Comparing SARS and Coronavirus economic impact

The novel coronavirus pneumonia (now known as COVID-19) was first encountered in the city Wuhan in December 2019. Like other coronaviruses, COVID-19 can cause various symptoms such as fever, coughing, and shortness of breath. In 2002 and 2003, Severe Acute Respiratory Syndrome (SARS-CoV) plagued China. The novel coronavirus outbreak echos that of SARS in 2003, which caused a chain of reactions in the global economy. Though in 2003, China was not considered a global superpower, an analysis of the events in 2003 can provide insight to what businesses will face in 2020. In the ultimate face off of SARS and Coronavirus, we will see what factors influence how much economic influence an outbreak has.

The so-called “China paradigm” is, once again, showing its consequences on the world. Similar to 2008 when imported infant formula was massively bought by Chinese due to the infant formula scandal, to the extent which some countries like the Netherlands or Australia experienced shortages and increased prices of infant formula in their own countries, we are currently witnessing the same for surgical masks. China is a new paradigm that shakes every single economy in the world. A few decades ago, the concept of the “butterfly effect” got popular as a tiny change at the opposite side of the world could lead to consequences oceans away. In the case of the virus, even small changes in Chinese consumption are impacting the rest of the world.

A Comparison between SARS and Coronavirus

Similar to SARS, the new coronavirus originated in animals and migrated to humans. The outbreak was initially associated with Wuhan’s Huanan Seafood Market that sells mainly seafood, in addition to chickens, bats, marmots, and other wild animals. With the human-to-human transmission, there was a spread of cases in Wuhan and other cities in China. By mid-January 2020, cases have been identified in Thailand, Japan, South Korea, as well as western countries like the U.S.

A brief comparison of SARS and Coronavirus

|

| SARS | Coronavirus (As of Feb 19th, 2020) |

| Origin |

Foshan, Guangdong (southeast of China) |

Wuhan, Hubei (middle part of China |

| Fatality Rate |

9.6% |

2.1% |

| Total Cases |

8,096 |

75,134 |

| Total fatalities |

744 |

2,007 |

| Number of HCW Affected |

1,706 |

1,716 |

| Period of Outbreak |

November 2002 – July 2003 |

December 2019 – Present |

| Reproduction Number |

2 |

1.4 to 4.0 |

| Incubation Time |

4-6 days |

2-14 days |

Data Source: WHO, Worldometer

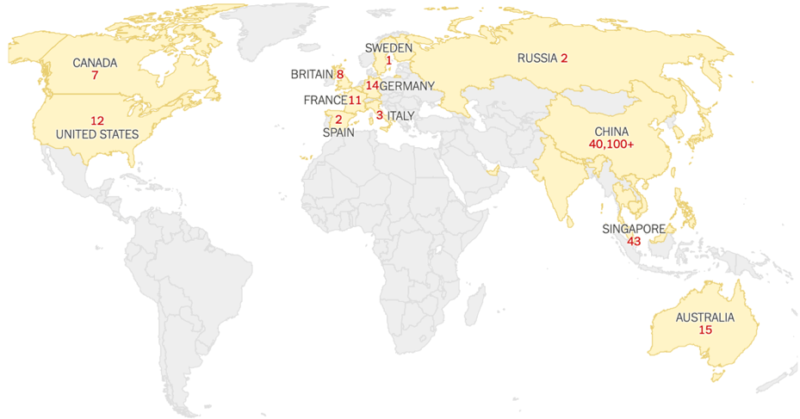

Based on the current data, new coronavirus seems to be less deadly than SARS. However, it is spreading much faster. The 2002/2003 SARS outbreak led to a total amount of 8,094 effected cases over the course of 8 months; whereas, the epidemic of COVID-19 has that number only within a couple of weeks. On January 30, 2020, the WHO Emergency Committee has declared the outbreak of new coronavirus disease is a “public health emergency of international concern” (PHEIC).

Confirmed Cases around the World (February 12, 2020)

