The milk market in China: consumers’ perception of nutrition has sustained the growth of this sector

The milk market in China consists of concentrated milk, fresh liquid milk, ultra-high temperature processing (UHT) milk (also known as long-life milk), powdered milk and all other milks that come from dairy sources.

Since the 2008 melamine scandal, the domestic milk market in China has had a hard time gaining the trust of consumers. This scandal hurt all players, including Mengniu Dairy and Yili Group, which are the leaders of the Chinese dairy industry. The crisis has also influenced milk consumers in China to purchase milk and dairy products from foreign brands, putting domestic milk producers at a disadvantage.

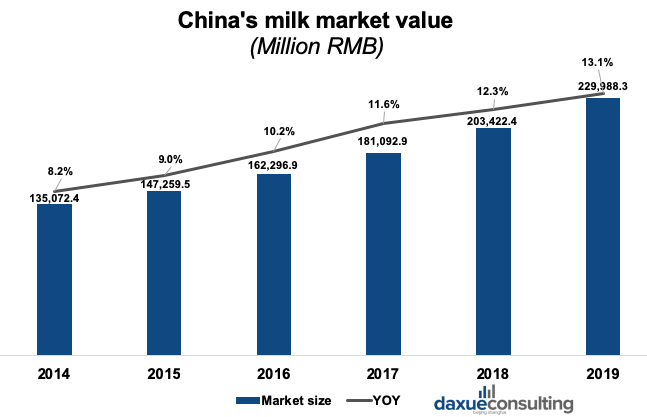

Even though the evolving consumer perception of milk in China has facilitated the growth of import and consumption of foreign milk firms, domestic milk firms in China still have dominated the milk market in China. Moreover, according to MarketLine, regarding the overall performance, from 2015 to 2019, the milk market in China has seen steady growth. Thus the market is anticipated to grow in the future.

Analysis of China’s milk market

Size of China’s milk market is gradually expanding

Chinese consumers are turning on to the nutritional benefits of milk products. It is predicted that sales of milk in China will increase from 11.95 billion RMB (2018) to 12.83 billion RMB (2022), with a 1.7% annual growth rate. Thus the market size of milk in China has been growing steadily.

