The Ice Cream Industry in China: The Biggest Market in the World

Ice cream industry in China shows stable growth

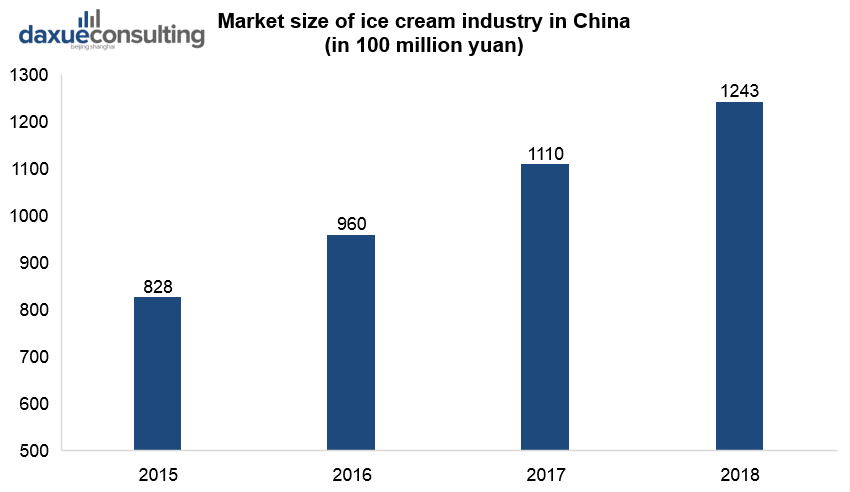

In 2018, the scale of ice cream industry in China reached 124.3 billion yuan, up 11.98% year-on-year. The sales volume was approximately 1.234 million tons, up 3.52% year-on-year.

[Data Source: Guanyan World Data Center, ‘Market size of ice cream industry in China’]

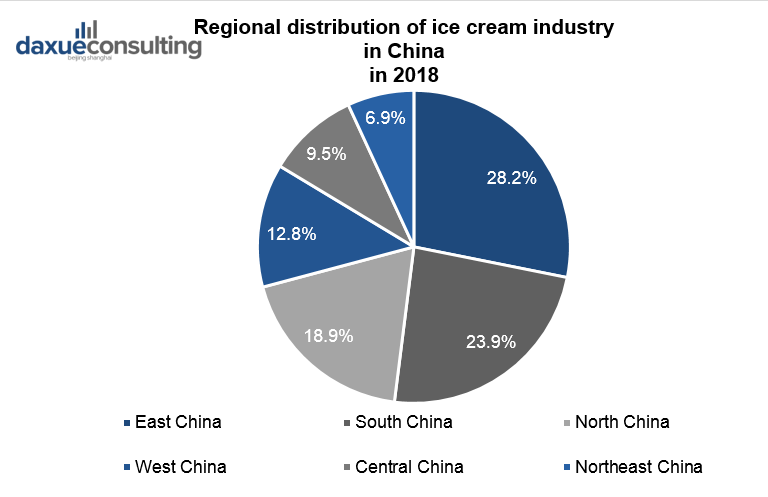

The market size distribution of ice cream industry was dominated by East China in 2018. It accounts for 28.2%. Market size in Central China was 9.5%, in South China 23.9%, in North China 18.9%, in Northeast China 6.9%, and in West China 12.8%.

