The spirits market in China: The four most popular alcoholic drinks among Chinese consumers | Daxue Consulting

Spirits market in China

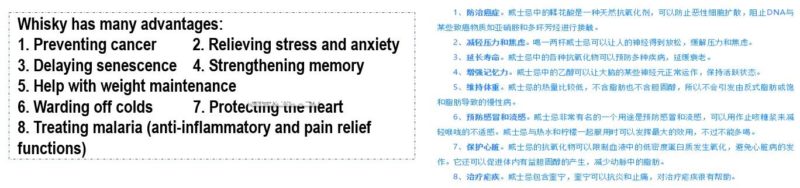

The spirits market in China is flourishing as the income level of Chinese consumers is increasing. High-end spirits, such as Moutai, Chivas, and Martell, are common guests on Chinese tables. Besides Baijiu, the local spirit of China still dominates the Chinese spirits market; while western spirits like whiskey and brandy have more and more influence on Chinese consumers’ alcohol choices. Western alcohol culture is becoming popular among the younger generation, and the rise of e-commerce platforms (e.g., Taobao, JD, etc.) enable western spirits brands to enter China’s alcoholic beverage market more easily. Nevertheless, the regulations of China’s alcoholic beverage market suffered changes for a long time, and the legislative body has still not reached consensus on how to regulate alcoholic drinks in China.

Spirits regulations in China

Various regulations of alcoholic beverages in China, including spirits regulations in China, are in place. The Ministry of Commerce of China (MOFCOM) issued the new version of the Food Safety Law of China in 2009 and amended it in 2018 as the document to regulate the Chinese spirits market. In 2015, MOFCOM also issued two standards, Management standard for alcohol commodities retailing and Management standard for alcohol commodities wholesale, to instruct alcohol business entities to undertake the purchasing, selling, distributing and storage of alcoholic drinks in China. At the same time, regional administrative bodies, such as provincial governments, also issued local spirits regulations as complementary documents to China’s alcoholic beverage market.

As for exporting alcohol to China, there are spirits regulations which exporters must become familiar with. The State Economic & Trade Commission, which is known as MOFCOM, issued Administrative Rules for Imported Alcohol in Chinese Market for all alcoholic beverages in China that are imported from other countries and areas.

In 2017, MOFCOM also mentioned that it would set up a comprehensive institution to guide and monitor the production, distribution, and consumption of alcoholic drinks in China. This institution would include unified spirits regulations in China as the guideline for the Chinese alcoholic beverage market.

Chinese spirits market size

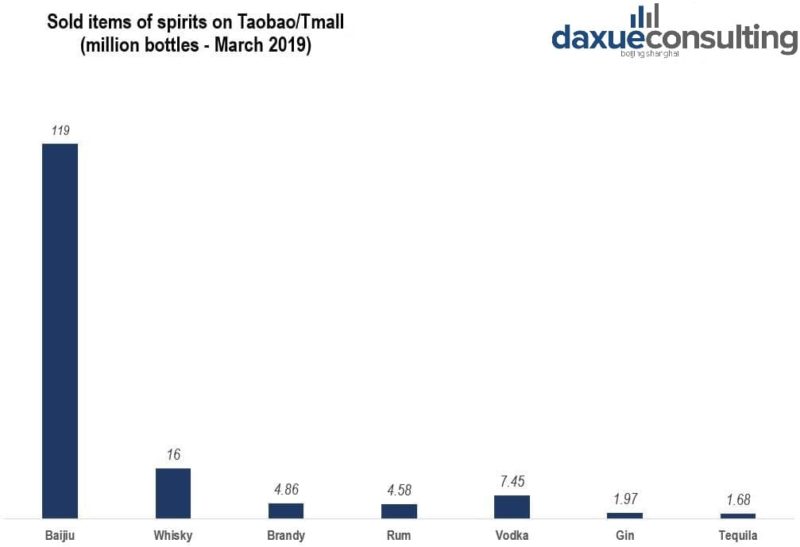

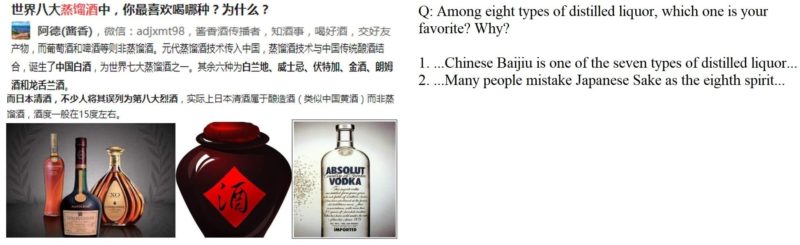

Seven kinds of spirits are on sale in China, respectively are Chinese Baijiu, Whisky, Brandy, Vodka, Rum, Gin, and Tequila. According to the data on Taobao and Tmall, which are the e-commerce platforms run by Alibaba Group, Chinese Baijiu sold most bottles in China compared to the other spirits. Considering the representations of Taobao and Tmall, it is clear that Chinese Baijiu still beverage of choice in the spirits market in China.