Source: The New York Times

The Possible Impact of COVID-19 on China’s Economy

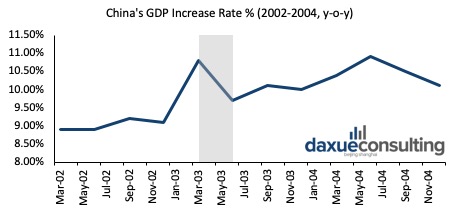

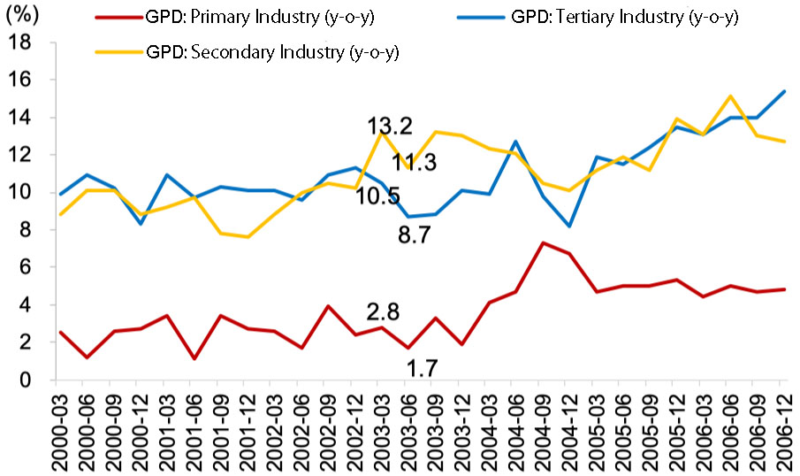

The outbreak of SARS in 2003 caused a sharp dip in China’s economic activity (shaded area). The growth rate of the second-quarter GDP (y-o-y) dropped to from 10.8 to 9.7%. After the outbreak, the growth rate returned to normal levels immediately. In total, it was estimated that SARS reduced China’s annual GDP growth rate in 2003 by 0.5%. Even though the negative influence came from SARS, by the end of the year, the GDP growth rate in 2003 still reached 10%. These numbers show that although SARS sharply affected GDP growth, China made a swift recovery.

Data Source: National Data

The adverse impact on China’s economy caused in COVID-19 might be much more profound compared to the effect of SARS in 2003. Before the financial crisis of 2007-2008, the economic development in China achieved significant momentum—growing by an average of almost 10% a year. However, China’s economic growth has slowedThe productivity and overall economic growth have been falling for several years. In 2018, the annual growth rate of GDP reduced to 6.57%.

Data Source: National Data

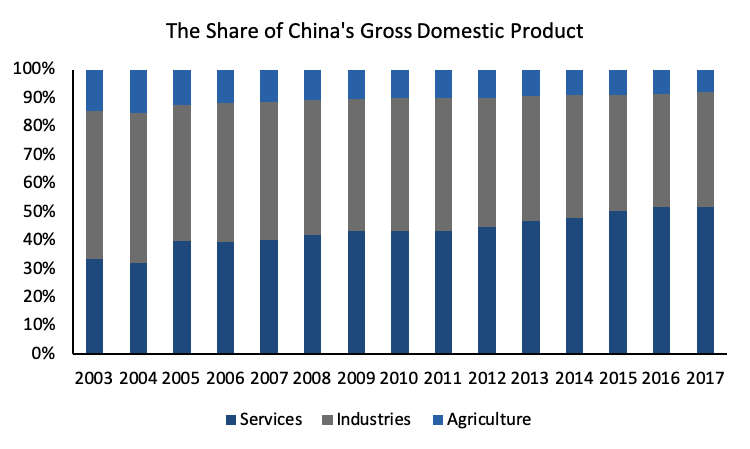

Besides, the tertiary industry has accounted for an increasing portion of China’s economy in the past decades. In 2003, the secondary industry accounted for the largest share (52.20%) of the country’s gross domestic product. The percentage of the tertiary industry was only 33.38% (3,918.8 billion yuan). However, in 2017, the tertiary industry became the dominant industry in China’s economy, with a share of 51.69% (42,703.15 billion yuan). Meanwhile, the percentage of the industry sector has gradually shrunk. In 2017, it decreased to 40.46%.

Data Source: National Bureau of Statistics of China

Service sector hit the hardest during SARS

According to the data in 2003, the outbreak of SARS had negative influences across all industries, ranging from primary (like mining and fishing), secondary (like manufacturing), and tertiary (service). . However, the service sector was hit the hardest. In the second quarter, the growth rate of the tertiary industry decreased by 1.8%, while the growth rate of primary and secondary industries only reduced by 1.1% and 0.9%, respectively. Furthermore, the growth rate of primary and secondary industries quickly rebounded to the average level in the third quarter. In contrast, the growth rate of the tertiary industry only increased by 0.1% in the third quarter, and it took an additional three months (the fourth quarter) to regain the previous growth rate. Since the tertiary industry becomes more important in China’s economy in present, the GDP growth will be held back by the new coronavirus more significantly.

The Growth of Three Industry GDP (2000-2006)

Picture Source: Sina Finance

In the following, we will give a detailed insight to analyze how COVID-19 will affect China’s economy from various aspects.

