Medical e-commerce in China: Get ready for the anticipated opportunity | Daxue Consulting

Medical e-commerce in China started in 2005 with the government’s permission of online pharmacy. After 13 years of rapid growth, the basic industrial structure of medical e-commerce is formed. Hundreds of online pharmacies and platforms are offering a variety of medicines and health products at a low price and a fast delivery service. However, the potential of the medical e-commerce market in China is still largely untapped. For pharmaceuticals companies and health product suppliers, preparation is needed to seize the anticipate opportunity.

B2C medical e-commerce market will keep growing in China

Intensifying aging and higher demand for medical service drive the growth of the healthcare industry

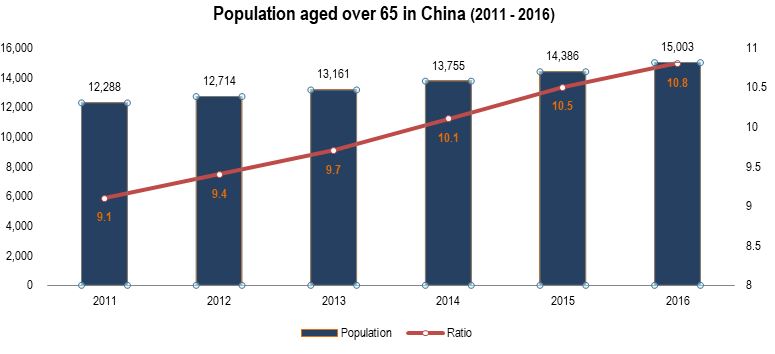

Due to the effect of a one-child policy, an imbalanced population structure is emerging. As the population aged over 65 keeps growing, more medical products and services will be needed, which provides a good environment for the growth of medical e-commerce.

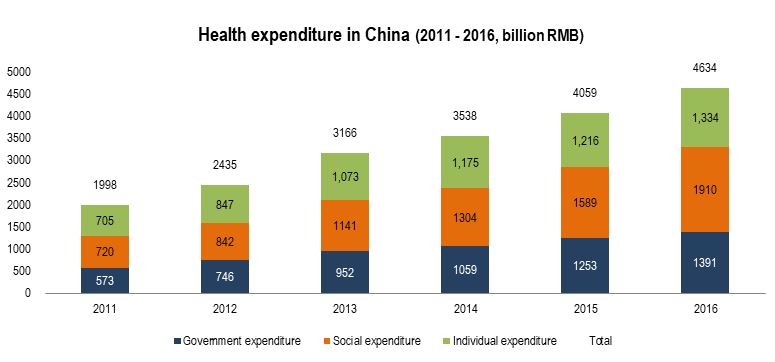

Meanwhile, the improvement of the economic condition and growing concern over health and diseases lead to a higher demand for health products and medical services. One demonstration is the health expenditure’s keeping growing despite the government’s effort on cutting down medical costs. In the future, better services provided by medical e-commerce platforms will be attractive and lower prices will make them even more competitive.