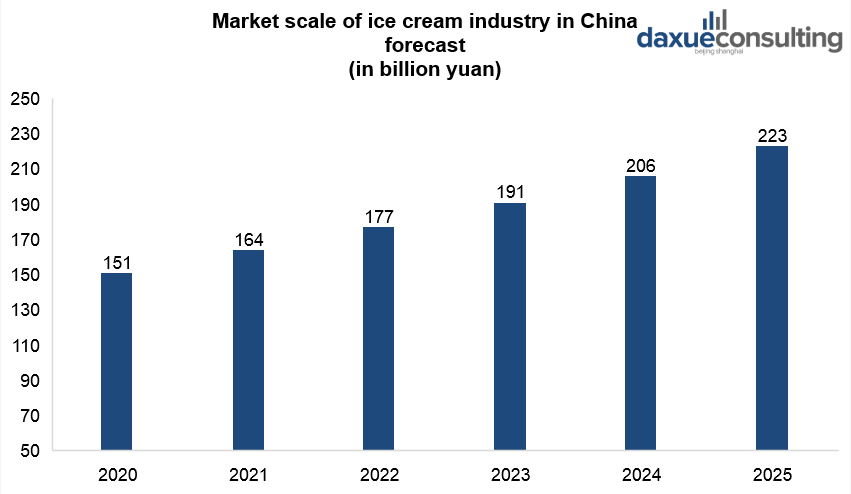

With the development of China’s economy, the income of residents will continue to increase. Therefore, the ice cream market still has a lot of room for improvement. Forecast shows that the market size of the ice cream industry in China will reach 223 billion yuan in 2025.

With the continuous expansion of the industry’s market space, the industry’s total profit will continue to increase. The industry’s total profit in 2019-2025 will maintain a year-on-year growth rate of about 3% -6%.

Ice-cream shop market shows is growing

Ice cream shops market in China grew 14% to reach an estimated 41 billion yuan in retail sales value in 2018. Forecast predicts that the ice cream shops market will grow further at a CAGR (compound annual growth rate) of 11.9%. It will reach 71 billion yuan in the five years to 2023.

COVID-19 impact the ice cream consumption in China

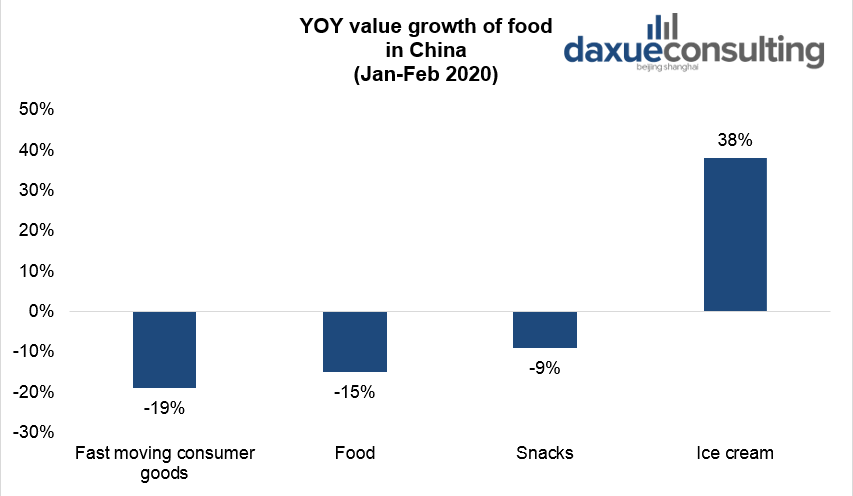

During the first two weeks of the coronavirus outbreak in China, in-home ice cream sales increased 18% year on year. The following fortnight this accelerated to 38%, surpassing the growth of both food as a whole and snacking. This is quite a different effect to 17 years ago when SARS hit China and ice cream sales lagged those of food and other snacks.

Chinese consumption habit is different

Chinese food buying habits are different from Western ones. In China, ice cream is something you enjoy on the spot where you buy it. This is partly due to the late development of a reliable cold chain in China. Currently this is changing due to dramatic increase of online shopping in China.

Despite the growth, ice cream has the lowest penetration rate among Chinese respondents when compared with Chinese and Western desserts. According to Mintel, 22% of Chinese respondents haven’t had ice cream in the last 12 months in 2018. Just 12% have not had Western desserts and a mere 8% have not had Chinese desserts. Moreover, over a tenth (12%) of Chinese respondents say they eat both Chinese and Western desserts. Just 3% claimed that they contribute ice cream very often.

New ingredients attract Chinese consumers

Almost two-thirds (64%) of dessert consumers would like to try ice cream that incorporates seasonal fruits (e.g. pomegranate, grapefruit). Mintel research also reveals that 43% of dessert consumers in China would like to try ice cream with superfoods (e.g. chia and avocado).

