Carrefour in China: 25 years of success ends with slow market exit

In China, Carrefour used to be the largest foreign retailer. However, after 24 years of operations it has taken steps to leave the Chinese market, where it was the fastest-growing among all foreign retail companies. On 23rd June 2019, Carrefour sold 80% of its share of Chinese stores to Suning International. As of March 2019, Carrefour China operated a network of 210 hypermarkets and 24 convenience stores in 22 provinces and 51 large and medium-sized cities. The network had about 30 million members.

Market Entry and Development

Carrefour entered China in 1995 through a joint venture and opened the first large hypermarket – Beijing Chuangyi Store. Enjoying first-comer advantages, Carrefour in the Chinese market had remained the fastest-growing foreign retailer for about two decades. Problems began arising when digital technologies came to the Chinese market in 2010.

Expansion Phase

Carrefour expanded throughout China in just a few years, led by its China CEO Shi Lerong. Between 2003 and 2006, Carrefour in the Chinese market was the fastest expanding foreign retailer, with over 10 stores opening each year. During this time, Carrefour had established several flagship stores and procedures in China. In 2011, Carrefour set up a top-level food security lab in Beijing – the first of its kind in China. The lab links 42 smaller labs together to enhance food security, becoming an example of the provision of high-quality food.

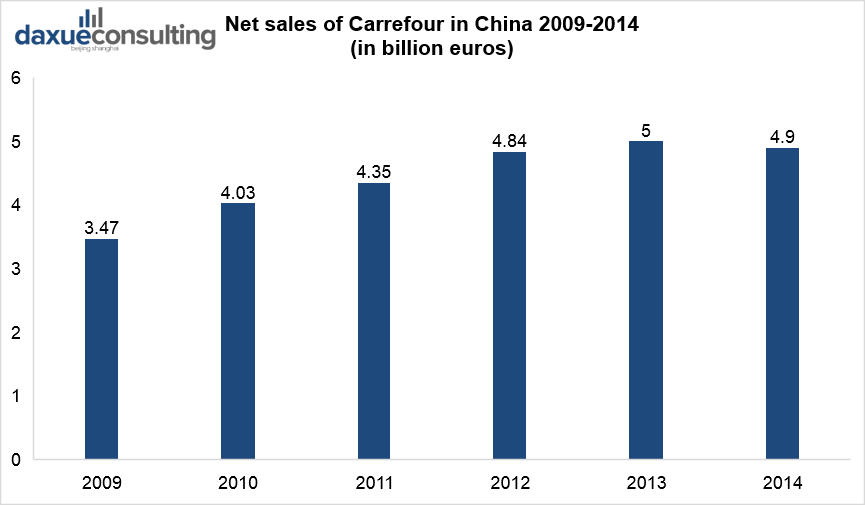

From 2009 to 2014 the sales of Carrefour in China had stable growth, reaching 4.9 billion euros.

