMAFREDA rank the top three market share, occupying 40%, 22% and 8% of the market share respectively. De’Longhi and Bear have a much higher share in the capsule coffee machine market than other brands.

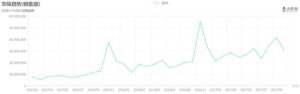

Dynamics of the capsule coffee machine market in China (January 2015 to September 2017): Coffee appreciation has left its imprint on the capsule coffee machine market, with sales trending upwards despite periodic fluctuations. Source: Decision dog (决策狗).

Dynamics of the capsule coffee machine market in China (January 2015 to September 2017): Coffee appreciation has left its imprint on the capsule coffee machine market, with sales trending upwards despite periodic fluctuations. Source: Decision dog (决策狗).

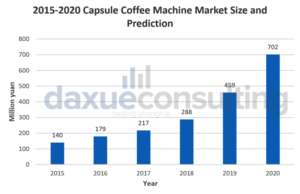

Another trend among households and office coffee machines is the proliferation of mini coffee machines, also known as capsule coffee machines in China. According to Decision Dog (决策狗), a Chinese big data platform, the capsule coffee machine market has grown by 19.1% in 2017 over 2016, which is slightly higher than the overall increase of 17.99% of the whole coffee machine market during that same time, indicating a faster uptick in capsule coffee machine usage. Meanwhile, opinion survey web-page askci.com (中商情报) predicted an increase in the revenue generated through the sales of capsule coffee machine from 288 million in 2018 to a high of 702 million over a period of two years through its surveys.

The upward growth trajectory of capsule coffee machine is predicted to continue until 2020. Source: Reproduced by Daxue Consulting with data from Decision dog (决策狗 ), Chinese big data platform.

The upward growth trajectory of capsule coffee machine is predicted to continue until 2020. Source: Reproduced by Daxue Consulting with data from Decision dog (决策狗 ), Chinese big data platform.

The coffee machine market in China is still a blue ocean

Household consumption is thriving

Exposure to western lifestyles and the desire to be more international has created an emergent craving for coffee in China. Satiating this customer need should be seen as a considerable growth opportunity for the coffee machine market in China. With coffee consumption levels steadily increasing, demand from both commercial and non-commercial segments of the coffee machine market in China is on an upward trajectory. This potential presents considerable opportunities for coffee machine companies intent on entering the Chinese market.

The majority of the increase in demand for coffee machines arises from households and offices, as the annual growth rate of household coffee consumption hit a record 58.9 % last year. Growing demand for household and office coffee machines has made a huge impact on coffee machine industry in Chinawith a market value of 616.6 million in the past year. Due to its high speed, efficiency and reasonable prices, fully automatic machines are the dominant player in household sales in China. As research has indicated, affordability plays a substantial role in Chinese household coffee machine market.

The sales of products priced in 349-1,729 yuan range took up 44% of the total sales, while the products priced in 1,729-2,987 yuan occupied 9%, and the products priced over 2,987 yuan only took up 6%. As the average spending power of Chinese households increases and coffee drinking becomes a more regular activity, household consumption is bound to grow even further.

Local distributors key cog of coffee machine supply chain in China

Commercial segment operators (coffee chains and F&B industry) purchase coffee machines, through local distributors. Jim Lee, stated that majority of coffee chains buy their coffee machines through HiangKee Coffee Group (香记咖啡集团)– a local distributor for most of the famous international brands. Headquartered in Hong-Kong and with offices scattered around the country, HiangKee Coffee Group is a well-known supplier of coffee machines, coffee grinders, hot and cold drink systems and other equipment for outlets and has a partnership with Victoria Arduino (维多利亚伊诺)amongst other international brands.

The speed of digitalization across all aspects of commerce in China has picked up steam in recent years. A report from JD.com, one of the major online retailer sales in China, finds that 89% of Chinese customers buy home appliances through the internet. The coffee machine market in China is no exception.The annual growth rate of the online market for small coffee machines in the recent 12 months is 157.2%. The most popular online channels for coffee machine purchases in China are JD.com, Taobao, Tmall, Suning, Gome and Amazon China. Coffee machine companies looking to succeed in the China market would be wise to develop an effective e-commerce presence and marketing strategy across multiple online platforms.

Despite periodic fluctuations, online coffee machine retails sales have recorded steady growth from 2015 onwards. Source: Decision dog (决策狗 ).

Despite periodic fluctuations, online coffee machine retails sales have recorded steady growth from 2015 onwards. Source: Decision dog (决策狗 ).

Recent tax laws create better business environment for domestic and foreign brands alike

On November 22, 2017, the Tariff Department of the Ministry of Finance in China (国家财政部关税司) reduced the tariff on 187 imported goods, including slashing the taxes on foreign coffee machines significantly, from 32% to only a 10% import duty. This new tax policy creates advantages for both producers and consumers of coffee machines in China.

With less custom duties, foreign brands now have the opportunity to expand their business in the Chinese coffee machine market. As previously mentioned, price continues to be one of the most decisive factors for the Chinese customer. Foreign brands are now able to offer machines at lower prices, thus enabling more customers to purchase their product and expand their own market share in China’s coffee machine industry.

Although, the new tariff adjustment presents local producers with more able and competitive international challengers, it will also stimulate innovation and encourage coffee entrepreneurs to use more innovative technologies and designs to compete alongside their Western rivals. Both producers and consumers of coffee machines in China will benefit as the market grows in size and sophistication.

Daxue Consulting Expertise

To take advantage of this loosening regulation, coffee machine manufacturers will need an effective marketing strategy to enter and grow within the China market. Contact us at Daxue Consulting to learn more about how our years of expertise and professional service could help you achieve your business objectives in the hospitality equipment market in China.

Main visual caption: VA388Black Eagle (黑鹰), from Italian manufacturer Nuova Simonelli (诺瓦咖啡机), is the official espresso machine of the World Barista Championship (WBC)国际咖啡师大赛) and a major player in the Chinese coffee machine industry. Feature Image Credit: Ocean Grounds Coffee Roasters.

![[Interview] Shanghai is for Entrepreneurs: Big Sur and the coffee shop industry in China](../wp-content/uploads/2017/11/Main-visual-150x150.jpg)

![[Podcast] China paradigm #15: How to successfully run a coffee shop chain in China](../wp-content/uploads/2018/12/Daxue-consulting_china-paradigm_Carol-Liu-Big-Sur-Tea-and-Coffee-150x150.jpg)