The convenience store market in China

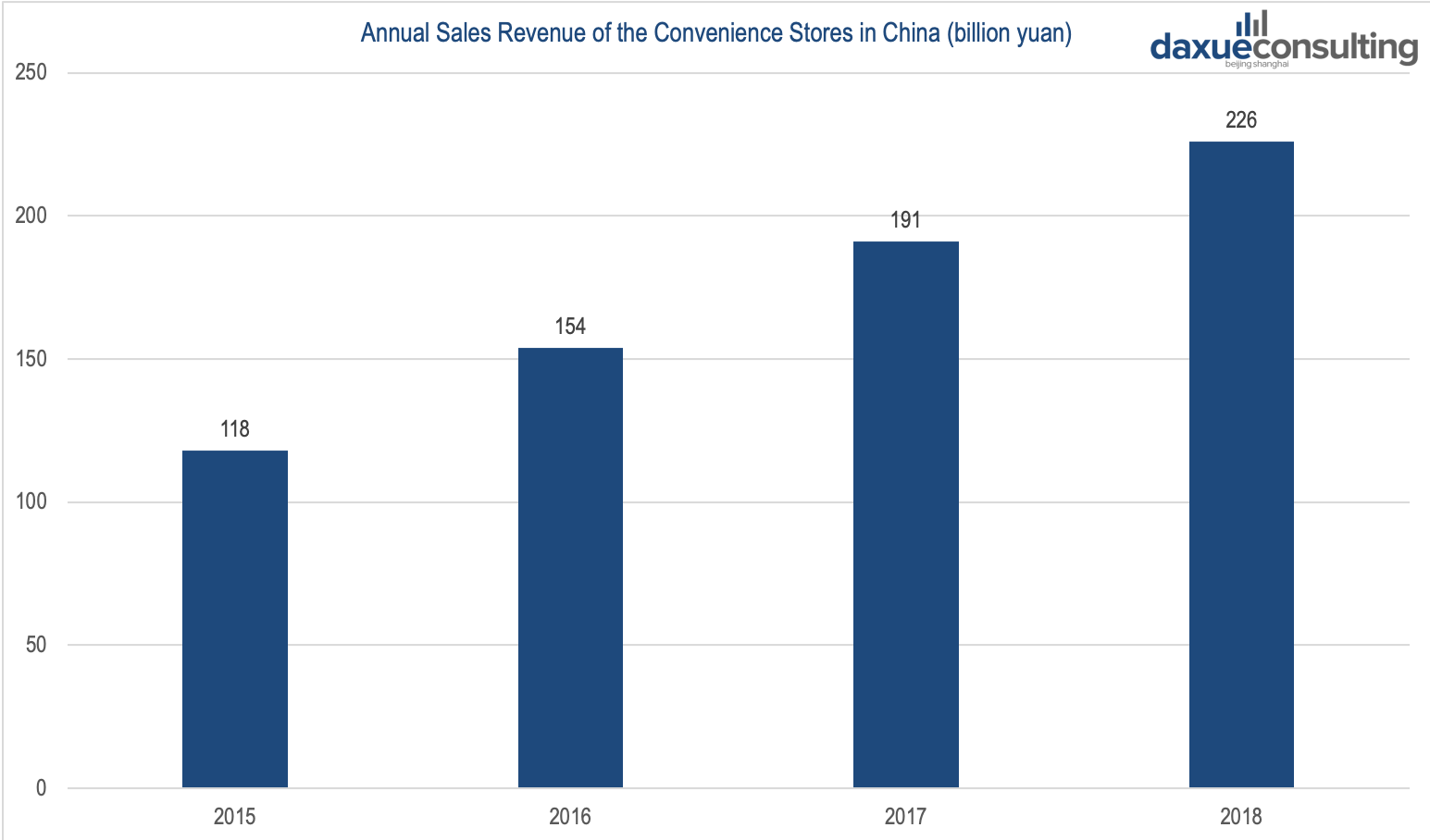

Convenience stores’ sales in China have exceeded 226 billion yuan in 2018, up 19% over last year. The convenience store market in China has grown, and will continue to grow in the near future.

