Market research: The soft drink market in China | Daxue Consulting

Continued expansion of China’s soft drink market

The soft drink market in China include drinks with alcohol content of less than 0.5%. It can be classified into bottled water, soda drinks, carbonated beverages, fruit and vegetable beverages, tea beverages, milk, etc. This market analysis focuses on the development, consumers, brands and segmentation of the soft drink market in China

The development of China’s soft drink market

The development of the soft drink market in China is roughly divided into three stages. Before 2000, carbonated beverages occupied the dominant position of the soft drink market in China; from 2000 to 2006, consumers’ attention has shifted to tea beverages and functional beverages. Then, with the increasing awareness of health, the concept of consumption changed accordingly. Bottled water, fruit and vegetable juices and protein drinks are now becoming more and more popular in China’s soft drink market.

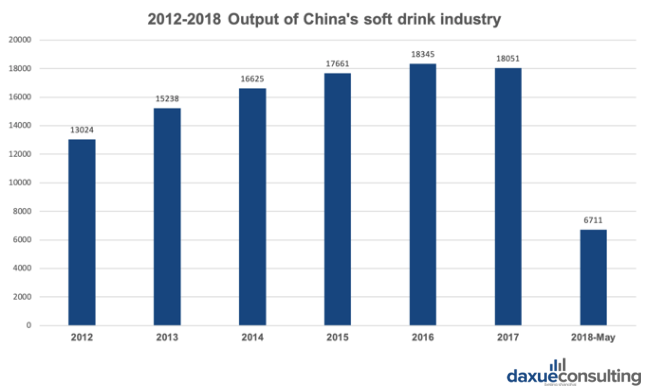

In recent years, the output of beverage industry in China has been increasing gradually. In 2012, the national output of beverages was 13.024 million tons, which increased to 18.0512 million tons in 2017. But the growth rate of output in China has slowed down in these years. The first year of negative growth was in 2017, at -1.60%.

Soft drinks in China are widely available at fast food restaurants, movie theaters, convenience stores, casual dining restaurants, dedicated stores, bars and vending machines. They are served in many formats, including cans, glass bottles, and plastic bottles. Constant value growth for soft drinks in China driven by the quickened pace and steady demand. Currently, the revenue rate is over 30% despite the high segmentation and competition in the China’s soft drink market. The soft drink market in China is expected to become the biggest worldwide in this year according to a related report. The potential growth of the beverage industry in China is, as a result, among the highest worldwide. The size of the China’s soft drink market has led importers and international beverage businesses to think through China as an essential market for their business expansion.

What soft drinks do Chinese people like to drink? By brand & type

PepsiCo and Coca-Cola remain important in China’s soft drink market

In 1979, Coca-Cola was the first to enter the Chinese market, followed by PepsiCo. The bottling factory of PepsiCo in China was built in Shenzhen in 1981, which started to attack the Chinese market. Coca-Cola in China now has 42% of the China’s soft drink market, including carbonated beverages, fruit drinks and bottled water. For PepsiCo in China, it has a market share of about 32%. “China is one of the top global markets driving PepsiCo’s growth,” said Ram Krishnan, president and CEO of PepsiCo Greater China Region.

No matter how many new soft drinks appear, coke will always play an important role in the hearts of Chinese consumers. Both PepsiCo and Coca-Cola have a large fan bases in China, and Chinese consumers often argue about which tastes better. In addition, the two giants have begun to transform, for ‘younger, diversified, healthy’ strategic layout, Coca-Cola in China even ventured into selling coke with added fiber. To transform, they also acquired young, healthy and strong brands, for quickly entering into new fields and saving the risk and time of independent research.

Mineral water

China has one of the biggest bottled water markets in the world, and it is expected to reach 49 million tons of total annual consumption by 2020. Popular bottled water brands include Kang Shifu (康师傅), Wahaha (娃哈哈), Nong Fu Spring (农夫山泉), C’estbon (怡宝), etc. Prices for a 500ml bottle of water range from 1.5 yuan to 10 yuan. Though compared to foreigners, Chinese people prefer to drink warm water, there are increasing number of Chinese young consumers like to drink cold or ice water especially in hot seasons.