Solid foundation: Prosperity of e-commerce in China

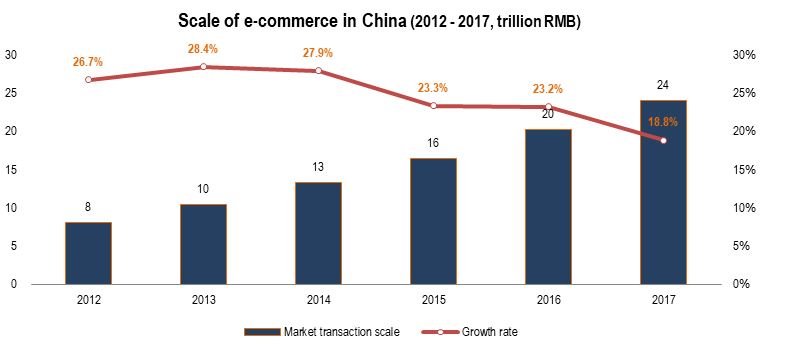

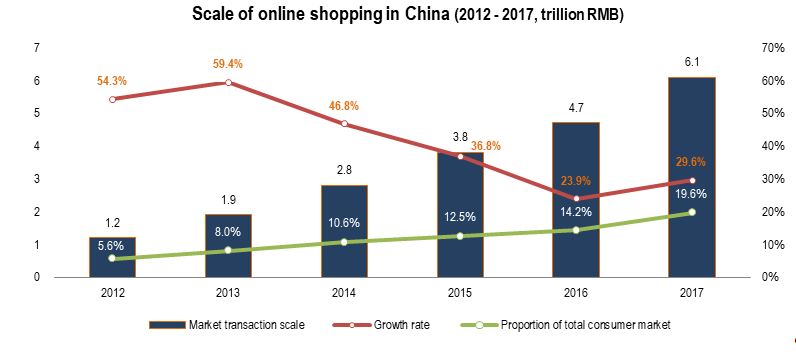

As shown below, the scale of e-commerce and online shopping is growing. The prosperity of e-commerce will benefit the growth of medical e-commerce market in two ways: customers’ behavior and whole-process operation support.

The development of e-commerce has greatly changed customers’ behavior in China. Giant e-commerce platforms like Tmall and JD which have a wide range of product portfolio offer cheap and fine goods with excellent customer services, fast delivery, and quality assurance, making online shopping care-free and convenient. Nowadays, trust has been built between the platforms and the customers and people are getting used to making purchases online. So, online pharmacies are also acceptable as long as the same quality and service as offline stores are assured.

Moreover, almost all mainstream e-commerce platforms provide simple and quick entry process for sellers and there are various operation supports offered by platforms and third-party companies, simplifying store operation. Meanwhile, the delivery services in China, credit to the prosperity of e-commerce, is fast and reliable. In brief, all these factors make up an excellent development environment for medical e-commerce.

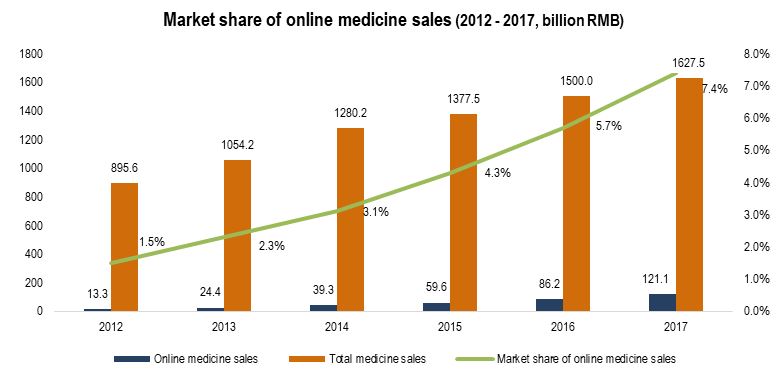

Good prospect for B2C medical e-commerce: Low market share and high growth rate

According to health-care information company IQVIA, China was the world’s second-largest national pharmaceutical market in 2017 — worth $122.6 billion. By 2017, the market of total medicine sales reached 1,600 billion RMB, while the market for online medicine sales was only 121.1 billion RMB, accounting for 7.4% of the total sales. Compared with America, whose market share of online medicine sales was 33.3% in 2015, the China market has plenty of room for the growth of online pharmacies. The CAGR (Compound annual growth rate) of online sales share in China from 2012 to 2017 was 37.6%, indicating a rapid growth rate and a large market potential.