[Data Source: China Chain Store & franchise “Annual Sales Revenue of the Convenience Store in China”]

Blooming convenience store market in China

In 1992, Seven-Eleven opened its first convenience store in Shenzhen, marking the beginning of the foreign chain convenience stores’ China market entry. Later, China’s domestic convenience stores started to become popular and established chain brands. The combination between convenience stores and online life platforms is also thriving and brings more convenience to customers.

The government issued supportive policies to contribute to the development of convenience store market in China as well. In 2018, Beijing has unveiled new policies to encourage the establishment of neighborhood convenience stores to ensure that there is at least one convenience store in every neighborhood. According to the policies, Beijing is encouraging the establishment of chain-supermarkets and convenience stores in residential neighborhoods. Enterprises will be given 30% of total investment in governmental fixed asset investment subsidies for each convenience store or supermarket successfully set up in residential neighborhoods.

After initial expansion in China, Japan’s convenience stores face an evolution.

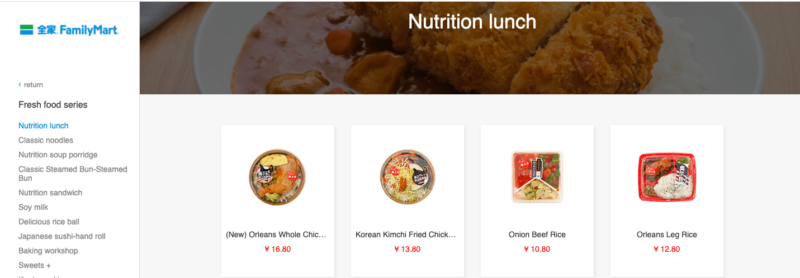

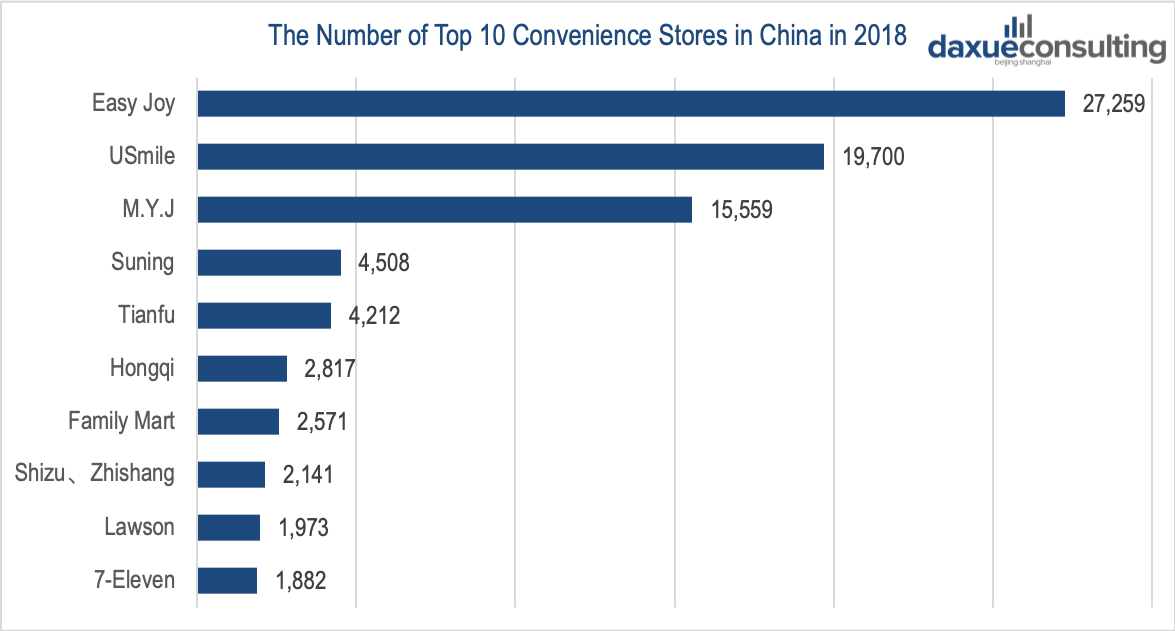

Japanese convenience stores expanded aggressively, where they see vast new markets being created by China’s rapid urbanization. However, they face the challenges of a retail culture of poor customer service and shoppers who value price over convenience. Seven-Eleven is the largest convenience store in Japan, but did not adapt to the Chinese market as well as Family Mart and Lawsons. It sells cold food like sandwiches which do not suit Chinese appetite, and the prices are a bit high. Family Mart takes more measures to adapt to the Chinese market. Now, Family Mart is the largest Japanese convenience store operator, with 2,571 stores in China. Family Mart provides customers with their preferred goods based on the research of customer preferences. Their sites selection is also sensible, people can find their stores in subways and other transportation junctions.

[Source: Family Mart “Food designed for Chinese appetite”]

Wal-Mart reopens its Chinese convenience stores after the first failure

