E-pharmacy in Mainland China: the health shift online

How will major market players come together to support the E-pharmacy in China?

E-pharmacy, also called “internet pharmacy” (网上药店) are online platforms that act as intermediaries or retailers to facilitate the sales of medicine, and are becoming increasingly popular across the world. China is currently facing many of the same regulatory and security challenges with their e-pharmacies as many other developing countries. Despite this, China has many unique market forces and players that make its e-pharmacy development different, and as Daxue Consulting has observed in the past, those agents often contribute and interact in unusual ways.

The Chinese e-pharmacy market has been growing substantially in the last six years according to Sinohealth CMH (中康 CMH). Sinohealth’s study shows that B2C e-pharmacy sales reached almost 28 billion CNY in 2016, which is a 93% YOY increase since 2015 and is over 17 times the sales amount in 2012. With its rapidly expanding size, China’s e-pharmacy market is already becoming one of the world’s most important sectors of the healthcare industry.

E-pharmacies allow for pharmaceutical to be conveniently delivered to a patient’s doorstep. Photo credit: Daxue Consulting.

Contact us for any question on the Chinese market

Today, the largest Chinese cities are experiencing a massive increase in demand for health care goods and services, averaging roughly 30% every year. According to China Internet Network Information Center (CNNIC,中国互联网络信息中心), over half of the Chinese population are internet users, with 5.14 million Chinese expected to regularly purchase products online through platforms such as Tmall and Jing Dong (京东), and those numbers will continue to rise in coming years. As a result, the combination of two major trends in China, healthcare and e-commerce, is powering the development of the e-pharmacy alternative at a tremendous pace. In 2016, China overtook Japan and became the world’s second largest pharmaceutical market, with over 914 enterprises approved to sell over-the-counter (OTC) medicines online in China as of January 2017, according to China Food and Drug Administration (CFDA,国家食品药品监督管理总局).

Succeeding in e-pharmacy in China: practicality over risk

One of the reasons for the success of e-pharmacy in China stems from the fact that many Chinese are being drawn into a busy lifestyle where short holidays, rigorous work environments, and long hours are all too common. This results in high levels of stress and pressure within the population and fueling the demand for consumer health products, particularly vitamins and dietary supplements (VDS). The average consumer’s purchasing power is rising quickly in China, and so too is the demand for healthier products to boost their immune systems, delay aging, and fight fatigue. Lack of free time leads the Chinese to value convenient round-the-clock shopping and the fast home-delivery services provided by e-pharmacies.

[ctt template=”2″ link=”g8Pap” via=”no” ]B2C e-pharmacy sales reached almost 28 billion CNY in 2016, a 93% YOY increase since 2015[/ctt]

In many cases, many Chinese citizens are increasingly finding less time to navigate a complex healthcare market, and are off-put by expensive medical services. It is only natural then that self-medication and traditional medicine have remained very common methods of healthcare in China. E-pharmacy services offer a clear solution to the current Chinese lifestyle and desire for rapid product delivery.

E-pharmacy platforms show that herbal and natural ingredients are the most popular medicines. The general Chinese consensus on non-herbal and non-natural medicines such as prescription drugs is quite poor, as they believe these medicines to cause unwanted side-effects and are generally less safe. Thus, OTC products intended for fighting allergies, colds and coughs saw strong growth in 2016, along with dermatological creams in Chinese e-pharmacies.

China’s air quality leads to dryness and other symptoms that are remedied with topical ointments. Calamine Lotion (炉甘石洗剂), developed by Winguide Huangpu Pharmaceutical Ltd (上海运佳黄埔制药有限公司), is an itch-relieving medication and one of the best sellers on Taobao and Tmall. Photo source: Tmall.

Skin products are getting sold faster than other OTC products in China because the highly polluted and often humid air is particularly damaging to skin. Also, Chinese consumers view dermatological products much more favorably, as they are perceived as less dangerous than ingested medicines when it comes to the use of potentially toxic substances.

Topical medication products, such as this one which can cure skin infections, are very popular on Chinese e-pharmacy platforms. Photo source: Tmall.

This e-pharmacy phenomenon is being primarily driven by China’s younger, tech-savvy demographic groups. Consumer reviews, websites ratings, discussion boards, blogs, and other social media platforms are used frequently by these younger consumers. Firms wanting to sell their products through an e-pharmacy in China must ensure they have a sufficient online presence and the capability to manage online business operations. E-pharmacy user purchases in China depend highly on the opinions of key internet influencers and on the experiences of other customers.

