Cosmetics and personal care market in China: Making use of the digital landscape | Daxue Consulting

China’s Skin Care market revenue will amount to around to US $28.7 billion in 2020. According to Statista, it is expected to grow annually by 8.9% (CAGR 2020-2023) and the Cosmetics market revenue amounts to US$19.2 billion in 2020 and is expected to grow annually by 11.0% (CAGR 2020-2023). Combining skin care and cosmetics, the estimated 2020 revenue of the cosmetics and personal care market in China is US$47.9 billion US.

Overview of China’s cosmetics and personal care market

Cosmetics and personal care are fast growing sectors within Mainland China. Spanning across a wide variety of industries including makeup, skin care, hair care, personal hygiene, fragrances, etc, the cosmetics and personal care market in China all around has experienced positive growth. The rise of the millennial generation has largely contributed to higher consumer demand, as well as the rapid expansion of the middle class.

Both domestic and international brands, particularly in the makeup and skincare industry, have taken great advantage of the digital landscape, penetrating the online environment with a combination of strong social media presence, e-commerce platforms, as well new Chinese reviewing and shopping platforms like Xiaohongshu (“little red book”). With an obvious advantage in the market share, international brands have made exceptional use of social media marketing and KOL influence, demonstrating the importance of building a digital platform in this new age of marketing.

Impact of Covid-19 on cosmetic sector in China

During the coronavirus outbreak, retail sales of beauty products in China dropped from 299 billion RMB in December 2019 to 37 billion RMB in the first two months in 2020. High-end brands were more affected than mass brands. Moreover, COVID-19 has different degrees of impact on different categories in the beauty market. The epidemic had a more negative impact on cosmetics than skincare products, while personal care products were gaining more popularity in this period. Indeed, people spent more time at home and they could focus more on their skincare.

In the past several years, live streaming has become increasingly popular as more consumers attach more importance to immersive experiences and personalized recommendations. The epidemic stimulated the dramatic growth of live streaming and made KOLs more important than ever, this trend can also be seen with the cosmetic sector.

Skin care products have the highest market penetration in China

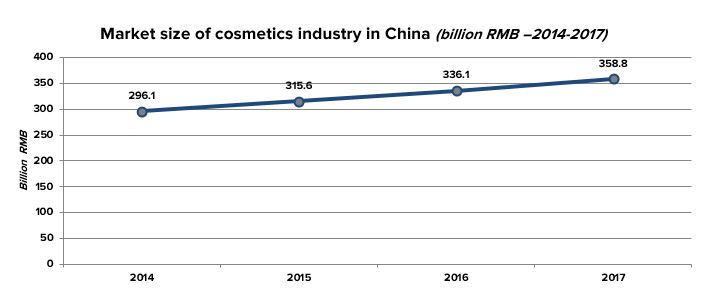

The market size of the cosmetics industry in China has been steadily rising in recent years, growing by 21% since 2014. Increasing income of the Chinese population, as well an increase in beauty consciousness and awareness has largely contributed to continuously increasing demands for cosmetic and personal care products in China. More people have started to pursue aesthetic trends, specifically honing into Western fashion and beauty trends.

Contact us for any question on the Chinese market

Portrait of the consumer in the cosmetics and personal care market in China

Consumers 30-35 years of age have been the largest consumer group due to their strong purchasing power. Consumers in the 25-29 years old range make up the second largest group, as this younger, more tech-savvy generation is much more exposed to social media and its proliferation of beauty-related content. This group is experiencing the most growth in terms of buying potential and willingness to purchase. As the middle class continues to grow, higher disposable income in the millennial generation is also expanding the market potential for cosmetics and beauty care in China.

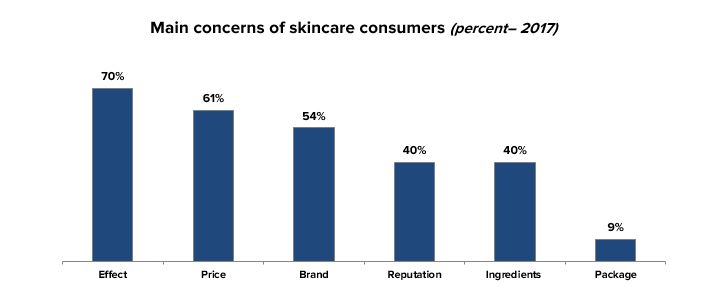

Effectiveness, Brand, and Price are most important to Chinese consumers

As of currently, China’s competitive landscape is very dense with a large presence of domestic and international players releasing high-quality products. Online discussion among consumers is thus very high. On Zhihu, the most frequently asked questions relating to cosmetics and beauty products in the Chinese market are: advice on picking products based on need, how to use certain products, and comparing different brands. On Wechat, the popular discussion is along similar lines, in addition to market share related questions. On Weibo, consumers and KOL’s share information of popular cosmetics brands in China through pictures and videos. Amongst the discussion, international brands are most popular.

