Expected transaction volume of RMB 7.5 trillion in 2017 shows the immense potential of cross-border e-commerce in China

What are the drivers for the exploding cross border e-commerce in China?

Thanks to the development of technology and the growth of the internet, it has provided consumers from all over the world with the possibility to purchase goods and services via Internet-based platforms that otherwise may be unattainable or too expensive in their home countries – the birth of cross-border e-commerce. Without a doubt, with China’s middle class and therefore, standards of living constantly growing, combined with the greater knowledge and desire of foreign products, the potential of cross-border e-commerce in China is prodigious. The simple convenience of online retail platforms, such as the two leaders TMall Global (天猫国际) from Alibaba (阿里巴巴) and JD Worldwide (京东全球购), is yet another driver amongst many for cross-border e-commerce in China, which already has reached US$ 259 billion in 2015, according to a former research of Daxue Consulting.

[ctt template=”2″ link=”fz51V” via=”yes” ]Chinese consumers spend on average 300-1000 RMB when purchasing foreign brands. [/ctt]E-commerce with growing significance for overall retail sales in China

Cross-border e-commerce is thereby only a consequence of the rising importance and affinity of the Chinese for online retail. With mobile payment becoming the norm in China, Chinese consumers more and more adapt to purchasing goods online. According to a study of the Ministry of Industry and Information, in 2016, China already accounted for 469 million mobile payment users, which was an increase of 31% compared to 2015. Mobile payment systems such as Alipay (支付宝) and Tenpay (财付通), the WeChat Wallet, allow the consumers to easily purchase the goods via QR code technology from any computing device such as their smartphones or tablets.

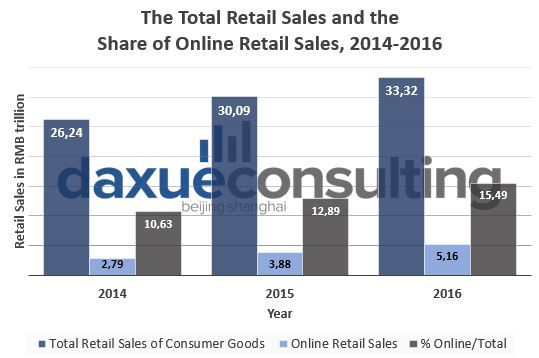

Every year, the National Bureau of Statistics of China (NBS, 中华人民共和国国家统计局) publishes data on the retail sales of consumer goods and services. According to this data of the NBS, the online retail sales grew much more year-on-year (YoY) than the total retail sales of consumer goods and services, with 26.2% compared to 10.4% in 2016.

Reproduced from Daxue Consulting with data from NBS for 2014, 2015 and 2016.

This development led to an increase of the share of the online retail sales on the total retail sales of consumer goods and services. While in 2014 it was at 10.63% with online retail sales at RMB 2.79 trillion, the share increased to over 15% with the online retail sales almost doubled to RMB 5.16 trillion in 2016. But what are the reasons for the growing success of Chinese e-commerce?

[ctt template=”2″ link=”dBGd2″ via=”yes” ]Cross-border e-commerce in China expected to grow by 19% in 2017 to RMB 7.5 trillion [/ctt]

5 key drivers for the success of the Chinese e-commerce

As cross-border e-commerce is just another part of the Chinese e-commerce, it is important to understand the reasons for its success over the last years to assess the great potential of cross-border e-commerce in China. While many people believe that Chinese websites are just copies from popular sites in the West, this is not the reality. Especially, Alibaba is often compared to Amazon as being another B2C retailer, however, the Alibaba Group (阿里巴巴集团) is a perfect example of the broad and unique scope of the Chinese e-commerce. In fact, the original Alibaba platform Alibaba.com (for global trade) as well as 1688.com, Alibaba’s platform for trade agents, wholesalers, retailers, manufacturers, and SMEs from China only, act as B2B wholesalers. Moreover, Tmall (天猫) indeed is a business arm of Alibaba which’s business model is being a B2C retail platform, while Taobao (淘宝) China’s leading C2C platform, can be named as the biggest success of the Chinese e-commerce.

