SARS crisis management: 3 inspiring cases that changed China’s business landscape

Severe acute respiratory syndrome (SARS) is a viral respiratory illness caused by a SARS-associated coronavirus. WHO recognized it as a global threat in mid-March 2003. The first confirmed cases of SARS occurred in Guangdong province in November 2002 and WHO reported that the last human chain of transmission of SARS in that epidemic had been broken on July 5th 2003. The features of SARS include 4-6 days of incubation period and 9.6% of fatality rate. Similar to our analysis of Coronavirus crisis response, we looked at inspiring cases of SARS crisis management in China.

Download our Crisis Management in China report

SARS has caused a significant impact regionally and globally. There were 8096 confirmed cases while 7429 of them were in China. The virus had caused 744 deaths, and 685 of them were in China. 26 countries, areas and territories were involved.

Impact on China’s economy during the SARS outbreak: service sector suffered the most

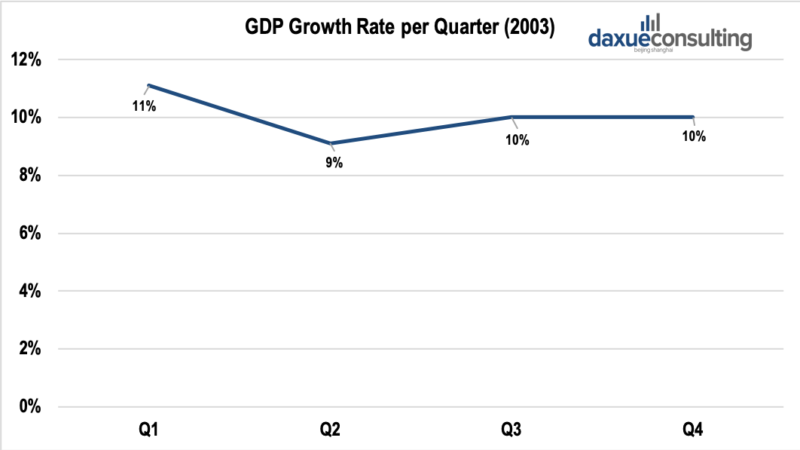

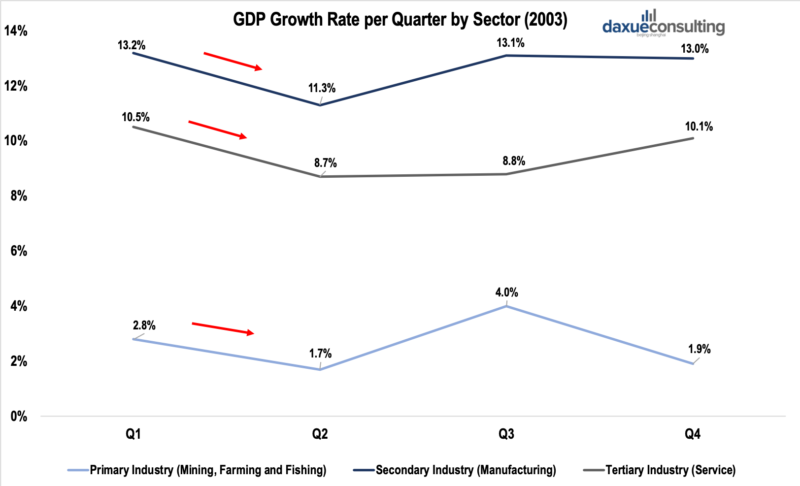

Originating in China, SARS impact on the Chinese economy was profound, though not to the extent of COVID-19. All the industries in China experienced significant downturns in Quarter 2, 2003, especially the service sector was hit the hardest and GDP growth rate decreased by 1.8%. As for primary industry (mining, farming and fishing) and secondary industry (manufacturing), the GDP growth rate dropped by 1.1% and 0.9% respectively.

[Data source: Sina finance, ‘GDP Growth Rate per Quarter (2003)’]

[Data source: Sina finance, ‘GDP Growth Rate per Quarter by Sector (2003)’]

Nevertheless, in the third quarter, most industries had recovered and rebounded to the average level except for the service sector. Moreover, it took an extra three months (until the fourth quarter) to regain the previous growth rate.

Alibaba’s crisis management strategy during SARS

The impact of SARS on Alibaba

Date through back to 2003, Alibaba was still a relatively small enterprise that specialized in B2B e-commerce. Additionally, it acted as an intermediary that connected export suppliers in China to international buyers.

