Energy Drinks Market in China: The beverage market’s fastest growing segment

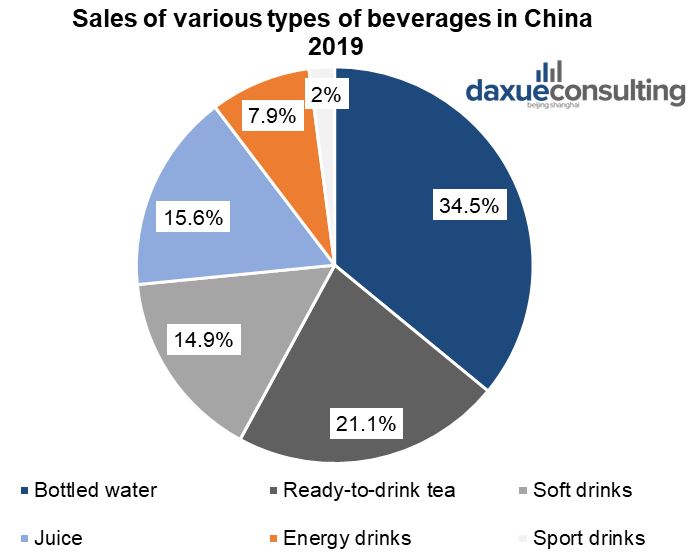

Bottled drinking water, ready-to-drink tea and soft drinks always dominated the beverage market in China. In 2019, they accounted for 34.5%, 21.1% and 14.9% of China’s beverage sales. After years of development, fruit juice and energy drinks markets have also become an important part of the beverage industry. In 2019, the top four companies in the energy drinks market in China totaled 37 billion yuan. In 2019, they accounted for 7.9% of China’s beverage sales.

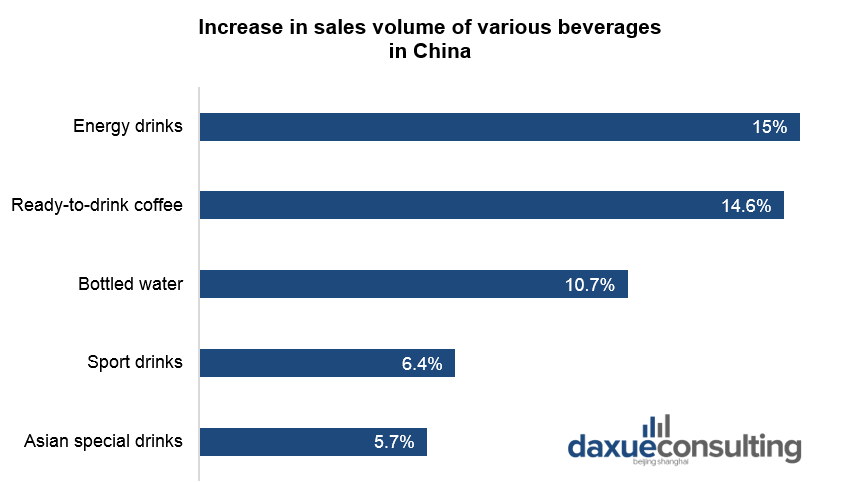

Energy drinks are not traditional Chinese drink, but they are gaining popularity among youngsters. Recently the variety of imported energy drinks to China is increasing. Today, China is the largest energy drink market. Statistics show that the retail sales value of canned energy drinks in China increased from 9 billion yuan in 2009 to 87.5 billion yuan in 2019. China as the largest energy drink market also has the highest market growth rate in the world. Sales amounted to over 1.3 billion litters in 2015, a year-on-year increase of 25 percent. In 2019 sales grew by 15 percent year-on-year to CNY 64.5 billion. It was one of the fastest growing sub-categories in the Chinese beverage market. Easy access and availability as well as the growing consumer purchasing power contributed to the increasing sales.