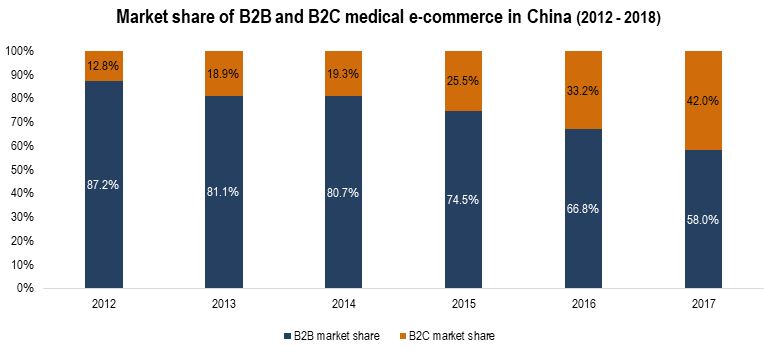

To look into the medical e-commerce market, B2B and B2C markets are growing at a different pace. In the past few years, B2B market share accounts for more than 50% due to the large purchase amount from hospitals, primary health care institutions and terminal pharmacies. However, the share of the B2C market has been increasing every year, indicating that more customers are buying medicines and health products online. In addition, OTC (Over-the-counter trading) is taking a larger proportion in the sales of online pharmacies, showing the customers’ acceptance for medical e-commerce. In the future, OTC online distribution will keep growing and become the main part of medical e-commerce in China.

More chances are springing up from the transition to medical e-commerce 2.0 in China

The limitation of traditional e-commerce methodology has appeared

In the first several years, online pharmacies were just online drug retailers, following the same methodology as other e-commerce sellers. Medical e-commerce 1.0 is the simple online sales service model which provides medicine transaction service for customers using the internet and information technology. They generally reached their growth and market share through their advantages of price and home delivery service over offline pharmacies. But with more competitors joining in, it becomes hard for an online pharmacy to be differentiated from others and gain profits from sales. To break the ceiling, some platforms start to provide personalized products and services like online clinical services, medication guidance, and health management. Advanced technologies are also applied to improve services in different ways. This trend is called medical e-commerce 2.0.

The focus is put on mobile applications

Mobilization is one of the main features of medical e-commerce 2.0. Medical e-commerce transactions on mobile devices started to exceed transactions on PC devices in 2015 and mobile devices will be the mainstream in the future. This is to a large extent due to the widespread of smartphones and the development and optimization of mobile applications. Data from Yiyaowang (1药网), Kangaiduo (康爱多) is to develop their own websites and applications specialized in medical products and services. This requires them to attract their own customers and maintain user activity. Either way is of importance to increase exposure and attract customers on mobile devices.

Professionalization is the driving factor of the transition to medical e-commerce 2.0

Professionalization is to provide additional services for customers on specialized medical platforms and their applications. It differentiates the specialized platforms from normal online pharmacies that only provide products. Many e-pharmacies such as Yiyaowang (1药网), Jianke (健客), Kangaiduo (康爱多) have launched a “medicine + doctor” model. They have included health management, clinical service, and medication guidance to attract customers. For example, the Yizhen (1诊) app developed by Yiyaowang is effective in driving customers by providing a series of additional services. The objective is to ensure the quality consistency of online and offline service so that a larger market share can be reached.

O2O model in medical e-commerce: One step ahead for better service and wider coverage

O2O model is still being explored in medical e-commerce with a good prospect.

The O2O model aims to combine online information and offline services. For customers, they can place an order online and pick up the products in offline stores where they can get additional services like medication guidance. Customers can also place their order in offline stores even if the goods are sold out. The products will be sent from another store or the warehouse directly to the customers’ home.

Online pharmacies, such as Kangaiduo, have built offline stores on the basis of online platforms of a self-built official website, flagship stores on JD and Tmall, mobile WAP website, WeChat store, and Kangaiduo App. Some traditional offline pharmacy chains after years of operation and development have also established their presence online based on their professional service that relies on the community.

“Web-based hospital + Drugstore” is another type of O2O strategy practiced by AliHealth. It founded China Medical O2O Pioneer League with many offline pharmacies and tried to use mobile internet technology and big data technology to realize data interaction, build customer profiles, and get through the upstream and downstream industry service. Online medical service “One-minute clinic” is offered in member store of the league, providing personalized health management services.

