COVID-19 impact on China’s beauty sector | Report by daxue consulting

In the past five years, the beauty sector in China had shown a steady increase, and China had become the world’s second largest beauty market in 2019. However in late 2019 to early 2020, COVID-19 impact on China’s beauty sector played out in many ways, forcing beauty brands to reconsider their China market strategies.

Learn how COVID-19 impacted China’s beauty sector by downloading our full report.

The beauty sector in China before the COVID-19 outbreak

China’s beauty market developed steadily before COVID-19

In the past five years, the beauty sector in China had shown a steady increase. China had become the world’s second-largest beauty market in 2019, and the size of China’s beauty market reached 425.6 billion yuan in the same year. China’s beauty market becomes one of the fastest-growing and most promising fields of business in the near future.

Source: 360 make-up, Total retail sales of the beauty sector in China

Three key trends in China’s beauty market before COVID-19

The high-end segment grew faster

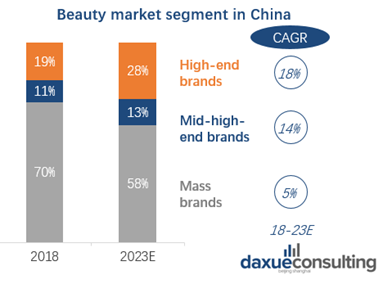

Source: Euromonitor, data.iimedia.cn, Beauty market segment in China

As China’s resident disposable income rises, people are more willing to consume, and there will be higher requirements in terms of the quality of life. According to data, in 2013-2018, the growth rate of the domestic high-end cosmetics market is accelerating, especially in 2017 and 2018, the growth rate reached 25% and 28.1% respectively. In China’s beauty market, although mass brands still play a major part in the market, the high-end segment was estimated to grow fastest in the next few years. It is predicted that the CAGR (Compound Annual Growth Rate) of the high-end brands, mid-high-end brands and mass brands from 2018 to 2023 will be 18%, 14% and 5%, respectively.

The popularity of social e-commerce on the rise

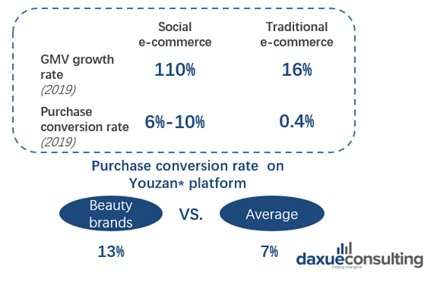

With the use of social media in the context of e-commerce is gaining popularity, increasing numbers of Chinese consumers are making their purchases through social media platforms such as Xiaohongshu and WeChat. It is a trend that social e-commerce is increasingly welcomed by both sellers and buyers in china. The social attributes and sharable characters make social e-commerce more friendly for beauty brands. For the beauty sector in China, the social attributes and shareable character make social e-commerce more friendly, and social e-commerce is set to become one of the mainstream sales channels in the future.

Source: Youzan, Beauty market segments in China

According to Youzan, a 3rd party WeChat e-commerce platform in China, the GMV growth rate and purchase convenience of social e-commerce are much higher than that of traditional e-commerce.

Rising preference for domestic brands

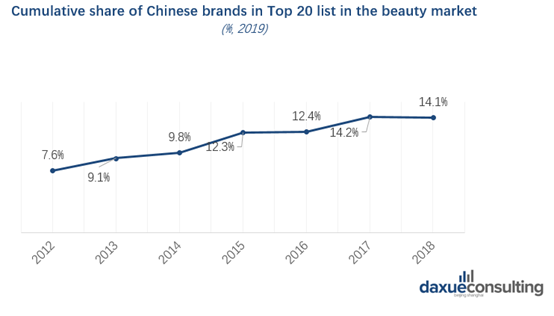

Source: China Association of Fragrance Flavor and Cosmetic, Cumulative share of domestic brands in Top 20 list in the beauty market

Thanks to the development of e-commerce, domestic beauty brands have risen strongly in recent years. Leveraging social media marketing and living marketing, some Chinese beauty brands, like Perfect Diary and Lin Qingxuan, have seen rapid growth. In 2018, the cumulative share of domestic brands in the Top 20 list in China’s beauty sector was 14.1%, increasing from 7.6% in 2012, and the percentage has been estimated to gain more market share in the future.

