B2C e-commerce in China Overview: E-commerce in China is growing at a rapid pace

The B2C e-commerce market in China is in the growth phase of its economic life cycle. According to an industry report, the industry revenue has grown from $229.9 billion in 2012 to $1.5 trillion in 2019 and is projected to grow at an annual 13.8% over the next five years, to $2.8 trillion in 2024. In 2019, e-commerce made up 36.6% of total retail sales. Such rapid growth could be attributed to the increasing number of online shoppers and e-commerce platforms and APPs in China. The number of online shoppers totaled 610.1 million in 2018, accounted for 73.6% of total internet users, whereas the number of listed e-commerce companies was 48, including 13 listed companies for B2C e-commerce in China.

Market Segmentation of the B2C e-commerce industry in China

The primary activities in this industry include sales of clothing, cosmetics , maternity and children’s goods, food, digital products, and jewelry and watches. As for products and services segmentation, computer, communications, and consumer electronics make up the largest share (34.2%). Clothes, shoes and bags make up the next largest share (31.5%).

Who are B2C e-commerce consumers in China

Digital-savvy consumers with higher education levels will be more likely to become e-commerce consumers. Therefore, as B2C e-commerce enterprises continuously improve their service and product quality with low prices for customers, they have managed to retain existing customers and attract new customers.

In terms of the geographic spread of the industry, first-tier cities, including Guangzhou, Zhejiang, Jiangsu, and Shanghai are more developed in Internet-based retail due to regional economic development and transportation infrastructure and are approaching saturation, with the e-commerce user penetration being as high as 73%. As a result, more businesses are expanding to second- and third-tier cities with the developments of the internet environment and logistics systems in those regions. Hence, the industry will gradually become more geographically balanced.

Key drivers that lead to the rapid growth of Chinese B2C e-commerce

Various factors have led to the ongoing success of B2C e-commerce in China. As for the technological factors, pervasive broadband connections have boosted demand in the e-commerce market, especially mobile e-commerce. According to the China Internet Network Information Center (CINIC), 73.6% of internet users had made purchases online in 2018.That is 592.1 million people spending more than $1.2 trillion online. Mobile transactions make up over half of the online sales. Besides, emerging technological trends, including new payment systems, Big Data analytics, and artificial intelligence, have supported the growth of e-commerce in China over the past years.

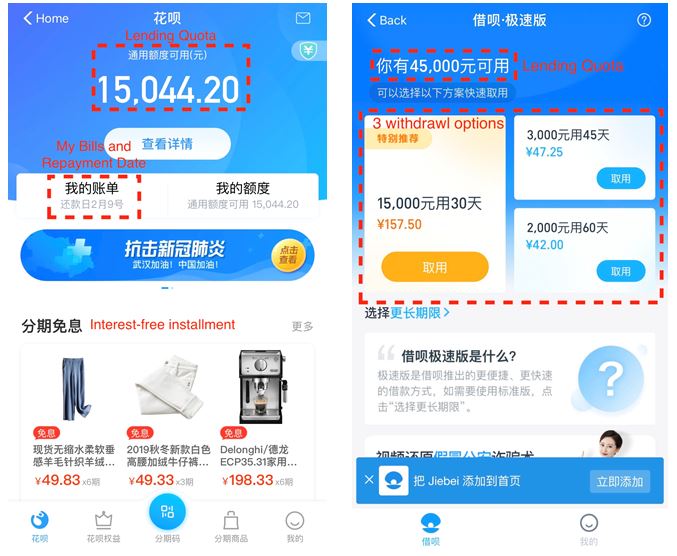

For instance, Alibaba Group created one of the most prolifically used online payment system Alipay to be used in Alibaba’s e-commerce platforms as well as other 460,000 external platforms (Alibaba), which controls around half of China’s online payment market. Alternative payment method such as deferred or installment plan Huabei (花呗) that has become ubiquitous in China also contributes significantly to the growth of Chines B2C e-commerce. It is projected that by 2024, 20% of B2C e-commerce transactions will be made using an installment plan, alternative payment. Moreover, big data-enabled product recommendations, as well as AI-based product recognition functions, have enhanced customer experiences to another level in e-commerce, with which the traditional brick-and-mortar model can never compete.

[Source: Alipay app, left: Huabei, a ubiquitous virtual credit card system available on Alipay. Right:Jiebei is a credit loan sub-system on Alipay that allows users to instantly withdraw money into Alipay’s savings account]

Taking socio-economic factors into consideration, B2C e-commerce displays more competitive advantages. According to a survey done among Chinese consumers, price competitiveness is the main reason for shopping online, with 52% of respondents saying it is a significant factor for them. Compared with physical stores, online stores are free from rent, utilities, store fixtures and fittings, and these savings are passed onto customers. Besides, free shipping, full visibility over the delivery process, reduced cost of delivery and returns, comprehensive parcel tracking altogether increases customer confidence in online shopping, and ultimately, affect consumer purchasing behaviors that are leaning towards electronic commerce.