Data source: MarketLine, China’s milk market value

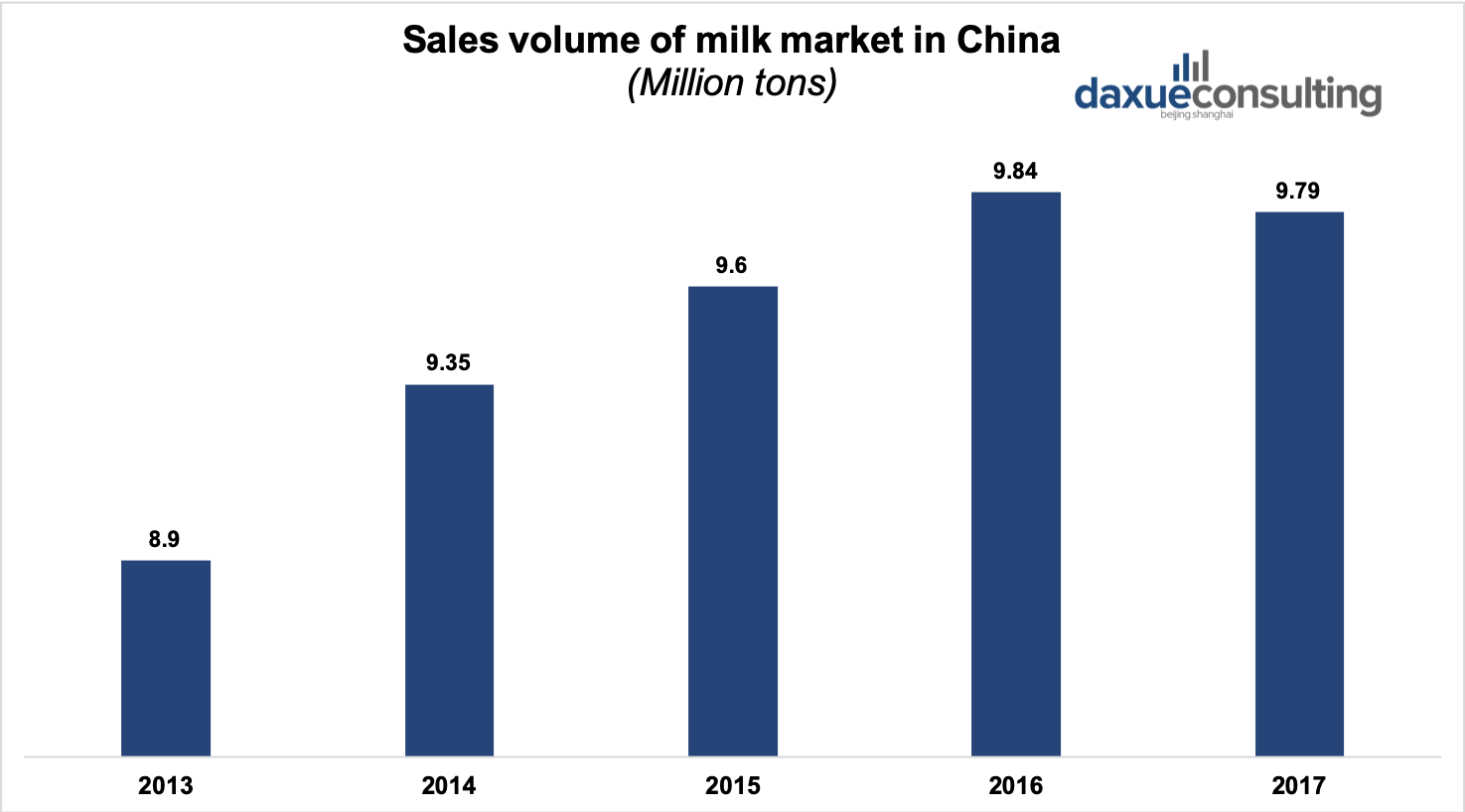

Consumption of milk in China has grown four-fold since 2012

Due to the influence of traditional dietary habits and limits of economic development, in 2012, each person consumed only about 6.39 kilograms of milk per year. That was only about 1/3 of the consumption of an average Indian consumer and 1/10 that of a western consumer. Moreover, the consumption of powder milk in China ranks at the top among all countries in the world.

In 2020, the consumption of milk in China has increased remarkably. The consumption of milk per capita is projected to reach 28 kilograms in 2020 and 41 kilograms in 2030.