COVID-19 impact on China’s beauty sector

General impacts of COVID-19 on China’s beauty market

COVID-19 had a strong impact on the beauty market in the short-term

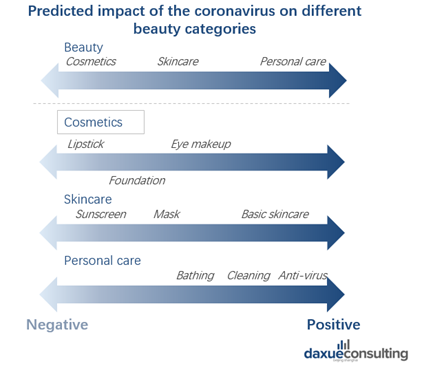

Source: iimedia research, Predicted impact of COVID-19 on China’s beauty market by product category

COVID-19 impact on China’s beauty sector was clearly negative in the short term. During the outbreak, retail sales of beauty products in China dropped from 299 billion RMB in December 2019 to 37 billion RMB in the first two months of 2020. High-end brands were more affected than mass brands. For different beauty sector segments, COVID-19 has varying degrees of impact on different categories in the beauty market. Also, the epidemic had a more negative impact on cosmetics than skincare products, while personal care products were gaining more popularity in this period. According to the Beauty Consumer Behavior Survey on 1,000 Chinese respondents, around 50% of the respondents stopped using cosmetics during the coronavirus.

Sales of beauty products decreased during COVID-19

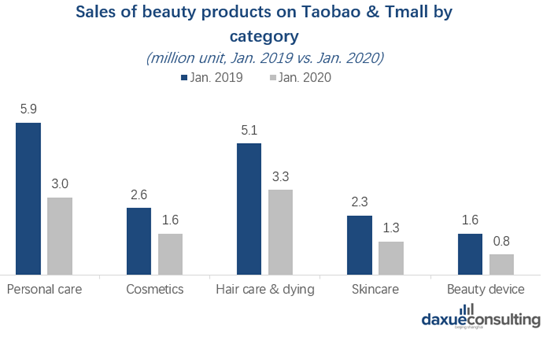

Online commerce events were also affected during the coronavirus outbreak. The sales performance of beauty products on Tmall and Taobao decreased by around 40% in January 2020 compared with the same time in 2019. Normally, shopping festivals on Tmall and Taobao might help to boost sales. However, in 2020, offline promotion activities on Tmall on Chinese New Year and Valentine’s day were all cancelled. The COVID-19 impact on China’s beauty sector was even more severe due to the cancelling of two commercial highlights.

Source: iimedia research, Sales of beauty products on Taobao & Tmall by category

The beauty consumption after COVID-19 experienced a dramatic drop, and the sales of beauty device products and that of personal care products both had a nearly 50% year on year decrease in Jan 2020. Compared with others, the sale of hair care and the dying sector suffered the least.

COVID-19 impedes beauty consumption in China

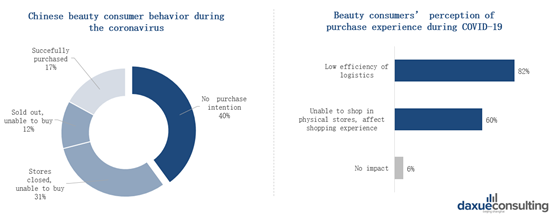

Source: Qinyan information, Chinese beauty consumers’ behavior and perception during COVID-19

Also, the negative COVID-19 impact on China’s beauty sector reflected in the purchase intention. According to a Beauty Consumer Behavior Survey conducted by Qinyan information, purchasing demand on beauty products sharply decreased during the COVID-19 outbreak. 40% of respondents suggested that they didn’t have purchase intention, while 43% said they were unable to buy beauty products. Only 6% of consumers said that there was no impact on their purchasing experience in beauty products during the epidemic.

