Top beauty review platforms in China: How to sell cosmetics in China | Daxue Consulting

With the accelerating penetration of digital devices, online beauty review platforms in China have recently become a significant factor of the Chinese cosmetics industry’s sales, and brand promotion. Beauty consumers are inclined to check online platforms for cosmetics recommendations in China, including E-commerce websites, cosmetics recommendation forums, mobile applications, to search for people sharing experiences with cosmetics on social media. By taking advantage of connections between Chinese consumers and beauty review platforms, digital marketing in China has been demonstrated as an essential strategy to create a reputation among Chinese consumers before entering the beauty market in China. It is also a valid approach to build and promote the trustful cosmetics brands and sell cosmetics in China.

Online purchasing of cosmetics products in China: Cross-border E-commerce websites

For foreign cosmetics brands, cross-border e-commerce websites are commonly used to sell cosmetics to Chinese consumers directly, following the B2C e-commerce logic. Dominant cosmetics brands have continuously expanded influence through such e-commerce platforms among Chinese consumers.

Meizhuang.Tmall.com (天猫美妆)

As an online retailer in China’s Cosmetics market, Mei Tmall is a relatively independent E-commerce beauty review platform in China, with comprehensive types of cosmetics products. The homepage of the website provides several navigations for viewers to choose cosmetics products. Selling cosmetics in China needs categorizing products with brands, functions, skin care, makeup, perfume, and men’s beauty. Specifically, the website provides detailed information on each product page, with comments and reviews from its previous buyers.

Many renowned foreign cosmetics brands also opened their flagship stores on Tmall, such as Dior, La Mer, Clinique, L’Oréal, SK-II, etc. It represents a direct-operated online sales channel for top international brands for online purchasing of cosmetics products in China.

JD (京东)

Similar to Mei Tmall, JD is also a third-party website which can serve as a beauty review platform in China. According to the cosmetics consumption trend report by JD, the number of new users attracted by high-end brands in 2017 was 10.7 times that of the same period last year, and the average amount of new users’ online purchasing of cosmetics products in China was 11.1 times that of the same period the previous year.

In China, as the top two B2C retailers, Tmall and JD have combined a market share of over 85% in China’s e-commerce market.

Jumei (聚美优品)

Jumei is a large Chinese cosmetics website, with a share of 22.1% cosmetics sales in China. To further develop the concept of e-commerce business like Tmall and JD, as well as making a distinction with competitors, Jumei is dedicated to selling cosmetics in China with a lower price by offering a discount, in turn, to target more consumers who have limited consumption capacity.

Additionally, Jumei is not only functioning on online purchasing of cosmetics products in China but also provides sufficient information in terms of brands review, cosmetics recommendations in China, as well as makeup and skin care tips for Chinese viewers.

VIPshop beauty (唯品会)

VIPshop beauty is a Chinese website specialized in discount sales for cosmetics brands online. As one of the top three profitable B2C platforms in China, it has achieved success on cooperating with popular branded products, by selling the excess inventory at discounted prices.

For the first quarter ended in 2019, VIPshop’s unaudited financial report shows the total number of orders has increased to 116.5 million, while the number of active users has reached 29.7 million. VIPshop remains the dominant position in China’s online purchasing of cosmetics products.

Kaola (网易考拉)

Kaola is among the most popular websites for people aged 20-40.

Popular cosmetics and fashion brands regard Kaola as a gateway to the Chinese beauty market. Choosing cosmetics in China is shown that it has a preference in purchasing foreign brands online, especially French beauty and cosmetics giants like L’Oréal.

Kaola achieved its success due to effective collaboration with many foreign brands. It, therefore, can offer a surprisingly low price for Chinese consumers, using its executives of website and the ability to orchestrate logistics and delivery, as well as the efficient operation of the warehouse management system.

Lefeng (乐峰)

Lefeng was established in 2008. It is the main competitor of Jumei in the field of online retailers in China’s cosmetics market. Lefeng’s strategy of digital marketing in China is used to provide China’s cosmetics recommendation with luxurious brands. Due to the quality of products proved by luxury brands, Lefeng has been recognized and popularized by Chinese beauty consumers.

ShowJoy (尚妆)

ShowJoy was founded in 2013 and operates a cosmetics retailer website. It offers cosmetics recommendation in China with individualization of personal needs, based on the database of its users.

The slogan of Showjoy company in Chinese is “正品无需代言,” refers to the confidence of certified products sales on this website. Also, the quality of products is insured by PICC, the largest insurance company in China.

Lizi (丽子美妆)

Lizi.com was founded in 2009, aiming to provide professional cosmetics recommendations in China.