Medical e-commerce platforms are quickly developing and forwarding their O2O strategy

Different entries to the medical e-commerce and their features

There are mainly two types of medical e-commerce platforms:

General e-commerce platforms such as Tmall and JD run medical e-commerce platforms as a segment. They have a large and steady population which can be easily transferred to customers of medicine and health products. In Tmall’s 2017 double eleven shopping festival, Tmall pharmacy reached sales value of 100 million RMB in 3 minutes and 300 million RMB in 6 minutes. Ali’s financial statement showed that the annual revenue of AliHealth in 2017 was 475 million RMB and it reached a year to year growth of 739.4%. This type of platforms has a variety of SKUs operated by themselves but retailers can set up their flagship stores as well.

The others are specialized platforms run by medical e-commerce verticals, such as Yiyaowang and Jianke. They offer both products and services on their websites and mobile applications. They do not have a regular population as general platforms but their specialized services and comprehensive product portfolio help them maintain a number of core customers.

Specialized e-pharmacies are gaining advantages in the increasingly fierce competitive environment

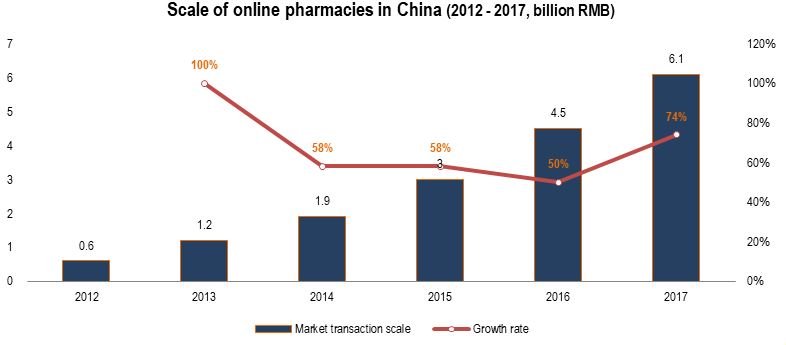

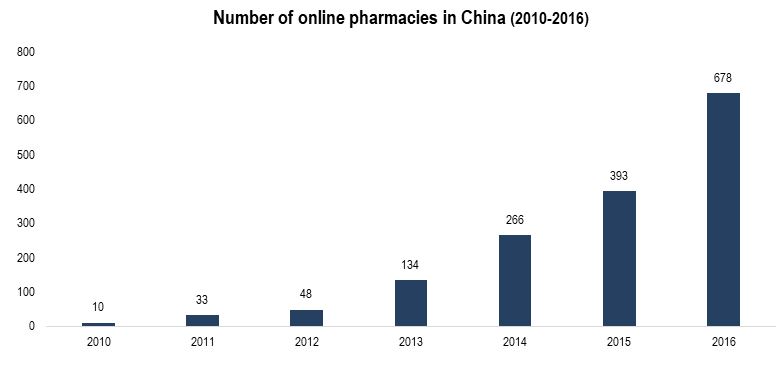

The market size of online pharmacies has gone through rapid growth, reached 6.1 billion RMB in 2017. But the competition is also tough: the number of online pharmacies has been growing fast, reaching 678 in 2016.

Of all online pharmacies, specialized online pharmacies are having a better performance. The Chinese Medical E-commerce Competitiveness Report ranked B2C e-pharmacy competitiveness on the basis of the platforms’ product range, financing capability, and service capability. Yiyaowang, Jianke, and Haoyaoshi, three medical e-commerce verticals were ranked at the top. They belong to three professional medical enterprises respectively, indicating that specialized platforms are more preferred by customers.

| Rank | Platform | Website |

| 1 | Yiyaowang (1药网) | 111.com.cn |

| 2 | Jianke (健客) | jianke.com |

| 3 | Haoyaoshi (好药师) | ehaoyao.com |

| 4 | Qilekang (七乐康) | 7lk.com |

| 5 | AliHealth Pharmacy (阿里健康大药房) | maiyao.liangxinyao.com |

| 6 | Kangaiduo (康爱多) | 360kad.com |

| 7 | JD Pharmacy (京东大药房) | mall.jd.com |

| 8 | 360 Haoyao (360好药) | 360haoyao.com |

| 9 | Yaofangwang (药房网) | Yaofangwang.com |

| 10 | Babaifang (八百方) | 800pharm.com |

Yiyaowang (1药网)

- Parent company: Guangdong No.1 Pharmacy Chain Co., Ltd. (广东壹号大药房连锁有限公司) owned by Guangdong No.1 pharmaceutical group. The 111 group has the B2C medical platform Yiyaowang, digital hospital (1诊) and B2B platform Yiyaocheng (1药城).