Data source: Qianzhan, Sales volume of the milk market in China

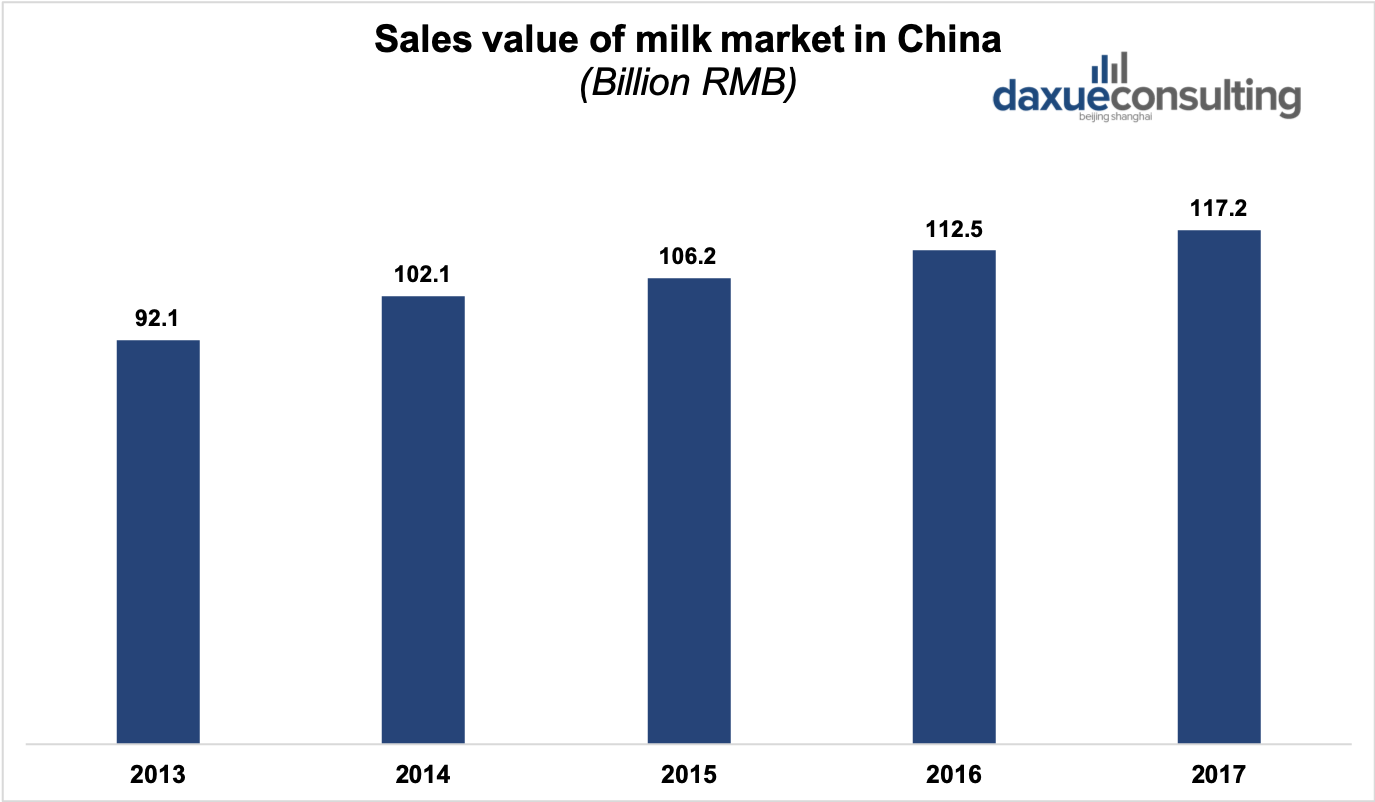

Data source: Qianzhan, Sales value of milk in China

Domestic brands regain trust, imported milk in China faces fierce competition

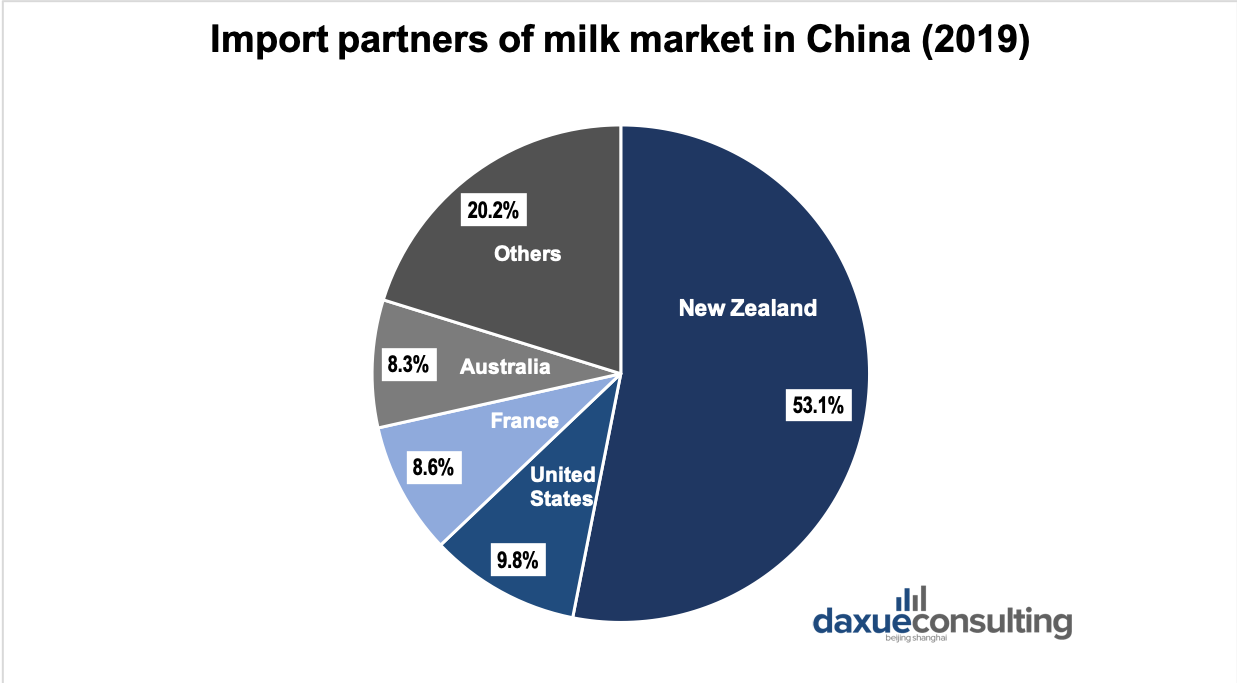

According to IBISWorld, due to the preference of milk consumers in China and demand for middle and high-end milk, import volume has increased steadily. With rising import volume and average prices, the import value of milk in China reached $5.47 billion in 2019, with a YOY growth of 7.6%.

