Food Supplements V.S. TCM: Complementary or Archrival?

Chinese herbal expert Tu Youyou’s (屠呦呦) receiving of the Nobel Prize in Physiology or Medicine in 2015 for her innovation in malaria therapy triggered a surge in popular support for Traditional Chinese Medicine (TCM). While sales of food supplements (considered healthcare products) have exceeded TCM products in volume since 2010, the fast-growing industry must face its foe—rebuilt and retooled for the coming decade—once more.

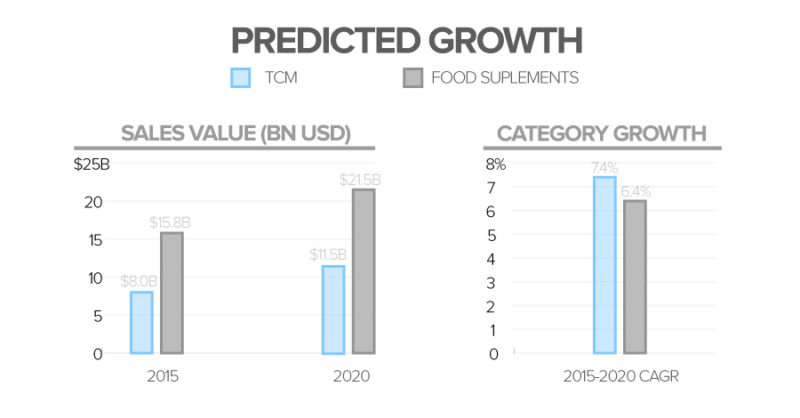

Supplements and Traditional Chinese Medicine set to boom by 2020, with TCM to grow faster

In 2020, the sales value of Traditional Chinese Medicine is expected to grow by 7.4%, a strong margin compared to food supplements, whose sales value will grow by 6.4%. However, the anticipated boom of TCM still cannot make it easy for it to seize the original market of food supplements.

“Vitamins and dietary supplements are expected to experience continued growth during the forecast period. The major growth driver will be the expansion of consumer needs, especially for functional supplements rather than general health.” Data from Euromonitor showed that vitamins and dietary supplements, which is a part of food supplements, will witness a large increase by 36.1% from 2015 to 2020.

Also, college students and the trend-conscious yuppies set will likely continue to respond favorably to beauty and thinness supplements (currently the most attractive market segments, according to our research) as well as sleep and stress products.

Most elderly consumers trust TCM, while food supplements appeal to millennials

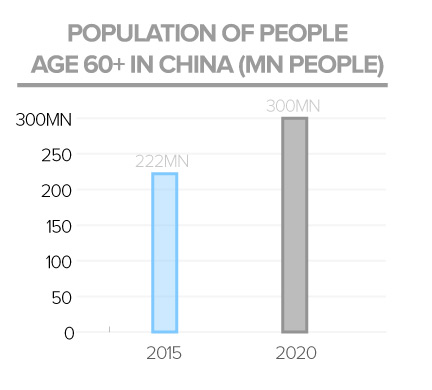

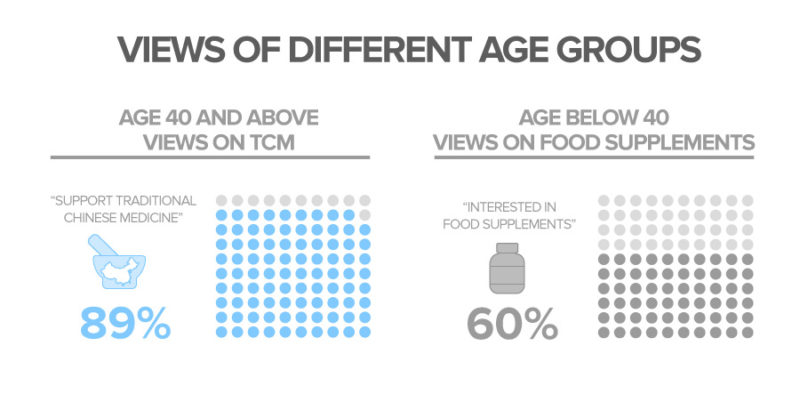

Companies could offer herbal supplements to entice consumers aged 40 and above, 89% of whom support Traditional Chinese Medicine, to grow market share, according to the China Health Care Association (中国保健协会). Plant-based products comprise the majority of TCM, so older consumers would not be alienated by herbal supplements. But this also carries the risk of being too thinly differentiated from traditional products. China’s population of elderly citizens was 222 million in 2015 and will reach 300 million by 2025. They will become a strong driving force for the TCM healthcare market and could pose a tremendous opportunity for innovative supplement firms.