The use of natural ingredients is becoming more important in the food and drink industry overall, including the dessert category. In fact, consumers are willing to pay more for options with natural ingredients.

In past few years, China has surpassed the US to become the largest ice cream market in the world. At Daxue Consulting, we observed in a previous article that this explosive growth has given rise to both international and domestic powerhouses. In 2015, the ice cream production volume in China was 3.06 million tons, and total sales value yielded over CNY 40.8 billion (USD 6.04 billion). Through a combination of forces is driving increased consumption, one of the chief proponents is rising middle-income stratum in China. With more disposable income and a proclivity for goods enjoyed in the West, ice cream consumption has never been higher in China.

Still, Chinese have yet to surpass the West in terms of per capita consumption. According to Mintel, US citizens were still the largest ice cream consumers in 2014, as they consumed on average 18.4 liters of ice cream per capita. Contrast with Chinese consumers, who ate less than four times that amount on average. The latest data from Mintel shows that Chinese ice cream sales value climbed to CNY 96 billion (USD 14.21 billion) in 2016, which was 20% higher than last year. In addition, the consumption volume in China reached 4.3 billion liters in 2016.

[ctt template=”4″ link=”P3eMi” via=”yes” ]Chinese ice cream sales value climbed to CNY 96 billion (USD 14.21 billion) in 2016.[/ctt]As higher leisure spending increasingly contributes to the growth of the ice cream industry in China, emerging consumer tastes and interests are changing how Chinese consumers are taking their ice cream. All things considered, this trend of growing consumption and new preferences is likely to continue for the foreseeable future.

Engines of Growth

Of all the growth drivers of the ice cream industry in China, perhaps the greatest is the increasing average socioeconomic levels and incomes across China.

In the past decade, according to the National Bureau of Statistics (中国国家统计局), annual Chinese salaries have tripled from CNY 21,001 (USD 3,108) in 2006 to CNY 67,569 (USD 10,000) in 2016. In the first quarter of 2017, the average monthly disposable income in China was CNY 7,184, which is a 7 percent year-on-year increase from 2016, according to Global Economic Data (全球经济数据). With higher income levels, Chinese citizens are spending more than ever before on leisure goods, and have taken particular interest in non-traditional desserts like ice cream.

When considering China’s population of over 1.38 billion, the increase of total consumption is staggering. Also, as current rapid economic development in China attracts more foreign enterprises and domestic investment in the frozen food sector, the industry is beginning to develop and address that growth accordingly. Notably, the frozen foods logistic industry is expected to maintain a 25% increase in market size and reach CNY 470 billion (USD 69.6 billion) in 2017. Thankfully, China is investing in improving the retail infrastructure and capability of the frozen food industry and its diversified distribution channels, which will make meeting the growing demand for ice cream a reality.

Ice cream has become a daily enjoyment for almost everyone in China. Photo source: Daxue Consulting

Product Adaptation According to Current Trends in China

More bizarre flavors

From the perspective of ice cream companies, ice cream consumption behaviors have changed in the past few years, which is presenting both challenges and opportunities. For Nestlé (雀巢), the growth of the ice cream industry in China has revealed two interesting trends. Not only are Chinese consumers looking for more refreshing and cold foods to beat the summer heat in China, which can reach 30℃- 42℃ on average in big cities, but also are gravitating towards subtler flavors. The traditional milk, chocolate, and vanilla flavors are not satisfying middle-class Chinese customers anymore. These new trends are forcing companies to adjust by diversifying their flavors and developing new products for the changing preferences of a growing upper middle-class in China.

For instance, Wufeng (五丰) introduced a spicy chocolate flavored ice cream called Mengxiaola (萌小辣) in 2016. Moreover, an ice cream store called Global (全球) has squid ink flavor and other unique flavors from across the world. The yolk ice cream can be found in Bonus (陆记蟹行), a Chinese ice cream store in Shanghai. These are all newly invented flavors and consumers are keen on trying them. On a widely used restaurants review and recommendation app called Dianping (大众点评), Global scored 8.3 on a scale from 1 to 10 in terms of its flavors, which is a pretty high mark.