Another thing to be noticed is that Whiskey performs better than western alcoholic beverages in China: about 2 times more than Vodka, 3 times more than Brandy and Rum, and 10 times more than Gin and Tequila.

Consumption of alcoholic drink in China

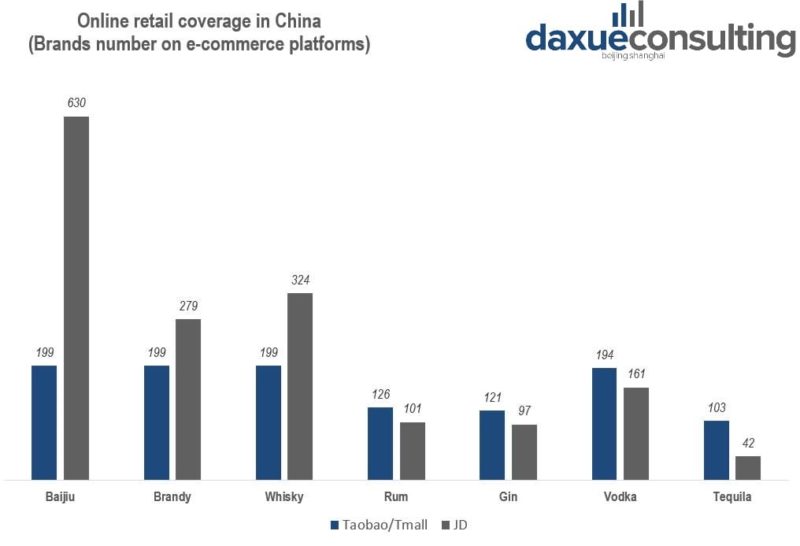

Spirits brands sell their products mainly through Taobao/Tmall and JD as online channels. These brands set up their official stores on the platforms and attract consumers by multiple discount activities. Some of these brands also build up their own e-commerce platforms or utilize their websites as part of their online sales channels. Among these platforms, JD is the most prevailing online channel for spirits brands. Baijiu brands on JD are 630, which is about 3 times more than those on Taobao/Tmall. Brandy and Whiskey, the other two prevailing spirits in China, both have more brands in JD than Taobao/Tmall as well.