Black market e-pharmacy presence in Mainland China

The rise of e-pharmacies has been mirrored by the surge of illegal sales as well, and the situation has reached a critical point. In China, according to Legit Script, only 3% of e-pharmacy websites comply with local laws and regulations. This means that 97% of e-pharmacies in China are operating somewhat illegally, and most likely with hazardous practices. Rogue e-pharmacies has become a genuine problem in China as these websites are not managed by qualified pharmacies or pharmacists, do not require prescriptions or medical examinations, and sell unapproved and falsified drugs. The public health of citizens is directly threatened by the high saturation of criminal entities in the pharmaceutical industry.

To fight the proliferation of these firms, agencies such as the Chinese Food and Drug Administration are building a drug database for public awareness. Ideally, the Chinese government will also be executing regular campaigns to shut down non-compliant sites and mitigate consumer risk. Furthermore, packaging will be improved, including clear color codes which let patients know if their medicine requires a medical consultation or a prescription.

New perspectives on diversification of e-pharmacy in China

Recent research conducted by Frost & Sullivan shows that there is a large gap between U.S. and China when it comes to the development of the e-pharmacy market. The report states that e-pharmacies accounts for over 30% of the total retail sales in U.S., but in China e-pharmacy sales only account for 1.5% of total market sales. Frost & Sullivan, therefore, concluded that foreign multinationals would be well-positioned to exploit the market differences.

[ctt template=”2″ link=”4GeeE” via=”no” ]China could legalize the selling of prescription drugs online within five years[/ctt]

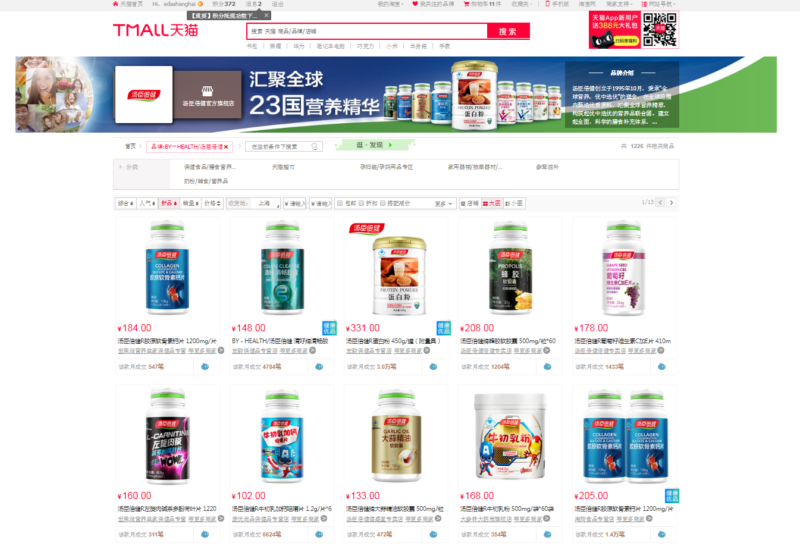

The leading consumer health players haven’t missed out on the e-commerce and e-retailing trends in China. Chinese pharmacies and international players have started selling online though the most popular e-commerce Chinese websites. For example, Guangzhou-based health giant By-Health (汤臣倍键) opened its flagship store on Tmall (天猫) in 2011. After 12 months, that had already realized over 600 million CNY on the platform. This new channel of e-pharmacy is letting large firms reach more customers than ever before.

Protein powder (蛋白粉), liquid calcium supplements (液体钙), fish oil supplements (鱼油) and folic acid vitamins (叶酸) are the top-selling categories on By-Health (汤臣倍键) Tmall store. Source: Tmall (天猫).