Lizi has been a cosmetics agent and e-commerce platform of more than 300 well-known cosmetics brands in domestic China and overseas. Since the establishment of a deep cooperative relationship with branded cosmetics companies and qualified user experiences, the total number of customers has exceeded 5 million, making it one of the fastest growing vertical e-commerce platforms in China during recent years.

Sephora China (丝芙兰中国)

Sephora.cn in addition to sales, also serves as a beauty review platform in China. Combined with widespread offline shops in China’s beauty market, Sephora.cn values for the authentic pricing and unbiased advice for the consumers who shop online currently with comprehensive cosmetics products and more convenient shopping experience.

Sephora has now expanded to 230 stores across 74 cities in China and is also sold through multiple online channels, including sephora.cn. Having the biggest market share, the disruptive and innovative e-commerce strategy has been implemented by Sephora to develop and collaborate with the various online platforms in China’s beauty market.

Sasa (莎莎网)

Since its founding in Hong Kong in 1978, Sasa has been a recognized and trustful beauty review platform in China, also an e-commerce website. The website of Sasa offers customers the ability to choose cosmetics in China, including Sasa’s own products and international brands. In this way, consumers can do online purchasing of cosmetics products in China while browsing, without the necessity to go to offline shops of Sasa.

Onlylady (Onlylady美妆)

Onlylady is a women’s high-class fashion lifestyle platform in China founded in 2002. With ten years of operation, Onlylady is deeply rooted in providing China’s female consumers with professional content and interactive services for cosmetics and beauty. It gathers the public opinion and in turn, to influence netizens about how to choose cosmetics in China. It also establishes a leading position in China’s beauty market with the unique and personal lifestyle of women.

Kimiss (闺蜜网)

Kimiss is a popular beauty review platform in China to reach trendsetters and influencers in China’s beauty market. It has a unique business model: first, the website’s users send products to the Kimiss community, then members of Kimiss write reviews and comment on the cosmetics brand or product. It turns to a distinct concept in which brands must pay to get these ratings. Hence, the authenticity and value of such positive reviews is often questioned.

Pclady (太平洋时尚网化妆品库)

Pclady is a digital platform which consists of E-shopping and network community, in terms of cosmetics products and female beauty market in China.

As a beauty review platform in China, Pclady website generally includes ranking lists of products in different categories. In line with it, articles about the information of makeup and skin care are offered as well, along with displays of particular comments, ranking and recommended collocation of each cosmetics product created by Chinese consumers.

Yoka (Yoka化妆品)

Established in 2006, Yoka Fashion Network is a vertical portal for high-end brands and high-quality beauty products, with target users of a relatively high income.

As a beauty review platform in China, the site partitions in Yoka also contain the E-shopping of cosmetics products, testing center, ranking, and reviews of particular cosmetics.

SMZDM (什么值得买)

SMZDM.com was established in 2010. It is an online shopping website including cosmetics recommendations in China, but also a consumption decision-making platform integrating with media, shopping guidance, and online community. It has built a good reputation among many netizens for its neutrality and professionalism. The central purpose is to tell consumers how to choose cosmetics in China.

Cosmetics Recommendations in China: Are beauty forums helpful?

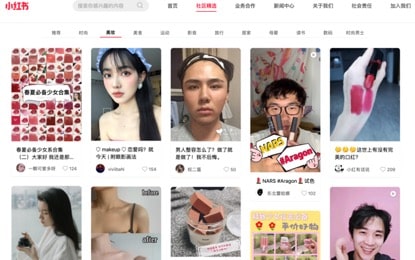

Xiaohongshu / RED (小红书美妆社区)

Xiaohongshu was created in 2013, and it has reached over 200m active users as of January 2019, among them of 70% are post-90s generation. Both website and application of Xiaohongshu are getting extremely popular recently in China.

Users of Xiaohongshu share their in-depth feedback about purchasing experiences, in terms of long-form reviews, images, and videos. It has contributed to lead the consumers’ orientation in China among those younger customers. Distinguished with other beauty review platforms in China, Xiaohongshu does not include functions of sharing or forwarding. It can only be used via adding cosmetics recommendations in China as personal posts.

In addition to endorsing beauty recommendations, Xiaohongshu also has high engagement in e-commerce service and cultivates its quality both in its forum sharing and selling products in the Chinese beauty market.

Bilibili (Bilibili 美妆视频区)

Bilibili is a website for vloggers to publish original videos in China. Within the category of fashion and beauty, personal experiences in related to how to choose cosmetics products in China have been recorded and shared. Video contents usually include usage and evaluation of products to recommend cosmetics in China. Watching these videos may influence Chinese consumer’s orientation before or during consumption. The most popular video of beauty recommendations in China has gathered 477,000 views on Bilibili website.