Since domestic Chinese milk brands have dedicate to enhancing the quality of milk they are replacing some import products, which has led to a declining proportion of imports in the domestic demand of milk market in China. As a result, in 2019, imported milk represented 7.5% of domestic demand for milk in China, which decreased from 10.1% in 2014.

Data source: IBISWorld, Import partners of milk market in China (2019)

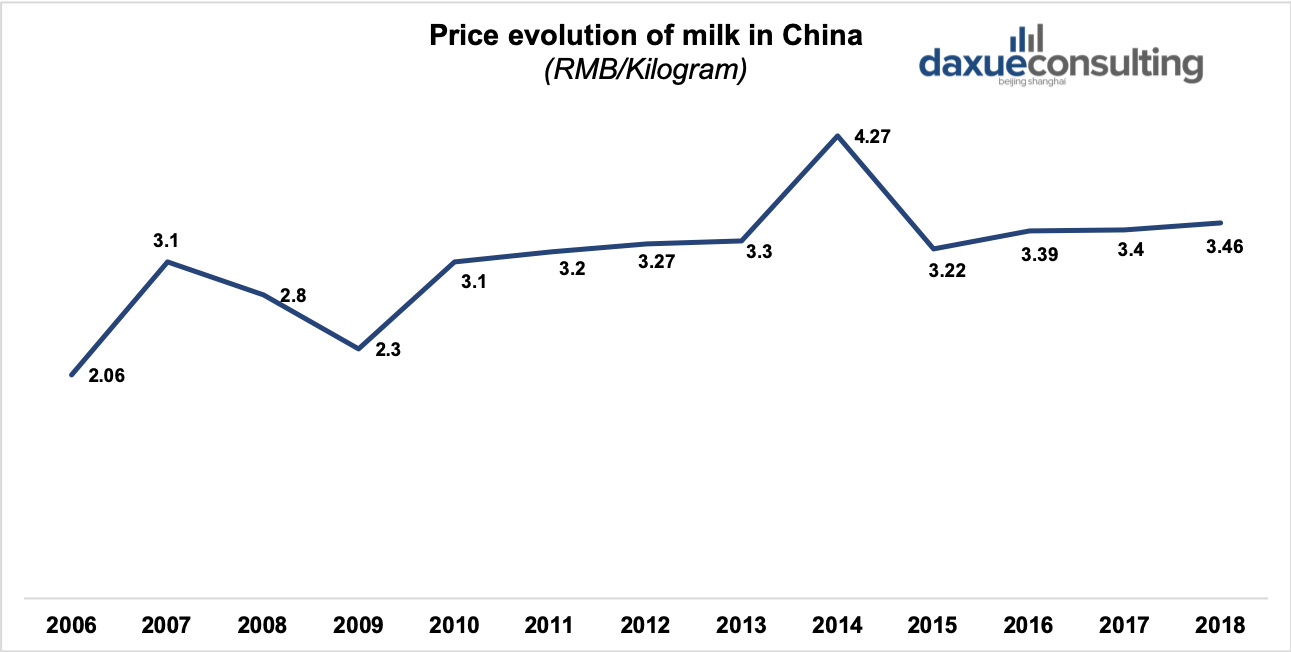

The price of milk in China is gradually increasing

Overall, the price of milk in China has a rising trend. The increasing price attributes to the rapid growth of consumption of milk in China and the condition of upstream supply chains.