Energy drinks market in China has a huge potential

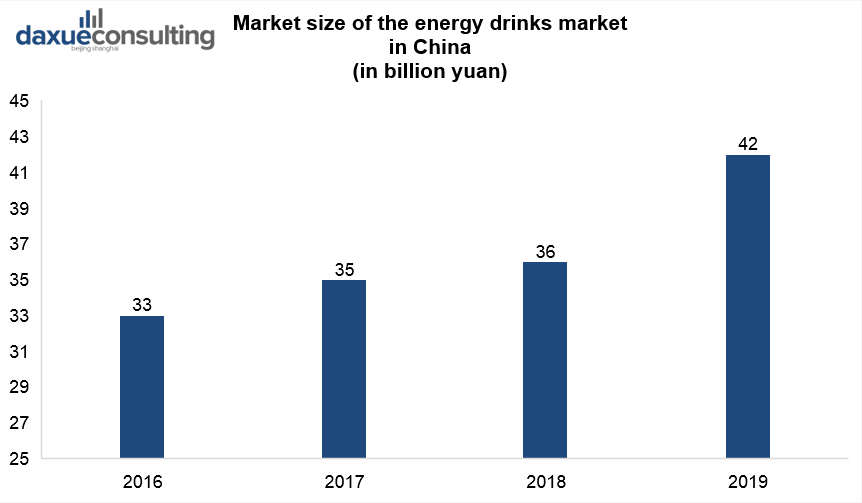

The size of energy drinks market in China has maintained an annual growth trend from 2011 to 2018. It grew from 9 billion yuan in 2011 to 36 billion yuan in 2018. Forecast shows it will rise to 48 billion yuan in 2021. In 2019, the total sales volume of the energy drink market in China was 42 billion yuan.

Per capita consumption of energy drinks is still quite low in China

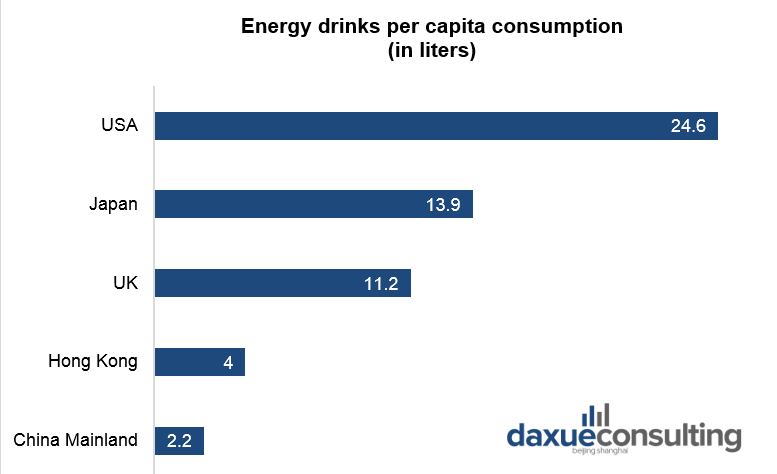

The energy beverage market in China started expanding quite late. The per capita consumption level of energy beverages is still significantly low, with broad room for growth. According to the data compiled by Euromonitor, the per capita consumption of energy drinks in mainland China in 2017 was 2.2 liters. This per capita consumption amount was 50% less than in Hong Kong. The gap was even more with the United Kingdom, Japan, and the United States.

Consumer groups are gradually expanding

The consumption group of energy drinks has gradually expanded, and consumption scenarios have become more diversified. In terms of occupational classification, the main consumer of energy drinks were drivers, couriers, medical workers. Currently energy drinks have more consumer groups such as students and white-collar workers in China. The consumption scenes have gradually expanded from overtime, staying up late to more casual such as parties and travelling. Some energy drink brands have begun to sponsor games and music festivals in China.

The expansion of consumer groups and diversification of consumption scenarios are important drivers of the growing energy drinks market in China.

China is the largest energy drink market with an exploding growth rate

Energy Drinks Market in China. Concerning global beverage consumption in 2021, China is expected to reach a 47.2 percent share, according to Beverage Daily, compared to the prediction of a 17.9 percent share of North America and Western Europe combined. Functional beverages have especially been enjoying a higher demand recently. Functional beverages are a sub-sector of the non-alcoholic industry and canned beverage, for instance, further classified into energy-, sports, or nutrient-enhanced drinks. Sports drinks primarily contain sodium, potassium, and magnesium, whereas nutrient-enhanced drinks usually include an extra supplement of vitamins, as reported by the Global Times. However, especially energy drinks, which already make up most of the functional beverages, are growing rapidly.

According to China’s General Administration of Quality Supervision and Standardization Administration, energy drinks are classified as “drinks with other special functions” as they contain caffeine, taurine, and sugar together with other ingredients such as guarana and B vitamins. Statista shows that the retail sales value of canned energy drinks in China increased immensely from CNY 9 billion in the year 2009 to an estimated CNY 87.5 billion in 2019.

Over the past decades, China’s industrialization and urbanization have been in the process of converting a large population to urban dwellers. This leads to increased regulations economic growth has continued to soar and develop into a market-based economy. The rising income and disposable income levels, and a constant improvement of living standards of Chinese people have resulted in modernized, busier lifestyles which is one of the primary drivers of the increase in demand.

The largest energy drink market China also has the highest growth rate in the world. In 2015, sales amounted to over 1.3 billion liters, a year-on-year increase of 25 percent, and sales grew by 15 percent YoY to CNY 64.5 billion, as analyst CCM stated. Easy access and availability through improved distribution infrastructure as well as the growing consumer purchasing power contributed to the increasing sales.