Mistrust over water safety is believed to boost the Chinese bottled water market. The growing awareness of personal wellbeing as well as strengthening purchasing power prompt consumers to trade up to healthier choices such as bottled water, giving rise to continuously burgeoning growth over the review period.

Fruit juice

In 2016, China’s fruit juice retail volume was 13.447 billion liters and retail sales reached 100.914 billion yuan, with an increase of 1.88%. It is predicted that in the past five years, the annual growth rate of retail sales of the juice beverage industry in China is about 7%. Main brands in the Chinese fruit juice market include Tongyi (统一), Kang Shifu, Nong Fu Spring, Huiyuan (汇源). Chinese consumers have increasingly high requirements for drinks, ‘healthy, natural and functional’ fruit juice is the trend of consumption. With the continuous improvement of consumers’ rational consumption, companies need to produce drinks with high quality, in line with industry trends, and cost-effective to win the recognition of consumers.

In terms of taste, orange juice is the largest category of the fruit juice market in China, the overall flavor is relatively concentrated. There are some differences in taste between the north and the south in China. Apple, peach and pear consumption is relatively high in the north market. Pure juice is the growth point of juice industry in the future. Chinese women have greater demand for juice, which is related to the pursuit of a healthy figure. Family consumption is the consumption scene that juice brands need to pay attention to, such as drinks for dinner, breakfast, snacks and drink after meals.

Tea & Coffee

The Chinese tea market has gone through three stages: the first stage is instant tea, then the second stage is bottled tea, such as unified (统一) milk tea, and the third stage is handmade tea represented by Gong cha (贡茶)、Royaltea (皇茶). In recent years, the new-style tea drinks are represented by HEYTEA (喜茶), Naixue cha (奈雪の茶). The tea drinks are made by pure tea, fresh milk and mixed with various fruits. They pay more attention to the quality and health, and at the same time develop the design of social space.

Competition in the new tea industry is extremely fierce, every link is crucial. From the selection of tea ingredients, to the decoration and location of stores, to the digital marketing of social platforms. It seems that the tea industry is a profiteering industry in China. However, as new brands are entering, some tea shops have been eliminated.

China’s coffee industry is not that old as tea, but it has been rapidly developed by European and American brands such as Starbucks and Costa Coffee. Nowadays, Chinese people attach great importance to coffee culture and cafe social culture. A cup of coffee a day is a common sight for commuters. Not only elaborate coffee shops that are growing fast, but also bottled espresso, convenience store coffee and Luckin coffee, which famous for providing coupons and takeout, are all on the rise. How does a café attract Chinese customers? Casual cafés generally has exquisite decorations and comfortable social space, and even extends to other peripheral products such as cat coffee to attract passers-by.

Nature, health and functionality are consumption trends

For the growing consumer demand, the soft drink market in China need to cater to consumers’ pursuit of “natural, healthy and functional” drinks, which has huge market potential. Meanwhile, with the increase of the number of energy drinks products, functionality will be injected into the fruit juice field from the dairy concept. Additionally, vitamins and minerals may be added to the fruit juice.

How to get customers to try new soft drinks in China?

It is necessary to have accurate positioning of the new product and deliver a clear concept, “diet coke” is one example that has a clear positioning as a lower calorie option. Secondly, try to add innovations to drinks, such as bottle design and unique taste. How to reach more customers as soon as possible? Luckin coffee is a typical example for the coffee market in China. Its coupons allow consumers to get a cup of coffee at a low price. Of course, this method requires a strong capital base, which is not feasible for most of new brands. In the second quarter of the 2019 financial report of Luckin Coffee, its net loss reached 680 million RMB, which most companies cannot afford. In the soft drink market in China, choosing the right distribution channel and finding an endorser with high purchasing power of fans is a relatively traditional and efficient strategy.

Let China Paradigms have a positive economic impact on your business

Listen to China Paradigms Podcast in iTunes

![[Podcast] China Paradigm #27: How to succeed in China’s tea market while starting from scratch](../wp-content/uploads/2019/04/China-marketing-podcast-27-150x150.jpg)