Data Source: Statista, Net sales of Carrefour in China 2009-2014

Carrefour decline in China

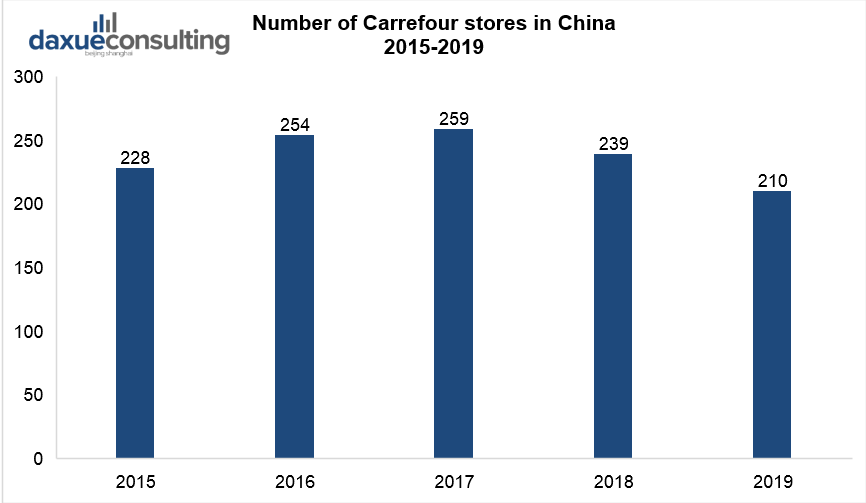

In 2009, Taiwan-based RT-Mart replaced Carrefour China as having the largest number of retail stores among foreign retail investors. In 2010, online retailing started to soar in China. By 2017, China’s e-commerce market became the largest in the world, accounting for 40% of worldwide e-commerce transaction. China’s online retail market has also become the world’s largest, with 38% annual growth rate (US$830 billion). To respond to the changing habits of Chinese consumers from in-store shopping to online shopping, Carrefour started to close some stores. The first store closure was Xiaozhai store in Xi’an. By the end of 2015, Carrefour had 228 stores. In the same year, it closed 18 stores, with only 210 outlets at the time of its exit in 2019.

Data Source: Statista, Number of Carrefour stores in China 2015-2019

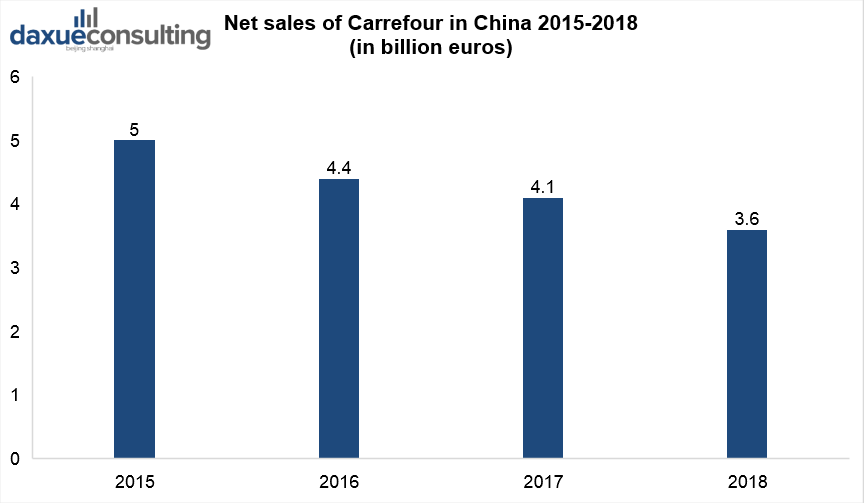

In 2015 the sales of Carrefour in the Chinese market started to decline and reached a low of 3.6 billion euros in 2018.

Data Source: Statista, Net sales of Carrefour in China 2015-2018

Carrefour’s measures to cope with decline

To respond to Chinese consumers’ preferences for convenience, Carrefour opened its first convenience stores in China in 2014. Carrefour Easy and Carrefour Express convenience stores opened in residential areas in Shanghai, targeting middle-class residents. The fast growth of its convenience stores contributed to Carrefour’s store and sales growth rate in 2016. According to data from China Chain Store and Franchise Association, Carrefour was 11th largest retailer by sales in 2016. Besides, it ranked 4th place among foreign retailers in China. In 2015, Carrefour introduced its online shopping tool to boost its market share.

In the same year, Carrefour opened its first shopping mall in Beijing. It rents out its store spaces to other retailers to attract customer flow and spread costs. It was also the first time that Carrefour purchased land to build and manage a mall.

Failure in terms of e-commerce

The rise of e-commerce has forced the transformation of traditional retailers’ businesses, but Carrefour has been too slow. The problem was a bad shopping experience. The Carrefour App ran slowly, product variety was limited and many regions did not support the distribution of fresh food.

After traditional retailers such as RT-Mart and Walmart have tried the “catering + retail” format, Carrefour’s similar format was late to the game. In 2018, Carrefour opened “Fisherman’s Kitchen” and “Extremely Fresh Workshop” in Shenyang and Wuhan. It only chose seafood products in China to try the new concept.

