Cloud computing in China

What is Cloud computing?

Cloud computing is the storage and processing of data on remote data centers. Cloud storage reduces the burden on computers which makes possible more work flexibility. A large tech savvy population and need for data security drive the development of cloud computing in China.

China has the largest online population in the world, with over 800 million internet users. Therefore it is no surprise that China generates an enormous amount of data that must be stored securely. Cloud-based servers are more scalable, affordable, and secure than on-site servers, so they perfectly satisfy China’s huge demand for flexible data storage.

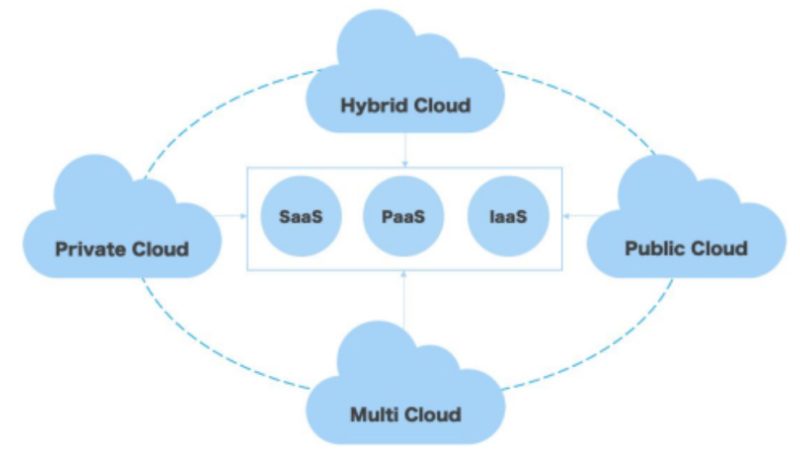

The technology is being rapidly developed in various sectors and is already generating over five billion dollars in revenue annually. Generally the three main types of business delivery models available for cloud computing are Software as a Service (SaaS), Platform as a Service (PaaS) and Infrastructure as a Service (IaaS). Meanwhile, data can be stored from the public cloud, private cloud and hybrid cloud.

Sizing the Chinese cloud computing market

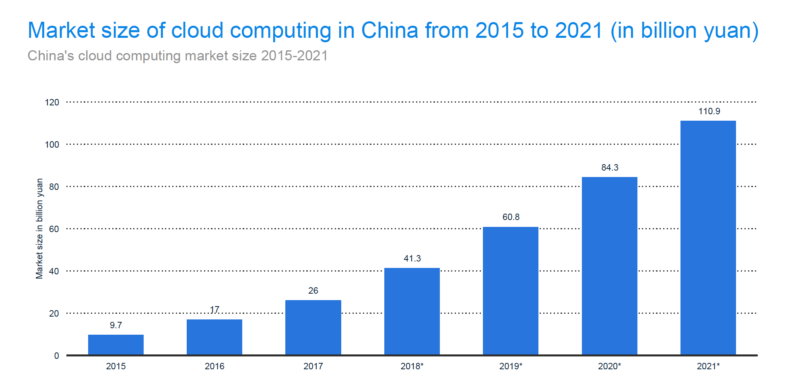

In 2018, the Chinese cloud computing market was second in terms of overall size. It accrued approximately $13.4 billion dollars in annual revenue compared to $53.4 billion of the US. Despite this, the Chinese government is dedicated to pushing the market to approximately $64 billion by 2020, creating major business opportunities for cloud computing providers. At any rate, China’s cloud computing industry is projected to exceed 300 billion yuan ($42.3 billion dollars) by 2023, by which time an estimated 60% of domestic companies and government agencies will be using cloud computing services.

[Source(s): Statista, IDC, China’s cloud computing market size]

According to the Chinese Ministry of Industry and Information Technology (MIIT), from 2015 to 2019 officials have been working to more than double the scale of China’s cloud computing industry. Many analysts predict that public cloud usage rates could grow more than 20% annually to 2023.