The most significant qualities that Chinese consumers look for in their products are effectiveness, price, and brand name. However, a 2018 survey from the Ministry of Commerce revealed that 75% of Chinese consumers claimed that skincare products in China’s domestic market did not fit their needs. Thus, this indicates an enormous potential for imported products as international companies can seek to fill this unmet demand in the Chinese market.

Cosmetics and beauty care in China: International brands show an obvious advantage

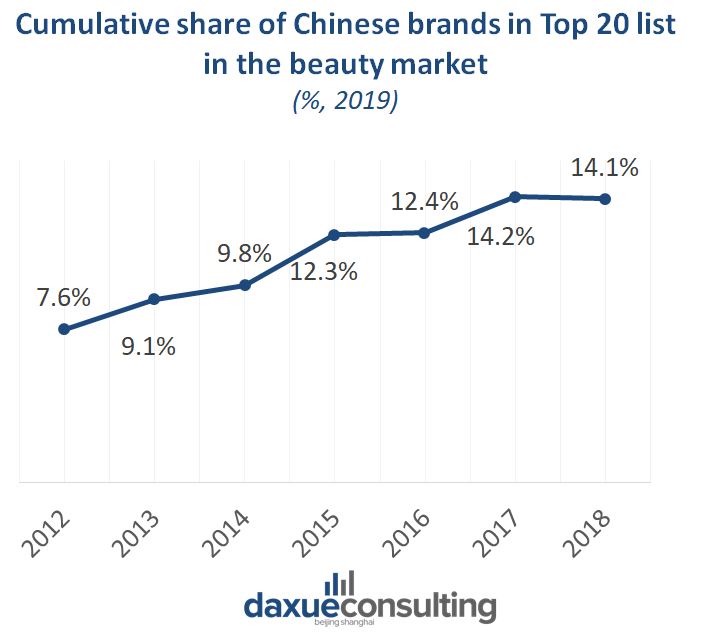

Among the top cosmetics players in the Chinese market, international brands show an obvious advantage. Among the top 10 cosmetics players in China, only 3 were domestic, with international markets dominating a significant market share of 61.5%. Among fragrances, international brands have a larger variety of product series, better product design, and a more well-received reputation.

As for makeup, the top seller price of international brands is higher than domestic brands, but both domestic and international brands are commerce on e-commerce platforms which demonstrates consumers are willing to pay more for brands that are better perceived. The biggest quality associated with international brands is its effectiveness, as its overall effects and benefits are thought to be higher than those of domestic brands. However, Chinese domestic beauty brands were gaining popularity in the past few years. They had been estimated to gain more market share in the future.

Data source: data.iimedia, 360 cosmetics, daxue consulting report. The share of domestic brands in China’s beauty market is increasing

Cosmetics industry in China: What are the main distribution channels?

Supermarkets and hypermarkets are the main winners in the battle for distribution share of beauty and personal care goods in China. Concerning the online sales, in 2018 Alibaba’s e-commerce platform Tmall accounted for nearly 49 percent of the total online cosmetic product retail revenue in China, followed by JD.com with 29 percent of the market revenue share. Online distribution channels accounted for almost 40 percent of the total cosmetic product retail sales in China that year.

How can international brands attract the attention of Chinese consumers?

For all cosmetics and personal care brands, social media and e-commerce platforms have been very effective approaches to branding in China. These online channels have successfully built trust and reputation among Chinese consumers. Cosmetics and beauty products are a thriving market for an online landscape in today’s social media proliferation.

Social media platforms are essential to international brands in order to engage with local Chinese consumers. Many cosmetics and personal care international brands have already created Wechat and Weibo accounts, as well as stores on e-commerce platforms. On Weibo, beauty/fashion KOLs can engage with fans and audiences, enabling them to easily affect consumers’ purchasing decision.

WeChat is often used as a channel for brands to quickly engage with consumers as well as collect personal feedback from them.

Moreover, some brands offer personalization to their client through mini-program. For example, Dior cosmetics and fragrance created an exclusive mini-program with a gift box that can be personalized with a little note (“我爱你”:I love you, “谢谢你”: thank you, “生日快乐”: happy birthday) while customer is buying a product. The large social engagement in the cosmetics and beauty care industry demonstrates its popularity in the online landscape.

Clinique WeChat Account

Cross-border e-commerce also makes international brands easily accessible to the Chinese market with fewer barriers such as tax. Tmall, JD, and JUMEI are the main platforms in the Chinese market for purchasing cosmetics and getting detailed info of products. The most popular brands have all built official offline stores on these platforms. On the Baidu Index, Dior showed the highest search frequency, Estee Lauder had the second highest search frequency, and Max Factor showed the lowest search number during the past year. Many of these brands also launched discount activities for the double 11 shopping carnival.