Corporate image and internal issues

On March 15, 2012, Chinese authorities reported that the Carrefour in Zhengzhou sold re-packaged expired food. On April 18, 2012, a Weibo user posted on her microblog that the codfish she bought for her baby at Carrefour turned out to be Ruvettus pretiosus, which is a poisonous variety of fish. On June 17, 2012 Carrefour was accused of price cheating in Wuhan.

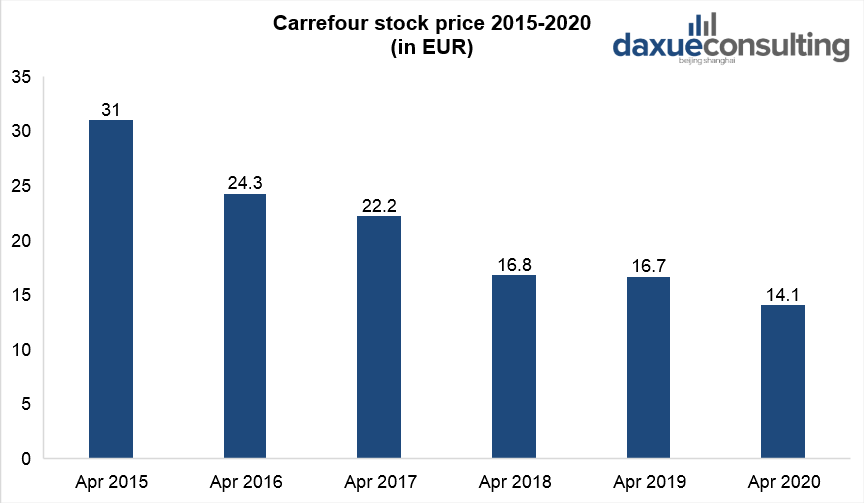

In addition to food safety issues, product prices, rigid relationships with suppliers and insufficient supply made it difficult for Carrefour to survive in the Chinese market. In January 2020 Carrefour faced a fine of 2 million yuan for violation of China’s price law. Due to all these problems, the stock price of Carrefour declined during the period from 2015-2020.

Data Source: Yahoo Finance, Carrefour stock price 2015-2020

Supply chain system problems

Carrefour did not have its own distribution center until 2015. By then, suppliers delivered most of goods directly to stores. The previous system caused inefficiency for managing both costs and sustainable growth. The reason for this late development was the lack of emphasis on distribution centers and logistics management.

Neglect of construction of a supply chain system forced Carrefour to pay a painful price. The slow supply speed not only affected the shopping experience and product sales, but also caused challenges with competitiveness.

For example, Yonghui Superstores formed a strong regional supply chain across Chinese regions relatively early. RT-Mart completed the construction of logistics distribution centers in four major regions in 2012. Walmart in China adopted the model of delivery to national distribution centers.