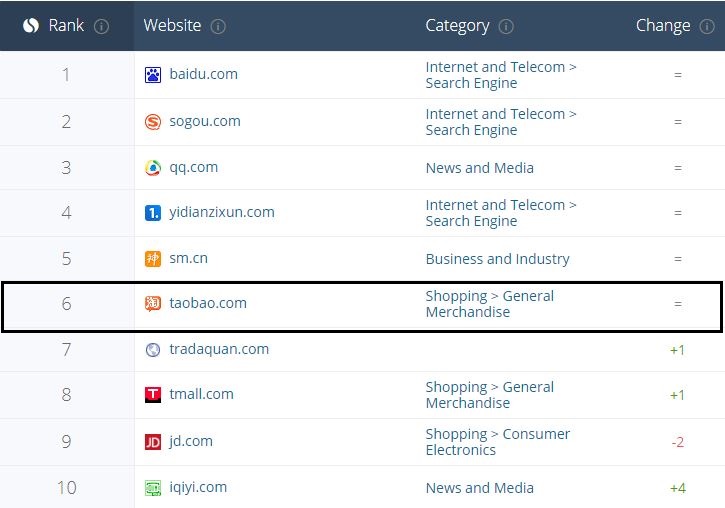

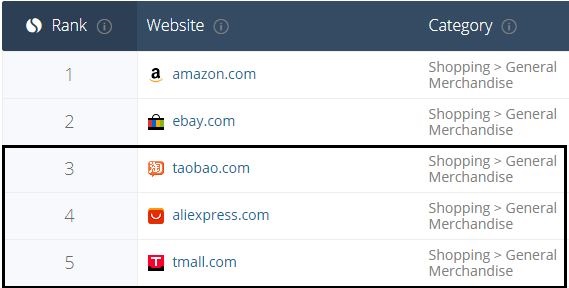

As of 2016, Taobao accounted for over 570 monthly active users and was the sixth most visited website in the whole Chinese web in July 2017, according to SimilarWeb, a leading digital market intelligence company. Thereby, Taobao was the most visited site of the category “shopping->general merchandise” in China. Another indicator for the global dominance of the Chinese e-commerce is that three of the Top 5 worldwide most visited general merchandise websites are from China, with Taobao placed third.

Taobao as the 6th most visited website in China and 3rd most worldwide visited general merchandise website in July 2017, according to SimilarWeb.

Taobao is, therefore, a great example for showing the five main drivers for the growing success of the Chinese e-commerce:

1.Low costs for both buyers and sellers

Thanks to free listings (at least for the first few years) and no additional charges for transactions made on the platform between buyers and sellers, Taobao’s low cost strategy helped also successfully fending off eBay when they tried to expand to China. This competitive advantage led to sellers wanting to set up stores on Taobao which on the other hand again helped drawing buyers to the platform that could profit from a wide range of goods.

2.User-friendly website features

The fact that Taobao is continuously the most visited shopping site in China and amongst the Top 3 in the world is certainly based on its user-friendly website features. The feature that contributes the most to this user-friendliness is the implementation of the instant messaging tool “Aliwangwang” (阿里旺旺), a tool where buyers can chat with sellers real-time to get information about the product they want to purchase.

Taobao User Interface – promotions in the middle and an overview of different product categories on the left

Furthermore, the website shows an intuitive access. Having the different categories in view on the left, users can also directly see the trendiest offers highlighted in the middle

3.Powerful promotions

The third key driver of powerful promotions picks up on that. Taobao makes use of special sales promotions to boost its sales throughout the year. A great example for that is the November 11th celebration of so-called “Single’s Day”. Originally celebrated by the young and single Chinese, it has now turned into the biggest commercial day all over the world. Filing record after record, Alibaba accounted a total sales revenue of RMB 120.7 billion (US$ 17.73 billion) on November 11th 2016.

But not only sales promotions but also strategic alliances contribute to promoting the website. In April 2013, Alibaba announced a US$ 586 million-large investment into Sina Weibo (新浪微博), China’s leading microblogging website. Since August 2013 Weibo got launched for Taobao which shall drive even more web traffic to China’s largest e-commerce site through linking the customers’ Sina Weibo accounts with their Taobao accounts.

4.Creating an own logistics network

Since May 2013, the Alibaba Group began cooperating with several Chinese logistics companies to establish its own logistics network called Cainiao Network (菜鸟网络). Businesses on Taobao shall partner with logistics companies of this network to ensure a reliable fulfillment of the promise to deliver within 24 hours anywhere in China. By 2016, 90% of the businesses on Taobao have a contract with the Cainiao Network which enabled the network to deliver an incredible of 42 million packages per day, provided by a personnel of 1.7 million employees and 180,000 delivery stations, according to Alibaba’s 2016 annual report.