Cosmetics and beauty care in China: KOL’s as a driving force

For international brands, KOLs are a huge part of modern Chinese product promotions. Consumers of this sector are highly influenced by shared opinions and experiences of KOL’s. Many of these KOL’s have a tremendous following in Chinese social media. In the cosmetics and personal care industry, they mainly consist of fashion writers and models, makeup artists, brand founders, and cosmetic formulators.

Dior: Adverting and digital landscape in the Chinese market

Diorsnow Campaign

Dior is a very popular foreign luxury cosmetics brands in China with a strong online presence both in e-commerce and social media. Its Chinese name 迪奥 is merely a phonetic translation of its English name. In October of 2018, Dior had the highest sales revenue with 72,280 items, despite the price of its top-selling item also being one of the highest, at 619RMB.

Dior’s advertising campaign for its Diorsnow line specifically for Asian skincare is a great example of how Dior has made use of its digital landscape within China. The content of this video clearly demonstrates localization to the Chinese market by appealing to the beauty standards of Asian women. The video describes a micro infused lotion, emphasizing its effects on skin brightening and whitening, which is a highly valued beauty trait for Chinese women. In addition, the brand is also very effective at engaging Chinese consumers by posting fashion news, videos, and pictures about its new products and arrivals on their Dior Weibo and WeChat accounts.

Xiaohongshu shaping online consumer discussion

Xiaohongshu 小红书 is a popular new social media and e-commerce platform. As of June 2018, the crowd-sourced review site has over 100 million registered users, 30% of which are under 30 years of age. It allows users to post and share product reviews, lifestyle blogs and articles using photos and short videos. It is also a very popular site for celebrity and KOL endorsement, thus attracting many users looking for recommendations in the cosmetics and beauty care industry China in China. The platform is especially popular amongst Chinese women as well and is a great way for brands to promote their products. By using mainstream social media and e-commerce platforms such as Xiaohongshu, brands can effectively build a good relationship with Chinese consumers by increasing trust and exposure within the Chinese community.

Contact us for any question on the Chinese market

The male beauty market is one of the booming sectors of the increasing cosmetics market in China

The data collected on Vipshop.com (唯品会) found that 96% of males purchased cosmetics. Moreover, the sales volume of skincare product purchased by men almost doubles every year. For the majority of Chinese men who have just awakened their skincare awareness, skin care awareness is no longer at the stage of “washing their faces clean”. Chinese men’s knowledge about cosmetics is constantly developing and improving, and the awareness of “facial care” is increasing. It is evident that facial masks rank first. BB creams, lips and eyebrow pencil also become the primary choice for most men. Therefore, the diversification of products is an important factor in the development of men’s product Chinese male consumers are more confident and willing to purchase and use beauty products, including both skin care and cosmetic products.

According to information released by L’Oreal, 16 brands are stationed in T-mall, and online sales in some business units account for more than 20%. Male may have more confidence in shopping online because they might feel freer and can choose what they want carefully.

Fast beauty in the Chinese market: Contract manufacturers have competencies to adapt to fast beauty

Recently, the influx of fast-beauty players is making its mark on the beauty industry. Fast beauty, by definition, refers to quickly on-trend products launch with the help of agile supply chain capability as well as digital marketing. In terms of its significant characteristic-fast adaptive, upstream segments of the beauty value chain like materials, packaging, Original Equipment Manufacturing (OEM), Original Design Manufacturing (ODM), Own Brand Manufacturing(OBM) and manufacturing equipment are also cashing in on the make-up boom. Winky Lux, for instance, aiming to quickly bring quality, affordable, on-trend products to the market, in its very early developing stage the founder Natalia Mackey decided to cooperate with a Chinese manufacturer.

Having convinced its contract manufacturer to invest equipment as well as some research and development, Winky Lux, due to this alliance, is capable of its dedication on fast turnaround times, and at the meantime guarantees the quality of products. The innovations conceptualization and the audits can be operated within 48 hours and then, are seamlessly delivered to the Chinese manufacturer to achieve quick aggregation and mass production. One of South Korean’s biggest contract cosmetic manufacturers, Cosmecca, has been expanding China production to meet surging demand, a third factory already in its plan. Even though the fierce competition of Chinese cosmetic landscape, these contract manufactures can gain stable earnings via effective and efficient production.

With more people than ever using the internet and other digital products, digital strategy in China is considered a major development direction for any company. Daxue Consulting works on the projects involving digital strategy and digital identity in the main cities as Shanghai and Beijing as we.