Carrefour’s competitors in China

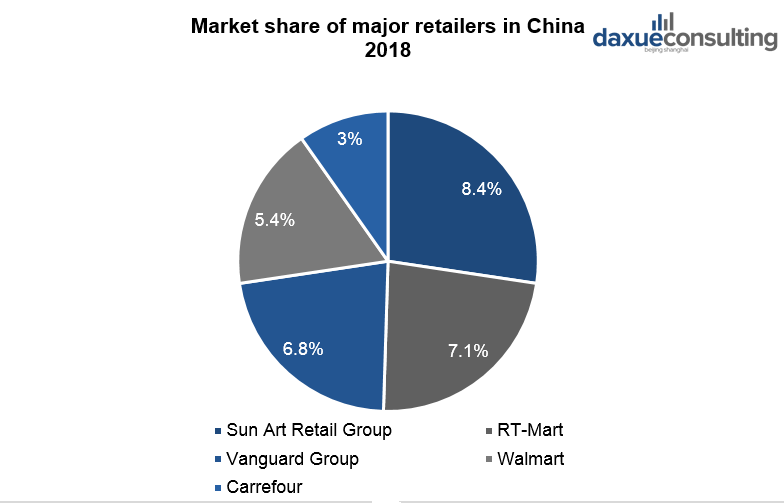

In terms of competition, in 2016 and 2018, Carrefour’s market share remained around 3%. It was lower than the industry’s TOP3 retailers: Sun Art Retail Group Limited (8.1% and 8.4%), RT-Mart (6.8% and 7.1%) and CR Vanguard Group (6.4% and 6.8%).

Data Source: Kantar Consumer Index, ‘Market share of major retailers in China 2018

Carrefour also competes with other foreign supermarkets and hypermarkets in China. ALDI, a recent China entrant, has shown to be a new favorite in the grocery market. Costco, an even more recent entrant, is known for causing huge commotion of popularity during its opening week. Then there is Walmart, which takes 5% of the market share, and Sam’s Club, which is known for it’s strong digital strategy.

Problem with city-based merchandise centers

In early 2015, Carrefour reduced its 24 CCU (city-based merchandise centers) to 6. In doing so, Carrefour in China centralized its merchandise systems. After this new establishment, regional directors of these six big regions started to focus more on store operations. The CCUs contributed to the increased centralization of power from stores to each CCU, making profit more transparent.

However, each region needed to allocate purchasing power to an increasing number of employees who were responsible for supply. Carrefour shifted staff from stores to CCUs. Consequently, many experienced store managers left Carrefour.

Carrefour’s current state in China

Acquisition by e-commerce retailer Suning.com gives positive results

In 2019, Suning.com announced that it had completed the acquisition of Carrefour China. The company acquired 80% of stakes in Carrefour China for 4.8 billion yuan. Jindong Zhang, the Chairman of Suning.com, said that Suning can transform Carrefour stores into fully integrated online-and-offline supermarkets.

The chronology of acquisition

- In early November 2019, Suning Finance successfully integrated Carrefour’s financial system, so customers can pay with their Suning Finance account.

- In mid-November 2019, Carrefour stores in Nanjing and Shanghai have built quick picking warehouses. Customers can place orders online through Suning’s Convenience Store app, Carrefour Mini WeChat program and third-party platforms. It delivers their package in 1 hour within 3 kilometers. During the Single’s Day period (Nov 1- Nov 11), Carrefour sales and orders broke historical records.

- At China International Import Expo, as a purchaser and exhibitor, Carrefour signed 150 million RMB in purchase contracts.

- On Black Friday in 2019, Carrefour’s online flagship store opened on Suning.com, focused on selling high value imports. Customers can place orders online and enjoy efficient delivery services through Suning Logistics.

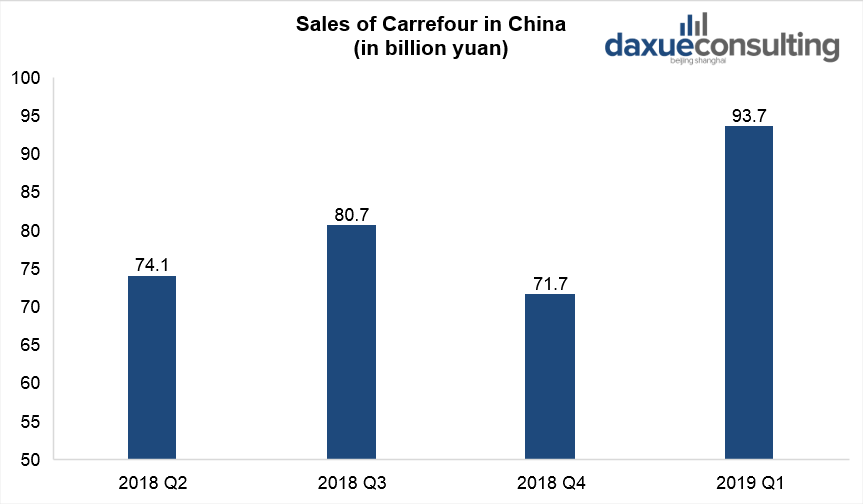

Data Source: jiemian, Sales of Carrefour in China’, the sales grew after the acquisition by Suning