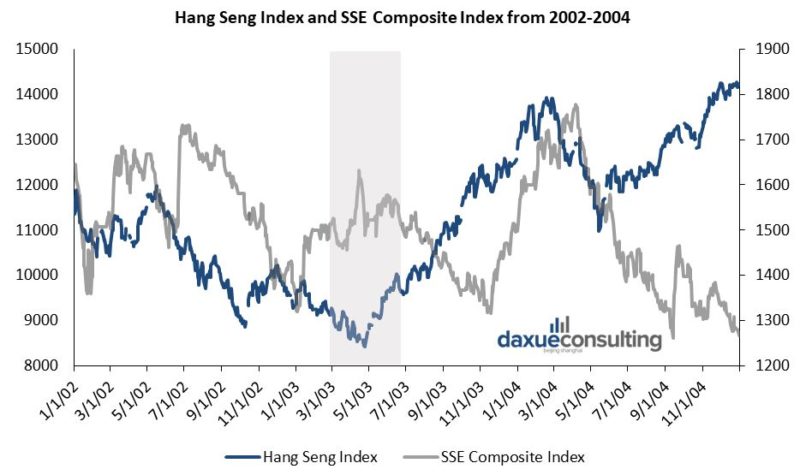

Financial Market’s impact from SARS and Coronavirus

The Hong Kong Stock Market reacted in advanced

During the SARS outbreak in 2003, both the Hang Seng Index and the SSE Composite Index have declined. However, the Hong Kong stock market reacted in advance of the Chinese stock market. From the middle March to the end of April (the peak outbreak in Guangdong Province), the Hang Seng Index dropped by more than 8%. On April 24, 2003, the Hang Seng Index hit the lowest point, consistent with the peak of the SARS epidemic. The reaction of the A-share market was a bit slow. The SSE Composite Index experienced the first round of crash from April 16 to May 9, 2003, with a drop of more than 8%–similar to the Hang Seng Index. For the rest of the time, the fluctuation of the SSE Composite Index was not out of the ordinary.

The stock markets recovered by July

From May 2003, as the epidemic of SARS was gradually contained, the Hang Seng Index started to rebound. Although the SSE Composite Index was increasing slowly in the meantime, it experienced a second sharp decrease in the middle of May. Then, it started to rise again. Generally, both the Hang Seng Index and the SSE Composite Index returned to the normal levels after the outbreak was under control. But after July 2003, the Hang Seng Index kept increasing, while the SSE Composite Index decreased again. However this likely resulted from the monetary policy at that time.

During the SARS outbreak, the central bank kept a stable and prudent monetary policy without the reduction of the interest rate. At that time, China just joined the WTO. The economy was booming with a vast amount of foreign exchange flowing to China. A large number of international payment surplus had appeared—both the current account and capital and financial account sustained high surplus.

How quickly will China’s economy bounce back in 2020?

However, in 2020, the driving force of China’s economy is much weaker. The financial market needs loose monetary policies to go through the outbreak. As a result, on February 3rd and 4th, 2020, the central bank conducted “reverse repos” and invested 1.7 trillion yuan in increasing liquidity.

Data Source: Yahoo finance

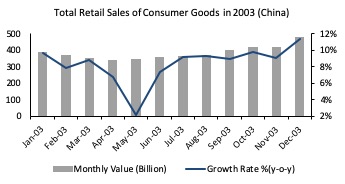

Retail Sales plummet during SARS outbreak

The outbreak of SARS hit the retail industry, and the total retail sales collapsed in April 2003. During the SARS peak period (May 2003), the growth rate reduced to 4.3%. With the outbreak appeared to be coming under control, the growth rate of retail sales quickly ensued. In July 2003, it returned to 9.8%. Consequently, the annual growth of retail sales of consumer goods in 2003 reached 9.1%, increased by 0.3% as compared to 2002.

Data Source: Golden Credit Rating International Co., Ltd.

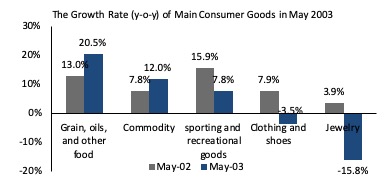

Consumer goods sales reflected low consumer confidence

In 2003, the essential consumer goods, including grain, oils, and daily commodity, kept a steady growth. It might be caused by citizens’ anxiety to save in preparation for an epidemic. In contrast, the sales of consumer discretionary, such as sporting goods, clothing and shoes, and jewelry, were adversely affected. The sales grew more slowly or even shrunk.

Data Source: Golden Credit Rating International Co., Ltd.

SARS was formative for e-commerce

Before the outbreak of SARS in 2003, e-commerce in China was at the emerging stage. SARS outbreak promoted e-commerce (e.g., eBay, 8848) in China, in fact, JD.com credits the SARS outbreak to their 2003 launch in e-commerce. The volume of e-commerce increased dramatically (166%) because people were kept indoors by the coronavirus. Taobao, the current leading e-commerce website in China, was founded by Alibaba on May 10, 2003, the peak of the SARS outbreak.

