Increased need to function in China: Overview of the growing energy and tonic drink trends and opportunities | Daxue Consulting

Functional drinks are being widely consumed in China, with a variety of purposes in mind, but all with the same want- to be immediately consumed. Functional drinks have gained a reputation of becoming increasingly more important as a subsector of the non-alcoholic and canned beverages industry which further divides itself into energy, sports and nutrient-enhanced drinks.

Functional drinks in China are a big part of consumer lives regardless of individual demographics such as age and gender. This is as they address personal needs and wants that arise from different lifestyles as stated by Gonzalez de Mejia and Heck in the volume of Functional and Speciality Beverage Technology. This can include functions such as providing an energy boost, aiding the prevention of specific diseases or aging, fighting fatigue and stress, and making up for the lack of healthy eating. This sector is increasingly seeing high growth and increasing demand as consumers seek out these drinks for their own individual purposes.

Functional drinks market in China: The Growth of Energy Drinks

Energy drinks as a sector are growing rapidly with sales forecasted to reach 88 billion RMB in 2019 in China alone. This can be compared to 2009 where the sales revenue totaled 9 billion, showing staggering growth in the last 10 years. In terms of volume, in 2015, a CCM analyst reported the sales of energy drinks to be 1.3 billion liters, with a yearly increase of 25% and a sale increase of 15% yearly overtime to a total of 64.5 billion RMB that year. This astounding growth has attracted the attention of the world stage where China now possesses both the largest energy drink market and the highest growth rate within this market worldwide. Within this market further, Redbull is the most dominant energy drink in China with 80% of the market share. The brands Eastroc and Hi-Tiger are the next highest followed by a wide range of Chinese and International brands.

Consumption Habits and the Need for Concentration and Energy Properties

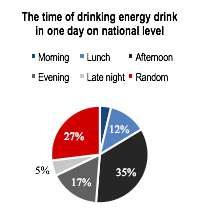

In terms of consumption, the Chinese population often makes their purchasing decisions on the basis of convenience and availability, preferring ready-to-drink beverages. Further, on a national level, China tends to consume energy drinks more commonly during the period of the afternoon until early evening from 1:30 pm until 6 pm. This is with 35% of energy drinks being purchased in this time period and 27% of consumption happening on a random basis. Of those who bought energy drinks in the afternoon, 39% of purchases were made at a convenience store and 33% were made at a supermarket. This shows a want for energy drinks near the end of the day when consumers need a renewal of concentration and energy.

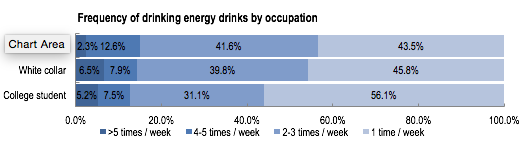

China’s beverage industry: Occupation as a determinant

Occupation is a determinant which, due to the needs of a Chinese person’s lifestyle, can provide insight into the purpose of consuming energy drinks. The typical consumption for the groupings of students, white collar and blue collar workers was 1 to 3 cans or bottles per week. The top drinking occasions for these were sports, working and studying. Overall, however, blue-collar workers purchase drinks more frequently than both white-collar workers and students who had a lower percentage as they only purchased once per week. Further, it was found that those who purchase drinks more frequently were more likely to buy more than one drink in a transaction.

For students specifically, energy drinks are bought in order to help them stay awake and to assist them in concentrating on studying. They have a need to stay focused and be efficient for a long time and this drives them to seek an energy boost. Their needs are not anticipated as they usually feel tired or a lack of concentration before buying. Therefore, the need to stay focused drives them to buy a drink in a convenient location in order to stay awake. Additionally, this is similar to blue-collar workers who need energy for a long period of time at work and often will grab a convenient boost during their break where needed. Comparatively, white collar workers utilize energy drinks collectively for a renewal of energy but in different circumstances. They often consume drinks whilst at work to stay on task but also use them during social situations. This includes late night events which can take the form of fancy dinners or in cocktails at a bar or nightclub.

