Outlook of the seafood market in China after COVID-19

Import and consumption of seafood are decreasing

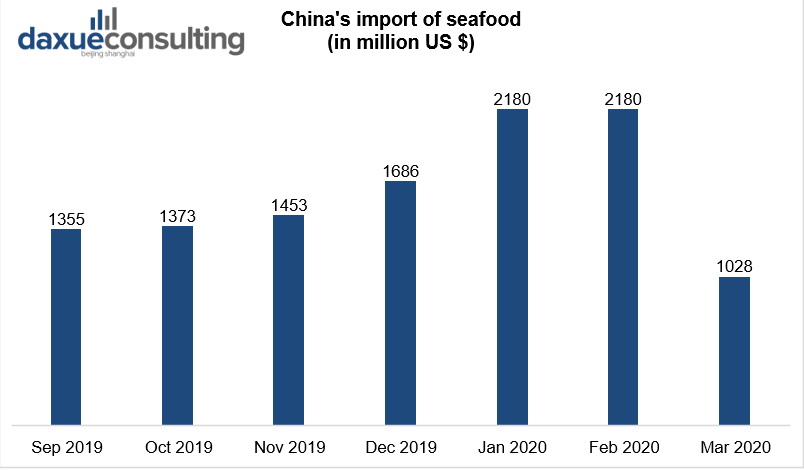

The total import of seafood in the first quarter of 2020 was 22.8 billion yuan. Import in the first quarter of 2020 fell by 27% from the fourth quarter of 2019. It is the lowest value of import volume since 2018.

[Data source: Statista, ‘China’s import of seafood’]

The COVID-19 outbreak in China came to public attention in January. It was announced during the Lunar New Year, which is also the traditional peak season for consumption. Before the outbreak, China’s seafood import had achieved consecutive growth during 11 quarters. However after the news broke, the seafood market in China experienced a decline in import.

On the one hand, COVID-19 outbreak impacts the consumption of seafood in China. By the first quarter of 2020, consumption was almost stagnant. On the other hand, the import and transportation of Chinese seafood was blocked.

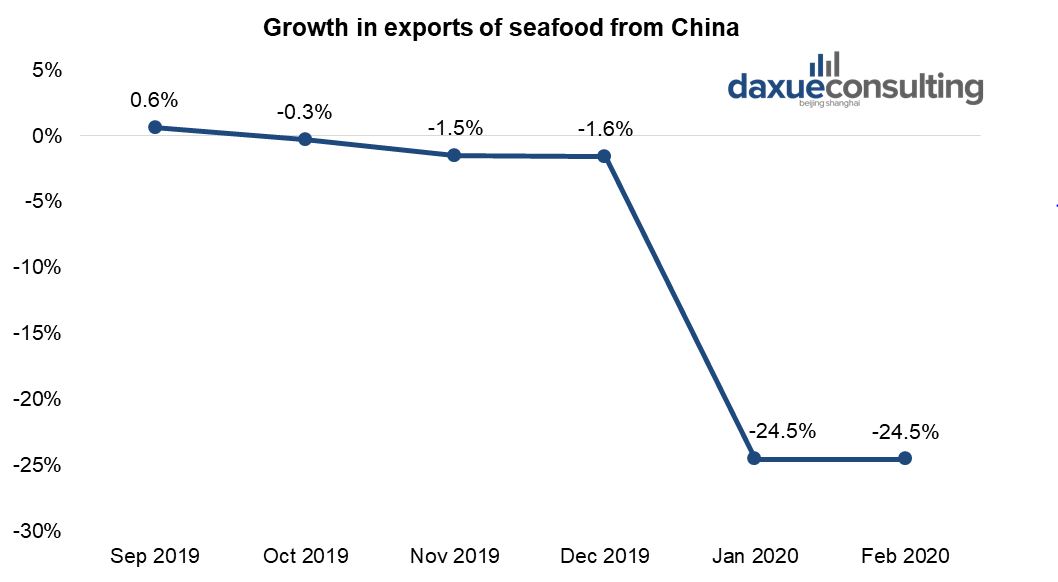

China also saw the decline in export of seafood products due to lockdown measures in other Asian countries.

[Data Source: General Administration of Customs of China, ‘Growth in exports of seafood from China’]

Fish industries are suffering from the COVID-19 outbreak

Producers of freshwater species are taking a big hit in the fallout from China’s coronavirus outbreak. They cannot harvest lot of fish and shrimp, but they still need to feed them. It erodes the financial wellbeing of producers.