- It was established in July 2010. It is one of the largest online pharmaceutical platforms and one of the first to upgrade to an O2O pharmaceutical platform driven by technology.

- Coverage across the country: main 23 provinces. The thorough warehouse and logistics system allows delivery within 24 hours.

- Yiyaowang and the digital hospital 1 Zhen (1诊) have more than 2000 in-house and third-party medical professionals who provide clinical and pharmaceutical services.

Recent activities:

- On the rank of China Pharmacy Chains Comprehensive Strengths Top 100 (中国连锁药店综合实力百强);

- Received $50 million in financing from 6 Dimensions Capital (通和毓承) in April 2018;

- Cooperation with Jiuzhoutong (九州通) on purchasing channels, co-marketing on the internet, logistics etc.

Jianke (健客网)

- Parent company: Jianke Pharmaceutical Co., Ltd. (广东健客医药有限公司) was founded in 2006. After 10 years of rapid development, it has become a famous Internet + pharmaceutical health service platform. It is listed as a unicorn company in the e-pharmacy industry by i-research Consulting.

- Recent activities

- In July 2018, Jianke has realized intelligent medicine purchasing by cooperating with JD Alpha, the intelligent service platform.

- In August 2018, Jianke announced that it will build 10,000 square meters industrial base in Guangdong for Internet pharmaceutical supply chains. The project is invested with 0.2 billion RMB and is expected to bring 2 billion RMB sales revenue.

Haoyaoshi (好药师)

- Haoyaoshi is the medical e-commerce platform owned by Jointown Pharmaceutical group (九州通). In 2016, Jointown integrated its internet business sections, including Haoyaoshi, and built Health 998 E-commerce group, realizing its O2O strategy.

- 2017 revenue: 1.078 billion RMB. It ranks the second among the platforms that revealed their revenue.

A brief summary of the top 3 platforms

| Yiyaowang | Jianke | Haoyaoshi | |

| Year of establishment | 2010 | 2006 | 2016 |

| SKU (stock keeping unit ) | more than 270,000 | Around 680,000 | Over 260,000 |

| Registered users | 15 million | 15 million | N/A |

| Delivery | Third-party delivery | Third-party delivery (Shunfeng express) | Third-party delivery |

| Revenue

(2017, billion RMB) |

Over 1.0 | 1.6 | 1.1 |

| Website traffic rank

(country rank /category rank) |

6,221 / 969 | 1,574 /228 | 31,450 / 4,730 |

Active social media presence is a clear feature shared by main platforms

Weibo and WeChat public account is their main focus on social media. Knowledge popularization by professionals and health advice are provided to the general population in the form of articles and videos. Meanwhile, product recommendation and purchase links are attached to promote sales.

For example, the official account of Haoyaoshi on Weibo, which has 459 thousand followers, provides a variety of information including public health events, health advice, and refutation to rumors. In addition, lottery events are held regularly to attract followers and increase exposure. On WeChat platform, original articles and serial caricatures about health knowledge and recommended products are sent. And customers can make purchases in Haoyaoshi online store through WeChat Mini program.

|

|

|

Popularity has been raised through online advertising

Baidu ranking is a widely used tool for online advertising. Relevant advertisements are showed on the result page of Baidu, which will greatly increase exposure. Many online pharmacies also purchased an online advertisement to raise popularity.

Below is the search result of “online drugstore” on Baidu APP. Haoyaoshi pays for better position and it is the second result. Also, Yiyaowang and Jianke can be found just under Haoyaoshi.

To have a brief look at the platforms’ popularity, Baidu index shows the rising or decreasing interest for specific brands. 2015 and 2016 are the peak for most platforms indicating that medical e-commerce had a rapid development in these two years.