The Coronavirus tells a different e-commerce story

We predict that the new coronavirus in 2019/2020 will also have a similar influence on retail sales in China. “Panic buying” is one of the most frequently mentioned word during the outbreak of COVID-19. However, the hit of coronavirus on sporting goods, clothing, and shoes may be milder. Thanks to the development of online shopping websites, citizens who are restricted at home can purchase needed products through several clicks at home.

Other online channels such as takeaway platform, fresh product platform, errand platform, and online business with offline supermarket will have more rapid development. The stock price of Yonghui supermarket, the leading player in fresh food e-commerce, has increased significantly by 24% in the past six trading days, with the market value reached to nearly 90 billion (yuan).

Catering, Hotel, and Tourism during SARS and Coronavirus

Outbound Tourism

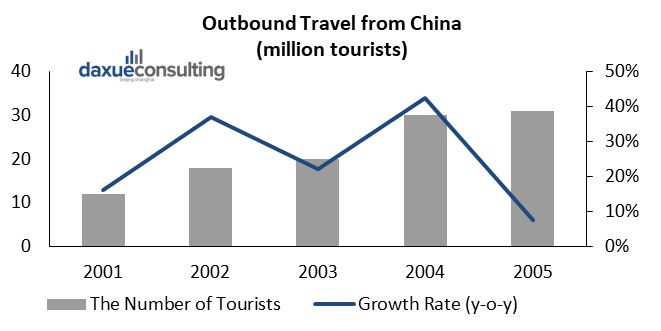

The SARS outbreak in 2003 caused the number of outbound visitors only increased by 21.8%, with a 15% decrease in the growth rate.

Data Source: National Tourism Administration

China remains the world’s biggest market in outbound tourism, with 149 million outbound visits made by Chinese travelers in 2018, up 14.7% year-on-year. While in 2003, the number was just over 20 million. China is also the largest spender in outbound tourism. In 2018, China’s outbound tourism pumped 277 billion USD into the global tourism industry.

To contain the spread of novel coronavirus, China’s Culture and Tourism Ministry had ordered travel agencies and tourism companies to cancel tour packages. The action came about at the start of 2020’s Chinese New Year holidays when millions of Chinese travelers travel across abroad. COVID-2109 will have a more severe influence on the global tourism industry and other related sectors. Due to the outbreak of novel coronavirus, the expected loss of Russian inbound tourism from China will be 10 million (USD); the predicted loss of South Korean tourism will reach 2.9 trillion (in South Korea won) in the first quarter of 2020.

Inbound Tourism

SARS outbreak heavily influenced the tourism industry in 2003. The number of inbound visitors reduced by 1% in 2003, but had a retaliatory increase in 2004 (27%). The recession’s hit also reflected in the number of visitors to some famous resorts. In 2003, the number of visitors to Huangshan, Lijiang, and Guilin was decreased by 20%, 11%, and 22%, respectively.

Data Source: National Tourism Administration

SARS choked luxury hotels

The pain was also felt in the hotel industry. In 2003, the growth rate of starred hotels’ occupancy rate in China became negative (-4%). Starred hotels incurred serious losses with a total profit of -4.1 billion yuan. Take the Jin Jiang Hotel as an example. On a year-on-year basis, the net profit in the first quarter of 2003 increased by 549%; but in the second quarter of 2003, it decreased by 159%. The growth rate did not return to the average level until the first quarter of 2004.

The Coronavirus halts tourism

The outbreak of COVID-19 will bring a similar impact on tourism, hotel, and catering—might be more severe. Chinese New Year is one of the most important festivals for catering, hotel, and tourism industries. The 15-day festival makes it an excellent time for travel. Because of the spread of novel coronavirus, the Chinese government halted all group tours. Many of the attractions (e.g., Shanghai Disney Land, the Forbidden City) are closed. In 2019’s Chinese New Year, it saw 415 million inbound trips, and its trade volume exceeded 500 billion yuan, which accounted for 7.8% of annual tourism income. However, this source of income faded away in the 2020’s Chinese New Year.

Food and Beverage impacted by SARS and Coronavirus

As for the catering industry, 2003 was a tough year, too. The growth rate of total income (y-o-y) reduced from 27.4% in 2002 to 19.7% in 2003. However, in 2004, it dramatically increased to 54.4%.

The tradition of having New Year’s Eve dinner with family members makes Chinese New Year an essential business opportunity for the catering industry as well. As a result, New Year’s Eve is the busiest time for most restaurants. However, the fear of contagion in public places and travel restrictions prevent people from dining in restaurants. Xibei Restaurant, one of China’s well-known catering brands, is through a difficult time. The turnover of Xibei Restaurant during the 2020’s Chinese New Year dropped by 87% as compared to 2019’s Chinese New Year. On February 10, 2020, the CEO claimed that the company could not last three months if the outbreak could not be controlled.