Particularly hard hit was the crayfish industry. The peak season for crayfish consumption starts around May and lasts through the summer. The epicenter of the outbreak, Hubei province, is also the largest production area for crayfish in China.

Due to isolation, all key tilapia processing factories on Hainan Island faced ongoing labor shortages. Fish factories are operating at average of just 25 to 40 percent of normal output.

The Seafood market in China after COVID-19

Although China’s seafood import slowed in 2020, consumption has a potential to grow.

The coronavirus epidemic in 2020 will have a serious impact on the Chinese and global seafood supply chain. It will also have an impact on both supply and demand of seafood in countries. Entering the middle of the second quarter, there has been no obvious improvement in catering consumption. Therefore, there is a probability of China’s seafood import growth to decline this year.

However, the Chinese market has recovered from COVID-19 earlier than other countries. There is a hope that once the supply chain of seafood will get back to normal, the industry will function normally.

Short-term effect of COVID-19 outbreak on the seafood market in China:

The epidemic control measures interrupted logistics and seafood catering companies had to cancel a lot of orders. Seafood products processing company’s halted operations, and the market transaction volume was extremely low. This has led to serious backlogs for farmers and middle-level distributors. It directly affected the income of fish farmers and distributors at all levels. Many small market participants could not afford the losses caused by the epidemic and went bankrupt.

In terms of international trade, the epidemic has caused panic in the global seafood products industry. Due to concerns that the epidemic will affect China’s demand for import of seafood products, the prices of foreign seafood have fallen steeply. In terms of exports, many countries have introduced entry controls. Under the circumstances that China has not completely controlled the epidemic, short-term forecast of seafood export is also not optimistic.

Mid-term effect

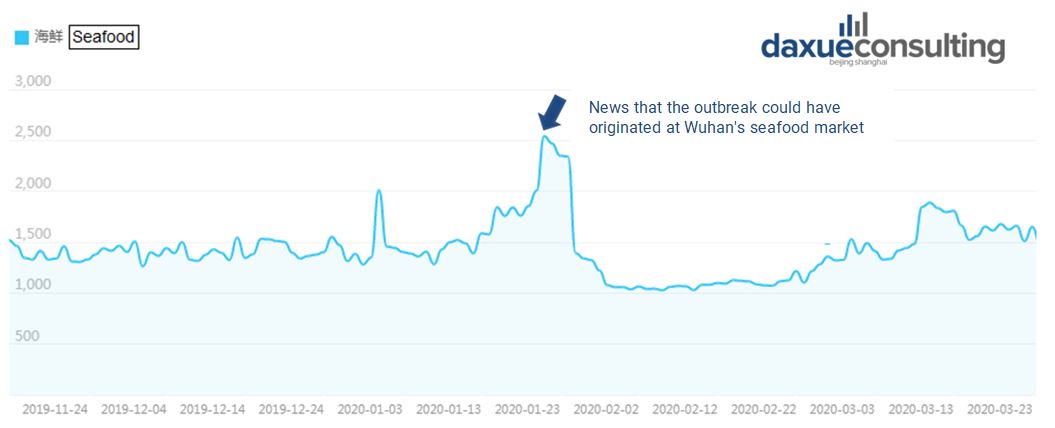

After the epidemic is over, experts expect that the public will experience retaliatory consumption. After the news emerged that the source of the virus could be the seafood market in Wuhan, the Chinese became more suspicious of seafood. However, gradually the demand for seafood is returning to normal, as scientists have not yet figured out which animal the infection occurred from.

[Source: Baidu Index, search frequency for ‘seafood’]

In addition, 2020 is the ending year of China’s “Thirteenth Five-Year Plan”. According to this, China’s total output of target fishery products in 2020 should be 66 million tons.

Long-term effect

With the improvement of people’s income level and the development of logistics, China’s seafood products consumer market will maintain long-term growth.

In addition, compared with wild terrestrial animals, wild seafood products are healthier. Since China has gradually issued policies and laws prohibiting wild animals trading, the demand for seafood products may increase. Experts claim that the market scale of aquaculture products in the future will be even broader.