5.Corporate cooperation with banks

Cooperations with major Chinese banks like the Bank of China (中国银行) and ICBC (中国工商银行) increase user trust. Thanks to those cooperations, the transactions carried out on Taobao are more secure against frauds and scams. Moreover, as Alibaba correctly predicted the emerging power of cross-border e-commerce in China, they already began accepting international credit cards from 2012. Especially with its TMall Global website, Alibaba is leading the cross border e-commerce in China.

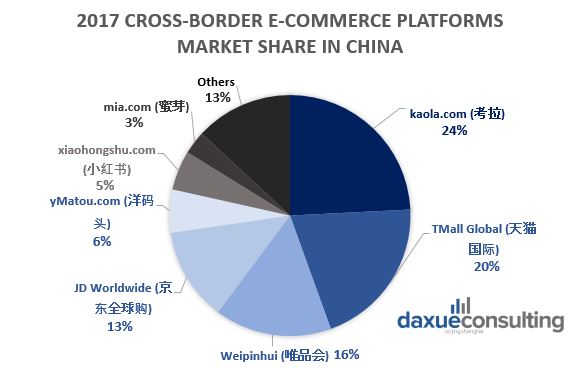

Kaola.com and Tmall Global lead the fragmented cross-border e-commerce in China

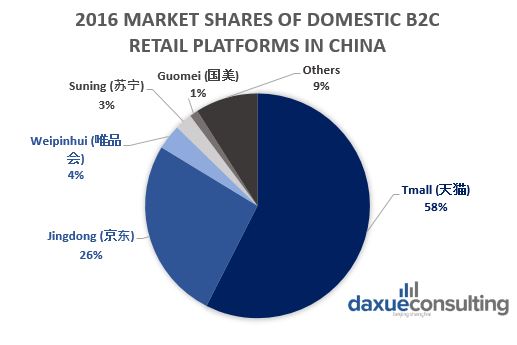

These drivers can be applied to the successful cross-border e-commerce websites, too, as they are set up the same, only with different targeting. Unlike the domestic e-commerce, where TMall and JD.com (Jingdong, 京东) clearly dominate with a combined share of the B2C retail market in 2016 of 83.7%, the Chinese cross-border e-commerce is highly fragmented and didn’t bring up a clear market leader yet.

Reproduced by Daxue Consulting with data from Analysys.

According to a newly released report from August 2017 from iiMedia, the media section of the leading Chinese research firm iResearch, four platforms have a market share in the Chinese cross-border e-commerce of 12.5% or above:

Reproduced by Daxue Consulting with data from iiMedia.

Despite the drivers for e-commerce sites in China in general, the high demand for cross-border e-commerce in China China can be explained in two ways: first, from the consumer point of view, the constantly growing middle class and thus, higher standards of living, enable the consumers to spend more money on desired foreign products. Next to luxury brands, e.g. for cosmetics or designer bags, demand is especially high for baby and maternal products as the Chinese consumers are concerned about the safety and don’t trust domestic brands which is why “dm – drogeriemarkt”, a leading drug store from Germany, is one of the biggest sellers on TMall Global, for instance. Second, from a seller’s point of view, the platforms set up foreign retailer-favorable requirements for them to be able to distribute their products. “The big advantage of foreign brands distributing on cross-border e-commerce platforms such as TMall Global is that, in the case of TMall Global, they don’t need to show any actual presence in China,” says Shawn Lou, project manager at Daxue Consulting. In fact, the only thing what they are required to do is to prove that they have a registered trademark overseas and to provide a certificate of origin that shows that the products are genuine. “This entices foreign brands to set up stores at Chinese cross-border e-commerce platforms to access the world’s largest e-commerce marketplace”, continues Lou.

“Leading cross-border e-commerce platforms in China set up seller-favorable requirements to entice foreign brands distributing their products in China”, says Shawn Lou, one of our experienced project managers at Daxue Consulting.