Large enterprises, government agencies and financial institutions accelerate the pace of cloud application

Furthermore, according to an interpretation of the MIIT’s Action Plan, China’s cloud computing industrial structure continues to optimize. Key technologies such as large-scale concurrent processing, mass data storage and data center energy-saving have achieved great breakthroughs in standards. Also, backbone enterprises are working to develop more strategies to improve their business categories. With many large bodies like enterprises and government institutions relying on cloud computing in China, the technology is applied into an increasingly wide range of industries.

According to data from market research firm IDC, cloud computing and artificial intelligence will more than double the rates of innovation and productivity at Chinese companies and organizations by 2021. For these reasons, cloud computing is considered a crucial infrastructural force in China’s push for an industrial upgrade as it moves to embrace new technologies like artificial intelligence, internet of things, and big data.

The graph below portrays IaaS as the segment with the biggest market share in cloud computing in China. The forecasted market size of software-as-a-service (SaaS) will continue to be the largest among the three with CRM and Mail management as the most widely used application types.

[Source: Statista, Cloud Computing in China – Statistics & Facts]

Chinese Government’s Cloud Computing Industry Development Mandate

As part of a larger development strategy for advancing Chinese software and information technology services, the Chinese government plans to continue to make large investments over the next few years to drive domestic cloud computing development.

Through the ‘Internet Plus’ strategy, introduced in 2015, the Chinese government is pushing for the development of the domestic cloud computing industry to modernize manufacturing and other domestic industries. In short, this strategy promotes the integration of cloud computing with big data and IoT.

China’s cloud computing market is still at the nascent stage; however, it is likely to witness tremendous growth across all the industry verticals with public sector, manufacturing, retail, and healthcare sectors among major adopters of cloud computing services. Also, fast pace deployment of 4G LTE mobile network across China is anticipated to support further penetration of cloud computing services among end user organizations. The cloud market has particularly strong growth potential, underpinned by government initiatives and major investment by vendors in infrastructure and human capital. A new cybersecurity law will protect local cloud and hosting players from growing international competition.

Government support for the Chinese cloud computing market will see strong growth continue. Domestic firms have been set the target by China’s Ministry of Industry and Information Technology’s goal of increasing cloud revenues by at least 50% annually over the next few years, including a focus on generating revenues for cloud services from international sources and building China’s presence in the global cloud computing market. There is also an eight-point initiative that includes the creation of a national industry data recovery center and a national safety control service center for China’s data security.

Trends in the Cloud Computing Space

The future of cloud computing looks vast, connected and increasingly fast. While the concept and initial design of cloud computing began in the United States as a way to store data, networks, intelligence and more over the Internet, the refinement of cloud-based platforms and services are spreading widely in China. From individual consumer cloud services for storing photos, to multibillion-dollar corporations that need to house intelligent data, this technology has become internationally ubiquitous in the last ten years.

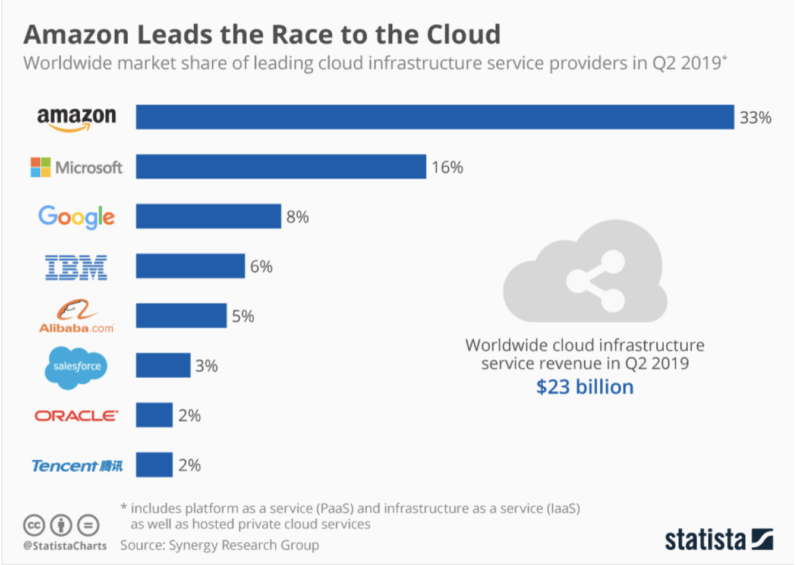

Globally, the cloud computing industry is dominated by American companies such as Amazon, Microsoft, and Google, which controlled a combined 57% of the overall market in 2018. According to Wikibon Research, the global cloud market hit $237 billion in 2018 and is estimated to reach $814 billion by 2027. With mega corporations like Google, IBM and Amazon mostly running cloud systems in the U.S., it’s easy to overlook China’s market for now. Data shows, however, that companies like Alibaba (which currently ranks fifth in the global cloud computing market), Tencent and Huawei have worked their way up the ranks and are growing rapidly.