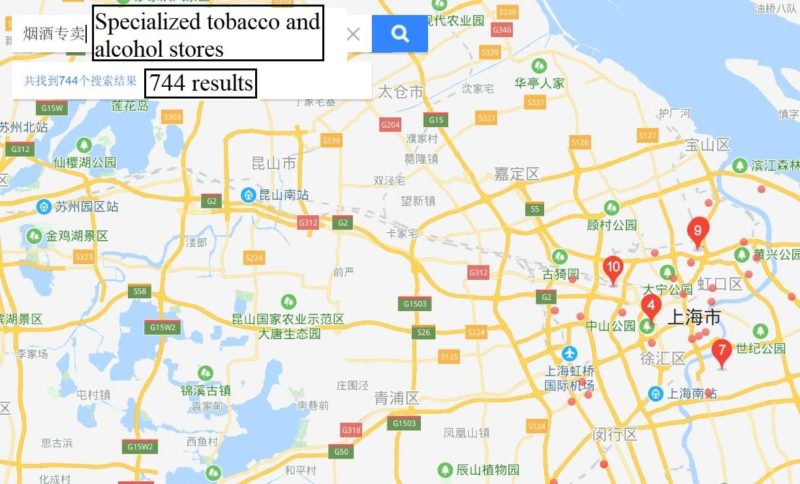

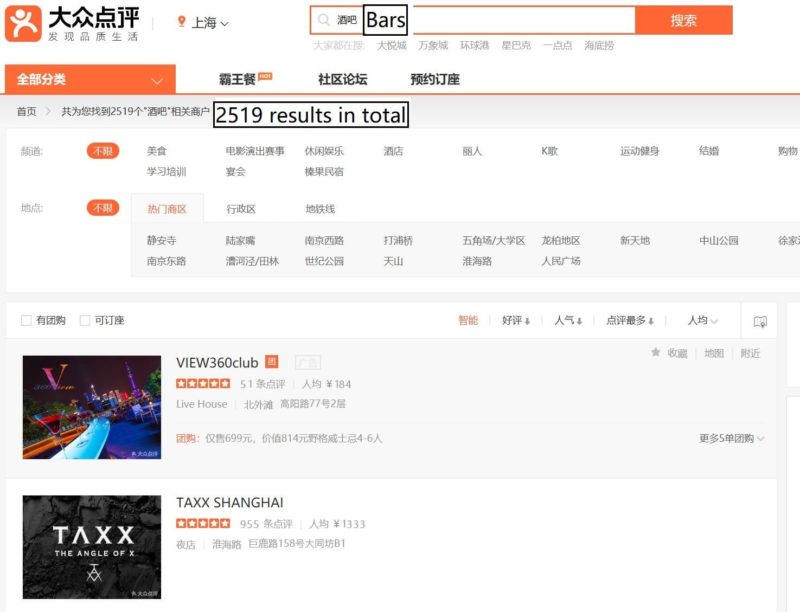

Offline sales channels are also crucial for promotion of to alcoholic drinks beverages in China. Spirits mostly are sold offline in bars, specialized alcohol stores, wholesales market, restaurants and supermarkets, and currently there are a lot of these spots. Taking Shanghai as an example, there are 670 specialized alcohol stores, 2581 bars, and 220 wholesale markets in total, exposing the spirits to more consumers. However, as bars are exotic and cocktail culture seldom includes Chinese Baijiu, bars are usually not the places to sell Chinese Baijiu with other western spirits.

Brands that are famous in the Chinese spirits market are Moutai for Baijiu, Martell for Brandy, Absolut for Vodka, Chivas for Whisky and Bacardi for Rum.