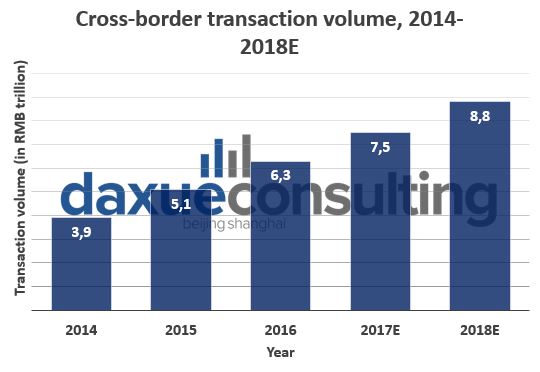

Cross-border e-commerce in China valued at RMB 6.3 trillion in 2016

That China has become the largest e-commerce marketplace in the world show the recent figures published by iiMedia in August 2017. Next to the outstanding domestic e-commerce, cross-border transactions in 2016 increased by 23.5% to RMB 6.3 trillion compared to 2015, according to the report. While the growth is expected to slightly decline, the forecast for 2017 so far holds an impressive transaction volume of RMB 7.5 billion which would be an increase of 19%.

Reproduced by Daxue Consulting with data from iiMedia.

If the forecasts prove to be true, Chinese cross-border e-commerce transactions will be doubled just within four years with an average CAGR of 22.65%. These numbers are proof of the great potential of the cross-border e-commerce in China.

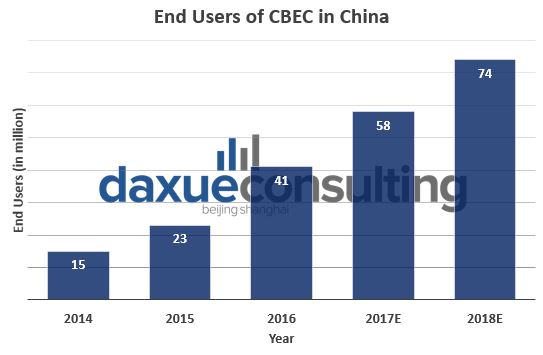

Cross-border e-commerce in China expected to reach 74 million users by 2018

However, this potential is not only illustrated in the transaction volume of the cross-border e-commerce in China. The numbers of end users engaging in cross-border e-commerce as well as the average spending when purchasing foreign goods also show why foreign brands shouldn’t miss to be part of the Chinese e-commerce if they aren’t already. Especially the case of the growth of the end users in cross-border e-commerce in China shows that.

Reproduced by Daxue Consulting with data from iiMedia.

In 2016, the number grew by 78.3% YoY to 41 million users. The growth rate may be expected to decline, however, this can be explained by the fact that cross-border buyers will naturally catch up with the overall users in the Chinese e-commerce. With an expected number of 74 million users by 2018, the future shows a largely growing Chinese cross-border e-commerce. Combined with the fact that, as of now, two-third of the users have an average order between RMB 300-1000(US$ 46-153), it means that the potential for foreign brands to make profits with the Chinese consumers is tremendous. Thereby, especially brands from South Korea and Japan (as for the Asian-Pacific region), Germany and France (as for Europe) and the US (as for America) enjoy being most favored of the Chinese consumers, according to iiMedia’s report. A brand selling cosmetics, childcare, healthcare as well as bags or fashion products in general rounds the ideal profile of a foreign brand retailing in the Chinese online marketplace.

Daxue’s experience with e-retailing clients

More and more companies get aware of the large potential of cross-border e-commerce in China, Daxue Consulting already had many clients seeking for help how to e-retail the best in China. One example would be when a European trading company approached us to assist with an in-depth online environment analysis, including comprising competitors, distribution, and advertisement channels as well as providing an overview of the current demand and supply and trading specificities on the Chinese online market.

Following the first step, an extensive desk research to gain a general overview of the market size and sales volume, Daxue’s consultants conducted multiple analyses to meet the client’s requirements. For instance, the consultants identified key competitors and their supply and online strategies such as website sections, pricing or delivery costs. Moreover, a distribution analysis was performed to benchmark the key competitors’ online strategies on channels such as TMall or JD.com. Another analysis of our research team consisted of partnership screening and creating a business plan where it assessed the costs of entering a specific channel and how to enter those as well as calculating the client’s ROI. At the end, the client received a detailed report providing him with a strategic business plan describing on which online distribution channels to focus, which marketing channels to use, as well as a comprehensive overview about costs, ROI, and the potential of the e-commerce in China.

Contact us now to discuss with our project managers how you can set up your own online retail business in China to profit from being part of the world’s largest e-commerce.

Daxue Consulting’s research team at our Shanghai office