Functional beverages market in China: Age as a determinant

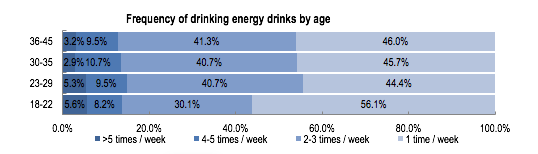

Age is also a driver of different consumption habits particularly in regards to frequency. The frequency of consumption by the 18 to 22 year old age group was a lot less than their counterparts surveyed from ages 23 to 45. This was with over 50% of the younger age group only consuming them once a week. This can be attributed to their younger age, their natural energy, and the lesser responsibilities they already possess at that stage of life.

This age group further contains a large portion of those studying who as an occupation grouping also drink significantly less. Comparatively, the age groups ranging from 23 to 45 consume energy drinks more frequently with consumption being at least 2 to 3 times a week. This is due to the more demanding nature of their stage of life which comes with greater responsibilities and demands. This can include work, financial and family responsibilities among others demands specific to individuals. Therefore, due to these demands, consumption is higher for these age brackets collectively. However, a frequency is slightly differentiated between these brackets with 23 to 29 year olds having a small margin of the higher overall quantity of consumption overall.

Chinese soft drinks: Distribution trends

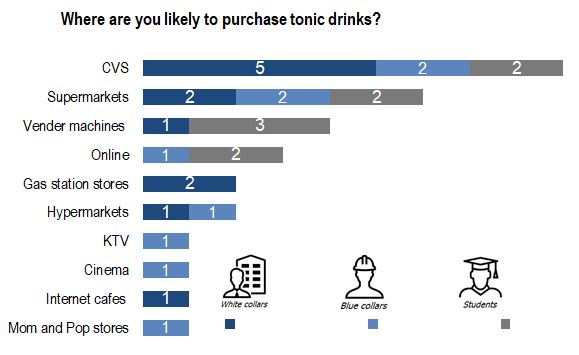

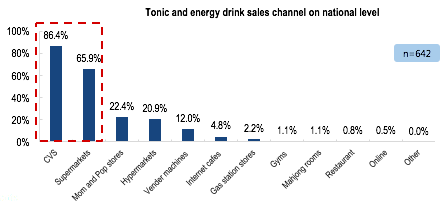

Distribution is fundamental to the functional drink industry with growing consumer purchasing power. The large availability of options along with a growing income for the emerging urban middle class in China makes the correct placement of products essential when considering distribution. Statistically, convenience stores are the most popular nationally, with 86.4% of purchases being made at this channel and supermarkets also are significantly higher than other mediums at 65.9%. Further, consumers of all groups are more likely to purchase on these two channels. Students, however, are an anomaly with their additional preference towards vending machines. This can be largely attributed to the study environment they are in and the comparatively limited options for ready-to-consume drinks surrounding them, especially at schools and universities. This is definitely an area that brands can capitalize on in order to better tune into the student demographic in China especially as their needs are often sporadic and where convenience may overtake brand loyalty.

Ease of access and convenience is nevertheless important to all demographics with the growing practice of out of home consumption especially in tier one and tier two cities. Brands looking to enter the market should focus on distributing firstly to convenience stores and supermarkets due to their popularity along with vending machines surrounding study spaces. Subsequently, they should branch out onwards to mom and pop stores and hypermarkets in order to increase brand awareness and sale expenditure.

Tonic drinks in China: The need for energy, nutrients and refreshment in one drink

China is undergoing a change currently as the emerging urban middle class increases the demand for higher quality and healthier products. The demanding fast-paced lifestyle and responsibilities of Chinese consumers drive them to consume drinks to stay more attentive but that also provide health benefits and taste great.