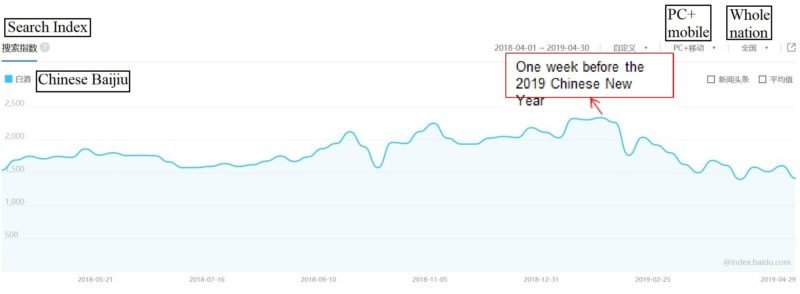

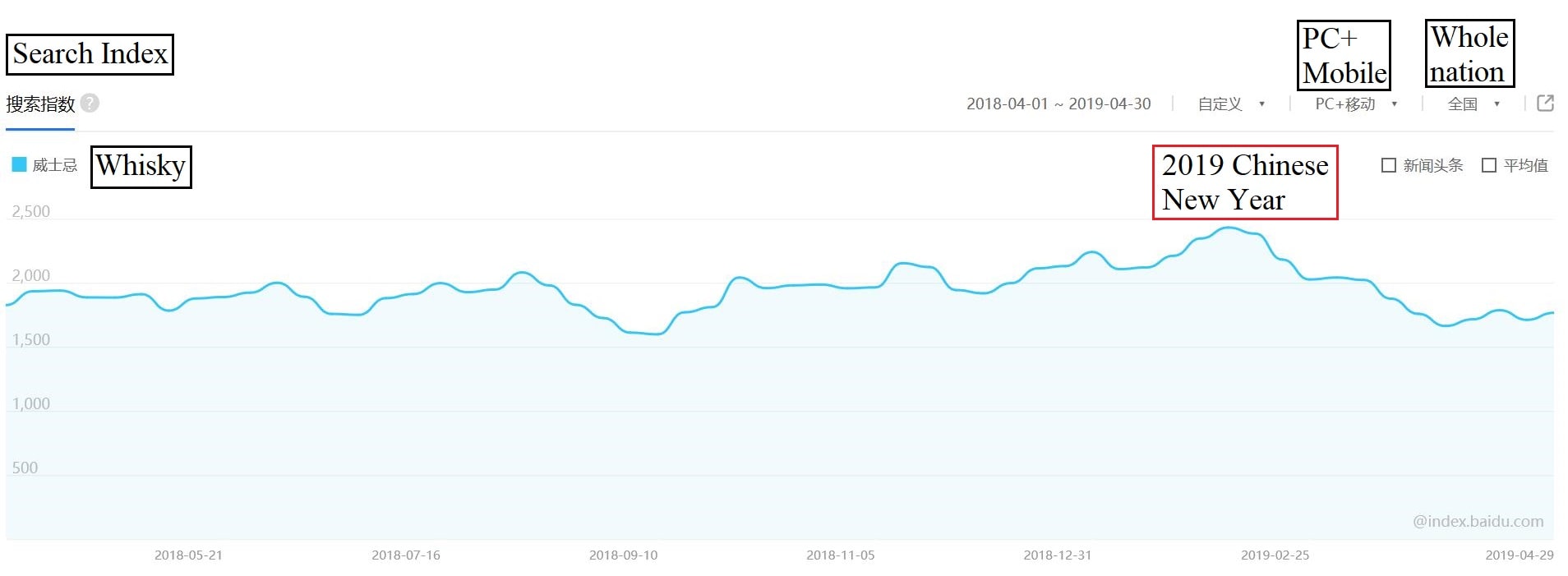

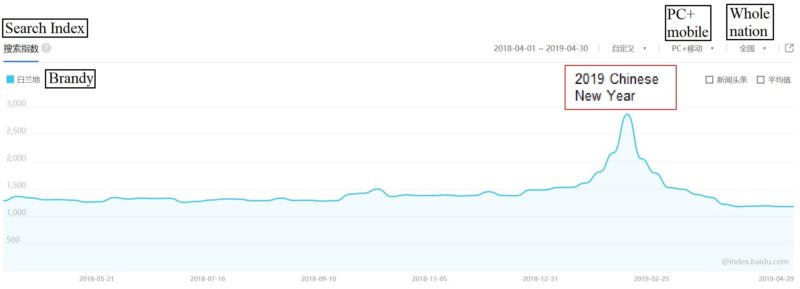

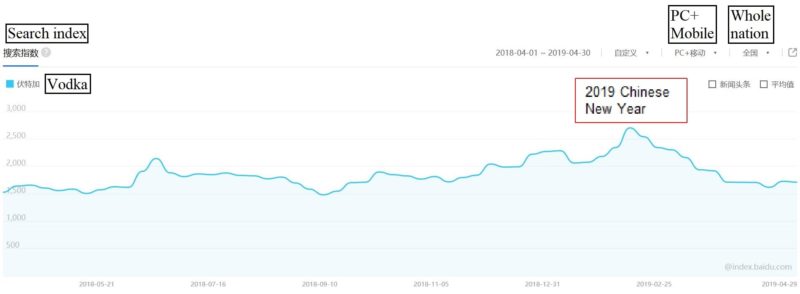

According to Baidu index, around Chinese new year in 2019 is the time when spirits were mostly searched by Chinese consumers. Chinese Baijiu had not as many increments in searching as other spirits; one explanation could be Chinese consumers are not as familiar with foreign liquors which warrant more research before buying, which reflects the desire of buying western spirits grows stronger.

Search results of specialized tobacco and alcohol stores and bars, which are the main spots that Chinese consumers buy alcohol beverage in China, in Baidu map and Dianping show that a good deal of these spots exist in Shanghai: there are about 744 specialized tobacco and alcohol stores and 2519 bars (including night clubs) where provide spirits sales in Shanghai, which are the same places as other cities in China. These alcohol stores and bars consist of Chinese spirits market and boost the sales of alcoholic drinks in China. One point is Chinese Baijiu is mostly sold in specialized stores while western spirits are mostly sold in bars and night clubs as bar culture is more compatible with western spirits, and cocktails are made by western spirits instead of Chinese Baijiu.

Spirits recognitions of Chinese consumers

Since the Chinese spirits market is still developing, Chinese consumers online searches are more queries about alcoholic drinks in China, asking questions about spirits and expressing different feelings of drinking spirits.

What are spirits for Chinese consumers?

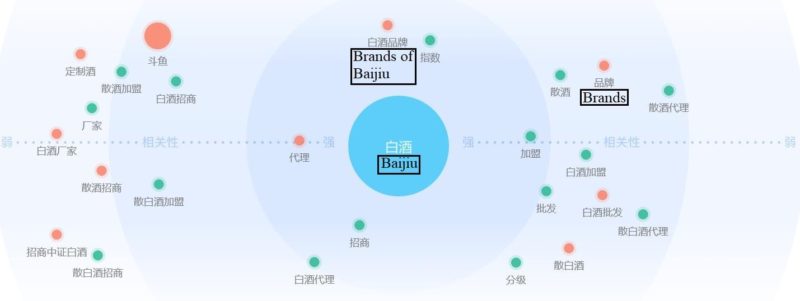

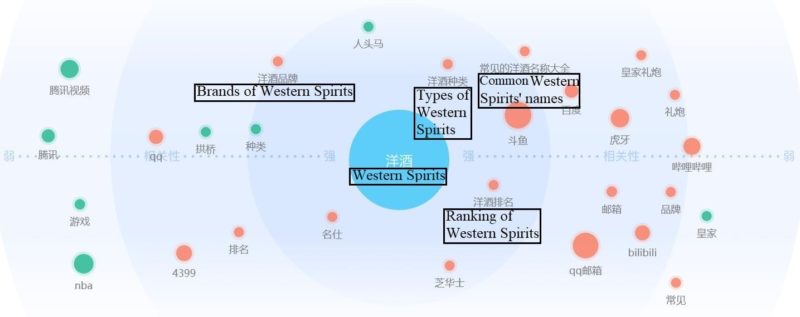

The result of Baidu index shows that Chinese consumers know more of Chinese Baijiu than western spirits. When it comes to western spirits in China, related words like ranking, names, brands, and types show up more than before.