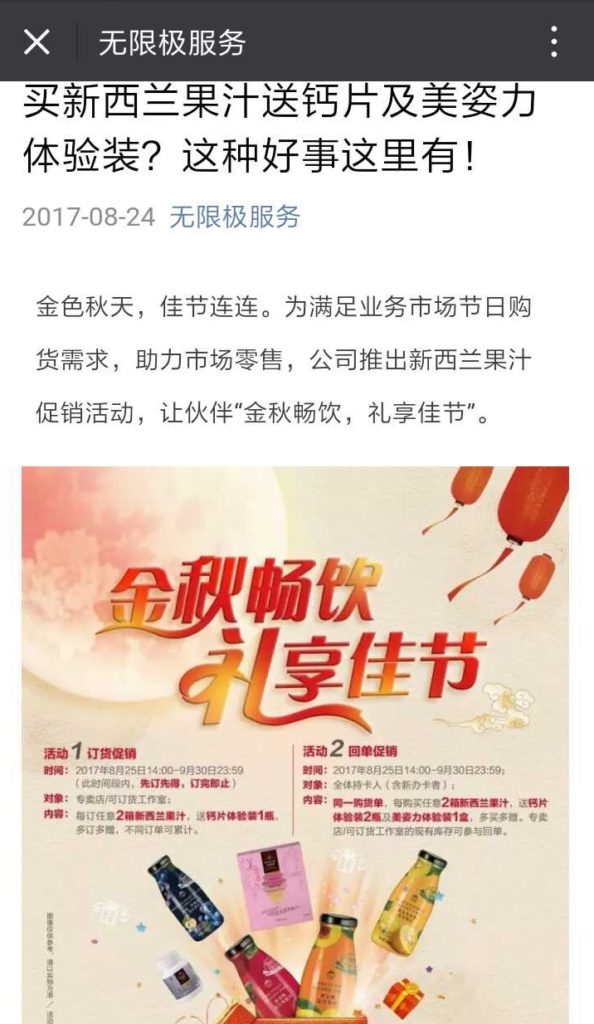

As online reputations are of paramount importance in Chinese e-pharmacy, direct selling companies are offering consumers various experience centers to review products. In this way, customer needs are targeted far more effectively, products can be segmented, the company’s internet image stands to improve, and brands can engage with consumers more directly. Amway (安利) and Infinitus (无限极) for example, both have implemented successful strategies with this in mind. By creating and maintaining a strong brand presence on WeChat and other top platforms, both brands could quickly garner helpful feedback and respond in kind. Other e-pharmacies should explore how to advertise in China, as mobile advertising is still one of the best solutions to boost sales in China, since mobile internet-based formats are skyrocketing at a yearly rate of 600%.

Amway and Infinitus have both created an online presence through successful branding and marketing. Bichen Zhang (张碧晨), a Chinese singer, is seen promoting an essence lotion product on Amway’s official WeChat account. Photo Source: Infinitus and Amway’s official WeChat account.

Most importantly, however, is the fact that China could legalize the selling of prescription drugs online within five years. As of May 2016, the CFDA has halted all online, third-party platform trial periods of prescription drug sales. However, the Chinese have also been looking to reintegrate those services into the economy. On December 2016, the Ministry of Commerce of China issued “The National Development Plan for Drug Circulation Industry (2016-2020)” (全国药品流通行业发展规划2016年-2020年) in which the government stated that China should cultivate many large-scale pharmaceutical enterprises with high-quality, standardized practices that extend all over mainland China.

At the same time, the government stated it would “support the cooperation between existing drug distribution enterprises and medical institutions and healthcare department, e-commerce enterprises to promote the medical e-commerce business services.” In January 2017, the Chinese government issued another series of documents, which aimed to provide a more comprehensive framework for growing the e-pharmacy industry, as well as encouraged the exploration of other prescription drug e-commerce operations.

However, the legalization of online prescription drugs sales is mainly targeted towards self-operated e-pharmacies, as they usually have the correct qualifications and certificates which allow them to sell drugs without being impacted by the policies. In that case, the investment in self-operated e-pharmacies will become a new trend. Although internet third party platforms, like Tmall, were forbidden to sell online in May 2016, those platform’s distribution channels are still stronger and more established than those of self-operated e-pharmacies.

According to the National Health and Family Planning Commission’s magazine (中华人民共和国国家卫生和计划生育委员会, China Pharmacy (中国药店), the sales of self-operated e-pharmacies and the third-party platforms account for 32% and 59% of the total online sales respectively. However, since the government is planning to standardize the market, there will be more restrictions for third-party platforms. From here, it is highly possible that self-operated e-pharmacies may overtake those third-party platforms in the future.

E-pharmacy consumers mainly consist of younger demographics. However, its convenience is also marketed to elders who have difficulties leaving the house.

In the past two years, many established pharmaceutical firms have begun to purchase self-operated e-pharmacies. For example, Renhe pharmacy (仁和药业) has purchased 56% of Yaofangwang’s (药房网) stock in 2016 for 600 million CNY, which lead Yaofangwang to realize 192 million in revenue during their first year of joint operations. Seeing successful acquisitions like Renhe’s, many third-party platforms have followed suit. AliHealth (阿里健康) purchased Guangzhou Wuqiannian Medicine (广州五千年医药) for 16.8 million CNY in 2016 to get the selling certification that Guangzhou Wuqiannian had been using.