The Chinese seafood market before COVID-19

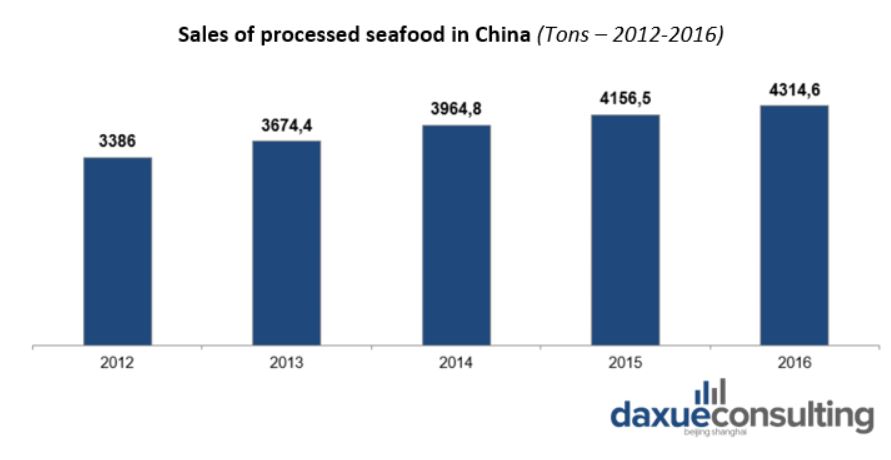

In the big picture, the Chinese seafood market is booming. China has a long history of eating seafood, especially for coastal residents, seafood has always been an indispensable component of a complete dining-table. After China’s reform and opening-up, an active import of foreign seafood began. Back then, imported seafood was considered novel and luxury. However, seafood is now accessible to the Chinese mass market. With China’s economy growing and people’s quality of life elevating, the seafood market has expanded continuously, e.g. the sales quantity of processed seafood, including chilled, frozen and shelf-stable seafood, shows a steady growth since 2012.

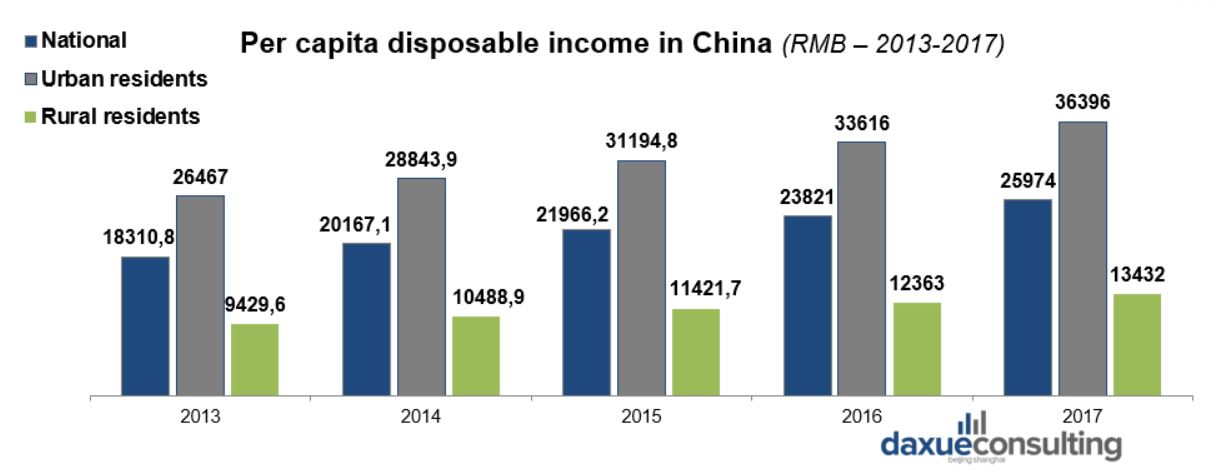

The credit of Chinese seafood market’s growth can go to rising per capita disposable income in China and improved life quality, both in rural and urban areas. In 2017, the disposable income of national residents has achieved a 7.3% year-on-year growth. This means, more consumers are able to afford seafood, even in inland rural areas.

Chinese seafood consumers want it all: Health, Freshness and Taste

China has a rich catering culture and a long food-therapy history, Chinese people deeply believe in the relation of what they put in mouth and their health condition. In recent years, environmental pollution and food safety have been seen as crucial issues, imported seafood is often considered more nutritious and safer due to the water quality and stricter quality control. Consumers are becoming more and more aware of the health benefits of seafood, such as the high amount of unsaturated fatty acids.

“Besides pork and egg, seafood has become an important source of protein for Chinese consumers, which influences the consumption structure in China”, says Mike Vinkenborg, project leader of Daxue consulting.

Although the health factor plays an important role of Chinese dining table, taste cannot be compromised. As we can see from the comments on Chinese popular e-commerce platforms, positive feedback coming from seafood buyers mainly focuses on deliciousness and freshness, while negative feedback is usually about safety issues.