[Source: Statista, Synergy Research Group, Global market share of leading cloud providers]

China’s cloud computing market will be the largest in the world

China’s cloud market is set to become the largest in the world by 2023. But right now, it remains nascent and insubstantial compared with its respective sectors in mature economies. The Chinese market is roughly one-tenth the size of the US equivalent. The market is expanding but remains fragmented, which means that much of it is up for grabs. Domestic tech heavyweights Alibaba and Tencent, along with international players like Amazon and Microsoft, all want a piece of what will eventually become a very large pie.

Despite the challenges presented by the Chinese market, several large, well-resourced U.S. cloud providers have established operations in China through joint partnerships with local companies. For example, Microsoft has partnered with 21Vianet, a Chinese data services firm, to roll out public cloud. Other U.S. companies are also operating in China. Amazon is partnering with ChinaNetCenter to offer cloud services and IBM is teaming with 21Vianet to offer its hybrid cloud platform.

Tense domestic competition drives growth

Furthermore, in the decade since e-commerce giant Alibaba became one of the first domestic players to tap into the market in 2009, China’s internet giants have been pouring resources into building up their cloud infrastructure services. Companies like Huawei, Tencent, and Baidu are now working feverishly to deploy their own cloud computing-based services. Among Chinese tech players, the excitement surrounding cloud computing’s potential as a growth driver is real.

Thus, local competition is another significant factor to take into consideration. Several Chinese companies are well-positioned in their domestic market. E-commerce giant Alibaba’s Aliyun is already a notable competitor, servicing 1.4 million customers directly and indirectly. China Mobile, China Unicom, China Telecom, Baidu, Tencent and ZTE among others, are also well-positioned in the market.

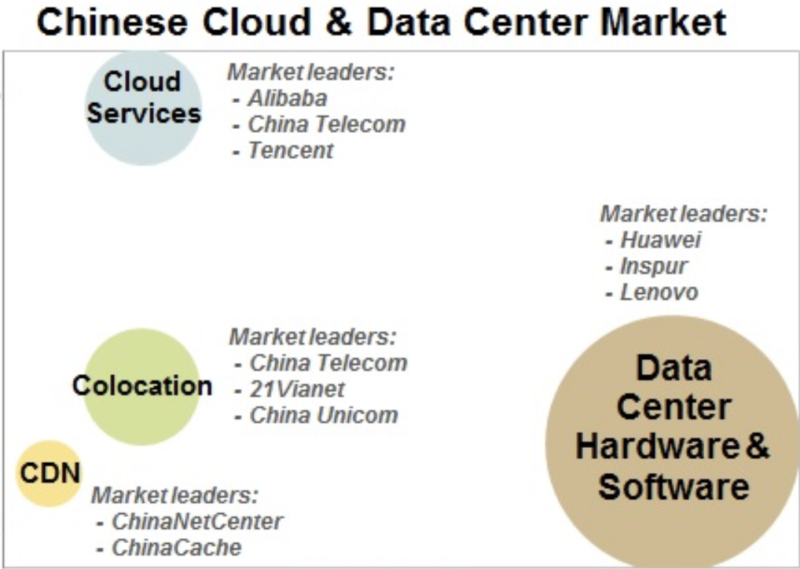

The Chinese cloud computing market is dominated by local players

China’s cloud market is dominated by local players, with IDC figures showing Alibaba Cloud as holding 42% of the public cloud marketplace in 2018, followed by Tencent Cloud at 12%, China Telecom with 9%, and Amazon Web Services (AWS) close behind with 6%. The total market for cloud infrastructure and software in the world’s second-largest economy reached $5.4 billion in the first half of 2019.

