With increased government intervention and sector growth, the OTC Healthcare Market in China continues to grow

How will the OTC Healthcare Market in China fare amidst growing pains?

Daxue Consulting has helped many clients in the health services industry navigate the myriad of challenges that the Chinese market holds. Through our work, we have developed our expert insights on the many intricacies of the Chinese market’s past, present, and future. Here we will examine how the growing healthcare market in China is facing its latest influencers.

The OTC healthcare market in China has continued to grow consistently despite the lackluster performance of world markets. According to our research, we estimate that the global market for OTC products grew by 5% in 2013, a growth of almost 16% since 2007, with the value standing at around $141 billion. IMS Health states that the OTC market has been consistently outgrowing the pharmaceutical sector. In 2015, Chinese OTC sales reached 174 billion CNY, which presently only occupies 15% of Chinese pharmaceutical market share, but OTC sales have contributed to 17% of Chinese pharmaceutical market’s growth rate, according to IMS Health.

Conversely, some factors such as the market growth in emerging countries, the growth of new distribution channels, and encouragement by market players for self-medication and development of strong brands have been the driving forces for general industry development. This is especially true in BRIC nations, where large populations and burgeoning middle-classes have spearheaded the growth. Larger consumer demographics will only serve to increase OTC sales margins as GDP in those countries continues to increase. Several studies state that this growth acceleration is amongst the highest in the world, with rates of 20% in China and Brazil and significant but slower rates of 8% in Russia and 7% in India.

While these countries lack some the regulations and structured operating environments of more developed markets, the changes in operating legislation and consumer attitudes towards the OTC concept are expected to provide the backbone for growth. Multinational corporations are expected to more aggressively pursue joint alliances with local manufacturers who have established distribution channels in these markets, as to offset the stagnant growth they are facing in their home markets. In China, the reality of the operational framework lies somewhere in between those of developing and developed markets.

Preference and Pricing in the OTC Healthcare Market in China

Popular pharmacy chains across China, like GuoDa Drugstore (国大药房), stock both premium western brands as well as local generics and TCMs. Photo credit: Daxue Consulting.

Chinese healthcare product spending per capita is still low, at only 28 USD per capita compared 1,000 USD per capita in U.S. in 2015, according to SOHU (搜狐), a leading media company in China. This means that there will be considerable growth space for the OTC healthcare market in China, as Chinese citizens’ income is increasing steadily.

However, the OTC healthcare system in China is quite different in comparison to those of developed countries. Indeed, the Chinese government announced a string of initiatives in a continued effort to overhaul the healthcare system in the country. As a result of the Chinese new medical reform program, the increase in hospital outpatient expenses and drug costs have begun to plateau due to the government’s controlling policy on “unreasonable medical expenses” in 2015. The sales of adjuvant drugs in China are much higher than in many Western countries, and in some Chinese hospitals, sales of adjuvant drugs account for as much as 60-70% of the total drug sales. In stark contrast, the world average is under 20%, according to National Business Daily (每日经济新闻). To reduce the pressure of public medical insurance, many provinces, like Yunnan (云南) and Inner Mongolia (内蒙古), have issued an adjuvant drugs list to regulate their prices and access levels.

[ctt template=”2″ link=”4cdOs” via=”yes” ]”In some Chinese hospitals, sales of adjuvant drugs account for as much as 60-70% of the total drug sales.”[/ctt]In comparison with consumers from Brazil, Russia, India, United States, Europe and Japan, Chinese consumers are among world’s most health conscious, with annual sales of healthy lifestyle products amounting to$71 billion. According to a survey conducted by Boston Consulting Group, 73% of people in China are willing to trade up and pay a premium for products they deem healthier. Besides that, people in China want to be happy, look good, and have enough energy for an active lifestyle; to achieve that, it is important for them to maintain their physical health and wellness. The rise in incomes of both the middle and upper-classes has driven the consumption of vitamins and supplements in China. As government policy controls OTC usage in hospitals while the demand for OTC keeps rising, retail pharmacies will become the primary channel for the OTC market.

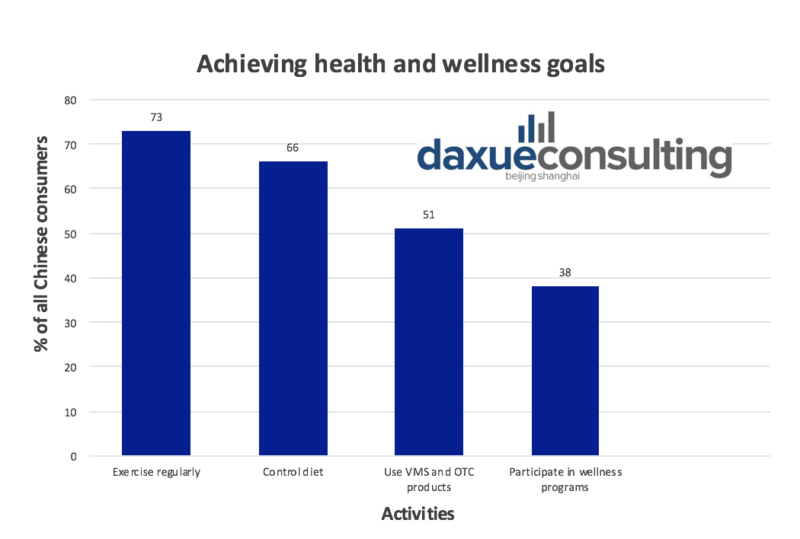

With common complaints such as insomnia, fatigue, lack of energy, obesity, and frequent illness, these stress-related ailments are caused by common lifestyle factors such as occupational and career pressure, family obligations and long work hours. The incidence of these complaints is growing fast especially among the younger generation. Daxue recently reported that 30% of survey respondents aged 18-24 have these lifestyle ailments compared with only 18% of people over age 40. With this in mind, Chinese consumers are looking not only for treatments, but for preventative measures as well; thus, they have turned to exercise, diet, VMS, and OTC products as a total wellness solution.