[Photo source: the street.com, ‘Logo of Alibaba’]

Damaged reputation: Alibaba was blamed for sending employees to the Canton Fair in 2003

During the SARS outbreak, Alibaba born the bad reputation of spreading SARS in the city of their headquarters, Hangzhou, due to the employee’s business trip in Guangzhou.

Jack Ma sent an Alibaba employee to participate in the 92nd Canton Fair in Guangzhou. After the employee’s travel from Guangzhou, she was diagnosed with SARS and become the fourth SARS patient in Hangzhou. As a result, more than 500 Alibaba employees were forced to quarantine and work at home. People in Hangzhou suspected that the Alibaba employee carried and spread the virus in Hangzhou and Alibaba became notorious at that time.

Business obstacle: loss of business opportunity

During the SARS outbreak, many business activities shut down temporarily, including exhibitions and order deliveries. Traditional business models came up against roadblocks. Owing to the out-of-control situation and employees’ quarantine, the world’s largest B2B website was under lockdown. Apart from Alibaba’s business, during the period of 92nd Canton Fair, Alibaba’s clients and other exhibitors were reluctant to attend the fair. Offline commerce was not an option during the outbreak.

Alibaba’s response to SARS

Agile adaptation: switching to working at home rapidly

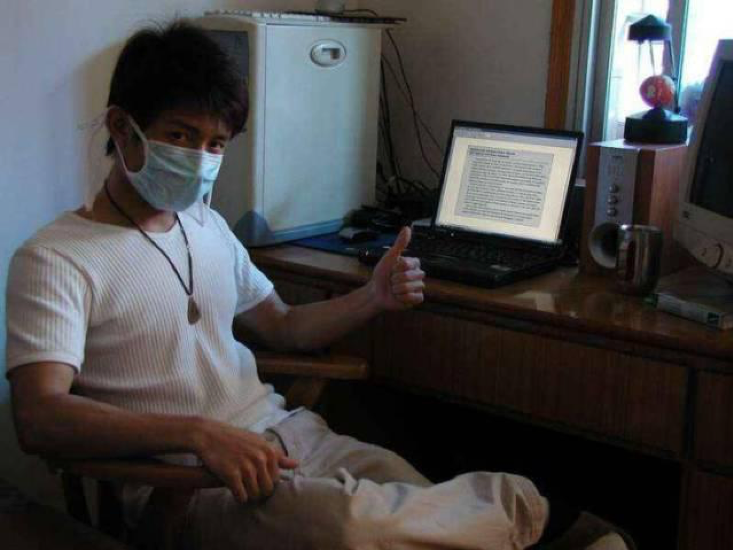

Alibaba made a rapid decision, all employees were required to work at home after May 6th 2003. This would have been unheard of in 2003, a less digital-savvy era. However, Alibaba employees were ready to work from home almost immediately. The technical staff of the engineering department set up the necessary equipment for employees to work at home within 2 hours.

[Photo source: Sohu, ‘Alibaba Employee working at home during SARS outbreak’]

Internal communication: extensively utilizing online communication channels and providing mental support

Jack Ma, as the founder of Alibaba, enhanced internal communication with Alibaba employees after the announcement of quarantine. Firstly, Jack Ma sent an email to all employees to comfort them. He also encouraged the staff to look at the positive side and tackle the new challenge. Secondly, Jack Ma initiated the extensive use of email and instant message software to improve the efficiency of communication with employees. He believed this kind of internal communication was more efficient and straightforward. What is more, Alibaba organized online group chats and held online singing competitions as means of providing the emotional support.

[Photo source: Huashang Taolue, ‘Jack Ma and Alibaba Employees during the SARS outbreak’]

Crisis as a mission: exploring a business opportunity

The SARS crisis response of e-commerce companies like Alibaba pushed e-commerce development in China. Taobao officially went online on May 10th 2003 as a result of discovering the need for online shopping during the epidemic. Jack Ma established a small R&D team to compete with E-commerce giant eBay. Also, Alibaba provided support and service for SMEs to transfer to online businesses.

The result of Alibaba’s crisis management

Due to Alibaba’s quick action, service was not suspended one day. The SARS crisis witnessed Alibaba’s solution to overcoming significant challenges, which made Alibaba’s team more committed than ever. 17 years ago, Alibaba was a relatively small scale of the firm. Nowadays, it has become the most significant internet enterprise in China with a market value of 3.89 trillion RMB. Surprisingly, some of Alibaba’s critical business decisions that led to the company’s future success arose during their SARS crisis management.