Carrefour’s ties with Alibaba

Suning has had close links to Alibaba. The Chinese e-commerce giant Alibaba owns a 20% stake in Suning courtesy of a $4.6 billion investment in 2015. Suning, in turn, invested 14 billion yuan ($2 billion) in Alibaba — a deal that kickstarted Alibaba’s ‘new retail’ strategy.

Suning last year cashed out and cut its stake in Alibaba from an initial 1.1% to 0.51%. In other words, Alibaba has gone from an ally to Suning to a potential competitor in the omnichannel commerce space. The Carrefour deal can lead to a race between retailers as Carrefour China’s retail presence could boost Suning’s offline reach.

Five long-term strategies of Carrefour in the Chinese market

In 2019 Suning announced five long-term strategies of Carrefour in the Chinese market. It included digitalizing Carrefour’s physical stores. Improving current store models and expanding to lower-tier cities with Suning’s Retail Cloud Franchise Store became key priorities. Integrating with Suning’s convenience store and opening new stores in the existing market are also strategies for Carrefour’s business development.

COVID-19 impact on Carrefour in China

Carrefour in China saw significant profit during COVID-19 outbreak

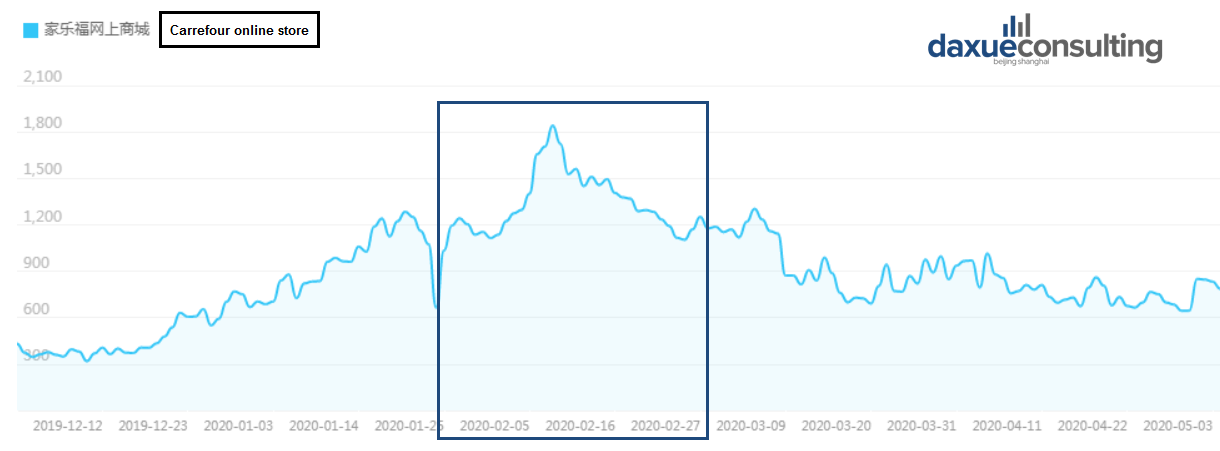

The implementation of the e-commerce strategy has come at the same time as the onset of the coronavirus in China. Carrefour launched flash delivery services that have been combined with Suning’s convenience stores to meet consumer demand. The average daily order has increased by 202 percent month-on-month, according to the company. In terms of digitalization, 210 existing stores nationwide have completed smart retail transformation to meet the one-hour delivery service within 3 km and the half-day service within 10 km of the same city.

Baidu Index: searching frequency for ‘Carrefour online store’ soared during the lock-down period in China

Listen to 100 China entrepreneur stories on China Paradigms, the China business podcast

Listen to China Paradigm on Apple Podcast