As you can see below, they are leading in each of the four key market segments: data center hardware/software, cloud computing services, colocation and CDN.

[Source: Synergy Research Group, This graph shows the market size (greater to the right) and annualized growth rate (high growth will place at the top of the chart) for the Chinese Cloud and Data Center Market]

Where is the growth and opportunities in the Chinese cloud computing market?

China has been a frontrunner in many different tech industry verticals, from AI and the Internet of Things (IoT), to smart cars and virtual reality (VR) services. As a direct result, the Chinese government and businesses have worked to also strengthen cloud computing technologies to support the data infrastructure of many of these emerging technologies.

According to Zhang Feng, chief engineer with China’s Ministry of Industry and Information Technology, China’s overall cloud industry reached a scale of $48 billion, and the IoT industry surpassed $174 billion in 2018. In other words, there are many businesses in many industries looking to implement cutting edge cloud computing technologies. Thus, increased development by Chinese companies on their cloud services offerings will continue to support the domestic market’s growth.

Along with this, the SME market in particular continues to offer strong growth potential and will be an important driver of demand for cloud computing in China. With security being a key hurdle, Chinese SMEs will likely continue to favor Chinese cloud providers for their IT services expansion. The SME cloud market was a key area of growth over the previous years and the fastest growth rates were for hosted communication and collaboration services, but in terms of total demand, it is Infrastructure-as-a-service (IaaS) and business applications that dominated.

Chinese companies are sensitive about their data

In the past, concerns over cost, security and logistics meant many Chinese businesses were reluctant to migrate to the cloud. Chinese companies are extremely sensitive when it comes to their data, with the vast majority still preferring it to be stored in-country.

However, encouraged by decreasing costs and Chinese government policy, a growing number of Chinese firms, unhampered by decades of outdated IT infrastructure, are now adopting cloud-based alternatives to on-site enterprise hardware and software. This is especially the case with China’s burgeoning number of SMEs, which typically have smaller budgets and therefore prefer the lean business models supported by SaaS. Customer relationship management software (CRM), office automation software (OA), intelligent manufacturing software (IM) and office collaboration software top their shopping lists.

Alibaba Cloud Leads China’s Cloud Computing Market

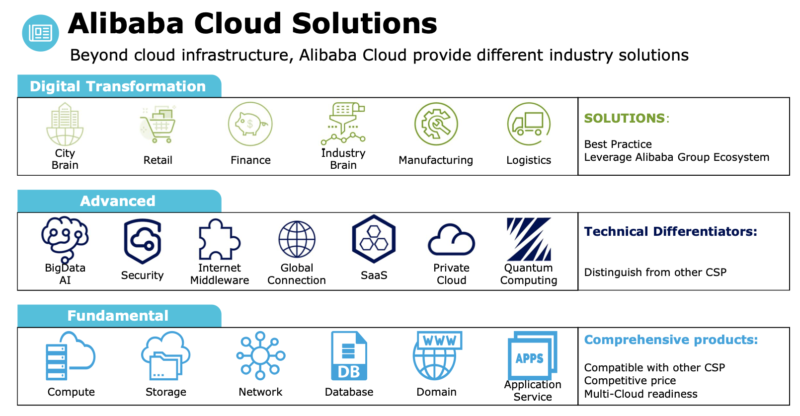

It opened up to third-party customers in 2009 and offers a comprehensive suite of cloud services, including web hosting, elastic computing, data migration, database, storage and content delivery networks, large-scale computing, security, and management and application serves.

Alibaba Cloud is China’s largest public cloud service provider with the most advanced cloud network, including 11 data centers and more than 2,300 CDN nodes in mainland China. Although being the world’s fifth biggest player in having just 5% of the global cloud market, it holds a 40% share of China’s domestic market and provides international companies with seamless access to China through Alibaba Cloud’s

China Gateway solution. Alibaba Cloud’s ongoing focus on innovation and internationalization has allowed it to outperform major Cloud vendors in the Asia Pacific market.