Brands capitalize on preference for freshness and flavor when naming their brand

Naming brands or products in China is a tricky, yet crucial part of a market-entry since Chinese people attach great importance to names. Not only the pronunciation but also the chosen characters have to be taken into consideration for brand naming. Looking at the Chinese seafood brands’ naming, most seafood vendors try to emphasize freshness by using Chinese words “鲜 (meaning fresh)” and/or “生 (meaning raw/living)”, as well as to imply deliciousness by using words like “味(taste)” and/or “香 (good smelling)”.

Source: daxue consulting, brand name’s on China’s seafood market

Chinese consumers are hungry for imported seafood

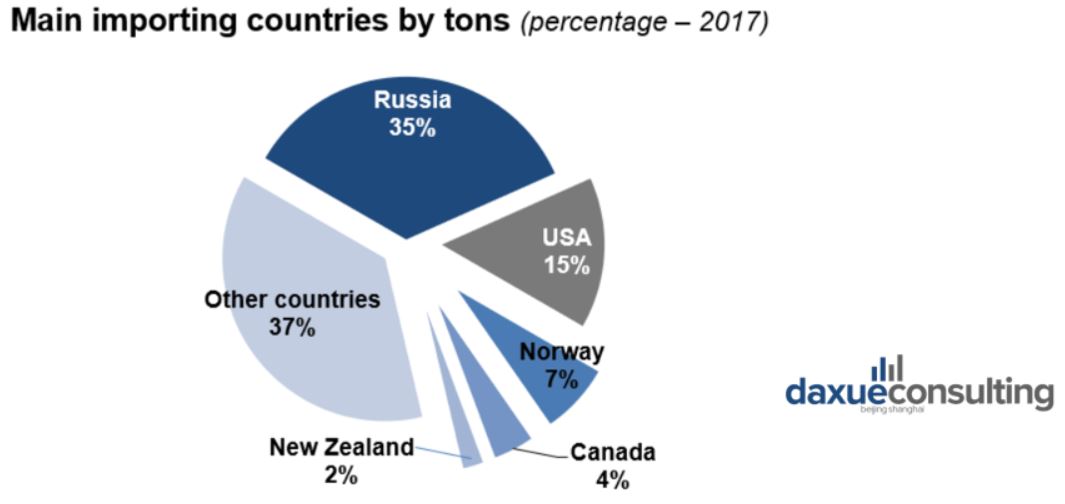

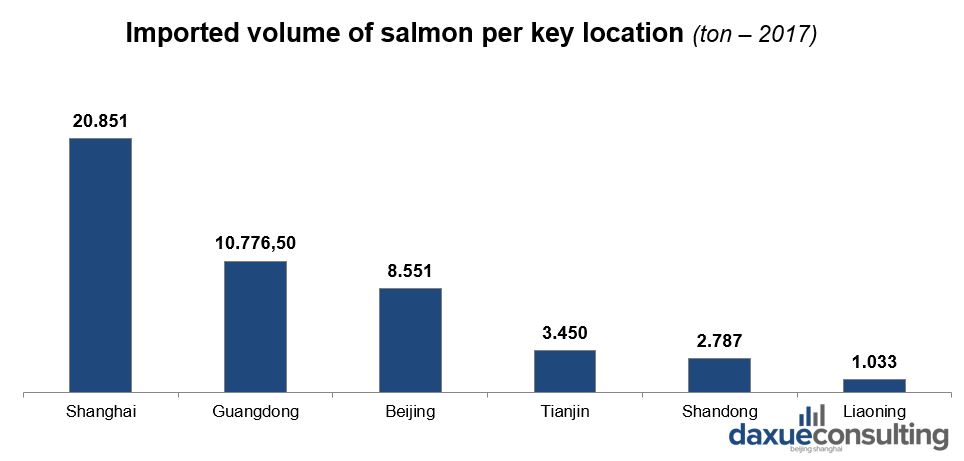

China has been one of the most important seafood markets in the world, its market demands of imported seafood have reached 7.6 million tons in 2017. In 2017, Russia is the largest exporter of seafood to the Chinese market. USA, Canada, New Zealand, and Norway are also important sources for importing seafood in China. Imported products mainly include shrimp, salmon, crab. Based on the information from e-commerce platforms, most popular imported seafood are frozen products. The top sellers’ prices are relatively low among all segments of imported seafood on JD. During important festivals, seafood has been one of the main products purchased online. For example, 38% of food sales on Fresh.jd.com came from seafood during Chinese New Year in 2018.