Energy Drinks Market in China: Red Bull remains the top market leader

Canned and bottled energy drinks are now sold everywhere in China, from supermarkets & hypermarkets to convenience stores, grocery stores, bars, nightclubs, and online. They have been enjoying a surge in popularity nationwide among its primary consumers such as gym goers, sports people, the working class, and school students who prefer a boosting beverage to recover their energy and stay awake.

China remains a fertile ground for the beverage market, and its energy drink segment and the vast market has attracted many businesses. However, the leading international player Red Bull dominates it. Competition is, therefore, rough. Red Bull in China unequivocally maintains the top position in the market. Bloomberg reports Red Bull having global energy-drink sales of $43 billion in 2015 and a global market share of 30.2 percent. Comparing global revenue of Red Bull in 2015 to their main competitor, Monster Beverage Corp with a market share of 21.10 percent, the picture on Chinese grounds looks entirely different.

Red Bull in China, which is not carbonated, accounts for a significant market share of about 80 percent. Eastroc Super Drink follows with about 10 percent, and others like Dali’s Hi-Tiger or Wahaha’s Qili share the remaining. Also, Monster Beverages has entered the Chinese market. According to Reuters, Coca-Cola Co bought a 17 percent stake in Monster Beverage Corp, also seeking to expand into the fast-growing energy drink category.

However, it remains unclear how successful Monster Beverages will be. Not only because of the intense competition but also because of beginning difficulties, as its trademark has already been registered in China, according to CCM Data and Business Intelligence.

A new trend towards flavored energy water?

The changing consumer preferences in China, such as a growing awareness about health and fitness benefits, and the willingness to pay more for a quality difference, indicates the energy drinks market will have to show adaptation. Concerns regarding high sugar content require upgrading products. In particular, as the young population at the age of 25-35 years is the target customer for energy and sports drinks, the brands should match their new expectations which are not only low-calorie, high nutrition, functional features but also natural and fashionable drink products.

One of the brands in the Chinese functional drinks market is Glaceau Vitamin Water. The world’s largest beverage maker, the multinational Coca-Cola Company, produces this brand. Unlike other energy drinks, which usually contain caffeine in combination with other energy-enhancing ingredients such as taurine, herbal extracts, and B vitamins plus calories, Glaceau Vitamin Water is made with natural ingredients preserving their nutritional values and gets rid of artificial flavors and preservatives which give it a wider appeal to existing and potential consumers.

The Chinese beverage brand Nongfu Spring launched Victory Vitamin Water, prompting Coca-Cola to accuse them of plagiarism, as reported by China Daily. Additionally, the success of Mizone, the flavored energy water brand owned by Danone, highlights the trend by taking first place in the sports drinks segment.

Nevertheless, energy drinks like Red Bull, for example, are very popular in the energy drinks market in China, yet each can (250 ml) contains 80 mg of caffeine which amounts to two cups of coffee or a cup of tea. Other brands of energy drinks contain several times this amount without displaying the presence of caffeine. William Reed Business Media describes energy drinks as controversial, but successful. The reason behind that phenomenon may be their efforts in marketing and advertisements, claiming energy-boosting effects as well as an impressive image, which consumers believe, according to Euromonitor. The Chinese government also keeps an eye on the production of energy drinks and has been controlling and mini increased regulation for the energy drinks industry. These include the production standards and strict acceptance standard given that energy drinks are directly related to the health of the consumers.

Energy Drinks Market in China Prospects for the industry

Energy drinks market in China will tend to be more competitive. Leading brands will consider investing more capital and energy on distribution penetration, marketing campaigns, and research and development of energy and sports drinks made of natural ingredients while preserving their nutritional values to fit requirements from the high-end market consumers. Other domestic players in the energy and sports drinks industry will put their focus much more on second- and third-tier cities and enhance their distribution channels to create an affordable alternative to the key players in the market.

Nevertheless, growing personal disposable income, changing lifestyles, and increasing consumer spending on food and beverages will further drive the energy and sports drink market in China. Thus, the segment provides immense opportunities in China. However, at the same time, one should not underestimate the challenges it entails and should do a professional market analysis and research in advance.

To know more about Energy Drinks Market in China, please don’t hesitate to contact us.

Stay Up To Date! Sign up for our Newsletter to Receive the Last Updates or Follow us on LinkedIn

Listen to 100 China entrepreneur stories on China Paradigms, the China business podcast

Listen to China Paradigm on Apple Podcast

![[Podcast] China Paradigm #27: How to succeed in China’s tea market while starting from scratch](../wp-content/uploads/2019/04/China-marketing-podcast-27-150x150.jpg)