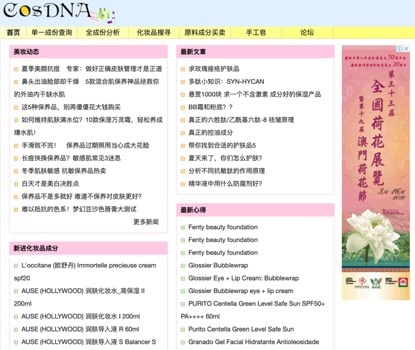

CosDNA

CosDNA provides unique information related to beauty recommendation in China, which refers to the composition analysis of cosmetics products. Also, articles published on the website include the personal sharing of single or multiple cosmetics products.

Cosme CNV

Cosme CNV is a website that contains detailed information and reviews of selected beauty products, based on the result of The Best Cosmetics Award in Japan annually. It is believed to be an authentic and trustful source of beauty recommendations in China among cosmetics consumers.

Beauty review mobile applications

Meizhuangxinde (美妆心得)

Meizhuangxinde a Chinese word for “美妆心得”, which refers to experiences of beauty and cosmetics. Its main functions are regarded to the ranking list of cosmetics, cosmetics product library, testing, brand discount, makeup learning, as well as forums of cosmetics recommendations in China and feature articles to guide consumer’s orientation in China.

MOGU (蘑菇街)

MOGU mainly focuses on two business segments, in terms of creating contents about cosmetics recommendations in China, and providing the e-commerce platform of online purchasing of cosmetics products in China.

Differed in other applications, MOGU innovatively concentrates on creating various sections of professional contents in its Chinese beauty review platform. MOGU launched a Live Stream sector in 2016, with a shopping bag added below the live studio interface. Users can click and see the products mentioned in the live broadcast, choose to join it in the shopping cart, buy immediately, or share the product to a friend

via WeChat program. Also, the updated homepage of the application sets the “Dynamic Posting” button to provide an entry for user-generated content sharing.

Miaoxuan (秒选APP)

Miaoxuan is an application to serve as a cross-border platform for selling cosmetics in China. It acts as an intermediary agent to contain 40 to 50 international e-commerce websites, including British, Japanese, American, etc., which are all real-time discounts for various brands and products.

Aoaola Meizhuang (凹凹啦美妆)

Aoaola is a community-based sharing platform focusing on beauty and skin care reviews. Users of this application will depend on those consumers who are similar to their own conditions when they are considering how to choose cosmetics in China. As a Chinese beauty review platform, this application provides authentic reviews, beauty information, as well as effective interactions between users.

Bevol (美丽修行)

The core function of Bevol is to query cosmetics ingredients, and match products according to the user’s skin quality. It leads consumer’s orientation in China to those cosmetics products with safe and skin-friendly ingredients. As of January 2019, the total number of downloads is estimated to be 2.3 million. Daily active users are about 200,000 while the monthly is about 1 million.

The skin quality testing, makeup information, discussion forum, and other services have made Bevol unique. Up to now, it has dedicated to interpreting cosmetics with ingredients, accurately matching 16 skin types and support researches with more than 700,000 kinds of cosmetics ingredients, also synchronize records of the Food and Drug Administration in China. It provides professional solutions for beauty.

Meiya (美芽)

Meiya is operating as a forum for beauty recommendations in China, also a media platform for professional makeup artists and KOLs to share their cosmetics information via videos and articles. Users can apply for the testing of new products via sharing and promoting this application in other mobile applications. In addition, the specific discussion community in Meiya is also offered for users to publish personal experiences of China’s online purchasing of cosmetics products and then to have interactions.

Red Line (红线)

Red line is a beauty review platform in China used for querying the date of production and the batch number of a particular cosmetics product. Users are able to establish a list to manage their own cosmetics. Currently, 380 brands can be queried within the database.

Also, the function of inquiring about cosmetics ingredients is added recently. Details of ingredients of 400,000 kinds of cosmetics products can be found and studied to avoid the mismatching between products and Chinese consumers.

The Beauty Influencers in Chinese Social Media

In addition to specialized mobile applications for China’s beauty market, how to reach the increasing number of social media users also becomes the consideration of new strategies of digital marketing in China, within the cosmetics market in China. Particularly, the leverage of Key Opinion Leaders (KOLs) is the most popular way to promote brands in Chinese social media, Weibo, and WeChat.