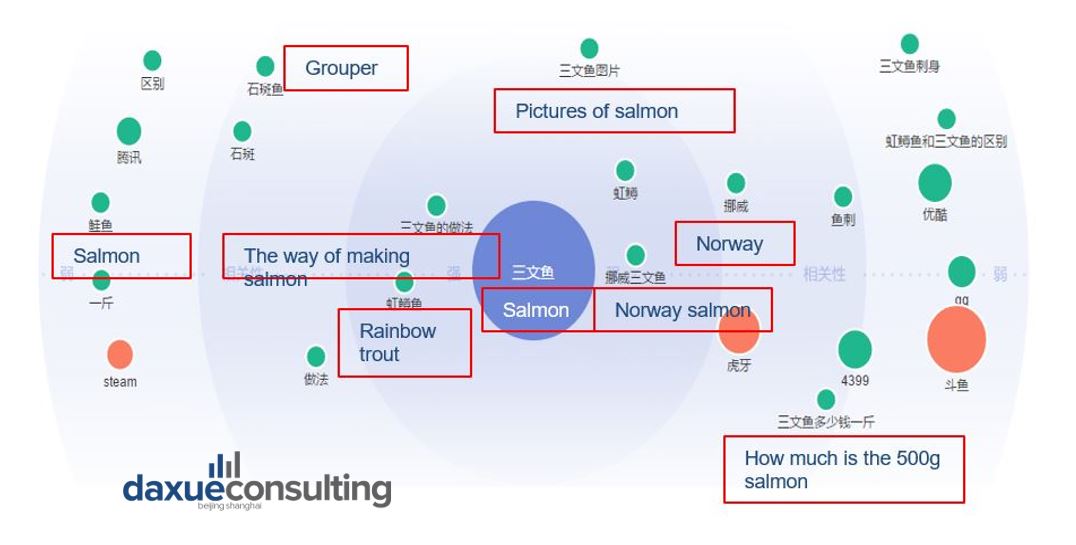

The most related keywords of “salmon” on Baidu Index mainly consist of “the way of making salmon”, “Norwegian salmon”, “price” and other saltwater fish like “trout” and “grouper”.

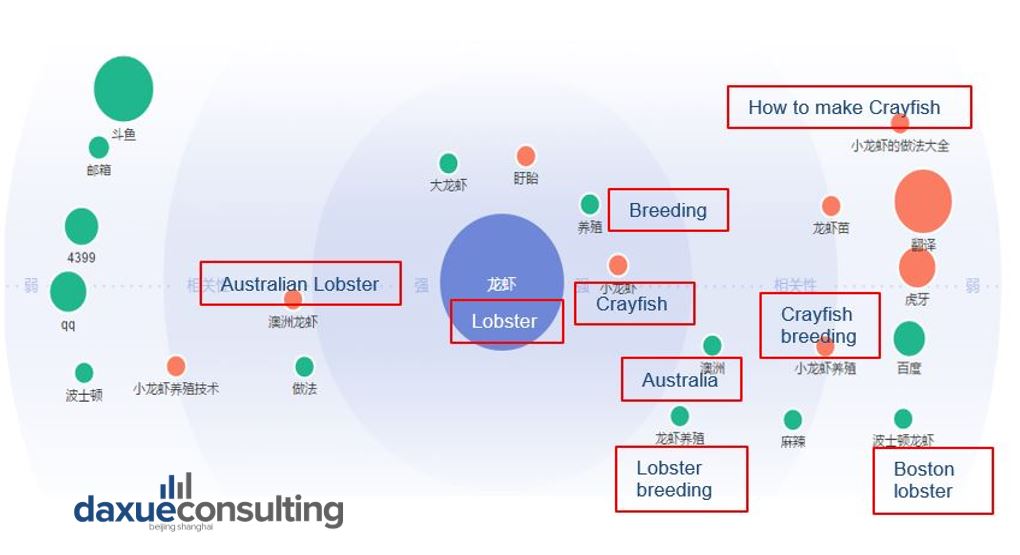

The most related keywords of “lobster” are “crayfish”, “Australian Lobster”, “lobster breeding”, “Australian” and “how to cook lobsters”.

Baidu is the number one search engine in China. More than ¾ of the total search is made by Baidu. Baidu index collects and analyzes the statistical data of searching behavior, which reveals the market trend.