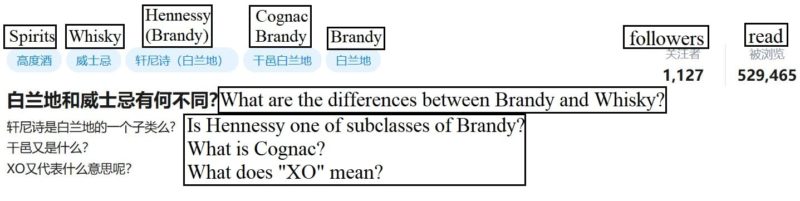

On Zhihu, while Chinese consumers are in the learning phase of the different liquors in China, there is a lot of questions on how to distinguish one spirit from another (Brandy and Whiskey), or Japanese Sake from true spirits. It seems that Chinese consumers don’t have much knowledge of identifying western spirits.

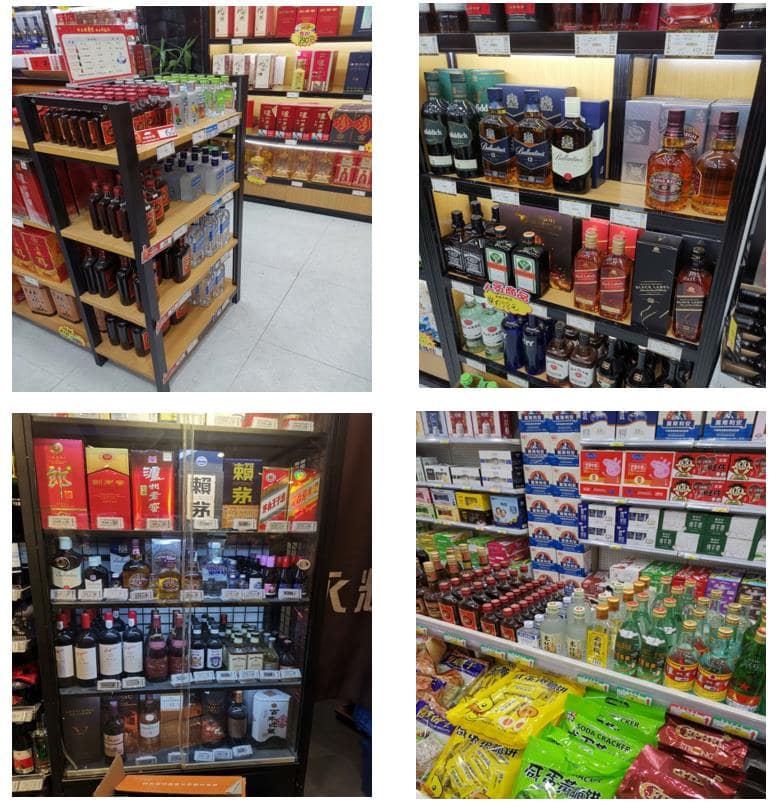

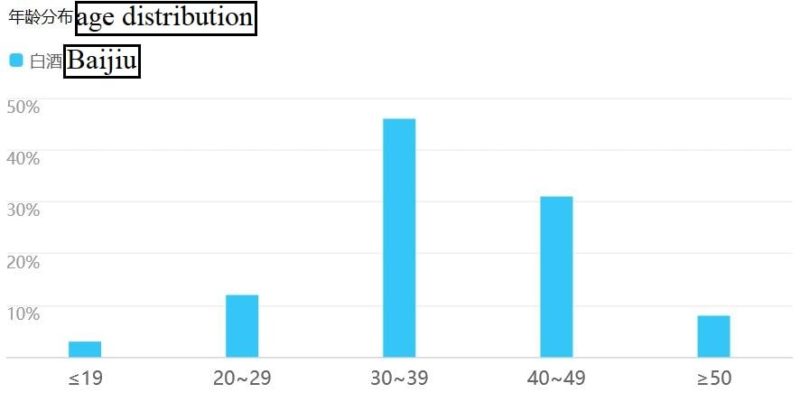

Chinese spirits market also has no detailed category of spirits when they are displayed in markets. Street shots of several Chinese specialized tobacco and alcohol stores reveal that spirits are easily separated by two types: Chinese Baijiu and other spirits.

Contact us for any question on the Chinese market

More Chinese consumers become big fans of western spirits

Despite the fact that Chinese consumers don’t know much about the western spirits, the culture of the western spirit becomes more and more popular among Chinese consumers, especially among the post-80’s.