Regulations have forced many small business operations to be acquired by large companies capable of meeting industry standards. Photo source: Alihealth.

What are the new trends for medical e-commerce in modern China?

With the competition of online pharmacies becoming more and more fierce, it becomes hard for a medical online platform to be differentiated from others and gain profits from sales. To break the ceiling, some platforms start to provide personalized products and services like online clinical services, medication guidance, and health management. Advanced technologies are also applied to improve services in different ways. This trend is called medical e-commerce 2.0. Furthermore, e-commerce 4.0 sheds light on the latest advanced technology which may have a big impact on the prospect of medical e-commerce. Technologies like voice assistance search, artificial intelligence, augmented reality and so forth likely improve consumers’ purchase journey experience and thus, online pharmacies could take initiatives to stay ahead of their competition.

So as to differentiate the specialized platforms from normal online pharmacies that only provide products, online medical stores draw much attention on professionalization which provides additional services for customers on specialized medical advice and their applications. Many e-pharmacies such as Yiyaowang (1药网), Jianke (健客), Kangaiduo (康爱多) have launched a “medicine + doctor” model. For example, the Yizhen (1诊) app developed by Yiyaowang is effective in driving customers by providing a series of additional services, such as clinical service and medication guidance from Xinan internet hospital. The objective is to ensure the quality consistency of online and offline service so that a larger market share can be reached.

Contact us for any question on the Chinese market

O2O strategy being widely adopted in medical e-commerce 2.0 in China

As a core part of the transition to medical e-commerce 2.0, O2O strategy helps medical e-commerce platforms to offer better medical service, shorten delivery time and cover more customers, which will improve the competitiveness of the industry.

The O2O model aims to combine online information and offline services. For customers, they can place an order online and pick up the products in offline stores where they can get additional services like medication guidance. Customers can also place their order in offline stores even if the goods are sold out. The products will be sent from another store or the warehouse directly to the customers’ home.

Online pharmacies, such as Kangaiduo, have built offline stores on the basis of online platforms of a self-built official website, flagship stores on JD and Tmall, mobile WAP website, WeChat store, and Kangaiduo App. Some traditional offline pharmacy chains after years of operation and development have also established their presence online based on their professional service that relies on the community.

“Web-based hospital + Drugstore” is another type of O2O strategy practiced by AliHealth. It founded China Medical O2O Pioneer League with many offline pharmacies and tried to use mobile internet technology and big data technology to realize data interaction, build customer profiles, and get through the upstream and downstream industry service. Online medical service “One-minute clinic” is offered in member store of the league, providing personalized health management services.

Active social media presence in China is a clear feature shared by main platforms

Weibo and WeChat public account is their main focus on social media. Knowledge popularization by professionals and health advice are provided to the general population in the form of articles and videos. Meanwhile, product recommendation and purchase links are attached to promote sales.

For example, the official account of Haoyaoshi on Weibo, which has 459 thousand followers, provides a variety of information including public health events, health advice, and refutation to rumors. In addition, lottery events are held regularly to attract followers and increase exposure. On WeChat platform, original articles and serial caricatures about health knowledge and recommended products are sent. And customers can make purchases in Haoyaoshi online store through WeChat Mini program.

Daxue Consulting expertise on the Chinese healthcare market

A major pharmaceutical player in Europe was looking to expand their operations in China and reached out to Daxue to gain a better understanding of the Chinese market, specifically in respiratory health. Many highly-industrialized regions and cities in China, like Beijing, regularly experience poor air quality. As a result, citizens of these areas are being affected by air quality related health concerns in record numbers. Daxue’s team provided the insight and research into these critical locations so that the client could best tailor their products and services for the Chinese market.

Our project managers approached the problem from multiple angles. Qualitative interviews with medical professionals, patients, and other industry insiders helped create a picture of the scope and implications of the problem. With extensive quantitative research using advanced analytics techniques, our team was able to discern key areas of focus for the client’s expansion. Ultimately, Daxue’s recommendations helped our client design the optimal strategy for increased profitability and addressing one of China’s greatest health concerns.

In the healthcare industry and other practices, our clients share our passion for results and success. For more on our expert insights and our work in the Chinese market, reach out to learn more.

Follow us on Twitter to be the first informed on the Chinese market:

New wave of #entrepreneurs in #China: discover the #coffeeshop Big Sur and the woman behind it: https://t.co/lBQw4GNmZh pic.twitter.com/9uZ6QxygZl

— Daxue Consulting (@DaxueConsulting) 20 novembre 2017

Our office in Shanghai