Results from the BCG study on Chinese consumers’ health and wellness preferences. Source: Reproduced by Daxue Consulting with data from the BCG study.

On Oct 2016, the Chinese government issued “Outline of the plan for healthy China 2030” (“健康中国2030”规划纲要) which states that the healthcare industry will be worth over 8,000 billion CNY by 2020 and over 16,000 billion CNY by 2030.

TCMs are still widely popular with many Chinese citizens, whether used in tandem or exclusively from Western medicine. Photo credit: Daxue Consulting.

Consumers in China have a unique preference for traditional Chinese medicines (TCM) over Western medicines. These types of traditional Chinese medicine are popular among all ages in China. In addition, TCM usage is still prevalent even among more educated consumers, who are aware and concerned about the side effects of Western OTC products. That being said, less educated consumers in China believe that Western medicines products are more effective and convenient than traditional Chinese medicine.

Chinese consumers as whole though still would prefer products that bring more multipurpose benefits and functionality as they are presumed as more convenient and worth the premium price. The added ingredients or vitamins in certain medicines are assumed to be artificial and less healthy; Chinese consumers often believe that healthy foods should be fresh, natural and organic. According to Boston Consulting Group (2014), more than half of respondents said they worry that health food products are not as advertised. This lack of knowledge and stringent regulation, when coupled with aggressive marketing techniques, often fosters mistrust among the Chinese consumers.

The competitive environment in China’s healthcare market is certainly complex, but with the arrival of large multinationals and their competition with domestic brands, retail prices for the OTC healthcare market in China have decreased and stabilized since 2005. The Chinese government has implemented price controls and the rapid expansion of mandated discounts across the country. As PWC suggests, given the current environment of China, foreign companies can gain a foothold in the market share through partnering with or acquiring existing Chinese firms. Due to the difficult nature of the market, working with domestic firms can offer improved operational capabilities and cost effectiveness. Successful entries in the past have included collaborating with partners in China or teaming with local biotech companies and research institutes by using the acquired company’s resources.

Dr. Xu Ming (许铭), represents over 2,400 pharmaceutical companies in China and works with foreign companies looking to enter China.

The Chinese market will continue to favor generic drugs to keep healthcare expenditures in check. According to Xu Ming (许铭), the vice-chairman of China Chamber of Commerce for Import & Export of Medicines & Health Products (中国医药保健品进出口商会, CCCMHPIE), R&D investment, on average, only accounts for 2% of a given Chinese pharmaceutical company’s sales. Compare that with pharmaceutical companies in the West, where 4% is considered low. The limited amount of domestically-launched patent drugs, when combined with a large number of drugs whose patents will soon expire, will both bolster the generic-brand market. The success of generic-brand drugs in China should also continue due to the difficulty that domestic brands face to launch their own patented drugs.

[ctt template=”2″ link=”3PY5z” via=”yes” ]”Retail pharmacies will become the primary channel for the OTC market in China.”[/ctt]The chief distribution channel of OTC selling in China will still be retail brick and mortar shops, as those retail stores accounted for 60% of the total OTC sales in 2016, according to an IMS report. This report shows that the retail pharmacy OTC sales growth rate is 7%, almost four times that of internal hospital sales. Among retail pharmacies, their performance at the county level is much more impressive. With the rapid growth of GDP and consumption in Chinese counties, more and more pharmacy chains are entering the regional markets. According to IMS, there are over 250,000 pharmacies in Chinese counties as of 2016, which account for around 57% of retail pharmacies nationwide and contribute to 72% of OTC sales.

OTC sales also stand to benefit from the rise of e-commerce. China has already overtaken the U.S. regarding mobile e-payments transactions in 2016, according to Daxue Consulting. There are 467 million people in China shopping online, and the value of trade has reached 3,800 billion CNY. Most of these commercial transactions take place on top social media platforms like WeChat. According to Tencent(腾讯), the leading brand of social media in China, over 889 million people use WeChat everyday, with the average user spending at least four hours on it per day. Apps like WeChat provide a direct and efficient channel for firms to promote and sell their goods. A recent survey conducted by Northeast Securities (东北证券), shows that 64% of consumers will buy medicine through online shopping. Sales of OTC on Taobao (淘宝) and Tmall (天猫) reached 1 billion CNY in the last 12 months, according to our research. With the penetration of online shopping habits and the popularity of smartphones, the Chinese online OTC market has considerable potential in the future.

A major pharmaceutical player in Europe was looking to expand their operations in China and reached out to Daxue to gain a better understanding of the Chinese market, specifically in respiratory health. Many highly-industrialized regions and cities in China, like Beijing, regularly experience poor air quality. As a result, citizens of these areas are being affected by air quality related health concerns in record numbers. Daxue’s team provided the insight and research into these critical locations so that the client could best tailor their products and services for the Chinese market.

The Daxueclientteam approached the problem from multiple angles. Qualitative interviews with medical professionals, patients, and other industry insiders helped create a picture of the scope and implications of the problem. With extensive quantitative research using advanced analytics techniques, the client team was able to discern key areas of focus for the client’s expansion. Ultimately, Daxue’s recommendations helped the client design the optimal strategy for increased profitability and addressing one China’s greatest health concerns.

In the healthcare industry and other practices, our clients share our passion for results and success. For more on our expert insights and our work in the Chinese market, reach out to learn more.

What are the untapped potentials for the #Chinese #medical #tourism? Find out here https://t.co/0G5fEK0uf6

— Daxue Consulting (@DaxueConsulting) May 24, 2017