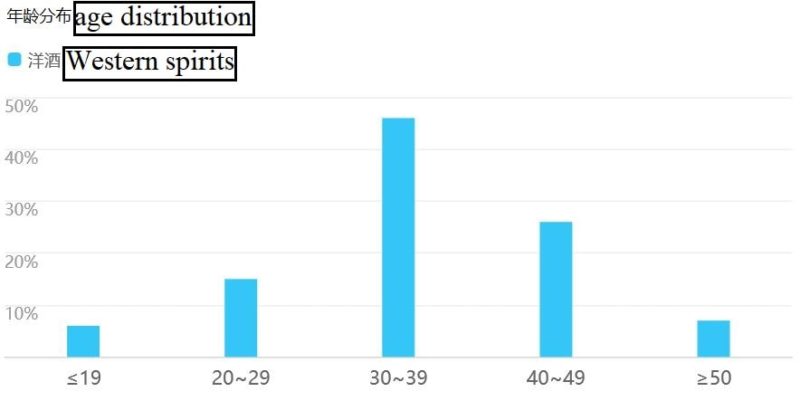

On Baidu index, it shows that age group 30-50-year-olds to the majority of Badu searches on spirits including Baijiu and foreign spirits. While the 20’s age group has not reached their max earning potential, but there are more people in this age group coming to understand the different spirits in China.

KOLs’ introduction of spirits

Besides the initiatives of Chinese consumers, KOLs on Weibo and other Chinese popular platforms also facilitate the understanding of the spirits in China. Certain KOLs post what they know about alcoholic beverages enabling more and more Chinese netizens to understand the alcoholic drinks in China, including how to drink them.

How Chinese drink western spirits: cocktails or shots

Spirits in China may be consumed differently than in the west. For Chinese Baijiu, it is almost always drunk straight. This method was not suitable to other western spirits for most Chinese consumers at the beginning because they were not accustomed to the flavors of western spirits, and therefore bars and night clubs mainly produced cocktails rather than serving shots. But currently, Chinese consumers are trying to take western spirits in the same way as Chinese Baijiu. Single malt Whisky, for example, is becoming a new favorite in bars as Scotch Whiskey become famous in the spirits market in China.

The four most popular alcoholic beverages in China

Based on the graphs showed above and current market situation, the four alcoholic beverages most popular spirits in China, namely Chinese Baijiu, Whiskey, Brandy, and Vodka.

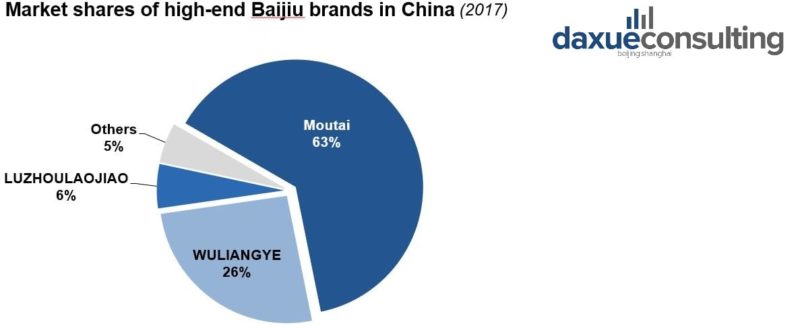

Competition analysis of Baijiu in China: Moutai still take the first

Chinese Baijiu is the best-selling spirit in the Chinese spirits market. At present, there are dozens of Baijiu brands in Baijiu market in China, and the most popular one is Moutai from Guizhou Province.

According to the pie graph of 2017, Moutai accounts for above 60% of the Baijiu market in China, followed by Wuliangye, which accounts for 26%, the remaining brands’ market shares don’t exceed 10% individually.

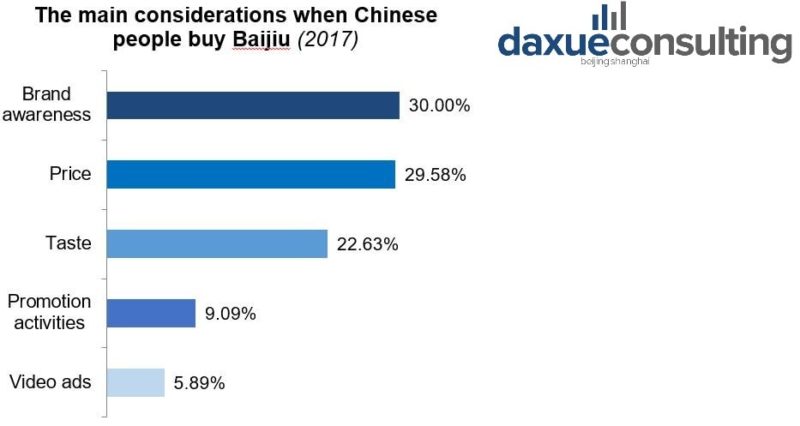

The bar graph above shows the preference of Chinese Baijiu consumers. It seems that the brand and the price are the main aspects when Chinese consumers consider most when they buy Baijiu. This can also explain why Moutai has the biggest market share in Chinese spirits: as Baijiu is already the most popular spirit in the Chinese spirits market, Moutai is also in the leading position of Baijiu market in China as it has both high price and low price products, which allow Moutai to keep its brand awareness and give diverse price choices to consumers.