Major changes in the beauty sector in China

Skincare products are gaining popularity

One major change in beauty consumption after COVID-19 is that skincare products will be more welcomed compared to make-up. Cosmetics’ sales in China declined by 14.1% in the first two months of the year compared with the same period last year. During the outbreak, people consumed more and talked more about skincare products than cosmetics. Chinese netizens showed more passion for discussing and sharing their skincare experience at home. Also, due to the damage from wearing face masks for a long time, products with “skin repair”, “basic skincare” and “first-aid care” functions are increasingly needed during the coronavirus.

Health and safety have become keywords for beauty consumption after COVID-19

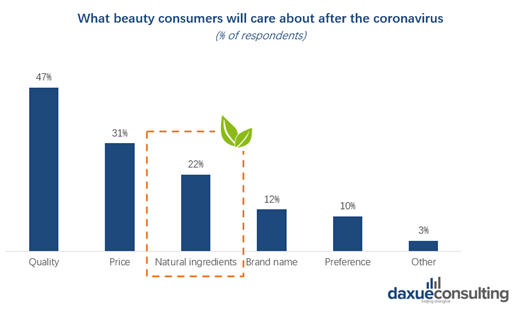

Source: Jumeili, What Chinese beauty consumers will care about after COVID-19

As society recovers from COVID-19, Chinese consumers are expected to pay more attention to the environment. This will be likely to inspire the beauty industry to focus more on products with natural and healthy concepts. For most beauty consumers, after COVID-19, they would only purchase necessities. Apart from the great concern of the cost-performance ratio, Chinese consumers also prefer beauty products with eco-friendly and natural ingredients.

Beauty brands are stepping into the disinfection sector

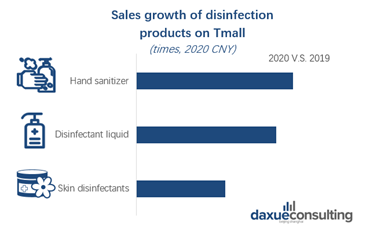

Source: Paidai, Sales growth of disinfection products on Tmall

Since Chinese consumers have an increased awareness of personal hygiene, disinfection products are expected to keep growing after the epidemic. The sales of disinfection products increased significantly during the 2020 Chinese New Year. Seeing business opportunities on disinfection products, many beauty brands stretched their category and started to produce hand sanitizers. For example, brands like CHANDO (自然堂), One Leaf (一叶子) and Geo skincare (纽西之谜) had started to produce and sell hand sanitizers.

DIY hairdressing is trending

Since most hair salons suspended service during the coronavirus outbreak, more people started to do hairdressing by themselves at home. In this case, hair dying products and related topics were gaining popularity. Specifically, Hairdressing products are mentioned more on social media platforms than before. Internet users in China showed great interest in learning how they can cut, dye and style their own hair. Some beauty brands adapted to this new trend fast, and promoted their hairdressing products. For example, L’ORÉAL collaborated with Tmall to promote their hair care products in early March 2020. In addition to meeting the rising demand for hairdressing at home, it also served as a women’s day promotion on Tmall.

Rising demand for doing SPA treatment and massages at home

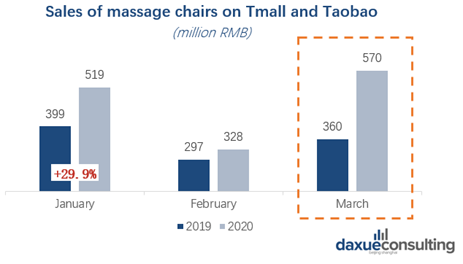

Source: Robodata, Sales of massage chairs on Tmall and Taobao

As SPA and massage parlors suspended service during the pandemic, people showed great interest in trying to do massages by themselves at home. Topics about doing SPA treatments, like foot soaks and massages at home, are trending on social media platforms. Meanwhile, the sales of related products surged compared to that in last year. Taking the massage chairs as an example, the sales of massage chairs on Taobao and Tmall increased a lot during the coronavirus, especially in March.