[Source: Deloitte, Overview of Alibaba’s Cloud Products and Solutions]

Alibaba Cloud’s Recent Performance

In its December 2019 4Q earnings, Alibaba maintained its leadership position in the Chinese cloud computing market by developing technology and business solutions that enable the digital transformation of businesses across industries in both the public and private sectors. During the quarter Alibaba Cloud reached two important financial and technological milestones.

62% YOY growth

First, their cloud computing business generated, for the first time, over 10 billion RMB in revenue, growing 62% year-over-year. This was driven by increased revenue in its public cloud and hybrid cloud businesses.

Applying public cloud infrastructure

Second, ahead of last year’s 11.11 Shopping Festival, Alibaba Cloud enabled the migration of the core systems of their e-commerce businesses onto their public cloud. During the festival, Alibaba Cloud provided a highly scalable, reliable and secure public cloud infrastructure that handled a single day GMV of RMB 268.4 billion (US$38.4 billion). Its public cloud infrastructure and technologies enabled Alibaba to process over 544,000 orders per second at peak and 970 petabytes of data without disruption for the full 24 hour period during the festival.

The company believes that the migration of the core systems of Alibaba’s e-commerce businesses onto the public cloud is a major milestone that not only will generate greater operating efficiencies for Alibaba but also will encourage more customers to adopt their public cloud infrastructure.

Cloud computing now represents more than 7% of all of the company’s revenues as Alibaba continues to cement its cloud position in China and in the Asia Pacific region.

A Promising Future for the Chinese Cloud Computing Industry

China still has a complex regulatory environment with intense local competition. However, the market opportunity is attractive to a point where foreign firms are willing to invest heavily in the cloud sector and take necessary measures to be compliant. Massive investments from both public and private actors also support this trend as it enables higher speed connections in remote areas and better wireless connectivity in the whole country.

Huge private sector investment, strong government backing and young talent are together rallying behind the growth of China’s cloud computing industry. The thirst for big data and information on consumer trends from corporate marketing departments will likewise drive demand for cloud-based database technology.

The other primary driving force will be market demand. Given the growing appetite for on-demand video, short-videos and live-streaming, mobile gaming and online content in China, content providers will need to invest in elastic computing services, auto-scaling, content delivery networks and server load balancers in order to provide uninterrupted service and fast download speeds. Demand for cloud products will also increase as companies invest in new technologies such as O2O services, IoT integration and online payments, or expand into overseas markets.

Mobile security will be another priority for the industry. As the world’s largest smartphone market, China is regarded as a mobile-centric market, and different to PC-centric markets found in the West. China’s tech savvy population is leading the way in adopting mobile payments, O2O services, mobile gaming and designing their lives around their smartphone. While Android is the leader in powering mobile applications for the China market, its operating system also remains highly susceptible to external attacks. To address data security and the concerns of Chinese mobile users, foreign companies will need to invest in mobile security, while still offering fast load speed and high availability to users.

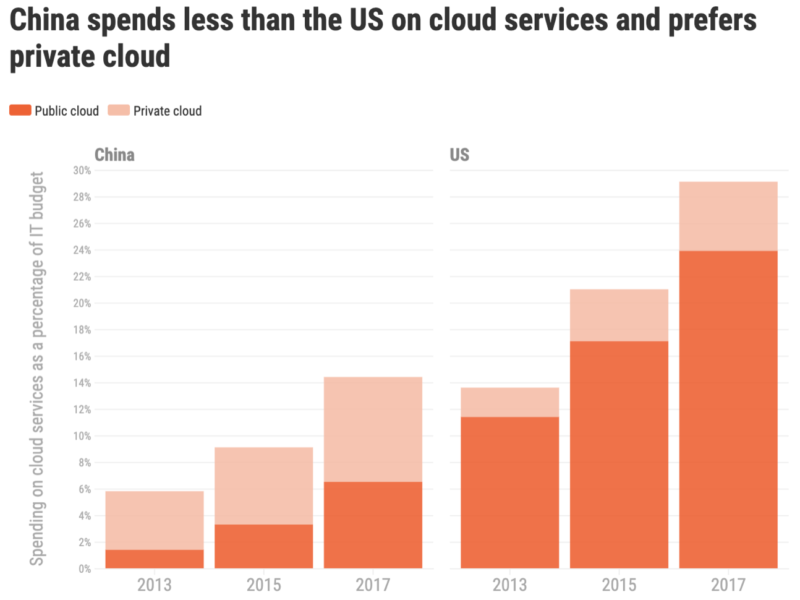

Public vs. Private Cloud

[Source: Technode, Mckinsey, Spending on public and private cloud computing in China]