Baidu index of “Yiyaowang”

The peak of the search is in 2015, which is estimated to be owing to following activities happened in this year:

- The website changed its name from “壹药网“ to “1药网” with a focus on 1.

- Its first O2O offline experience store was launched in Chengdu.

- Yiyaowang received 0.45 billion RMB financing, which was the largest financing for medical e-commerce

- The financing was used on supply chain construction and mobile device investment.

Baidu index of “Jiankewang”

The peak of the search is in 2016, which is estimated to be mainly owing to its DTP strategy starting in that year.

Baidu index of “Haoyaoshi”

The peak of the search is in 2015, which is estimated to be owing to its active O2O strategy this year – cooperation with medical institutions to realize hospital + medicine e-commerce.

O2O model has been applied widely and will be the dominant operation mode of medical e-commerce

As a core part of the transition to medical e-commerce 2.0, O2O strategy helps medical e-commerce platforms to offer better medical service, shorten delivery time and cover more customers, which will improve the competitiveness of the industry. No wonder that all top 3 medical e-commerce platforms have been forwarding their O2O strategy.

Yiyaowang

- Established cooperation with Jointown pharmaceutical group (九州通) on purchasing channels, co-marketing on the internet, logistics etc. With the help of offline pharmacies of Jiuzhoutong, Yiyaowang is able to increase coverage and shorten the delivery time.

- Established cooperation with Beijing Tongrentang (同仁堂) to integrate online and offline resources. Tongrentang has entered Yiyaowang and become the first traditional Chinese medicine brand on Yiyaowang. Consumers can purchase online and then get online service for further advice in Tongrentang offline stores.

- Launched an O2O experience store in Chengdu in 2015, marking a new step for Yiyaowang’s O2O strategy. Consumers can choose medicine online and make purchases offline. The store also provides clinical service and delivery service.

Jianke

- Has opened 8 DTP (direct-to-patient) pharmacies so far, which is an important part for Jianke O2O strategy. DTP model is going to be a good solution given the separation of hospital and medicine and the outflow of prescription.

- Plans to locate the digital hospital in Guangdong. Jianke will work with offline medical institutions to realize the digitalization of the whole process except for face-to-face diagnose and physical examination.

- Acquired a hospital in Wuhan in 2017 and has been working with a hospital in Guangdong.

Haoyaoshi

- Possessed over 300 stores in 12 cities across the country, over 100 of which have O2O medicine delivery service. Haoyaoshi app has 160 members, 310,000 active users, and over 3000 orders per day. Jointown has built a nationwide supply chain and logistics information service system.

- Uses offline pharmacies as delivery points. In the future, Haoyaoshi plans to cover over 30 cities, satisfying the needs in all tier1, tier2, and tier3 cities.

- Has been working with a hospital in Beijing to build its digital hospital.

Brightness under uncertainty: Be prepared for the promising future

A huge opportunity is to be released with the deregulation of medical policy

Due to the particularity of the medical industry itself and the medical system in China, strict laws and regulations are set to ensure medication safety. Companies have to acquire a license for online drug sales and prescription medicines are forbidden to be sold on e-commerce platforms. But the government is also pushing forward the application of Internet technology to improve medical services in China. And it is said that restrictions on online sales of prescription drugs are going to be loosened in the near future. Once the policy is enacted, medical e-commerce will face another boom because the medicine market in China in 2016 was 1,490 billion RMB, 85% of which came from prescription drugs. At present, hospitals are the main sales channels of prescription drugs. This is going to change in the future and a large portion of sales will go to online pharmacies, which will benefit online pharmacies a lot.

Limitation of licensed pharmacists is still to be overcome

Pharmacists are responsible for examining the prescriptions and providing medication suggestions for patients. However, pharmacists seldom play their due role in China. They only follow the prescriptions rather than provide professional insights. But online sales of prescription medicines to a large extent rely on the assurance of pharmacists’ services. So, it’s of importance to overcome the limitation of pharmacists for the development of medical e-commerce. This requires the licensed pharmacists to have clinical pharmacy knowledge and practical working experience so that they are capable of providing professional pharmaceutical services.