Data source: ruzhipincy & chyxx, Price evolution of milk in China

UHT milk is the most popular milk among Chinese consumers

The product segmentation of milk in China is mainly categorized into liquid milk and powdered milk. They are similar in terms of nutrients while different in terms of taste, form and price. Powdered milk consists of the process of dehydration and evaporation, which helps preserve it. Even though it loses its flavor during the dehydration process, it perfectly matches with smoothies, tea and filtered coffee. On the other hand, fresh milk contains more nutrition than powdered milk does and has a better taste.

Liquid milk is the largest segment. According to MarketLine, UHT milk is more popular with milk consumers in China, in contrast to western consumers who prefer fresh liquid milk.

The milk powder segment in China targets both adults and infants. According to Nielsen China, online and offline milk powder sales reached 1.8 billion RMB and 1.5 billion respectively in 2018. Specifically, according to IBISWorld, the infant milk powder segment has been experiencing rapid growth and highly profitable. The market size reached 175.5 billion RMB in 2019 and is expected to reach 216.3 billion RMB by 2024. With the implementation of the two-child policy, demand for infant milk powder is increasing rapidly.

Consumption of milk powder for adults, especially for families, has been rising steadily. Online shopping has facilitated the growth of this segment. The milk powder for adults in China is in the early stage of the product lifecycle by considering its market scale and profitability. Hence the market size of this segment remains stable as milk consumers in China lack product awareness.

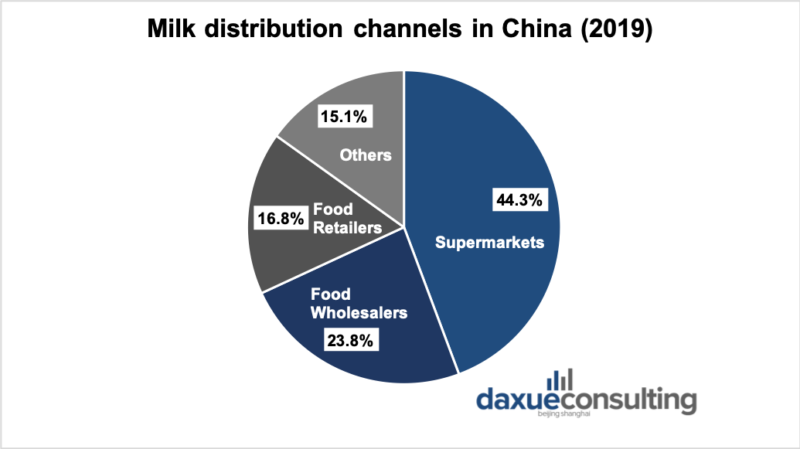

The supermarket is the most important distribution channel in China’s milk market

According to IBISWorld, Supermarkets are the largest suppliers of milk and offer the most extensive product range. Regarding food wholesalers, the majority of milk brands in China sell their products in local regions. They often establish wholesalers in the target province and are in charge of recruiting and managing distributors in tier-two or three cities. Regarding food retailers convenience stores, the revenue generated from these channels has experienced continuous growth. Other markets, including online shopping, have been developing rapidly in recent years. Milk consumers in China purchase milk from online shops due to its convenience and low prices.

Data source: IBISWorld, Distribution Channels of Milk Market in China (2019)

‘Safety’ is the number one concern of Chinese milk consumers. Consumers from different regions and segment groups in China consume milk in different ways.

Regarding Chinese consumers’ attributes of milk, consumers from developed areas value “safety first” while consumers from less developed regions value quality and brand. In general, both of the groups value safety certification, shelf life, nutrition, taste, brand organic, etc.

Families are likely to purchase a large amount of milk on the weekends and prefer fresh milk; office workers and students prefer buying liquid milk with paperboard packaging in the morning.

Milk packaging in China

Regarding the packaging of milk in China, paperboard, plastic and glass are common materials. Domestic milk firms in China mainly outsource both paperboard and plastic packaging to foreign firms such as Tetra Pak, PrePack and SIG Combibloc. Paperboard packaging is normally used in preserving both UHT milk and fresh milk. It helps preserve the quality of the milk. Thus the quality is less likely to go bad easily and can preserve more than six months. Plastic and glass are used in preserving fresh milk. The size of the packaging is mainly standardized as 250 ml.