Although Chinese businesses are beginning to ramp up investment in cloud computing, they use cloud computing services at a lower rate than companies in the United States and other developed markets. While Chinese companies generally prefer the private cloud (i.e., data is stored on a company’s intranet), rather than the public cloud (i.e., data is stored by the provider), China’s public cloud market is set to grow over 20% by 2020 as more Chinese companies adopt public cloud services.

For foreign cloud firms, the local ecosystem features several peculiarities that have so far restricted them from securing significant market share on a global level. In addition to standard regulations that prohibit foreign cloud providers, they also face a market unready for widespread public cloud adoption. Unlike more mature cloud markets, firms still prefer private cloud solutions, which allow them to maintain full ownership and control of physical resources. However, the public cloud model is slowly waking up in China and in the future hybrid cloud models will likely become mainstream as more businesses choose both solutions for different ends.

What are the opportunities and concerns for foreign businesses?

Given the growing importance of data in business operations, cloud computing is a must for MNCs operating in China. However, setting up cloud computing solutions in China presents unique challenges including legislative and technical aspects of MNC cloud options. Despite the uncertainties and challenges, global cloud providers cannot afford to ignore China’s large and growing market. Increasingly competitive domestic players are finding their niche, but multinationals still have an opportunity to shape the market. As a market player it is time to identify target segments and invest in solutions for this customer base, as China’s IT buyers decide how they will take advantage of what the cloud has to offer.

Current regulations stipulate that foreign cloud providers must partner with local Chinese companies to serve customers in China, and the cloud computing industry is still regulated. The main challenges facing cloud computing within, from or to China stem from the information security aspect. This involves issues such as data cross-border transfer, personal information protection, data processing and mining among others.

While its tech market is growing, China still needs to enhance its core cloud technologies and encourage its adoption across markets. According to a recent report by Alibaba, areas that Chinese businesses require the most cloud assistance include IoT integration, mobile security and expansion into overseas markets. However, the convergence of emerging cloud technology trends and China’s increasing demands for the use of cloud services will open cross-border business opportunities. The tech sector will benefit tremendously from collaboration and partnership initiatives between firms in China and the rest of the world.

Mastering the Cloud Economy

How to navigate your approach?

Two characteristics of China’s cloud market may help enterprise vendors navigate their approach.

- Technology providers selling cloud software, services and hardware can strengthen their value proposition by developing a better understanding of cloud economics, customer preferences, and the impact of the cloud’s ascendance in legacy and disruptive technologies.

- State-owned enterprises account for a large share of total IT spending and are highly concentrated in government, banking and financial services. In these sectors, most IT spending focuses on large, complex, highly integrated legacy systems that cannot easily move to the cloud. A large and dynamic start-up scene has emerged in China, and is spending on the cloud. However, that still represents only a small fraction of total IT spending. In the U.S., cloud providers are addressing mainstream companies across industries, but that’s more difficult to do in an economy dominated by state-owned enterprises.

Choosing a Provider

When entering the Chinese cloud market, Alibaba maintains that website load speed is crucial anywhere, but particularly important in the mobile-centric market like China. Thus, the best option to minimize latency, improve SEO visibility, and provide high availability is to host in Mainland China.

The clear local market leader, Alibaba has earned the title of trusted partner for Chinese firms expanding into European availability zones. And with the growth of China’s cloud industry and now with China Gateway, it’s looking to do the same for companies moving in the other direction. Selina Yuan, president of international business of Alibaba Cloud Intelligence says that the “primary challenges foreign organizations face are “security, connectivity and demanding cross-border digital infrastructure setup issues.”

Therefore, for any multinational vendors or business it is important to assess how your business can fit into the proper Chinese ecosystem from both a technology and business perspective.

Author: Jeffrey Craig

Let China Paradigm have a positive impact on your business!

Listen to China Paradigm on iTunes