Competition analysis of Whiskey in China: Single malt whiskey booms

Chinese liquor consumers are younger compared to other countries, according to the news report on ifeng. Whiskey brands like Chivas have already noticed this trend and adopted the corresponding tactic to attract young consumers group. Chivas, one of the famous Whisky Brand, invited Kris Wu, who is a pop star in China and is popular among Chinese more youthful generation, to shoot the advertisement for its Whisky. The advertisement aimed to attract Kris Wu’s fans, who mostly are young people as well as the potential consumers of the whiskey market in China. To attract more young consumers, Chivas also cooperated with the NBA and successfully increased its spirits sales in China as basketball is popular in China.

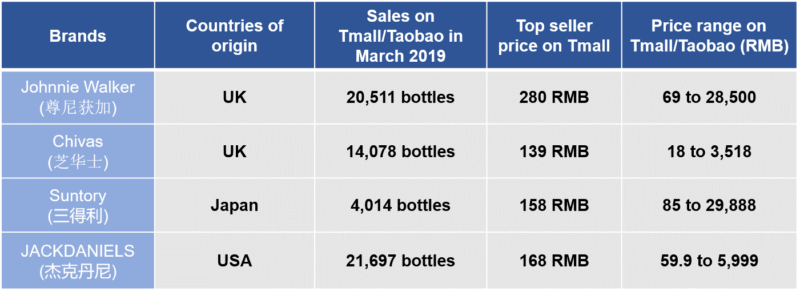

UK (Scotland) and the USA are the original countries of popular brands on Taobao/Tmall. Due to a good reputation, flavor, high-end images, and fashionable package design, their spirits sales in China are quite high.

There are a few Asian brands (such as Japanese) selling on Taobao/Tmall, but their sales are much lower than Western brands.

With the popularity of Whisky, Scotch Whisky exposes more to Chinese spirits consumers, which creates a new submarket of the Whiskey market in China: single malt Whisky. According to the data released in 2018 by SWA (Scotch Whiskey Association), “a record number of 2,026,779 bottles of single malt 70cl Scotch were exported to China in 2017, a surge of 190 percent compared to five years ago, and equivalent in value to 20.1 million pounds ($25.3 million).” China Daily reported. It shows that the exporting alcohol to China of SWA will increase, and single malt Whiskey is expected to grow in sales and stimulate the growth of the Whiskey market in China. First-tier cities like Beijing, Shanghai, Guangzhou, and Shenzhen have bars specialize in providing single malt whiskey to Chinese consumers.

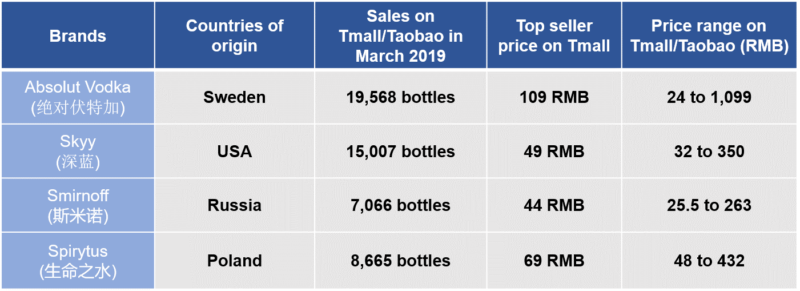

Competition analysis of Vodka in China: Vodka and fashion

The Vodka market in China is led by Absolut Vodka produced in Sweden, followed by Skyy produced in the USA. The reason that Absolut Vodka has led the Vodka market in China for many years is it cooperated tightly with different sectors. In the past years, Absolut Vodka considered what was popular and utilized the favorite element to decorate its products and create an appealing advertisement. By the upscale images, pleasant taste and creative advertising, Absolut Vodka has been the most popular vodka brand and attracted many high-income consumers in the Vodka market in China, although its price is relatively high.