Qualities of the Chinese seafood market that brands should consider

The Chinese seafood market is highly seasonal and festival-dependent

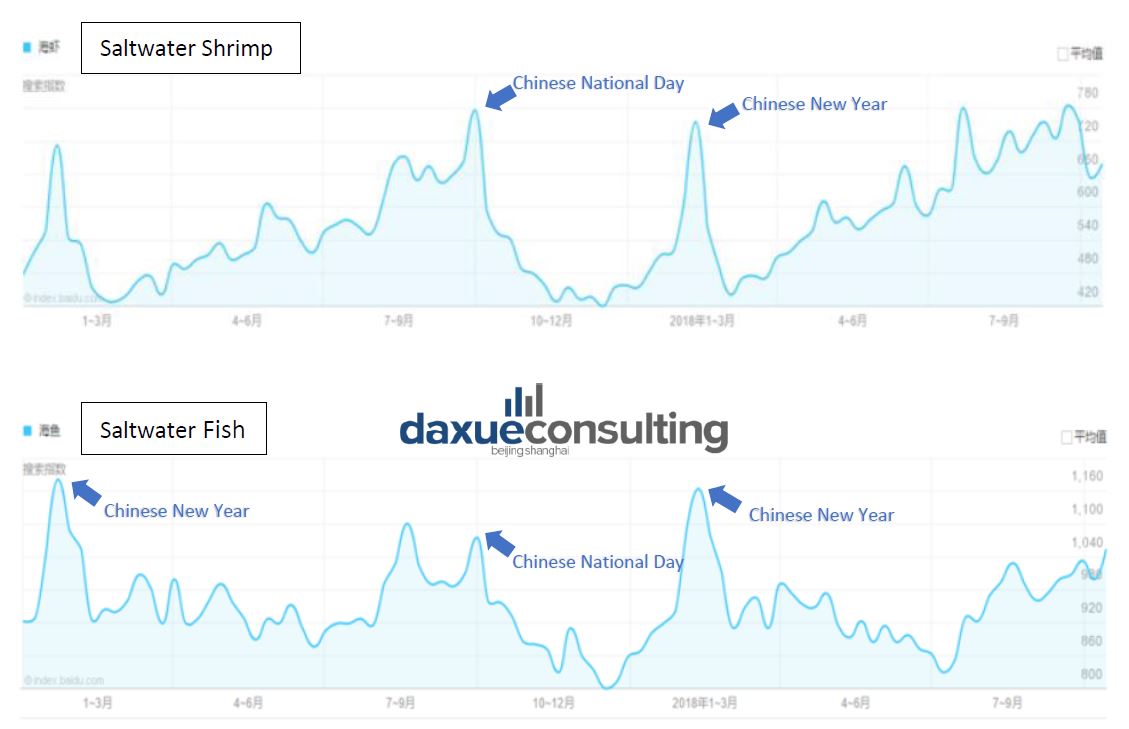

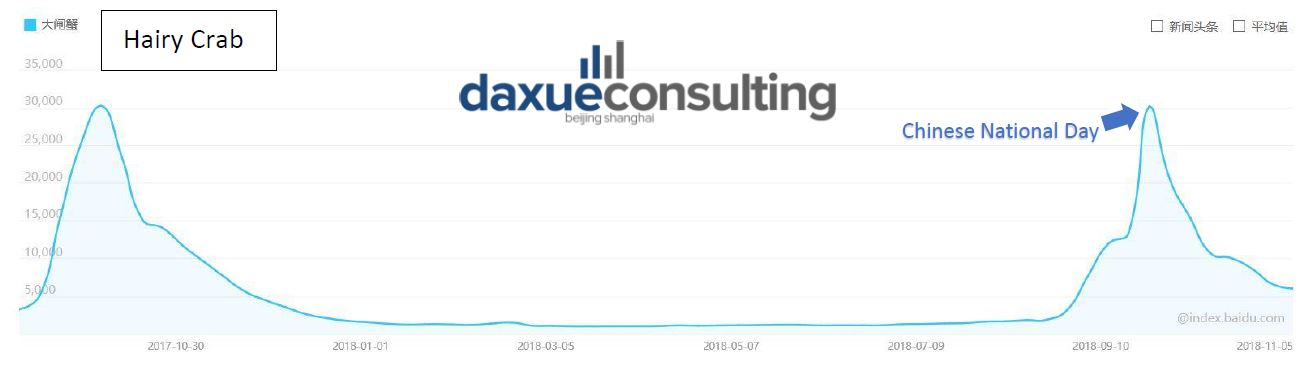

As we can see on Baidu index, the search frequency of both “saltwater fish” and “saltwater shrimp” went significantly high during the periods of Chinese New Year (normally at the end of Jan. to the beginning of Feb.). And again, search frequency grew enormously every year in the fall season, which is considered by the Chinese as a good season to eat fresh fish/shrimps. Due to the Chinese national day, which is on the 1st of October, the search frequency goes very high every time at the beginning of October. The whole country will have a 7-day-holiday at this period of time, and seafood producers may also prepare special gift boxes with living or frozen seafood inside so that the Chinese consumers can just grab it in an online or offline shop and bring as a present when visiting family or friends.