Less sugar, less cholesterol, healthier food material

Considering that China has the largest number of diabetes cases in the world, an increasing number of people are calling for healthy or low-fat diets, which facilitates the creation of new ice cream lines. Indeed, conventional ice cream ingredients may contain high sugar, fat, and additives, but to satisfy customers’ healthy requirements, many manufacturers are returning to natural ingredients. For instance, in Europe and the U.S., many brands are experimenting with 35 percent of concentrate whey protein instead of dried skim milk for a healthier end product, a design choice that Chinese brands may seek to emulate.

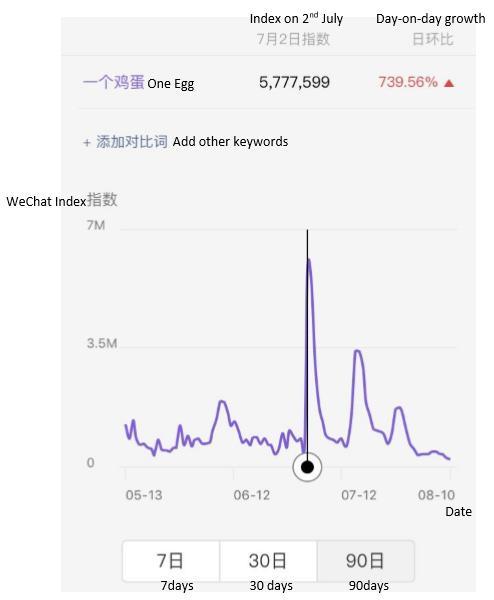

Noticeably, frozen yogurt has also become a popular choice in China. The probiotics found in frozen yogurt help conserve some of the nutritional value in ice-cream, which is conducive to maintaining beauty, slimming, and digestion. Another example is the “one egg” ice cream (一个鸡蛋) introduced by Deshi (德氏), a well known Chinese ice cream company, in 2016, the special ‘’egg + oats’’ ingredients draws a significant amount of attention. Astoundingly, In Dongbei (东北) region, the average daily sales volume of “one egg’’ was 2 million in the beginning of 2017.

The WeChat index of “One Egg” ice cream (一个鸡蛋) remains high this summer, with a massive peak in searches in July. Source: WeChat Index (微信指数).

Offer DIY experience

As Chinese are putting more focus on experience as opposed to the food itself, ice cream are no longer just seen as just treats, but as a product of modern life. In traditional Chinese mindsets, eating very cold food is perceived as adverse to health; however, the considerable impact of Western ice cream has changed perceptions. Since overseas ice cream companies began entering China in the 1990s, ice cream sales in China have maintained a 20% increase each year.

Nowadays, opening DIY experience ice cream stores is a new strategy to cater to the requirement of customers. Nestlé(雀巢), Yili (伊利), and the Japanese brand Meiji(明治) have all invested over CNY 1 billion for developing new ice cream projects in 2016 to win more shares on the market.

In May 2017, Magnum (梦龙) reopened its DIY experience shop called “Pleasure Store” in K11 Shopping and Art Center, Shanghai for the third time, which rekindled the enthusiasm of many ice cream enthusiats. In other cities like Nanjing (南京), Beijing (北京), Chengdu (成都), Pleasure Store also left footprints in the busiest commercial districts like Jinmaohui (金茂汇), Sanlitun (三里屯) and Taiguli (太古里) in the last two years. Notably, this DIY shop only opened for one month, the short time period stimulates consumers to seize the opportunities to try. The DIY experience does not only endow ice cream with higher value, but also strengthens the ice cream brand and customers relationship.