Competition analysis of Brandy in China: Chinese Brandy producer Zhangyu

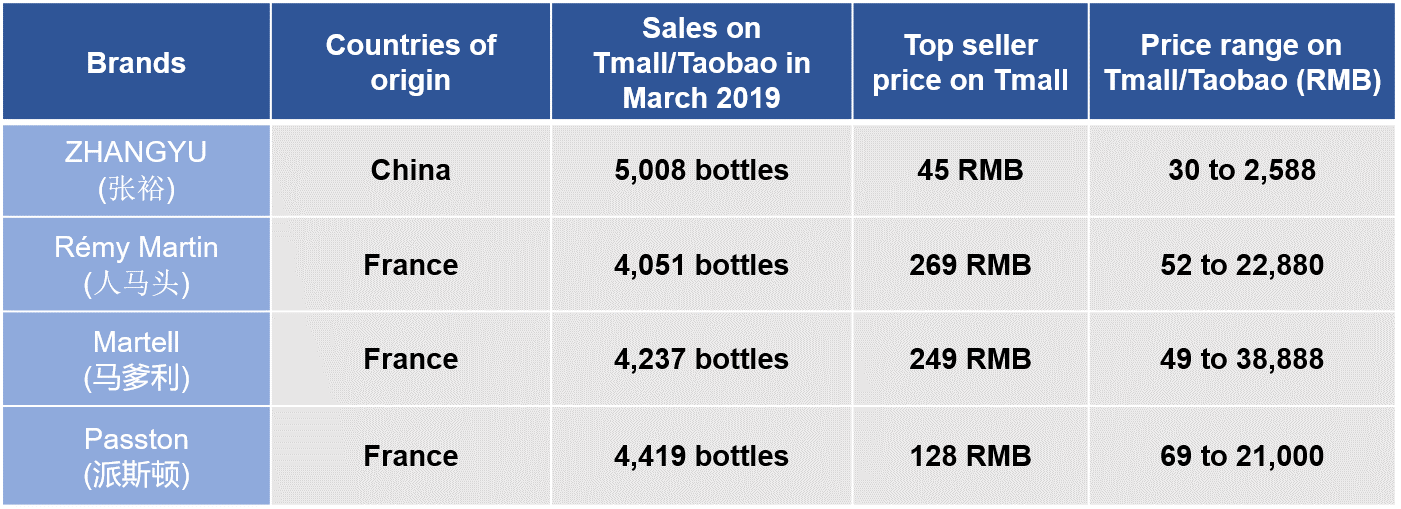

The table above shows the Brandy market in China is occupied by French Brandy brands, which enjoy a long history of Brandy production and decent reputation. Their high-end images, good quality, and appealing package designs attracted a large number of Chinese consumers.

Brandy brands in the Chinese spirits market utilize digital activities to advertise themselves and boost Brandy spirits sales in China. Martell, a famous Brandy brand, makes its advertisement by cooperating with e-commerce platforms and social media to build up its high-end image, such as participate in Tmall’s “Super Brand Day” and shoot videos for ads.

One thing noticeable is that Chinese Brandy brand Zhangyu also emerges and accounts for the most market share in the Brandy market in China. It seems that Chinese domestic alcoholic beverage manufacturers are also entering the Brandy market in China to compete with foreign brands. However, as Zhangyu shows, Chinese Brandy products are at a low price to win the market share compared to French counterparts.

The current trend on the Chinese spirits Market

For China’s alcoholic beverage market, the spirits market is promising, and three trends are predicted to be shown as follows:

The majority are young consumers

More and more international brands are targeting young consumers (post-90s) by building fashionable images since they have enormous consuming potential and willing to pay for fashionable lifestyles. At present, as more and more night clubs, bars, pubs are prevailing around 1~ and 2-tier cities in China, and they are the central bodies who receive exporting alcohol to China, younger generation group have more chances to get access to western spirits, knowing more about western spirits culture as well as stimulating the growth of the spirits market in China. With growing China’s alcoholic beverage market, and higher income level, the scale of the market may influence more young consumers to enter the Chinese spirits market.

More sales of mobile shopping apps

Mobile shopping apps are creating new distribution channels for many brands; international brands are trying to increase their sales through the rising mobile shopping in China. At present, 71.7% of mobile devices had shopping apps installed, and as Taobao/Tmall and JD develop their own mobile app to access to their online platforms, the popular spirits brands like and Martell who have already set up official stores on the platforms or had cooperation with them will probably surge their sales in Chinese spirits market.

Author: Dennis Deng

Make the new economic China Paradigm positive leverage for your business

Do not hesitate to reach out our project managers at dx@daxue-consulting.com to get all answers to your questions

![[Podcast] China Paradigm 41: How to start a trendy wine chain in China](../wp-content/uploads/2019/05/Podcast-wine-chain-China-150x150.jpg)

![[Podcast] China Paradigm #27: How to succeed in China’s tea market while starting from scratch](../wp-content/uploads/2019/04/China-marketing-podcast-27-150x150.jpg)