Increased brand awareness and business volume: surging business volume and members

Alibaba broke its record by reaching the highest business volume. On May 7th, the first day of remote work, the company achieved 12,500 business leads in China’s market. During the SARS outbreak, the daily amount of business opportunities surged by 3-5 times in comparison with the same period of 2002. As a consequence, in March 2003, Alibaba accumulated 3,500 new members per day and increased by 50% from the previous quarter. Moreover, the amount of Alibaba’s membership had increased significantly. 42% of the total members (1.4 million members in total) claimed that they became Alibaba’s members during SARS.

The game-changer in China’s market: Taobao went public successfully and has changed Chinese consumer behavior

Since Alibaba’s SARS crisis management turned out to initiate their online shopping business, the company successfully fulfilled Chinese peoples’ new demands and turned them into online shoppers. More and more people knew about E-commerce and digital technology. As a result, Taobao went public successfully and has become one of the representative e-commerce retailers in China.

Ctrip’s crisis management strategy during SARS

The impact of SARS on Ctrip

In 2003, Ctrip had become the largest hotel distributor and online travel agency in China. During the first quarter of 2003, because of its mature business and profitability, its listing was around the corner.

[Photo source: ChinaDaily, ‘Logo of Ctrip’]

Reduced business volume: plummeted business activities that had nearly led to bankruptcy

During the SARS outbreak, Ctrip’s business performance suffered. With decreased demand for travel, the business volume of Ctrip experienced a substantial decrease. One Ctrip employee recalled that the workload declined by 70% at that time. The epidemic had also ceased Crip’s collaboration with hotels and airlines. If it lasted several months longer, Ctrip would have gone bankrupt.

Plummeted turnover: Ctrip’s business performance was in danger

The SARS outbreak worsened Ctrip’s business operation. Its operating profit fell below the company’s benchmark profit and loss line, and revenue went down by 42%. The performance of the tourism industry in China suffered during the SARS outbreak, and China’s domestic tourism spend decreased by 11.2% in comparison with the year before.

Ctrip’s response to SARS

Quick strategy adaptation: flexible working schedule and alternatives

Ctrip adopted a rotation system for employees to deal with the decreasing staff workload. The company has also provided subsidies for rotating personnel to keep business operate regularly. Managers and some staff were required to work for half a day. Nevertheless, they would get 60% of their original salary.

Ctrip also developed alternatives to utilize its business resources efficiently. The company collaborated with China Merchants Bank and sold credit cards. Moreover, Ctrip also rented its call center out to China Merchants Bank.

Employee care policy

Ctrip implemented employee care policy during the SARS outbreak. Liang Jianzhang, the CEO of Ctrip, sent several letters to encourage employees. The company also promised that they would not lay off any employee and even retained the employees whose contracts had already expired.

Internal upgrade

Ctrip optimized its business process during the industry recession. What is more, the company provided training courses for employees and encouraged them to improve themselves during the SARS period. Customer service staff stepped up to recite various helpful business information such as call scripts, operation procedures and maps.

The result of Ctrip’s crisis management

Strong rebound after the epidemic

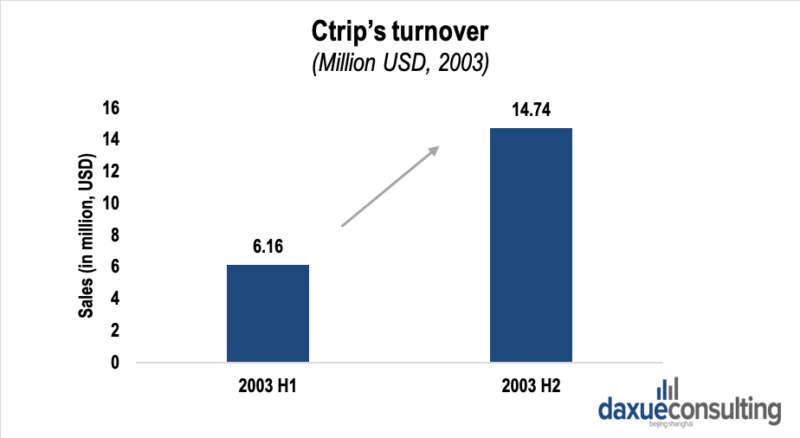

Ctrip capitalized on the expected business rebounded after the epidemic. The expected retaliatory consumption in China’s tourism industry came true. Owing to Ctrip’s policy of retaining employees and improving employees’ abilities during their SARS crisis management, Ctrip became the winner in the tourism market. In 2003 Q3, Ctrip’s turnover reached 66 million RMB and increased by 73% from Q1. Its outstanding performance had facilitated its IPO on the NASDAQ Stock Exchange.