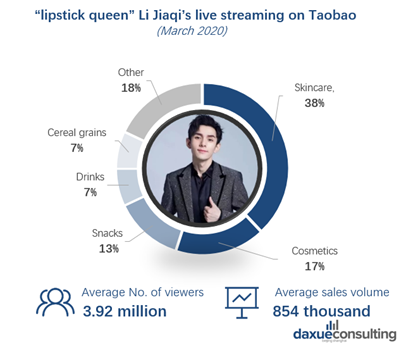

Live streaming for beauty products is increasingly welcomed

Live streaming has become increasingly popular in China in the last few years as more consumers attach more importance to immersive experiences and personalized recommendations. The epidemic stimulated the dramatic growth of live streaming and made Chinese KOLs more important than ever. This trend can also be seen in the beauty sector.

Source: Taobao, ‘lipstick queen’ Li Jiaqi’s live streaming on Taobao

According to the data of one of the most famous influencers in China — Li Jiaqi, who first made his name selling lipstick on Taobao, his live streaming on Taobao attracted around 3.92 million views a day in March 2020, and the average daily sales volume approached 854 thousand RMB.

Beauty brands tend to attach more emphasis on private traffic

Due to the coronavirus outbreak, online marketing is blooming, which spots the light on private traffic. Realizing the trend of private traffic, beauty brands present a great passion for learning how to leverage private traffic. Some beauty brands in China transformed their business model quickly into the epidemic and started to put effort into private traffic marketing.

Jumeili initiated a social marketing online summit on April 28. The summit discussed how beauty brands in China could leverage private traffic and social marketing to gain traffic and increase conversion rates. The online summit had attracted more than 7,000 registers within 6 days.

Some brands take advantage of private traffic to boost sales during the epidemic. For instance, Cloris Land, an Australian brand that entered China in 2011, directed its offline stores to sell in the WeChat community and mini-program live streaming. From March 6 to 8th, 1,057 stores joined in the live streaming sales event; the sales reached 6.3 million RMB.

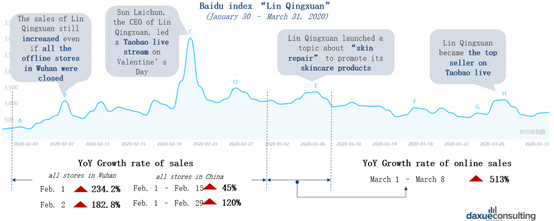

Case Study: The impact of COVID-19 on Lin Qingxuan

Lin Qingxuan, a Chinese homegrown beauty brand, was severely affected by the coronavirus epidemic. In 2020 Chinese New Year, it had a year-over-year decline of 90% in sales, and lost over 10 million RMB as of January 31, 2020.

Source: Baidu Index; Pang Jing; Weibo, The impact of COVID-19 on Lin Qingxuan

Lin Qingxuan had made a quick response to the coronavirus crisis in early February, based on the changes in beauty consumption after COVID-19. Baidu index shows Lin Qingxuan has successfully improved its brand awareness by taking quick adaptation.

Responses of Lin Qingxuan during the crisis

Several timely measures successfully saved the brand from the crisis. First, It met consumers’ demand for skin repair products as people paid more attention to skin care and skin repair during the coronavirus outbreak. Specifically, Lin Qingxuan made more an effort to promote its skincare, especially skin repair products like the camellia oil.

Second, since offline stores suspended service during the coronavirus, Lin Qingxuan transferred its offline business to online channels at the very beginning of the epidemic.

Last but not least, Lin Qingxuan expanded its private traffic marketing. The brand has begun to build its private traffic pool on WeChat in 2018. Due to the coronavirus, Lin Qingxuan started to expand its private traffic pool from WeChat to Taobao with the collaboration with DingTalk. This helped Lin Qingxuan transfer rich public traffic from Taobao into private traffic, where it can manage its own consumer traffic.

Learn how COVID-19 impacted Xiaohongshu on Daxue Talks