Major players in China’s B2C e-commerce industry

Looking only at the B2C e-commerce market in China, Tmall, JD, Suning, Vipshop stand out for this review. It is noted that the market displays high market share penetration with the leading four enterprises accounting for 96.1% of the industry Gross Merchandise Volume (GMV) share. By the end of 2018, Tmall and JD are the top two B2C e-commerce platforms in China, taking 61.4% and 24.2% of the Gross Merchandise Volume (GMV) share respectively. Suning and Vipshop rank the third and the fourth respectively in the industry.

Meanwhile, it is also worth noting that the market, over the recent years, has witnessed several emerging minor players such as Pinduoduo(拼多多)and Hema(盒马), providing expanded products and services to the industry while the market share of the top four players has declined slightly.

Tmall’s Singles’ Day Marketing Plan

Tmall is an independent B2C online platform under the Alibaba Group. Unlike Taobao Marketplace, which is Alibaba’s C2C e-commerce platform that used to have counterfeiting issues, Tmall is perceived as a more reliable channel to purchase authentic and quality branded products through well-established brands’ flagship stores on Tmall. In 2008, Alibaba Group launched its Singles’ Day shopping festival via its B2C e-commerce platform Tmall, hosting a large-scale online shopping event to drive sales, including extensive discounts from retailers and incentives. As the Singles’ Day event expanded into a larger scale retail event, it is rebranded as the ‘11.11 Global Shopping Festival’, in conjunction with the Group’s globalization strategy, targeting not only the domestic market, but also the international online shoppers.

As of 2018, the 10th anniversary of the festival has witnessed more than $20 billion in transactions in 24 hours. These days the festival is more than prices and aggressive discounts, it has gradually evolved to an interactive shopping experience, moving towards gamification in a fun and social way that is paramount in improving customer engagement.

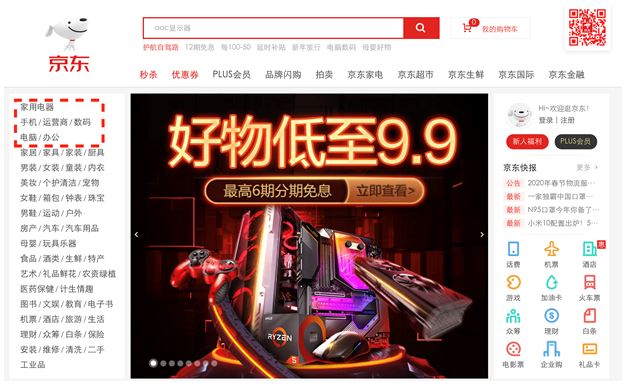

The Competitive Advantage of JD.com

Jingdong (JD.com), as the biggest 3C (computer, communication, consumer electronics) online shopping platform in the B2C sector of e-commerce in China, gains its competitive edge through three strategies: price, channel, and sales promotion. The CEO Liu Qiangdong believes the high inventory turnover and cash turnover rate and good cost management contribute as key to his company’s success as an online retail business. Statistics show that JD.com has an inventory turnover rate of 12 days and pays off its inventory at the spot while its major competitor Suning and Gome have an average of 47 to 60 days of inventory turnover and 112 days of payment term.

[Source: JD.com “The top three product categories at JD.com are household appliance, mobile phone/communication/electronics, and computer/office, indicating a 3C-focused market positioning”]

Emerging trends in China’s B2C e-commerce industry: Demand for more integrated solutions

JD.com vice president and JD Retail Solutions general manager Chenkai Ling revealed that the future of retail will be boundless, that is the merging of content commerce, social commerce, and AI would create a seamless online-to-offline (O2O) shopping experiences. Jack Ma, the founder of Alibaba, envisioned future retail as the era of New Retail and has started to established New Retail infrastructure, empowering brands with data that redefines the relationship among customers, merchandise, and stores. With many brands have started to leverage the New Retail model, the sector will see more integrated solutions to the seamless omnichannel consumer experience.

Technological advances benefit retailers in the B2C e-commerce

Jayne James, the director of international services at the UK delivery company Yodel, believed that the key factor led to the success of many Chinese e-commerce companies like Alibaba and JD.com is that they grow their businesses in the internet age with tech at their core. Over the past few years, we have seen many Chinese e-commerce enterprises employing Big Data analytics to study customers and impact their decision-making journey at hyper-speed while enhancing their competitiveness of supply chain, resulting in better operational efficiency and reduced costs. Suggested products and adverts from brands can access targeted customers instantaneously based on customers’ search and are easier to make real impact with just one click. Artificial intelligence (AI), Virtual Reality (VR), and instant mobile payments have also been used to enhance companies’ store performance on digital platforms, stimulating purchases.