Yum China, which owns both KFC and Pizza Hut, has closed 30% of its stores in China, and has stated that the remaining stores are making half the sales as usual. This could cause the company a net loss of up to 450 million USD in the first quarter of 2020.

Transportation and Logistics challenged by SARS and Coronavirus

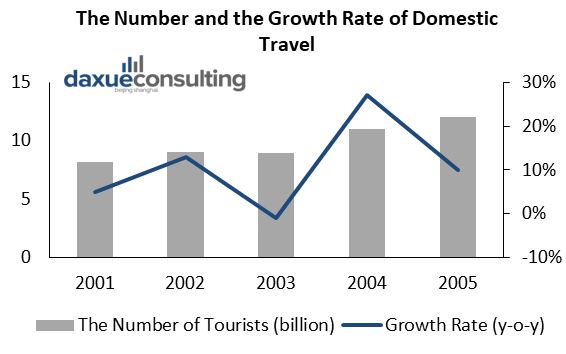

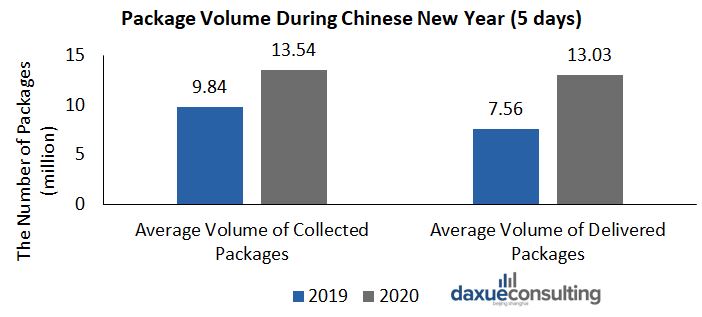

According to the data from State Post Burea, from January 24 to 29th 2020, the whole delivery industry collected 81.25 million packages from customers and delivered 78.17 million packages to customers. As compared to the same period (according to the Chinese calendar), the growth rate reached 37.6% and 72.3%, respectively (y-o-y).

Data Source: State Post Bureau

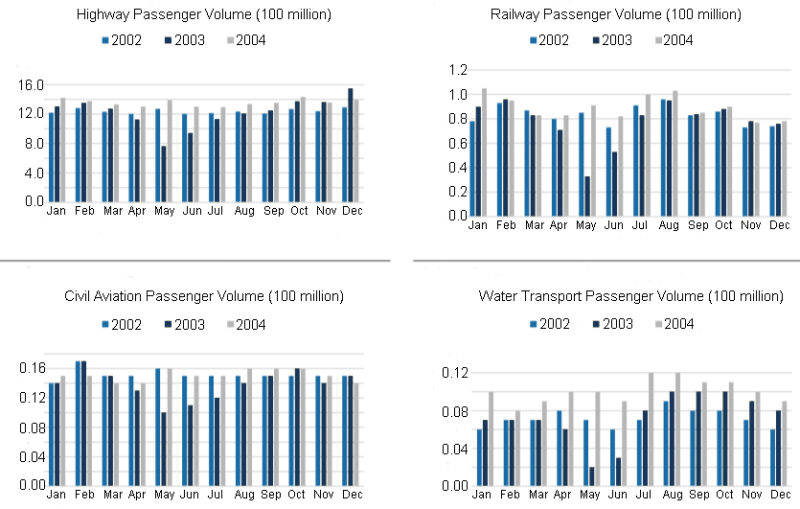

During the outbreak of SARS in 2003, highway, railway, civil aviation, and water transportation were all shut down. Passengers on highways, railways, civil aviation, and water transport all fell remarkably. The negative influences peaked in May and recovered gradually. In the third quarter, the passenger volume rebounded.

Picture Source: GF Securities

Civil aviation was hit the hardest during SARS

The most affected sector was civil aviation. Take China Eastern as an example. The outbreak of SARS significantly reduced passenger volume in the second quarter. The growth rate of net operating income reduced from 15.10% for the first quarter to -37.18% for the second quarter. Hence, China Eastern suffered from a net loss of 1.24 billion yuan, and the stock price reduced from 5.06 yuan (at the end of March) to 4.28 yuan (at the end of June).

SARS boosted the development of logistics

The reduction of population mobility contributed to the development of logistics during the SARS outbreak. The delivery industry bucked up. In 2003, the volume of domestic express delivery increased by 23% (y-o-y)—much higher than the growth rate in other years.