The world’s top retailer, had launched a pilot program to open convenience stores in China. Wal-Mart China opened three convenience stores named Hui Xuan in 2009, in the South China city of Shenzhen in a low-key initiative. Unfortunately, these stores closed in 2012. Wal-Mart claimed that they closed these stores due to the end of the test. However, the stores’ operational staff revealed that the competitive market environment and the upstream production also caused the closure. Meanwhile, Brand Hui Xuan started to appear in tier 3 and 4 cities.

In 2018, Hui Xuan re-entered Shenzhen with its technology evolution. Now, Hui Xuan takes an omni-channel retailing model, allowing customers to buy products in multiple ways. Customers can purchase products in retail stores and pay by traditional methods like cash, Alipay, and other payment platforms. Additionally, they can utilize the WeChat’s Mini Program, Sao Ma Gou, to scan products’ bar code to pay without waiting in line. Hui Xuan also cooperates with JD Daojia. Customers can make orders in JD Daojia application and get their goods in 29 minutes within 2 kilometers. Beside product sales, Hui Xuan offers many convenient services including free hot water, and shoe repair.

The rise of domestic convenience store brands in China

During the 1970s, the usual convenience stores were stores in gas stations. After the reform and the opening up, convenience stores gradually appeared in residential areas. In 1993, Shenzhen had had mature local convenience stores brand named Polison with 300 stores. With the support of government policies and the boom of the economy, China’s domestic convenience store chains are flourishing.

Currently, local chains occupy 8 out of the top 10 convenience stores brands in China. These domestic brands present the characteristics of the region that they are from. For example, Hi-24 concentrates on the Beijing market. Hi-24 researched the Chinese characteristics to improve their sales. Rather than cold sandwiches, they sell hot food like pies, Douhua and other food with Beijing features to satisfy Chinese appetites. Domestic convenience stores also have irreplaceable advantages. Alldays, a state-owned convenience store brand, has the license to sell cigarettes while foreign enterprises are forbidden from selling cigarettes in China.

Convenience stores plus O2O is becoming popular in China.