Chinese seafood is as peculiar as it is delicious

Many kinds of seafood which Chinese consumers love are not common in other countries and even considered as peculiar, like sea cucumber, fish balls, turtle and eel. However, even though consumers from other countries don’t purchase certain kinds of seafood, it is still an opportunity for international seafood exporters. For example, there are lots of dried sea cucumber from the U.S., Canada and New Zealand being sold at relatively high prices, China has a long history eating sea cucumbers and believe they have a lot of health benefits. Also, seafood snacks are quite common in China, e.g. processed dried squids or fish, which suit many Chinese consumers’ taste better and considered as a healthier option compared to other snack options like candy or chocolates.

Seafood has different presentation and distribution channels in China

As mentioned before, Chinese consumers attach great importance to the freshness of the seafood. That’s why purchasing living seafood on a Chinese traditional food market is still common, especially for the older generation. Meanwhile, many retailers and restaurants present their seafood in glass tanks or on the ice, no matter if it is fish, crabs or turtles, in order to show the freshness of their products.

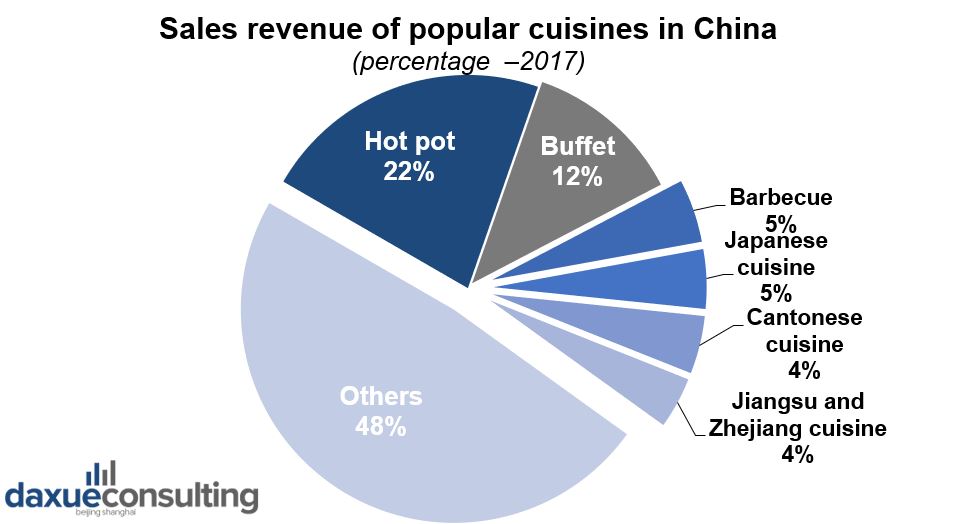

By looking at the Chinese catering industry structure, we see hot pot contributing 22% of the total revenue of China’s catering industry, following by Buffet with 12% and barbecue as well as Japanese cuisine both with 5%. For all these types of Chinese cuisines, seafood plays a significant role, which provides huge opportunities for imported seafood. For example, a major proportion of imported salmon on Chinese seafood market are not consumed at home, but on the catering market. China has no long history of consuming salmon, however, in the last decades, Japanese cuisine has become very popular, especially among Chinese millennials. Sushi and Sashimi (Japanese raw fish) are being widely accepted, raw salmon is even on the menu of many traditional Chinese restaurants as an appetizer.