[Data source: 36 Kr, ‘Ctrip’s Turnover’]

Successful IPO

Crip’s rapid growth after the epidemic made it famous in the capital market. On December 9th, 2003, Ctrip successfully listed on the NASDAQ Stock Exchange. On Ctrip’s first day of trading, it closed 88.5% higher than the initial offering. Such a prominent performance made Ctrip become the first company that doubled its share in one day since 2000.

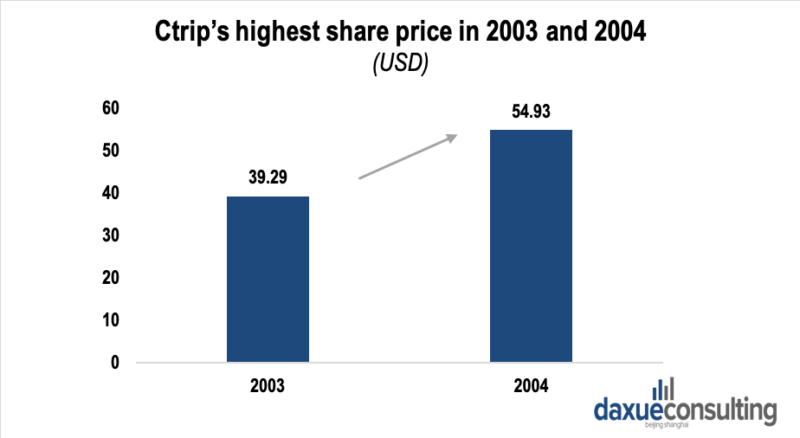

[Data source: Google Books, ‘Ctrip’s Highest Share Price in 2003 and 2004 (USD)’]

P&G’s SARS crisis management strategy

The impact of SARS on P&G

P&G entered China in 1988 and have become a thriving market player since 2003. China was P&G’s sixth-largest market, up from tenth just three years earlier.

[Photo source: ChinaDaily, ‘P&G in China’]

SARS impact uncertainty and market demand uncertainty

P&G assumed that the SARS outbreak caused market turbulence and changed consumer behavior. As a result, the situation matched with their assumption. From April to September 2003, the market demand for FMCG experienced wild fluctuations. For example, in April, the demand of anti-bacterial cleaning products increased drastically while plummeted in May due to consumers’ sufficient stock at home. From June to September, as summer closed in and people improved their cleaning habits, the demand for cleaning products increased again.

P&G’s response to SARS

Action before the crisis: market demand prediction

P&G made market demand prediction before the crisis to eliminate the loss caused from being unprepared for fluctuations. The company headquarters is in Guangzhou, the epicenter of the SARS outbreak. P&G China had already paid close attention to the issue. The company decided to make some business adaptations during the period of January-February 2003 when the impact of the epidemic was still unknown. P&G predicted that the demand for cleaning products would surge and the market would face a huge challenge. These had indicated that P&G China had been fully ready for the crisis.

Quick response to the crisis: the establishment of the emergency response system regarding capacity

P&G China also established an emergency response system to confront the situation. In March 2003, the outbreak in Hong Kong was severe, and the demand for Safeguard soap soared. This was a signal that demand for Safeguard was likely to soar in mainland China.

The P&G supply chain began to prepare an emergency response system. Once the demand for the Safeguard reached a target number, the system would be activated, and the production line of P&G could be produced at full capacity as planned.

At the height of the crisis, the government requested that Safeguard cannot be out of stock in Beijing. Therefore, P&G deployed the products from less affected areas to Beijing while increasing the output.

The result of P&G’s SARS crisis management: expected sales performance

In April 2003, the production of Safeguard set a record without selling out of stock. Moreover, the supply and inventory quantity of Safeguard in each city were entirely in line with headquarters requirements during SARS.

Sales of Safeguard during SARS soared by 40%. SARS had rapidly promoted the sales of Safeguard in China. It became an essential external factor in boosting Safeguard’s healthy development in China.

What can we learn from these three SARS crisis management strategies: Business adaptation, predictions, and employee care

“When facing crisis, we should not see it as opportunity. Instead, we should consider what trouble people encountered, how we can offer help.”

Jack Ma, founder of Alibaba

No matter the era, the country, and the crisis, the ability to adapt, make predictions, and care for employees is crucial in crisis management. Alibaba displays the power of adaptability by changing to remote work in only two hours, and again in catering to new consumer e-commerce demand. P&G showed us the power of forecasting supply and demand during a crisis. Ctrip reaped the benefits of retaining employees through tough times.

Author: Amelia Han

Let China Paradigm have a positive impact on your business!

Listen to China Paradigm on iTunes