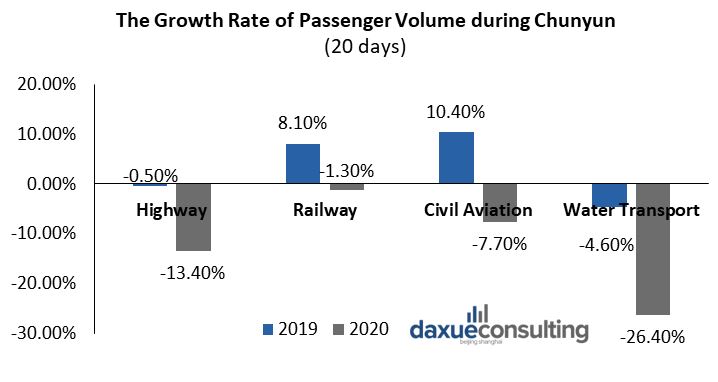

Similar patterns are being witnessed during the COVID-19 outbreak. According to the data disclosed by the Ministry of Transport, from January 10 to January 29 (the first 20 days of Chunyun period), railway, road, water transport, and civil aviation in total handled 1.23 billion passengers, a decrease of 11.9% year-on-year. Specifically, 183 million passengers took the railway with the smallest decline of 1.3%; 998 million passengers took the highway with the largest decline of 26.4%; 15.61 million passengers took the water transport with a drop of 26.4%; 32.76 million passengers took the flights with a drop of 7.7%. The passenger volume growth rate of highway, railway, civil aviation, and water transport decreased by 13.0%, 9.4%, 21.8%, and 18.1%, respectively.

Data Source: Ministry of Transport

Light Industry during SARS

The growth of light industries was heavily influenced by the SARS epidemic. In 2003, the operating income growth rate of office and school supplies reached 26.8% (y-o-y) during the first two months. But the average monthly growth rate in the following three months reduced below 20%. The epidemic reduced commercial activities, which was a major reason of reduction of demand of office and school supplies.

Household appliance industry

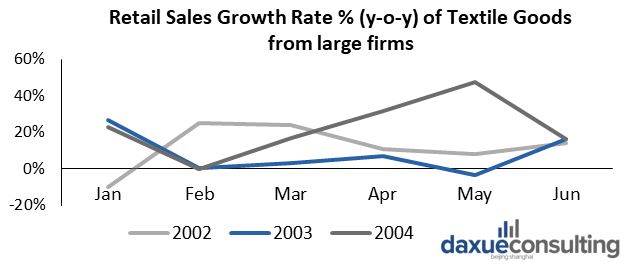

Similarly, the income growth rate of household appliances slowed down during the outbreak, resulted from shutting down offline shops and supermarkets. As for the textile industry, SARS had limited influence on upstream firms but had a considerable impact on the downstream firms. According to the National Bureau of Statistics, the retail sales growth rate of textile goods (e.g., clothes, shoes, knitwear, hats, etc. ) dipped sharply during the outbreak. In May 2003, the growth rate decreased to -3.5%. The grim period was caused by shutting down offline shops as well. In 2003, the number of Internet users in China was small (79.5 million), and e-commerce was not poplar. Hence, the sales of textile goods were heavily dependent on offline shops.

Data Source: National Bureau of Statistics of China

One might say that the well-developed digital eco-system in current China will eliminate the adverse impact caused by coronavirus on the downstream firms. That might be true for the textile industry. E-commerce has become the primary sales channel of textile and knitwear. In 2018, the number of Internet users increased to 828.51 million, and online shoppers reached 610.11 million. In the Apparel market, 54% of total revenue came from online channels. However, in other industries such as household appliances and electronic devices, offline shops still play vital roles in retail sales. According to the data from Mobile No.1 Research Institute, the mobile phone offline market accounted for 80% of the total sales in May 2019. As a result, the novel coronavirus will cause a reduction in retail sales in the light industry.

The upstream firms will also be affected by the COVID-19 epidemic. After Wuhan was cut off from the outside world, governments in the rest provinces put travel restrictions in the local cities and asked offices and production facilities to postpone reopening. These labor-intensive firms may suffer from labor shortages after the outbreak, which will contribute to the increase in costs and the decrease of output.

Livestock and Poultry Industry prices fluctuate from SARS and Coronavirus

Due to the travel restrictions, the closing of farmers’ markets, and decreased demand from the catering industry, the outbreak of COVID-19 will influence the livestock and poultry industry as well.