In its experience shop called “Pleasure Store”, Magnum (梦龙) offered a fascinating experience which included a wide array of toppings, sauces, and other garnishes for truly unique products for every consumer. Photo source: Baijiahao (百家号)

The aesthetic advantage

To sustain people’s interest, constant innovation is a necessity for every ice-cream brand striving to succeed. Hence, more and more unique styles can be seen in the ice cream market, and some of them are considered as “food celebrity”(“食物网红”)on Weibo because of their novelty.

Huang Cheng Chi Zhu (皇城吃主), a food KOL on Weibo who has more than 490,000 followers, highly recommended Gooble(果堡), an ice-cream that turns the fruit into the wrapper of the ice-cream, which is both aesthetic and nutritious.

Food KOL Huang Cheng Chi Zhu (皇城吃主)] introduces Gooble: a relatively healthier option for ice cream lovers. Source: Weibo (微博)

Another trendy type is the shining ice cream (闪光冰淇淋), which is made by putting ice-cream on top of sparkling soda water in a delicate jar. This eye-catching design attracts numerous customers to queue for it and post pictures of it on social media afterwards. Additionally, mini ice-cream (迷你冰淇淋) is a new fashion. For instance, Cornetto (可爱多) launched a mini set of ice cream collaborating with Line Friends (连我), a famous cartoon brand in June, 2017. This mini set of ice cream is priced at CNY 15.9 per box and has received wide popularity in China. The topic #Mini Cornetto LINE FRIENDS# on Weibo has accumulated 390,000 reads up to now.

Chinese citizens beating the summer heat with the new “Shining Ice Cream” (闪光冰淇淋) on top of the colorful soda water. Photo source: Sohu (搜狐)

Brands Competition Escalated: Domestic VS Foreign

[ctt template=”1″ link=”8i80Z” via=”no” ]Fresh milk ice cream could be a hit as Chinese’s awareness of healthy diet is rising. [/ctt]The expansion of domestic brands in the ice cream industry in China has not gone on unchallenged, has many international brands are innovating as well. The competition between domestic and foreign ice cream brands has entered a critical point after ten years of development. Here is a table presenting all the major Chinese and foreign brands on the market now.

Chinese ice cream brands

| Name | Group |

| Meiyile(美怡乐) | Meiyile(美怡乐) |

| Qiaolezi(巧乐兹) | Yili(伊利) |

| Binggongchang (冰工厂) | Yili(伊利) |

| Little pudding(小布丁) | Yili(伊利) |

| Guangming(光明) | Shanghai Yimin(上海益民) |

| DilanShengxue (蒂兰圣雪) | Mengniu(蒙牛) |

| Suibian(随变) | Mengniu(蒙牛) |

| One egg(一个鸡蛋) | Deshi(德氏) |

| Naipa(奶葩) | Deshi(德氏) |

Foreign ice cream brands

| Name | Group | Nationality | Date of group entry in China |

| Dairypure (纯牛奶冰淇淋) | BAXY (八喜) | US | 1990 |

| Nestlé flower cone (雀巢花心筒) | Nestlé(雀巢) | Switzerland | 1990 |

| Mega (魔爵) | Nestlé(雀巢) | Switzerland | 1990 |

| Magnum(梦龙) | Wall’s(和路雪) | UK | 1992 |

| Cornetto(可爱多) | Wall’s(和路雪) | UK | 1992 |

| Viennetta(千层雪) | Wall’s(和路雪) | UK | 1992 |

| Green tongue (绿舌头) | Wall’s(和路雪) | UK | 1992 |

| Haagen-Dazs(哈根达斯 | Haagen-Dazs(哈根达斯 | US | 28th June, 1996 |

| Blizzard(暴风雪) | Dairy Queen(冰雪皇后) | US | 2005 |

| Meiji(明治冰淇淋) | Meiji Dairy(明治乳业) | Japan | 2006 |

| Poonmanee (蓬玛尼) | Poonmanee (蓬玛尼) | Thailand | 2015 |

| Tip top | Fonterra(恒天然) | New Zealand | 2016 |

| Walrus (海象) | Walrus (海象) | Russia | 2016 |

While domestic producers are superior concerning distribution channels and prices, international brands are known for higher quality. Fonterra Co-operative Group (恒天然集团) launched Tip Top(哈奇贝奇), a beloved New Zealand ice-cream brand in China and collaborated with Tmall (天猫) to deliver them efficiently. Seeing the tremendous potential in a geographically close market, a Russian fresh milk ice cream brand Kopobka (格里诺夫) also decided to get in on the action. The proportion of butter in Kopobkais approximately 15 percent-18 percent, which is healthier than most other ice cream brands.