KOLs are capable of influencing numerous individual users who regarded them as specialists and trustworthy information resources in connection with fashion and beauty recommendation in China. As the driving force to impact on vast groups of people and achieve potential customers, KOLs are selected by cosmetics companies to faithful brand promotion in Chinese social media. Thusly beauty recommendations in China, posted by KOLs, can reach millions of potential Chinese consumers and offer them a primary impression on certain brands, finally influence their decision on choosing cosmetics in China.

Sina Weibo

As one of the principally community-based social media in China, the number of active users in Weibo has exceeded 300 million presently. The daily reading volume of beauty influencers is more than 1 million. Weibo provides users as a Chinese beauty review platform for direct communication and interactions; besides, a large number of user groups enable the information to spread effectively and quickly.

Example of a KOL on Weibo: @Kakakaoo~

With over 9.7 million followers on Weibo, the account of @Kakakaoo (aka AQin, “阿沁”) is operated with the beauty recommendation, vlogs of her daily life, as well as the advertising with branded products. Plenty of filtered and lively posts have depicted herself with an elegant and glamorous image, therefore, attracting a huge fanbase.

Her growing popularity has led to being more influential and trustworthy on her beauty recommendations and cosmetics product reviews. Simultaneously, she now works as the professional representative of MAC lipsticks, which also indicates the powerful leverage of KOLs in selling cosmetics in China and branding promotion in Chinese social media.

Example of a KOL on Weibo: @李佳琦Austin

@李佳琦Austin. Li Jiaqi is an acclaimed celebrity in multiple Chinese social media platforms recently, with continuously increasing number of followers. Instead of alluding persuasion in posting texts or pictures, the main form of his beauty sharing to attract Chinese consumer’s is live videos. He streamlines the processes that contribute to saving the audience’s time cost for choosing cosmetics in China. All his videos on the homepage are in a unified mode, that is, take a set of lipsticks from a certain brand, compare the color testing, describe their characteristics separately, and finally summarize the most recommended ones. Another important factor in Li’s significant influence is his gender performance to act as women’s friend, as well as the brainwashing repetition of “oh my god” during his beauty recommendation.

As one of the biggest social media platforms in China, WeChat is both a messaging tool and an outlet for brands’ official accounts to publish information.

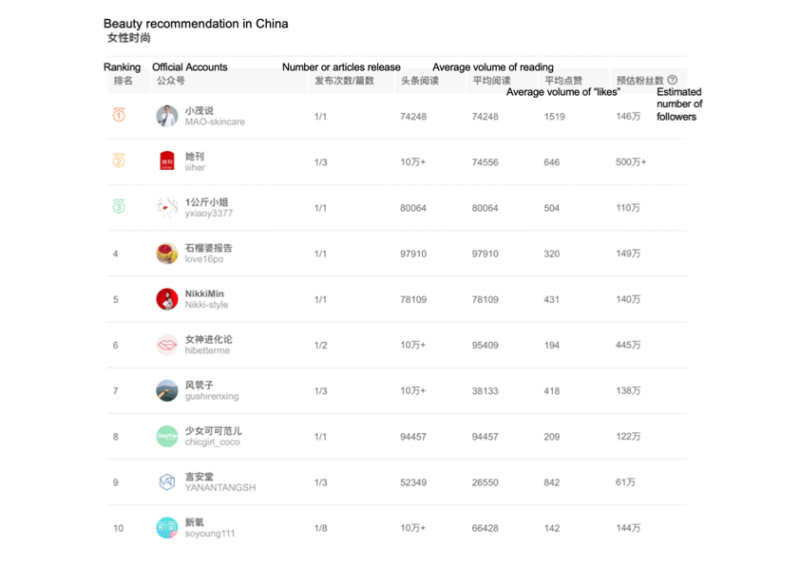

KOLs and celebrities are capable of promoting brands on Chinese social media, through WeChat official accounts. According to Tencent’s statistical data, the total number of WeChat cosmetics accounts exceeds 18,000, with an average 62 million daily readers. Due to the direct impact on users, in particular, the post-80 and post-90 generations, KOLs’ customized contents of cosmetics recommendations in China can effectively contribute to promoting branded products sales. The following statistics of wxb data shows the top ten WeChat official accounts of beauty recommendation in China ranked by average page views.

Apart from official accounts, individual retailers in WeChat online shopping platform are also known as “Weishang” (微商). Such kind of retails has become a common-place to sell cosmetics in China since around 2015. Product sales for individual uses and companies are conducted on the WeChat, which have more than 100 million Monthly Active Users. The Chinese government has implemented the ‘E-commerce Law of the Republic of China’ to regulate micro-commerce businesses.

Author: Yufeng GUO

Make the new economic China Paradigm positive leverage for your business

Do not hesitate to reach out our project managers at dx@daxue-consulting.com to get all answers to your questions