Photo source: Zhihu, Packaging of milk in China

Chinese prefer to purchase milk in smaller packaging than westerners do. Owing to the habit of some milk consumers in China, it is convenient for students and office workers to carry a single serving size of milk with them. Secondly, the established supply chain and logistics in China cannot support the transportation of fresh milk perfectly. Hence milk with paperboard packaging is more prevalent in the milk market in China as it can preserve for an extended period and does not require a sophisticated logistics system to preserve the quality.

Does being lactose intolerant stop Chinese from consuming milk?

Even though research shows that Asians, including Chinese, are mostly lactose-intolerant, it does not affect the sales of milk in China significantly. According to Zhihu, their consistent milk consumption can be explained by:

- Consumers perceive that a small amount of milk would not aggravate the discomfort of lactose-intolerance, and this might is another reason why packaging milk in small portions popular in China.

- Some people do not even realize they suffer from lactose-intolerance since their symptoms are not obvious.

- Some of them perceive that the ingredients of Chinese milk are adapted to eliminate the effect caused by lactose-intolerance, that is, ingredients such as water and chemicals are added to dilute the lactose.

Brand analysis of China’s milk market

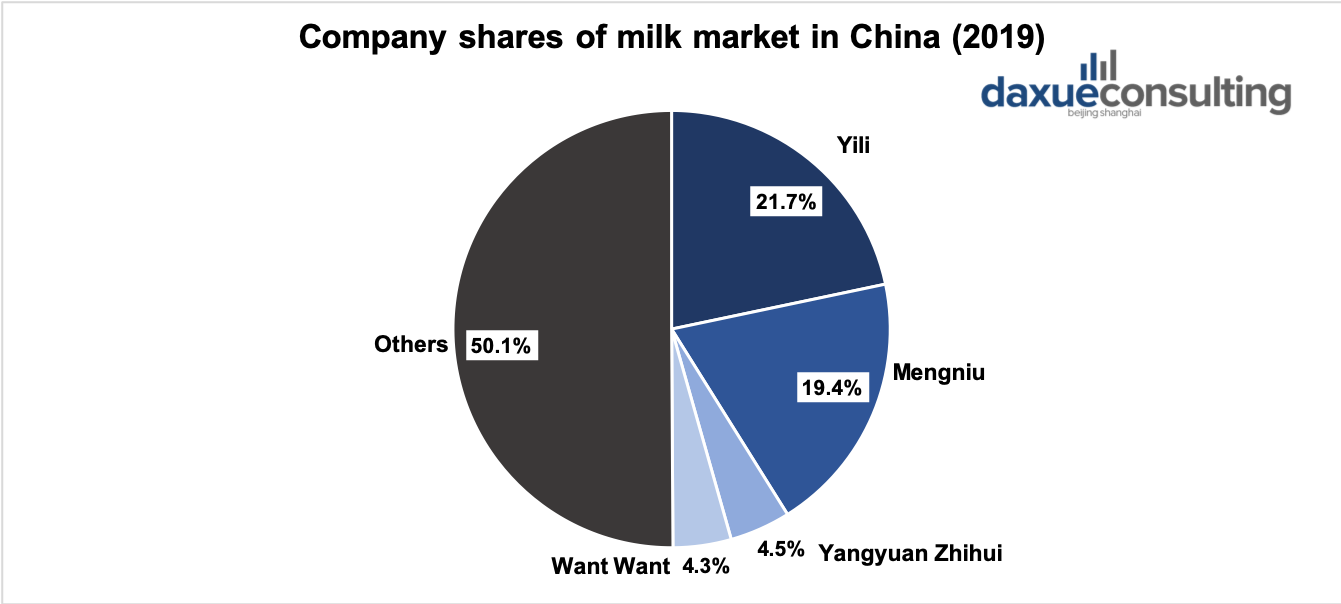

Domestic Chinese milk brands are making a return after being tarnished by scandals

Among the top 10 dairy milk companies, 9 are local brands. Mengniu, Yili, Guangming, Wangzai, Wandashan, Weita Milk and Chenguang are the top seven Chinese domestic brands with two producers originating from Taiwan and Hong Kong. Founded in 1999, Mengniu is the largest dairy milk company in China. It possesses over 20 branches in 15 provinces and exports its products to the US, Canada, Mongolia and South-East Asia. Although it maintains a good reputation, not even Mengniu can escape from the melamine scandal. As a 2008 Olympic Games sponsor, Yili, the second-largest dairy company, has explored a new way to market its product and overcome the scandal.