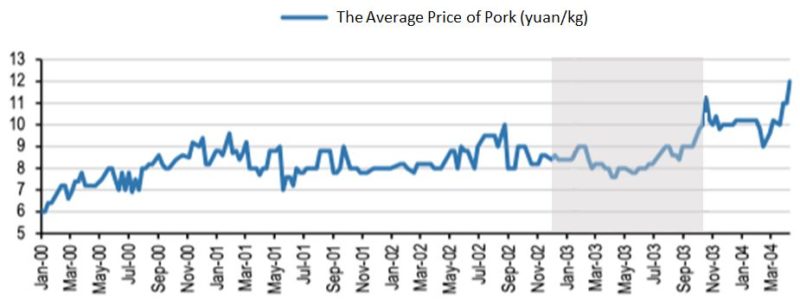

SARS outbreak in 2003, however, exerted a limited impact on the pork price. The consistent fluctuation may due to two factors. On the one hand, since cargo transportation was blocked during the outbreak, pork from remote areas did not have access to the market. On the other hand, catering companies were suffering a difficult time. They were incapable of purchasing more pork. Supply and demand fell simultaneously. Consequently, the price fluctuation was not significant. However, immediately after the epidemic, pent-up demand was unleashed, causing pork prices to soar up in October 2003.

When it comes to the current coronavirus outbreak, the cross-regional transport of live pigs is blocked with a disordered circulation market. Therefore, the discrepancy of pork price between main selling areas and main producing areas are continuously expanding. Meanwhile, the catering industry is suffering from similar misery. That is, both supply and demand are going through a hard hit. Nonetheless, because of the African Swine Fever (ASF), the pork industry had been profoundly hurt in 2019. The outbreak of coronavirus will make it worse—the pork market in China will take more time to recover

The Average Pork Price in China during SARS

Source: Ministry of Agriculture and Rural Affairs

Different from pork prices, the price of processed chicken had large swings during the pandemic in 2003. The price crashed down after a slight rise. Wens, one of the biggest broiler companies in Guangdong Province, had an average sales of 800,000 broiler chickens per day before SARS epidemic. However, the average sales shrunk to less than 400,000 broiler chickens per day, and the number of overstocked broiler chickens was over 3.3 million, resulting in a 70% decline of the broiler chicken price. After the SARS outbreak, the price of processed chicken was increased significantly—a similar trend to pork price. It is predicted that the price of livestock and poultry will decrease during the current outbreak but will increase to varying degrees after the outbreak.

Otaku Economy has taken off during Coronavirus

The so-called Otaku Economy has benefited from the Coronavirus break. Online video hosting services (e.g., Youku, iQiyi, Tencent Video, Bilibili), Short video platforms (e.g., Kuaishou, Douyin, Xigua), and online social network platforms (e.g., Weibo, Wechat, Toutiao, Zhihu) peaked during 2020’s Chinese New Year. According to the data from Quest Mobile, Douyin and Kuaishou grew to more than 40 million users every day; Toutiao grew to more than 20 million users per day during the Chinese New Year holidays. On average, people spent 98 minutes per day on online video hosting services and 105 minutes per day on short video apps. The collaboration between the movie “Lost in Russia” and Byte Dance made the downloads of Xigua app reached the first place on that day.

More importantly, these platforms have made an enormous contribution to information transparency, popularization of science, and information transmission during the epidemic period. Medical apps such as DXY (丁香园 in Chinese) have become essential platforms for people to understand the knowledge of the novel coronavirus. Weibo has become a public platform for people to oversee the government’s reactions during the epidemic. In the 2002/2003 SARS outbreak, the Chinese government refused to provide information to Chinese outside of Guangdong Province and even did not allow a WHO team to visit Guangdong province early in the epidemic. The lack of openness caused delays in efforts to control the outbreak, resulting in criticism of China from the international community.

The gaming industry, especially mobile games, has boomed during the Chinese New Year holidays. Honor of Kings (王者荣耀 in Chinese), on average, had 120-150 million active users per day, reaching one-tenth of the entire population. On New Year’s Eve, the total transaction was over 2 billion yuan (single day), which was only 1.3 billion yuan last year. Additionally, the outbreak of novel coronavirus has promoted online education and telecommuting. DingTalk (钉钉 in Chinese), the enterprise communication and collaboration platform developed by Alibaba Group, has exploded during the outbreak. More than 200 million people use the app to work at home. On February 5, 2020, the downloads of DingTalk, for the first time, exceeded Wechat and reached the first place on the Apple App Store.

The Possible Impact of the Coronavirus on the Global Economy

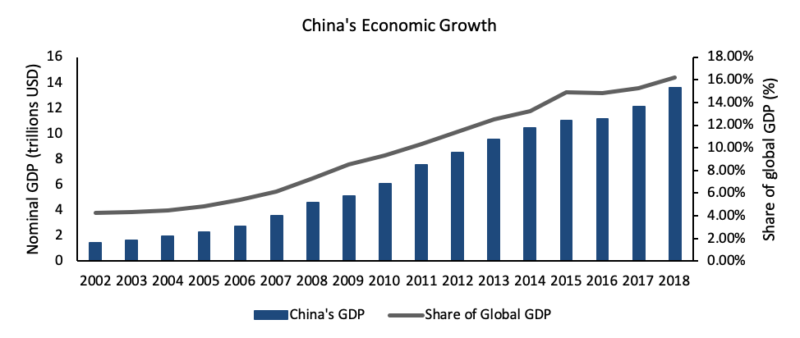

2002/2003 SARS outbreak wiped 40 billion (USD) off the world markets. Compared to the 2002/2003 SARS outbreak, the global economic effects of COVID-19 are likely to be more severe. Simply because China’s economy is much bigger and more intertwined with the global economy.