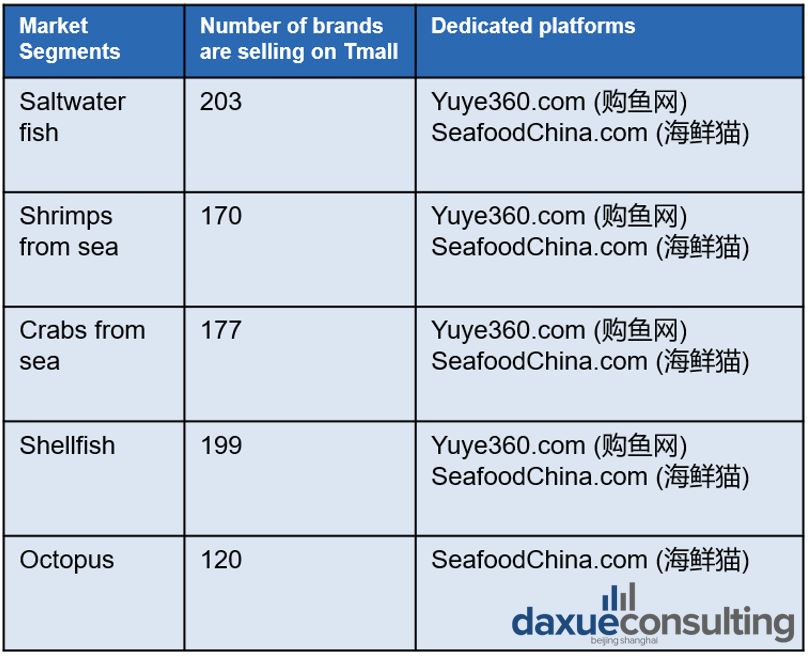

Despite traditional offline retail channels and catering market, Chines e-commerce platforms can also not be ignored. Besides well-known platforms like Taobao and JD, many fresh food platforms have been developed and are achieving great success, e.g. the sales value of seafood has entered the top 3 on FFresh.jd.com in2017. For domestics and international seafood brands, dedicated websites are also important distribution channels. “Most popular seafood brands on the Chinese Market are selling their products on main e-commerce platforms. Fish dominates the seafood consumption in China for its rich variety and affordable price”, says Vinkenborg.

On Tmall/Taobao, frozen shrimp is the most popular product among all categories of saltwater shrimp and abalone is the most popular products among all categories of shellfish. There are many imported abalones being sold from different areas like Australia, South Africa, and New Zealand. According to Vinkenborg: “Argentinian shrimp remains the most popular imported seafood in China, salmon and crab also perform well in terms of online sales.”

A new blended retail ecosystem offers opportunities for fresh seafood distribution

New-retail is a retail ecosystem that blends online and offline channels in a unified way. Due to the rise of e-commerce, traditional retail businesses have experienced downturns. A number of foreign retailers have encountered difficulties in China, including Korea’s Lotte Mart, the US’ Walmart, and France’s Carrefour. But the growth of online retail sales will slow down as physical retail still dominates consumption, especially in the seafood section. Although many seafood products can be bought online, Chinese consumers’ buying habits make them prefer fresh seafood which they can see in a tank or on ice. New-retail offers good opportunities for the distribution of seafood on the Chinese market.

The Chinese seafood market meets all requirements for new-retail thanks to its strong consumer base, increasing purchasing power, preference for novel and luxury shopping experiences, and the widespread use of mobile payment.

Pioneer example of the new-retail model while selling seafood in China: Hema Xiansheng

Hema Xiansheng (盒马鲜生) owned by Alibaba is a combination of a supermarket, restaurant, seafood market, and mobile application. According to Daniel Zhang, Alibaba Group CEO: “Hema supermarket is what you get when you imagine a seamless blend of the online and offline shopping experience.” Chinese consumers can order seafood on Hema mobile App, which will be delivered within 2 hours to wished address. Consumers can also go to Hema supermarket to purchase grocery and pick up fresh seafood, which can be prepared and served directly in the dining area of Hema supermarket.

Now is the ideal time for foreign brands to enter the Chinese seafood market

To sum up, the booming Chinese seafood market is offering huge opportunities for international seafood exporters. This is supported by the following chain of events: 1) the rising disposable income, the life quality of Chinese consumers has been significantly improved and can afford seafood as a protein source. 2) Because of the improving quality of life, Chinese consumers are pickier about the health, freshness, and taste of seafood. 3) Seafood from overseas is considered safer because of the higher water quality and stricter control standards.

Yet international seafood exporters should pay attention to and take advantage of the particularities of the Chinese seafood market. For example, the climaxes of the Chinese seafood market is dependent on seasons and festivals; the sales volume reaches the peak during Chinese New Year, followed by Chinese national day. There is also much peculiar seafood like sea cucumbers and eel which are not consumed in the west also offer opportunities for seafood exporters. Last but not least, the different distribution channels of Chinese seafood market should also be taken into consideration. For instance, the catering industry is a crucial distribution channel for China’s seafood market. Popular types of cuisines like Hotpot, buffet and Japanese food all contribute an enormous percentage of seafood consuming amount.

Authors: Chencen Zhu & Valeriia Mikhailova

Daxue Consulting can help with the analysis of any market in China, including the seafood industry

Daxue Consulting, as a market research company, provides the adapted data in one of the most challenging markets in the world, China. We have a wide range of services to deliver competitive market research. To know more about the F&B market in general or a specific industry in China, do not hesitate to contact our project managers at dx@daxueconsulting.com.

Listen to 100 China entrepreneur stories on China Paradigms, the China business podcast

Listen to China Paradigm on Apple Podcast