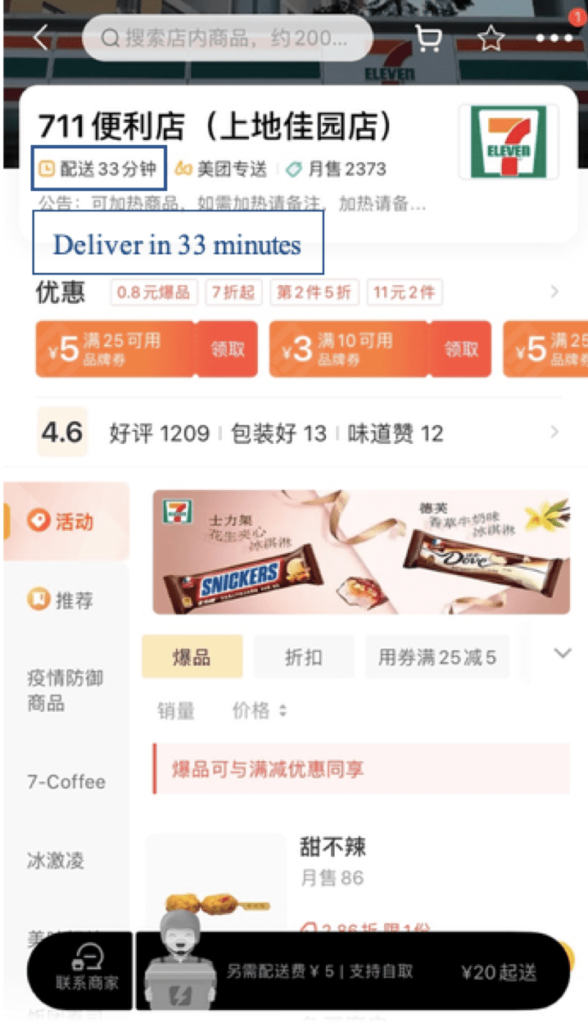

As technology develops, numerous convenience stores gradually combine their sales with O2O platforms in China. Some convenience stores choose to use popular online sales platforms. Sina Finance reported that Seven-Eleven in Beijing did not want to join online sales at the beginning. However, as its competitors joined Meituan, Elema and JD Daojia, Seven-Eleven decided to make their products available on these platforms. In January 2016, the sales of Seven-Eleven in JD Daojia surged 400% over the same period last year. There are also many convenience stores that establish their own O2O platforms, like WeChat miniprograms.

[Source: Meituan “Seven-Eleven Online Store in Meituan”]

Convenience stores in China under Coronavirus Outbreak

Due to the impact of China’s Coronavirus outbreak, all shopping sites were shut down. Only convenience stores, supermarkets and pharmacies remained open. Thus, it triggered the boom of convenience stores sales. Meanwhile, the post-pandemic economic recession may also influence the convenience store market in China, which is a recession-proof market.

The contributions of convenience stores under the epidemic control period in China

Convenience stores Coronavirus crisis management was quick and flexible. During this time, people have to stay at home, so many ones choose to make online orders to supply necessities. Hangzhou.com reported that Lawson stopped providing cooked food to avoid possible virus infection and replenished more instant food. The online orders of the convenience store Hangzhou.com increased by over 3 times. Meanwhile, many convenience stores use their ways to support anti-virus. Lawson started to sell fresh vegetables, and fruits that it did not replenish before. It also provided free breakfasts and food delivery to people who are against the epidemic now.

After Coronavirus, convenience stores may face more challenges in China.

According to OSTRICH’s data, its daily sales were around 8,000 yuan per store during the epidemic. In 2018, the daily sales of sample convenience stores in China was 5,299 yuan per store. In a short time, the sales of convenience stores may be intact. However, Wang Wei, the founder of Sheng Xian Chuan Qi, reminded us that retail enterprises may face the inflation brought by the economic downturn and the sluggish consumptions caused by the price rising. Convenience stores are forced to think about their future operation due to the potential economic recession.

The convenience stores market in China is promising and competitive.

Convenience stores in China have experienced several decades’ evolution and especially during the Coronavirus period, they reacted efficiently. Now, even facing challenges, the convenience stores market in China is still promising and competitive.

Listen to 100 China entrepreneur stories on China Paradigms, the China business podcast

Listen to China Paradigm on Apple Podcast

![[Podcast] China Paradigm 47: How to improve your distribution strategy in China](../wp-content/uploads/2019/06/China-podcast-distribution-strategy-China-150x150.jpg)