To avoid endangering growth, food supplement companies should sidestep products directed at cough, cold and joint pain alleviation. Traditional Chinese Medicine dominates these areas, which are too overtly “medicinal” to draw consumers. In general, there is low growth potential for these segments. Supplement sellers should avoid confusing older consumers, who consider some supplements to be medicine, by differentiating their products clearly.

Chinese young people are food supplements’ biggest fans nationwide; in fact, 60% of consumers under 40 are interested in food supplements, and for good reason. In order to gain access to China’s top colleges, each year, over nine million high school students sit for one of the world’s most grueling entrance exam, the gaokao 高考. The exam is high stakes—an exceptional score could guarantee a high-level job or even lift an entire family out of poverty. To maximize their performance, students and their families could choose safe (foreign), non-medicinal supplements designed to boost energy, and improve sleep and memory. Marketed well, supplements that earn the badge of consistently providing a distinct advantage to the consumer could achieve rapid growth.

[ctt template=”2″ link=”5Wgfc” via=”yes” ]60% of Chinese consumers under 40 are interested in food supplements.[/ctt]Elderly Chinese could choose food supplements for their reliability

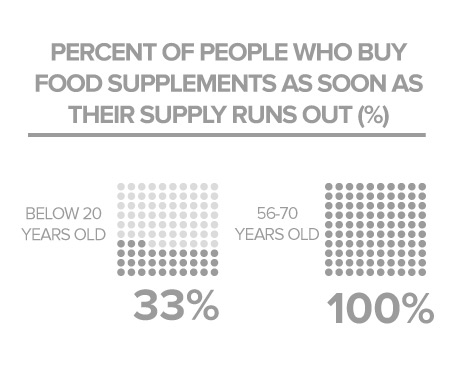

Equipped with more savings than other age groups, older customers wield stronger consuming power, making them a key cohort for sales growth of both food supplements and Traditional Chinese Medicine. However, elder customers also have great reliance on food supplements once they find it safe and effective, 100% of whom buy more supplements as soon as their supply runs out. Also, their children will buy food supplements for them to convey good wishes.

Brand name, naturalness and safety are the three main concerns of Chinese supplement consumers. Food supplements connote authenticity (a major concern for Chinese consumers), quality (important for millennial shoppers), and could evoke Traditional Chinese Medicine, which would appeal to older consumers. Gaining elderly consumers’ trust is absolutely necessary for the entrant.

“What’s more intriguing is that so many people still cry in their heart for high-quality food supplements which can earn their fundamental trust with a grandeur brand image. So the affluent ask their friends or children to buy it in a foreign country and carry with them overseas. The environment pollution and the food crisis have further implanted distrust in people’s mind which will need decades to be uprooted.” Food Law Latest