In 2020, Mengniu and Yili have further consolidated their leading positions in China’s milk market, with more than 30% of market share. Both firms have developed differentiated milk products to capture market share aggressively.

Data source: Euromonitor, Company Shares of Milk in China (2019)

Yili has focused on high-end milk products

Regarding milk products of Yili, even though the company has developed a variety of milk products, it aims to focus on its high-end segment. Its representative product, Yili and Satine, according to Euromonitor, earned the third (7.4%) and fourth (6.7%) place respectively, in the brand shares of milk product (2019). Satine is positioned as the high-end brand as Yili has significant investment across different business units. Shuhua is a lactose-free product and targets lactose-intolerant consumers. School milk targets students and solely sells to schools in China while QQ Star targets kids in China. Wei Ke Zi is the flavored milk product.

Photo source: Yili, Milk Products of Yili

Mengniu has adhered to the product differentiation strategy

Likewise, Mengniu has developed various milk products to tailor to different competing with Yili. According to Euromonitor, Mengniu and Deluxe are the pure milk and earned the first (7.9%) and second (7.4%) place respectively, in the brand shares of milk product (2019). Deluxe is the high-end pure milk product. Future Star targets kid consumers in China while Xin Yang Dao targets lactose-intolerant consumers. Mengniu has also developed flavored milk such as Zhen Guo Li and Nai Te. Zhe Zhi Niu Lai (This cow) is the milk product that targets university students in China. Mengniu has also expanded its product lines to fresh milk (i.e. Shiny Meadow and Green House) which Yili has yet to focus on.

Photo source: Mengniu, Milk Products of Mengniu

Influence of COVID-19 and future trends

The outbreak of COVID-19 has affected lots of industries, including China’s milk market. The pandemic has affected each business unit of the milk’s value chain in China.

The value chain of China’s milk market goes through the process of feed manufacturing, milk production, delivery, processing, packaging, distribution, and lastly, retail. Regarding the upstream business, the pandemic has affected the production of

As the situation is gradually recovering in China, so does the milk market. The government in China has implemented particular policies and subsidized the business involved in the milk’s value chain. These actions have sped up the recovery of the milk market in China.

Fresh liquid milk is the future trend

In 2019, the trend of “freshness” has emerged in the milk market. Key industry players such as Yili and Mengniu have started to invest in fresh milk significantly. The outbreak of Covid-19 may foster the growth of this trend since the National Health Commission of China recommends drinking milk. The government sector has suggested that drinking milk is an effective method to strengthen the immune system. Moreover, milk consumers in China have consistently perceived drinking milk as a means of calcium supplement and skincare. Thus it helps to cure osteoporosis and facilitates growing height. As more and more milk consumers in China value nutrition, taste and freshness, nutrition-added fresh liquid milk is likely to be the future trend in China’s milk market.

Photo source: Sohu, Nutritious and fresh liquid milk sold in small cartons in the Chinese market

Creative product packaging can draw consumers’ attention

In comparison with traditional promotion tools such as advertising and direct selling, creative product packaging is a cost-effective tool to promote products and is popular with young consumers. Hence more and more companies have gradually applied this tool.

Photo source: adquan, Creative product packaging of New Hope Group’s milk

New Hope Group has applied the creative product packaging successfully on its flavored milk. With this co-creation strategy, New Hope Group has collected a list of mottos via social media in China and printed them on the packaging. Meanwhile, the company has designed cute images that are popular among Chinese consumers. These mottos reflect the current Chinese culture and humor of self-depreciating optimism, or passive acceptance of negativity. They are relatable and effectively tease young people’s lifestyles in a lighthearted way.

In conclusion, China’s milk market is experiencing a steady growth in market size and revenue. Domestic milk brands have occupied the majority of the market share. Currently, the dominant milk product in this market is long-life liquid milk. Nonetheless, with the changing consumers’ perception and improving logistics, fresh liquid milk is projected to be the future trend in this market. Moreover, creative packaging is a useful promotional tool to appeal to milk consumers in China effectively.

Author: Amelia Han

Listen to 100 China entrepreneur stories on China Paradigms, the China business podcast

Listen to China Paradigm on Apple Podcast

Would you like to try our South African produced Kosher Long Life Milk packed in Full Cream and Fat Free varients.