Shawn Lou, senior project manager at Daxue Consulting, stated that fresh milk ice cream could be a segment with large potential in China. Photo source: Daxue Consulting

According to Shawn Lou, senior project manager at Daxue Consulting, fresh milk ice cream could be a hit as Chinese’s awareness of healthy diet is rising and fresh milk contains the largest amount of nutrition among all kinds of liquid milk. Kopobka also benefitted by partnering with various distribution companies in Chinese industry to ensure quality deliveries. Consequently, the sales of Kopobka mounted to CNY 20,000 CNY on the first day of it’s sales on the Silk Road Expo (丝博会), an exhibition of new products in various industries from countries and cities near the Silk Road (丝绸之路), making a grand entry in June 2017.

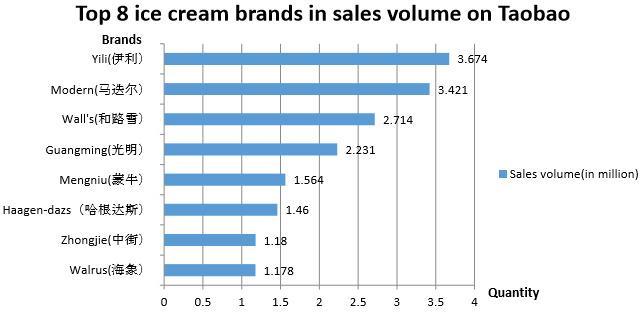

The rising of foreign ice-cream brands can also be identified from the data on Taobao (淘宝).

Chinese brands Yili(伊利), Modern (马迭尔), Guangming(光明), Mengniu (蒙牛), Zhongjie (中街) taking over the sales volume ranking. Source: Maijia(卖家网)

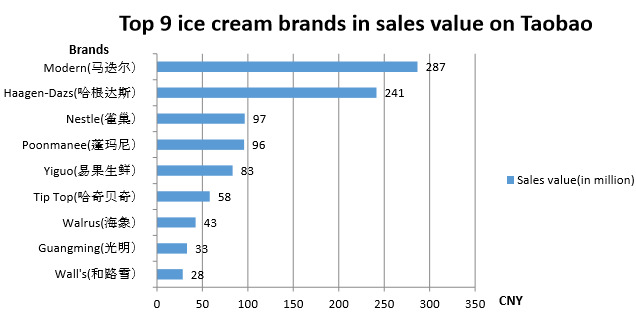

Six international brands ranked in top nine of sales value due to higher quality and rising popularity, namely Haagen-Dazs, Nestlé, Poonmanee, Tip Top, Walrus and Wall’s. Source: Maijia (卖家网).

The higher chart of the two above presents the top eight ice cream brands in terms of sales volume, and the lower displays the top nine brands in sales on Taobao in June 2017. Notably, Chinese brands still dominate with regard to sales volumes, with only three foreign brands; Haagen-Dazs (哈根达斯), Wall’s (和路雪) and Walrus (海象) cracking the list. It is also interesting to note that foreign brands took six places of the sales value ranking:Haagen-Dazs (哈根达斯),Nestlé (雀巢), Poonmanee (蓬玛尼) , Tip Top (哈奇贝奇), Walrus (海象) and Wall’s (和路雪). By occupying these slots in sales value, they represent a declining effectiveness of the domestic brands’ low price strategies. As Chinese consumers are prone to switch to the high-end ice cream market, which is priced at between CNY 150 and CNY 300, they are willing to pay extra for premium quality or attractive features of the products, which is a golden opportunity for overseas brands.