In 2003, China only represented 4.31% of the global GDP, while in 2019, it represented more than 16%. China’s economy is critical to the worldwide economy. It is now the biggest market for new cars and semiconductors, the largest spender on international tourism, and the leading exporter of clothing and textiles. Thus, the negative effect caused by COVID-19 is likely to have more global consequences. That is, if the growth of China’s economy slumps, the global spillover will be much more significant. It is estimated that the outbreak of the novel coronavirus in China will be three to four times larger than 40 billion blow from SARS.

Source: The World Bank

Major International Commodities

The outbreak of COVID-19 will also influence the prices of major commodities. Take oil as an example, in the second quarter of 2003 (the outbreak of SARS), the growth rate of domestic gasoline consumption fell 8%; the growth rate of domestic kerosene consumption decreased by 40%. The growth rate of overall oils demands fell from 10% to 3%. Affected by the declining market in China, the growth rate of global oils consumption reduced from 2.5% to 1.5% as well. Correspondingly, the international oil price, which was $33.9 (USD) per barrel before the outbreak, suffered a sharp decrease by 28%.

In 2003, domestic consumption in China only accounted for 6.9% of global consumption. In 2018, the share increased to 13.4%, doubled since 2003. Therefore, it is predicted that the outbreak of novel coronavirus will dampen the domestic oils consumption by 10% (around 1.3 million barrels per day), and subsequently will make the growth rate of global oils demand to go from positive to negative.

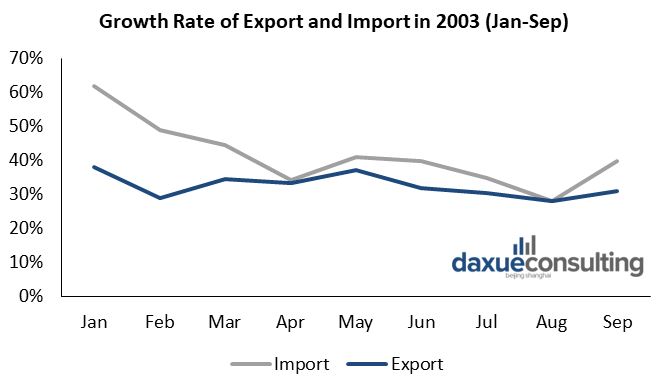

Import and ExportSARS outbreak in 2003 suppressed both consumption and productivity. However, import was struck harder than export. The panic of contagion and the reduction of population mobility decreased domestic demand. The following three reasons caused a limited influence on export. First, SARS was controllable. As a result, it had a limited negative impact on the global economy and furthered the global demand. Second, in 2003, China just joined WTO, and the oversea orders were increasing. Third, the peak of the SARS outbreak started in March 2003. Unlike Chinese New Year, it was less likely to affect manufacturing or reopening, and firms could deliver the products in time.

Data Source: Ministry of Commerce

The impact of COVID-19 on foreign trade maybe more severe. With a high reproductivity rate, the novel coronavirus is hard to contain. Since the outbreak started during the Chinese New Year, the government has carried out more strict policies including sealing off cities, postponing school and work, cancelation of public transportation. In addition to the reduction in imports, exports will also suffer.

China plays a vital role in the global supply chain. The manufacturing output in China accounts for around 30% of the global manufacturing output. However, the epidemic delays the reopening of offices and production facilities. The decreasing productivity result from a novel coronavirus outbreak will continuously shake China’s status in the global supply chain. Currently, the interrupted supply of components made in China has affected groups of manufacturing companies around the world. For instance, South Korea’s Hyundai, the world’s fifth-largest carmaker, suspended operations at its giant Ulsan complex on February 7, 2020, caused by the short on supplies of China-made wiring harness. If the interrupted supply happens continuously, it will force the upstream companies to shift manufacturing from China to other Southeast Asian countries. Then the decline in export will be irreversible.

Meanwhile, the supply chain crisis in China has been used as an opportunity by politicians in the United States. Secretary of Commerce, Wilbur Ross claimed on January 30, 2020, that the coronavirus outbreak in China would have a positive impact on the U.S. economy as it could help jobs and manufacturing industries return to the U.S. from overseas at a quicker pace.

Read about China’s economic recovery from COVID-19.