E-tail to lead supplement growth, appeal to young consumers

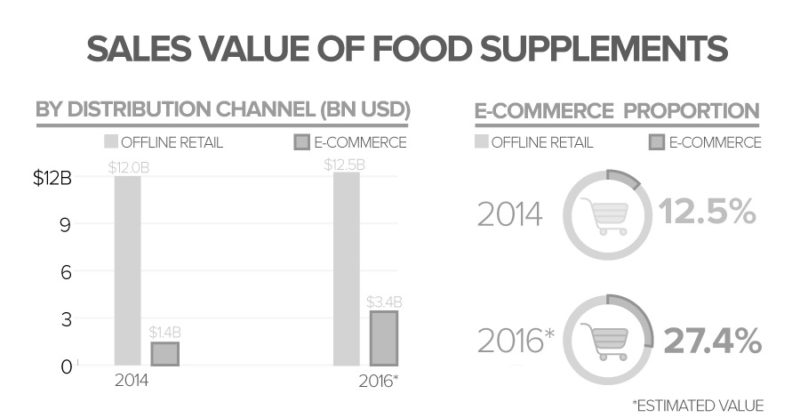

Online shopping platforms, like Taobao (淘宝) and Tmall (天猫), will provide firms access to more markets via reduced geographic limits. Central to these markets are internet-savvy millennial shoppers, who make up the bulk of the beauty/productivity segment, and are inclined to spend a premium on high-quality goods, often through online vendors.

sales value food supplements

From 2014 to 2016, e-commerce sales for food supplements rose from $1.4 billion to $3.4 billion. In 2016, the proportion of sales on e-commerce accounted for 27.4%, among all retail channels.

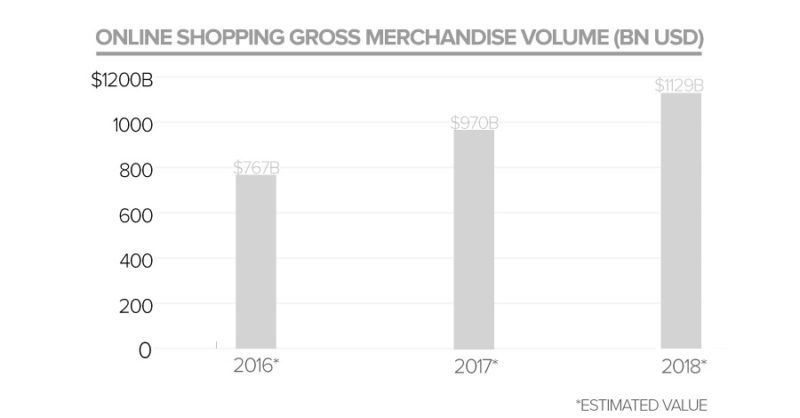

online shopping gross merchandise volume

Experiential shopping points to indirect distribution

Because a third of Chinese shoppers who buy products online visit brick-and-mortar stores (malls, in particular, have risen with retailtainment) to experience products before they pull out their wallets, it would benefit the supplement company to focus on indirect distribution.

Foreign companies setting up stores in China will encounter moderate barriers to entry. They must pass through a tedious administrative process. Indirect distribution bypasses this. Large-scale indirect distribution channels can boost brand reputation; better reach targeted customers; and, depending on the retailer, allow the supplement firm to sell at a premium. Indeed, supplements marketed as distinct from medicine means that pharmacies should not be main vendors.

Differentiation could be the key in a competitive, mature market

Differentiation will be critical for new entrants to the Chinese food supplement market. Beauty products are already a mature market in China. The government is inclined to support local businesses through favorable policies that border on protectionism. Moreover, intense industry rivalry brought on by veteran players (many of whom entered the market in the 1990s and are familiar with consumers) means that strong product differentiation, while no easy task, should be paramount.

[ctt template=”2″ link=”Z6ekA” via=”yes” ]Brand name, naturalness and safety are the three main concerns of Chinese supplement consumers.[/ctt]Conclusion: Herbal supplements blend-in TCM, widen reach

While Traditional Chinese Medicine “could be considered a substitute,” herbal supplement products could blend TCM and food supplements into a trustworthy, yet trendy new product. TCM is not likely to grow in popularity (despite an aging population) in youth-dominated markets unless more luxurious brands adopt TCM elements. However, a top-down (or even grassroots) nationalist push could disrupt this trend. From 2014 to 2016, some of the top food supplements brands like Amway, By-health (汤臣倍健) and Blackmores have invested in herb developing and cooperated with herbal companies in order to take advantage of providing traditional herbal resources for their Chinese consumers.

Infographics produced by Daxue Consulting, All Rights Reserved.

To know more about Chinese food supplements and traditional chinese medicine markets, please don’t hesitate to contact us.

Stay Up To Date! Sign up for our Newsletter to Receive the Last Updates.