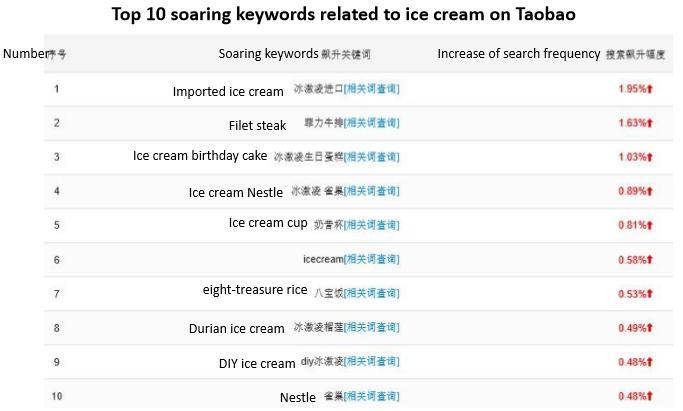

Keywords related to foreign ice cream brands soars on Taobao in June, 2017. Source: Maijia (卖家网)

Here, we see that the top 10 keywords related to ice cream industry from 12th June to 18th June on Taobao, with “imported ice cream” (冰激凌进口) being the hottest search keyword with a growing percentage of 1.95 %. The search frequency of the keyword “ice cream” and “Nestlé” (雀巢) also increased sharply with 0.58% and 0.48%, ranked 6th and 10th respectively.

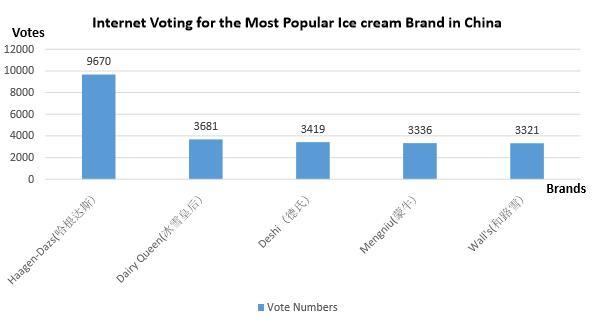

Foreign ice cream brands take the leading position in the internet voting of popularity. Source: CNPP & Maigoo (买购网)

The results from a recent internet poll of 41,823 people showed that Haagen-Dazs is the most popular ice cream brand in China from a comprehensive perspective placing over three popular domestic brands in the top five and 51 other brands. Haagen-Dazs received 9,670 votes, followed by Dairy Queen (冰雪皇后) at 3,681.

Still, domestic brands have certain advantages in the homeland. For instance, De Shi was the first enterprise in ice-cream industry that held new product release conference in the Great Hall of People (人民大会堂) in February 2017,helping to convey a trustworthy, people-focused image. Holding a conference in this place used for formal government meetings and high-grade business conferences, stands for high recognition and great honor for companies.

There are still some well known foreign ice cream brands that have not entered China, like Coppelia (葛蓓莉亚), BimBom of Cuba, Crescent Ridge Dairy (新月山脊) and Handel’s Homemade (汉德尔自制) from the U.S. Seeing the large potential in Chinese ice cream market, it is highly probable that these companies will attempt to enter China in the near future.

CONTACT US TO LEARN MORE ABOUT THE CHINESE MARKET

Daxue Consulting’s Expertise: Market Entry Study

Daxue Consulting helped a client, a French frozen food company, to develop its line of dairy products in Chinese brick and mortar grocery shops. Initially, we conducted a market entry to help understand the competitor’s positioning in China. The second stage of the project was to implement a market survey with a focus group in first and second tier cities in China. Our research revealed that Chinese ice cream consumes in grocery stores are predisposed to first look at the brand, then the flavor, and then the price to make their decision. Indeed, the aesthetic appeal of a product is therefore paramount in the ice cream industry in China.

In the food and beverage industry and in other practices, our clients share our passion for results and success. For more on our expert insights on and our work in the Chinese market, please see our site, follow our newsletter, or reach out to us to learn more.

Fascinating – a very detailed and comprehensive review.

Thank you!