Medical insurance is another challenge faced by medical e-commerce in China

The medical insurance in China is regulated by areas. Although the government has already been forwarding the integration of medical insurance, there are still obstacles due to different medical policies in different areas. So, it’s still uncertain if customers can use medical insurance to buy medicines online, which has a significant influence on the medical e-commerce market.

Customers’ main concern about online pharmacies calls for the perfection of government regulation

Medical consumption is different from other consumer goods because the quality and authenticity of medicines have a direct influence on one’s health. In hospitals and offline chain pharmacies, the safety of medicines is ensured, but for online pharmacies, customers will have more doubts about the qualification of the platforms.

On Zhihu, a question and answer platform in China, top-rated questions regarding “online pharmacy” and “buy drugs online” are:

- Are online pharmacies on Tmall reliable?

- Which online pharmacy is reliable?

- Are there any recommendations for apps for buying drugs?

Most of the answers are positive regarding the online pharmacies. They also provided methods to identify formal platforms.

|

|

One of the top-rated answers says:

- The government is very strict at the qualification of online pharmacies. Therefore, it’s actually safe to buy drugs on online pharmacies, including pharmacies on JD and Tmall.

- It’s important to choose an online pharmacy that is approved by the government, which can be checked by the China Food and Drug Administration or the operation certificate issued by the government.

- Recommended online pharmacies: Jianyiwang, Haoyaoshi, Tmall Yiyaoguan, Qilekang, and Yiyaowang.

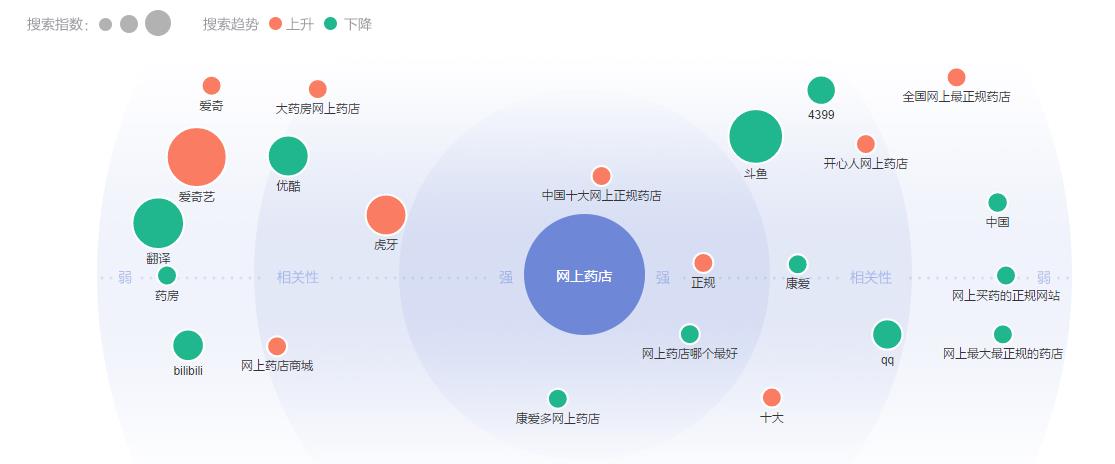

According to Baidu behavior search, keywords associated with the search of “online pharmacy” are “formal”, “Which is the best online pharmacy”, “top ten formal online pharmacies in China”, etc. indicating that consumers are extremely concerned about the reliability of online channels of buying drugs as they can’t take the risks when it comes to medicine.

Indeed, further development of the medical e-commerce industry relies on the looser regulation of the government but when it comes to the supervision of the platforms’ qualification and the assurance of medical safety, present regulations are still not enough. Uncertainty will still exist due to the contradiction and complexity of the medical industry. But what is certain is that the industry has a promising future and big development space with the perfection of government regulation.

Daxue Consulting can help with the analysis of any market in China, including the medical e-commerce market

Daxue Consulting, as a market research company, provides the adapted data in one of the most challenging markets in the world, China. We have a wide range of services to deliver competitive market research. To know more about the online pharmacy market in China, do not hesitate to contact our project managers at dx@daxueconsulting.com.