[Source: Taobao “Alternative payment methods like interest-free installment payment stimulate online purchases”]

Leveraging social media trends

Though technological advances in B2C e-commerce sites are effective in driving e-store foot traffic, it is still hard to drive purchases. Therefore, social factors play vital roles in the sales pipeline and contributing significantly to store conversion rates. It is said that Chinese consumers are generally influenced by online content and 31% of Chinese consumers share a picture of food or drink they consume several times per week on social media. This indicates that brands have to work on the human side of the marketing and leverage the “Check-in Economy” (打卡经济) to impact customer consumption behaviours.

The Check-In Economy describes the social media phenomena of Chinese consumers taking photos to show their current location or activity. Leveraging the Check-In Economy means that brands try to capitalize on this phenomena by encouraging people to take photos of places or products and upload onto social media, creating user-generated content.

KOL marketing for B2C ecommerce

Numerous brands enter their target customer groups through collaborations with social media influencers or Key Opinion Leaders (KOLs) who have a solid audience base that will be converted into the buyers of the endorsed brands. For brands that have a limited budget, Key Opinion Customers (KOCs) and live streaming provide alternative ways to drive leads. The former is the main force of UGC, and the later uses a push marketing strategy to target mobile users. According to statistics, Chinese consumers use their phones for mobile payments 60 times more than consumers in the States do.

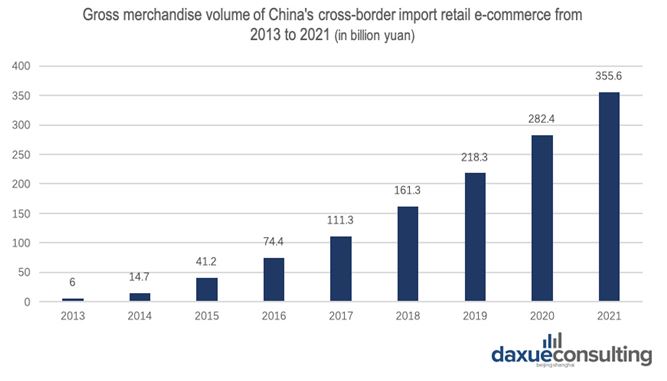

Cross-border import retail e-commerce platforms are gaining popularity in China

Chinese consumers generally perceive imported products and foreign brands as premium. Thus, it makes sense that cross-border import retail e-commerce has displayed double-digit growth since 2013 and will continue to grow strongly. According to Statista, Chinese online shoppers go for cross-border import e-commerce platforms mainly for food, beauty, and personal care products, and apparel, footwear, and bags. In recent years, there is an increasing number of cross-border import e-commerce platforms emerging in the B2C e-commerce market in China. Brands capitalize on the consumption trend that leans towards foreign products and international brands.

Tmall International, NetEase Kaola, JD Global are the three most popular platforms in this sector, with NetEase Kaola making up the highest transaction value (27.7%), followed by Tmall Global (25.1%) in 2019. The consumer confidence in product authenticity on cross-border e-commerce platforms in China showed the same ranking as transaction value, with NetEase Kaola (38.8%) slightly outmatching Tmall International (36.1%). It is of importance to point out that although Little Red Book (Xiaohongshu) only ranks the fifth in transaction value, it has a strong presence among the female online shoppers in China and enjoys relatively high consumer confidence in product authenticity (15.9%). Considering that its main features as a platform for user-generated content (UGC), especially product reviews and native ads through celebrities’ and influencers’ accounts, it has great potential to become a major cross-border import B2C e-commerce platform.

[Data Source: Statista “Cross-border import retail e-commerce sector is gaining popularity in the B2C e-commerce in China”]

Why foreign brands should enter China’s B2C e-commerce market

The B2C e-commerce market in China displays high profit, high customer concentrations as well as high labor efficiency. Additionally, Chinese online shoppers generally have customer confidence and positive attitudes towards imported products and brands, indicating a great market potential for foreign brands planning to enter the B2C e-commerce in China. Moreover, as the country’s middle-class grows and disposable incomes increase, consumers tend to purchase not only greater quantity but a variety of goods on online platforms, which have competitive advantages at price, services, customer experiences and alternative payment methods over physical stores. Last but not least, the future B2C e-commerce in China is likely to enjoy preferential regulations from the Chinese government, creating a more favorable environment that will benefit both domestic and foreign investors.

Let China Paradigm have a positive impact on your business!

Listen to China Paradigm on iTunes