Healthier consumption habits and natural beverage demand

Recently, in China, there has been a greater demand for natural beverages as consumers turn to healthier consumption habits. There has been an increased awareness surrounding food and beverages with more western influence in purchasing. This is seen with 40% of Chinese consumers paying more attention to the ingredients of items as they specifically look for healthier and more natural ingredients. Moreover, consumers have become more concerned about the sugar level in drinks. This is particularly evident as when searching for energy drinks, a common question being asked by the online community is whether or not ‘it is dangerous to drink energy drinks often’. This shows an awareness of their consumption habits and concern for their health with this is further being illustrated with China being ranked the world’s most health-conscious country according to a BCG survey conducted in 2014. This health-conscious mindset and necessity have to lead to huge potential in the market for more natural beverages especially as consumers seek out information and are willing to pay more for products that fulfill their needs.

However, they are still concerned about the performance and functional benefits the beverage may bring with the same community asking ‘what brand of energy drinks work well’. Moreover, when asking the Chinese community their perception of energy drinks, the keywords ‘refreshing’, ‘replenish energy’ and ‘with various nutrients’ were used to describe them. This is as the busier lifestyle of China’s growing urban middle class has caused a need for more energy and more nutrients that are missed in not having balanced and healthy meals every day. The lack of these things can be made up by consuming the taurine and vitamins that are present in functional drinks and are convenient and save time for consumers. This is further evident with Chinese consumers wanting drinks that are not only healthy but that look and taste good as well. As a result, Chinese consumers are looking for drinks with health benefits that help them regain energy whilst also enjoying a refreshing and appealing taste that makes them want to consume the beverage.

Opportunities for brands wanting to enter the Chinese functional drinks market

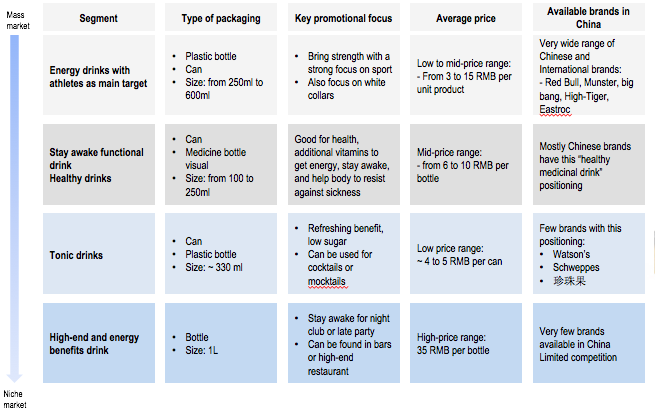

The market for energy and tonic drinks can be broken up into four main segments. All of which have many opportunities but with stronger competition within the energy drinks targeting athletes. Whilst all segments are experiencing growth, functional and healthy beverages, with the healthier consumption habits of the Chinese, particularly has opportunities for growth. With a lot of Chinese brands advertising in this category, brands can still come in with a foreign product that, due to the growing western interest by the Chinese and the disposable income available to the emerging middle class, is an exciting investment opportunity for foreign companies to enter the market space. By emphasizing the energy and health benefits to be gained and great taste along with an organization’s expertise as a foreign brand, interest will be sparked by Chinese consumers who are searching for new products and healthier options. This is further true with the trust Chinese consumers place on products and brands from western countries.

High-end and energy benefit drinks, especially foreign brands, are more of a niche market currently but as the middle class grows there is an opportunity for foreign brands to enter this market space. Additionally, the tonic drinks sector has prospects for growth especially as Chinese consumers look at sugar consumption and healthier options. Further, as a whole, in global beverage consumption in 2021, China is expected to reach 47.2% in comparison to 17.9% which is North America and Western Europe combined. Moreover, China is also the biggest market for carbonated soft drinks which are drinks that contain nutrients or an added health benefit although the consumption per capita is lower than in western countries. This further indicates the growth China is about to undertake and the opportunities that are available to those wanting to enter the market. This is especially with the expanding consumption and the growing interest and trust in foreign and western products. The functional beverage industry has big things on the horizon in China.

Author: Jessica Farrell

Finding accurate data concerning distribution and supplier in China has become nearly impossible. Daxue Consulting has the capacity of screening in China with the help of our nationwide reach network involving main actors of universities, industries, and cities.

So, to use such a service as Distribution & supplier screening in China and find answers to all questions do not hesitate to contact our project managers at dx@daxueconsulting.com.